Professional Documents

Culture Documents

Accg200 L12

Uploaded by

Nikita Singh DhamiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accg200 L12

Uploaded by

Nikita Singh DhamiCopyright:

Available Formats

Welcome to ACCG200

Lecture 12

Standard costs for control

Chapters 10 and 11 p.519-531

1

Standard costs for control

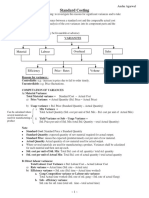

Standard costs are benchmarks or "norms for measuring

performance and controlling costs. In management

accounting, two types of standards are commonly used.

Quantity standards

specify how much of an

input should be used to

make a product or

provide a service.

Price standards

specify how much

should be paid for

each unit of the

input.

Standard costs for control

A standard is the

expected cost for one

unit.

A budget is the expected

cost for all units

produced.

What is the difference

between standards

and budgets?

Setting Standard Costs

Should we use

ideal standards that

require employees to

work at 100 percent

peak efficiency?

Engineer

Management Accountant

I recommend using practical

standards that are currently

attainable with reasonable

and efficient effort.

Type of Product Cost

A

m

o

u

n

t

Direct

Labor

Standard

Favorable versus Unfavorable

Variances

This variance is unfavorable

because the actual cost

exceeds the standard cost.

Direct

Material

These variances are favorable

because the actual cost

is less than the standard cost.

Manufacturing

Overhead

Standard Costs

Direct

Material

Deviations from standards deemed significant

are brought to the attention of management, a

practice known as management by exception.

Type of Product Cost

A

m

o

u

n

t

Direct

Labor

Manufacturing

Overhead

Standard

Determine cost variances

Three basic parts/steps:

1. A standard cost is developed

A standard cost is a budgeted cost of one unit of product, including

cost of material, labour and overhead.

2. The actual cost incurred in the product process is measured

3. The actual cost is compared to the standard cost to determine a

cost variance

7

Standard cost variances

Direct material standards

Direct Material Quantity Variance

Direct Material Price Variance

Direct labour Standards

Direct Labour Efficiency Variance

Direct Labour Rate Variance

Variable overhead standards

Variable overhead efficiency variance

Variable overhead spending variance

Fixed overhead standards

Fixed overhead budget variance

Fixed overhead volume variance

8

Direct material standards

Standard material quantity

The total amount of direct material normally required

to produce one unit of product

Standard material price

The total delivered cost of per unit of direct material

after subtracting any quantity discounts

9

A General Model for Variance

Analysis

Variance Analysis

Price Variance

Difference between

actual price and

standard price

Quantity Variance

Difference between

actual quantity and

standard quantity

Direct material variances

1) Direct Material (Purchase) Price Variance

Caused by the difference between

the actual price paid for materials and

the budgeted (standard) price that we anticipated.

= PQ(AP SP)

Where PQ = quantity purchased

AP = actual price

SP = standard price

11

Direct material variances (cont.)

2) Direct material quantity variance

A measure of the effect on cost of using a different quantity of

material in production compared with the standard quantity that

should have been used for the actual production output

= SP(AQ SQ)

Where SP = standard price

AQ = actual quantity used

SQ = standard quantity used, given actual output

12

SQ per unit of output Actual output

Lecture Example 1

Johnson Ltd manufactures a single product, A. The standard cost

specification sheet shows the following for one unit of A:

13

6 kg of material X @ $15/kg $90

Actual costs incurred in July when 10000 units of A were produced

were:

67000 kg of material were purchased at $16.50/kg

59000 kg of material were used

Required:

a)Calculate the Direct Material Price Variance

b)Calculate the Direct Material Quantity Variance

a) The Direct Material Price Variance

= PQ (AP SP)

= 67000 (16.5 - 15)

= $100 500

Is this variance favourable or unfavourable? Unfavourable

b) The Direct Material Quantity Variance

= SP (AQ SQ)

= 15 (59000 6 10000)

= $15000

Is this variance favourable or unfavourable? Favourable

Lecture Example 1 - Solution

Materials Price Variance Materials Quantity Variance

Production Manager Purchasing Manager

The standard price is used to compute the quantity variance

so that the production manager is not held responsible for

the purchasing manager's performance.

Responsibility for Materials

Variances

I am not responsible for

this unfavorable materials

quantity variance.

You purchased cheap

material, so my people

had to use more of it.

Your poor scheduling

sometimes requires me to

rush order materials at a

higher price, causing

unfavorable price variances.

Responsibility for Materials

Variances

Production Manager Purchasing Manager

Direct labour variances

1) Direct labour rate variance

Caused by the difference between

the actual labour rate we paid for employees and

the budgeted (standard) labour rate anticipated

= AH(AR SR)

Where AH = actual hours used

AR = actual rate per hour

SR = standard rate per hour

17

Direct labour variances (cont.)

2) Direct Labour Efficiency Variance

Caused by the difference between

the actual hours worked by employees and

the budgeted (standard) labour hours allowed

= SR(AH SH)

Where AH = actual hours used

SH = standard hours allowed, given actual output

SR = standard rate per hour

18

SH per unit of output Actual output

Lecture Example 2

Johnson Ltd manufactures a single product, A. The standard

cost specification sheet shows the following for one unit of A:

19

4 hours of direct labour @ $12.50/hour $50

In July 10000 units of A were actually produced, and 38500

direct labour hours were actually consumed at an average

wage rate of $12.60 per hour

Required:

a) Calculate the Direct Labour Rate Variance

b) Calculate the Direct Labour Efficiency Variance

a) Direct Labour Rate Variance

= AH (AR SR)

= 38500 (12.6 12.5)

= $3850

Is this variance favourable or unfavourable? Unfavourable

Give a possible reason for the direct labour rate variance:

More higher-skilled workers were scheduled than planned.

20

Lecture Example 2 Solutions

b) Direct Labour Efficiency Variance

= SR (AH SH)

= 12.5 (38500 4 10000)

= $18750

Is this variance favourable or unfavourable? Favourable

Provide a reason for the direct labour efficency variance:

1. well maintained machinery

2. Experienced workers

3. High quality of raw materials

4. Budgeted time standards are too loose

21

Lecture Example 2 Solutions Responsibility for Labour

Variances

Production Manager

Production managers are

usually held accountable

for labour variances

because they can

influence the:

Mix of skill levels

assigned to work tasks.

Level of employee

motivation.

Quality of production

supervision.

Quality of training

provided to employees.

I am not responsible for

the unfavorable labor

efficiency variance!

You purchased cheap

material, so it took more

time to process it.

I think it took more time

to process the

materials because the

Maintenance

Department has poorly

maintained your

equipment.

Responsibility for Labor

Variances

Overhead cost variances

Four different overhead variances can be

calculated to compare the actual overhead cost

incurred with the flexible budget:

1. Variable overhead spending variance

2. Variable overhead efficiency variance

3. Fixed overhead budget variance

4. Fixed overhead volume variance

24

Variable overhead cost variances

1) Variable overhead spending variance

A measure of the difference between the actual variable

overhead and the standard variable overhead rate multiplied by

actual activity

= Actual variable overhead (AH ! SVR)

Where

AH = actual direct labour hours/ any other cost driver

SVR = standard variable overhead rate

25

Variable overhead cost variances

2) Variable overhead efficiency variance

A measure of the difference between the actual activity and the

standard activity allowed, given the actual output multiplied by the

standard variable overhead rate

= SVR(AH SH)

Where SH = standard direct labour hours allowed for actual output

AH = actual direct labour hours

SVR = standard variable overhead rate

26

SH per unit of output Actual output

Interpreting variable overhead variances

Spending variance: Actual variable overhead (AH ! SVR)

Actual cost of variable overhead is greater/less than expected, after

adjusting for the actual quantity of cost driver that is used;

Used to control variable overhead cost

Efficiency variance: SVR(AH SH)

The cost effects of excessive or low use of the particular cost driver

Does not measure the efficient or inefficient usage of individual

overhead items.

27

Lecture Example 3

Security Doors has a standard variable overhead rate of $4 per

direct labour hour. The standard quantity of direct labour per unit

of production is 3 hours. The company's static budget was based

on 50,000 units. Actual results for the year are as follows:

Actual units produced 45,000

Actual direct labour hours 120,000

Actual variable overhead $495,000

Calculate the following variances and indicate whether each is

favourable or unfavourable.

a) The variable overhead spending variance

b) The variable overhead efficiency variance

28

a) Variable overhead spending variance?

29

= Actual VOH (AH x SVR)

= 495 000 (120 000 x 4)

= 495 000 480 000

= $ 15 000 UF

Lecture Example 3 - Solution

b) Variable Overhead efficiency variance

= SVR (AH SH)

= 4 x (120 000 3 x 45 000)

= 4 x (120 000 135 000)

= $ 60 000 F

Fixed overhead variances

1) Fixed overhead budget variance

The difference between actual fixed overhead and budgeted fixed

overhead

= actual fixed overhead budgeted fixed overhead

2) Fixed overhead volume variance

The difference between budgeted fixed overhead and fixed overhead

applied to production

= budgeted fixed overhead applied fixed overhead*

* Applied fixed OH= standard fixed OH rate x

30

Standard hours allowed

for actual output

SH per unit of output Actual output

Interpreting fixed overhead variances

Fixed overhead budget variance

(actual fixed overhead budgeted fixed overhead)

Assumes fixed overhead will not change as activity

varies

Real control variance for fixed overhead costs

Fixed overhead volume variance

(budgeted fixed overhead applied fixed overhead)

Provides information capacity utilisation

Does not provide useful information for controlling

fixed overhead costs

31

Lecture Example 4

CB company has set the following standard cost per unit

for 2011:

Fixed overhead: 4 machine hours @ $10 per machine hour

The standards were set based on a capacity of 20000

machine hours.

During the year 6000 units were produced.

Actual fixed overhead was $205,000.

Calculate the following variances and indicate whether

each is favorable or unfavourable:

1. Fixed overhead budget variance

2. Fixed overhead volume variance

1. Fixed overhead budget variance

= Actual FOH Budgeted FOH

= 205 000 10 x 20 000

= 205 000 200 000

= $ 5000 UF

2. Fixed overhead volume variance

= budgeted fixed overhead applied fixed overhead

= 200 000 10 x (4 x 6000)

= 200 000 240 000

= $40 000 F

33

Lecture Example 4 - Solution

Lecture example 5

Broome Instruments Company manufactures a control

valve used in air-conditioning systems. The manufacturing

overhead rate is based on a normal annual activity level of

600 000 machine hours. The company planned to produce

25 000 units each month during 2011. The budgeted

manufacturing for 2011 is as follows:

Variable: $3600 000

Fixed: 3000 000

Total $6 600 000

34

Lecture example 5 cont.

During November, the company produced 26 000 units and used 53 500

machine hours. Actual manufacturing overhead for the month was $260

000 fixed and $320 000 variable. The total manufacturing overhead applied

during November was $572 000. The standard cost of a control valve is as

follows:

Direct material $14.50

Direct labour (2 hrs @ $ 8) 16.00

Manufacturing OH (2 mhrs @ $11) 22.00

Total standard cost $ 52.50

Required: 1) calculate the standard variable overhead rate and standard

fixed overhead rate;

2) calculate the variable and fixed overhead variances for

November and indicate whether each variance is

favourable or unfavourable.

35

Lecture example 5 solutions

1) Standard variable overhead rate

= total budgeted variable overhead/ total budgeted machine hrs

= 3600 000/ 600 000

= $ 6/Mhr

Standard fixed overhead rate

= total budgeted fixed overhead/ total budgeted machine hrs

= 3000 000/ 600 000

= $5/Mhr

36

Lecture example 5 solutions

2)Variable overhead spending variance

37

= Actual VOH (AH x SVR)

= 320 000 (53 500 x 6)

= 320 000 321 000

= $ 1000 F

Variable Overhead efficiency variance

= SVR (AH SH)

= 6 x (53 500 2 x 26 000)

= 6 x (53 500 52 000)

= $ 9 000 UF

Lecture example 5 solutions

Fixed overhead budget variance

= Actual FOH Budgeted FOH

= 260 000 3000 000/12

= 260 000 250 000

= $ 10 000 UF

Fixed overhead volume variance

= budgeted fixed overhead applied fixed overhead

= 250 000 5 x (2 x 26 000)

= 250 000 260 000

= $10 000 F

38

Investigating significant variances and

taking corrective actions

Management by exception

Only significant cost variances are reported and

investigated

Which variances are significant?

Size of variance

Recurring variances

Trends

Controllability

39

Behavioural impact of standard

costing

Standard costing can be used to evaluate the

performance of managers, employees and departments.

Comparing individuals' performance with standards or

budgets can be used to determine salary increases,

bonuses and promotions.

These practices can profoundly influence behaviour.

Motivate positive behaviours;

Encourage the manipulation of data and reports and

dysfunctional activities and decisions.

40

Standard costs for product costing

Standard costing system

All inventories are recorded at standard cost

Variances are closed off at the end of the

accounting period

To cost of goods sold expense

Prorate variances between WIP, FG and COGS,

if significant

10-41

Additional question

Number of units produced ......................................................... 28,000

Actual direct labour-hours worked............................................. 60,000

Actual variable manufacturing overhead cost incurred............. $163,000

Actual fixed manufacturing cost incurred.................................. $221,000

42

Lower Hut Company produces a single product that requires a large amount oI

labour time. Overhead cost is applied on the basis oI standard direct labour

hours. Variable manuIacturing overhead should be $3.00 per standard direct

labour hour and Iixed manuIacturing overhead should be $210,000 per year.

The product requires 2 hours oI direct labour time. During the year, the

company had planned to operate at an activity oI level oI 50,000 direct labour

hours and to produce 25,000 units oI product. Actual activity and costs Ior the

year were as Iollows:

a) Variable overhead spending variance

43

= Actual VOH (AH x SVR)

= 163 000 (60 000 x 4)

= $ 17 000 F

Solutions

b) Variable Overhead efficiency variance

= SVR (AH SH)

= 3 x (60 000 2 x 28 000)

= 3 x (60 000 56 000)

= $ 12 000 UF

Solutions

c) Fixed overhead budget variance

= Actual FOH Budgeted FOH

= 221 000 210 000

= $ 11 000 UF

d) Fixed overhead volume variance

= budgeted fixed overhead applied fixed overhead

= 210 000 FOH Rate x (2 x 28 000)

= 210 000 (210 000/50 000) x 56 000

= 210 000 235 200

= $ 25 200 F

44

You might also like

- Operation Management (Case: MRP at A-Cat Corp.)Document44 pagesOperation Management (Case: MRP at A-Cat Corp.)Camelia Indah Murniwati77% (13)

- Strategic Market Management, 11th Edition WileyDocument1 pageStrategic Market Management, 11th Edition Wileyshubhangi choudhary0% (1)

- What-If Analysis and Sensitivity Analysis for Evaluating Decision AlternativesDocument8 pagesWhat-If Analysis and Sensitivity Analysis for Evaluating Decision AlternativesNadia SwaisNo ratings yet

- ACCG200 Lectures 2-11 HandoutDocument108 pagesACCG200 Lectures 2-11 HandoutNikita Singh DhamiNo ratings yet

- 2020 Scrum Guide ArabicDocument15 pages2020 Scrum Guide Arabicnbo100% (1)

- 02 - Cost Accounting CycleDocument10 pages02 - Cost Accounting CycleFerdinand Caralde Narciso ImportadoNo ratings yet

- Standard Costs and Variance AnalysisDocument43 pagesStandard Costs and Variance AnalysisnnonscribdNo ratings yet

- Managerial Accounting CHPTR 9Document7 pagesManagerial Accounting CHPTR 9Rifqi Dhia RamadhanNo ratings yet

- Assignment Standard Costing SolutionsDocument13 pagesAssignment Standard Costing SolutionsMartha MasalangkayNo ratings yet

- SCM Discussion 6Document10 pagesSCM Discussion 6M4ZONSK1E OfficialNo ratings yet

- Standard Costing and Variance AnalysisDocument6 pagesStandard Costing and Variance AnalysisBarby Angel100% (3)

- CH 11Document48 pagesCH 11Amanda SaffouriNo ratings yet

- Standard Costing and Variance AnalysisDocument33 pagesStandard Costing and Variance Analysisnhtiwari16No ratings yet

- Module 10 Standard CostsDocument28 pagesModule 10 Standard Costsi_kostadinovicNo ratings yet

- Synth 1 (STD COSTING)Document11 pagesSynth 1 (STD COSTING)Hassan AdamNo ratings yet

- Analysis of Variance for Material and Labour CostsDocument6 pagesAnalysis of Variance for Material and Labour CostsBhavna SharmaNo ratings yet

- Standard Cost Variance AnalysisDocument48 pagesStandard Cost Variance AnalysisLight knightNo ratings yet

- 02.12.21 Variance AnalysisDocument25 pages02.12.21 Variance Analysisejazahmad5No ratings yet

- Standard Costing and Variance AnalysisDocument8 pagesStandard Costing and Variance AnalysisTariku KolchaNo ratings yet

- STANDARD COSTING and Variance AnalysisDocument28 pagesSTANDARD COSTING and Variance AnalysisDanica VillaganteNo ratings yet

- CMA II - Chapter 3, Flexible Budgets & StandardsDocument77 pagesCMA II - Chapter 3, Flexible Budgets & StandardsLakachew Getasew0% (1)

- Management AccountsDocument5 pagesManagement Accountspaul chishimbaNo ratings yet

- COMA - 04 Variaance PDFDocument49 pagesCOMA - 04 Variaance PDFAbhishekNo ratings yet

- Presented By:: Mr. Jaswant Singh Mr. Kadir Shaikh Ms. Jigyasa Soni Ms. Vibhavari PawarDocument48 pagesPresented By:: Mr. Jaswant Singh Mr. Kadir Shaikh Ms. Jigyasa Soni Ms. Vibhavari Pawarms_s_jigyasaNo ratings yet

- Standard CostingDocument36 pagesStandard CostingParamjit Sharma96% (24)

- STD CSTGDocument42 pagesSTD CSTGsanam20191No ratings yet

- Standard Costing Summary For CA Inter, CMA Inter, CS ExecutiveDocument5 pagesStandard Costing Summary For CA Inter, CMA Inter, CS Executivecd classes100% (1)

- Colegio de San Gabriel Arcangel: Learning Module in Strategic Cost Management Unit TitleDocument8 pagesColegio de San Gabriel Arcangel: Learning Module in Strategic Cost Management Unit TitleC XNo ratings yet

- Standared CostingDocument18 pagesStandared Costingiram2005No ratings yet

- Variance AnalysisDocument10 pagesVariance AnalysisPalesaNo ratings yet

- Standard Costing - Materials and LaborDocument4 pagesStandard Costing - Materials and LaborTupe LeiNo ratings yet

- MBA 504 Ch11 SolutionsDocument31 pagesMBA 504 Ch11 Solutionschawlavishnu100% (1)

- MS 3404 Standard Costing and Variance AnalysisDocument6 pagesMS 3404 Standard Costing and Variance AnalysisMonica GarciaNo ratings yet

- CH00 Standard Costing and Variance AnalysisDocument75 pagesCH00 Standard Costing and Variance AnalysisDimple AtienzaNo ratings yet

- L-31, 32, 33,34 Standard CostingDocument52 pagesL-31, 32, 33,34 Standard CostingYashvi GargNo ratings yet

- Standard Costing and Variance AnalysisDocument13 pagesStandard Costing and Variance AnalysisSigei Leonard100% (1)

- Variance AnalysisDocument9 pagesVariance AnalysisAnand PatilNo ratings yet

- Materials price and yield variances explainedDocument11 pagesMaterials price and yield variances explainedAsim Hasan UsmaniNo ratings yet

- Quizz C3Document10 pagesQuizz C3Thanh NgânNo ratings yet

- Variable Overhead Variance AnalysisDocument30 pagesVariable Overhead Variance Analysismohammed azizNo ratings yet

- (Mas) 04 - Standard Costing and Variance AnalysisDocument7 pages(Mas) 04 - Standard Costing and Variance AnalysisCykee Hanna Quizo Lumongsod0% (1)

- Module 2 Sub Mod 2 Standard Costing and Material Variance FinalDocument31 pagesModule 2 Sub Mod 2 Standard Costing and Material Variance Finalmaheshbendigeri5945No ratings yet

- Standard Costing & Variance AnalysisDocument29 pagesStandard Costing & Variance Analysisadityaraj143143No ratings yet

- CH 24 Quiz ADocument12 pagesCH 24 Quiz AAaron Carter KennedyNo ratings yet

- Job Order, Operation and Life Cycle Costing Job Order CostingDocument19 pagesJob Order, Operation and Life Cycle Costing Job Order Costingjessa mae zerdaNo ratings yet

- Mas 9303 - Standard Costs and Variance AnalysisDocument21 pagesMas 9303 - Standard Costs and Variance AnalysisJowel BernabeNo ratings yet

- 26560standard Costing and Variance AnalysisDocument2 pages26560standard Costing and Variance AnalysisTalha HanifNo ratings yet

- Chapter 9Document8 pagesChapter 9AbdulAzeemNo ratings yet

- Standard Costing and Variance Analysis ExplainedDocument64 pagesStandard Costing and Variance Analysis ExplainedPooja Grover ShandilyaNo ratings yet

- Standard Costing and Variance Analysis Case Study - 2Document17 pagesStandard Costing and Variance Analysis Case Study - 2Gauri SinghNo ratings yet

- Standard CostingDocument41 pagesStandard CostingMRIDUL GOELNo ratings yet

- Variance Analysis - Patubo, Ma. Angelli M.Document21 pagesVariance Analysis - Patubo, Ma. Angelli M.Ma Angelli PatuboNo ratings yet

- Standard Costing: Variance AnalysisDocument3 pagesStandard Costing: Variance AnalysisVIHARI DNo ratings yet

- Chapter 03Document74 pagesChapter 03Kent Raysil PamaongNo ratings yet

- Material Labour Overhead Cost VarianceDocument15 pagesMaterial Labour Overhead Cost VarianceSandhya RajNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 5Document5 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 5LaVida LocaNo ratings yet

- Variance Analysis With The Reasons of VariancesDocument19 pagesVariance Analysis With The Reasons of Variancesmohamed Suhuraab100% (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- CH1 7Document224 pagesCH1 7Nikita Singh DhamiNo ratings yet

- Beyond Cops and Robbers - The Contextual Challenge Driving The Multinational Corporation Public Crisis in China and RussiaDocument11 pagesBeyond Cops and Robbers - The Contextual Challenge Driving The Multinational Corporation Public Crisis in China and RussiaNikita Singh DhamiNo ratings yet

- 79696Document25 pages79696Nikita Singh DhamiNo ratings yet

- Solutions To Questions Due On 17th Dec.2014Document5 pagesSolutions To Questions Due On 17th Dec.2014Nikita Singh DhamiNo ratings yet

- An Empirical Investigation On Firms' Proactive and Passive Motivation For Bribery in ChinaDocument13 pagesAn Empirical Investigation On Firms' Proactive and Passive Motivation For Bribery in ChinaNikita Singh DhamiNo ratings yet

- Solutions To Questions Due On 19th Dec. 2014Document5 pagesSolutions To Questions Due On 19th Dec. 2014Nikita Singh DhamiNo ratings yet

- Solutions To Questions Due On 12 Dec 2014Document4 pagesSolutions To Questions Due On 12 Dec 2014Nikita Singh DhamiNo ratings yet

- Solutions To Questions Due On 15 Dec.Document3 pagesSolutions To Questions Due On 15 Dec.Nikita Singh DhamiNo ratings yet

- Solutions To Questions Due On 10 Dec 2014Document3 pagesSolutions To Questions Due On 10 Dec 2014Nikita Singh DhamiNo ratings yet

- Global Business NotesDocument25 pagesGlobal Business NotesNikita Singh DhamiNo ratings yet

- How To Analyse A Case StudyDocument11 pagesHow To Analyse A Case StudyNikita Singh DhamiNo ratings yet

- Ch19 Management Accounting 5eDocument10 pagesCh19 Management Accounting 5eNikita Singh DhamiNo ratings yet

- Ch18 Management Accounting 5eDocument9 pagesCh18 Management Accounting 5eNikita Singh DhamiNo ratings yet

- Chapter 1 Strategy and Competitive AdvantageDocument157 pagesChapter 1 Strategy and Competitive AdvantageMeha DaveNo ratings yet

- Strategic ManagementDocument157 pagesStrategic ManagementNikita Singh DhamiNo ratings yet

- Doctoral Degree Prestige and The Academic Marketplace A Study of Career Mobility Within The Management Discipline-Web of ScienceDocument16 pagesDoctoral Degree Prestige and The Academic Marketplace A Study of Career Mobility Within The Management Discipline-Web of ScienceNikita Singh DhamiNo ratings yet

- Application For CSPC CET Rev 8Document2 pagesApplication For CSPC CET Rev 8Kein idiyaNo ratings yet

- Ashish ChandrakarDocument2 pagesAshish ChandrakarKulsum ZaweriNo ratings yet

- FMS Admission Brochure 2011Document40 pagesFMS Admission Brochure 2011Manasvi MehtaNo ratings yet

- WWW - Law.cornell - Edu CFR Text 26 1.41-4Document9 pagesWWW - Law.cornell - Edu CFR Text 26 1.41-4Research and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910No ratings yet

- Marginal Costing ProjectDocument27 pagesMarginal Costing ProjectMeerarose travlsNo ratings yet

- Introduction to HRM ConceptsDocument49 pagesIntroduction to HRM Conceptsraazoo19No ratings yet

- BMC Ent300Document9 pagesBMC Ent300Aimi Rozelan100% (3)

- Unit-4 Strategy Implementation: Dr. Prashant B. KalaskarDocument170 pagesUnit-4 Strategy Implementation: Dr. Prashant B. KalaskarAdil Bin KhalidNo ratings yet

- Master AccountingDocument12 pagesMaster Accountingyeshi janexoNo ratings yet

- Basic Cost Accounting Notes TermsDocument89 pagesBasic Cost Accounting Notes TermsAbdulWahab100% (7)

- Farook Institute of Management Studies: Project OrientationDocument13 pagesFarook Institute of Management Studies: Project OrientationAshwinPrinceNo ratings yet

- Bba I Semester Important QuestionsDocument4 pagesBba I Semester Important QuestionsSadhi KumarNo ratings yet

- Cost Accounting BookDocument197 pagesCost Accounting Booktanifor100% (3)

- PMP Examination Preparatory Course Topic: Project Procurement ManagementDocument46 pagesPMP Examination Preparatory Course Topic: Project Procurement ManagementAshraf MansourNo ratings yet

- Electronic Transcript Management SystemDocument5 pagesElectronic Transcript Management SystemATSNo ratings yet

- SNIUKAS, Marc - How To Make Business Model Innovation HappenDocument28 pagesSNIUKAS, Marc - How To Make Business Model Innovation HappenRildo Polycarpo OliveiraNo ratings yet

- Iso 9001-2015 Clause 7 SupportDocument14 pagesIso 9001-2015 Clause 7 SupportalexrferreiraNo ratings yet

- Principles of Marketing Chapter 7 NotesDocument12 pagesPrinciples of Marketing Chapter 7 Notessam williamNo ratings yet

- ISO 17025 vs ISO 10012 calibration standardsDocument3 pagesISO 17025 vs ISO 10012 calibration standardscarlosalejo100% (1)

- Djurdjevic DraganDocument164 pagesDjurdjevic DraganNebojša PerišićNo ratings yet

- CV - Omid KhodadadfarDocument4 pagesCV - Omid KhodadadfarGurvir SinghNo ratings yet

- Chapter 2-Culture and Corporate StrategyDocument16 pagesChapter 2-Culture and Corporate StrategyNor LailyNo ratings yet

- 6.MAF 603 CH 10 - Mergers, Acquisitions and DivestituresDocument45 pages6.MAF 603 CH 10 - Mergers, Acquisitions and DivestituresSullivan LyaNo ratings yet

- OM Course Outline 2021-22 v1Document6 pagesOM Course Outline 2021-22 v1BhavnaNo ratings yet

- 07 - Functional Areas of MGT PDFDocument8 pages07 - Functional Areas of MGT PDFRegine MoranNo ratings yet

- Kaizen Workshop As An Important Element of ContinuDocument7 pagesKaizen Workshop As An Important Element of ContinuIvica KorenNo ratings yet