Professional Documents

Culture Documents

ACC 317 Homework CH 20

Uploaded by

leelee0302Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 317 Homework CH 20

Uploaded by

leelee0302Copyright:

Available Formats

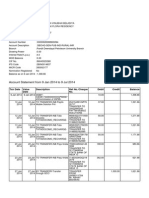

Leah Pasternak Federal Taxation ACC317 Chapter 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization Homework

k Submission

20. Mulberry Corporation cannot recognize any of the realized loss of $75,000 since both shareholders are related parties and own 100% of the stock of Mulberry. Also, the land was transferred to the Mulberry Corporation within the five-year before the liquidation took effect. Because of this, the related-party loss limitation applies to the distribution of the land. Since disqualified property was distributed to related parties, is does not matter that the distribution is considered pro rata. 24 a. The land is disqualified property that is distributed to a related party; thus, the entire $160,000 loss realized is disallowed under the related-party loss limitation. b. The property had a built-in loss of $90,000 when it was transferred to Pink Corporation originally. Since the transfer occurred within 2 years of the date the plan of liquidation was adopted the built-in loss of $90,000 is disallowed. The remaining $130,000 loss can be recognized. Because Paul owns only 15% he is considered an unrelated party therefore, the related-party loss limitation does not apply to a distribution to him. Pink Corporation needs to establish a solid business reason for the transfer of the property to the corporation and see if they can rebut the 2-year presumption rule, that way the entire $220,000 loss would be recognized. c. The loss on the property distributed to Maria will be disallowed in its entirety because it is a distribution of disqualified property to a related party. Unless Pink Corporation can rebut the presumption of a tax avoidance purpose for the transfer, an additional $13,500 of the loss will be disallowed. $19,500 of the loss will still be recognized from the post transfer loss amount. Pink Corporation needs to rebut the 2-year presumption rule so that $33,000 of the loss can be recognized. d. The loss on the distribution of disqualified property to Maria will be disallowed due to the related party loss limitation. Of the remaining $120,000 loss, 50% of the built-in loss of $90,000 will be disallowed unless Pink Corporation can demonstrate a business purpose for the transfer. If Pink can rebut the 2-year presumption rule, $120,000 of the loss distribution to Paul can be recognized. e. If Pink Corporation cannot show a business purpose for the transfer then the built-in loss of $90,000 would be disallowed. The remaining $130,000 loss can be recognized. If Pink can rebut the 2year presumption rule, the entire $220,000 loss would be recognized. The related-party loss limitation does not apply to a sale of property. 25. Scarlet Corporation will recognize a long-term capital gain of $35,000 on the liquidating distribution of land. Jake will recognize a long-term capital gain of $365,000. 29. Green Corporation recognizes no gain on the transfer of the land. Transfers by a subsidiary corporation pursuant to a 332 liquidation are subject to the non-recognition rules of 337. Orange Corporation, however, will recognize a loss of $50,000.

32. Beths basis in her original Cerise stock would carry over after the consolidation with Pink Corporation, so her new basis would be $160,000. Normally there is no realized gain or loss when exchanging stock during a consolidation however, Beth would have to treat the $200,000 bond as boot and would therefore realize a gain of $40,000.

You might also like

- ACC403 Homework Chapter 7-8 ProblemsDocument2 pagesACC403 Homework Chapter 7-8 Problemsleelee0302No ratings yet

- Chapter 14 QuizDocument4 pagesChapter 14 Quizleelee0302No ratings yet

- ACC 403 Homework CH 10 and 11Document5 pagesACC 403 Homework CH 10 and 11leelee0302100% (1)

- ACC 403 Homework CH 3 and 4Document5 pagesACC 403 Homework CH 3 and 4leelee0302No ratings yet

- ACC 410 Homework CH 1Document2 pagesACC 410 Homework CH 1leelee0302100% (1)

- Week 7 Homework Problems & AnswersDocument4 pagesWeek 7 Homework Problems & Answersleelee0302No ratings yet

- AllligDJDent:Week 4 HomeworkDocument14 pagesAllligDJDent:Week 4 Homeworkleelee0302No ratings yet

- Equity Investment and Impairment at AmazonDocument7 pagesEquity Investment and Impairment at Amazonleelee0302No ratings yet

- Federal Taxation Week 9 AssignmentDocument7 pagesFederal Taxation Week 9 Assignmentleelee0302No ratings yet

- Chapter 14 QuizDocument4 pagesChapter 14 Quizleelee0302No ratings yet

- CH 6 Cost AccountingDocument4 pagesCH 6 Cost Accountingleelee0302No ratings yet

- Chapter 4 Question 3Document3 pagesChapter 4 Question 3leelee0302No ratings yet

- Cost AccountingDocument4 pagesCost Accountingleelee0302No ratings yet

- Chapter 6 Cost AccountingDocument11 pagesChapter 6 Cost Accountingleelee0302No ratings yet

- ACC410 CH 10 QuizDocument8 pagesACC410 CH 10 Quizleelee0302No ratings yet

- Week 3 Solutions and Consolidated Balance SheetsDocument6 pagesWeek 3 Solutions and Consolidated Balance Sheetsleelee0302No ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- Advanced Accounting Chapter 5Document21 pagesAdvanced Accounting Chapter 5leelee030275% (4)

- Cost Acct CH 2 HW 2Document2 pagesCost Acct CH 2 HW 2leelee0302No ratings yet

- Test Bank Chapter 11Document25 pagesTest Bank Chapter 11leelee0302No ratings yet

- Chapter 3 Homework Problem 2Document2 pagesChapter 3 Homework Problem 2leelee0302No ratings yet

- Chapter 4 Question 3 DataDocument1 pageChapter 4 Question 3 Dataleelee0302No ratings yet

- Chapter 3 Question 1Document2 pagesChapter 3 Question 1leelee0302No ratings yet

- Cost Acct CH 2 HW 1Document2 pagesCost Acct CH 2 HW 1leelee0302No ratings yet

- ACC410 CH 10 QuizDocument8 pagesACC410 CH 10 Quizleelee0302No ratings yet

- ACC 317 Homework CH 28Document1 pageACC 317 Homework CH 28leelee0302No ratings yet

- ACC 317 Homework CH 25Document1 pageACC 317 Homework CH 25leelee0302No ratings yet

- ACC 410 Homework CH 1Document2 pagesACC 410 Homework CH 1leelee0302100% (1)

- ACC 317 Homework CH 28Document1 pageACC 317 Homework CH 28leelee0302No ratings yet

- Final Exam Part 1Document9 pagesFinal Exam Part 1leelee0302No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CashDocument7 pagesCashhellohello100% (1)

- TellersLogFile Report - 02182023Document1 pageTellersLogFile Report - 02182023GAISANO TAGUM VISMINNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- Tax Compliance and Self-Assessment Models ExploredDocument16 pagesTax Compliance and Self-Assessment Models ExploredarekdarmoNo ratings yet

- I941 INSTRUCTIONS 2019 PDFDocument12 pagesI941 INSTRUCTIONS 2019 PDFH126 IN5No ratings yet

- Tax, Budget, InterstDocument10 pagesTax, Budget, InterstNegese MinaluNo ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- GSTDocument40 pagesGSTdurairajNo ratings yet

- How To Setup EBTax So Tax Is Calculated On Payables InvoiceDocument21 pagesHow To Setup EBTax So Tax Is Calculated On Payables InvoiceFajar S YogiswaraNo ratings yet

- Haryana CST Return Format Form - 1Document2 pagesHaryana CST Return Format Form - 1Virender SainiNo ratings yet

- Account Statement SummaryDocument5 pagesAccount Statement SummaryManthan BeladiyaNo ratings yet

- Invoice20200845240058CBN4514017082045 24005 8Document1 pageInvoice20200845240058CBN4514017082045 24005 8Ayu MangNo ratings yet

- Accounting Entries Under GSTDocument6 pagesAccounting Entries Under GSTmadhu100% (1)

- Pan-Aarca9082e Pan-Aarca9082eDocument4 pagesPan-Aarca9082e Pan-Aarca9082eDilip KumarNo ratings yet

- Conventional RatesDocument1 pageConventional RatesRiaz AhmedNo ratings yet

- Withholding Tax PPT PresentationDocument16 pagesWithholding Tax PPT PresentationClyde Louis Oliver-Linag100% (1)

- Telugu and I HaveDocument7 pagesTelugu and I HaveSunidhi KNo ratings yet

- Substantive Test: of TransactionsDocument56 pagesSubstantive Test: of Transactionsjoza100% (1)

- Cir Vs Central Luzon Drug CorporationDocument2 pagesCir Vs Central Luzon Drug CorporationVincent Quiña Piga71% (7)

- Ethiopia's Federal Tax System ExplainedDocument40 pagesEthiopia's Federal Tax System ExplainedMule AbuyeNo ratings yet

- Tax Law PowerpointDocument7 pagesTax Law PowerpointAbhishekNo ratings yet

- BUSINESS UNIT PAYROLL COMPUTATION (ERT PAYROLL) .XLSX'Document18 pagesBUSINESS UNIT PAYROLL COMPUTATION (ERT PAYROLL) .XLSX'Jane Leona Almosa DaguploNo ratings yet

- Budget & EconomyDocument13 pagesBudget & Economysonu_dpsNo ratings yet

- Airtel Prepaid Payment ReceiptDocument1 pageAirtel Prepaid Payment ReceiptygraoNo ratings yet

- Anak Mami PenangDocument1 pageAnak Mami PenangAnonymous fE2l3DzlNo ratings yet

- G.R. No. 187485 CIR v. San Roque Power CorporationDocument24 pagesG.R. No. 187485 CIR v. San Roque Power CorporationPaul Joshua SubaNo ratings yet

- All-Time High (ATH) - Cryptocurrency Price List - CoinGoLiveDocument1 pageAll-Time High (ATH) - Cryptocurrency Price List - CoinGoLivejorgefkingNo ratings yet

- TransNum - Aug 03 - 210633 PDFDocument2 pagesTransNum - Aug 03 - 210633 PDFDEBASISH MOHANTYNo ratings yet

- Si04253409 4 PDFDocument1 pageSi04253409 4 PDFclintNo ratings yet

- Fees and Commissions Guide For IndividualsDocument29 pagesFees and Commissions Guide For IndividualsDNo ratings yet