Professional Documents

Culture Documents

Suspense Accounts and Error Correction

Uploaded by

AllzoommoodCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suspense Accounts and Error Correction

Uploaded by

AllzoommoodCopyright:

Available Formats

Suspense Accounts and Errors Correction

Introduction A suspense account is a temporary resting place for an entry that will end up somewhere else once its final destination is determined. There are two reasons why a suspense account could be opened: 1. a bookkeeper is unsure where to post an item and enters it to a suspense account pending instructions 2. there is a difference in a trial balance and a suspense account is opened with the amount of the difference so that the trial balance agrees (pending the discovery and correction of the errors causing the difference). This is the only time an entry is made in the records without a corresponding entry elsewhere ( ee e!hibit A). "hen the trial balance does not agree# the amount of the difference is entered in a suspense account. Exhibit A

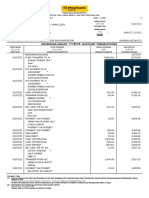

Trial Balance as on 31 December 2005 $r. & 1''#''' 1''#''' %r. & ((#()' *' 1''#'''

Total after all the accounts have been listed uspense account

T pes o! Errors There are two types of errors: (i) +rrors not affecting Trial ,alance Agreement (i.e. total debit - total credit) (ii) +rrors affecting Trial ,alance Agreement (i.e total debit . total credit or total debit / total credit) Treatment: The difference is temporaril entered into 0suspense account1 .

Exhibit B" T pes o! errors

2dentify the following errors whether they affect the trial balance agreement or not. Error t pe Suspense account in#ol#ed$ 1 Error o! %mission 3 a transaction is not recorded at all 2 Error o! commission 3 an item is entered to the correct side of the wrong account (there is a debit and a credit here# so the records balance) +!ample: 5. 6uen paid us by che7ue &1''# correctly entered in the cash book# but it entered wrongly into the account of 5. 6ee. 3 Error o! principle 3 an item is posted to the correct side of the wrong type (nature) of account +!ample: when cash paid for plant repairs (e!pense) is debited to plant account (asset). (errors of principle are really a special case of errors of commission# and once again there is a debit and a credit) & Error o! ori'inal entr 3 an incorrect figure is entered in the records and then posted to the correct account +!ample: %ash 89&1#''' for plant repairs is entered as 89&1'': plant repairs account is debited with 89&1'' 5 Complete (e#ersal o! entries 3 the amount is correct# the accounts used are correct# but the account that should have been debited is credited and vice versa +!ample: "e paid che7ue of &2'' on 2' ;ay 2''< to $.%han. $ebit: ,ank %redit: $. %han 4o 4o 4o 4o 4o

) Compensatin' errors 3 two e7ual and opposite errors leave the trial balance balancing. (this case is rare) +!ample: 5urchases and ales were overstated by &1''. * Addition errors 3 figures are incorrectly added in a ledger account e.g. overcast or undercast + ,ostin' error 3 a) debit but no credit: credit but no debit b) enter a different amount on the debit side from the amount on the credit side. +!ample: cash 89&1'#''' entered in the cash book for the purchase of a car is: a) posted to ;otor cars account as 89&1#''' only# no posted to cash book - Trial balance errors 3 a balance is omitted# posting an amount incorrectly# or posting a balance to wrong side of the trial balance Correctin' errors (2) 3 uspense account not involved

4o

=es =es

=es

+rrors 1 to )# when discovered# will be corrected by means of a >ournal entries between the accounts affected.

T pes o! errors 1 5urchases & 2<' 2<' 1'' 1'' <#<'' <#<'' &

T. 8ung 5urchase of &2<' was omitted# now corrected. 2 5. 6ee 5. 6uen 5urchases entered in wrong personal account# now corrected ? 5lant repairs 5lant @epairs of 5lant were wrongly entered to 5lant account# now corrected.

* 5lant repairs %ash 5ayment of &1#''' incorrectly entered as &1''# now corrected.

('' ('' *'' *'' 1'' 1''

< $. %han ,ank 5ayment of &2'' to $. %han incorrectly credited to his account# and debited to bank. +rror now corrected ) ales 5urchases ales and purchases accounts were overcast by &1''# now corrected.

* For public examinations, narrations are usually not required for this topic.

%lasswork 1. how the >ournal entries necessary to correct the following errors: (4arrations are not re7uired) (i) A sale of goods &)AB to 8. 6uen had been entered in 8. 6uiCs account. (ii) The purchase of a machine on credit from 6. 5o for &*#?(' had been completely omitted from our books. (iii) The purchase of a motor van &?#B'' had been entered in error in the motor e!penses account. (iv) A sale of &221 to %. Dat had been entered in the books# both debit and credit as &212. (v) %ommission received &2<A had been entered in error in the sales account.

%orrecting +rrors (22) 3 uspense account involved +rrors A to B also re7uire >ournal entries to correct them. Ene side of the >ournal entry will be entered to the suspense account opened for the difference in the records. +rror (# trial balance errorsF are different. As the suspense account records the difference# an entry to it is needed# because the error affects the difference. 8owever# there is no ledger entry for the other side of the correction. Enly single entry is needed.

Types of errors B B

+!amples

%orrecting >ournal entries &

A credit sale of &1<' to ;r. %han has been omitted from his account. A sale to %. 6ee for &2<' was correctly entered in the sales book but entered in %. 6eeCs account as &<2'. A credit sale of &1'' has been credited to 8. %heungCs account ales day book was overcast by &2'' ales account was undercast by &*' The total of the sales account of &1#<'' has been omitted from the trial balance The total of the sales account of &1#<'' has been e!tracted as &1#2'' in the trial balance. The total of the sales account of &1#<'' has been e!tracted to the debit column of the trial balance

$r. ;r. %han %r. uspense $r. uspense %r. %. 6ee $r. 8. %heung %r. uspense $r ales %r uspense $r uspense %r ales $r uspense $r. uspense $r uspense (&1#<'' ! 2)

1<' 1<' 2A' 2A' 2'' 2'' 2'' 2'' *' *' 1#<'' ?'' ?#'''

B A A ( ( (

.or /0CEE examinations1 it o!ten re2uires ou to do the !ollo3in' 3 thin's" Sho3 the 4ournal entries to correct the errors Dra3 up the suspense account Sho3 the calculation o! the o! the corrected net pro!it

An illustrati#e example 5in#ol#in' errors 1 6-7 The bookFkeeper of == 6imited e!tracted a trial balance on ?1 $ecember 2'') which failed to agree by &??'# a shortage on the credit side of the trial balance. A suspense account was opened for the difference. 2n Ganuary 2''A the following errors made in 2'') were found: (a) ales day book had been undercast by &1''. (b) ales of &2<' to 9. 8ou had been debited in error to 9. 8ungCs account. (c) @ent account had been undercast by &A'. (d) $iscounts received account had been undercast &?''. (e) The sale of motor vehicle at book value had been credited in error to sales account &?)'. (i) (ii) (iii) how the >ournal entries necessary to correct the errors. (narrations not re7uired) $raw up the suspense account after the errors described have been corrected. 2f the net profit had previously been calculated at &A#('' for the year ended ?1 $ecember 2'')# show the calculation of the corrected net profit.

uggested olutions: (i) == 6imited The 8ournal 5articulars 1. uspense 5 H 6 F ales 2. 9. 8ou 9. 8ung ?. 5 H 6 3 @ent uspense A' A' 2<' 2<' $r 89& 1'' 1'' %r 89&

*. uspense 5 H 6 3 $iscount received <. 5 H 6 3 ales ;otor vehicle ). uspense account $iscount received account (ii) uspense Account 89& 1'' ,al bIf ?'' @ent *''

?'' ?'' ?'' ?'' ?)' ?)'

89& ??' A' *''

ales $iscounts received

(iii) Leave for your own practice. ome hints on preparing suspense accounts

$oes a correction involve the suspense accountJ The type of error determines this. 5ractice and study of +!hibit , should ensure that you see immediately which errors affect the balancing of the records and hence the suspense account. "hich side of the suspense account must an entry goJ This is one of the most awkward problems in preparing suspense accounts. The best way of solving it is to ask yourself which side the entry needs to be on in the other account concerned. The suspense account entry is then obviously to the opposite side. 6ook out for errors with two aspects. An entry has been made to the wrong account# but also to the wrong side of the wrong account. ,oth errors must be corrected. 2t is very easy to fall into the trap of correcting only one of the errors# especially when working 7uickly under e!amination conditions.

Durther 5ractice 89%++ Kuestions: 1((A 89%++ 5ast 5aper Kuestion ? 2''' 89%++ 5ast 5aper Kuestion 1' 2''2 89%++ 5ast 5aper Kuestion <

You might also like

- Tutorial Questions - Suspense and ErrorsDocument4 pagesTutorial Questions - Suspense and ErrorsDebbie DebzNo ratings yet

- 13 Single Entry and Incomplete Records - Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records - Additional ExercisesMei Mei Chan100% (2)

- Level 1 Book Keeping With Logo PDFDocument14 pagesLevel 1 Book Keeping With Logo PDFShwe HtayNo ratings yet

- Incomplete Record - QuestionDocument4 pagesIncomplete Record - QuestionChandran Pachapan100% (3)

- Sales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankDocument10 pagesSales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankUmar SageerNo ratings yet

- Chapter 17 - Control AccountsDocument17 pagesChapter 17 - Control Accountsshemida75% (4)

- Revision Worksheet FundamentalsDocument2 pagesRevision Worksheet Fundamentalssshyam3100% (1)

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Incomplete RecordsDocument27 pagesIncomplete RecordsSteven Raintung0% (1)

- Ch2 Control AccountsDocument21 pagesCh2 Control AccountsahmadNo ratings yet

- Accounting Principle Kieso 8e - Ch07Document30 pagesAccounting Principle Kieso 8e - Ch07Sania M. JayantiNo ratings yet

- What is a Control AccountDocument2 pagesWhat is a Control AccountVicky Lawson100% (3)

- ACCOUNTING CONTROL ACCOUNTSDocument8 pagesACCOUNTING CONTROL ACCOUNTSMehereen AubdoollahNo ratings yet

- 9706 Y16 SP 3Document10 pages9706 Y16 SP 3Wi Mae RiNo ratings yet

- Control AccountsDocument22 pagesControl AccountsLorato Tunah Mokibito100% (1)

- Errors Suspense AccountDocument21 pagesErrors Suspense AccountShayan KhanNo ratings yet

- Accounting Problem Book 2011 PDFDocument103 pagesAccounting Problem Book 2011 PDFViệt Đức Lê67% (3)

- Level 12 Text Update June 20211Document110 pagesLevel 12 Text Update June 20211Swe Zin Thet100% (2)

- Control Account Reconciliation StatementDocument8 pagesControl Account Reconciliation StatementVinay JugooNo ratings yet

- Control Accounts: Check Accuracy of LedgersDocument13 pagesControl Accounts: Check Accuracy of LedgersLathifa Sykes100% (1)

- Petty Cash Book BDocument15 pagesPetty Cash Book Bgnanaselvi88No ratings yet

- Chapter17 Incomplete RecordsDocument24 pagesChapter17 Incomplete Recordsmustafakarim100% (1)

- LCCI L2 Bookkeeping and Accounting ASE20093 Jan 2017Document16 pagesLCCI L2 Bookkeeping and Accounting ASE20093 Jan 2017chee pin wongNo ratings yet

- Accounting Notes PDFDocument129 pagesAccounting Notes PDFLeeroy Gift100% (1)

- Reporting and Analyzing Receivables Answers To QuestionsDocument57 pagesReporting and Analyzing Receivables Answers To Questionsislandguy19100% (3)

- Fa1 PilotDocument14 pagesFa1 PilotMuhammad Yousuf100% (3)

- Igcse Accounting Control Accounts - Questions AnswersDocument24 pagesIgcse Accounting Control Accounts - Questions AnswersOmar WaheedNo ratings yet

- 7110 Specimen Paper 2010 P2msDocument8 pages7110 Specimen Paper 2010 P2msfgaushiya67% (3)

- FA1 Bank ReconciliationDocument4 pagesFA1 Bank Reconciliationamir100% (1)

- Review Questions Volume 1 - Chapter 28Document2 pagesReview Questions Volume 1 - Chapter 28YelenochkaNo ratings yet

- Accounting SolutionsDocument30 pagesAccounting SolutionsmerityesNo ratings yet

- Adjustments for Bad Debts and DiscountsDocument24 pagesAdjustments for Bad Debts and DiscountsMuhammad Adib100% (2)

- Self Balancing Ledger Question BankDocument4 pagesSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- ACCA - F-2 - Managment Accountant Topic-Wise Q & ADocument44 pagesACCA - F-2 - Managment Accountant Topic-Wise Q & Aonthelinealways71% (14)

- FA1 MOCK EXAM CHAPTER 1 To 5Document6 pagesFA1 MOCK EXAM CHAPTER 1 To 5Haris AhnedNo ratings yet

- Chapter 12-Depreciation and Disposal of Non-Current AssetsDocument15 pagesChapter 12-Depreciation and Disposal of Non-Current AssetsJunaid IslamNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Control AccoutsDocument12 pagesControl Accoutssanjayappiah93% (14)

- Bank Reconciliation Statement-2 MCQSFFDDocument11 pagesBank Reconciliation Statement-2 MCQSFFDAbdul Ahad YousafNo ratings yet

- LCCI LEVEL 1&2 TextbookDocument100 pagesLCCI LEVEL 1&2 TextbookJohn Sue Han100% (1)

- Chapter 07 - Fraud, Internal Control, and CashDocument55 pagesChapter 07 - Fraud, Internal Control, and CashDrake Adam100% (1)

- Igcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossDocument42 pagesIgcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossArvind Harrah100% (1)

- Chapter (2) Eg Ex No 1 To 6 AnswersDocument3 pagesChapter (2) Eg Ex No 1 To 6 AnswersJames Milzer100% (1)

- Pearson LCCI Level 2 Certifi Cate in Cost Accounting: Sample Assessment MaterialsDocument47 pagesPearson LCCI Level 2 Certifi Cate in Cost Accounting: Sample Assessment MaterialsPinky PinkyNo ratings yet

- 3.Chapter3-Trial Balance and Correction of ErrorsDocument9 pages3.Chapter3-Trial Balance and Correction of ErrorsAhmad ShahNo ratings yet

- Ca Q&a Dec 2018 PDFDocument392 pagesCa Q&a Dec 2018 PDFBruce GomaNo ratings yet

- Financial AccountingDocument22 pagesFinancial AccountingHoàng Minh Nguyễn100% (2)

- Suspense accounts and error correction guideDocument5 pagesSuspense accounts and error correction guideludin00No ratings yet

- Suspense AccDocument4 pagesSuspense AccAhmad Hafid HanifahNo ratings yet

- Examining suspense accounts and error correctionDocument12 pagesExamining suspense accounts and error correctionocalmaviliNo ratings yet

- Question What Could Be The Probable Reason For Not Showing The Taxes in Project Draft Invoices?Document16 pagesQuestion What Could Be The Probable Reason For Not Showing The Taxes in Project Draft Invoices?rasemahe4No ratings yet

- Control AccoutsDocument7 pagesControl AccoutsJohn Bates BlanksonNo ratings yet

- Control Systems: Errors and Suspense AccountsDocument12 pagesControl Systems: Errors and Suspense AccountskeishaNo ratings yet

- Theory of Correction of Errors and The Suspense AccountDocument3 pagesTheory of Correction of Errors and The Suspense AccountYcarta SleumasNo ratings yet

- Glossary of Terms Chapter 2 Accounting RecordsDocument18 pagesGlossary of Terms Chapter 2 Accounting RecordsallthefreakypeopleNo ratings yet

- Errors Not Affecting Trial Balance AgreementDocument4 pagesErrors Not Affecting Trial Balance AgreementTawanda Tatenda HerbertNo ratings yet

- Rowkish Acc Binder UpdatedDocument197 pagesRowkish Acc Binder Updatedjeffmalcon519No ratings yet

- Final Accounts-AdjustmentsDocument197 pagesFinal Accounts-AdjustmentsRaviSankarNo ratings yet

- Control Systems PDFDocument12 pagesControl Systems PDFtylerNo ratings yet

- Suspense Accounts and Error CorrectionDocument5 pagesSuspense Accounts and Error CorrectionNozimanga ChiroroNo ratings yet

- Control Account & ReconciliationDocument2 pagesControl Account & ReconciliationnjoharaNo ratings yet

- Correction of ErrorsDocument32 pagesCorrection of ErrorsAllzoommood100% (2)

- Chapter 8 Control AccountsDocument11 pagesChapter 8 Control AccountsAllzoommoodNo ratings yet

- Financial Accounting Study ManualDocument311 pagesFinancial Accounting Study ManualLuke Shaw100% (3)

- L5 ManAc Manual Advance EditionDocument310 pagesL5 ManAc Manual Advance EditionEbooks Prints0% (1)

- KBTU ENG 210 IELTS Exam RequirementsDocument1 pageKBTU ENG 210 IELTS Exam RequirementsAllzoommoodNo ratings yet

- 03 Intro To AccountingDocument407 pages03 Intro To AccountingAllzoommood100% (3)

- CLP Brochure EuropeDocument4 pagesCLP Brochure EuropeAllzoommoodNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Visa Copy and EditDocument3 pagesVisa Copy and Editbookhunter01No ratings yet

- Chit Fund CompanyDocument34 pagesChit Fund CompanyPARAS JAINNo ratings yet

- Presentation On ICICI Bank.Document16 pagesPresentation On ICICI Bank.minhaz4uNo ratings yet

- Notice: Premerger Notification Waiting Periods Early TerminationsDocument4 pagesNotice: Premerger Notification Waiting Periods Early TerminationsJustia.comNo ratings yet

- MBBsavings - 164017 212412 - 2022 07 31 PDFDocument3 pagesMBBsavings - 164017 212412 - 2022 07 31 PDFAdeela fazlinNo ratings yet

- Not So Far From Crypto: Bitcoin National TelevisionDocument2 pagesNot So Far From Crypto: Bitcoin National Televisionong0625No ratings yet

- 60 Amada Resterio Vs PeopleDocument2 pages60 Amada Resterio Vs PeopleGSS100% (1)

- Platni Sistemi Participants ListDocument6 pagesPlatni Sistemi Participants ListKristijan PetrovskiNo ratings yet

- Real Estate TerminologyDocument7 pagesReal Estate TerminologyriaheartsNo ratings yet

- Citibank Government Travel Card Program Change FormDocument4 pagesCitibank Government Travel Card Program Change FormcskjainNo ratings yet

- Project Proposal DraftDocument12 pagesProject Proposal DraftraderpinaNo ratings yet

- Union Bank Credit Appraisal Project ReportDocument43 pagesUnion Bank Credit Appraisal Project Reportkamdica42% (12)

- Rebuilding Zimbabwe's Microfinance SectorDocument25 pagesRebuilding Zimbabwe's Microfinance SectorBengt PostNo ratings yet

- Citi Statement Jan 2023Document5 pagesCiti Statement Jan 2023Neeraj_Kumar_Agrawal80% (5)

- Guide LebanonDocument71 pagesGuide LebanonRabih DabajiNo ratings yet

- 5 6125287842781331528Document15 pages5 6125287842781331528Anuj SaxenaNo ratings yet

- Chapter-1 The Indian Contract Act, 1872Document39 pagesChapter-1 The Indian Contract Act, 1872Vishal GattaniNo ratings yet

- Dishonour of ChequeDocument21 pagesDishonour of ChequeratnapraNo ratings yet

- The Global Economic Crisis - Let It Develop Not Destroy YouDocument10 pagesThe Global Economic Crisis - Let It Develop Not Destroy YouAngelina LazarNo ratings yet

- Fixed Deposits - January 17 2019Document1 pageFixed Deposits - January 17 2019Tiso Blackstar GroupNo ratings yet

- Aug'18Document1 pageAug'18shakeel aftab100% (1)

- Ifr Magazine 2019 No 2289 June 22 PDFDocument114 pagesIfr Magazine 2019 No 2289 June 22 PDFИрина ДубовскаяNo ratings yet

- Weekly Oneliner 15th To 21th Feb Gradeup - PDF 63Document9 pagesWeekly Oneliner 15th To 21th Feb Gradeup - PDF 63Sukant MakhijaNo ratings yet

- Chapter 4Document7 pagesChapter 4Gilang PurwoNo ratings yet

- 2018 List of Lending Companies With CADocument70 pages2018 List of Lending Companies With CARadee King CorpuzNo ratings yet

- 2015-Investment and Wealth ManagementDocument127 pages2015-Investment and Wealth ManagementJuan David RugeNo ratings yet

- Colinares Vs CADocument2 pagesColinares Vs CARyD100% (1)

- ABM+2 Learning+Material+No.+4Document3 pagesABM+2 Learning+Material+No.+4Gelesabeth GarciaNo ratings yet

- HadeesDocument7 pagesHadeesSyed QuadriNo ratings yet