Professional Documents

Culture Documents

Capital Structure

Uploaded by

Adeem AshrafiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Structure

Uploaded by

Adeem AshrafiCopyright:

Available Formats

CAPITAL STRUCTURE

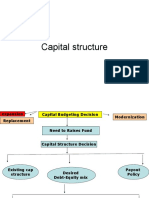

MEANING OF CAPITAL STRUCTURE Capital structure refers to the kinds of securities and the proportionate amounts that make up capitalization. It is the mix of different sources of long-term sources such as equity shares, preference shares, debentures, long-term loans and retained earnings. The term capital structure refers to the relationship between the various long-term source financing such as equity capital, preference share capital and debt capital. Deciding the suitable capital structure is the important decision of the financial management because it is closely related to the value of the firm. Capital structure is the permanent financing of the company represented primarily by long-term debt and equity. DEFINITION OF CAPITAL STRUCTURE The following definitions clearly initiate, the meaning and objective of the capital structures. According to the definition of Gerestenbeg, Capital Structure of a company refers to the composition or make up of its capitalization and it includes all long -term capital resources. According to the definition of James C. Van Horne, The mix of a firms permanent long-term financing represented by debt, preferred stock, and common stock equity. According to the definition of Presana Chandra, The composition of a firms financing consists of equity, preference, and debt. According to the definition of R.H. Wessel, The long term sources of fund employed in a business enterprise. FINANCIAL STRUCTURE The term financial structure is different from the capital structure. Financial structure shows the pattern total financing. It measures the extent to which total funds are available to finance the total assets of the business. Financial Structure = Total liabilities Or Financial Structure = Capital Structure + Current liabilities. The following points indicate the difference between the financial structure and capital structure.

OPTIMUM CAPITAL STRUCTURE Optimum capital structure is the capital structure at which the weighted average cost of capital is minimum and thereby the value of the firm is maximum. Optimum capital structure may be defined as the capital structure or combination of debt and equity, that leads to the maximum value of the firm. Objectives of Capital Structure Decision of capital structure aims at the following two important objectives: 1. Maximize the value of the firm. 2. Minimize the overall cost of capital. Forms of Capital Structure Capital structure pattern varies from company to company and the availability of finance. Normally the following forms of capital structure are popular in practice. 1. Equity shares only. 2. Equity and preference shares only. 3. Equity and Debentures only. 4. Equity shares, preference shares and debentures. FACTORS DETERMINING CAPITAL STRUCTURE (1) Minimization of Risk: (a) Capital structure must be consistent with business risk. (b) It should result in a certain level of financial risk. (2) Control: It should reflect the managements philosophy of control over the firm. (3) Flexibility: It refers to the ability of the firm to meet the requirements of the changing situations. (4) Profitability: It should be profitable from the equity shareholders point of view.

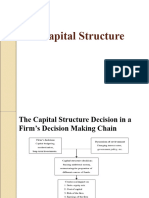

(5) Solvency: The use of excessive debt may threaten the solvency of the company. (6)Leverage: It is the basic and important factor, which affect the capital structure. It uses the fixed cost financing such as debt, equity and preference share capital. It is closely related to the overall cost of capital. (7)Cost of Capital: Cost of capital constitutes the major part for deciding the capital structure of a firm. Normally long- term finance such as equity and debt consist of fixed cost while mobilization. When the cost of capital increases, value of the firm will also decrease. Hence the firm must take careful steps to reduce the cost of capital. (a) Nature of the business: Use of fixed interest/dividend bearing finance depends upon the nature of the business. If the business consists of long period of operation, it will apply for equity than debt, and it will reduce the cost of capital. (b) Size of the company: It also affects the capital structure of a firm. If the firm belongs to large scale, it can manage the financial requirements with the help of internal sources. But if it is small size, they will go for external finance. It consist of high cost of capital. (c) Legal requirements: Legal requirements are also one of the considerations while dividing the capital structure of a firm. For example, banking companies are restricted to raise funds from some sources. (d) Requirement of investors: In order to collect funds from different type of investors, it will be appropriate for the companies to issue different sources of securities. (8)Government policy: Promoter contribution is fixed by the company Act. It restricts to mobilize large, longterm funds from external sources. Hence the company must consider government policy regarding the capital structure. PROCESS OF CAPITAL STRUCTURE DECISIONS

CAPITAL STRUCTURE THEORIES Capital structure is the major part of the firms financial decision which affects the value of the firm and it leads to change EBIT and market value of the shares. There is a relationship among the capital structure, cost of capital and value of the firm. The aim of effective capital structure is to maximize the value of the firm and to reduce the cost of capital. There are two major theories explaining the relationship between capital structure, cost of capital and value of the firm.

NET INCOME (NI) APPROACH Net income approach suggested by the Durand. According to this approach, the capital structure decision is relevant to the valuation of the firm. In other words, a change in the capital structure leads to a corresponding change in the overall cost of capital as well as the total value of the firm. According to this approach, use more debt finance to reduce the overall cost of capital and increase the value of firm. Net income approach is based on the following three important assumptions: 1. There are no corporate taxes. 2. The cost debt is less than the cost of equity. 3. The use of debt does not change the risk perception of the investor. Where: V = S+B V = Value of firm S = Market value of equity B = Market value of debt Market value of the equity can be ascertained by the following formula:

Where NI = Earnings available to equity shareholder & Ke = Cost of equity/equity capitalization rate NET OPERATING INCOME (NOI) APPROACH Another modern theory of capital structure, suggested by Durand. This is just the opposite to the Net Income approach. According to this approach, Capital Structure decision is irrelevant to the valuation of the firm. The market value of the firm is not at all affected by the capital structure changes. According to this approach, the change in capital structure will not lead to any change in the total value of the firm and market price of shares as well as the overall cost of capital. NI approach is based on the following important assumptions; 1. The overall cost of capital remains constant; 2. There are no corporate taxes; 3. The market capitalizes the value of the firm as a whole; Value of the firm (V) can be calculated with the help of the following formula

Where, V = Value of the firm EBIT = Earnings before interest and tax Ko = Overall cost of capital MODIGLIANI AND MILLER APPROACH Modigliani and Miller approach states that the financing decision of a firm does not affect the market value of a firm in a perfect capital market. In other words MM approach maintains that the average cost of capital does not change with change in the debt weighted equity mix or capital structures of the firm. Modigliani and Miller approach is based on the following important assumptions: 1. There is a perfect capital market. 2. There are no retained earnings. 3. There are no corporate taxes. 4. The investors act rationally. 5. The dividend payout ratio is 100%. 6. The business consists of the same level of business risk. Value of the firm can be calculated with the help of the following formula:

Where EBIT = Earnings before interest and tax Ko = Overall cost of capital t = Tax rate

ARBITRAGE PROCESS According to M M, two firms identical in all respects except their capital structure, cannot have different market values or different cost of capital. In case, these firms have different market values, the arbitrage will take place and equilibrium in market values is restored in no time. Arbitrage process refers to switching of investment from one firm to another. When market values are different, the investors will try to take advantage of it by selling their securities with high market price and buying the securities with low market price. Because of this arbitrage process, the market price of securities in higher valued market will come down and the market price of securities in the lower valued market will go up, and this switching process is continued until the equilibrium is established in the market values. So, M M, argue that there is no possibility of different market values for identical firms. TRADITIONAL APPROACH It is the mix of Net Income approach and Net Operating Income approach. Hence, it is also called as intermediate approach. According to the traditional approach, mix of debt and equity capital can increase the value of the firm by reducing overall cost of capital up to certain level of debt. Traditional approach states that the Ko decreases only within the responsible limit of financial leverage and when reaching the minimum level, it starts increasing with financial leverage. Assumptions Capital structure theories are based on certain assumption to analysis in a single andconvenient manner: There are only two sources of funds used by a firm; debt and shares. The firm pays 100% of its earning as dividend. The total assets are given and do not change. The total finance remains constant. The operating profits (EBIT) are not expected to grow. The business risk remains constant. The firm has a perpetual life. The investors behave rationally.

You might also like

- FM S5 Capitalstructure TheoriesDocument36 pagesFM S5 Capitalstructure TheoriesSunny RajoraNo ratings yet

- Capital StructureDocument23 pagesCapital StructureDrishti BhushanNo ratings yet

- Corporate FinanceDocument18 pagesCorporate FinanceNishakdasNo ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMathilda UllyNo ratings yet

- Buyback of SharesDocument8 pagesBuyback of SharesBabitaKakkar100% (1)

- 12 Main Objectives of National Wage Policy in IndiaDocument3 pages12 Main Objectives of National Wage Policy in IndiaDhaval ThakorNo ratings yet

- Naresh Chandra Committe, PresentationDocument14 pagesNaresh Chandra Committe, Presentationrjruchirocks100% (9)

- Narayan Murthy Committee Report 2003Document12 pagesNarayan Murthy Committee Report 2003Gaurav Kumar50% (2)

- Capital Structure Capital StructureDocument34 pagesCapital Structure Capital StructureREEN RIO100% (1)

- Clause - 49Document18 pagesClause - 49Manish AroraNo ratings yet

- Capital Budgeting NotesDocument46 pagesCapital Budgeting NotesShilpa Arora NarangNo ratings yet

- Notes On Capital Structure PDFDocument9 pagesNotes On Capital Structure PDFRahamat Ali Sardar83% (12)

- List of Topics For Cost Accounting Assignments - Sem V - AY 2021-22-1Document2 pagesList of Topics For Cost Accounting Assignments - Sem V - AY 2021-22-1Manan Shah0% (1)

- Cost of Capital: Vivek College of CommerceDocument31 pagesCost of Capital: Vivek College of Commercekarthika kounderNo ratings yet

- Income From Salary Final SEM 3Document49 pagesIncome From Salary Final SEM 3Baleshwar ChauhanNo ratings yet

- Income Tax Planning Related Bonus ShareDocument14 pagesIncome Tax Planning Related Bonus Sharealokshri25100% (2)

- Leverage PPTDocument13 pagesLeverage PPTamdNo ratings yet

- Capital StructureDocument41 pagesCapital StructuremobinsaiNo ratings yet

- Chapter 2 - Profit Prior To Incorporation NEW v2Document15 pagesChapter 2 - Profit Prior To Incorporation NEW v2SonamNo ratings yet

- Financial ManagementDocument17 pagesFinancial ManagementANAND100% (1)

- Solved Problems Cost of CapitalDocument16 pagesSolved Problems Cost of CapitalPrramakrishnanRamaKrishnan0% (1)

- Sales MaximizationDocument8 pagesSales Maximizationbsreddy12-1No ratings yet

- Presentation on Amalgamation and Merger of BanksDocument14 pagesPresentation on Amalgamation and Merger of BanksKrishnakant Mishra100% (1)

- Capital StructureDocument33 pagesCapital StructurezewdieNo ratings yet

- Capital Structure TheoriesDocument2 pagesCapital Structure TheoriesTHEOPHILUS ATO FLETCHERNo ratings yet

- Financing Decisions and Capital Structure OptimizationDocument2 pagesFinancing Decisions and Capital Structure OptimizationTitus ClementNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsSugandhaShaikh0% (1)

- EBIT EPS AnalysisDocument17 pagesEBIT EPS AnalysisAditya GuptaNo ratings yet

- Cost of Capital: Concept, Components, Importance, Example, Formula and SignificanceDocument72 pagesCost of Capital: Concept, Components, Importance, Example, Formula and SignificanceRamya GowdaNo ratings yet

- Working Capital Requirement QuestionsDocument2 pagesWorking Capital Requirement QuestionsVIRAL DOSHI100% (1)

- B.Com. Degree Exam Income Tax PaperDocument0 pagesB.Com. Degree Exam Income Tax PaperbkamithNo ratings yet

- Lease vs Buy Machinery: 6 Factors to ConsiderDocument2 pagesLease vs Buy Machinery: 6 Factors to Consider29_ramesh17050% (2)

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- Module 2.1-Cost of CapitalDocument12 pagesModule 2.1-Cost of CapitalBheemeswar ReddyNo ratings yet

- 19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopeDocument8 pages19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopePriya KudnekarNo ratings yet

- Auditing Standards in IndiaDocument8 pagesAuditing Standards in IndiaInderdeep SharmaNo ratings yet

- Capital Structure Theory - MM ApproachDocument2 pagesCapital Structure Theory - MM ApproachSigei Leonard100% (1)

- Pricing Decision ReportDocument36 pagesPricing Decision ReportGirlie MazonNo ratings yet

- Responsibility Accounting Explained: Cost, Profit, Investment & Revenue CentersDocument17 pagesResponsibility Accounting Explained: Cost, Profit, Investment & Revenue CentersSangeeta100% (2)

- Optimize Capital Structure for Tax ManagementDocument2 pagesOptimize Capital Structure for Tax ManagementDr Linda Mary Simon100% (1)

- Notes Toredemption of Preference SharesDocument40 pagesNotes Toredemption of Preference Sharesaparna bingiNo ratings yet

- Problems Solved Pay Back PeriodDocument7 pagesProblems Solved Pay Back PeriodAfthab MuhammedNo ratings yet

- Cost of CapitalDocument19 pagesCost of CapitalADITYA KUMARNo ratings yet

- Debentures ProjectDocument28 pagesDebentures ProjectMT RA100% (1)

- Multiplicity of Financial Instruments and Reforms in IndiaDocument30 pagesMultiplicity of Financial Instruments and Reforms in IndiaSarath KumarNo ratings yet

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- 11 Business Studies Notes Ch07 Sources of Business Finance 02Document10 pages11 Business Studies Notes Ch07 Sources of Business Finance 02vichmega100% (1)

- Walter ModelDocument9 pagesWalter Modelshivam7706No ratings yet

- Unit II.2 Capital Structure MainDocument52 pagesUnit II.2 Capital Structure MainDhruv singhNo ratings yet

- Funds Flow and Cash Flow NotesDocument12 pagesFunds Flow and Cash Flow NotesSoumendra RoyNo ratings yet

- Companies Act 2013 - Ppt-1Document21 pagesCompanies Act 2013 - Ppt-1raj kumar100% (2)

- Corporate Tax PlanningDocument21 pagesCorporate Tax Planninggauravbpit100% (3)

- 48 Ty Chap3 MCQDocument18 pages48 Ty Chap3 MCQKadam Kartikesh67% (3)

- Capital Structure Planning: Unit: 3Document46 pagesCapital Structure Planning: Unit: 3Shaifali ChauhanNo ratings yet

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDDocument25 pagesHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313No ratings yet

- FM Capital StructureDocument5 pagesFM Capital Structuremugojulius671No ratings yet

- CH 5Document10 pagesCH 5malo baNo ratings yet

- Capital StructureDocument14 pagesCapital StructureArul Dass0% (1)

- Optimal Capital Structure and Cost ComponentsDocument12 pagesOptimal Capital Structure and Cost ComponentsBhartiNo ratings yet

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDocument11 pagesCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNo ratings yet

- Meaning of LeverageDocument5 pagesMeaning of LeverageAdeem AshrafiNo ratings yet

- Barriers To EntrepreneurshipDocument2 pagesBarriers To Entrepreneurshipanas_786No ratings yet

- MMDocument2 pagesMMAdeem AshrafiNo ratings yet

- Security and Security Market OperationsDocument303 pagesSecurity and Security Market OperationsAdeem AshrafiNo ratings yet

- Types of Business Entities in IndiaDocument5 pagesTypes of Business Entities in IndiaAdeem AshrafiNo ratings yet

- Financial Policy and Strategic PlanningDocument294 pagesFinancial Policy and Strategic PlanningAdeem AshrafiNo ratings yet

- Capital StructureDocument4 pagesCapital StructureAdeem Ashrafi100% (2)

- Risk and UncertainityDocument2 pagesRisk and UncertainityAdeem AshrafiNo ratings yet

- Working CapitalDocument15 pagesWorking CapitalAdeem AshrafiNo ratings yet

- Recent Trends in Financial InnovationDocument5 pagesRecent Trends in Financial InnovationAdeem AshrafiNo ratings yet

- PlanningDocument53 pagesPlanningAdeem AshrafiNo ratings yet

- Dividend DecisionDocument4 pagesDividend DecisionAdeem AshrafiNo ratings yet

- Job DesignDocument3 pagesJob DesignAdeem AshrafiNo ratings yet

- Meaning of StaffingDocument11 pagesMeaning of StaffingAdeem AshrafiNo ratings yet

- The Universal BankingDocument5 pagesThe Universal BankingAdeem AshrafiNo ratings yet

- Entrepreneurial ProcessDocument2 pagesEntrepreneurial ProcessAdeem AshrafiNo ratings yet

- Operations Managemen1Document1 pageOperations Managemen1Adeem AshrafiNo ratings yet

- Working CapitalDocument15 pagesWorking CapitalAdeem AshrafiNo ratings yet

- Institutional Support For New VenturesDocument8 pagesInstitutional Support For New VenturesAdeem AshrafiNo ratings yet

- Meaning of StaffingDocument11 pagesMeaning of StaffingAdeem AshrafiNo ratings yet

- Institutional Support For SSIDocument3 pagesInstitutional Support For SSIAdeem AshrafiNo ratings yet

- Family VentureDocument5 pagesFamily VentureAdeem AshrafiNo ratings yet

- DEPARTMENTATIONDocument1 pageDEPARTMENTATIONAdeem Ashrafi100% (1)

- Hawthorne ExperimentDocument4 pagesHawthorne ExperimentAdeem Ashrafi100% (1)

- DEPARTMENTATIONDocument1 pageDEPARTMENTATIONAdeem Ashrafi100% (1)

- Risk and UncertainityDocument7 pagesRisk and UncertainityAdeem AshrafiNo ratings yet

- Choosing Your Business Organizational StructureDocument3 pagesChoosing Your Business Organizational StructureAdeem Ashrafi100% (1)

- BusinessesDocument4 pagesBusinessesAdeem AshrafiNo ratings yet

- TechnicallyDocument5 pagesTechnicallyAdeem AshrafiNo ratings yet

- Carrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)Document23 pagesCarrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)WerchampiomsNo ratings yet

- BP Investment AppraisalDocument71 pagesBP Investment Appraisalprashanth AtleeNo ratings yet

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDocument3 pagesHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- FEU bonds and stocks valuationDocument7 pagesFEU bonds and stocks valuationAleah Jehan AbuatNo ratings yet

- Trade War Between China and USDocument5 pagesTrade War Between China and USShayan HiraniNo ratings yet

- Study Notes On Financial Statement Analysis PDFDocument2 pagesStudy Notes On Financial Statement Analysis PDFKris ANo ratings yet

- 27 DT Case LawsDocument26 pages27 DT Case LawsVishakha MangtaniNo ratings yet

- MS Tube ManufacturingDocument2 pagesMS Tube ManufacturingDhanraj PatilNo ratings yet

- Real Estate Agent Company ProfileDocument14 pagesReal Estate Agent Company ProfileAkash Ranjan100% (1)

- Investment:: Process of Estimating Return and Risk of A Security Is Known As Security AnalysisDocument76 pagesInvestment:: Process of Estimating Return and Risk of A Security Is Known As Security AnalysisDowlathAhmedNo ratings yet

- MANAGEMENT ADVISORY SERVICES: RECEIVABLEDocument6 pagesMANAGEMENT ADVISORY SERVICES: RECEIVABLEKarlo D. ReclaNo ratings yet

- The Effects of Firm-Specific Factors On The Profitability of Non-Life Insurance Companies in TurkeyDocument20 pagesThe Effects of Firm-Specific Factors On The Profitability of Non-Life Insurance Companies in TurkeyDyenNo ratings yet

- Evidence 7 Workshop Business Plan AnalysisDocument6 pagesEvidence 7 Workshop Business Plan AnalysisFJohana Aponte MorenoNo ratings yet

- My Crusade Against Permanent Gold BackwardationDocument12 pagesMy Crusade Against Permanent Gold BackwardationlarsrordamNo ratings yet

- TS309 - Financial Management EssentialsDocument49 pagesTS309 - Financial Management EssentialsJosephine LalNo ratings yet

- Objectives and Methodology of RSRM Cost StudyDocument46 pagesObjectives and Methodology of RSRM Cost StudySaikat DuttaNo ratings yet

- Public Sector AccountingDocument10 pagesPublic Sector AccountingbillNo ratings yet

- AAPL ReportDocument4 pagesAAPL Reportyovokew738No ratings yet

- A Study On Working Capital Management - AVA Cholayil Health Care Pvt. LTDDocument77 pagesA Study On Working Capital Management - AVA Cholayil Health Care Pvt. LTDRohithNo ratings yet

- Report (PB)Document57 pagesReport (PB)prateekbansal09100% (1)

- Insead Mba Employment Statistics 2010Document27 pagesInsead Mba Employment Statistics 2010ian_plugge817No ratings yet

- Slides Session 1Document41 pagesSlides Session 1Fabio BarbosaNo ratings yet

- Annual Report 2011Document216 pagesAnnual Report 2011shaan_ahNo ratings yet

- Singapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationDocument3 pagesSingapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationWeR1 Consultants Pte LtdNo ratings yet

- Role of Accounting in Economic DevelopmentDocument2 pagesRole of Accounting in Economic DevelopmentMary Ymanuella BorjalNo ratings yet

- Fundraising Techniques and MethodsDocument22 pagesFundraising Techniques and MethodsPratyush GuptaNo ratings yet

- Marketing Sustainable Tourism ProductsDocument42 pagesMarketing Sustainable Tourism ProductsIlkin Guliyev100% (2)

- Inv How-To Manual V Erwin OpallaDocument264 pagesInv How-To Manual V Erwin OpallaBudi SafrudinNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument37 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskMohammed MiftahNo ratings yet

- Earnings Presentation FY24 Q3Document35 pagesEarnings Presentation FY24 Q3Zerohedge JanitorNo ratings yet

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsFrom EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNo ratings yet

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionFrom EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionRating: 5 out of 5 stars5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Will Work for Pie: Building Your Startup Using Equity Instead of CashFrom EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNo ratings yet

- The Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupFrom EverandThe Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupNo ratings yet

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)