Professional Documents

Culture Documents

Asset Accounting Configuration Steps

Uploaded by

cecileekoveCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Accounting Configuration Steps

Uploaded by

cecileekoveCopyright:

Available Formats

Asset Accounting configuration Tangible asset - which can be seen, touched ex: computers, land and building, plant

and machinery etc Intangible Assets - which cannot e seen ex: goodwill, patents etc In Financial accounting module, we have lot of components:

-> General ledger ( FI-G ! -> "ccount receivable (FI-"#! -> "ccounts payable ( FI-"$! -> Fixed assets ( FI-""! %here would be few companies who can implement only asset accounting ( FI-""! and there can be few companies who can implement all the components in the fi module& If you are not implementing FI-"" component, all the asset transactions are posted into the asset G account& 'o asset master record maintained& For ex: when you purchase an asset from a vendor (r "sset Gl account )r *endor account

If you are implementing the FI-"" )omponent, "sset will become a sub ledger, you would have an asset master record and all the asset transactions are posted into the asset master record (in turn the system would update automatically the asset G accounts! For ex: when you are purchasing an asset from a vendor (r "sset master record (asset number! cr vendor account Stage of learning the asset accounting: -> +rgani,ation structure -> )hart of (epreciation -> "sset classes -> "sset master record -

-> $osting the business %ransactions "c.uisition #etirements %ransfers -

-> (epreciation calculation and posting -> #eporting and the closing process -> *alidation and substitution

%he first and the foremost is to understand the org& structure relevant for asset accounting

/ap provides with the minimum structure to be set up to wor0 on the asset accounting -> (efine chart of accounts -> (efine chart of depreciation -> 1oth the chart of accounts and the chart of depreciation should be assigned to the company code -> %hen, add the necessary data for asset accounting -> %hen, you are ready to do the asset accounting in your company code& Observer the figure 5 on the page no.14

!A"T OF A

O#$TS - is a chart specifying the list of all the G "))+2'%/

!A"T OF %&'"& IATIO$: (((((((((((((((((((((( -> )hart of depreciation is a chart specifying the list of all the depreciation areas -> 3ach chart of depreciation is identified by a 4 character alphanumeric 0ey -> /"$ provides with the country specific charts of depreciation& If you want to create your own chart of depreciation, you can also do it by copying an existing one& 5

-> )hart of depreciation is a country specific and it contains lot of depreciation areas -> 3very company code implementing the asset accounting must have one chart of accounts and one chart of depreciation assigned -> +ne chart of accounts can be assigned to several company codes (follows variant principle! -> +ne chart of depreciation can also be assigned to several company codes (follows a variant principle!

-> (epreciation area represents different types of valuations For 3xample: in G#3"% 1#I%"I' %epreciation calculation is )one as per the co*panies Act -+ one )ep area %epreciation calculation is )one as per the inco*e tax act -+another )ep area %epreciation calculation is )one for costing purposes -+ another )ep area

Observer the figure 4 on the page no.1,

3ach dep area represents different type of valuations 3ach dep area results into different balance sheet values and different depreciation area values& (ifferent valuation approaches are used for -> Financial statement for local reporting - for which you want to follow one dep area -> 1alance sheet for tax purposes - another dep area -> Internal accounting (for cost accounting purposes! - another dep area -> $arallel financial reporting as per the 2/ gaap or ifrs - another dep area -> For consolidation in group currency - dep area -> (epreciation area is identified by a 5 digit numeric 0ey -> /"$ provides with the country specific chart of depreciation and also the dep areas in each chart of depreciation& If you want to copy or delete the dep areas, you can also do it& Observer the figure , on the page no.16

ex: )hart of depreciation -(3 - you have lot of dep area "nother chart of depreciation -2/ - you have lot of dep areas

+ut of the several dep areas, dep area 7- is the leading depreciation area& %his is the most important dep area (boo0 dep! - from here, the figures would go into the local financial statements

3xcept 7-, if you want to delete the other dep area, you can do the deletion of other dep areas except 7-&

Step1:

reate a ne. chart of )epreciation b/ cop/ing an existing .O.%

'ath in I01: F" -> "sset "ccounting -> organi,ational structures -> )opy reference chart of depreciation 8depreciation areas clic0 on the cloc0 and the system will pop up a window with the three activities clic0 on the first activity -> )opy reference chart of depreciation (ouble clic0 on this activity "nd then clic0 on the second icon

From which chart of dep (source! 9> -I' %o which chart of dep ( target! -> /+':

%he system would give the message as ;chart of dep -I' copies to /+':< )lic0s enter and then clic0 on completed activities )hart of dep -I' copied to /+':

Step -: hanging the )escription of the chart of )epreciation ((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( $ath in the I=G - it is the same path 4

)lic0 on the second activity -> /pecify the description of chart of depreciation (ouble clic0 on it and then change the description

Step ,: op/2)elete the )epreciation areas (((((((((((((((((((((((((((((((((((((((((( )lic0 on the third activity %he new chart of depreciation is /+': :ou have lot of depreciation areas, I am going to 0eep two dep areas and delete all the remaining dep areas& 7- -> boo0 depreciation -> -> tax depreciation

Step 4: Assign the chart of accounts to the co*pan/ co)e ((((((((((((((((((((((((((((((((((((((((((((((((((((((( $ath in I=G F" -> G "ccounting -> G accounts -> master data -> $reparations 9> "ssign company code to chart of accounts

Step 5: Assign the chart of )epreciation to the co*pan/ co)e (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( $ath in I=G F" -> "sset accounting -> +rgani,ational structures -> "ssign chart of dep to the company code ?hen you are doing this step, you would get an error& %he error is: )ompany code entries for /+': are incomplete& %here are some setting that are missing for doing the asset accounting )hec0 the following settings -> )urrency -> )hart of accounts >

->fiscal year version -> Input tax indicator for non-taxable ac.uisition (this is the pending step!

Step 3: Assign the input tax in)icator for non-taxable ac4uisition (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( /"$ recommend to assign input tax code of 7@ and output tax code of 7@ for the nontaxable ac.uisitions& $ath in I=G Financial accounting -> "sset "ccounting -> integration with the general ledger -> "ssign input tax indicator for non-taxable ac.uisitions )lic0 on the cloc0 and then select your company code +nce you have done this step, then you can assign the chart of depreciation to the company code and then do the step > & Step 5: 'osting to the general le)ger ((((((((((((((((((((((((((((((((((((( )hart of depreciation contains lot of dep area and each depreciation area contains important control settings: -> )ontrols how the posting is done to the general ledger -> *alue maintenance (epreciation areas contains the depreciation attributes8settings $ath in I=G: F" -> "sset "ccounting -> Integration with the general ledger -> (efine how the depreciation areas post to the general ledger )lic0 on the cloc0 and for each dep area, you can see the indicatoG1$& $osting in G controls: 7 -area does not post - - "rea posts in real time 5- "rea posts apc and depreciation periodically 6 - "rea posts depreciation only 4 - "rea posts apc directly and depreciation > - "rea posts apc only A - "rea posts only apc directly A

+ut of the A above, 7,-,5,6 are the most important which you find in real time (ep area 7- -> ?ill always have - (area posts in real time! (ep area -> -> 7 (area does not post!

Select the )ep area an) then clic6 on )etails -+ 7alue *aintenance ", +nly positive values or ,eros allowed 1, only negative values or ,eros allowed ), no values allowed (, all values allowed

/tep B: specifying the financial statement version for asset reports 99999999999999999999999999999999999999999999999999999999999999999999 Financial statement version - formats of the financial statements& I can prepare one financial statement version for companies act "nother financial statement version for income tax purpose +ne more financial statement version for ban0 loans& :ou can prepare several financial statement versions per chart of accounts in the company code& -> If you are having more than one financial statement version, you should have more than one depreciation area& $ath in I=G: F" -> "sset "ccounting -> Integration with the general ledger -> specify the financial statement version for asset reports

/tep C: )reation of financial statement version 99999999999999999999999999999999999999999999999 $ath in I=G F" -> G "ccounting -> 1usiness %ransactions -> )losing -> (ocument -> (efine the financial statement versions )lic0 on the cloc0 and then clic0 on new entries

3ach financial stateme6tn version will have financial statement items and for each financial statement item, assign the G accounts ?e have two financial statement versions -> /+': -> '3"/ Go bac0 to step B, and then assign the financial statement versions to each dep area& Step 18 A: Overvie. an) %efining the Asset classes ((((((((((((((((((((((((((((((((((( Fixed "sset are classified into various asset classes -> $lant and machinery -> Furniture and fixtures -> )omputers "sset classes are created at the client level &this means that you can use the asset classes in any company code& Asset lass have t.o sections

-> =aster data section -> (epreciation area section -> =aster data section ", 'umber ranges 1, /creen layout ), account determination (defining the G accounts! -+ %epreciation area section ", depreciation terms (screen layout! +nce you create an asset class with these two sections, then only you are ready to crate the asset master record in the sap easy access& In other words, you cannot create an asset master record without the asset classes& Observer the figure 1- on the page no.,9 -> "sset class -> "sset master record -> "c.uisition entries B

O0'A$:

O%&: SO$:;$&AS

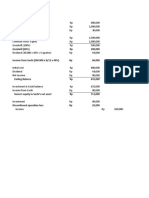

#emember, with the asset accounting -> created a new chart of depreciation by copying an existing chart of depreciation -> changed the description of the chart of depreciation -> copy8deleted depreciation areas (except 7- and ->! -> "ssigned the chart of accounts and the chart of depreciation to the company code -> "ssigned input tax indicator for non taxable transactions (input tax code of 7@ and output tax code of 7@! -> $osting to the general ledger -> /eparate financial statement version for each depreciation area&

Step 18 0ain: reation of $u*ber ranges (((((((((((((((((((((((((((((((((( 'ath in I01 Financial "ccounting -> "sset "ccounting -> organi,ational structures -> "sset )lasses -> (efine 'umber #ange intervals :ou can define the number range with internal or external number assignment Si*pl/ cop/ for* Stan)ar) co*pan/ co)e 1888. Step 11: %efining the screen la/out for the *aster )ata section of the asset *aster recor) (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( ((( $ath in I=G F" -> "" -> =aster data -> /creen layout -> (efine /creen layout for "sset master data In this, we have to two activities )lic0 on the second activity first -> )reate screen layout rules )reate a new screen layout by copying an existing screen layout -> by a 4 character alphanumeric 0ey and description )lic0 on the first activity - (efine the screen layout for the asset master data (ouble clic0 on it C

/elect the screen layout - '3"/ and then on the left side, clic0 on logical field groups Step 1-: %efining the Account %eter*ination ((((((((((((((((((((((((((((((((((((((((((( 'ath in I01 for account determination F" -> ""-> organi,ational structure -> "sset classes -> /pecify the account determination clic0 on the cloc0 and then clic0 on new entries 3nter a 4 character alphanumeric 0ey and short description "ccount determination - '3"/ Step 1,: Assigning the 1< account to the account )eter*ination (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( $ath in I=G F" -> "" -> Integration with the general ledger -> assign G "ccounts )lic0 on the cloc0 and then enter the chart of depreciation /elect the chart of accounts and then on the left side, clic0 on account determination (efine the G accounts for balance sheet accounts, depreciation and special reserves /ince, you are implementing FI-"" component, the asset G account will become a reconciliation account to the asset sub ledger If you post the transactions on the asset master record, the asset G account would get updated automatically& <i6e for exa*: If you are posting on the customer account (debit 8credit side! - the relevant account receivable (reconciliation account! will get updated automatically& /imilarly it is the case with the asset master record and asset G account Once /ou have )efine) all the three settings -> 'umber ranges -> /creen layout -> "ccount determination,

%hen you are ready to create the asset class with the master data section Step 18 1 : reation of Asset classes (((((((((((((((((((((((((((((((((( "sset class li0e an account groups ?hen you are creating a G account, we have > account groups ?hen you are re.uired to create an asset master record, you should have asset classes -7

Fixed "sset are classified into various "sset classes 3xample: )omputer, $lant and =achinery, Furniture and Fixtures etc& Asset class - 'lant an) *achiner/ "sset master records- machinery"sset master record - machinery5 :ou cannot create an asset *aster recor) .ithout asset classes. =h/> ?ecause Asset classes contain i*portant control settings: "sset )lass are created at the client level, it can be used in any company codes&

Asset class contains t.o sections: (((((((((((((((((((((((((((((((((( -> =aster data /ection -> *aluation /ection 0aster )ata section of the Asset class consists of three settings: ((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( -> 'umber #ange (internal or external! -> /creen layout (li0e a field status - which fields are re.uired, which fields are optional etc! -> "ccount determination (assign the G accounts for automatic postings! 7aluation section of the Asset lass contains one settings: ((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( -+ Screen la/out these two sections contains the control parameter and the default values which are copied into the asset master record& "gain, "sset master record is classified into two sections: -> =aster data section -> (epreciation area section %he control parameters and the default values from master data section of the asset class will be copied into the master data section of the asset master record %he control parameters and the default values from the valuation section in the asset class will be copied into the depreciation area section of the asset master record&

--

1efore creating the asset class, you have to create the master data section of the asset class with all the three settings ->'umber ranges -> /creen layout -> "ccount determination %he asset class which I am going to create -> plant and machinery

'ath in I01 F" -> "" -> +rgani,ational /tructures -> "ssets )lasses -> define "sset classes )lic0 on the cloc0 and then clic0 on new entries "sset )lass -> '3"/

Step 14: %efining the screen la/out for the )epreciation area section of the asset 0aster recor) (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( (((((((( 'ath in I01 F" -> "" -> =aster data -> /creen ayout -> (efine the screen layout for the "sset (epreciation areas :ou are creating a new screen layout by copying an existing one for each screen layout, define the field group rules Step 15: %eter*ining the )epreciation areas in the asset classes 99999999999999999999999999999999999999999999999999999999999999999 $ath in I=G F" -> "" -> *aluation -> (etermine the depreciation areas in the asset class )lic0 on the cloc0 /elect the asset class '3"/ "nd then on the left side, clic0 on depreciation area -, #emove the deactivation indicator 5, assign the screen layout '3"/ 6, define the depreciation 0ey ( 7777! :ou have to assign these settings for each depreciation area -5

/o, if you have done up to -> steps, then you are ready to create the asset master record&

$OT&: ?efore )oing AS81 please chec6 follo.ing setting for %ep.6e/ 8888 'ath in I01 Fin& "ccounting asset accounting dep& valuation method dep&0ey maintain dep&0ey clic0 on cloc0 =a0e sure dep&0ey 7777 status is A TI7& If its not active, select row for dep&0ey 7777 and clic0 on above %"1 ")%I*3 and status will change and save it& "&ATIO$ OF T!& ASS&T 0AST&" "& O"%: ((((((((((((((((((((((((((((((((((((

Step 13: reation of asset *aster recor) (((((((((((((((((((((((((((((((((((((((( $ath in 3"/: "))3//: "ccounting -> Financial "ccounting -> Fixed "ssets -> "sset -> create -> "sset

%code -> "/7)hange -> "/75 (isplay -> "/76 %he message is <%he asset -777 7 is created< %he asset -77- 7 is created

?henever you change an asset master record, the system will create a change document& Fro* the *enu bar; clic6 on &nviron*ent -+ change )ocu*ents -+ on asset

!A$1& an) %IS'<A: the asset *aster recor): (((((((((((((((((((((((((((((((((((((((((( )hange - "/75 (isplay - "/76 -6

Step 15: Activating a))itional account assign*ent ob@ects ((((((((((((((((((((((((((((((((((((((((((((((((((((((((( 'ath in I01 F" -> "" -> integration with the general ledger -> "dditional account assignment obEects -> "ctivate account assignment obEects

Step 19: hanging the la/out of the asset *aster recor) (((((((((((((((((((((((((((((((((((((((((((((((((((((((( -> %he no& of tab pages -> %he title of the tab pages -> %he field groups and their position $ath in I=G F" -> "" -> =aster data -> /creen layout -> /pecify the tab layout for the asset master record

Step 1A: 0aintenance levels (((((((((((((((((((((((((((( %he screen layout for the master data section of the asset master record can be maintained at the three levels -+ At the asset class -+ At the *ain asset -+ At the asset sub nu*ber

:ou can create various asset classes -> "sset class for regular asset ($lant and machinery, computers -> "sset class for A# ("sset under construction!

-> "sset class for ow value assets

Step -8: reation of asset class for asset un)er construction BAucC (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((( -4

For example: your company is constructing staff .uarters to the employees and the tenure of the construction is > years& 2ntil the >th year i&e until the construction is completed, it will not be a completed asset (capitali,ed asset! For the first -st > years, it will be considered as "u) asset under construction& "n asset under "u)- no depreciation is charged& :ou would have special tax depreciation at a fixed percentage "t the end of the >th year, when you are doing the capitali,ation, you do settlements&

Step -1: reation of asset class for lo. value assets ((((((((((((((((((((((((((((((((((((((((((((((((((((( Tr/ to )o the exercises fro* page no.4A to 31

ASS&T 0AST&" "& O"% ((((((((((((((((((( %here are two ways of creating the asset master record -> :ou create an asset master record using the asset class or -> :ou can create an asset master record by copying an existing master record (with reference! Observer the figure -, on the page no.3-

"&ATI$1 0#<TI'<& SI0I<A" ASS&T 0AST&" "& O"%S (((((((((((((((((((((((((((((((((((((((((((((( :ou are having > computers and you have to the master record for > computeG1$& "ll the computers have the same settings& Instead of creating it one by one, you can create all the asset record for the > computers at the same time tcode - "/7'o& of similar asset master record - > ->

?hen you clic0 on save, the system will pop up a window to maintain and create )lic0 on =aintain first %hen clic0 on create %he message is : "ssets -775 to -77A have been created 9999999999999999999999999999999999999999999999999999999999999999999999 99999999999

o*pan/ co)e: SO$: In the last session, we have seen how to create the asset master record TI0& %&'&$%&$T %ATA: ((((((((((((((((((((( /ome asset master records may be considered as time -dependent %his because of cost accounting assignments Figure -5 on the page no.34 ?e will see how to create an asset master record on a time dependent basis %he asset 577- 7 is created 2se the tcde "/75 )lic0 on time dependent tab page and then clic0 on more intervals )lic0 on add interval "sset is used in the business area, plant and location 3xample: 1" - -777

$lant - 777> ocation - 2sed from 7-&7-&57-- to 6-&7>&57------------------------------------1" - -777 $lant - 777> ocation - 5 -A

2sed from 7-&7A&57-- to 6-&-5&CCCC 999999999999999999999999999999999999999999999999999999999999999999999 ASS&T S#?$#0?&"S: (((((((((((((((( Figure -A on the page no.33 +ne main asset is classified into various sub numbers ", computer - main asset -> =onitor - sub number -> Fey board - sub number -> )$2 - sub number "sset values can be managed at the sub numbers also& Gow to create an asset master record with the sub numbersH

%he main asset is 5775 For this asset 5775 , I will have three sub numbers From the menu bar, clic0 on "sset -> )reate the sub number 3nter as <'umber of similar sub number as 6< )lic0 on maintain and then clic0 on create %he message is <"ssets 5775 - to 5775 6 have been created< For one main asset, you can create <n< no& +f sub numbeG1$& &xercise fro* page no.3A to 59 9999999999999999999999999999999999999999999999999999999999999999999999 9999999999 2nit 6: 9999999 Asset Transactions -+ Ac4uisition -+ "etire*ents -+ Transfers

-D

A D#ISITIO$S ?hen you are implementing FI-"", asset is a sub ledger i&e you would be posting all the transactions in the asset master record and the system would update the relevant gl accounts lin0ed to the asset master record& Figure ,, on the page no.94 "sset "c.uisition entries can be of three types: 999999999999999999999999999999999999999999999999 1; Asset ac4uisition - .ith integration Bintegrate) .ith the A' co*ponentC %he entry is: (r asset )r vendor

%he relevant G accounting entry is (r "sset G account cr accounts payable account

-; Asset Ac4uisition - .ithout integration B not integrate) .ith the A' co*ponentC %he entry is: (r "sset master record cr asset clearing account

,; Asset ac4uisition - integrate) .ith 00 0o)ule

Figure ,4 on the page no.95 sho.s the )ifferent t/pes of asset ac4uisition. ?hen we discuss about ac.uisition -+ &xternal ac4uisition Bfro* a ven)orC -+ Internal ac4uisition Bin-house pro)uctionC

-B

In-house production -> trac0 all the costs incurred on a product -> create an investment measure (this is done in investment management module! -> settle to "u) -> capitali,e the asset 'ath in eas/ access: Asset ac4uisition (with integration! "ccounting -> F" -> Fixed "ssets -> $osting -> ac.uisition -> 3xternal ac.uisition -> with vendor tco)e - F-A8 The *ost i*portant point: ((((((((((((((((((((((((( ?hen you are posting an ac.uisition entry in the asset line item, there are two important fields -> "sset value date -> %ransaction type Observe the figure ,5 on the page no.93

(r "sset -> in the asset line item -> transaction type and the asset value date )r vendor

Asset value )ate - is the date on which the asset is capitali,ed

Transaction t/pe - specified the type of transactions (whether it is ac.uisition or a retirement or a transfer! you are posting and this would be shown in the asset history sheet Observer the figure ,3 on the page no.95

(r "sset - D7 cr vendor - 6-

trans type

asset value date

%he relevant G account that would get affected are (r "sset G account cr account payable G account

-C

ASS&T &E'<O"&": ((((((((((((((( $ath in easy access: "ccounting -> Financial accounting -> Fixed assets -> "sset -> asset explorer tco)e - "?7-'

Observer the figure ,5 on the page no.95 -> It is a tool which would be display the asset values -> %he asset explorer contains all the functions of the asset value display as well as the option of simulation different dep areas&

-> From here, you can directly go to the FI document -> :ou can also display the asset master data -> :ou can have planned and posted values -> :ou can also ta0e the print outs& -> :ou can view all account assignment obEects lin0ed to the asset master record Observer the figure ,9 on the page no.99

=hen /ou are )oing the first ac4uisition; -> It will update the posting information in the master data section of the asset master record under the general tab page

AC

apitaliFe) on B)erive) fro* the asset value )ateC

?C First ac4uisition on B)erive) fro* the asset value )ateC C Ac4uisition /ear B)erive) fro* the posting )ateC These three fiel)s .oul) be up)ate) -> It will update the ord&dep start date in the depreciation area section of the asset master record AC ord&dep start field %his field would be updated& 57

1ased on the asset value date and the transaction type, the system would update the posting information and the depreciation start date& I0'O"T$AT $OT&: (((((((((((((( %he system determines the depreciation start date for ordinary depreciation using the asset value date of the ac.uisition posting and the period control method and writes this date to the depreciation areas in the asset master record& This is a ver/ i*portant note. %he asset value date (which is the capitali,ed date! helps in determine the depreciation start date& Observer the figure ,A on the page no.9A ?hen you do the ac.uisition integrated with "$ component, the system would also update the vendor information in the GO"I1I$G data field in the asset master record& -------------------------------------------------------------------------------------%ocu*ent t/pes use) for asset posting: 1ross posting AA - you ta0e into the discount and taxes $et posting A$ - you ta0e into account the taxes& $ath in I=G F" -> F" Global settings -> (ocument -> (ocument header -> document types For document type A$, there will be tic0 mar0 for the field G$et )ocu*ent t/peG 9999999999999999999999999999999999999999999999999999999999999999999999 99999999999 T"A$SA TIO$ T:'&S: 99999999999999999 ?henever you are posting a transaction relating to asset, you have to enter the transaction type for every posting& %he transaction type identify the ac.uisition, retirement and transfers 3ach transaction type has lot of control settings: -> %he transaction type specifies which field are to be updated AC Asset balance sheet accounts ?C %epreciation areas C 7alue fiel) 5-

'ath in I01 F" -> "" -> transactions -> "c.uisitions -> (efine %ransaction types for ac.uisitions clic0 on the cloc0 and then clic0 on first activity -> (efine transaction type for ac.uisitions 3xample: %%ype -77

-> ?hether it is to be posted on debit or credit transaction -> ?hether to capitali,e the asset or not -> ?hat is the document type allowed for this transaction type -> ?hether the posting related to affiliated company

:ou can also create your own transaction type "c.uisitions -> #etirements -> 5 %ransfers -> 6 Observer the figure 4, on the page no.A3very transaction type which you create belongs to a transaction type group& %he transaction type group define the features of the transaction type& -> :ou can limit transaction type to depreciation areas $ath in I=G F" -> "" -> %ransactions -> "c.uisition -> (efine transaction type for ac.uisition )lic0 on the cloc0 and then clic0 on the second activity -< imit the transaction types to depreciation areas< -> :ou can limit transaction type groups to asset classes

%he transaction type groups are fixed and cannot be changed& 9999999999999999999999999999999999999999999999999999999999999999999999 999999999999 ASS&T A D#ISTIO$ - $OT I$T&1"AT&% =IT! A' Busing clearing accountC 55

-> /ometime when you purchase the asset, the asset been received but the invoice not yet received (r "sset cr clearing account

at a later stage, the invoice received dr clearing account cr vendor

Finally the entry is dr asset cr vendor

-> %he invoice received but asset not yet delivered 999999999999999999999999999999999999999999999999999 dr clearing account cr vendor account

ater, when the asset is delivered dr asset cr clearing account

Observe the figure 44 on the page no.A,

ASS&T A D#ISITIO$ I$T&1"AT&% =IT! 00 0o)uleG (((((((((((((((((((((((((((((((((((((((((((( Observer the figure 45 on the page no.A4 3xercise on page no&C> to --4 dealing with the exercise on asset ac.uisition

56

9999999999999999999999999999999999999999999999999999999999999999999999

)ompany code: /+': In ast session, "c.uisition transactions -> with integration -> ?ithout integration -> integrated with the mm module

(r "sset D7 - %%: - "//3% *" 23 ("%3 )r vendor 6?hen you are ma0ing posting to the asset line item, you have to enter the transaction type and the asset value date Transaction t/pe - specifies the t/pe of transaction /ou are posting Asset value )ate - is the capitaliFation )ate - )ate on .hich the asset is capitaliFe)

"&TI"&0&$TS: (((((((((((( (ifferent types of retirements - #etirement with or without customer -> #etirement with or without sales -> $artial or full retirements -> =ass retirements -> #etirement of several assets

#etirement with integration (with the customer! dr customer cr asset 54

%his will be entry #etirement without integration (without customer! (r "sset clearing account cr asset ?hen you sell an asset, what are the accounts that will get affectedH -> "sset -> ban08customer -> gain8loss

%here are lot of G and sub ledger accounts that are getting affected when you sell the asset& Observer the figure 49 on the page no.115

I*portant point to be note): ((((((((((((((((((((((((((( %he system determines the depreciation date for the asset retirement based on the asset value date and the period control method of the depreciation 0ey& 1efore posting the transactions, create few important G accounts -> Gain on asset sale G account - I-CA7 -> oss on asset sale G account - 3-CA7 -> "sset clearing G account - in the form of asset account - "-CA7 -> )learing revenue from asset sale G account- I-CA-> "ccumulated Idep&account "-CD7 i.e ?hen you are selling an asset without a customer (r )learing revenue cr asset

"nd then assign them in I=G 5>

o*pan/ co)e: SO$: 'ath in I01 F" -> "" -> integration with the G -> "ssign G accounts -, $urchase an asset for G1$&-7777 ("sset ac.uisition without integration! 'ath in the eas/ access: "ccounting -> F" -> Fixed "ssets -> $osting -> "c.uisition -> 3xt "c.uisition -> "c.uisition with automatic offsetting entry T-tco)e: "1J7' ?e are purchasing an asset on 7-&7A&57-- for G1$&-7777 "sset value date as 7-&7A&57-%he message is: "sset transaction posted with the document no& 7-77777774< (r "sset cr clearing account

%he relevant G account that are affected are

dr asset G account cr asset clearing account

go to the asset master record&&&&&&& In the master data section, observer the posting information -> )apitali,ed on -7-&7A&57-- (from the asset value date! -> First ac.uisition on - 7-&7A&57-- (from the asset value date! -> "c.uisition year - 57-- 776 (from the posting date and the posting period!

go to the dep area section of the asset master record %hen go to the asset explorer - "?7-n "lso chec0 the asset G account - "->75A

5, /ell the asset for G1$&C777 (#etirement of an asset reclogging there revenue without integration! %here is a loss of G1$&-777 'ath in the eas/ access "ccounting -> F" -> Fixed "ssets -> $osting -> #etirements -> #etirement with revenue -> "sset sales without a customer T-co)e -> "1"on )lic0 on post %he message is: "sset transaction posted with the document no&/+': 7-7777777><

(r )learing revenue G account C777 dr loss on sale of asset -777 cr asset master record -7777

First go and chec0 the asset master record in the master data section under the posting information %he system will update the field H)eactivation onI Secon)l/, go to the asset explorer

,; $urchase an asset for G1$&-7777 and sell >7@ of the asset value (G1$&>777 ! for G1$&A777 (without depreciation !

-> 1alance of >777 in the asset -> Gain of G1$&-777 -> clearing revenue G1$&A777

?e have purchased an asset, the document number is 7-7777777A

5D

(r "sset cr "sset clearing account

/ell >7@ of G1$&-7777 for G1$&A777 'ath in the eas/ access: "ccounting -> Fa -> Fixed assets -> posting -> #etirement -> retirement with revenue -> asset sale without customer T-co)e: "1"+' %he document number is 7-7777777D

(r )learing account A777 cr gain on asset sale -777 cr asset master record >777 (asset G account!

Go and chec0 the asset explorer

4; Tr/ to )o an exa*ple $urchase an asset for G1$&-7, 777 and then sell the asset for G1$&D777& A months +riginal asset - -7777 ess dep - >77 'et boo0 value C>77 ess sales value D777 oss on asset sale 5>77

In the material, have a lot of exercises on ac.uisition and retirements& 9999999999999999999999999999999999999999999999999999999999999999999999 999999999 T"A$SF&"S: (((((((((( 5B

%ransfer of assets -> %here are two types of transfers AC intra-co*pan/ asset transfer ?C Inter-co*pan/ asset transfer

Intra-co*pan/ asset transfer - when the transfer is ta0ing place within the company code (one singe company code! Inter-co*pan/ asset transfer - transfer ta0ing place between two company codes in a company and %ransfer ta0ing place from one company code in one company to another company code in another company #easons for intra company asset transfer -> :ou have crate an asset in a wrong asset class -> "sset has changed the location -> "sset needs to be split -> /toc0 materials to be transferred to an asset

?hen you are posting a transaction for intra company asset transfer, you have to use a transfer variant 4& Observer the figure 58 on the page no.1-5 "easons for inter co*pan/ asset transfer -> "sset has changed the location -> org structure for the asset accounting is changed AC %ransfer of an asset from one company code to another company code in a company > For this, you use the transfer variant of relationship type 75

?C %ransfer of an asset from one company code in a company to another company code in another company, for this, you use the transfer variant of relationship type 7?hen you are doing the intra or inter-company asset transfer, at what price the transfer should ta0e place& =e have three *etho)s 5C

-> Gross method -> 'et method -& 'ew value method

For intra company asset transfers - we follow gross methods For inter company asset transfer - either net method or new value method can be followed %here is an asset transfer from source company code to the target company code In case of intra company asset transfer, the source and the target company code is one and the same& %he original values remain the same&

$&T 0&T!O% -> In the source company code +riginal asset value -77 dep 57 net boo0 value B7 %his would be the sale value - is e.ual to the net boo0 value In the target company code "sset value - B7 $&= 7A<#& 0&T!O% -> In the source company code +riginal asset value -77 dep 57 'et boo0 value B7 /ale value D7

<oss or gain in the source co*pan/ co)e -> In the target company code $urchase value D7 Observer the figure 5- on the page no.1-5 67

&xercise fro* page no.1,1 to 14o*pan/ co)e: SO$: #nit 4: 'erio)ic 'rocessing (((((((((((((((((((((((((((( In the last few session 2nit -, 5, and 6 on "sset "ccounting -> Gow to create an asset master record (-A steps! -> $ost the asset transactions AC Ac4uisition - "c.uisition integrated with ap component -> "c.uisition non-integrated with the ap component -> "c.uisition from mm module

?C "etire*ents -> #etirement with or without sales -> #etirement with or without the customer -> =ass retirements

C Transfers -> intra-company asset transfers -> Inter-company asset transfer

?hat are the two important fieldsH -> %ransaction type -specifies the type of transaction you are posting -> "sset value date - is the date on which the asset is capitali,ed or the asset is sold in case of retirements&

%he depreciation is calculated using the (3$#3)I"%I+' F3:/& 6-

%&'"&I AITO$ J&: is a field appearing in the depreciation area section of the asset master record&

%he posting of depreciation is done automatically by running a program called "A'OST-888. 1efore we do the execution of this program, ma0e note of the following points

Observer the figure 38 on the page no.138

-> $rimary cost planning (chec0 whether there is to be co account assignment obEects li0e cost centre, internal order, profit centre, business processes etc! -> Investment support (capital subsidy received!& 3ach investment support is identified by an investment support 0ey& -> Inflation management (this is a county specific setting! (epreciation posting is done on a periodical basis (onKt get confused between depreciation areas and depreciation 0eys (ep area represents different type of valuation and appears in the chart of depreciation dep 0ey specifies the method of depreciation

-> /"$ support three types of depreciation AC +rdinary depreciation - due to wear and tear ?C /pecial depreciation - for asset under construction C 2nplanned depreciation - manual depreciation&

%&'"& IATIO$ J&:S /pecifies the methods of depreciation Figure 31 on the page no.13,

-> 1asic method -> (eclining balance method 65

-> =aximum amount method -> =ultilevel method -> $eriod control method

'ath in I01 F" -> "" -> (epreciation -> *aluation methods -> (epreciation 0ey -> )alculation methods +bserve the depreciation area section of the asset master record Figure 35 on the page no.133

(epreciation area for cost accounting purposes -> %he system ta0es into the imputed interest portion -> indexing

The i*portant )iagra* is on figure 58 page no.151 If /ou run the progra* "A'OST-888 -> %he system will identify the ordinary depreciation, special depreciation, unplanned depreciation, interest, revaluations etc

-> %he system will update the relevant G "ccount and also to the sub ledger& :ou can also do the test run go and chec0 the dep 0eys for the assts in the company code '3"/&&&& /ome of the errors when you are running the program "A'OST-888: -> Incorrect account assignment obEects -> "ccounts for posting missing -> $osting period was entered incorrectly& -> /ettings missing in the asset master record for deprecation 0ey - 7777

&xercise on 'age no.155 to 1A8

66

Fiscal /ear change an) /ear en) closing ((((((((((((((((((((((((((((((((((((((( :ear en) closing - .hen /ou are closing boo6s of accounts of the en) Fiscal /ear change - change of the account /ear

Figure 5, on the page no.1A1

-> %he year end closing program is done at the end of the last posting period For ex: Lan to dec - in the month of dec you can do year end closing program -> %he year end closing program for the whole company code& -> For example 1oo0s of accounts are prepared for 577C 57-7 57-If you want to do the year end closing for 57--, then you have to see that the year end closing program is done for 577C and also for 57-7 then only you can do the year end closing program for the year 57--&

Observer the figure 54 on the page no.1A-

%he yearend closing program chec0s whether -> %he depreciation and the asset values have been posted in full or not -> %he asset contains any error or are incomplete 1y chance, you have done the closing process and after closing, you have realised that you have done a mista0eM you have re-run the whole program again&

$rogram names for Fiscal /ear change -+ 99999999999999999999 64

'ath in eas/ access "ccounting -> Financial "ccounting -> Fixed "ssets -> periodic processing -> fiscal year change T-co)e -+ AK"= "AKA=&88

:ear en) closing -+ 999999999999999999 'ath in eas/ access "ccounting -> financial accounting -> fixed assts -9> periodic processing - year end closing Tco)e + AKA? executive 'rogra* na*e -+ "AKA?S88 3xercise on page no&-C> to 575 I$FO"0ATIO$ S:S:ST&0 -+ Stan)ar) reports In order to run the standard reports in asset accounting 'ath in the eas/ access: "ccounting -> F" -> Fixed "ssets -> Information system -> #eports on "sset "ccounting

<ist vie.er -> +utput is in the form of the list -> apply lot of feature for the output -> do in ascend G1$ or descending order -> totalling& /ubtotalling -> Increase 8decreasing the columns

ASS&T !ISTO": S!&&T -+ this is a yearend closing report& %his sheet shows the transactions that occurred on an asset& :ou can also customi,e the asset history sheet 3xercise -5 on the page no&57C to 5-4 9999999999999999999999999999999999999999999999999999999999999999999999 99999 6>

%&'"& IATIO$ SI0#<ATIO$ For instance, you are following straight line method and also simultaneously you would li0e to 0now how much would be thee amt of depreciate under base level method :ou can crate various simulation version -9 each version having different depreciation methods& /imulation can be applied to a single asset or for the whole asset portfolio&

"eport na*e -+ "ASI0#83xercise from page no&5-C to 55A -------------------------------------------------------------------------------------------------------------------------------------

6A

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial Management - Midterm Exam: False P126,000Document3 pagesFinancial Management - Midterm Exam: False P126,000Jalyn Jalando-onNo ratings yet

- SRMDocument35 pagesSRMlalit74uNo ratings yet

- SAP SRM Common Issues, Definitions, and ProcessDocument11 pagesSAP SRM Common Issues, Definitions, and ProcessShahid_ON0% (1)

- Auto ClearingDocument2 pagesAuto ClearingcecileekoveNo ratings yet

- SAP SRM Common Issues, Definitions, and ProcessDocument11 pagesSAP SRM Common Issues, Definitions, and ProcessShahid_ON0% (1)

- Auto ClearingDocument2 pagesAuto ClearingcecileekoveNo ratings yet

- Consultancy For Customization and Configuration of SAP FI and MM at FBRDocument75 pagesConsultancy For Customization and Configuration of SAP FI and MM at FBRpikachudanNo ratings yet

- What Are The Differences Between A Functional and Business ConsultantDocument2 pagesWhat Are The Differences Between A Functional and Business ConsultantcecileekoveNo ratings yet

- Auto ClearingDocument2 pagesAuto ClearingcecileekoveNo ratings yet

- IndexesDocument1 pageIndexescecileekoveNo ratings yet

- Configuration APP: FBZP: Step1: First You Send A Purchase Order To The VendorDocument2 pagesConfiguration APP: FBZP: Step1: First You Send A Purchase Order To The VendorcecileekoveNo ratings yet

- Asset Accounting Configuration StepsDocument36 pagesAsset Accounting Configuration StepscecileekoveNo ratings yet

- Understanding SAP Lock ObjectsDocument1 pageUnderstanding SAP Lock ObjectscecileekoveNo ratings yet

- Early Watch ReportDocument5 pagesEarly Watch ReportcecileekoveNo ratings yet

- Early Watch ReportDocument5 pagesEarly Watch ReportcecileekoveNo ratings yet

- KB11N Cost Centre JournalDocument1 pageKB11N Cost Centre JournalcecileekoveNo ratings yet

- ERPtips SAP Training Manual SAMPLE CHAPTER From Fixed AssetsDocument21 pagesERPtips SAP Training Manual SAMPLE CHAPTER From Fixed AssetsSuresh KumarNo ratings yet

- SAP Upgrade UnderstandingDocument2 pagesSAP Upgrade UnderstandingcecileekoveNo ratings yet

- Periodic Processing LogsDocument25 pagesPeriodic Processing LogscecileekoveNo ratings yet

- ERPtips SAP Training Manual SAMPLE CHAPTER From Fixed AssetsDocument21 pagesERPtips SAP Training Manual SAMPLE CHAPTER From Fixed AssetsSuresh KumarNo ratings yet

- Patient Capital - A Study On The Outperformance of Infrequent TradersDocument72 pagesPatient Capital - A Study On The Outperformance of Infrequent TradersCanadianValueNo ratings yet

- Taxation and ObjectivesDocument32 pagesTaxation and ObjectivesgeddadaarunNo ratings yet

- Job Order Costing Spoilage and Rework QuizDocument3 pagesJob Order Costing Spoilage and Rework Quizela kikayNo ratings yet

- Pom Registration Form 2019Document3 pagesPom Registration Form 2019Lydia Salatiel GarambiniNo ratings yet

- Ratio Formula Calculation Industry Average CommentDocument2 pagesRatio Formula Calculation Industry Average Commentjay balmesNo ratings yet

- Capital StructureDocument42 pagesCapital Structurevarsha raichalNo ratings yet

- Ramo 1-86Document6 pagesRamo 1-86RB BalanayNo ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- Accounting Concepts and Principles PDFDocument9 pagesAccounting Concepts and Principles PDFDennis LacsonNo ratings yet

- Qa Ca Zambia Programme December 2019 ExaminationDocument449 pagesQa Ca Zambia Programme December 2019 ExaminationimasikudenisiahNo ratings yet

- PAS 2 InventoriesDocument3 pagesPAS 2 InventoriesLary Lou Ventura100% (4)

- Zakat (Practice Questions)Document4 pagesZakat (Practice Questions)ibrahim sameerNo ratings yet

- Chapter 2 Payroll NotesDocument7 pagesChapter 2 Payroll NotesHarithaNo ratings yet

- Your Money or Your Life (Vicki Robin and Joe Dominguez)Document7 pagesYour Money or Your Life (Vicki Robin and Joe Dominguez)homo.ingratusNo ratings yet

- Financial and Managerial Accounting 12th Edition Warren Test Bank DownloadDocument90 pagesFinancial and Managerial Accounting 12th Edition Warren Test Bank DownloadAbbie Brown100% (25)

- Valuing Stocks: Fundamentals of Corporate FinanceDocument32 pagesValuing Stocks: Fundamentals of Corporate FinanceMuh BilalNo ratings yet

- DEC 2016 AnswersDocument37 pagesDEC 2016 AnswersBKS SannyasiNo ratings yet

- Set Off and Carry Forward Capital LossesDocument4 pagesSet Off and Carry Forward Capital LossesBalraj Singh SandhuNo ratings yet

- ANNUAL TAX STATEMENT 2021-22Document1 pageANNUAL TAX STATEMENT 2021-22adnan JamilNo ratings yet

- Major Heads & Allocation Structure in Indian RailwaysDocument3 pagesMajor Heads & Allocation Structure in Indian RailwaysSri Nagesh KumarNo ratings yet

- Module in Management Accounting: Batangas State UniversityDocument2 pagesModule in Management Accounting: Batangas State Universityjustine reine cornicoNo ratings yet

- Block-02 Appraisal Monitoring and Evaluation PDFDocument55 pagesBlock-02 Appraisal Monitoring and Evaluation PDFrameshNo ratings yet

- P2 investment analysisDocument8 pagesP2 investment analysisVahrul DavidNo ratings yet

- C 3 Project Investment EvaluationDocument21 pagesC 3 Project Investment EvaluationAbenezer WondimuNo ratings yet

- Flexible Budget PreparationDocument4 pagesFlexible Budget Preparationvijayadarshini vNo ratings yet

- Annual Report 2011-2012Document44 pagesAnnual Report 2011-2012snm1976No ratings yet

- CS5 SopolDocument2 pagesCS5 SopolBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Cost Structure AnalysisDocument8 pagesCost Structure AnalysisuOwOuNo ratings yet

- Complete 2017 Busorg PDFDocument127 pagesComplete 2017 Busorg PDFKrismaeNo ratings yet