Professional Documents

Culture Documents

Accounting Entries

Uploaded by

krishanu1013Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Entries

Uploaded by

krishanu1013Copyright:

Available Formats

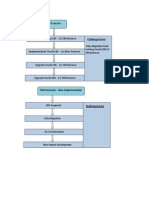

P2P Training Server P2P WITH EXCISE AND VAT 1 (RECOVERABLE)

Accounting Entries

Po no:1000012 RC NO:101000003 Receipt Stage Excise duty /CENVAT RM A/C DR Cess on Excise duty/Cess ont RM A/C Dr SH Cess on Excise Duty/Sh Cess RM A/C Dr To Receing Inventory A/C Cr

Receing Inventory A/C Dr Local Sales tax /Vat Interim Recovery A/C Dr To Ap Accruval A/c Cr Basic price Receing Inventory A/C Dr To Ap Accruval A/c Cr At Invoice Generation Stage Accrual A/c Dr To Libility A/c Cr VAT CLAIM VAT Recovery A/c Dr TO Vat Interim recovery A/C Cr

P2P INV ITEM EXCISE WITH VAT( NON 2 RECOVERABLE) PO NO:1000020 RC NO:101000013

DELIVER STAGE 221000 INVENTORY RM A/C DR 221500 RECEING INVENTORY A/C DR RECEIVE STAGE 221500 RECEING INVENTORY A/C DR 151200 AP ACCRUVAL A/C NO CR Baic Price 221500 RECEING INVENTORY A/C DR 151200 AP ACCRUVAL A/C NO CR

INVOICE GENERATION STAGE 151200 Accrual( With Tax) 151100 Liability(With Tax) Payment Make to Supplier 151100 Liability 241100 Cash

Page 1

P2P

P2P INV ITEM WITH EXCISE AND 3 VAT(VAT NON RECOVERABLE) PO NO:1000021 DELIVER STAGE 221000 INVENTORY RM A/C DR 221500 RECEING INVENTORY A/C DR RECEIVE STAGE 221500 RECEING INVENTORY A/C DR 151200 AP ACCRUVAL A/C NO CR CENVAT CLAIM 252100 Excise duty /CENVAT RM A/C DR 252200 Cess on Excise duty/Cess ont RM A/C Dr 252300 SH Cess on Excise Duty/Sh Cess RM A/C Dr 221500 RECEING INVENTORY A/C Cr

RC NO:101000014

ERS NO: 101000014-46

221500 RECEING INVENTORY A/C DR 151200 AP ACCRUVAL A/C NO CR INVOICE GENERATION STAGE 151200 Accrual 151100 TO Liability

SUPPLIER PAYMENT STAGE 151100 Liability 241100 To Cash

P2P INV ITEM EXCISE AND VAT 4 (EXCISE NON RECOVERABLE) PO NO:1000022 RC NO:101000015

ERS NO:101000015-47

DELIVER STAGE 221000 INVENTORY RM A/C DR 221500 RECEING INVENTORY A/C DR RECEIVE STAGE 221500 RECEING INVENTORY A/C DR 151200 To AP ACCRUVAL A/C NO CR 251360 SALES TAX/VAT INTERIM RECOVERY A/C DR

221500 RECEING INVENTORY A/C DR 151200 AP ACCRUVAL A/C NO CR

INVOICE GENERATION STAGE 151200 Accrual 151100 TO Liability

Page 2

P2P VAT CLAIM VAT Recovery A/c Dr TO Vat Interim recovery A/C Cr SUPPLIER PAYMENT 151100 Liability 241100 To Cash

6 P2P EXP ITEM With SERVICE TAX 2 Way PO NO:1000022 152150 252410 252610 252610 151100 INVOICE GENERATION STAGE Ap Accrual A/c Cr Service tax interim Recovery A/C Dr Service tax Cess interim Recovery A/C Dr Service tax SHCess interim Recovery A/C Dr TO LIBILITY A/C Cr SUPPLIER PAYMENT STAGE 151100 Liability A/ C DR 241100 TO Cash A/C CR After Running India Service tax Processing Service tax Recovery A/C Dr Service tax Cess Recovery /Benfit Service taxSH cess Recovery /Benfit TO Service tax Cess interim Recovery A/C Dr TO Service tax Cess interim Recovery A/C Dr TO Service tax SHCess interim Recovery A/C Dr

252400 252600 252600 252410 252610 252610

7 P2P EXP ITEM WITH SERVICE 3 WAY PO NO:1000024 ERS-101000016 INVOICE GENERATION STAGE Ap Accrual A/c Cr Service tax interim Recovery A/C Dr Service tax Cess interim Recovery A/C Dr Service tax SHCess interim Recovery A/C Dr 151100 To Liability Cr A/C(With tax)

SUPPLIER PAYMENT 151100 Liability A/C Dr 241100 TO Cash A/C CR

Page 3

P2P 252400 252600 252600 252410 252610 252610 After Running India Service tax Processing Service tax Recovery A/C Dr Service tax Cess Recovery /Benfit Service taxSH cess Recovery /Benfit TO Service tax Cess interim Recovery A/C Dr TO Service tax Cess interim Recovery A/C Dr TO Service tax SHCess interim Recovery A/C Dr

P2P WITH EXCISE AND FRIEGHT INV ERS-101000139-541 PO NO:1000193 RC NO:101000139

Receipt Stage RECEING INVENTORY A/C CR AP ACCRUAL A/C NO DR EXCISE DUTY/CENVAT RM A/C DR CESS ON EXCISE DUTY/CESS RM A/C DR SH CESS ON EXCISE DUTY/CESS RM A/C DR TO RECEIVING INVENTORY A/C Cr DELIVER STAGE TO RECEIVING INVENTORY A/C Cr INV RM A/C DR

INV Generation AP ACCRUAL A/C NO DR TO LIBILITY A/C Cr THIRD PARTY INV Item Expense A/C DR TO LIBILITY A/C Cr SUPPLIER PAYMENT Liability TO CASH A/ C CR Third Party Inv NO: Receipt /10100139/10000 THIRD PARTY PAYMENT Liability TO CASH A/ C CR

TDS PREPAYMENT INVOICE inv no:HPRE-01

Prepayment Inv Supplier 251370 Prepaid Expense A/C Dr 151100 TO Libililty A/C Cr CREDIT MEMO to Supplier 151100 Liability A/C Dr Page 4

P2P 153410 TO Item Expense A/C CR Standard inv to Commissioner income tax 153410 Item Expense A/C DR 152100 To Libility A/c Cr

Prepayment make to Supplier 151100 Liability A/C Dr 241100 To Cash A/C Cr

TDS Standard invoice inv no:HTDS-01

Standar Inv Generations 153410 Item Expense A/C DR 152100 TO LIBILITY A/C Cr Standard inv to Commissioner income tax 153410 Item Expense A/C DR 152100 TO LIBILITY A/C Cr CREDIT MEMO to Supplier 151100 Liability 153410 TO Item Expense A/C CR PREPAYMENT ADJUST TO STANDARD INV 151100 Liability 251370 TO Prepaid Expense A/C Cr Balance Standard Inv Amt Payment Entry 151100 Liability 241100 To Cash A/C Cr

Automatically Return Entries Created For Prepayment creditmemo a CREDIT MEMO INV 151100 Liability 153410 TO Item Expense A/C CR STANDARD INVOICE 153410 Item Expense A/C DR 1511100 TO LIBILITY A/C Cr

Payment Make to Commissoner incometax 151100 Liability to cash in hand A/C Cr

ITEM NAME:PLATE 15 MM P2P With EXCISE CAPITAL Goods Page 5

P2P PO NO:1000047 RC NO:101000027 Receinving Inv A/c Dr Vat interim Recovery A/C Dr To AP Accrual A/C cr Cenvat Claim 252140 252220 252320 221500 Cenvat on CG A/C Dr Cess on CG A/C Dr SH Cess on CG A/C Dr To Receiving Inv A/C Cr Cenvat Recoverable Entry 50% 252140 252220 252320 251320 251330 251340 Cenvat on CG A/C Dr Cess on CG A/C Dr SH Cess on CG A/C Dr To Excise Duty Recoverable on capital Goods TCess Recoverable on capital Goods To SH Cess Recoverable on capital Goods

221500 Receiving Inv A/C Dr 151200 To AP Accrual A/C cr

151200 151200 151200 151200 151100 151100 151100 151100

INV GENERATION STAGE Accrual A/C Dr MIS Exp A/C Dr MIS Exp A/C Dr MIS Exp A/C Dr MIS Exp A/C Dr To Libility A/c Cr To Libility A/c Cr To Libility A/c Cr To Libility A/c Cr

Payment make to supplier 151100 Libility A/C Dr 241100 To Cash A/c Cr

Customs Duty PO NO:1000125 RC NO:101000087 BOE INV NO:10141 ITEM NAME:PLATE 15 MM Page 6

P2P TYPE:Raw Material AB1 Cutsoms Assessable Value AB2 Customs Duty Basic 10 AB3 Customs Duty Additional AB4 - Cutoms Duty - CVD Education Cess AB5 (2) Customs Duty CVD SCH Education Cess AB6 Customs Duty - Education Cess 2.3.4.5 AB7 Customs Duty SH Education Cess 2.3.4.5 AB8 Customs Duty Additional CVD 1.2.3.4.5.6.7 Customs Duty Assessable Value Reversal

1 1.2 3 3

252100 252200 252300 221500

Receiving inv A/c Dr To Custome Duty/Bill of Entry A/C Cr CENVAT CLAIM Excise Duty /Cenvat RM A/C Dr Cess on Excise Duty/Cess on RM A/C Dr SH Cess on Excise Duty/SH Cess on RM A/C Dr To Receiving Inv A/C Cr

Non Recoverable Tax entry 221000 Receiving Inv A/C Cr 221500 TO Inv Rm A/c Cr INV GENERATION STAGE Accrual A/C Dr To Libility A/c Cr

USD CURRENCY USD CURRENCY

Payment Make to Supplier Libility A/C Dr To Cash A/c Cr Custom Duty invoice Item Exp A/C Dr To Libility A/c Cr Payment Made Customes Dept Libility A/C Dr To Cash A/c Cr

Page 7

P2P

counting Entries

Amt 1232 24.64 12.32 1268.96 Amt A/C Code Pickup From Additional Org info Additional Org info Additional Org info Inventory Org parmeters

1268.96 2083.62 3352.58 15400 15400

Inventory Org parmeters Vat Regime Registration

Inventory Org parmeters

18751.96 18751.96

Purchase options Financial options

2083.62 2083.62

257.42 257.42 257.42 257.42 1000 1000

221000 221500 221500 151200 221500 151200

1257.42 1257.42

151200 151100

1257.42 1257.42

151100 241100

Page 8

P2P

Vat Amt 233.94 233.94 151.54 151.54 80 1.6 0.8 82.4 Basic Price Basic Price 1000 1000

221000 221500 221500 151200 252100 252200 252300 221500

221500 151200

1233.94 1233.94

151200 151100

1233.94 1233.94

151100 241100

103 103 103 240.88 137.88

221000 221500 221500 151200 251360

Basic Price Basic Price 1000 1000

221500 151200

1240.88 1240.88

151200 151100

Page 9

P2P 137.88 137.88

1240.88 1240.88

144000 14400 288 144 158832

158832 158832

14400 288 144 14400 288 144

1000 100 2 1 1103

1103 1103

Page 10

P2P 100 2 1 100 2 1

6236 6236 1200 24 12 1236

5000 5000

13236 13236 5000 5000

13236 13236

5000 5000

50000 50000

-1000 Page 11

P2P -1000

1000 1000

50000 50000

100000 100000 2000 2000

-2000 -2000

50000 5000 50000 5000

es Created For Prepayment creditmemo and Standard Inv To Supplier -1000 -1000

1000 1000

2000 2000

Page 12

P2P 8240 13530 21770

8000 160 80 8240

4000 80 40

Additional Org Additional Org Additional Org 4000 Additional Org 80 Additional Org 40 Additional Org

100000 100000

100000 13530 8000 160 80 100000 13530 8000 160 80

CAPITAL GOODS APH-EXCISE DUTY @8% APH-EXCISE EDUCATION CESS @2% APH-EXCISE SH EDUCATION CESS @1% APH-VAT @12.5%

121770 121770

Page 13

P2P Tax Rate Currency USD INR INR INR INR INR INR INR USD Tax Amt 10000 40000 35200 704 352 1525.12 762.56 19141.75 -10000

97685.43 97685.43 35200 704 352 36256

61429.43 61429.43

10000 10000

10000 10000

97685 97685 97685 97685

Page 14

O2C

O2C (ORDER TO CASH )

O2C WITH EXCISE AND VAT AT Shipping Stage Cost of goods Sold A/C Dr To inventor A/C Cr SO NO:10100075 INV GENERATION Receivable A/c Dr To Revenue A/C Cr To Loca sales tax /Vat interim recovery A/C Cr To Excise duty Paid /Payable To Cess paid/payable A/C Cr To SH Cess paid /payable A/C Cr Customer Receipt Cash A/C Dr To Receivable A/C Cr AFTER RUNNING INDIA EXCISE INVOICE GENERATION Excise duty Paid /Payable Dr A/C Cess paid/payable A/C Dr SH Cess paid /payable A/C Dr To Cen Vat Rm A/C Cr TO Cess on Excise Duty A/C Cr To SH Cess on Excise Duty A/C Cr AFTER RUNNING INDIA VAT INVOICE GENERATION Vat Libility A/C Dr ToVat interim Recovery A/c Cr

O2C WITH EXCISE NON RECOVERABLE SO NO:10100077 INV GENERATION Receivable A/c Dr To Revenue A/C Cr To Excise duty Paid /Payable To Cess paid/payable A/C Cr To SH Cess paid /payable A/C Cr

Page 15

O2C Customer Receipt Cash A/C Dr To Receivable A/C Cr

O2C VAT NON RECOVERABLE SO NO:10100078 INV GENERATION Receivable A/c Dr To Revenue A/C Cr To Local Sales tax/Vat Interim libility A/C Cr Customer Receipt Cash A/C Dr To Receivable A/C Cr

O2C SERVICE TAX SO NO:10100079

INV GENERATION Receivable A/c Dr To Revenue A/C Cr TO Service tax Interim Libility A/c TO Cess on Service tax Libility A/C Cr TO SH Cess on Service tax Libility A/C Cr Customer Receipt Cash A/C Dr To Receivable A/C Cr

AFTER RUNNING INDIA VAT INVOICE GENERATION Service tax Interim Libility A/c Cess on Service tax Libility A/C Cr SH Cess on Service tax Libility A/C Cr To Service tax libility A/C

Page 16

O2C

50000 50000

A/c Code no Pick up From Item Master

60885 50000 6765 4000 80 40

231000 311100 153130 252130 252210 252310

Transaction Type Transaction Type Vat Regime Registration Additional Org Info Additional Org Info Additional Org Info

11.101.0000.000.231000.00.000000 11.101.0000.000.311100.00.000000 11.101.0000.000.153130.00.000000 11.101.0000.000.252130.00.000000 11.101.0000.000.252210.00.000000 11.101.0000.000.252310.00.000000

60885 60885

242100 232000 Transaction Type

VOICE GENERATION 4000 80 40 4000 80 40 Additional Org Info Additional Org Info Additional Org Info Additional Org Info Additional Org Info Additional Org Info

6765 6765

153130 Vat Regime Registration 153120 Vat Regime Registration

13236 12000 1200 24 12

231000 Transaction Type 311100 Transaction Type 252130 252200 252300

11.101.0000.000.231000.00.000000 11.101.0000.000.311100.00.000000 11.000.0000.000.252130.00.000000 11.000.0000.000.252200.00.000000 11.000.0000.000.252300.00.000000

Page 17

O2C

13236 13236

242100 232000 Transaction Type

68400 60000 8400

231000 Transaction Type 311100 Transaction Type 153130

68400 68400

242100 232000 Transaction Type

55150 50000 5000 100 50

231000 311100 153220 153240 153260

55150 55150

242100 232000 Transaction Type

5000 100 50 5150

Page 18

O2C

1.0000.000.231000.00.000000 1.0000.000.311100.00.000000 1.0000.000.153130.00.000000 1.0000.000.252130.00.000000 1.0000.000.252210.00.000000 1.0000.000.252310.00.000000

1.0000.000.231000.00.000000 1.0000.000.311100.00.000000 0.0000.000.252130.00.000000 0.0000.000.252200.00.000000 0.0000.000.252300.00.000000

Page 19

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Computer Fundamental (Bangla Book)Document6 pagesComputer Fundamental (Bangla Book)Abdullah Al Mamun79% (67)

- Org Wise Pricing Lists & Approval ProcessDocument1 pageOrg Wise Pricing Lists & Approval Processkrishanu1013No ratings yet

- Advantage Standard ERPDocument13 pagesAdvantage Standard ERPkrishanu1013No ratings yet

- SBI PO Exam Previous Year Question PaperDocument78 pagesSBI PO Exam Previous Year Question Paperठलुआ क्लब100% (1)

- Oracle R12 Upgrade Sub Ledger Accounting by EnrichDocument20 pagesOracle R12 Upgrade Sub Ledger Accounting by EnrichEnrich LLCNo ratings yet

- R12.2 Features - MotorolaDocument56 pagesR12.2 Features - Motorolakrishanu1013No ratings yet

- Inventory and Order Management FundamentalsDocument10 pagesInventory and Order Management FundamentalscvkrajNo ratings yet

- Essential SAP Sales Configuration StepsDocument8 pagesEssential SAP Sales Configuration Stepskrishanu1013No ratings yet

- 2015 03 17costmgmtwhitepaperDocument37 pages2015 03 17costmgmtwhitepaperkrishanu1013No ratings yet

- 2007 Hansen Meissner Tracking Epc Rfid IfipDocument8 pages2007 Hansen Meissner Tracking Epc Rfid IfipRodrigo Ruiz MezaNo ratings yet

- SAP123 - Setting Up Simple Release Procedure For Purchase RequisitionsDocument10 pagesSAP123 - Setting Up Simple Release Procedure For Purchase Requisitionskrishanu1013No ratings yet

- Oracle R12 Upgrade Sub Ledger Accounting by EnrichDocument20 pagesOracle R12 Upgrade Sub Ledger Accounting by EnrichEnrich LLCNo ratings yet

- Oracle E-Business Suite R12: E-Business Essentials - Exam Study GuideDocument5 pagesOracle E-Business Suite R12: E-Business Essentials - Exam Study Guidekrishanu1013No ratings yet

- Consignment ProcessDocument32 pagesConsignment Processkrishanu1013No ratings yet

- Rfid Solution DesignDocument3 pagesRfid Solution Designkrishanu1013No ratings yet

- Tax Basics: Types of TaxesDocument8 pagesTax Basics: Types of Taxeskrishanu1013No ratings yet

- TRANSACTION_TYPE_NAMEDocument1 pageTRANSACTION_TYPE_NAMEkrishanu1013No ratings yet

- IsoDocument3 pagesIsokrishanu1013No ratings yet

- Additional Info DataDocument345 pagesAdditional Info Datakrishanu1013No ratings yet

- Cona Jainbbr1Document1 pageCona Jainbbr1krishanu1013No ratings yet

- Third Scenario - New ImplementationDocument2 pagesThird Scenario - New Implementationkrishanu1013No ratings yet

- C Form Issue To Vendor QueryDocument5 pagesC Form Issue To Vendor Querykrishanu1013No ratings yet

- PacDocument1 pagePackrishanu1013No ratings yet

- Oracle PlanningDocument27 pagesOracle PlanningLarry Sherrod100% (2)

- SMZPL Purchasing User ManualDocument72 pagesSMZPL Purchasing User Manualkrishanu1013No ratings yet

- SMZPL Inventory User ManualDocument34 pagesSMZPL Inventory User Manualkrishanu1013No ratings yet

- FND GFM 547510Document1 pageFND GFM 547510krishanu1013No ratings yet

- Application Title Form Position ContextDocument3 pagesApplication Title Form Position Contextkrishanu1013No ratings yet

- FND GFM 547510Document1 pageFND GFM 547510krishanu1013No ratings yet

- Estate Tax PornDocument52 pagesEstate Tax PornPJ HongNo ratings yet

- Taxa7319 MoDocument50 pagesTaxa7319 MoarronyeagarNo ratings yet

- Estate Tax (Single) ReportDocument18 pagesEstate Tax (Single) ReportPatricia RodriguezNo ratings yet

- Assignment - Karla Company Provided The Following Information For 2016Document1 pageAssignment - Karla Company Provided The Following Information For 2016April Boreres33% (3)

- Define Permanent Account Number (PAN) - Who Are Liable To Apply For Allotment of PANDocument6 pagesDefine Permanent Account Number (PAN) - Who Are Liable To Apply For Allotment of PANDebasis MisraNo ratings yet

- Tax Book Part PDFDocument128 pagesTax Book Part PDFTimothy WilliamsNo ratings yet

- Quiz 4Document3 pagesQuiz 4Brier Jaspin AguirreNo ratings yet

- 2023_TaxReturnDocument27 pages2023_TaxReturnLuiNo ratings yet

- TaxInvoiceDocument1 pageTaxInvoicek maheshNo ratings yet

- OIEP0012674800000044837d : Electricity BillDocument1 pageOIEP0012674800000044837d : Electricity BillOkla OkiloaNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- Subnational Taxation in Developing Countries: A Review of The LiteratureDocument24 pagesSubnational Taxation in Developing Countries: A Review of The LiteratureKelas MPA Fiskal Kelompok 2No ratings yet

- ApolloinvoiceDocument1 pageApolloinvoiceMd ZaheerNo ratings yet

- 14 Grace: Practice QuestionsDocument1 page14 Grace: Practice QuestionsIvy NjorogeNo ratings yet

- Solved Burgundy Inc and Violet Are Equal Partners in The Calendar PDFDocument1 pageSolved Burgundy Inc and Violet Are Equal Partners in The Calendar PDFAnbu jaromiaNo ratings yet

- Domestic LPG price build-up explainedDocument2 pagesDomestic LPG price build-up explainedSanjai bhadouriaNo ratings yet

- Skyview ManorDocument3 pagesSkyview ManormargaretadeviNo ratings yet

- Key Budget Documents 2022-23Document11 pagesKey Budget Documents 2022-23ravipatelNo ratings yet

- Negotiable Commercial Paper: Not Guaranteed ProgrammeDocument21 pagesNegotiable Commercial Paper: Not Guaranteed ProgrammeDavid CartellaNo ratings yet

- How To Compute Income TaxDocument36 pagesHow To Compute Income TaxbrownboomerangNo ratings yet

- 0968 Hostplus Additional Contributions BrochureDocument9 pages0968 Hostplus Additional Contributions BrochureSepehrNo ratings yet

- Merak Fiscal Model Library: Kurdistan PSC (2006)Document2 pagesMerak Fiscal Model Library: Kurdistan PSC (2006)Libya TripoliNo ratings yet

- UnileverDocument5 pagesUnileverKevin PratamaNo ratings yet

- Calculate Payroll in 40 CharactersDocument1 pageCalculate Payroll in 40 CharactersIbrahim ElbrolosyNo ratings yet

- 5254__Tax regime_2024_240408_212256Document3 pages5254__Tax regime_2024_240408_212256sunil78No ratings yet

- CHAP 13 Partnerships and Limited Liability CorporationsDocument89 pagesCHAP 13 Partnerships and Limited Liability Corporationspriyankagrawal7100% (1)

- Module 3 PDFDocument16 pagesModule 3 PDFJennifer AdvientoNo ratings yet

- Plan Expenditure and NonDocument3 pagesPlan Expenditure and NonkankshNo ratings yet

- 07 - Excise For Dealers PDFDocument57 pages07 - Excise For Dealers PDFsanku guptaNo ratings yet