Professional Documents

Culture Documents

Myths and Mining:: The Reality of Resource Governance in Africa

Uploaded by

sofiabloemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Myths and Mining:: The Reality of Resource Governance in Africa

Uploaded by

sofiabloemCopyright:

Available Formats

08

Myths and Mining:

The reality of resource governance in Africa

Dr Claude Kabamba

OPEN DEBATE 08 Myths and Mining: The reality of resource governance in Africa

01

here are two economic realities on the African continent today. You will nd the rst one in World Bank, IMF and Africa Development Bank reports and in articles across the globe about Africa Rising. This reality depicts Africa as a continent that is forging ahead onwards and upwards. And some of the worlds best performing economies are indeed in Africa, such as Angola and Mozambique, which are growing at an extractive-powered rate of knots. Meanwhile, other southern African states are also surging ahead with Zambia, Zimbabwe and the Democratic Republic of Congo (DRC) growing at speeds not seen in a very long time. The second reality depicts Africa as the worlds poorest continent, where the majority of people live with no access to clean water, decent health care, education and electricity, and struggle to survive in the face of high levels of unemployment, poverty and inequality. This is the reality we see all around us when we travel through southern Africa. Unsurprisingly, many people are asking how there can be two such conicting realities. And in particular they are asking about the exploitation and export of our regions mineral resources. They want to know what governments are doing with the revenues that they collect from the commercialisation of these minerals and why our natural riches do not seem to translate into a reduction in poverty. And another question that comes up time and again is how have other nations managed to use their minerals to successfully build their societies and diversify their economies? The extraction of Africas minerals by Africans started long before colonialism and even before the slave trade. In fact, the oldest mines in the world are to be found in Africa such as the

Ingwenya mine in Swaziland, which was being exploited 2000 years ago for iron ochre for rock paintings. In addition, there are thousands of ancient gold and base metal mines across the continent. In general, these mines were integrated into the local pre-colonial economies, providing essential raw materials and high value goods for trade (gold, copper). The extraction took another form when the Arabs began trading in mineral resources, such copper and gold, in addition to their existing slave and ivory trading. And extraction took yet another turn with colonisation, which stopped the evolution of mineral trading in its tracks by directing everything towards Europe. Africa has never recovered.Following the European colonial conquest of the continent, African mining became integrated into the economies of European countries, providing raw material for their industrialisation. Subsequently, Europe monopolised the exploitation and commercialisation of Africas mineral resources for its own advantage. Indeed, African minerals contributed signicantly to the development of Europe a reality that is not always told. Europe expanded natural resource extraction in Africa dramatically by using forced labour and ensuring that access to the continents minerals was free. There was no compensation for people displaced from their ancestral land or for the destruction of the environment. Human right abuses were seen as normal and acceptable. The custodians of land and customs, the chiefs, were introduced to corruption. They sold their land and their people as slaves and labourers in exchange for beer and guns often with no bullets. African chiefs were transformed into administrative clerks for the colonialists. This is important because the picture has not changed much today.

02

OPEN DEBATE 08 Myths and Mining: The reality of resource governance in Africa

03

HE OUTSIDE WORLD CONTINUES TO ENJOY a monopoly over African resources today. Since colonialism, the Wests approach to African resources has been to exploit them as much as they can for as little as they can or ideally for free. The method has changed depending on the circumstances but the philosophy remains the same. At independence, most aspects of African economies, including control of mineral resources, remained in the hands of elite metropolitans. These groups continued to control, exploit and trade in minerals resources as in the past without being threatened by the new political elite. The few African leaders who dared to speak about reclaiming let alone those who actually tried to take control of these resources were silenced or their political goals were sabotaged by fomenting chaos in their countries. In other situations, African leaders many of whom came to power with the support of the West gave European powers free access to minerals to ensure the security of their regimes. While the Cold War raged, Africa was the scene of many proxy battles since economic control of resource rich countries was critical in the geostrategic considerations of the two superpowers and their supporters. The structural adjustment programmes that were imposed on African countries were also designed to ensure that the continents mineral resources would continue to be exploited for the benet of Western countries primarily as the main means of repaying Africas vast debts. In the 1980s most African countries were deeply indebted because of the nature of the international economic system, which ensured that Africa was a net exporter of raw materials and a net importer

of manufactured goods. Because of the decline in the price of minerals in the early 1970s, African countries were accumulating less revenue from their mineral exports than they needed to pay for all the manufactured goods that were being imported forcing them to borrow to fund their ever increasing trade decits. At this point, African nations lost control of their own economies and economic policies and were forced to abide by decisions imposed on them by foreign creditors, including governments and international multilateral institutions such the World Bank, the IMF, the Club of Paris and the Club of London. One of the results was the imposition of structural adjustment programmes. These were not introduced to help Africa countries restructure their economies but rather to ensure that they were able to continue repaying their debts. It was an era when key countries the United States under President Ronald Reagan and the United Kingdom under Prime Minister Margaret Thatcher were pushing a less statist, more market-orientated approach. This philosophy inuenced the SAPs with states being required to cut the number of teachers, health care workers and other civil servants as well as workers in the manufacturing and agricultural sectors. Indeed, only one sector was spared the axe the mining sector. It was critical to protect this sector because it was the only sector capable of generating sufficient returns to repay the Western debt. But with mineral revenues being used to cover debt repayments, there was very little left over and not much from any other sector to support state administration and social services. Indeed, with the price of raw materials continuing to fall, mineral revenues were often insufficient to cover all the repayments, so debts and defaults increased.

Following the European colonial conquest of the continent, African mining became integrated into the economies of European countries, providing raw material for their industrialisation. Subsequently, Europe monopolised the exploitation and commercialisation of Africas mineral resources for its own advantage.

04

OPEN DEBATE 08 Myths and Mining: The reality of resource governance in Africa

05

T

democratisation gave African people the opportunity to ask questions that they could not ask previously, it also brought with it a new economic strategy privatisation.

HE END OF THE COLD WAR AND THE FAILURE of the structural adjustment programmes paved the way for the wave of democratisation that swept across much of the continent in the early 1990s. While democratisation gave African people the opportunity to ask questions that they could not ask previously, it also brought with it a new economic strategy privatisation. Right from the start, the crown jewels of the privatisation process were mineral resources. Two cases of failed state run mining companies will help us understand this phenomenon namely Zambia Consolidated Copper Mines, and Gecamines in the DRC. In both cases, the World Bank advised the governments to privatise these companies by unbundling them into different units. Unsure whether to follow this advice or not, both countries delayed implementation and their relationship with key donors suffered. Eventually, they proceeded with privatisation when they qualied for the World Banks Heavily Indebted Poor Country (HIPC). But the key point is that both countries were put under serious pressure to choose between debt relief or control over their own mineral resources. Throughout the privatisation process, African governments were encouraged to establish an investor friendly policy regime. What did this mean? Simple it meant allowing the unrestricted ow of foreign direct investment (FDI), particularly into the mineral sector. Because of price pressures and difficulties in attracting FDI, countries were forced to sell off their precious mineral rights cheaply on the assumption that private owners would pump money into the mines, revive the sector, generate employment and help kick-start the economies. But many

countries including the DRC and Zambia were misled into thinking that the foreign purchase of existing capital goods was the same as foreign direct investment. In reality, many investors who bought into the mining sector were solely interested in asset stripping the mines, not wealth and job creation. And the result in the long run, the countries, especially the DRC, became poorer. This is not to say that privatisation failed. In both DRC and Zambia production increased from 50,000 tons in the late 1990s to 600,000 tons today in the DRC and from 250.000 tons to 850.000 over the same period in Zambia. But privatisation has not signicantly resolved the previous problems faced by the mining sector or contributed to genuine, sustainable socio-economic development. The biggest problem with privatisation is that it has created enclave economies. Companies are reluctant to beneciate minerals on the continent, preferring to export the raw materials and add value elsewhere. Across Africa, mining economies are not really linked to the broader local economies. Equally, because of increased automation in the mining sector, it is unable to contribute signicantly to job creation. Meanwhile, as Africa continues to be pressurised into privatising its extractive industries, much of the rest of the world is intent on nationalising its natural resources. Today two thirds of oil exploration and extraction is controlled by state companies from Russia, China, Saudi Arabia, Venezuela, Iraq, Norway etc. But in Africa, mining activities are undertaken by private foreign entities, which pay taxes to

the state. However, mining activities are not contributing as much as they should to national economies. Despite the increase in productivity and prots, the real benets of mining have yet to be felt by the majority of the people, especially mining communities. Many factors including the negotiation of dubious mining contracts by politicians with no real experience in the sector, keeping contracts secrets , lack of transparency by both mining companies and governments, tax evasion, transfer pricing and corruption have contributed to reducing the amount of revenue that goes to governments and is therefore available to support critical socio-economic development programmes. Furthermore, the mining companies much celebrated corporate social responsibility projects are usually little more than charity and not pursued out of any real conviction or determination to improve the socio-economic conditions of mining communities. And while the SAPs played a critical role in destroying African states capacity, internal economic policies and corruption also contributed signicantly to the demise of the mining sector. Many prominent political gures from both ruling and opposition parties in southern Africa have interests in extractive industries and this can compromise government policies by putting the interests of the well-connected elite ahead of the needs of the majority. Fortunately, there is no evidence of the direct involvement of political parties themselves in the mining sector with the exception of the African National Congress in South Africa, which has a holding company called Chancellor House, which does invest directly in mining activities (including across the border in Swaziland).

06

OPEN DEBATE 08 Myths and Mining: The reality of resource governance in Africa

07

LL OF THIS POINTS TO THE NEED FOR a new approach to mineral resources in Africa. And governments and civil society on the continent are reecting on the current state of the extractive industry and discussing different models to ensure that Africa benets as much as possible from its natural wealth. In South Africa, a debate on nationalisation has been raging for the past few years but the government has now made it clear that it will not pursue that approach. Instead, the ANC is considering the introduction of a super tax. Meanwhile, in Zimbabwe, the government has introduced an indigenisation policy, which calls for 51 percent of all shares in mining companies to be in the hands of indigenous Zimbabweans. This policy has been widely criticised but the reality is that most governments in SADC are partners in mining companies. The DRC government controls 25-30 percent of the shares in all mining companies, while

the Zambian government holds 20-25 percent of the shares in most mining companies. The Zimbabwean government boasts a 50 percent shareholding in two diamonds companies, while Botswana owns a 51 percent stake in Debswana and Namibia control 51 percent of NamDeb (both of which are joint ventures with De Beers). And Mozambique has just decided that it should maintain 20 percent shareholdings in all extractive companies. Governments are also increasingly prepared to review badly negotiated mining contracts. In the DRC, the government has renegotiated 63 dubious contracts. Mozambique is also considering reviewing previous deals but it is not clear whether the government has the stamina or political will to go through the lengthy process since investors are strongly opposed to it. Zimbabwe could also review some of its diamond contracts.

Another option is the introduction of a windfall tax, In Zambia, the MMD government introduced a windfall tax just before the nancial crisis hit but then U-turned when commodity prices started to fall. However, what is really interesting here is that the Zambian government reversed a decision that mining companies, despite their earlier opposition, had agreed to implement. Needless to say, the price of copper soon picked up but by then it was too politically embarrassing to try and reintroduce the windfall tax. A lot of attention has been focussed on the Botswana model, which has attracted considerable praise over the years. The model, which has benefited from luck and strong leadership certainly seems to have been more successful than most. Many other governments have studied it but none have subsequently intro-

duced it in their own countries. And it is true that the model is not perfect. Indeed, a very similar model in Namibia does not seem to work so well. For example, according to a statement made by the Namibian Minister of Mines and Energy, Erkki Nghimtina in 2009, NamDeb is literally a post office through which money is dispatched. The money is just for operational costs and the real profits go to De Beers. Furthermore, while the Botswana government has invested heavily in social services using the proceeds from the countrys diamonds and its 51 percent stake in Debswana, the fact is that Botswana is still struggling with acute poverty, serious inequality, and one of the highest rates of HIV/AIDS in the world. This suggests that even Botswanas celebrated model is inefficient and not up to the task of truly transforming society for the better.

governments and civil society on the continent are reecting on the current state of the extractive industry and discussing different models to ensure that Africa benets as much as possible from its natural wealth.

08

O WHAT NEEDS TO BE DONE? Clearly, governments need to tackle corruption and try to ensure that policies and prots benet all the people, not just the elite few. However, it is far too simplistic to simply affirm that corruption and a lack of transparency and accountability are solely responsible for limiting the benets of natural resource extraction. While corruption and secrecy remain serious challenges, there is also a genuine lack of capacity within government administrations to manage the sector. Many countries in SADC are facing administrative challenges in terms of the necessary qualied staff, infrastructure, information, technology and nancial resources to manage properly the sector. Indeed, the intrinsic complexity of managing the sector including developing laws and regulations; conducting contract negotiations; monitoring the behaviour of mining companies in relation to production levels, tax evasion, environmental controls, human rights; collecting and distributing revenues; and continually re-evaluating policies may be the biggest challenge to better resource governance in southern Africa, especially as weak administrations also foster corruption. This weakness extends beyond the executive to other key institutions of the state such as parliament, the police and the judiciary that are supposed to provide oversight, support and control. And it is not just the state. Civil society groups are also weak, while most communities are not empowered and are unable to make their voices heard. It is clear that drastic changes are necessary and that there is now a chance that real change can now happen. The African Mining Vision has nally produced a charter that all African countries can use to improve the governance of

their natural resources to start to transform the mining sector so that it benets everyone not just foreign mining companies and local elites. But to achieve change, countries need to strengthen those institutions that are essential to controlling, directing and overseeing the mining sector. In particular, parliaments need to be given the skills and knowledge to perform their role better. It is not a silver bullet since other work also needs to be done to build capacity of civil society and local community groups, to root out corruption, to make companies adhere to international best practices but boosting the ability of parliaments to oversee the mining sector would go a long way towards improving governance of this critical sector. And this is why SARW in partnership with the SADC-Parliamentary Forum has devoted considerable time and resources over the past three years to develop a Southern Africa Resource Governance Barometer, which can help to empower members of parliaments to play a more constructive role in the extractive sector in the region on behalf of all the people by highlighting key issues and demonstrating how they can be most effective. The design of the barometer was enhanced by contributions from civil society activists, members of all 14 SADC parliaments, selected mining companies and community members. Created to strengthen the capacity of parliaments and parliamentarians, the barometer is a set of simple and clear principles to measure transparency, accountability and equity in the management and distribution of mining benets. It is expected that the barometer will be officially launched in November 2013 in Mozambique and will be utilised across the region. Indeed, as it is in line with the African Mining Vision, the barometer could easily be used in the rest of the continent as well.

The Open Society Initiative for Southern Africa (OSISA) is a growing African institution committed to deepening democracy, protecting human rights and enhancing good governance in southern Africa. OSISAs vision is to promote and sustain the ideals, values, institutions and practice of open society, with the aim of establishing a vibrant southern African society in which people, free from material and other deprivation, understand their rights and responsibilities and participate democratically in all spheres of life. Open Debate is funded by OSISA and is intended to spark debate on critical issues. Feel free to join in the discussion, send your thoughts to opendebate@osisa.org or alicek@osisa.org or comment on the website: www.osisa.org

The mission of the Southern Africa Resource Watch (SARW) is to ensure that extraction of natural resources in southern Africa contributes to sustainable development, which meets the needs of the present without compromising the ability of future generations to meet their needs. SARW aims to monitor corporate and state conduct in the extraction and beneciation of natural resources in the region; consolidate research and advocacy on natural resources extraction issues; shine a spotlight on the specic dynamics of natural resources in the region and building a distinctive understanding of the regional geo-political dynamics of resource economics; provide a platform of action, coordination and organization for researchers, policy makers and social justice activists to help oversee and strengthen corporate and state accountability in natural resources extraction; and, highlight the relationship between resource extraction activities and human rights and advocate for improved environmental and social responsibility practices. SARW focuses on 10 southern Africa countries but is also working to build a strong research and advocacy network with research institutions, think tanks, universities, civil society organizations, lawyers and communities in southern Africa, the African continent and beyond that are interested in the extractive industries as it relates to revenue transparency, corporate social responsibility, human rights and poverty eradication. www.sarwatch.org

Johannesburg Office Phone +27 (0)11 587 5000 Fax +27 (0)11 587 5099 opendebate@osisa.org www.osisa.org

Dr Claude Kabamba is the Director of the Southern Africa Resource Watch (SARW). Before joining SARW, he worked as the Chief Research Manager of the Human Sciences Research Council and the Research Manager at the Electoral Institute of Southern Africa. He has also worked at the Development Bank of Southern Africa as trade policy analyst. Claude received his PHD and MA in International Relations (Political Economy) from the University of Witwatersrand.

Physical Address 1st Floor, President Place 1 Hood Avenue / 148 Jan Smuts Avenue (corner Bolton Road) Rosebank Postal Address PO Box 678 Wits 2050 Johannesburg South Africa

You might also like

- Globalist's Plan To Depopulate The PlanetDocument16 pagesGlobalist's Plan To Depopulate The PlanetEverman's Cafe100% (5)

- Disrupting Harm-Conversations With Young SurvivorsDocument76 pagesDisrupting Harm-Conversations With Young SurvivorssofiabloemNo ratings yet

- Dana Property Law OutlineDocument32 pagesDana Property Law Outlinedboybaggin50% (2)

- Explaining Zambian Poverty: A History of Economic Policy Since IndependenceDocument37 pagesExplaining Zambian Poverty: A History of Economic Policy Since IndependenceChola Mukanga100% (3)

- How Europe Underdeveloped AfricaDocument6 pagesHow Europe Underdeveloped AfricaChris Wright100% (1)

- Jurisprudence Notes - Nature and Scope of JurisprudenceDocument11 pagesJurisprudence Notes - Nature and Scope of JurisprudenceMoniruzzaman Juror100% (4)

- Ra 7941 - Party List System ActDocument5 pagesRa 7941 - Party List System Act文子No ratings yet

- Barbri Notes Personal JurisdictionDocument28 pagesBarbri Notes Personal Jurisdictionaconklin20100% (1)

- Black Africa: The Economic and Cultural Basis for a Federated StateFrom EverandBlack Africa: The Economic and Cultural Basis for a Federated StateRating: 4 out of 5 stars4/5 (14)

- Garcia Fule vs. CA DigestDocument1 pageGarcia Fule vs. CA DigestPMV100% (1)

- Reasons For Underdeveloped West AFRICADocument15 pagesReasons For Underdeveloped West AFRICAFunke Deborah100% (4)

- Why Africa Is Poor PDFDocument8 pagesWhy Africa Is Poor PDFEvah Boemo MosetlhaneNo ratings yet

- Skills Training on Catering Services cum Provision of Starter KitDocument4 pagesSkills Training on Catering Services cum Provision of Starter KitKim Boyles Fuentes100% (1)

- 3 Branches of The Philippine GovernmentDocument2 pages3 Branches of The Philippine GovernmentKaren De LeonNo ratings yet

- Native Merchants: The building of the black business class in South AfricaFrom EverandNative Merchants: The building of the black business class in South AfricaRating: 5 out of 5 stars5/5 (2)

- Ending Online Sexual Exploitation and AbuseDocument106 pagesEnding Online Sexual Exploitation and AbusesofiabloemNo ratings yet

- Global Report On Trafficking in Persons 2020Document176 pagesGlobal Report On Trafficking in Persons 2020catolicoNo ratings yet

- Why Africa Fails: The case for growth before democracyFrom EverandWhy Africa Fails: The case for growth before democracyRating: 3 out of 5 stars3/5 (5)

- Colonial EconomyDocument25 pagesColonial Economygonza luks7No ratings yet

- How Europe Underdeveloped Africa: January 2020Document7 pagesHow Europe Underdeveloped Africa: January 2020Khalfan MngoyaNo ratings yet

- UnderdevelopmentDocument5 pagesUnderdevelopmentjm2476No ratings yet

- China Africa Study SmarterDocument4 pagesChina Africa Study SmarterMelanie HarveyNo ratings yet

- Ten Point Program of Uganda's National Resistance Movement (NRM) - 1984Document24 pagesTen Point Program of Uganda's National Resistance Movement (NRM) - 1984nabukenyatracy031No ratings yet

- Nkrumah's Intellectual and Political LegaciesDocument16 pagesNkrumah's Intellectual and Political LegaciesMunini K. PierreNo ratings yet

- Pro Lumumba Harmonising African Resources Power Point 1Document38 pagesPro Lumumba Harmonising African Resources Power Point 1Mixo HlaiseNo ratings yet

- Exploitation of The Natural Resources: Mining EnclavesDocument13 pagesExploitation of The Natural Resources: Mining EnclavesfannyDDNo ratings yet

- Ataberk Güngör - 24155 - Negative Effects of Globalization On South AfricaDocument7 pagesAtaberk Güngör - 24155 - Negative Effects of Globalization On South AfricaUlaş TuraNo ratings yet

- A Historical PerspectiveDocument4 pagesA Historical PerspectiveAnonymous sZSZdlpNo ratings yet

- World Revolution GwakaDocument13 pagesWorld Revolution GwakaEmmar MukisaNo ratings yet

- ECHS210 Essay Mineral RevolutionDocument5 pagesECHS210 Essay Mineral RevolutionSphesihle KhanyileNo ratings yet

- MiningDocument6 pagesMiningARIES C. BULLONo ratings yet

- A New Phase For African Liberation - Socialism From BelowDocument19 pagesA New Phase For African Liberation - Socialism From BelowDrew PoveyNo ratings yet

- Political Economy Presentation FinalDocument5 pagesPolitical Economy Presentation FinalSean JoshuaNo ratings yet

- How Colonialism Stunted Africa's Economic GrowthDocument8 pagesHow Colonialism Stunted Africa's Economic GrowthEarnestNo ratings yet

- Opportunities in the global mining industry despite fluctuationsDocument3 pagesOpportunities in the global mining industry despite fluctuationsAnil Kumar KnNo ratings yet

- Lumumba SpeechDocument25 pagesLumumba Speechsalahdifa7No ratings yet

- Mercantalism - 1500 To 1800 A.DDocument7 pagesMercantalism - 1500 To 1800 A.DAbraham L ALEMUNo ratings yet

- Chapter 3. The EconomyDocument62 pagesChapter 3. The EconomymatijciogeraldineNo ratings yet

- Building Independent Mass Media in AfricaDocument11 pagesBuilding Independent Mass Media in AfricaAlainzhuNo ratings yet

- His - 9310 - Regina ChandaDocument7 pagesHis - 9310 - Regina ChandaFrancis MbeweNo ratings yet

- Mali's History and Influencing FactorsDocument6 pagesMali's History and Influencing FactorsEdmilson JackNo ratings yet

- The Impact of Colonialism On African Economic DevelopmentDocument13 pagesThe Impact of Colonialism On African Economic Developmentsulaiman yusufNo ratings yet

- Cairo Progressing but Poverty Persists for Many EgyptiansDocument3 pagesCairo Progressing but Poverty Persists for Many EgyptiansNamita VirmaniNo ratings yet

- Underdevelopment in Sub-Saharan Africa: The Role of The Private Sector and Political Elites, Cato Foreign Policy Briefing No. 85Document12 pagesUnderdevelopment in Sub-Saharan Africa: The Role of The Private Sector and Political Elites, Cato Foreign Policy Briefing No. 85Cato Institute100% (1)

- Globalization A New Name of Neo-Colonialism.Document10 pagesGlobalization A New Name of Neo-Colonialism.SNS 456No ratings yet

- Africa Economic Brief: Africa's Growth Trajectory: Lessons From HistoryDocument3 pagesAfrica Economic Brief: Africa's Growth Trajectory: Lessons From Historytoni_yousf2418No ratings yet

- Dependency Theory Summary: How Colonialism Created Unequal DevelopmentDocument5 pagesDependency Theory Summary: How Colonialism Created Unequal DevelopmentIfe BarryNo ratings yet

- NRM Ten-Point-ProgrammeDocument16 pagesNRM Ten-Point-ProgrammeMasuumi JumaNo ratings yet

- Hidden Truth Disclosed To Create Awareness and Mentally Rehabilitate The MassesDocument28 pagesHidden Truth Disclosed To Create Awareness and Mentally Rehabilitate The MassesChristine AdamsNo ratings yet

- AfricaDocument36 pagesAfricaLuis NarváezNo ratings yet

- Africa's "Coconut Republics": A. The Origins of StatismDocument20 pagesAfrica's "Coconut Republics": A. The Origins of Statismjoseph YattaNo ratings yet

- Geography Final Study NotesDocument11 pagesGeography Final Study NotesPedro OsorioNo ratings yet

- Mercantilist and PhysiocratsDocument10 pagesMercantilist and PhysiocratsJhay Zem OrtizNo ratings yet

- Hist 322 DLMDocument7 pagesHist 322 DLMAlexy Muleh MulihNo ratings yet

- Underdevelopment and Dependence Theories NotesDocument6 pagesUnderdevelopment and Dependence Theories NotesShanice NyairoNo ratings yet

- Chapter 18: Physical Geography of Africa: The Plateau ContinentDocument10 pagesChapter 18: Physical Geography of Africa: The Plateau ContinentCatNo ratings yet

- 32-130-168C-84-PB CAAC Newslet May June 84Document4 pages32-130-168C-84-PB CAAC Newslet May June 84Kellney GwembeNo ratings yet

- Africa's Economy Rough Draft NEWDocument4 pagesAfrica's Economy Rough Draft NEWmariahneuNo ratings yet

- Political Economy of Rhodesia PDFDocument31 pagesPolitical Economy of Rhodesia PDFGuruuswaNo ratings yet

- From Aspiration To Reality: Unpacking The Africa Mining VisionDocument40 pagesFrom Aspiration To Reality: Unpacking The Africa Mining VisionOxfamNo ratings yet

- From Aspiration To Reality: Unpacking The Africa Mining VisionDocument40 pagesFrom Aspiration To Reality: Unpacking The Africa Mining VisionOxfamNo ratings yet

- Country Report: South AfricaDocument17 pagesCountry Report: South AfricaSneha SinghNo ratings yet

- Effects of Black Men Slave TradeDocument7 pagesEffects of Black Men Slave TradeHafsa WaqarNo ratings yet

- BRAND AFRICA' - The Branding of Places by Penelope Muzanenhamo, WBSDocument12 pagesBRAND AFRICA' - The Branding of Places by Penelope Muzanenhamo, WBSkNo ratings yet

- 27 The Age of Imperialism, 1850-1914Document3 pages27 The Age of Imperialism, 1850-1914api-276669719No ratings yet

- Chapter 27 OutlineDocument5 pagesChapter 27 OutlineFerrari100% (10)

- Impact of Slave Trade on Global EconomyDocument5 pagesImpact of Slave Trade on Global EconomySarah AkkaouiNo ratings yet

- Impact of Colonization - Minh AnDocument4 pagesImpact of Colonization - Minh AnMinh An NguyenNo ratings yet

- SRSG Child-Friendly-Version-Unga-2022-En PDFDocument12 pagesSRSG Child-Friendly-Version-Unga-2022-En PDFsofiabloemNo ratings yet

- SRSG Child Friendly Report SpanishDocument11 pagesSRSG Child Friendly Report SpanishsofiabloemNo ratings yet

- HRW Peru Deadly Decline Web Abril2023Document117 pagesHRW Peru Deadly Decline Web Abril2023sofiabloemNo ratings yet

- IDMC Grid 2022 LRDocument89 pagesIDMC Grid 2022 LRsofiabloem100% (1)

- 2021 Annual Report End Violence PartnershipDocument91 pages2021 Annual Report End Violence PartnershipsofiabloemNo ratings yet

- UNODC South AmericaDocument29 pagesUNODC South AmericasofiabloemNo ratings yet

- UNICEF Innocenti Prospects For Children Global Outlook 2023Document53 pagesUNICEF Innocenti Prospects For Children Global Outlook 2023sofiabloemNo ratings yet

- UNICEF RITEC Responsible Innovation in Technology For Children Digital Technology Play and Child Well Being SpreadsDocument37 pagesUNICEF RITEC Responsible Innovation in Technology For Children Digital Technology Play and Child Well Being Spreadssofiabloem100% (1)

- UN Secretary General Annual Report On Children and Armed ConflictDocument45 pagesUN Secretary General Annual Report On Children and Armed ConflictsofiabloemNo ratings yet

- UNICEF The Power of Education To End FGM 2022Document14 pagesUNICEF The Power of Education To End FGM 2022sofiabloemNo ratings yet

- Its Difficult To Grow Up in An Apocalypse Childrens and Adolescents Experiences Perceptions and Opinions On The COVID 19 Pandemic in CanadaDocument46 pagesIts Difficult To Grow Up in An Apocalypse Childrens and Adolescents Experiences Perceptions and Opinions On The COVID 19 Pandemic in CanadasofiabloemNo ratings yet

- UNICEF I Was Not Safe in His House en Final 4 3Document76 pagesUNICEF I Was Not Safe in His House en Final 4 3sofiabloemNo ratings yet

- Onu FSDR - 2022Document208 pagesOnu FSDR - 2022sofiabloemNo ratings yet

- OPS Covid 19210006 SpanishDocument62 pagesOPS Covid 19210006 SpanishsofiabloemNo ratings yet

- What Makes Me Core Capacities For Living and LearningDocument90 pagesWhat Makes Me Core Capacities For Living and LearningsofiabloemNo ratings yet

- UPR Good Practices 2022Document80 pagesUPR Good Practices 2022sofiabloemNo ratings yet

- Children in Detention Estimating The Number of Children Deprived of Liberty 2021Document20 pagesChildren in Detention Estimating The Number of Children Deprived of Liberty 2021sofiabloemNo ratings yet

- UNICEF Detention COVID Children 2021Document16 pagesUNICEF Detention COVID Children 2021sofiabloemNo ratings yet

- Children As Agents of Positive Change 2021Document49 pagesChildren As Agents of Positive Change 2021sofiabloemNo ratings yet

- Monitoring UN Convention Rights of ChildDocument429 pagesMonitoring UN Convention Rights of ChildsofiabloemNo ratings yet

- Seen Counted Included Children With Disabilities 10nov2021Document176 pagesSeen Counted Included Children With Disabilities 10nov2021sofiabloemNo ratings yet

- UNICEF Ensuring Equal Access To Education in Future Crises FindingsDocument30 pagesUNICEF Ensuring Equal Access To Education in Future Crises FindingssofiabloemNo ratings yet

- Towards Ending Child Marriage Global Trends and Profiles of ProgressDocument39 pagesTowards Ending Child Marriage Global Trends and Profiles of ProgresssofiabloemNo ratings yet

- CRC C PER QPR 6-7-47107 E Lista Cuestiones Previas ENGDocument11 pagesCRC C PER QPR 6-7-47107 E Lista Cuestiones Previas ENGsofiabloemNo ratings yet

- CRC Open Letter On Climate ChangeDocument3 pagesCRC Open Letter On Climate ChangesofiabloemNo ratings yet

- Children As Agents of Positive Change 2021Document49 pagesChildren As Agents of Positive Change 2021sofiabloemNo ratings yet

- UPR Emerging UPR GoodPracticesDocument25 pagesUPR Emerging UPR GoodPracticessofiabloemNo ratings yet

- Constitutional Law Study Guide 4Document4 pagesConstitutional Law Study Guide 4Javis OtienoNo ratings yet

- History of QuezonDocument5 pagesHistory of QuezonVIVIAN JEN BERNARDINONo ratings yet

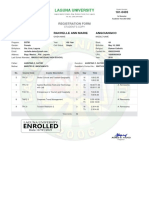

- Laguna University: Registration FormDocument1 pageLaguna University: Registration FormMonica EspinosaNo ratings yet

- Shop Act PDFDocument2 pagesShop Act PDFSudhir KotkarNo ratings yet

- Transfer of PropertyDocument18 pagesTransfer of Propertynitin0010No ratings yet

- 3.20.23 OIS ShootingDocument2 pages3.20.23 OIS ShootingNews 8 WROCNo ratings yet

- Contemporary Latino MediaDocument358 pagesContemporary Latino MediaDavid González TolosaNo ratings yet

- Party 2: Dr. Ramiz J. Aliyev Ukraine: Non-Circumvention, Non-Disclosure, Confidentiality AgreementDocument2 pagesParty 2: Dr. Ramiz J. Aliyev Ukraine: Non-Circumvention, Non-Disclosure, Confidentiality AgreementAmaliri GeoffreyNo ratings yet

- 860600-Identifying Modes of CirculationDocument7 pages860600-Identifying Modes of CirculationericNo ratings yet

- United States v. American Library Assn., Inc., 539 U.S. 194 (2003)Document39 pagesUnited States v. American Library Assn., Inc., 539 U.S. 194 (2003)Scribd Government DocsNo ratings yet

- Latar Belakang MayzulDocument3 pagesLatar Belakang MayzulZilong HeroNo ratings yet

- Agnes Henderson InfoDocument2 pagesAgnes Henderson Infopaul nadarNo ratings yet

- S.B. 43Document22 pagesS.B. 43Circa NewsNo ratings yet

- BC Fresh 2021-2022-1-2Document2 pagesBC Fresh 2021-2022-1-2KALIDAS MANU.MNo ratings yet

- Spanish Explorations in AsiaDocument4 pagesSpanish Explorations in AsiaKimlan MK GoNo ratings yet

- Iowa State U.A.W. PAC - 6084 - DR1Document2 pagesIowa State U.A.W. PAC - 6084 - DR1Zach EdwardsNo ratings yet

- Equal Remuneration Act, 1976Document9 pagesEqual Remuneration Act, 1976Shilpi KulshresthaNo ratings yet

- Iqbal'S Thought and Contemporary Challenges: Research Scholar, University of Kashmir, Srinagar, IndiaDocument4 pagesIqbal'S Thought and Contemporary Challenges: Research Scholar, University of Kashmir, Srinagar, IndiaTJPRC PublicationsNo ratings yet

- A Guide To The Characters in The Buddha of SuburbiaDocument5 pagesA Guide To The Characters in The Buddha of SuburbiaM.ZubairNo ratings yet

- Bengali Journalism: First Newspapers and Their ContributionsDocument32 pagesBengali Journalism: First Newspapers and Their ContributionsSamuel LeitaoNo ratings yet

- Erd.2.f.008 Sworn AffidavitDocument2 pagesErd.2.f.008 Sworn Affidavitblueberry712No ratings yet

- Capital PunishmentDocument3 pagesCapital PunishmentAnony MuseNo ratings yet