Professional Documents

Culture Documents

ACC 345 Answer Key (Exam #1)

Uploaded by

Remi MolakeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 345 Answer Key (Exam #1)

Uploaded by

Remi MolakeCopyright:

Available Formats

1 2

3 4 5 6 7 8 9 10 11 12 13 14 15

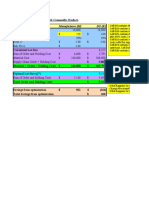

C OH control used to record "expenses" in a factory A the allocated was under by $28,000 allocated $606,000 under by 28,000 actually used $634,000 A WIP contains actual prime costs + allocated overhead D fixed cost because higher denominator -- variable cost per unit never changes C the $140,000 ($14 * 10,000 units) not divided over 20,000 units A the paper becomes the actual book C $420 DL to WIP -- straight time 42 hours at $10 each 10 2 hours of overtime premium at $5 per hour B that's the definition of finished goods C use the actual prime costs so only overhead is allocated A the total is given, so if one product has smaller cost, something must have higher cost B DL and DM are recorded in WIP, all other "expenses" are recorded in overhead control C product costs are recorded in COGS on the Inc. Stmt. Upon sale -- before they're on the Bal Sht as inventory B see below B see below A WIP is goods being manufactured #13 beg WIP DM used DL overhead total mfg. costs end WIP COGM beg WIP DM used DL overhead end WIP COGM as given $15 30 45 90 (20) $70 NEED $30 MORE $15 30 PLUG 30 45 120 (20) $100 #14 beg FG COGM GAS less end FG COGS as given $36,000 246,000 282,000 (34,000) $248,000

#1

a $257,000

beg FG COGM GAS end FG COGS $500,000 (270,000) $230,000

$80,000

PLUG

80,000 (67,000) $13,000 NEED $257,000 more

beg FG COGM GAS end FG COGS

$80,000 257,000 337,000 (67,000) $270,000

sales COGS GM

finished goods 80,000 270,000 257,000 67,000 beg FG $85,000 COGM 378,000 GAS 463,000 end FG (92,000) COGS b $371,000

#2

DM beg purchases DM ending DM used DL overhead current year costs beg WIP end WIP COGM

$45,000 112,000 157,000 (42,000) $115,000 119,000 150,000 384,000 12,000 (18,000) $378,000

DL $119,000 OH 150,000 conversion costs c $269,000

DM used $115,000 DL 119,000 prime costs d $234,000

sales $650,000 COGS (371,000) GM e $279,000 SINCE THIS WASN'T LABELLED AS "e" , WON'T COUNT

#3

a budgeted rate: $150,000 b $187,500 c $7.50

20,000

$7.50

per hour worked

25,000 actual hours worked

WIP 187,500 overhead allocated overhead allocated 187,500 COGS overhead control [actual]

187,500

7,500 180,000

#4

a WIP 12,000 salary expense 4,000 Sal. Pay. or cash b WIP 9,000 overhead allocated OH cont. 900 prepaid rent

d 16,000 e 9,000

FG

11,000 WIP 14,250 sales --- and--9,000 FG

11,000

AR

14,250

COGS c 900

9,000

#5 a

Standard

375/600

Deluxe

225/600

total $60,000 total $20,000 $40,000 $60,000 allocate $20,000 using setups allocate $40,000 using components Total OH allocated to each product allocate the $60,000 using hours

$37,500 Standard

22/50

$22,500 Deluxe

28/50

$8,800

8/20

$11,200

12/20

$16,000 b $24,800

$24,000 $35,200

c When Barnes used the functional system Standard had too much overhead and Deluxe had too little. By switching to ABC method the overhead will be allocated more realistically. With better product costing information Barnes will be able to make more rational pricing and other decisions.

You might also like

- Libro 7.5 InglesDocument14 pagesLibro 7.5 InglesChristopher StrongNo ratings yet

- Breeden Security BDocument6 pagesBreeden Security BKitty ThaparNo ratings yet

- Assignment 4 - CostAcc - ExerciseDocument22 pagesAssignment 4 - CostAcc - ExerciseVanessa vnssNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- Capital Budgeting Cash Flows: Solutions To ProblemsDocument20 pagesCapital Budgeting Cash Flows: Solutions To ProblemsRau MohdNo ratings yet

- Ma PHD01003 Harshad Savant Term2 EndtermDocument8 pagesMa PHD01003 Harshad Savant Term2 EndtermHarshad SavantNo ratings yet

- QS07 - Class Exercises SolutionDocument8 pagesQS07 - Class Exercises Solutionlyk0texNo ratings yet

- LEVEL 2 Online Quiz - Answers SET ADocument10 pagesLEVEL 2 Online Quiz - Answers SET AVincent Larrie MoldezNo ratings yet

- 4 51Document3 pages4 51Achmad Faizal AzmiNo ratings yet

- Chapter 3 Sol 11-20Document4 pagesChapter 3 Sol 11-20Something ChicNo ratings yet

- Input Form: Input For Venture Guidance AppraisalDocument7 pagesInput Form: Input For Venture Guidance AppraisalgenergiaNo ratings yet

- CH2 QuizkeyDocument5 pagesCH2 QuizkeyiamacrusaderNo ratings yet

- Final for PDFDocument8 pagesFinal for PDFWaizin KyawNo ratings yet

- Flexible Budgetand Activity Based CostingDocument13 pagesFlexible Budgetand Activity Based CostingLhorene Hope DueñasNo ratings yet

- Unit 6 Chapter 11Document5 pagesUnit 6 Chapter 11Kimberly A AlanizNo ratings yet

- Lesson 5 Activity Based CostingDocument39 pagesLesson 5 Activity Based CostingMELODY MAE TIONGSONNo ratings yet

- Spoilage, Scrap, ReworkDocument6 pagesSpoilage, Scrap, ReworkJanine Malicdem AvilaNo ratings yet

- Test 2 Sample Questions With Correct AnswersDocument8 pagesTest 2 Sample Questions With Correct AnswersBayoumy ElyanNo ratings yet

- Chapter 1 - Inventory Models - Part 1Document30 pagesChapter 1 - Inventory Models - Part 1Binyam KebedeNo ratings yet

- ACCT 306 PowerpointDocument30 pagesACCT 306 PowerpointKayla SheltonNo ratings yet

- CMADocument24 pagesCMAeiNo ratings yet

- Exercise 7.5Document16 pagesExercise 7.5MJSANCHEZPILTAXINo ratings yet

- Fima Week 2 ActivitiesDocument9 pagesFima Week 2 ActivitiesKatrina PaquizNo ratings yet

- ACC 231 Pre TestDocument4 pagesACC 231 Pre TestM ANo ratings yet

- Optimize pricing document titleDocument11 pagesOptimize pricing document titleQuỳnh ChâuNo ratings yet

- Chapter 6-7Document14 pagesChapter 6-7gmamagloriaNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- Final examDocument9 pagesFinal examWaizin KyawNo ratings yet

- Cyclohexane plant simulation and cost analysis in Aspen Hysis V8.8Document5 pagesCyclohexane plant simulation and cost analysis in Aspen Hysis V8.8Luffy RajNo ratings yet

- Review SessionDocument10 pagesReview SessionMaajid Bashir0% (1)

- Quiz Internal AccountingDocument3 pagesQuiz Internal AccountingMili Dit100% (1)

- 1.05 Cost Accumulation SystemsDocument37 pages1.05 Cost Accumulation SystemsmymyNo ratings yet

- Chap 10Document7 pagesChap 10Putri EkaNo ratings yet

- Chapter 11-Quantity DiscountsDocument8 pagesChapter 11-Quantity DiscountsshivamNo ratings yet

- Capital Budgeting Problems SolutionsDocument22 pagesCapital Budgeting Problems SolutionsChander Santos Monteiro100% (3)

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument10 pagesCH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionssamahNo ratings yet

- 10 Cases Accounting - Answered-1 PDFDocument10 pages10 Cases Accounting - Answered-1 PDFNehal NabilNo ratings yet

- Kerjakan 4-12 Dan 4 - 17: 1. "Plantwide"Document4 pagesKerjakan 4-12 Dan 4 - 17: 1. "Plantwide"natan. lieNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Shah ReenNo ratings yet

- Hilton Chap 17 SolutionsDocument9 pagesHilton Chap 17 Solutionstarcher1987No ratings yet

- Chapter 2 Homework SolutionsDocument7 pagesChapter 2 Homework SolutionsAlex RomanovNo ratings yet

- HW Git Man 10 Solution CH 08Document21 pagesHW Git Man 10 Solution CH 08Latifah MunassarNo ratings yet

- 2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Document7 pages2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Ali MohammedNo ratings yet

- Pacific Pool CompanyDocument10 pagesPacific Pool CompanyAnayeli SanchezNo ratings yet

- Management Accounting QuestionsDocument11 pagesManagement Accounting QuestionsManfredNo ratings yet

- CM121.Solution September-2023 Exam.Document7 pagesCM121.Solution September-2023 Exam.Arif HossainNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- 2020 Manufacturing Cost Estimates and Income Statement Analysis Using Traditional and Activity-Based CostingDocument6 pages2020 Manufacturing Cost Estimates and Income Statement Analysis Using Traditional and Activity-Based CostingBornyNo ratings yet

- Chapter 14Document38 pagesChapter 14Carmelie CumigadNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyArchie Lazaro100% (1)

- Bethesda Mining: Input AreaDocument15 pagesBethesda Mining: Input AreaJenkins Qing100% (1)

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- CH 26Document9 pagesCH 26MohitNo ratings yet

- Chapter 11Document5 pagesChapter 11River Wu0% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Air & Gas Compressors World Summary: Market Values & Financials by CountryFrom EverandAir & Gas Compressors World Summary: Market Values & Financials by CountryNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- UCL Fire Safety Guide ChecklistDocument1 pageUCL Fire Safety Guide Checklistalive2flirtNo ratings yet

- Minimum Variance Portfolio WeightsDocument4 pagesMinimum Variance Portfolio WeightsDaniel Dunlap100% (1)

- HZS 120 Concrete Batching PlantDocument2 pagesHZS 120 Concrete Batching PlantHenan NF Mechanical Installation Co., Ltd.No ratings yet

- How To Write A ProposalDocument16 pagesHow To Write A ProposalnasrullahdharejoNo ratings yet

- PC Spun PilesDocument2 pagesPC Spun PilesFaridah Zahra100% (1)

- This File Was Produced Natively: Highly Confidential Hal 0543273Document6 pagesThis File Was Produced Natively: Highly Confidential Hal 0543273OSDocs2012No ratings yet

- INDIAREIT Fund Scheme V - 2nd Drawdown NoticeDocument1 pageINDIAREIT Fund Scheme V - 2nd Drawdown NoticeRavi Naid GorleNo ratings yet

- Flat End PlatesDocument4 pagesFlat End Platesb_wooNo ratings yet

- CTI vs Artex Development Co Customs Bonded Warehouse Cotton CaseDocument1 pageCTI vs Artex Development Co Customs Bonded Warehouse Cotton Caseeiram23No ratings yet

- International Marketing ImperativeDocument12 pagesInternational Marketing ImperativeLuca-John De Grossi50% (2)

- Volume Spread AnalysisDocument3 pagesVolume Spread Analysisswifty4000No ratings yet

- Et 101 (A)Document4 pagesEt 101 (A)murugan_collegemanNo ratings yet

- ch09 - IGBT SYSTEM A.C Motor PDFDocument8 pagesch09 - IGBT SYSTEM A.C Motor PDFJohan EstradaNo ratings yet

- Nss CalculatorDocument4 pagesNss CalculatorZoebair100% (1)

- Indigenous architecture of hot-dry desert climateDocument3 pagesIndigenous architecture of hot-dry desert climateNagpal ChetanNo ratings yet

- Accounting Ratios FormulasDocument2 pagesAccounting Ratios Formulastuku67No ratings yet

- Transcorp - Notice of Extra-Ordinary General MeetingDocument2 pagesTranscorp - Notice of Extra-Ordinary General MeetingTransnational Corporation of Nigeria PLCNo ratings yet

- Chem 237 Exam 2 ReviewDocument7 pagesChem 237 Exam 2 ReviewNgoc Minh NgoNo ratings yet

- Erin Nugent: 6323 Alden Street Shawnee, KS - (913) 961-0072Document2 pagesErin Nugent: 6323 Alden Street Shawnee, KS - (913) 961-0072ErinNugentNo ratings yet

- BIG 2013 AllDocument1,657 pagesBIG 2013 AllMuhammad SyofianNo ratings yet

- Cathay PacificDocument6 pagesCathay PacificIIMnotes100% (1)

- Feasibility Study On A Hotel ProjectDocument3 pagesFeasibility Study On A Hotel ProjectLalyn P. Gan79% (19)

- Automatic Curtain Opener PDFDocument2 pagesAutomatic Curtain Opener PDFSuresh Kaushik100% (1)

- Laser Metal Cutting MachineDocument2 pagesLaser Metal Cutting Machineinalac2No ratings yet

- Electro Statics - Balaji PaperDocument2 pagesElectro Statics - Balaji PaperKrishna Vijay Kumar GangisettyNo ratings yet

- KW4 361 PDFDocument1 pageKW4 361 PDFanon_242149013No ratings yet

- Presentation About SIX SIGMA - DMADV ApproachDocument20 pagesPresentation About SIX SIGMA - DMADV ApproachPiotr BartenbachNo ratings yet

- Dry GranulationDocument1 pageDry Granulationnadira_rahmiNo ratings yet

- ARHAMDocument2 pagesARHAMFaizan RashidNo ratings yet

- Aloo Tikki BurgerDocument7 pagesAloo Tikki Burgermukti banaNo ratings yet