Professional Documents

Culture Documents

CH 14

Uploaded by

Hoàng HuyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 14

Uploaded by

Hoàng HuyCopyright:

Available Formats

File: ch14, Chapter 14: Managerial Accounting

Multiple Choice

1. Managerial accounting: a) is governed by generally accepted accounting principles. b) places emphasis on special-purpose information. c) pertains to the entity as a whole and is highly aggregated. d) is limited to cost data. Ans: b Response A: Financial accounting, not managerial accounting is governed by generally accepted accounting principles. Response B: Correct! This is an accurate statement about managerial accounting. Response C: Financial accounting, not managerial accounting pertains to the entity as a whole and is highly aggregated. Response D: Cost accounting and cost data are a subset of management accounting.

2. The management of an organization performs several broad functions. They are: a) planning, directing, and selling. b) planning, directing, and controlling. c) planning, manufacturing, and controlling. d) directing, manufacturing, and controlling. Ans: b Response A: Planning and directing are two of the functions performed by management, but selling is performed by the selling group in the organization, not by management. Response B: Correct! These are the broad functions performed by the management of an organization. Response C: Planning and controlling are two of the functions performed by management, but manufacturing is performed by the manufacturing group in the organization, not by management. Response D: Directing and controlling are two of the functions performed by management, but manufacturing is performed by the manufacturing group in the organization, not by management.

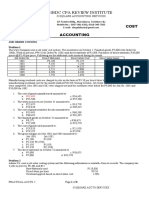

3. Direct materials are a: Product Cost Yes Yes Yes No Manufacturing Overhead Yes No Yes No Period Cost No No Yes No

a) b) c) d)

Ans: b Response A: Direct materials are a product cost but not manufacturing overhead or a period cost. Response B: Correct! Direct materials are a product cost but not manufacturing overhead or a period cost. Response C: Direct materials are not manufacturing overhead or a period cost but are a product cost. Response D: If B is correct than this answer is not correct.

4. Indirect labor is a: a) nonmanufacturing cost. b) raw material cost. c) product cost. d) period cost. Ans: c Response A: Indirect labor is not a nonmanufacturing cost because it is part of the effort required to produce a product. Response B: Indirect labor is not a raw material cost because raw material costs only include direct materials and indirect materials. Response C: Correct! Indirect labor is a product cost because it is part of the effort required to produce a product. Response D: Indirect labor is not a period cost because it is part of the effort required to produce a product.

5. Which of the following costs would be included in manufacturing overhead of a computer manufacturer? a) The cost of the disk drives. b) The wages earned by computer assemblers. c) The cost of the memory chips. d) Depreciation on testing equipment. Ans: d Response A: The cost of the disk drives would be included as direct materials, not manufacturing overhead of a computer company. Response B: The wages earned by computer assemblers would be included as direct labor, not manufacturing overhead of a computer company. Response C: The cost of the memory chips would be included as direct materials, not manufacturing overhead of a computer company. Response D: Correct! Depreciation on testing equipment would be included in manufacturing overhead because it is indirectly associated with the finished product.

6. Which of the following is not an element of manufacturing overhead? a) Sales managers salary. b) Plant managers salary.

c) Factory repairmans wages. d) Product inspectors salary. Ans: a Response A: Correct! The sales manager's salary is considered a period cost, not a product cost. Response B: The plant managers salary is considered an element of manufacturing overhead. Response C: The factory repairmans wages are considered an element of manufacturing overhead. Response D: The product inspectors salary is considered an element of manufacturing overhead.

7. For the year, Redder Company has cost of goods manufactured of $600,000, beginning finished goods inventory of $200,000, and ending finished goods inventory of $250,000. The cost of goods sold is: a) $450,000. b) $500,000. c) $550,000. d) $600,000. Ans: c Response A: Cost of goods sold is computed as follows: Beginning finished goods inventory ($200,000) plus cost of goods manufactured ($600,000) minus ending finished goods inventory ($250,000), or $200,000 + $600,000 - $250,000 = $550,000. Response B: Cost of goods sold is computed as follows: Beginning finished goods inventory ($200,000) plus cost of goods manufactured ($600,000) minus ending finished goods inventory ($250,000), or $200,000 + $600,000 - $250,000 = $550,000. Response C: Correct! Cost of goods sold is computed as follows: Beginning finished goods inventory ($200,000) plus cost of goods manufactured ($600,000) minus ending finished goods inventory ($250,000), or $200,000 + $600,000 - $250,000 = $550,000. Response D: Cost of goods sold is computed as follows: Beginning finished goods inventory ($200,000) plus cost of goods manufactured ($600,000) minus ending finished goods inventory ($250,000), or $200,000 + $600,000 - $250,000 = $550,000.

8. A cost of goods manufactured schedule shows beginning and ending inventories for: a) raw materials and work in process only. b) work in process only. c) raw materials only. d) raw materials, work in process, and finished goods. Ans: a Response A: Correct! A cost of goods manufactured schedule shows beginning and ending inventories for raw materials and work in process only. Response B: A cost of goods manufactured schedule shows beginning and ending inventories for raw materials and work in process, not work in process only. Response C: A cost of goods manufactured schedule shows beginning and ending inventories for raw materials and work in process, not raw materials only. Response D: A cost of goods manufactured schedule shows beginning and ending inventories for raw materials and work in process only, not raw materials, work in process, and finished goods.

9. In a manufacturers balance sheet, three inventories may be reported: (1) raw materials, (2) work in process, and (3) finished goods. Indicate in what sequence these inventories generally appear on a balance sheet. a) (1), (2), (3) b) (2), (3), (1) c) (3), (1), (2) d) (3), (2), (1) Ans: d Response A: On the balance sheet of a manufacturer, inventories are reported with (3) finished goods first, (2) work in process second and (1) raw materials third. Response B: On the balance sheet of a manufacturer, inventories are reported with (3) finished goods first, (2) work in process second and (1) raw materials third. Response C: On the balance sheet of a manufacturer, inventories are reported with (3) finished goods first, (2) work in process second and (1) raw materials third. Response D: Correct! On the balance sheet of a manufacturer, inventories are reported with (3) finished goods first, (2) work in process second and (1) raw materials third.

10. Which of the following managerial accounting techniques attempts to allocate manufacturing overhead in a more meaningful fashion? a) Just-in-time inventory. b) Total-quality management. c) Theory of constraints. d) Activity-based costing. Ans: d Response A: Activity-based costing, not just-in-time inventory, attempts to allocate manufacturing overhead in a more meaningful fashion. Response B: Activity-based costing, not total quality management, attempts to allocate manufacturing overhead in a more meaningful fashion. Response C: Activity-based costing, not theory of constraints, attempts to allocate manufacturing overhead in a more meaningful fashion. Response D: Correct! Activity-based costing attempts to allocate manufacturing overhead in a more meaningful fashion.

You might also like

- Daily Accomplishment Report - JANRICKDocument3 pagesDaily Accomplishment Report - JANRICKJudy Anne BautistaNo ratings yet

- Quali ExamDocument7 pagesQuali ExamLovenia Magpatoc50% (2)

- Best of SQL Server Central Vol 2Document195 pagesBest of SQL Server Central Vol 2madhavareddy29100% (3)

- CH 15Document4 pagesCH 15huongthuy1811100% (1)

- 0016 SAP ABAP With S4 HANA Syllabus UCPL TechnologiesDocument7 pages0016 SAP ABAP With S4 HANA Syllabus UCPL TechnologiesUCPL TrainingNo ratings yet

- Lloyd Industries Manufactures Electrical Equipment From Specifications Received From CustomersDocument2 pagesLloyd Industries Manufactures Electrical Equipment From Specifications Received From CustomersAmit PandeyNo ratings yet

- As We May ThinkDocument8 pagesAs We May ThinkPaulla PereiraNo ratings yet

- Prescott Manufacturing Evaluates The Performance of Its Production Managers Based On A Variety of FactorsDocument3 pagesPrescott Manufacturing Evaluates The Performance of Its Production Managers Based On A Variety of FactorsElliot RichardNo ratings yet

- Calculating variable and fixed costs for units producedDocument12 pagesCalculating variable and fixed costs for units producedashibhallau100% (1)

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Exercises On Chapter 3 PDFDocument8 pagesExercises On Chapter 3 PDFhanaNo ratings yet

- Ch10tif (Determining How Cost Behave)Document35 pagesCh10tif (Determining How Cost Behave)Mary Grace Ofamin100% (1)

- 2010-03-22 081114 PribumDocument10 pages2010-03-22 081114 PribumAndrea RobinsonNo ratings yet

- Not Sure What This Is, Could Be ch08Document29 pagesNot Sure What This Is, Could Be ch08ryukenNo ratings yet

- Chap7vanderbeck ReviewerDocument8 pagesChap7vanderbeck ReviewerSaeym SegoviaNo ratings yet

- 1.05 Cost Accumulation SystemsDocument37 pages1.05 Cost Accumulation SystemsmymyNo ratings yet

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- SEATWORKDocument4 pagesSEATWORKMarc MagbalonNo ratings yet

- Chapter 10: Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument41 pagesChapter 10: Standard Costing, Operational Performance Measures, and The Balanced ScorecardSucreNo ratings yet

- Cost Accounting An Introduction To Cost Terms and PurposesDocument66 pagesCost Accounting An Introduction To Cost Terms and PurposesAhmadnur JulNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Jit PDFDocument28 pagesJit PDFRona S. Pepino - AguirreNo ratings yet

- Pricing 2 ProbDocument2 pagesPricing 2 ProbPines MacapagalNo ratings yet

- Process Costing NotesDocument3 pagesProcess Costing NotesOlin Pitters100% (1)

- Chapter 15 Transfer Pricing QDocument9 pagesChapter 15 Transfer Pricing QMaryane AngelaNo ratings yet

- Day 7 Chap 3 Rev. FI5 Ex PR PDFDocument5 pagesDay 7 Chap 3 Rev. FI5 Ex PR PDFJames Erick LermaNo ratings yet

- Job-Order Costing: Calculating Predetermined Overhead RatesDocument76 pagesJob-Order Costing: Calculating Predetermined Overhead RatesMulugeta GirmaNo ratings yet

- Managerial Accounting Mid-term Exam Break-even Analysis & Costing MethodsDocument3 pagesManagerial Accounting Mid-term Exam Break-even Analysis & Costing MethodsjaeNo ratings yet

- Chapter 8 - Standard CostingDocument8 pagesChapter 8 - Standard CostingJoey LazarteNo ratings yet

- Peter Senen overhead calculations and journal entriesDocument5 pagesPeter Senen overhead calculations and journal entriesAccounting Files0% (1)

- Programmazione e Controllo Esercizi Capitolo 9Document32 pagesProgrammazione e Controllo Esercizi Capitolo 9Azhar SeptariNo ratings yet

- Dokumen PDFDocument21 pagesDokumen PDFMark AlcazarNo ratings yet

- Kuis Perbaikan UTS AKbi 2016-2017Document6 pagesKuis Perbaikan UTS AKbi 2016-2017Rizal Sukma PNo ratings yet

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

- Humble Company Has Provided The Following Budget Information For TheDocument2 pagesHumble Company Has Provided The Following Budget Information For TheAmit PandeyNo ratings yet

- CHAPTER FOUR Process CostingDocument10 pagesCHAPTER FOUR Process Costingzewdie100% (1)

- Handout 7 - Process CostingDocument32 pagesHandout 7 - Process CostingDonovan Leong 도노반No ratings yet

- Chapter 03 Instructor Homework & AnswersDocument5 pagesChapter 03 Instructor Homework & AnswersSeng TheamNo ratings yet

- Acc2002 PPT FinalDocument53 pagesAcc2002 PPT FinalSabina TanNo ratings yet

- Assignment 2Document4 pagesAssignment 2Ella Davis0% (1)

- Question Bank - Practical QuestionsDocument10 pagesQuestion Bank - Practical QuestionsNeel KapoorNo ratings yet

- Relevant Costs For Decision Making: MANAGEMENT ACCOUNTING - Solutions ManualDocument33 pagesRelevant Costs For Decision Making: MANAGEMENT ACCOUNTING - Solutions ManualClaire BarbaNo ratings yet

- Week 12 Assignment Chapter 8Document2 pagesWeek 12 Assignment Chapter 8tucker jacobsNo ratings yet

- Stracos Module 1 Quiz Cost ConceptsDocument12 pagesStracos Module 1 Quiz Cost ConceptsGemNo ratings yet

- Activity-Based Costing Systems: Benefits, Concepts & ImplementationDocument11 pagesActivity-Based Costing Systems: Benefits, Concepts & ImplementationKeach Harrel CabagayNo ratings yet

- ADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdDocument3 pagesADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdSam FishNo ratings yet

- Activity Based Costing, Management, and Budgeting - ABC in A Government SettingDocument9 pagesActivity Based Costing, Management, and Budgeting - ABC in A Government Settingelvarg09No ratings yet

- KAYE ALEXIS B. DAYAG (BSAIS 2A) ACTIVITY-BASED COSTINGDocument3 pagesKAYE ALEXIS B. DAYAG (BSAIS 2A) ACTIVITY-BASED COSTINGAlexis Kaye DayagNo ratings yet

- S06 - Process Costing ProblemsDocument1 pageS06 - Process Costing ProblemsRigel Kent MansuetoNo ratings yet

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Case of 7-17 - Syndicate Group 4 - SLEMBA BPOM1Document7 pagesCase of 7-17 - Syndicate Group 4 - SLEMBA BPOM1Fadhila HanifNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument9 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionCHAU Nguyen Ngoc BaoNo ratings yet

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

- Break-Even Analysis and Sales Mix CalculationsDocument5 pagesBreak-Even Analysis and Sales Mix CalculationsFlorabelle May LibawanNo ratings yet

- Chap 006Document285 pagesChap 006Jessica Cola86% (7)

- Analyze Job Order Costing Transactions and CalculationsDocument8 pagesAnalyze Job Order Costing Transactions and CalculationsZakaria HasaneenNo ratings yet

- Programmazione e Controllo Esercizi Capitolo 11Document31 pagesProgrammazione e Controllo Esercizi Capitolo 11Jamie Shaula ColladoNo ratings yet

- 10 ACCT 1A&B Mfg.Document14 pages10 ACCT 1A&B Mfg.Shannon MojicaNo ratings yet

- Cost Concept Exercises PDFDocument2 pagesCost Concept Exercises PDFAina OracionNo ratings yet

- Chap 004Document149 pagesChap 004Jessica Cola100% (1)

- 2012 EE enDocument76 pages2012 EE enDiane MoutranNo ratings yet

- Cost Accounting Hilton 14Document13 pagesCost Accounting Hilton 14Vin TenNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Chapter 7 Activity Based CostingDocument5 pagesChapter 7 Activity Based CostingCh KingNo ratings yet

- CH 02Document5 pagesCH 02Hoàng HuyNo ratings yet

- CH 03Document4 pagesCH 03Hoàng HuyNo ratings yet

- CH 02Document5 pagesCH 02Hoàng HuyNo ratings yet

- 0132067331Document47 pages0132067331Hoàng HuyNo ratings yet

- CH 18Document4 pagesCH 18Hoàng HuyNo ratings yet

- The Capital Budgeting ProcessDocument36 pagesThe Capital Budgeting ProcessSyed Arbab Ahmed100% (1)

- BUS 415 Investment and Portfolio Management Spring 2011, AUBG Quiz #6 (A)Document3 pagesBUS 415 Investment and Portfolio Management Spring 2011, AUBG Quiz #6 (A)Hoàng HuyNo ratings yet

- CH 16Document6 pagesCH 16Hoàng HuyNo ratings yet

- Chapter 5 Exercise SolutionsDocument12 pagesChapter 5 Exercise SolutionsHoàng HuyNo ratings yet

- Introduction to Financial StatementsDocument4 pagesIntroduction to Financial StatementsHoàng HuyNo ratings yet

- CH 09Document6 pagesCH 09Hoàng HuyNo ratings yet

- BM410-07 Forwards Futures and Options 22sep05 - 2Document45 pagesBM410-07 Forwards Futures and Options 22sep05 - 2Phung DinhNo ratings yet

- CH 4Document20 pagesCH 4Hoàng HuyNo ratings yet

- Test 2Document21 pagesTest 2Ryka Aguinaldo100% (1)

- QuizF CH8Document7 pagesQuizF CH8Hoàng HuyNo ratings yet

- CH 1Document25 pagesCH 1Rakesh VarmaNo ratings yet

- 157957Document18 pages157957Hoàng Huy0% (1)

- QuizF CH10Document7 pagesQuizF CH10Hoàng HuyNo ratings yet

- Chapter 3 Exercise SolutionsDocument14 pagesChapter 3 Exercise SolutionsHoàng HuyNo ratings yet

- Ch003.Lam2e TBDocument25 pagesCh003.Lam2e TBHoàng HuyNo ratings yet

- Chapter 2 Problem SolutionsDocument5 pagesChapter 2 Problem SolutionsHoàng HuyNo ratings yet

- Answer Chap05Document22 pagesAnswer Chap05Hoàng HuyNo ratings yet

- Chap 3 SolutionsDocument70 pagesChap 3 SolutionsHoàng Huy80% (10)

- Ch1 Lecture NotesDocument9 pagesCh1 Lecture NotesHoàng HuyNo ratings yet

- CH 12Document23 pagesCH 12Hoàng HuyNo ratings yet

- CH 14Document10 pagesCH 14Hoàng HuyNo ratings yet

- 5 Net Present Value and Other Investment CriteriaDocument42 pages5 Net Present Value and Other Investment CriteriaHoàng HuyNo ratings yet

- Introduction To MicroeconomicsDocument13 pagesIntroduction To MicroeconomicsHoàng HuyNo ratings yet

- Air Flow Clustering HADocument32 pagesAir Flow Clustering HADeepak ManeNo ratings yet

- Quality Planning Using APQP Phases Nicely ExplainedDocument5 pagesQuality Planning Using APQP Phases Nicely ExplainedsofihussainNo ratings yet

- Job Description: Key Position Information Key Position InformationDocument3 pagesJob Description: Key Position Information Key Position Informationnotes.mcpuNo ratings yet

- HMK12AA Product Specification and Performance DataDocument4 pagesHMK12AA Product Specification and Performance DataMarcos EvansNo ratings yet

- EMarkSheet-A Web Portal For Online Verification of Statement of Marks and Certificate For SSC and HSC (Maharashtra) 2Document1 pageEMarkSheet-A Web Portal For Online Verification of Statement of Marks and Certificate For SSC and HSC (Maharashtra) 2yuvrajNo ratings yet

- SB286 Update For EMV Book C 5Document4 pagesSB286 Update For EMV Book C 5Raven 83No ratings yet

- Field Devices - Flow: Log oDocument16 pagesField Devices - Flow: Log osalmo83:18No ratings yet

- Quick Start Operating Procedures MkiiiDocument2 pagesQuick Start Operating Procedures MkiiiNopi EkoNo ratings yet

- Script FontDocument76 pagesScript FontJulio Gomez SilvermanNo ratings yet

- Hellas Sat 4Document1 pageHellas Sat 4Paolo LobbaNo ratings yet

- ZXR10 5900E Configuration Guide (Basic Configuration)Document174 pagesZXR10 5900E Configuration Guide (Basic Configuration)HectorNo ratings yet

- PUFF-CONSTRUCTION ESTIMATE USER MANUALDocument5 pagesPUFF-CONSTRUCTION ESTIMATE USER MANUALjoanNo ratings yet

- UserBenchmark - AMD Radeon HD 6670 Vs Nvidia GeForce GT 730Document6 pagesUserBenchmark - AMD Radeon HD 6670 Vs Nvidia GeForce GT 730IreneNo ratings yet

- Promocion Tiendas Te-Ka Bodega 2021-9Document22 pagesPromocion Tiendas Te-Ka Bodega 2021-9Beiker Jose Palencia SarmientoNo ratings yet

- 95 8657 2.3 FlexSonic AcousticDocument37 pages95 8657 2.3 FlexSonic Acousticsudipta_kolNo ratings yet

- Manually Configure Devices by Using Device Manager: Windows XPDocument4 pagesManually Configure Devices by Using Device Manager: Windows XPlucky_4u15No ratings yet

- Kent Bulldozer TY320Document1 pageKent Bulldozer TY320MOZAMBiCARNo ratings yet

- Lecture 2 Is in The EnterpriseDocument44 pagesLecture 2 Is in The EnterpriseAludahNo ratings yet

- The Application of Information Technology in Apparel ManufacturingDocument39 pagesThe Application of Information Technology in Apparel Manufacturingmihret henokNo ratings yet

- Resume Allison VincentDocument3 pagesResume Allison Vincentapi-351166570No ratings yet

- Design and simulation of a 2x2 MIMO antenna system for IEEE 802.11a applicationsDocument7 pagesDesign and simulation of a 2x2 MIMO antenna system for IEEE 802.11a applicationsValery ShevchenkoNo ratings yet

- DrivingDocument64 pagesDrivingjamb2316No ratings yet

- LJQHelp PaletteDocument2 pagesLJQHelp PaletteMuhammad AwaisNo ratings yet

- UI Field Level Security - v1 0 - ScopeDocument11 pagesUI Field Level Security - v1 0 - Scopefaraz_ec10No ratings yet

- Technicolor DOCSIS Gateway - MODEL CGM4331XXX - User GuideDocument19 pagesTechnicolor DOCSIS Gateway - MODEL CGM4331XXX - User GuideDaveNo ratings yet

- AP2610-20 - Install 9034544-01Document2 pagesAP2610-20 - Install 9034544-01CartoonXNo ratings yet