Professional Documents

Culture Documents

Case Study - Linear Tech - Christopher Taylor - Sample

Uploaded by

akshay87kumar8193Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study - Linear Tech - Christopher Taylor - Sample

Uploaded by

akshay87kumar8193Copyright:

Available Formats

Executive Summary Entering the 4th quarter of Linear Technologys fiscal year 2003 the market continues to show

signs of improvement. The company has shown steady growth in the last year and revenues are estimated to increase 19% over FY 2002. Based on this estimate, FY 2003 net income will hit $222.7 million ($0.71 earnings per share); a 12.6% growth from the previous year. Operating cash flow; while lower than 2000 and 2001 has shown a modest increase since 2002 and continues to be positive due to the companys variable cost structure. This is in-part is due to more efficient working capital investments and other adjustments to income, awarding the company a 10% increase in net cash flow year-over-year. Linear Technology has increased its cash holdings to excess of $1.5 billion through employing cost savings initiatives, though these holdings have only shown investors modest returns in the neighborhood of 4.25% ($0.10 earnings per share). While modest, investors have come to expect this form of conservativeness and there has been little outcry of agency issues. Looking ahead, based on an analog fabs life expectancy of 10 plus years, capital investments, for a new fab, will be required in the next one or two years in excess of $200 million; leaving more than sufficient cash holdings while requiring no leveraging. Based on these financials, Linear Technology should look to increase its dividend payout by $0.01 per share. This has become the expected trend over the last 3 plus years and any adjustment to this could show signs of weakening in the businesses outlook. This increase would raise dividend payouts to an estimated $66 million, a 22% increase from the FY 2002. An estimated 8.5% increase in the payout ratio, from 27.31% to estimated 29.64%; ranking Linear Technology higher than any other company in the SOX for the dividend-toearnings payout ratio.

Created by: Christopher B Taylor

Page 1

Potential Issues Linear Technology is holding on to $1.5 billion in cash and short-term investments which invests in low risk securities. This can be seen as an agency issue. By Linear Technology holding onto all this cash and only placing it in short-term debt securities, they are only providing an internal rate of return of 4.25% ($0.10 per share). See Exhibit 1. Investors may want to see some of these current assets used to acquire other companies or invested in more R&D that would keep the internal rate of return above the marginal cost of capital. The company is faced with the option of keeping the quarterly dividend at $0.05 per share or increasing the payout to $0.06 per share. If Linear Technology leaves the dividend payout unchanged, investors could take this move as a sign of weakness. Acknowledging that in January 2003 institutional holdings of the stock LLTC made up 84.93%; the companys move to continue to be over-cautious with its current assets and not provide an increase in the dividend payout may lead the investors to seek greater returns in other securities. By raising the dividend payout, the company will be faced with a 29.64% payout ratio; the highest in the SOX. See Exhibit 2. By spending an estimated 66 million on dividend payouts, the company will see a percentage increase in operating cash flow payout of 26.13%, up from an operating cash flow payout of 21%. See Exhibit 3.

Created by: Christopher B Taylor

Page 2

Methodology It is suggested that Linear Technology uses pro-forma statements, value of cash holdings statements, and dividend payout charts to determine if an increase in dividend payouts will be of value to the company. Secondly, an overview of the dividend payouts and ratios from previous years can be used to approximate the clientele effect information effect on investors. Thirdly, while a comparison of Linear Technology to the market and semiconductor industry will help determine their position in various categories. Finally, an overview of economists and analysts outlooks for the coming year in the analog market and semiconductor market can be helpful in spotting future trends.

Data Requirements for Methodology Initially Linear Technology will need to create a pro-forma statement for the 4th quarter based on growth results over the last year. See Exhibit 4. In the exhibit provided, the pro-forma statement for 2003 was developed based on a 19% increase in sales from the first half of 2003 verse 2002 ($287 million/$241 million = 19%) and adding an estimated growth of 19% to the second half of FY 2002 figures ($271 million*1.19 = $323 million). The summation of these figures gives us an estimated sales figure of $610 million ($287 million+$323 million). From this we can create the pro-forma statements needed to determine net income and cash flows. This allows the company to estimate dividend payout, dividend earnings, and earnings per share.

Created by: Christopher B Taylor

Page 3

The valuation of cash holdings can be completed by using figures from the balance sheet, income statement, and current money market rates. See Exhibit 1. Using the valuation of cash holdings, Linear Technology can see that they are only providing a return of $0.11 on every $3.56 of investments; a 3.1% return. See Exhibit 4. This formula is used to see how much value is being added through current asset investments and can be compared with IRR of potential other projects. Another tool the company can use is a dividend payout chart that will show the after-tax percent return to investors dependent on dividend payouts, repurchases and tax rates. See Exhibit 5. Due to the possible overhaul of the tax structure for capital gains and dividends for the 2003 tax year, this chart can be useful in understanding the investors attitude towards the companys use of cash. By using scenario analysis the company can compare various situations they could embark upon. Key Assumptions This analysis is drawn upon some assumptions made by the author. These assumptions are as follows: The estimated end-of-year income statement is mostly based on a 19% sales increase year-over-year; except for other expense based on a 4% increase year-over-year. It is also assumed that investors are considered Bird in the Hand investors; that they prefer the certainty of a cash dividend to that of the company placing their investments in uncertainties. Asymmetry is assumed to be invalid due to the possibility of lower taxes on capital gains and dividends, hence removing the theory based on investors preferred choice in relation to tax percentages.

Created by: Christopher B Taylor

Page 4

Analysis The data shows that an increase of $0.01 in the dividend payout will put Linear Technology at its highest payout ratio level ever, 29.64%. However, the company will be using only 26.13% of operating cash flow, up 24.43% from the prior year. In many semiconductor companies this may be seen as high, but Linear Technology has cash sitting in excess of $1.5 billion and will still be contributing estimates of $48 million to this at the end of FY 2003, even after $66 million is paid out to investors. If we were to compare the payout ratios to other technology firms it would suggest that Linear Technology is over paying on its dividend and should not make an increase. In this case the payout ratio would begin to decline, though investors would begin to doubt the growth of the company, causing a clientele effect. It must be mentioned in the analysis that institutional holdings makes up 84.93% of Linear Technologys stock as of January 2002. See Exhibit 5. This is much higher than the semiconductor industrys average of 42.09% in 2002. Taking this into consideration, the company may be able to hear insight from the top institutional holdings to determine their take on the dividend policy. This was already announced by Blaine Rollins, Portfolio Manager of Janus Capital, when he made it clear that he was comfortable with the current dividend approach and ideally liked the strong cash flows and repurchases of stock.

Created by: Christopher B Taylor

Page 5

Finally a look at the expected rate of return compared with the required rate of return for Linear Technology tells us that by offering an increase in the dividend payout, the expected rate of return comes in at 24.21%; much higher than the -0.45% required rate of return that the company would see based on its correlation since the establishment of the SOX. See Exhibit 6. By illustrating the various situations of dividend payouts, a payout that is based on no increase or a decrease leaves the investor with a lower expected rate of return of 18.29% and 12.38%, respectively. Meaning the company would be valued more highly by investors if it was to increase the dividend.

Conclusion It is recommended that Linear Technology increases their quarterly dividend up to $0.06 per share, from $0.05 per share. Current increased growth quarter-over-quarter in Linear Technologys revenues and predicted growth in the world market for 2003 primarily China and Taiwan provides a solid footing for the future ahead. In times of uncertainty, investors are looking for companies that continue to show stability. By following the trend of the companys historic dividend policy, Linear Technology is showing confidence in their outlook going into Fiscal Year 2004.

Created by: Christopher B Taylor

Page 6

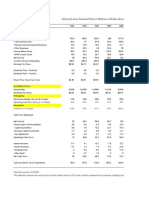

Exhibit 1 - Valuation of Cash Holdings of Linear Technology 2003 Amount Invested in Marketable Securities

1,113,000,000 Assumed Rate of Return 4.25% Effective Tax Rate 30.00% Before Tax Return 47,302,500 Taxes 14,190,750 After Tax Return 33,111,750 Number of Shares Outstanding 312,400,000 Recent Stock Price Investments/Share Total Market Value Per Share Return Value as a Perpetuity at 8% Value as a Perpetuity at 20% Taxes Per Share Value as a Perpetuity at 8% Value as a Perpetuity at 20% 30.87 3.56 9,643,788,000 0.11 1.32 0.53 0.05 0.57 0.23 % of Market Value 4.29% 1.72% % of Market Value 1.84% 0.74%

Based on 2002 estimated short-term debt security funds (4.67% - Federal Reserve Bank of NY). Equation: 52 mil/4.67% =1,113 mil Wall Street Journal 2003 Money Markey Rate

Exhibit 2 - Data On Dividend Paying Companies In The Semiconductor Index (SOX) In $M (Except Per Share Data), 2002

Company Linear Technology Intel STMicroelectronics (d) Motorola Texas Instruments Ticker LLTC INTC STM MOT TXN Share Pricea 30.87 16.28 18.90 8.26 16.37 Shares (Millions) 316.2 6,575.0 887.5 2,315.3 1,730.6 Net Income 197.6 3,117.0 429.0 -2,485.0 -344.0 Cash Flowb 239.3 4,426.0 718.0 732.0 1,190.0 Cashc 1,552.0 12,587.0 2,564.0 6,566.0 3,012.0 LongTerm Debt 0.0 929.0 2,797.0 7,674.0 833.0 Dividends (in cents) 54.00 533.00 36.00 364.00 147.00 Stock Repurchases 221.6 4,014.0 115.0 0.0 370.0 Dividend Initiation Date October 1992 September 1992 May 1999 November 1946 April 1926 Operating Rank by Payout Market Cap Cash Flow Market Ratio (Millions) Payout Cap 0.22565817 0.2732794 9761 5 0.120424763 0.1709978 0.050139276 0.0839161 0.49726776 -0.1464789 0.123529412 -0.4273256 0.4934 107041 16774 19124 28330 1 4 3 2

Semiconductor Industry (e):

Source: Adapted from Compustat; Center for Research on Security Prices. a - Share price on March 31, 2003. b - Compustat operating cash flow (Item 308) less capital expenditures (Item 128). c - Cash and short-term investments. d - STMicroelectronics is an American Depository Receipt (ADR), based in France. e - Figure taken from nyu.edu data page

Exhibit 3 - Dividend Payout Ratios of Linear Technology Year Total Common Dividends Net Income for Common Stock Cash Flow from Operations Free Cash Flow to Equity Dividend Payout Ratio Operating Cash Flow Payout Free Cash Flow to Equity Payout 1992 25.00 28.70 29.90 1993 5.30 36.50 42.50 32.80 1994 8.30 56.80 62.40 48.80 1995 9.80 84.60 103.90 73.50 1996 11.90 134.00 164.70 72.20 1997 15.00 134.30 150.80 120.80 1998 18.30 180.80 266.90 194.30 1999 22.10 194.30 280.50 148.90 2000 28.00 287.80 442.30 388.80 2001 41.20 427.40 559.50 373.30 2002 54.00 197.70 257.20 3.00 2003 47.00 170.60 189.90 13.20

a

2003 66.00 222.67

252.54

48.74

0.00% 14.52% 14.61% 11.58% 8.88% 11.17% 10.12% 11.37% 0.00% 12.47% 13.30% 9.43% 7.23% 9.95% 6.86% 7.88% 0.00% 16.16% 17.01% 13.33% 16.48% 12.42% 9.42% 14.84%

9.73% 9.64% 27.31% 27.55% 29.64% 6.33% 7.36% 21.00% 24.75% 26.13% 7.20% 11.04% 1800.00% 356.06% 217.53%

Estimated figures based on 19% increase in sales and 0.06 dividend payout in 4Q a - First three quarters of FY2003. ( 15.67/Q)

Created by: Christopher B Taylor

Page 7

Exhibit 4 - Pro Forma Statement for 2003 2003 Estimated 19% Increase 609.64 172.19 94.96 24.39 318.10 95.43 222.67 312.40 0.71

Income Statement Sales - Cost of Goods Sold - Research and Development Expense - Other Expenses (estimate 4% of sales) Income Before Taxes - GAAP Income Taxes (30%) Net Income Common Shares Outstanding (Split-Adjusted) Earnings Per Share (Split-Adjusted) Stock Repurchase Stock Repurchase Amount Cash Flow Statement Net Income + Depreciation and Amortization - Working Capital Investments + Tax Adjustment Operating Cash Flow

b

2002 512.30 144.70 79.80 9.40 278.40 80.70 197.70 316.20 0.63

2003 440.80 114.60 67.00 18.90 240.30 69.70 170.60 312.40 0.55

197.70 46.30 42.00 55.20 239.30 17.90 39.30 221.60 54.00 0.00 3.00

170.60 33.50 14.90 0.70 189.90 9.80 27.40 165.70 47.00 -18.40 13.20

222.67 44.70 14.90 0.07 252.54 17.90 27.40 165.70 66.00 -18.40 48.74

- Capital Expenditure + Stock Issuance - Stock Purchases - Dividends Paid - Other Items Net Cash Flow Balance Sheet Cash and Short-Term Investments

Source: Adapted from Compustat. a - First three quarters of FY2003.

b - T he difference between the exercise price and the market value of LLT C stock could be expensed for tax purposes, leading to large tax adjustments on the cash flow statement. c - Other Items includes long-term investments and acquisitions (other than capital expenditures), extraordinary items, and other adjustments to net income.

Created by: Christopher B Taylor

Page 8

Exhibit 5 - Dividend Policy Chart

Increase Dividend LLTC Share Price April 2002 45.93 LLTC Share Price April 2003 30.85 Capital Gain -15.08 Dividend Paid 0.21 Pre-tax % Return -0.323753538 Capital Gain Tax (stock sold) -2.262 Dividend Tax (stock sold) 0.0315 After-tax % Return (stock sold) -0.275190507 After-tax % Return (stock not sold) -0.324439364

* Repurchase of $3,124,000 of stock at $30.85 with no dividend increase.

Repurchase Stock* 45.93 30.86 -15.07 0.20 -0.323753538 -2.2605 0.03 -0.275190507 -0.324406706

Exhibit 6 - Linear Technology Quick Details as of January 2002 Market Cap $ Current Company Name Industry (Mil) Total Debt Firm Value Cash Revenues Linear Technology Semiconductor $9,156.80 $0.00 $9,156.80 $1,552.00 $512.30 Reinvestment Rate -14.59% Institutional Holdings 84.93%

Current PE 46.34 Fiscal Year End Date Jun/30/2002

Correlation 66.92%

Payout Ratio 31.51%

ROE 11.09%

Beta 1.14

Insider Holdings 2.40%

* Items partially based on nyu.edu financial company databases and Professor Johnston's excel spreadsheets.

Exhibit 7 - Expected v. Required Rate of Return [D(1+g)/P [+ g] (P) (Ks) ] Expected Expected (D) (D) Current Expected Dividend Growth Current Expected Stock Return = Return Return Dividend Dividend Price Dividend Increase 0.242101 0.0068071 0.235294 0.17 0.21 30.85 Dividend Neutral 0.182954 0.006483 0.176471 0.17 0.20 30.85 Dividend Decrease 0.123806 0.0061588 0.117647 0.17 0.19 30.85 (RRR) Required Rate of Return -0.47%

LLTC

(Rm -Rf) (Rm) (Rf) Risk Risk Market Free Rate Premium () Beta Risk 1.02% -1.31% 1.14 -0.29%

Rf based on 2002 US T reasury Bill from Professor Johnston's Historical Equity Risk Premiums Beta based on LLT C comparison to SOX (Oct. 94 to Jan 03) Rm based on SOX (Oct. 94 to Jan 03)

Created by: Christopher B Taylor

Page 9

You might also like

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Linear Tech FY03 Exec Summary Recommends Dividend HikeDocument9 pagesLinear Tech FY03 Exec Summary Recommends Dividend HikeTestNo ratings yet

- Linear Technology Case - Ashmita SrivastavaDocument4 pagesLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Nike Inc. Case StudyDocument3 pagesNike Inc. Case Studyshikhagupta3288No ratings yet

- Linear Technology's dividend policy decision: pay dividends or repurchase sharesDocument6 pagesLinear Technology's dividend policy decision: pay dividends or repurchase sharesprashantkumarsinha007100% (1)

- Cooper Case SolutionsDocument6 pagesCooper Case SolutionsDarshan Salgia100% (1)

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- AutoZone financial analysis and stock repurchase impactDocument1 pageAutoZone financial analysis and stock repurchase impactmalimojNo ratings yet

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDocument2 pagesMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7No ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143No ratings yet

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Rosetta Stone 2009 IPO Financial ForecastDocument8 pagesRosetta Stone 2009 IPO Financial ForecastgerardoNo ratings yet

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoNo ratings yet

- Nike Case - Team 5 Windsor - FinalDocument10 pagesNike Case - Team 5 Windsor - Finalalosada01No ratings yet

- FVC Merger Benefits and AlternativesDocument1 pageFVC Merger Benefits and AlternativesStephanie WidjayaNo ratings yet

- JC Penney CaseDocument8 pagesJC Penney CaseSebastian MansillaNo ratings yet

- World Wide Paper CompanyDocument2 pagesWorld Wide Paper CompanyAshwinKumarNo ratings yet

- Annualized Net Income GrowthDocument25 pagesAnnualized Net Income GrowthAdarsh Chhajed0% (2)

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Caso Nextel DataDocument42 pagesCaso Nextel Dataelena ubillasNo ratings yet

- Dividend Policy at FPL Group, Inc. (A)Document16 pagesDividend Policy at FPL Group, Inc. (A)Aslan Alp0% (1)

- Acova Radiateurs (v7)Document4 pagesAcova Radiateurs (v7)Sarvagya JhaNo ratings yet

- Arcadian Business CaseDocument20 pagesArcadian Business CaseHeniNo ratings yet

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- Tottenham Case SolutionDocument14 pagesTottenham Case SolutionVivek SinghNo ratings yet

- Corporation CaseDocument39 pagesCorporation Caseayane_sendoNo ratings yet

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocument17 pages9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Dividend Policy at FPL Group: Submitted byDocument13 pagesDividend Policy at FPL Group: Submitted byismathNo ratings yet

- Case 5Document15 pagesCase 5Qiao LengNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyNo ratings yet

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Cooper Industries CaseDocument3 pagesCooper Industries CaseGeorge LamNo ratings yet

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- Capital StructureDocument9 pagesCapital Structurealokkuma050% (2)

- Case Study Q4 - Hill Country Snack FoodsDocument2 pagesCase Study Q4 - Hill Country Snack FoodsSpencer1234556789No ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Betas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Document21 pagesBetas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Elias del CampoNo ratings yet

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73No ratings yet

- Jetblue Airways Ipo ValuationDocument6 pagesJetblue Airways Ipo ValuationXing Liang HuangNo ratings yet

- Winfield Refuse Management Inc. Raising Debt vs. EquityDocument13 pagesWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezNo ratings yet

- Dividend Decision at Linear TechnologyDocument8 pagesDividend Decision at Linear TechnologyNikhilaNo ratings yet

- California Pizza Chicken Share Repurchase AnalysisDocument13 pagesCalifornia Pizza Chicken Share Repurchase AnalysisBerni RahmanNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Linear Dividend PolicyDocument4 pagesLinear Dividend Policyhenry.alvarado.vargasNo ratings yet

- Artko Capital 2019 Q2 LetterDocument7 pagesArtko Capital 2019 Q2 LetterSmitty WNo ratings yet

- Investment Markets and Principles PADocument17 pagesInvestment Markets and Principles PAnguyenphuonganh07102002No ratings yet

- Valuation Analysis and StructuredDocument19 pagesValuation Analysis and StructuredvasoskNo ratings yet

- P7int 2013 Jun A PDFDocument17 pagesP7int 2013 Jun A PDFhiruspoonNo ratings yet

- How Earnings Per Share Measures Organizational PerformanceDocument3 pagesHow Earnings Per Share Measures Organizational PerformanceSapcon ThePhoenixNo ratings yet

- 4th Edition Summary Valuation Measuring and Managing The ValueDocument17 pages4th Edition Summary Valuation Measuring and Managing The Valuekrb2709No ratings yet

- S&S AkshayDocument4 pagesS&S Akshayakshay87kumar8193No ratings yet

- List of Service Providers and Accredited Agencies For BioplantDocument10 pagesList of Service Providers and Accredited Agencies For Bioplantakshay87kumar8193No ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- OBProject PDFDocument11 pagesOBProject PDFakshay87kumar8193No ratings yet

- Dabur Marketing StrategyDocument17 pagesDabur Marketing Strategyakshay87kumar8193No ratings yet

- NATL Sugar LyleDocument7 pagesNATL Sugar Lyleakshay87kumar8193100% (2)

- Siddha Newsletter PDFDocument8 pagesSiddha Newsletter PDFRavi Kant MishraNo ratings yet

- Notice: Meetings: Registration Maintenance Fees Cancellation of Pesticides For Non-PaymentDocument9 pagesNotice: Meetings: Registration Maintenance Fees Cancellation of Pesticides For Non-PaymentJustia.comNo ratings yet

- Garcia-Tinoco v. Holder, JR., 10th Cir. (2011)Document3 pagesGarcia-Tinoco v. Holder, JR., 10th Cir. (2011)Scribd Government DocsNo ratings yet

- Court denies writ of possession due to pending caseDocument1 pageCourt denies writ of possession due to pending caseKeren del RosarioNo ratings yet

- Bunga Lawas Shipping Agencies SDN BHD v. NusantaraDocument7 pagesBunga Lawas Shipping Agencies SDN BHD v. NusantaraNur Azwa ZulaikaNo ratings yet

- Accounting For Merchandising Operations: Accounting Principles, Ninth EditionDocument17 pagesAccounting For Merchandising Operations: Accounting Principles, Ninth EditionMehedi HasanNo ratings yet

- Speaking Supplementary Notes UpdatedDocument1 pageSpeaking Supplementary Notes UpdatedAnson LchNo ratings yet

- MC No. 01, S. 2021Document11 pagesMC No. 01, S. 2021Abra PPO PTOCNo ratings yet

- Why Collective Bargaining Should Be Made Possible, Especially For The Public Sector in Zimbabwe. DiscussDocument6 pagesWhy Collective Bargaining Should Be Made Possible, Especially For The Public Sector in Zimbabwe. DiscussWinnie MugovaNo ratings yet

- Sorting Hat's SongDocument12 pagesSorting Hat's Songennaej_0505No ratings yet

- Forensic Pathologist Richard Shepherd PTSD Cutting Up 23000 Bodies Not Normal PDFDocument6 pagesForensic Pathologist Richard Shepherd PTSD Cutting Up 23000 Bodies Not Normal PDFPuspa Sari WijayaNo ratings yet

- Reduce Traffic CongestionDocument6 pagesReduce Traffic CongestionJayone LowNo ratings yet

- Imtex 2019Document8 pagesImtex 2019PrakashNo ratings yet

- Mae Ngai - The Chinese Question - The Gold Rushes and Global Politics-W. W. Norton Company (2021) - CompressedDocument608 pagesMae Ngai - The Chinese Question - The Gold Rushes and Global Politics-W. W. Norton Company (2021) - Compressedjuan lopez100% (1)

- Confidentiality Agreement NCNDA Product BTC-USDT-OTHERDocument2 pagesConfidentiality Agreement NCNDA Product BTC-USDT-OTHERchristianNo ratings yet

- Bode and Museum Display 1996Document12 pagesBode and Museum Display 1996FranciscoNo ratings yet

- The Presbitero Anchor Vol 1 Issue 2Document4 pagesThe Presbitero Anchor Vol 1 Issue 2PresbiteroNo ratings yet

- BRS TestDocument2 pagesBRS TestMuhammad Ibrahim KhanNo ratings yet

- 2018 Papyrologica. VII PDFDocument20 pages2018 Papyrologica. VII PDFcodytlseNo ratings yet

- 12-Week Shortcut to Size Workout PlanDocument8 pages12-Week Shortcut to Size Workout PlanMustafa AlrashidiNo ratings yet

- MC 2015-004 - Clarification To The CCO For PCBDocument8 pagesMC 2015-004 - Clarification To The CCO For PCBguiyab.pauNo ratings yet

- Pinocchio Story: Pinocchio Ate Until He Could No Longer, and As Soon AsDocument1 pagePinocchio Story: Pinocchio Ate Until He Could No Longer, and As Soon AsGerrahmae Arlan - MicayasNo ratings yet

- Albert The Great, OP - Commentary To The Mystical Theology of DionysiusDocument189 pagesAlbert The Great, OP - Commentary To The Mystical Theology of DionysiusAllan Dos Santos100% (3)

- LNAT Test 1Document27 pagesLNAT Test 1Faye Karam100% (2)

- 2022-09-20 Gov. McMaster To CCSD BoT Chmn. Mack Re Camp Road Middle School MatterDocument10 pages2022-09-20 Gov. McMaster To CCSD BoT Chmn. Mack Re Camp Road Middle School MatterLive 5 NewsNo ratings yet

- IDE Ar Feats: Special Disp SationDocument3 pagesIDE Ar Feats: Special Disp SationEtienne LNo ratings yet

- The Spiritual Significance of Our Australian FlagDocument5 pagesThe Spiritual Significance of Our Australian FlagRev. Dr Jeffry David CammNo ratings yet

- Etiological Spectrum and Antimicrobial Resistance Among Bacterial Pathogen Association With Urinary Tract Infection in Wasit Governorate/ IraqDocument11 pagesEtiological Spectrum and Antimicrobial Resistance Among Bacterial Pathogen Association With Urinary Tract Infection in Wasit Governorate/ IraqCentral Asian StudiesNo ratings yet

- Fortress Fasteners Nuts & Washers Product CatalogueDocument20 pagesFortress Fasteners Nuts & Washers Product CatalogueTohir AhmadNo ratings yet

- Policeman job demands and responsibilitiesDocument57 pagesPoliceman job demands and responsibilitiesshahronishNo ratings yet