Professional Documents

Culture Documents

Netscape's $140 Million IPO in 1995

Uploaded by

Anonymous F2NHsfqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Netscape's $140 Million IPO in 1995

Uploaded by

Anonymous F2NHsfqCopyright:

Available Formats

Casestudy Netscape 1995 (Simulation)

Casestudy re-resolved by Richard L.A. Meijs, M.B.A. [Founder NeoMinds Consulting]

1. Introduction

Netscape Communications

Netscape was found in 1994, where it provided a comprehensive line of client, server, and integrated applications software for communications and commerce on the Internet and private Internet protocol (IP) networks. The companys most popular product, Netscape Navigator, was the leading client software program that allowed individual personal computers (PC) users to exchange information and conduct commerce on the Internet. Netscapes server software provided enterprises with the basic capabilities necessary for c reating and operating Web server sites, or places on the Web which browsers could visit.

Background

The demand for Netscapes products had evolved out of the development of the Internet in the late 1960s. The Internet was a global network designed to facilitate communication between some 35,000-computer networks using the enabling code termed Internet protocol. Engineered in the early 1990s, the Web was a technology that linked one bit of information on the Internet with another so those users could share webs of ideas. The Web consisted of a network of Web servers that posited infor mation in a common format described by the Hypertext Markup Language (HTML). Internet users were able to access information on the web by implementing the appropriate Hypertext Transfer Protocol (HTTP).

Netscapes Entrance

Meanwhile at the University of Illinois at Urbana-Champain, a group of computer science students working at the National Center for Supercomputing Applications (NCSA) developed the graphical software program that gave rise to the notion of surfing. Named NCSA Mosaic, the software program enabled nontechnical users to access and retrieve information on the Web. Netscape entered the broad Internet market via the Web browser market, where it faced two challenges: it had to set a new industry standard, and it had to make money. The former challenge was the immediate concern. To set a new standard, Netscape had to create a new program that would destroy Mosaic, which in 1994 ended wielded 60% of the Web browser market.

Competition

Netscape was the indisputable leader of its kind. As the Internet community and its demands continued to increase, however, so did the multitude of competitors. Spyglass, Inc. was Netscapes nearest competitor with its Enhanced Mosaic Web browser technology. A s the facto gatekeeper of computing, Microsoft was perhaps the most formidable of Netscapes competitors in the long-term. The online computer service also had made strides recently to move into Netscapes market.

Initial Public Offerings

Young. Rapidly growing companies facing intense competition typically raise equity capital in two broad ways. One way is through a private equity transaction, and the other is through a public offering of stock. A public issue entails the sale of a companys equit y to the public at large. While the monetary benefits of going public are potentially sizeable, so too are the associated costs. The human capital resources involved in the process of an initial public offering include the companys founder and senior management, the underwriters, and institutional investors.

The Going Public Process

In the United States, companies issuing stock to the public for the first time typically use what is known as a firm commitment contract. (Another type of contract between the issuer and the underwriters is known as a best efforts contrac t. Unlike a firm commitment in which the underwriters assume risk, a best efforts contract only requires the investment bankers to make their best efforts to sell the minimum number of shares. In the event there is insufficient demand to fully subscribe the minimum number of shares, the issue is withdrawn. This type of contract is typically used in smaller, more speculative offerings.) This contract describes the relationship between the issuing firm and the investment bankers underwriting the offering. At times, the IPO market is characterized as a hot issue market because of the high returns earned by initial buyers of the shares. In response to its growing capital needs, in early 1995 Netscape began to explore the option of raising money through an initial public offering (IPO). The IPO market in the first half had generated proceeds totaling nearly $12 billion for some 300 companies, which saw their stock prices increase on the first day of trading by an average of 20%. Since Clarks initial investment, Netscape had been injected with various forms of investment capital. Sillicon Valley venture capital firm of Kleiner, Perkins, Caufield & Byers invested $5 million.

The Board Decision

The time had come when Clark and the other Netscape board members had to approve or reject their underwriters vote of high confidence. In going over the new valuation of the company, the board struggled to disregard the wild speculation surrounding what had been called the hottest IPO of the year. Perhaps most unavoidable in the minds of the board members, the subscription for such a hot stock had the potential of reaching many times five million shares by the time offering the next morning. The boards responsibility was to determine the appropriateness of the proposed increase in price after balancing the potential risks and rewards that might accompany such a move.

2. Definition of the Problem Only 16 months after the companys founding, in April 1994, Netscape completed an initial public offering (IPO). In one way t his early IPO was a remarkable step. In another way it was not. Netscape grew faster than any other software company in history in its full year of revenues. Its initial market value was already around $ 1 billion vs. the 250 million or 300 million fetched by many young, profitless companies. In this case we go deeper into details of the IPO.

Situation before the IPO

Since 1994 the company issued three series of preferred stock to companies directors, executive officers, 5% stockholders and their respective affiliates. Later in 1994 the company issued preferred stock and common stock. These financing activities brought $ 9.5 million to Netscape. At the end of 1994 net revenues were $696.000 and Netscape had a net loss of $ 8.470.000. (Cash flow from operating activities). Because of the financing activities, Netscape had enough cash to pay most of their expenses. In 1995 Netscape has built up a substantial majority of the global market for client software designed to help navigate and enhance communications over the Internet and private enterprise networks (Intranets). In order to keep this position Netscape had to continue to invest in different projects. So far, the young company used foreign equity to finance its activities. The foresight of needing more brought also the question; how?

Netscapes Possibilities

Netscape needs to raise capital for the following reasons:

Netscape Corporation needs to finance activities to compete with the other competitors; They need to invest in a new browser or new activities such as web builders; They need cash to repay their long term and short term debt; The principal reasons for going public was to fund expected future growth, to stockpile cash reserves for potential acquisitions, and to gain visibility and creditability within the industry; They already needed capital in April 1994 when they issued the preferred stock for the first time. But what they raised was not enough, so they realized they needed to issue more shares (preferred stock and common stock). They made a stock option plan in 1994, the second stock plan in June 1995, and the third employee stock purchase plan in July 1995; They initially need in 1995 $49 million ? 3.5 million shares times $14 per share. The initial stock-price of $14 is too little, because the initial stock-price of $14 was underestimated regarding to the overall opinion of the investors and the evaluation of the value of the company. They decided to raise more capital then the $49 million by raising the share price to $28. Above all they raised the amount of shares issued to 5 million. The total raised capital would be 140 ? 5 million times $28.

3. Raising Equity Capital

Option 1

Raising equity capital through private equity transaction A private transaction involves direct negotiations with various financial or nonfinancial institutions. In such a case the company raises money from these various entities, which then own a portion of that company in the form of its privately held shares of stock or other securities convertible into stock. If these private investors wish to sell their stakes in the company, they must negotiate the terms of the sale with known buyers given the absence of a liquid market. Pro The power is in hands of a few investors who negotiate the price and interest. Then you always have the possibility to go public later on. Con A few investors have a lot of power with decision making. If you want to buy some of the shares back it would be more easie r and less costing then from public investors.

Option 2

Another option to raise equity capital is to get a loan from the bank. Pro There are no more additional owners of the company who would have power in power decision making. Con No bank would give such a loan, because they would make losses. It also expects to have losses in the future. If the company does get the loan from the bank the risk will be too high so the interest rate would be high too.

Option 3

Another option to raise equity is to have a joint venture with another competitor, example Microsoft. Pro If we merge with Microsoft we would be already be the leader on the market, the general costs will be less and the competitor will be eliminated. Con If we share ideas the profit will be shared. Netscape will loose future decision-making.

Option 4

Going Public (IPO). Pro They get cash immediately upon the sale of the stocks The underwriters will get some fees. Con Once they set the price and it is too high the people wont buy the stock, but if the price is set too low during the introduction of the stock the price will go up fast and the company will loose the opportunity to get the difference between the prices. Once the stock is out you dont have immediate control over the buyers action (sell the stock to other people). 4. Swot Analysis

Strengths

They have the most popular product, Netscape Navigator. This was a leading client software program that allowed individual personal computer users to exchange information and conduct commerce n the Internet. Navigator. Navigator featured click-and-points graphical user interfaces that enabled users to navigate the Internet by manipulating icons and windows rather than by using text commands. With the user-friendly interface as a guide, Navigator offered a variety of Internet functions including Web browsing, file transfers, news group communications, and e-mail. Initially shipped in December 1994, Netscape Navigator generated 49% and 65% of total revenues for the quarters ended March31, 1995, and June 30, 1995, respectively. The second product was the server software of Netscape navigator which provided enterprises with the basic capabilities necessary for creating and operating Web server sites, or places on the web which browsers could visit. This server product combined with integrated applications software programs, which were designed to provide enterprises with the capability to manage large-scale commercial sites on the Internet. Together server and integrated applications software accounted for 35% of total revenues in the first quarter of 1995 and 28% of total revenues in the second. Of these revenues, the majority was generated by one of Netscapes three server products, Netscape commerce server. Revenues from Netscapes server and integrated applications products were expected to increase as a percentage of overall revenues in the future.

Weaknesses

Depended on the Internet. Dependence on key-personnel. Length of the sales cycles.

Opportunities

Obtain additional capital. Create public market for the companys common stock. Facilitate future access by the company to go public equity markets. International expansions. Brand recognition of Netscape (new) products.

Threats

Competition. New product development and technological change. Involving distribution channels. Government regulation and legal uncertainties. Security risks and system disruptions ? lack of product liability insurance for products incorporating security features. Possible future payments; uncertain protection of intellectual property. Concentration of stock ownership. No prior public market. Dilution. Limited operating history; accumulated deficit. New entrants; unproved acceptance of the companies products; price erosion; uncertain adoption of Internet as a medium of commerce and communications. 5. The Decision

Netscape choose the option to go public

While the monetary benefits of going public are potentially sizeable, so too are the associated costs. The total costs are compromised of ongoing costs associated with being a publicly traded company and one-time costs associated with the IPO itself. Monetary of going public are potentially sizeable, so too are the associated costs. Specifically, ongoing costs result in need the report timely information to investors and regulators. One time costs, which attributable to direct cost (legal, auditing, and under writing fees.) and indirect costs (management time invested in the process, and the dilution associated with selling shares at an offering price that is, on average below the selling price prevailing in the market shortly after the IPO), which are the floatation costs. All of the above reflect the time and financial commitments associated with the IPO process. If the Underwriters over-allotment opinion were exercised in full the total raised capital would be ranging between $129.3 and $148.8 million. The floatation costs will be approximately $10.7 million $140 million - $129.3.

Was the price of $28 reasonable?

Looking at the other companies in the same industry, see exhibit 6, the price per share offered varied between $12 to $17. Looking at this data, our price is quite high. The question is they really our competitors. We think they are not, because we are the only one providing these products, so we are able to set the price ourselves as high as we want it to be. The first offering price was between 12 and 14, but the information gathered from the Road show showed there is a potential demand for Netscape s shares. This 28 was based on calculations we were not provided with. At its initial price of $28 Netscape was among the highest priced IPOs ever, based on such traditional measures as price-to-sales and price-to-forward earnings. The fact is that the company had only a couple of quarters of revenues, and they had done only $11 million in the most recent quarter. When you are in a situation like that, youre torn between pricing at a level you know can clear the market today, rather than at a level that can be sustained over a longer period of time. As it stands Netscapes initial market value was around $1 billion versus the $250 million or $300 million fetched by many young, profitless companies. 6. Netscapes products as future industry standards

They have the most popular product, Netscape Navigator. This was a leading client software program that allowed individual personal computer users to exchange information and conduct commerce on the Internet. Navigator. Navigator featured a clickand-points graphical user interface that enabled users to navigate the Internet by manipulating icons and windows rather than by using text commands. With the user-friendly interface as a guide, Navigator offered a variety of Internet functions including Web browsing, file transfers, news group communications, and e-mail. Initially shipped in December 1994, Netscape Navigator generated 49% and 65% of total revenues for the quarters ended March31, 1995, and June 30, 1995, respectively. The second product was the server software of Netscape navigator which provided enterprises with the basic capabilities necessary for creating and operating Web server sites, or places on the web which browser could visit. This server product combined with integrated applications software programs, which were designed to provide enterprises with the capability to manage large-scale commercial sites on the Internet. Together server and integrated applications software accounted for 35% of total revenues in the first quarter of 1995 and 28% of total revenues in the second. Of these revenues, the majorities were generated by one of Netscapes three server products, Netscape commerce server (bundled packages of Netscape Navigator and Netscape Commerce server accounted for about 10% of total revenues in the first quarter, while its contribution in the second quarter was immaterial). Revenues from Netscapes server and integrated applications products were expected to increase as a percentage of overall revenues in the future. In addition to product revenues, Netscape generated service revenues, which were attributable to fees from consulting, maintenance, and support services. These revenues amounted to approximately 5% and 7% of total revenues for the quarters ended March 31, 1995 and June 30, 1995, respectively.

For product 1 (Client Software) By adding more features and make them more user-friendly we could improve the product. It is also possible to concentrate on building web pages. For product 2 (Server Software) If Netscape directs its activities to users of servers (businesses) e.g. by making special packages, and improve the product, it could get higher profits (change of target group orientation). For product 3 (Service) Improve services, and providing it for low costs, provide training courses for clients, providing more consultancies, concentrating on larger companies in stead of smaller firms/stores (economies of scale). 7. Future Prospects Netscape is a leading provider of software that allows computer users to exchange information and conduct businesses on the Internet and other global networks, and the potential for this market is anybodys guess. Netscape is being evaluated like a biotech company. With biotech you dont have to worry much about price-earnings multiples, because most companies dont have earnings. You look strictly at the future. Netscape has a lot of potential. See products mentioned above.

Stock Split

On 14 November 1995 the Mountain View producer of Internet software announced a 2 for 1 stock split just 97 days after going public. That ranks among the fastest few dozen stock splits ever. Netscapes management wasnt just showboating: The stock was ripe for a split. It has soared spectacularly since its initial public offering at $28 per share on August 9, and last week it broke through $100. It closed at 96 . The split will cut the price by half, but shareholders will get an additional share for every one they hold, so the total value wont change. Its stock trading was 242% premium to its initial public offering price.

Market Capitalization

After they went public Netscapes equity was a bit more that $3.5 billion which is $2.5 billion more than they estimated to be. In comparison to the other companies (Apple, Avon, Quaker, etc.) its $3.5 billion market value is still the lowest, but it doesnt differ that much from other companies like Kmart and Ingersoll-Rand.

The technologies used by Netscape are very quickly outdated. That means that there always is a need for capital for new instruments. The question is always:

Is the company investing in the right products and are the cash flows of investments enough to cover all expenses?

Risk for Potential Buyers

There is a risk for investors, and even investment strategists do not know if the shares are overvalued or undervalued. What could be said is that Netscape is acting in an industry with revenues overall of a billion dollars, and it could be $25 billion by the end of the decade. But nobody knows when somebody is going to stick a pin in the hot-air balloon, but may be the price will go up to 150 first. The offering price takes into account that the price could go up after the issue. The risk for the first owners of the shares is not that high as for the later buyers who could be surprised by continuous losses over the future. 8. Appendix Current position of the company is due June 1995.

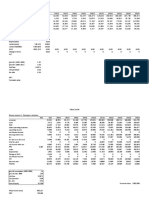

Return on Equity:

= -0.10 (1995)

Net profit margin

= -0.26 (1995)

You might also like

- Netscape Growth Rate Needed to Justify $28 Share PriceDocument9 pagesNetscape Growth Rate Needed to Justify $28 Share PriceRasheeq Rayhan100% (1)

- Netscape SummaryDocument4 pagesNetscape SummaryAbdul Basit Lakhani100% (2)

- Netscape Case SolutionDocument6 pagesNetscape Case SolutionMaksym Malovichko60% (5)

- Netscape IPO ExcelDocument7 pagesNetscape IPO Exceldchristensen5100% (1)

- Netscape HomeworkDocument3 pagesNetscape HomeworkJaime Zulueta0% (2)

- Netscape Valuation For IPO... PV of FCFs-2Document1 pageNetscape Valuation For IPO... PV of FCFs-2aveenobeatnikNo ratings yet

- 1.2. Netscape Sample Soln by A Student in A Previous Offering of The CourseDocument5 pages1.2. Netscape Sample Soln by A Student in A Previous Offering of The CoursehadeshungNo ratings yet

- Analysis of Historical Financials and Projections to Calculate Stock PriceDocument2 pagesAnalysis of Historical Financials and Projections to Calculate Stock Pricemc1012No ratings yet

- Netscape Initial Public OfferingDocument1 pageNetscape Initial Public Offeringaruncec2001No ratings yet

- Netscape's Groundbreaking $1 Billion IPODocument28 pagesNetscape's Groundbreaking $1 Billion IPOfjvillegas0% (1)

- Investment Banking: Individual Assignment 2Document5 pagesInvestment Banking: Individual Assignment 2Aakash Ladha100% (3)

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Netscape CaseDocument6 pagesNetscape CaseVikram RathiNo ratings yet

- Group 3 - Clarkson Write UpDocument7 pagesGroup 3 - Clarkson Write UpCarlos Eduardo Ventura GonçalvesNo ratings yet

- Clarkson Lumber Financial AnalysisDocument7 pagesClarkson Lumber Financial AnalysisSharon RasheedNo ratings yet

- Bidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIDocument6 pagesBidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIAnh ThoNo ratings yet

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- NetscapeDocument17 pagesNetscapeaquel19830% (1)

- NetscapeDocument3 pagesNetscapeulix1985No ratings yet

- Clarkson Lumber Case 1 Write UpDocument9 pagesClarkson Lumber Case 1 Write UpStefan Radisavljevic100% (1)

- The Birth of The Internet Bubble: Netscape IPODocument12 pagesThe Birth of The Internet Bubble: Netscape IPOMridul GreenwoldNo ratings yet

- Sampa Video CaseDocument6 pagesSampa Video CaseRahul BhatnagarNo ratings yet

- Lecture 6 Clarkson LumberDocument8 pagesLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Valuing A Cross Border LBO PDFDocument17 pagesValuing A Cross Border LBO PDFjhuaranccac0% (1)

- ClarksonDocument2 pagesClarksonYang Pu100% (3)

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- The Japanese Financial SystemDocument1 pageThe Japanese Financial SystemSalil AggarwalNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDocument4 pagesDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000No ratings yet

- Clarkson TemplateDocument7 pagesClarkson TemplateJeffery KaoNo ratings yet

- Netscape ProformaDocument6 pagesNetscape ProformabobscribdNo ratings yet

- Case Marriott A and Flinder ValvesDocument6 pagesCase Marriott A and Flinder ValvesGerardo FumagalNo ratings yet

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- Radio OneDocument1 pageRadio OneTommy Choi100% (1)

- UST Debt Policy and Capital Structure AnalysisDocument10 pagesUST Debt Policy and Capital Structure AnalysisIrfan MohdNo ratings yet

- Particulars 2001 2002 2003 2004: Less LessDocument7 pagesParticulars 2001 2002 2003 2004: Less LessrishabhaaaNo ratings yet

- Aggregate MW Production and cash Flow ProjectionsDocument15 pagesAggregate MW Production and cash Flow ProjectionsDebasmita Nandy100% (3)

- Radio One's Potential Market ValuationDocument24 pagesRadio One's Potential Market Valuationgawadesx0% (1)

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- Sampa Video Inc.: Case 3 Corporate Finance December 3, 2015Document5 pagesSampa Video Inc.: Case 3 Corporate Finance December 3, 2015Morsal SarwarzadehNo ratings yet

- Ocean CarriersDocument7 pagesOcean CarriersAvinash ChoudharyNo ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Clarkson Lumber Co (Calculations) For StudentsDocument18 pagesClarkson Lumber Co (Calculations) For StudentsShahid Iqbal100% (5)

- Radio OneDocument7 pagesRadio OneVvb Satyanarayana0% (1)

- FIN RealOptionsDocument3 pagesFIN RealOptionsveda20No ratings yet

- Netscape: Simulation Techniques For Company Valuation: CentreDocument4 pagesNetscape: Simulation Techniques For Company Valuation: CentreRia MehtaNo ratings yet

- Sampa Video Group 5Document6 pagesSampa Video Group 5Ankit MittalNo ratings yet

- Valuing Cross-Border Yell Group LBODocument17 pagesValuing Cross-Border Yell Group LBOasdhjshfdsjauildgfyh50% (6)

- Kohler Case Leo Final DraftDocument16 pagesKohler Case Leo Final DraftLeo Ng Shee Zher67% (3)

- MCI Communications CorporationDocument6 pagesMCI Communications Corporationnipun9143No ratings yet

- Radio OneDocument23 pagesRadio Onepsu0168100% (1)

- Fonderia Di Torino FinancialsDocument4 pagesFonderia Di Torino Financialspeachrose12No ratings yet

- Ocean Carriers FinalDocument4 pagesOcean Carriers FinalBilal AsifNo ratings yet

- Ameritrade Case PDFDocument6 pagesAmeritrade Case PDFAnish Anish100% (1)

- FreeMarkets: Procurement & Outsourcing StrategiesDocument44 pagesFreeMarkets: Procurement & Outsourcing StrategiesFarhaad MohsinNo ratings yet

- Contemporary Engineering Economics 7th Edition by Chan Park PDFDocument35 pagesContemporary Engineering Economics 7th Edition by Chan Park PDFNeta Lavi100% (1)

- Open Source Crash Course - Understanding the Business of Open Source SoftwareDocument20 pagesOpen Source Crash Course - Understanding the Business of Open Source SoftwareAbcd123411No ratings yet

- Value Lies in The Belief of The Investor Prof. R. RamaseshanDocument5 pagesValue Lies in The Belief of The Investor Prof. R. RamaseshanMighty SinghNo ratings yet

- Chapter 11Document29 pagesChapter 11chelintiNo ratings yet

- DH 0526Document12 pagesDH 0526The Delphos HeraldNo ratings yet

- BCM 304Document5 pagesBCM 304SHIVAM SANTOSHNo ratings yet

- MEP Civil Clearance 15-July-2017Document4 pagesMEP Civil Clearance 15-July-2017Mario R. KallabNo ratings yet

- Financial Reporting Standards SummaryDocument5 pagesFinancial Reporting Standards SummaryKsenia DroNo ratings yet

- Ethics GE 6: Tanauan City CollegeDocument15 pagesEthics GE 6: Tanauan City CollegeRowena Bathan SolomonNo ratings yet

- Software Quality Assurance FundamentalsDocument6 pagesSoftware Quality Assurance FundamentalsTrendkill Trendkill TrendkillNo ratings yet

- Boundary computation detailsDocument6 pagesBoundary computation detailsJomar FrogosoNo ratings yet

- Allodial InterestDocument17 pagesAllodial InterestSarah75% (4)

- Islam Today: Syed Abul Ala MawdudiDocument21 pagesIslam Today: Syed Abul Ala MawdudiArap MamboNo ratings yet

- Shareholding Agreement PFLDocument3 pagesShareholding Agreement PFLHitesh SainiNo ratings yet

- Benno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981Document198 pagesBenno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981alenin1No ratings yet

- 2 PBDocument17 pages2 PBNasrullah hidayahNo ratings yet

- Leave Travel Concession PDFDocument7 pagesLeave Travel Concession PDFMagesssNo ratings yet

- Elements of Consideration: Consideration: Usually Defined As The Value Given in Return ForDocument8 pagesElements of Consideration: Consideration: Usually Defined As The Value Given in Return ForAngelicaNo ratings yet

- Agrade CAPSIM SECRETS PDFDocument3 pagesAgrade CAPSIM SECRETS PDFAMAN CHAVANNo ratings yet

- DefenseDocument18 pagesDefenseRicardo DelacruzNo ratings yet

- I I I I I I I: Quipwerx Support Request FormDocument2 pagesI I I I I I I: Quipwerx Support Request Form08. Ngọ Thị Hồng DuyênNo ratings yet

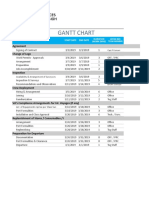

- Gantt Chart TemplateDocument3 pagesGantt Chart TemplateAamir SirohiNo ratings yet

- What Is The Meaning of Tawheed and What Are Its Categories?Document7 pagesWhat Is The Meaning of Tawheed and What Are Its Categories?ausaf9900No ratings yet

- PHILIP MORRIS Vs FORTUNE TOBACCODocument2 pagesPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRNo ratings yet

- Display of Order of IC Constitution and Penal Consequences of Sexual HarassmentDocument1 pageDisplay of Order of IC Constitution and Penal Consequences of Sexual HarassmentDhananjayan GopinathanNo ratings yet

- Project ReportDocument55 pagesProject Reportshrestha mobile repringNo ratings yet

- Lecture-1 An Introduction To Indian PhilosophyDocument14 pagesLecture-1 An Introduction To Indian PhilosophySravan Kumar Reddy100% (1)

- O&M Manager Seeks New Career OpportunityDocument7 pagesO&M Manager Seeks New Career Opportunitybruno devinckNo ratings yet

- Life of Prophet Muhammad Before ProphethoodDocument5 pagesLife of Prophet Muhammad Before ProphethoodHoorain HameedNo ratings yet

- Developer Extensibility For SAP S4HANA Cloud On The SAP API Business HubDocument8 pagesDeveloper Extensibility For SAP S4HANA Cloud On The SAP API Business Hubkoizak3No ratings yet

- Family Law Study Material for LL.B. and BA.LL.B. CoursesDocument134 pagesFamily Law Study Material for LL.B. and BA.LL.B. CoursesDigambar DesaleNo ratings yet

- Janice Perlman, FavelaDocument3 pagesJanice Perlman, FavelaOrlando Deavila PertuzNo ratings yet

- iOS E PDFDocument1 pageiOS E PDFMateo 19alNo ratings yet

- 79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Document9 pages79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Scribd Government DocsNo ratings yet