Professional Documents

Culture Documents

Wm. Wrigley Jr. Company Capital Structure Valuation Cost of Capital

Uploaded by

Nicholas Reyner TjoegitoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wm. Wrigley Jr. Company Capital Structure Valuation Cost of Capital

Uploaded by

Nicholas Reyner TjoegitoCopyright:

Available Formats

Final Exam Case: The WM. Wrigley Jr.

Company: Capital Structure, Valuation and Cost of Capital Submitted by: Rashid Mammadov, FTMBA 2014 Instructor: Prof. Sergei Chernenko, BUSFIN 7210 Date: April 28, 2013

I.

Business and credit risks at The Wm. Wrigley Jr. Company.

With round 13.1 billion worth of equity by June 2002, the Wm. Wrigley Jr. Company (herein after the Wrigleys) is operating in branded consumer foods and candy industry, an industry with high level of concentration and intense rivalry. Although the industry itself is highly competitive, the Wrigleys occupies a specific niche in the market as the leading producer and distributor of chewing gums putting itself into more advantageous position compared to the other industry players. As of 2002 the Wrigleys was the biggest manufacturer of chewing gums with very high brand equity and strong presence globally. Being geographically diversified in multiple markets, maintaining market leadership in anti-cyclical industry and having strong growth in foreign markets the Wrigleys is safe from the business risks prospective. Its low riskiness is also reflected in its equity beta of 0.75 as of 2002. Adding that through its history Wrigley has always maintained extremely conservative financial policy with zero debt, we can consider the Wrigleys as AAA/AA graded company. In terms of financial risks, since the Wrigleys does not have any debt obligations at the moment, it is financially risk free. With different levels of debt in its capital structure, the Wrigleys credit ratings will change. II. Effect of recapitalization on The Wrigleys financial ratios and credit rating.

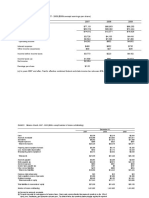

For analysis of the effect of proposed USD 3 billion recapitalization on the Wrigleys, pro forma financial statements were forecasted under 10 per cent sales growth rate and percentage of sales method. The pro forma financials are given in Exhibits 1-4. Exhibit 1 shows key financial ratios under different credit rating assumptions reflecting changing interest burden and taxes. Further, the calculated ratios are compared to industry averages by credit ratings, shown in exhibit 2. From the comparison of exhibits 1 and 2, the Wrigleys cant maintain its high grade credit rating if it borrows 3 billion, as its main financial ratios will correspond to speculative grade levels. Therefore, restructured capital shall be most probably funded with debt rated between BB and B, which is supported by EBIT coverage, FFO-to-debt and FCFO-to-debt ratios. The other indicators, EBIT coverage and return on capital support higher credit rating. As the company book value of equity does not reflect the company real value, market leverage of the company was shown in Exhibit 1, which is 20.7% - rather consistent with high grade companies. Since the business risks are low for the Wrigleys a BB rating - a higher side of the credit rating range that major financial ratios imply - is more likely. Rating agencies also account on management as an indicator of credibility therefore credible management character of the company also supports BB rating. 1

If company follows a share repurchase or dividend payout its book value will be reduced by 3 billion and will become negative, -1.6 billion. Possible prudential or accounting restrictions associated with negative book equity of public corporations were omitted in current analysis. III. The Wrigleys WACC without leverage.

Since the Wrigleys is 100% owned by equity holders its WACC will be equal to its rate of equity (due to miscellaneous impact, a potential small negative leverage created by the excess cash is omitted). Given the unlevered beta of equity of 0.75, risk premium of 7% and risk-free rate of 4.86%, the Wrigleys, according to CAPM, has cost of equity and WACC of 10.11% for fully equity owned company. IV. The Wrigleys WACC after recapitalization.

Method 1 Assuming debt beta of 0.17 for BB rated borrowing, according to CAPM, cost of debt equals 6.05%, which is risk free rate of 4.86% added product of beta of 0.17 and risk premium or 7%. Then, based on Miller Modigliani Proposition II, with unlevered beta of equity of 0.75 and beta of debt of 0.17, equity beta re-levered by D/E of 26.2% will equal to 0.9. With equity beta of 0.9 and risk free rate and risk premium of 4.86% and 7% estimated cost of equity is 11.2%. In that case, given recapitalized D/V of 20.7% WACC equals 9.61%. Method 2 Assuming yield on corporate debt of the Wrigleys equals to average YTM of 10 year BB rated bond of 9.70% given from the case, cost of debt is equal to 7.63%. This reflects the adjustment for the expected probability and level of losses associated with debt. Calculation assumes rate of loss of 0.6 and default rate of 3.45% - average for consumer industry in 2002, which is also consistent with the range of default rates of 1.4% to 4.0% for BB+ to BB- rated bonds in 2002 in the US1. Given cost of debt of 7.63%, beta of debt shall equal to 0.40 according to CAPM. Miller Modigliani Proposition II formula implies that unlevered beta of equity of 0.75 with debt beta of 0.40 and D/E of 26.2 will result in levered equity beta of 0.84. Again from CAPM, given equity beta of 0.84 cost of equity will equal to 10.76%. With leverage of D/V of 20.7% that is implied from recapitalization, our WACC will equal 9.48%. The calculations assume risk free rate equal to YTM of 10 year US Treasury Bond, BB-rated debt YTM of 9.7%, market premium of 7% and tax rate of 40% which are given from the case. The results from two methods have a very small difference of 13 basis point and for further necessary calculations I would suggest Dobrynin uses WACC of 9.61%.

https://www.standardandpoors.com/ratings/articles/en/us/?articleType=HTML&assetID=1245331026864#ID1942 5

Cost of debt Beta of debt Equity Beta (relev) Cost of equity WACC V.

Given benchmark YTM 7.63% 0.40 0.84 10.76% 9.48%

Given Debt Beta 6.05% 0.17 0.90 11.2% 9.61%

Effect of interest tax shield on stock price of the Wrigleys.

On June 7, 2002 the Wrigleys stock price was USD 57.07 per share. Given 232.441 million shares it means market capitalization of almost 13.26 billion US dollars. At tax rate of 40%, 3,000 million debt will result in interest tax shield of 1,200 million. The effect of interest tax shield will immediately be reflected into the new share price under perfect capital market assumptions. It means shareholders of the Wrigleys will be 5.16 dollars better-of and the share price will go up to USD 62.23 per share. Under stock repurchase scenario, share prices will not change from 62.23 but the total market value of equity will be reduced through reduction in number of shares outstanding. Under 3 billion special dividend scenario, after pay back of 12.90 dollar per share, share price will go down to 49.33. Thus in both payout scenarios total value of equity will be the same 11,465.41 million after the transactions. VI. Using share repurchase at the Wrigley versus paying special dividends.

Although under capital market assumptions both share repurchase and special dividends yield same results and shareholders are indifferent between those two, tax legislations and behavioral perceptions favor price repurchase to special dividends. Firsts, capital gain was often taxed less than dividend income. But in 2002 under J.W. Bush legislation both tax rates were same. However, shareholders might postpone their revenue recognition for tax purposes under share repurchase thus preferring share repurchase. Second reason for favoring share repurchase is that due to behavioral imperfections it is considered by investors as indicator of underpriced share which can drive company share prices up. Thus, share repurchase may cause extra capital gain for investors in addition to realization of interest tax shield. Third, the Wrigleys stuff who receive options will be better of if 3,000 million will be distributed through capital gain rather than dividends, since capital gain of shares will also increase their stock option value. VII. Possible financial distress costs at the Wrigleys.

Under perfect capital market, bankruptcy will cause the shift of ownership from equity holders to debt holders while the total value of the firm will not be damaged. This assumption omits the fact companies under bankruptcy follow either liquidation or reorganization both processes involving direct and indirect costs. Debt holders foreseeing the costs of distress, which is usually 15-20% of the total value, set their lending rates at levels that already incorporate the bankruptcy costs therefore shifting those costs to equity

holders. Therefore, price of fairly traded company stock will already incorporate the present value of likely bankruptcy costs imposed to them by debt holders. Direct costs associated with bankruptcy are costs for hiring experts in the area such as lawyers, accountants, auditors and other experts. In addition, management engagement in bankruptcy rather than to their business as usual duties is an opportunity costs associated with bankruptcy. Since Wrigley is a huge organization with operations in various countries possible direct costs of distress can be medium to high. Indirect costs for the Wrigleys shall be very high. First of all, Wrigley is a producer and distributor of chewing gums, it means that partial liquidation of the Wrigleys will damage distribution channels, important value added for the Wrigleys. Second, company suppliers, various contractors, transportation providers that operate in different countries may not rely on the Wrigleys anymore and request cash for the services. As we see from the Wrigleys balance sheet in year 2001 company had accounts and accrued payables of round 220 million, in worst case scenario when partners may not be willing to maintain credit terms with the Wrigleys, The Wrigley Jr. Company would require additional 220 million in cash for its daily operations. Third, the most important, the balance sheet shows that company does not have huge tangible assets that it can realize at reasonable price. The biggest assets of the Wrigleys are its intangible patents and brand names. In case of fire sell with limited bargaining power, company may sell those assets at very low price which significantly increase the costs of bankruptcy for the Wrigleys. VIII. The effect of recapitalization on EPS of the Wrigleys.

The below table illustrates the Wrigleys share price, EPS and total value of the firm under three scenarios. Under first scenario Status Quo, The Wrigleys has highest EPS since it does not have any interest expenses. But it is also worth to notice that the total value of the Wrigleys is the lowest. Adding the leverage of USD 3,000 million under BB rating assumption will significantly reduce the net income of the company therefore reduce the EPS. Therefore, if only effect on EPS is considered, misguiding conclusion to not to issue debt can be inferred. This effect will partially be offset in case of share repurchases, since decrease of the number of shares outstanding associated with share repurchase will push EPS up. In case of special dividend payout the downward effect of recapitalization and interest burden on EPS will not be adjusted since the number of shares outstanding will remain same. I believe that although EPS is an important index, it is not reliable indicator of value maximization of the shareholders, the ultimate goal in an organization that the decision should serve to. As we further see from the below table the total value will be maximized under recapitalization assumption through realization of interest tax shield which EPS measure does not support. Therefore, EPS shall not play a primary role in recapitalization decision. 4

Status Quo Repurchase Sp. Dividends IX.

# of shares 232.441 184.2 232.441

Share Price $57.07 $62.23 $49.33

EPS $1.45 $0.88 $0.70

Total Value $13,265.41 $14,465.41 $14,465.41

Opinion on Dobrynin to pursue or not with recapitalization proposal.

The decision on recapitalization shall consider several important factors: the amount of interest tax shield generated by leveraging, the probability of bankruptcy, costs of bankruptcy, effects on financial ratios, risk culture of company management and ownership. The recapitalization of the Wrigleys will increase the total value of the company by 1.200 billion, which shareholders will immediately realize through capital appreciation. It is a very strong support toward leveraging. Another support for the recapitalization is that the revenues of the Wrigleys are not volatile and business risks are low which makes the probability of the bankruptcy for the company low. Meanwhile, the impact of the bankruptcy through high costs of the financial distress associated with the nature of the business model of the Wrigleys will increase the bankruptcy costs thus not favoring high leveraging. The implications on financial ratios show that the company will move to higher range of speculative grade from high grade level of credibility. This move may not be consistent to the risk culture of the management and the owners of the Wrigleys therefore recapitalization could be rejected in spite of huge financial benefits. Given the pros and cons of re-leveraging, in my opinion, recapitalization through 3 billion of debt and same share repurchase is in the best interests of The WM. Wrigley Jr. Company shareholders, since it will in total increase their wealth by 1.2 billion which is a fair premium for the risks associated with leveraging the company.

Exhibit 1. Pro Forma Financial Ratios under various credit rating assumptions The Wm. Wrigley Jr. Company - Key Financial Ratios under different credit rating assumptions AAA AA A BBB BB B EBIT interest coverage (x) 3.50 3.56 3.17 2.58 1.93 1.73 Funds from operations/total debt (%) 9.4% 9.5% 9.1% 8.3% 6.8% 6.2% Free operating cash flow/total debt (%) 6.6% 6.6% 6.2% 5.4% 3.9% 3.3% Return on capital (%) - market value 33.4% 33.4% 33.5% 33.6% 33.8% 33.9% Operating income/sales (%) 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% Long-term debt/capital (%) - b.v. 195.2% 195.2% 195.2% 195.2% 195.2% 195.2% Total debt/capital (%) 195.2% 195.2% 195.2% 195.2% 195.2% 195.2% Long-term debt/capital (%) - market v. 20.7% 20.7% 20.7% 20.7% 20.7% 20.7% Inputs for calculations: Interest burden Funds from operations Free operating cash flow

$160.5 $283.1 $196.5

$157.8 $284.7 $198.2

$177.0 $273.2 $186.6

$217.8 $248.7 $162.2

$291.0 $204.8 $118.2

$324.6 $184.6 $98.1

Exhibit 2. Key Industrial Financial Ratios (Three-year medians 2000-2002) AAA 23.4 214.2 156.6 35.0 23.4 (1.1) 5.0 AA 13.3 65.7 33.6 26.6 24.0 21.1 35.9 A 6.3 42.2 22.3 18.1 18.1 33.8 42.6 BBB 3.9 30.6 12.8 13.1 15.5 40.3 47.0 BB 2.2 19.7 7.3 11.5 15.4 53.6 57.7 B 1.0 10.4 1.5 8.0 14.7 72.6 75.1

EBIT interest coverage (x) Funds from operations/total debt (%) Free operating cash flow/total debt (%) Return on capital (%) Operating income/sales (%) Long-term debt/capital (%) Total debt/capital (%)

Exhibit 3. Pro Forma Statement of Earnings (assuming BB debt rating for recapitalization scenario) The Wm. Wrigley Jr. Company Pro Forma Statement of Earnings (in millions) Earnings Net sales Cost of sales Gross profit Selling, general and administrative Operating income Investment income Other expense Earnings before income taxes Interest Expense Income taxes Net earnings Divideds Retained Earnings year ended December 31 1999 2000 2001 $2,061.6 $904.2 $1,157.4 $721.8 $435.6 $17.6 ($8.8) $444.4 $0.0 $136.2 $308.2 $152.9 $155.3 $2,145.7 $904.3 $1,241.4 $778.2 $463.2 $19.2 ($3.1) $479.3 $0.0 $150.4 $328.9 $158.8 $170.1 $2,429.6 $997.1 $1,432.6 $919.2 $513.4 $18.6 ($4.5) $527.4 $0.0 $164.4 $363.0 $168.0 $195.0 Status Quo 2002* $2,672.6 $1,095.8 $1,576.8 $1,015.6 $561.2 $0.0 $0.0 $561.2 $0.0 $224.5 $336.7 $154.9 $181.8 Recapitalized 2002** $2,672.6 $1,095.8 $1,576.8 $1,015.6 $561.2 $0.0 $0.0 $561.2 ($291.0) $108.1 $162.1 $74.6 $87.6

Exhibit 4. Pro Forma Balance Sheet Statement (assuming BB debt raging for recapitalization scenario) The Wim. Wrigley Jr. Company Consolidated Pro Forma Balance Sheet (in millions of dollars) ASSETS Current assets: Cash and equivalents Short-term investments, amortized cost Accounts receivable Inventories Other current assets Deferred income taxes - current Total current assets Marketable equity securities, fair value Deferred charges and other assets Deferred income taxes - noncurrent Property, plant, and equipment (at cost) Less accumulated depreciation Net property, plant and equipment TOTAL ASSETS LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued expenses Dividends payable Income and other taxes payable Deferred income taxes - current Total current liabilities Deferred income taxes - noncurrent Long term debt liabilities Other non-current liabilities Common stock Class B convertible stock Additional paid-in capital Retained earnings Treasury stock Accumulated other comprehensive income Total stockholders' equity TOTAL LIABILITIES AND EQUITY 2000 2001 Status quo 2002* Restructure 2002**

$ $ $ $ $ $ $ $ $ $ $ $ $ $

300.60 29.30 191.57 253.29 39.73 14.23 828.72 28.54 83.71 26.74 1,139.63 532.60 607.03 1,574.74

$ $ $ $ $ $ $ $ $ $ $ $ $ $

307.79 25.45 239.89 278.98 46.90 14.85 913.84 25.30 115.75 26.38 1,256.09 571.72 684.37 1,765.64

$ $ $ $ $ $ $ $ $ $ $ $ $ $

378.26 28.00 263.87 306.88 51.59 16.33 1,044.92 27.83 127.32 29.02 1,381.69 614.36 767.34 1,996.43

$ $ $ $ $ $ $ $ $ $ $ $ $ $

283.97 28.00 263.87 306.88 51.59 16.33 950.64 27.83 127.32 29.02 1,381.69 614.36 767.34 1,902.14

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

73.13 113.78 39.47 60.98 0.86 288.21 40.14 113.49 12.56 2.94 0.35 1,492.55 (256.48) (119.01) 1,132.90 1,574.74 8

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

91.23 128.41 42.71 68.44 1.46 332.23 43.21 113.92 12.65 2.85 1.15 1,684.34 (289.80) (134.90) 1,276.29 1,765.65

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

100.35 141.25 46.98 75.28 1.60 365.46 47.53 125.31 12.65 2.85 1.15 1,866.18 (289.80) (134.90) 1,458.13 1,996.43

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

100.35 141.25 46.98 75.28 1.60 365.46 47.53 3,000.00 125.31 12.65 2.85 1.15 1,771.90 (3,289.80) (134.90) (1,636.15) 1,902.14

You might also like

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument19 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalMai Pham100% (1)

- Case 30: Efficient Financing DiscussionsDocument5 pagesCase 30: Efficient Financing Discussionswaldek87No ratings yet

- Wrigley CaseDocument15 pagesWrigley CaseDwayne100% (4)

- Wrigley CaseDocument12 pagesWrigley Caseresat gürNo ratings yet

- Paper Wrigley gr.4Document9 pagesPaper Wrigley gr.4shaherikhkhanNo ratings yet

- Case 5Document15 pagesCase 5Qiao LengNo ratings yet

- Ugcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCoDocument6 pagesUgcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCotimbulmanaluNo ratings yet

- The History and Business of Wm. Wrigley Jr. CompanyDocument7 pagesThe History and Business of Wm. Wrigley Jr. CompanySyed Ahmedullah Hashmi100% (1)

- WrigleyDocument28 pagesWrigleyKaran Rana100% (1)

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument4 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- TN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalDocument108 pagesTN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalStanisla Lee0% (2)

- Wm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of CapitalDocument14 pagesWm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of Capitalsotki4100% (1)

- Wrigley CalculationDocument13 pagesWrigley CalculationAnindito W WicaksonoNo ratings yet

- SFM Wrigley JR Case Solution HBRDocument17 pagesSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- Wm. Wrigley Jr. CompanyDocument5 pagesWm. Wrigley Jr. CompanyTarun Gupta0% (1)

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Case 30 The WM Wrigley J Company QuestionsDocument1 pageCase 30 The WM Wrigley J Company Questionsodie99No ratings yet

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Document25 pagesIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420No ratings yet

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDocument11 pagesMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghNo ratings yet

- Cooper Case SolutionsDocument6 pagesCooper Case SolutionsDarshan Salgia100% (1)

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Knoll Furniture CaseDocument5 pagesKnoll Furniture CaseIni EjideleNo ratings yet

- Mercury - Case SOLUTIONDocument36 pagesMercury - Case SOLUTIONSwaraj DharNo ratings yet

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadeNo ratings yet

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Fin 321 Case PresentationDocument19 pagesFin 321 Case PresentationJose ValdiviaNo ratings yet

- Flash Memory CaseDocument6 pagesFlash Memory Casechitu199233% (3)

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- TN-1 TN-2 Financials Cost CapitalDocument9 pagesTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Boeing's New 7E7 AircraftDocument10 pagesBoeing's New 7E7 AircraftTommy Suryo100% (1)

- Financial analysis of company shares and earningsDocument1 pageFinancial analysis of company shares and earningsRoderick Jackson JrNo ratings yet

- M&ADocument7 pagesM&AAntónio CaleiaNo ratings yet

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- Wrigley Case AnswerDocument4 pagesWrigley Case AnswerYehan MatuilanaNo ratings yet

- AIRTHREAD ACQUISITION Revenue and Expense ProjectionsDocument24 pagesAIRTHREAD ACQUISITION Revenue and Expense ProjectionsHimanshu AgrawalNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- Wrigley Case FinalDocument9 pagesWrigley Case FinalhnooyNo ratings yet

- The Effect of The Present Value of Debt Tax Shields: It Shows That Adding $3 Billion in Debt ToDocument5 pagesThe Effect of The Present Value of Debt Tax Shields: It Shows That Adding $3 Billion in Debt ToJuris PasionNo ratings yet

- CASE6Document7 pagesCASE6Yến NhiNo ratings yet

- (Lecture 10 & 11) - Gearing & Capital StructureDocument18 pages(Lecture 10 & 11) - Gearing & Capital StructureAjay Kumar TakiarNo ratings yet

- Wm. Wrigley Jr. Co. recapitalization analysisDocument8 pagesWm. Wrigley Jr. Co. recapitalization analysisHussain AhmedNo ratings yet

- William WrigleyDocument8 pagesWilliam WrigleyRajaram Iyengar100% (2)

- Blain Kitchenware CF CaseDocument25 pagesBlain Kitchenware CF CaseAnurag Chandel67% (3)

- IMChap 020Document29 pagesIMChap 020Roger TanNo ratings yet

- EY Commercial Real Estate DebtDocument16 pagesEY Commercial Real Estate DebtPaul BalbinNo ratings yet

- AuroraDocument6 pagesAuroraNathan LimNo ratings yet

- The Wm. Wrigley Jr. Company Case Study - Kimesha Clarke - 412002313Document6 pagesThe Wm. Wrigley Jr. Company Case Study - Kimesha Clarke - 412002313Kym LatoyNo ratings yet

- Financial Institutions Management - Chap020Document20 pagesFinancial Institutions Management - Chap020renad_No ratings yet

- VocDocument1 pageVocNicholas Reyner TjoegitoNo ratings yet

- GloriaDocument3 pagesGloriaNicholas Reyner TjoegitoNo ratings yet

- 3 PoinDocument1 page3 PoinNicholas Reyner TjoegitoNo ratings yet

- Nytrip 1Document1 pageNytrip 1Nicholas Reyner TjoegitoNo ratings yet

- Demo Softexpert EqmDocument60 pagesDemo Softexpert EqmNicholas Reyner TjoegitoNo ratings yet

- Cambodia LaosDocument7 pagesCambodia LaosNicholas Reyner TjoegitoNo ratings yet

- LeasesDocument29 pagesLeasesPriyanka KumbhareNo ratings yet

- SLDocument2 pagesSLNicholas Reyner TjoegitoNo ratings yet

- Case 5 2 5 3 DisneyDocument11 pagesCase 5 2 5 3 DisneyNicholas Reyner TjoegitoNo ratings yet

- Brown FormanCaseStudyDocument16 pagesBrown FormanCaseStudyNicholas Reyner TjoegitoNo ratings yet

- Drop DateFileDocument2 pagesDrop DateFileNicholas Reyner TjoegitoNo ratings yet

- MBA 570x Homework 1 Fund and Hedge Fund StrategiesDocument4 pagesMBA 570x Homework 1 Fund and Hedge Fund StrategiesNicholas Reyner TjoegitoNo ratings yet

- GARCHDocument51 pagesGARCHAjinkya AgrawalNo ratings yet

- Implementing The Index Model1Document10 pagesImplementing The Index Model1Nicholas Reyner TjoegitoNo ratings yet

- Dynamic Chart (6 Assets) )Document5 pagesDynamic Chart (6 Assets) )Nicholas Reyner TjoegitoNo ratings yet

- Chapter 8Document15 pagesChapter 8Tug PugNo ratings yet

- 2011 Global Ugrad Prog ApplicationDocument9 pages2011 Global Ugrad Prog ApplicationsyawbeNo ratings yet

- Wm. Wrigley Jr. Company Capital Structure Valuation Cost of CapitalDocument8 pagesWm. Wrigley Jr. Company Capital Structure Valuation Cost of CapitalNicholas Reyner Tjoegito100% (4)

- GarudaDocument3 pagesGarudaNicholas Reyner TjoegitoNo ratings yet

- Critical & Analytical ThinkingDocument42 pagesCritical & Analytical ThinkingNicholas Reyner TjoegitoNo ratings yet

- Guideline For Security Analysis - 2013Document2 pagesGuideline For Security Analysis - 2013Nicholas Reyner TjoegitoNo ratings yet

- Sample Market AnalysisDocument9 pagesSample Market AnalysisMark ButtressNo ratings yet

- What Is A StockDocument16 pagesWhat Is A StockRomeo Bea BaynosaNo ratings yet

- Ch12 - SlideDocument147 pagesCh12 - SlideReda SalihiNo ratings yet

- SLC NotesDocument803 pagesSLC NotesManishankar SharmaNo ratings yet

- Use The Following Information To Answer The Question(s) BelowDocument43 pagesUse The Following Information To Answer The Question(s) BelowWesNo ratings yet

- BVS Sample Valuation Report 01Document59 pagesBVS Sample Valuation Report 01Yahye AbdillahiNo ratings yet

- Edelweiss Twin Win 7.15% - Aug'19Document10 pagesEdelweiss Twin Win 7.15% - Aug'19speedenquiryNo ratings yet

- JC Penney Bankruptcy FilingDocument24 pagesJC Penney Bankruptcy FilingTradeHawkNo ratings yet

- JF - India 31 01 07 PDFDocument3 pagesJF - India 31 01 07 PDFstavros7No ratings yet

- 6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Document13 pages6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Marlito Joshua AmistosoNo ratings yet

- Chapter 8 Types of Major AccountsDocument42 pagesChapter 8 Types of Major AccountsMylene Salvador100% (1)

- Taxation LawDocument10 pagesTaxation LawflorNo ratings yet

- Fibonacci NumbersDocument101 pagesFibonacci NumbersJhunmar PahimnayanNo ratings yet

- Circular 14 2021Document8 pagesCircular 14 2021SachinNo ratings yet

- 1 Business and Finance SpeakingDocument7 pages1 Business and Finance SpeakingJelica VukoticNo ratings yet

- Cost Theory - Professional CourseDocument79 pagesCost Theory - Professional CourseManojkumar KumarNo ratings yet

- Fabv 632 All PDFDocument62 pagesFabv 632 All PDFNageshwar SinghNo ratings yet

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- NOTICE OF RELINQUISHMENT OF COMPANY STOCKDocument4 pagesNOTICE OF RELINQUISHMENT OF COMPANY STOCKRico Elmore100% (2)

- IASB Framework Sets Financial Reporting StandardsDocument3 pagesIASB Framework Sets Financial Reporting StandardsFaizSheikhNo ratings yet

- Financial Management AssignmentDocument8 pagesFinancial Management AssignmentMBA 8th Batch At MUSOMNo ratings yet

- Payment, Clearing and Settlement Systems in Russia: CPSS - Red Book - 2011Document44 pagesPayment, Clearing and Settlement Systems in Russia: CPSS - Red Book - 2011pallakuNo ratings yet

- Credit monitoring: key part of credit managementDocument15 pagesCredit monitoring: key part of credit managementSyam Sandeep67% (3)

- 2019 Samsung Biologics Annual ReportDocument107 pages2019 Samsung Biologics Annual ReportĐào ĐứcNo ratings yet

- Accounting For Treasury SharesDocument2 pagesAccounting For Treasury SharesCharles Reginald K. Hwang100% (1)

- Week 1: Introduction To Financial MarketsDocument11 pagesWeek 1: Introduction To Financial Marketsbanana lalaNo ratings yet

- Internal Proposal of 2023 International Stock Portfolio Analysis CompetitionDocument10 pagesInternal Proposal of 2023 International Stock Portfolio Analysis Competitiondestria87No ratings yet

- Nism Ii B - Registrar - Practice Test 4Document19 pagesNism Ii B - Registrar - Practice Test 4HEMANSH vNo ratings yet

- What Is Stock Market?: (Bursa Saham Malaysia)Document9 pagesWhat Is Stock Market?: (Bursa Saham Malaysia)Halim ZulkifliNo ratings yet

- Project report on mergers, amalgamations and takeoversDocument18 pagesProject report on mergers, amalgamations and takeoversSunita YadavNo ratings yet

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsFrom EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNo ratings yet

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionFrom EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionRating: 5 out of 5 stars5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Will Work for Pie: Building Your Startup Using Equity Instead of CashFrom EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNo ratings yet

- The Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupFrom EverandThe Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupNo ratings yet

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)