Professional Documents

Culture Documents

ACCY122 Fa09 Notes15 StratCost Other Methods

Uploaded by

Gladys Fortin CabugonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCY122 Fa09 Notes15 StratCost Other Methods

Uploaded by

Gladys Fortin CabugonCopyright:

Available Formats

ACCY 122 Fall 2009

Strategic Costing #2 Miscellaneous Costing Methods

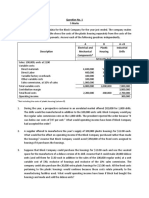

Topic #1 Relevant Costing Lewis Auto Company manufactures a part for use in its production of automobiles. When 10,000 items are produced, the costs per unit are: Direct materials Direct manufacturin! labor #ariable manufacturin! o$erhead &i'ed manufacturin! o$erhead )otal $ 1 "0 % ( $1 *

+onty Company has offered to sell Lewis Auto Company 10,000 units of the part for $1 0 per unit. )he plant facilities could be used to manufacture another part at a sa$in!s of $1*0,000 if Lewis Auto accepts the supplier,s offer. -n addition, $ 0 per unit of fi'ed manufacturin! o$erhead on the ori!inal part would be eliminated. Re uired! a. What is the rele$ant per unit cost for the ori!inal part. b. Which alternati$e is best for Lewis Auto Company. /y how much. "ere is the per#unit relevant cost $%T& T"AT T"& '1(0)000 *S $%T *$C+,-&- AS *T *S $%T A .&R ,$*T C%ST /,T A +,M. S,M0 Direct materials $1 Direct manufacturin! labor "0 #ariable manufacturin! o$erhead % A$oidable fi'ed manufacturin! o$erhead 0 )otal rele$ant per unit costs $11" "ere is the alternative anal1sis! $%T& T"AT 2& -% T"*S *$ C%+,MS 2*T" T"& -*FF&R&$C&S *$C+,-&- AS A C%+,M$ Ma3e 0urchase price 3a$in!s in space Direct materials Direct manufacturin! labor #ariable o$erhead &i'ed o$erhead sa$ed )otals $1 0,000 "00,000 %0,000 $4"0,000 1 00,0002 $* 0,000 /u1 $1, 00,000 11*0,0002 &44ect o4 /u1ing1 $11, 00,0002 1*0,000 1 0,000 "00,000 %0,000 00,000 $1%0,000

Topic #2! Cost Allocation 4or 5oint .roduct and /1products 1. )erms a. 5oint cost b. 3plitoff point c. 3eparable costs d. /yproducts . 6eed to cost out in$entory so we need a number (. +ethods 7 )wo mar8et based and one physical 7 in order of !eneral preference:

1

)his is the differential cost 7 the cost differences between the two options.

212982309.doc

ACCY 122 Fall 2009

Strategic Costing #2 Miscellaneous Costing Methods

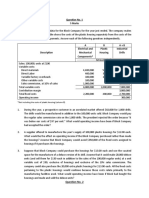

a. 3ales $alue methods if there is a sales $alue that can be determined at the splitoff point b. 6et reali9able $alue method if the separable cost are hi!h and different relati$e to other costs )he difference between a. and b. is that a. use the separable costs to !et the 6:#: $R6 7 Final sales price separa8le cost vs0 Sales price at the splito44 point0 c. Allocate on pounds, !allons and the li8e 7 wor8s of products are similar after the splitoff point ;a8ima +anufacturin! purchases trees from Cascade Lumber and processes them up to the splitoff point where two products 1paper and pencil casin!s2 are obtained. )he products are then sold to an independent company that mar8ets and distributes them to retail outlets. )he followin! information was collected for the month of 6o$ember: )rees processed: <0 trees 1yield is (0,000 sheets of paper and (0,000 pencil casin!s and no scrap2 0roduction: paper (0,000 sheets and pencil casin!s (0,000 3ales: paper: 4,000 at $0.0% per pa!e and pencil casin!s:(0,000 at $0.10 per casin! )he cost of purchasin! <0 trees and processin! them up to the splitoff point to yield (0,000 sheets of paper and (0,000 pencil casin!s is $1,<00. ;a8ima,s accountin! department reported no be!innin! in$entories and an endin! in$entory of 1,000 sheets of paper. A. What is the sales $alue at the splitoff point for paper. 0aper: 90)000 sheets : '000; 7 '1)200000 /. What is the sales $alue at the splitoff point of the pencil casin!s. 0encils: 90)000 casings : '0010 7 '9)000000 C. -f the sales $alue at splitoff method is used, what are the appro'imate =oint costs assi!ned to endin! in$entory for paper. $1, 00>1$1, 00 ? $(,0002 @ *.<AB so 2(0<=> : '1)<00 : 1)000?90)000 7 '1;029 D. -f the sales $alue at splitoff method is used, what is the appro'imate production cost for each pencil casin!. $(,000>1$1, 00 ? $(,0002 ' $1,<00 @ $1,0A1 so '1)0=1?90)000 casings 7 '0009<= C. What are the paperDs and the pencilsD appro'imate wei!hted cost proportions usin! the sales $alue at splitoff method, respecti$ely. 1(<,000 ' $0.0%2 ? 1(0,000 ' $0.102 @ $%,%00 so '1);00?';);00 7 910(2> and '9)000?';);00 7 @(01(>

/yproducts! either contra#costs or additional revenue

212982309.doc

ACCY 122 Fall 2009 .

Strategic Costing #2 Miscellaneous Costing Methods

)he Carolina Company prepares lumber for companies who manufacture furniture. )he main product is finished lumber with a byproduct of wood sha$in!s. )he byproduct is sold to plywood manufacturers. &or 5uly, the manufacturin! process incurred $(( ,000 in total costs. Ci!hty thousand board feet of lumber were produced and sold alon! with ",*00 pounds of sha$in!s. )he finished lumber sold for $".00 per board foot and the sha$in!s sold for $0."0 a pound. )here were no be!innin! or endin! in$entories. 0repare an income statement showin! the byproduct 112 as a cost reduction durin! production, and 1 2 as a re$enue item when sold. Cost reduction Ahen produced $%*0,000 $%*0,000 $(( ,000 %,0*0 ( A,4 0 $1< ,0*0 Revenue Ahen sold $%*0,000 %,0*0 %*%,0*0 $(( ,000 0 (( ,000 $1< ,0*0

Sales: Lumber 3ha$in!s )otal 3ales: Cost of Good Sold: )otal manufacturin! costs /yproduct )otal CEF3 Gross Margin

Topic #9! $orBal Spoilage or Shrin3age) A8norBal Spoilage) ReAor3 and Scrap 1. 6ormal 3poila!e or 3hrin8a!e included in Cost of Foods +anufactured on a set rate . Abnormal 3poila!e accounted for in a loss account (. )he abo$e items are usually found in processGcostin!, the followin! two are found in =obGcostin!. %. :ewor8 7 similar to spoila!e accountin! <. 3crap 7 usually a contraGcost account Topic #; Capital /udgeting on class Ae8 page

212982309.doc

You might also like

- Answers 10Document5 pagesAnswers 10Ash KaiNo ratings yet

- True or FalseDocument2 pagesTrue or FalseJan Clark LogronioNo ratings yet

- 1 MGT 630 OM 630 Final Exam Review QuestionsDocument5 pages1 MGT 630 OM 630 Final Exam Review Questionsaagrawal3No ratings yet

- ConAgra Processes Beef Cattle ProductsDocument13 pagesConAgra Processes Beef Cattle ProductsMawaz Khan MirzaNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- Name: Student No.: Exercises For Decision MakingDocument7 pagesName: Student No.: Exercises For Decision MakingShohnura FayzulloevaNo ratings yet

- Multiple choice questions on economics conceptsDocument4 pagesMultiple choice questions on economics conceptsChaitram MohamedNo ratings yet

- Arctic InsulationDocument5 pagesArctic InsulationjhonmarteNo ratings yet

- Joint Cost QuizzerDocument5 pagesJoint Cost QuizzerxjammerNo ratings yet

- Economics 102 Orange Grove CaseDocument21 pagesEconomics 102 Orange Grove CaseairtonfelixNo ratings yet

- Ch 7 & 8 Variance AnalysisDocument6 pagesCh 7 & 8 Variance AnalysisTammy 27No ratings yet

- Image0 (8 Files Merged)Document8 pagesImage0 (8 Files Merged)Fatima Ansari d/o Muhammad AshrafNo ratings yet

- Chapter 1. Break-Even AnalysisDocument3 pagesChapter 1. Break-Even AnalysispantyafranciskaNo ratings yet

- 18-Joint Products and Byproducts PDFDocument17 pages18-Joint Products and Byproducts PDFSyed Ahsan Hussain XaidiNo ratings yet

- Sample MAS 3rd Evals KEY Set BDocument13 pagesSample MAS 3rd Evals KEY Set BJoanna MNo ratings yet

- Engineering Economy (Lecture 2)Document26 pagesEngineering Economy (Lecture 2)Anonymous d6Etxrtb100% (2)

- Expected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHDocument5 pagesExpected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHiceds01No ratings yet

- Worksheet About Breakeven AnalysisDocument2 pagesWorksheet About Breakeven AnalysisAnuka YituNo ratings yet

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocument12 pagesReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraNo ratings yet

- Industrial Organization SolutionsDocument89 pagesIndustrial Organization SolutionsDavide Rossetto80% (5)

- Question - Mid Term Parallel Quiz 2324Document4 pagesQuestion - Mid Term Parallel Quiz 2324haikal.abiyu.w41No ratings yet

- Akb 2Document9 pagesAkb 2Dani m DarmawanNo ratings yet

- 10 Cases Accounting - Answered-1 PDFDocument10 pages10 Cases Accounting - Answered-1 PDFNehal NabilNo ratings yet

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument10 pagesCH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionssamahNo ratings yet

- Amercian FuelDocument8 pagesAmercian FuelAsh KaiNo ratings yet

- Unit 1Document5 pagesUnit 1Baba Baby NathNo ratings yet

- Ch26 Lecture and ExercisesDocument4 pagesCh26 Lecture and Exercisesaldz_sawadjaanNo ratings yet

- 1 Ass-2Document13 pages1 Ass-2Kim SooanNo ratings yet

- BDC Preboard Feb 2011 - MasDocument10 pagesBDC Preboard Feb 2011 - Mas1hewlett100% (1)

- Sample Questions - Life Cycle Costing and Target CostingDocument2 pagesSample Questions - Life Cycle Costing and Target Costingzohashafqat31No ratings yet

- Practice Problems Standard CostDocument5 pagesPractice Problems Standard Costlulughosh100% (1)

- Task 5 Differential Analysis P2 - QuesDocument4 pagesTask 5 Differential Analysis P2 - Queslớp 2/7 Hoàng LongNo ratings yet

- Aurora AnalysisDocument26 pagesAurora AnalysismoeNo ratings yet

- Task 5 Differential Analysis P2 - QuesDocument4 pagesTask 5 Differential Analysis P2 - Queslớp 2/7 Hoàng LongNo ratings yet

- PDE Work Sheet-2Document4 pagesPDE Work Sheet-2Goitom GebreslassieNo ratings yet

- OPTIMIZING PRODUCTION COSTSDocument9 pagesOPTIMIZING PRODUCTION COSTSCarlos Peconcillo ImperialNo ratings yet

- Kasus Beauvellie Furniture-SendDocument5 pagesKasus Beauvellie Furniture-Send06. Ni Komang Ayu Trisia Dewi0% (1)

- 1.05 Cost Accumulation SystemsDocument37 pages1.05 Cost Accumulation SystemsmymyNo ratings yet

- Lanen 3e, Chapter 17 Additional Topics in Variance Analysis: Learning ObjectivesDocument12 pagesLanen 3e, Chapter 17 Additional Topics in Variance Analysis: Learning ObjectivesPhuong TaNo ratings yet

- CH #2 NumericalsDocument3 pagesCH #2 NumericalsMs Noor ul AinNo ratings yet

- Should Barbour Drop Product T-2Document33 pagesShould Barbour Drop Product T-2Vias TikaNo ratings yet

- Decision MakingDocument33 pagesDecision Makingali100% (1)

- UNIVERSIDAD DE MANILA MIDTERM EXAMDocument6 pagesUNIVERSIDAD DE MANILA MIDTERM EXAMShiela Mae Pon AnNo ratings yet

- Ma 123Document21 pagesMa 123Dean CraigNo ratings yet

- CVP AnalysisDocument4 pagesCVP Analysisrhandy oyaoNo ratings yet

- Comprehensive Case 2 Chapters 5-10Document10 pagesComprehensive Case 2 Chapters 5-10Ato SumartoNo ratings yet

- Cost Accounting 1 8 Final 4 PDF FreeDocument7 pagesCost Accounting 1 8 Final 4 PDF FreeAzi EvangelistaNo ratings yet

- Business Plan Proposal For Keur Massar Sewing WorkshopDocument14 pagesBusiness Plan Proposal For Keur Massar Sewing WorkshopFazalNo ratings yet

- Topic 4 Finals BREAK EVEN AnalysisDocument4 pagesTopic 4 Finals BREAK EVEN Analysisrommel satajoNo ratings yet

- Cost classification and income statement analysisDocument7 pagesCost classification and income statement analysisVincent PanisalesNo ratings yet

- Full Download Test Bank For Accounting For Decision Making and Control 8th 0078025745 PDF Full ChapterDocument36 pagesFull Download Test Bank For Accounting For Decision Making and Control 8th 0078025745 PDF Full Chapterdoxologyknee3uyj100% (17)

- Ma Assignment 2Document7 pagesMa Assignment 2Osama YaqoobNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Measuring and Marking Metals for Home Machinists: Accurate Techniques for the Small ShopFrom EverandMeasuring and Marking Metals for Home Machinists: Accurate Techniques for the Small ShopNo ratings yet

- Real Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)From EverandReal Estate License Exam Calculation Workbook: Volume 2 (2023 Edition)No ratings yet

- Accounting For Management QuestAnsDocument47 pagesAccounting For Management QuestAnspappu_5889% (9)

- Practicum Report on Practical Training at Tenaga Nasional BerhadDocument50 pagesPracticum Report on Practical Training at Tenaga Nasional BerhadDanial AzmiNo ratings yet

- 5 - Profitability AnalysisDocument42 pages5 - Profitability AnalysisGioacchinoNo ratings yet

- Financial Accounting Theory Test BankDocument14 pagesFinancial Accounting Theory Test BankAnas K. B. AbuiweimerNo ratings yet

- Final Accounts Past Paper Questions Model AnswersDocument2 pagesFinal Accounts Past Paper Questions Model Answersberenika netíkováNo ratings yet

- Chapter 7 Basic Acctg (Merchandising)Document59 pagesChapter 7 Basic Acctg (Merchandising)Jamez Zen BronzNo ratings yet

- Chapter 2 Problems Working PapersDocument28 pagesChapter 2 Problems Working PapersZachLoving0% (1)

- DocxDocument28 pagesDocxSunil KumarNo ratings yet

- Financial Statement Analysis of British American Tobacco BangladeshDocument30 pagesFinancial Statement Analysis of British American Tobacco BangladeshFahim YusufNo ratings yet

- CaseStudy RevlonDocument24 pagesCaseStudy RevlonVũ Trang100% (1)

- The Figures in The Margin On The Right Side Indicate Full MarksDocument8 pagesThe Figures in The Margin On The Right Side Indicate Full MarksManas Kumar SahooNo ratings yet

- Guidelines For Obtaining License For Providing Direct-To-Home (DTH) Broadcasting Service in India (As Amended Upto 6.11.2007)Document28 pagesGuidelines For Obtaining License For Providing Direct-To-Home (DTH) Broadcasting Service in India (As Amended Upto 6.11.2007)Karthik VaratharajanNo ratings yet

- Financial Statements OverviewDocument36 pagesFinancial Statements OverviewIrvin OngyacoNo ratings yet

- ACFrOgCQb6wa8qC80YIgWx nX6TZBAv20t36Y6v4IINI tRrVqMKoatALM-RVzRoSlFJ3q DBWgUS7WKpaLaGx4C85SucFsMtbhmcAs-y6GE5Sgvzh4F49OEvpet2gphKgF6qFglhWYwVwKMmoJDocument3 pagesACFrOgCQb6wa8qC80YIgWx nX6TZBAv20t36Y6v4IINI tRrVqMKoatALM-RVzRoSlFJ3q DBWgUS7WKpaLaGx4C85SucFsMtbhmcAs-y6GE5Sgvzh4F49OEvpet2gphKgF6qFglhWYwVwKMmoJDarlene Bacatan AmancioNo ratings yet

- Examples For Review (Income Statement)Document9 pagesExamples For Review (Income Statement)Michelle S. AlejandrinoNo ratings yet

- Topic 10 - Cash FlowDocument53 pagesTopic 10 - Cash FlowChan WaiyinNo ratings yet

- Taxation of Cooperatives PDFDocument110 pagesTaxation of Cooperatives PDFJaquelyn RaccaNo ratings yet

- Consequential Loss, FireDocument51 pagesConsequential Loss, FirehhvkvujbkhihNo ratings yet

- VAT Problems SolvedDocument3 pagesVAT Problems Solvedtisha10rahman50% (4)

- Project feasibility analysisDocument13 pagesProject feasibility analysisRei Villanueva100% (2)

- Account Unit3 MbaDocument27 pagesAccount Unit3 MbaAnantha KrishnaNo ratings yet

- Fam PPT 2Document40 pagesFam PPT 2Varun RaiNo ratings yet

- f2 Financial Accounting April 2016Document20 pagesf2 Financial Accounting April 2016Edson Jorge MandlateNo ratings yet

- Fabm2 Module 3Document18 pagesFabm2 Module 3Rea Mariz Jordan50% (2)

- Laaaaaafarge 1st Quarter Report 2021Document24 pagesLaaaaaafarge 1st Quarter Report 2021Ahm FerdousNo ratings yet

- 2001 Annual ReportDocument100 pages2001 Annual Reportxaveone100% (1)

- Chap 6 ExercisesDocument15 pagesChap 6 ExercisesQuokka KyuNo ratings yet

- River Valley Regional YMCA - 2016 Annual Impact ReportDocument9 pagesRiver Valley Regional YMCA - 2016 Annual Impact ReportDavid FagerstromNo ratings yet

- Adam Sugar LTD Financial AnalysisDocument20 pagesAdam Sugar LTD Financial AnalysiswamiqrasheedNo ratings yet

- MBA-Financial and Managerial Accounting Question BankDocument87 pagesMBA-Financial and Managerial Accounting Question BankElroy Barry100% (2)