Professional Documents

Culture Documents

Untitled

Uploaded by

api-228714775Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

api-228714775Copyright:

Available Formats

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Primary Credit Analysts: Gregoire Buet, New York (1) 212-438-4122; gregoire_buet@standardandpoors.com Anna Stegert, Frankfurt (49) 69-33-999-128; anna_stegert@standardandpoors.com Secondary Contact: Sarah E Wyeth, New York (1) 212-438-5658; sarah_wyeth@standardandpoors.com Research Contributors: Shweta Vora, Mumbai; shweta_vora@standardandpoors.com Sujit R Kumar, Mumbai; sujit_kumar@standardandpoors.com Vinayak Venkatraman, Mumbai; vvenkatraman@crisil.com

Table Of Contents

Regional Economic Trends Will Shape Performance This Year Again 2012 Ended On A Slow Note, But With Some Improvement In Sight Profitability Trends: Margins Remain Sound But Upside Appears Limited Prudent Financial Policies Are Key To Investment-Grade Ratings In 2013 For Speculative-Grade Issuers, Leverage Trends Are Steady, And After A Wave Of Refinancing, 2013 And 2014 Maturities Are Manageable Our Outlook For Select Key Capital Goods Segments

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 1

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Global capital goods companies face another year of uneven conditions in 2013, but credit quality should remain relatively stable. Varying regional economic outlooks and end-market conditions continue to translate into diverging prospects for individual issuers. Overall, we expect stable operating trends, but with some downside risk. The capital goods sector is fairly diverse with providers selling a large variety of industrial equipment, products, and services, including those used for agriculture, construction, transportation, energy production and power generation, building and plant infrastructure, or general manufacturing. Among these, pockets of weakness and areas of strengths will continue to make for a mixed environment, and financial policy decisions that either support credit quality (voluntary pension funding, use of equity financing for acquisitions) or weaken it (debt-funded share buybacks or dividend recapitalizations) will continue to be a key influencer of rating performance. Overview We expect creditworthiness in the global capital goods sector to be generally stable in 2013, although European issuers continue to face more downside risks than U.S. issuers. We rest this expectation on our base case scenario for protracted weak industrial activity in Europe, an improving if not yet robust outlook for the U.S. economy, and volatile but more positive growth prospects in key emerging markets like China. End-market conditions are mixed, but on balance we see a steady operating outlook, and issuers should keep operating with credit measures that are commensurate for their ratings. Financial policies will remain key factors of rating performance. Acquisitions and shareholder returns will likely remain consistent with the capacity afforded by current credit ratios, but aggressive initiatives could lead to some downgrades.

For the third consecutive year, upgrades outnumbered downgrades in U.S. capital goods ratings in 2012, although the trend faded in the later part of the year. In Europe, conversely there were more downgrades than upgrades, all among speculative-grade issuers. As of early 2013, the majority of ratings globally carry a stable outlook. The outlooks are supported by many companies showing good headroom against credits metrics commensurate with the ratings, and by still-high cash reserves, despite the weakening trend in operating and financial performances often observed through 2012. About 84% of U.S. capital goods companies carry a stable outlook, whereas the proportion of stable outlooks in Europe is significantly lower at about 69%. Negative outlooks represent 17% in Europe and 11% in the U.S., while positive outlooks account for 14% and 5% in Europe and the U.S., respectively.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 2

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 1

In the U.S., we see the recent political compromise to avoid the so-called fiscal-cliff as paving a first step toward a more solid economic recovery. This suggests that capital goods issuers might, despite ongoing uncertainties around a final budget resolution, face another year of moderate growth. On the other hand, our forecasts for Europe remain bleak with flat GDP growth for 2013, which is likely translate into moderate declines for equipment demand within the Eurozone. Demand from emerging markets, where capital good issuers are increasingly present, will continue to fuel growth. For China, following a relatively volatile 2012, we see increasing signs for a more robust growth track in 2013. Latin America should also see growth rising slightly from 2012 levels. For investment-grade issuers (those with 'BBB-' or higher ratings) we generally see some flexibility also for a less supportive economic climate given relatively strong credit metrics and cash reserves in excess of maintenance needs. Therefore, we see a move to more aggressive financial policies as one of the key risks to credit quality as opposed to performance-related downside risks. For speculative-grade issuers (those with 'BB+' or lower ratings), leverage metrics are broadly steady, and most of the issuers have adequate liquidity because refinancing needs for 2013 and 2014 have mostly been addressed. Still, covenants headroom remains a risk for some, and debt-funded dividend payouts are on the rise.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 3

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Regional Economic Trends Will Shape Performance This Year Again

Demand for capital goods is sensitive to changes in business confidence and closely correlates with economic swings. The major risks that clouded 2012 remain prevalent for 2013: a protracted recession in Europe, the slowdown in China, sluggish growth in the U.S., and uncertainty about governments' abilities to resolve fiscal challenges. All continue to constrain business confidence levels and capital spending. A continued recession in Europe likely will hurt sales and profitability for issuers most exposed to that region. Globally, however, the moderate global economic expansion that we expect for 2013 and 2014 should underpin demand. This is supported by industrial activity in the U.S. remaining on a slow-growth trajectory and by activity in China showing some early signs of positive momentum. In addition, customers will need to invest in equipment that helps them maintain or increase their productivity--especially important when growth is subdued. And beyond short- and medium-term macroeconomic considerations, long-term underlying trends, such as the industrialization and urbanization of developing markets and the global movement toward energy-efficient products and processes, should help fuel demand for many capital goods issuers. Specifically, Standard & Poor's economists believe that: Following the compromise Congress reached on Jan. 1, 2013, to avoid the fiscal cliff, there is a significantly lower probability (0% to 15%) of another U.S. recession, and our GDP forecast is for 2.7% growth in 2013 and 3% in 2014. (see "Economic Research: U.S. Economic Forecast: Like A Box of Chocolates," published on Feb. 19, 2013). Europe will face difficult economic conditions in 2013. Our base case is for 0% GDP growth for the Eurozone, albeit with some discrepancy between Southern Europe and Germany and France (see "The Eurozone Enters An Uncertain 2013 As The New Recession Drags On," published on Dec. 13, 2012). For 2014, we expect to see slow growth of 1%. Nonetheless, we continue to see a likelihood of 33% for a more severe economic downturn that could result in a 1.6% GDP decline in 2013 followed by a recovery of 0.4% in 2014. Chinese GDP growth will reaccelerate, albeit only modestly, to about 8% in 2013, after a slowdown last year to about 7.8%, which was the lowest rate since 1999. In Latin America, we expect growth to rise to 3.5% in 2013 from 2.5% in 2012 (see "Economic Growth In Latin America Will Pick Up Slightly In 2013," published on Dec. 28, 2012).

Key industry indicators point toward a low-growth environment in 2013

Key business indicators for capital goods firms globally remain somewhat volatile month-over-month, but generally appear to be somewhat firmer than through most of the second half of 2012, suggesting some fragile improvement is taking place.

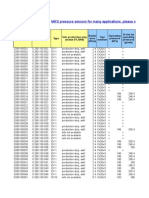

Table 1

Select Industry Indicators And Statistics

Dec-07 U.S. Manufacturing PMI Industrial Production (annual % change) Equipment Investment (annual % change) 49.0 2.1 33.3 (11.3) (2.6) 55.3 (2.9) (16.0) 57.3 6.7 8.9 52.9 3.6 11.0 50.2 2.2 6.9 3.3 7.2 3.4 8.5 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 2013fc 2014fc

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 4

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Table 1

Select Industry Indicators And Statistics (cont.)

Total Industry Capacity Utilization (%) Nonresidential Construction (annual % change) Architectural Billing Index Eurozone Manufacturing PMI Industrial Production (annual % change) Capacity Utilization (%) 52.6 2.2 85.2 43.9 (12.6) 81.6 51.6 (3.5) 70.7 57.1 8.8 78.1 46.9 (2.8) 79.7 46.1 (1.1) 76.8 1.6 2.3 81.3 52 71.9 10.3 35 70.8 (21.1) 45 76.8 (15.6) 53 77.8 2.7 51 78.8 9.6 52 4.5 10.3 -

Sources: Bloomberg; Institute for Supply Management; U.S Federal Reserve; Bureau Of Economic Analysis; EuroStat; Markit; China Federation of Logistics; Standard & Poor's. Gross fixed private investment--Equipment and software. Gross fixed private investment--Nonresidential structures. fc--Forecast.

In the U.S., recent manufacturing purchasing managers' index (PMI) figures and industrial production data indicate a moderate growth trend in demand for capital goods. Equipment spending (which includes both industrial equipment and software) grew at a healthy pace in 2012 and we expect decelerating rate in 2013. Total industry capacity utilization continues its slow recovery as well, but it remains slightly less than its long-term average of 80%. Real nonresidential construction activity is another key indicator for demand in the sector. We expect 4%-5% growth in private nonresidential construction spending in 2013, partially offset by likely decline in public spending. Europe: The relatively weak picture for European capital goods is in line with the Eurozone's macroeconomic outlook. The region's manufacturing was consistently below 50 throughout 2012, whereas it showed an improvement from its trough in summer 2012 to reach 47.4 by year-end. Industrial production growth similarly declined modestly throughout 2012, after it grew for two years. Altogether, this led to Eurozone capacity utilization statistics that remain around 77% at year-end 2012, below the long-term historical average. The picture within the region, however, is fairly uneven: Utilization rates in Germany and France are above or in line with the long-term average, but they remain very weak in Spain and Italy. We expect European construction markets to experience some moderate decline for the year: Budget austerity, especially in Southern Europe, will likely force governments to curtail infrastructure spending, and the weak economy will weigh on private-sector investments. Other regions: We expect growth for equipment in other key emerging markets to stay relatively consistent with our economic growth expectations. PMI index readings in China and Brazil have also been strengthening modestly in recent months.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 5

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 2

Geographic exposure will remain a key factor for operating performance

The mix of regional exposures is a key aspect for growth prospects of global capital goods issuers. We believe that performance continues to hinge to a large degree on their exposure to each of the world's main regions. Many U.S. rated issuers focus primarily on North America, while a few others derive more than one-third of revenues from the EMEA region. Overall, we estimate exposure to Europe averages about 20% of revenues. Asia and Latin America (combined still well below 20% on average) are becoming increasingly important. Overall, we think ratings on U.S. issuers can withstand our current baseline economic scenario for Europe, especially if industrial activity in the U.S. and emerging markets remain positive. For European capital goods issuers, in general, troubles in the region are likely to have a more significant effect on their performance. On average, the EMEA region accounts for about 45% to 50% of the revenues of the 17 Europe-based investment-grade issuers we rate. A tempering factor, European issuers' exposure to emerging markets, tends to be somewhat greater, on average than for the U.S.-based issuers we rate.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 6

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

2012 Ended On A Slow Note, But With Some Improvement In Sight

Based on about two-thirds of public filer rated issuers that have reported 2012 results, U.S. capital goods companies experienced mixed revenue growth in the fourth quarter of 2012, with about 55% of rated companies achieving organic expansion (excluding acquisitions and foreign exchange effects) and 45% recording flat or negative organic revenue performance. Median organic growth was less than 1%. Declines were especially prevalent at short-cycle companies (Kennametal, Parker Hannifin, Timken) where demand tracks closely to industrial activity, which started to weaken in the second half. Results were frequently affected by persisting inventory destocking in certain segments, resulting in lower production levels and fixed cost absorption, and by a general lack of business confidence, in part due to lingering fiscal and political uncertainty. Yet there was some positive tone with many issuers noting the beginning of an uptick in order trends in the later part of the quarter, consistent with recent industrial indictors, including in key areas like China. The sector's larger and most diversified issuers generally provided growth guidance in the low- to mid-single-digit range, which against the fourth-quarter backdrop and considering our regional economic growth forecasts, is relatively consistent with our expectations for 2013. Overall, the first half of 2013 is shaping up as being somewhat weak, with positive momentum increasing in the second half. Still, differences across various end markets will continue to shape the performance of individual issuers: Those more exposed to U.S. residential construction and commercial aerospace should have some favorable tailwinds. But those exposed to Europe, mining, trucks, or defense will face continued headwinds this year. Despite a moderation of order intake growth over recent quarters, European issuers' organic expansion for full-year 2012 ended on a relatively solid base. Among a number of European companies that have reported fourth-quarter results, only SKF AB, which is one that moves fairly early with the cycle, has reported an organic decline. The remaining group of the sample has reported positive, albeit low sales expansion. Full-year growth in 2012 was more solid, thanks to a more robust first half and solid order backlogs at the beginning of the year. But issuers with a larger position in emerging markets and in the U.S. could potentially balance Europe's well-known woes with stronger operations elsewhere. Overall, we expect these dynamics to translate into a broadly flat environment for 2013 with some downside risks, in particular for companies that are most exposed to Europe and to public spending.

Profitability Trends: Margins Remain Sound But Upside Appears Limited

In the U.S., we expect overall margin performance to flatten or weaken somewhat, and we see a potentially more significant moderation in Europe. Profitability of U.S. issuers remains above prior peak levels as volumes have generally bounced back to or above pre-financial-crisis levels, and margins have benefited from disciplined pricing as well as restructuring and productivity initiatives. On average, EBITDA margin continued to expand through the third quarter of 2012, but upside potential appears limited. While several issuers have achieved margins higher than the peak of the previous five years, others continue to lag their prior five-year average (e.g., Harsco, Xerium), because of either extended market weakness or

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 7

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

operational inefficiencies. Along with other considerations, this has occasionally been cause for downgrades or negative outlooks. In Europe, we have seen margins holding up fairly robustly, declining on average by 50 basis points (bps) in 2012, with most issuers showing a relatively stable trend. Average EBITDA margins remain close to the previous average peak in 2007, with most notable declines among construction companies and those supplying equipment to the industry (Strabag SE, Peri GmbH). SKF was one exception to the trend of relative stability in 2012 among investment-grade issuers with its adjusted EBITDA margin declining by close to 300 bps largely due to high fixed costs as production was significantly lower. Despite many companies' attempt to intensify restructuring initiatives to counterbalance the impact of underutilization, we anticipate a continued moderation of profitability measures. We anticipate that charges related to these programs will also negatively weigh on profitability metrics of European capital goods issuers.

Chart 3

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 8

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 4

Margin performance will continue to depend primarily on changes in production volumes and their positive or negative effect on operating leverage. The effect of other potentially significant factors will be mixed. Factors that will affect profitability include: Inventory management and the destocking cycle Cost management and restructuring actions: Capital goods companies continue to embrace lean manufacturing and continuous improvement through "operational business systems," although with various degrees of success. With a focus on making products available to the market faster, enhancing quality, and reducing footprint, this can help improve productivity and reduce operating and nonoperating expenses. In addition, as growth slowed in the second half of last year, a number of management teams initiated new restructuring plans. This should help protect margins this year. Price competition: We expect demand for many capital goods products to remain moderately price-sensitive because they are often highly engineered, "mission-critical" components for their customers. Quality and service capability are frequently more important competitive factors than price for products that go into aerospace, energy, and mining applications for which the cost of failure and technical tolerance are very high. Still, in segments such as construction equipment or power supply competition from local players in emerging markets is intensifying as the quality of their products gradually improves toward Western performance standards, and supply capacity can exceed demand, if only temporarily. In addition, commoditization of certain products remains a key component of

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 9

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

price competition. Integration of acquisitions. Serial acquirers in the sector (e.g., ITW, Ametek, and Roper) rely on a well-tested blueprint to integrate the many small to midsize companies they acquire every year (scale leveraging, low-cost sourcing, overhead structure simplification), providing scope for margin expansion after a few years. Yet, the integration of acquisitions or realization of planned synergies often leads to a shortfall in performance. And recent impairment announcements at Caterpillar or Emerson related to acquisitions underscore the various risks of these transactions, even at issuers whose management abilities we otherwise regard positively. Commodities and component input costs. Managing the volatility of materials costs will remain tough for the sector's issuers. Although higher commodity prices generally tend to boost demand for the many original equipment manufacturers (OEMs) and component makers that serve the energy, mining, and agricultural sectors, commodity cost swings can cut into profit margins if companies aren't able to quickly raise prices in response. Steel is often the most important commodity, but copper and a variety of other metals and resins are also common raw materials that capital goods companies use. Prices have generally declined in the past six months, so companies could continue to see some input cost benefit for a few more quarters. Currency volatility. We believe fluctuations in global currencies will also remain a concern for management teams. Global issuers, whether in the U.S. or Europe, tend to have a production base in local markets that provide a natural, if imperfect, hedge against currency swings. However, some manufacturers (AGCO, Xerium, or Blount for example) are more exposed than others to changes in currency rates because they export from various countries. Japanese players have started to benefit from the weakening of the yen against other major currencies. Supply chain risks. Supply chain disruptions remain another risk to profit margins, as natural disasters in Asia (the earthquake in Japan and flooding in Thailand in 2011) have shown. The near-term cost of having to replace a supply source can be significant. Although just-in-time manufacturing helps companies identify sources of the supply problems, disrupted supply for a product can mean lost revenue, higher materials costs (when all industry participants scramble to secure an alternative supply source, they drive up prices), and bulging inventory of unfinished products. And for highly engineered capital goods that need to meet specific quality and tolerance criteria, even if an alternative supply source for a component is readily available, the process of ensuring that the new supplier meets stringent quality standards can take several months.

Prudent Financial Policies Are Key To Investment-Grade Ratings In 2013

Cash reserves and pension liabilities continue to represent significant balance sheet amounts

Cash positions for investment-grade issuers remain well in excess of operating needs, providing some buffer against the ongoing economic uncertainty. Cash reserves as a percentage of funded debt remain sizable and higher than pre-crisis levels but have been gradually declining as companies use cash to fund various initiatives, including mergers and acquisitions (M&A) and shareholder-friendly activities. We expect further gradual declines, but U.S. issuers hold a significant portion of these cash reserves abroad, and tax effects are an important consideration in repatriating cash, or not. In Europe, the relation of cash to funded debt stayed virtually unchanged and above U.S. levels, with cash balance at about 57% of funded debt reflecting a more prudent approach toward liquidity management following the last downturn. This also suggests that companies have more funds available to pull off acquisitions and hike shareholder remuneration levels.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 10

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 5

On the liability side, the magnitude of underfunded pension and postretirement obligations in the sector remains a credit negative. Issuers continue to take actions to address these liabilities, implementing de-risking strategies and using cash to fund pension plans (Pentair, Joy Global, Honeywell). Yet, while asset returns were also generally good last year, often exceeding expected returns assumptions, funded status haven't improved much because of the offsetting effect of lower discount rates. This continues to hurt adjusted credit ratios. We expect companies will continue to use cash to make voluntary contributions in 2013, but the magnitude will likely depend on interest rate trends. In Europe, we similarly expect postretirement obligations to increase because fewer companies have undertaken efforts to make contributions to their plan assets.

Large acquisitions and share buybacks remain key drivers of rating changes

Following the trend that started in 2011, 2012 was another active year for cash deployment featuring a number of transformational M&A transactions (mostly involving U.S. issuers), multiple midsize deals, and a variety of share buyback announcements. We expect continued active acquisition and buyback spending in 2013, although some of the large acquirers of 2012 will likely focus on integration this year. Further consolidation in sectors such as mining equipment, electrical products and distribution, or industrial pumps is possible, however. Issuers will likely generally continue to balance acquisitions and share repurchases in a manner that is consistent with

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 11

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

their cash flow generation and the capacity afforded by their credit ratios. With historically low borrowing costs, debt financing has been a preferred source for acquisition funding, although several large deals have included an equity component, limiting credit quality deterioration. Share repurchases, while credit-negative, appear to remain calibrated to excess cash generation, rather than being debt-funded, releveraging events. Most announcements, therefore, will likely not result in rating changes, but discipline in using funds for such initiatives is often a key rating consideration, especially when the economic outlook remains fragile. Among announcements over the past few months that resulted in rating changes or outlook revision were: Siemens' (A+/Stable/A-1+) execution of a $3 billion stock repurchase, which amid an expected weakening in operating trends, led us to revise the outlook to stable from positive; Eaton Corp.'s (A-/Negative/A-2) $12 billion acquisition of Cooper PLC, funded with a combination of equity and debt, which led to a revision of the outlook to negative from stable. Ingersoll Rand's (BBB+/Watch Neg/A-2) asset spin off and $2 billion buyback announcement, causing us to place the ratings on CreditWatch Negative; and Pentair's (BBB/Stable/A-2) $5 billion largely stock-based acquisition of Tyco Flow Control, which led to a one-notch rating upgrade. We expect the large acquirers of 2012 (United Technologies, ABB, Eaton, Ropers, Crane) to focus on integrating past acquisitions. Conversely, others have restored good capacity for larger deals and will likely be active in M&A (Danaher). If growth is slower than expected, strategic acquirers will look to bolster growth. On the other side, divestitures remain another lever for portfolio management and are often a source of funding for other growth opportunities, for compensating shareholders, or reducing debt (GE, Siemens, SPX). Over the past two years, former conglomerates like ITT Corp. and Tyco International Ltd. have spun off divisions to enhance shareholder value. In Europe, acquisitions were less pronounced over recent years with many companies focusing on making a number of bolt-on purchases as opposed to engaging into larger deals. ABB remained among the most active consolidators in 2012. It closed the $3.9 acquisition of Thomas & Bett's in May 2012, following a transaction of a similar size in 2011. The rating remained unchanged given the significant headroom the company's financial metrics had at that time compared to levels commensurate with the rating. Headroom to digest further medium to large deals in the short term has clearly dropped, however.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 12

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 6

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 13

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 7

For Speculative-Grade Issuers, Leverage Trends Are Steady, And After A Wave Of Refinancing, 2013 And 2014 Maturities Are Manageable

About 65% of our issuer ratings in the U.S. sector are speculative-grade, and the majority of those are ratings of 'B+' or lower. Generally, credit quality continued to improve for these issuers in 2012, marked by a combination of improved operating performance and adequate credit measures. At the end of the third quarter of 2012, leverage for speculative-grade companies had stabilized with the average of 4.8x, and the median at roughly 4x. These measures are comparable with the pre-recession levels of 2007. Most issuers have adequate liquidity largely due to the many refinancings that have taken place in recent quarters, and this has helped push back debt maturities largely beyond 2015. Most bank debt agreements require compliance with certain leverage or coverage ratios and many companies reduced debt last year to comply with gradually tightening covenants. In the U.S., 79% of our speculative-grade ratings on capital goods companies carry stable outlooks, reflecting our view of steady credit quality. A number continue to maintain good cushion in their credit measures, which should allow

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 14

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

them to maintain their credit quality in case of unforeseen decline in profits and cash flow, or if they temporarily incur somewhat higher debt. Others that are more or less meeting our respective rating expectations will have less room for underperformance, but their downside risk depends largely on the end markets they serve. We could upgrade four issuers (Oshkosh, Wesco, Sunstate, Mueller) if they can continue to improve or maintain their credit measures over the coming quarters. Meanwhile, eight issuers (all in the 'B' category) face some risk of downgrade. The reasons are varied but include elevated leverage either due to weak operating and financial performance (Tempel Steel, Xerium) or to liquidity challenges in the form of tight covenants and weak cash generation (Sensus, Maxim Crane). Another risk to ratings of many private equity owned speculative-grade issuers is debt-funded dividend payout to sponsors which is often a downside rating trigger. In Europe, only about half of the issuers we rate are speculative-grade. We have stable outlooks on about two-thirds of our speculative-grade issuer ratings. About another 25% carry a negative outlook, reflecting the uncertain economic outlook in their domestic European market (e.g., Dometic, Financiere SPIE), while others also face structural industry challenges (Heidelberger Druck). We expect that economic woes will limit those companies' ability to deleverage sufficiently and could also lead to violations of their financial covenants, particularly for Dometic. The companies that we rate with a positive outlook typically have significant headroom in their credit measures against levels we feel are commensurate with current ratings. For one issuer, KUKA, this could translate into an upgrade if the company maintains its strong financial performance over the coming year.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 15

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Chart 8

Our Outlook For Select Key Capital Goods Segments

Agricultural, construction, and mining equipment

Agriculture. Global trends for agricultural equipment demand in 2013 should remain positive overall, supported by still high crop prices after last year's North American drought. U.S. farmers' incomes are at record levels and balance sheets remain healthy. In other key growth markets such as Brazil, activity has remained solid, and this should continue unless changes in commodity prices or financing programs dampen demand. Tempering this is evidence of some weakness in European demand that could be protracted. In light of this backdrop we expect the three large rated OEMs--Deere, CNH Global, and AGCO--to post mid-single-digit positive revenue growth this year. Construction. Demand for construction equipment (Caterpillar, Komatsu, Terex, Manitowoc) remains tied to the health of building and infrastructure markets globally. On the positive side, the recovery in residential and nonresidential construction in the U.S. should continue strengthen from its still very low levels, benefiting demand for construction equipment, although we expect the upcycle to be bumpy. In addition, U.S. construction equipment rental companies, which are significant customers for the OEMs, should continue to place equipment orders because builders increasingly rent equipment, rather than purchase it. The picture is mixed elsewhere, and we expect the world's largest market--China--to only slowly recover from a weak year and a half that has exposed over-inventory and overcapacity in certain segments of construction equipment there. Other emerging economies should, on balance, provide a source of increasing demand for equipment, although sales can be bumpy. European activity remains subdued and we expect

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 16

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

that economy to slow along at about flat GDP this year. Mining. The outlook for mining equipment (Caterpillar, Komatsu, Joy Global, Sandvik, Atlas Copco, Metso) is comparatively somewhat weaker, and order trends in the second half of 2012 suggest mining equipment revenues at the largest OEMs (Caterpillar, Joy Global, Metso, Atlas Copco, Sandvik) will likely decline this year. Capital spending for large greenfield projects has generally been reduced globally, creating some headwinds, and for equipment providers serving the U.S. coal mining market, production declines are causing structurally lower demand. Still, mining companies continue to invest in production capacity to meet current and long-term demand and improve their mines' productivity. Although prices for key metals and minerals such as coal, copper, and iron ore fluctuate widely, they generally remain above levels that continue to spur capital investment.

Transportation equipment

Auto. Capital goods companies typically have only moderate exposure to the automotive sector, except for a few names (SKF and Sandvik) that derive more than 10% to 15% of sales from that segment. We expect U.S. auto sales to grow by some 6% in 2013 (see "U.S. Auto Sales Poised To Continue Recovery In 2013; 2012 Sales In Line With Standard & Poor's Expectations," published Jan. 4, 2013) after a strong increase for 2012 of about 13%. Our base case predicts another slow year for the Western European car market following the expected 8% decline in 2012. More specifically, we think growth, if any, in 2013 will be at best anemic and that a low single-digit sales decline this year is plausible (see "Top 10 Investor Questions For 2013: Global Autos and Trucks," published Dec. 5, 2012). Growth in the key emerging market of China is expected to continue, although at a flatter pace. A more severe recession in Europe or a return to recession in the U.S., on the other hand, would lead to more pronounced revenue declines for automakers and, in turn, would pressure margins and cash flow generation, in our view. This likely would hurt demand for capital goods issuers that are auto industry suppliers, in particular those that produce components rather than capital equipment. Trucks. The outlook for the global heavy-truck market is relatively hazy owing to uncertainty over the world economy. However, even if another recession hits, we don't anticipate as severe a slump in demand for trucks as during the global recession of 2008-2009, which decimated the market and wiped out huge chunks of business for Cummins and Eaton. But unlike then, the market is not currently overheated, order inventories are manageable, and the number of truck owners replacing older, worn-out vehicles will cushion a slowdown (see "Top 10 Investor Questions For 2013: Global Autos And Trucks," Dec. 5, 2012). Rail equipment. In 2012, rail orders for European players such as Siemens AG and Alstom S.A. (which primarily operate in the passenger railcar market) have shown robust growth that should bolster 2013 performances. Despite the good industry fundamentals, we consider the current economic uncertainties to be a major risk because order delays or cancellations could squeeze margins and cash generation. In the U.S., where rated issuers have often more exposure to freightcar than to passenger-railcar demand (except for locomotives at GE and Caterpillar), industry conditions remain sound overall, reflecting continued high demand for tank cars to support the transportation of shale oil. High product prices should help manufacturing profits, offsetting mixed demand for other railcar types and weak conditions for coal-carrying freightcars. While we are cautious about long-term strength of tank-car demand amid growing supply capacity, manufacturers are also investing in their lease fleets, which should improve business stability. Aerospace. Several diversified capital goods issuers (GE, UTX, Honeywell, Parker-Hannifin, Eaton, Timken) have significant exposure to commercial aerospace both through new aircraft and aftermarket parts and services. The commercial aerospace sector is in the midst of what we expect will be a prolonged period of increasing deliveries that could translate into consistent mid- to high-single digit revenue growth at many suppliers. This is supported by large order backlogs, the ramp-up of key platforms, and a pipeline of new model introductions for the current decade. Still, high fuel prices, specific platform development delays, and the possibility of reduced availability of aircraft financing remain inherent risks. In addition, demand for aftermarket parts and services should recover from somewhat weak

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 17

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

levels experienced in 2012 when airlines managed inventories very tightly, offsetting positive passenger traffic trends. On the negative side, these companies are also often suppliers to defense contractors, which are facing weaker demand because of military budget cuts leading to program reductions and cancellations.

Electrical, Process, and Flow Control equipment

Building and utilities. A recovery in U.S. construction markets appears to be on firmer ground, although we expect nonresidential construction spending will increase only 4%-5% this year, lagging the housing recovery. While suppliers of building equipment (HVAC, security, lighting) should benefit, fiscal uncertainties in the U.S. and the risk of an extended recession in Europe could still hamper investment. Emerging markets offer better opportunities, and the industry maintains its long-term growth potential, in our opinion. We expect the underlying long-term trends of energy efficiency and environmental consciousness will continue to benefit suppliers of related products and services, such as Eaton, Hubbell, Schneider Electric S.A., and Koninklijke Philips Electronics N.V. Power. Some signs indicate that the margin pressure, especially within high-voltage equipment, is easing somewhat compared with recent years. In the past year, margin deterioration has stemmed mainly from heavy pricing pressure and overcapacity in parts of the industry, such as power transformers. ABB has now reported four consecutive quarters of stable underlying margins for its Power Products division, and Alstom presented stable half-year figures for its Grid division. Siemens AG's negative result in power transmission came on the back of one-off charges, although it still faces challenges ahead from offshore wind projects. Although we expect this sector to remain heavily competitive, the combination of capacity reductions and the antidumping ruling in the U.S. seem to have stabilized prices at manageable levels. In the project-related parts of the sector, companies still have low-margin orders to work through before margins can improve again. In the more stable mid- and low-voltage sector, market leader Schneider continues to report stable operating margins, although with a slowdown in line with the economy, especially in Europe because this business tends to be more short cycle. The longer-term outlook remains solid on the back of continued investment needs from growing energy demand in emerging markets and replacement and interconnection needs in the mature markets. We expect ongoing economic obstacles for this sector, with more difficult funding conditions likely to hamper some buyers and with wind and solar companies still likely to consolidate through M&A. In addition to this, we expect fading U.S. subsidies for wind energy to lead to significant declines in demand for wind power generators. Process and flow control products. Process and flow control products (valves, pumps, hydraulic systems) are typically mid- to late-cycle businesses, with investment correlating to end-market conditions. We expect healthy backlogs at the end of 2012 to translate into continued stable demand in 2013 in the oil and gas, mining, and food and beverage sectors, despite some recent project delays. In infrastructure, weakness in Europe is likely to keep weighing on demand. Power markets have been slack, especially in North America and Europe, but industry players (such as Pentair Inc., Flowserve Corp., and SPX Corp.) point to an uptick in bidding activity as an indicator that 2013 will be a turning point. In water markets, we expect growth in emerging economies and maintenance spending to offset project delays in the U.S. and Europe. Industrial automation makers. Industrial automation makers (including key players Emerson Electric, Rockwell Automation, and Honeywell in the U.S. and Schneider Electric, Siemens, ABB Ltd., and Invensys PLC in Europe) ended 2012 with softness in Europe and Asia due to lower OEM demand and project delays, but they reported increasing orders, which indicates a modest pickup in 2013. Demand correlates closely with economic and industrial activity, and although indicators such as the ISM's manufacturing index in the U.S., are showing positive trends, uncertainty is likely to temper growth in developed markets. Those in motion-control markets (Parker-Hannifin Corp., Danaher, Rexnord) are likely to experience a similar operating environment. Aftermarket servicing of the installed base and customers' pursuit of more efficient production techniques should provide some offset to subdued investment in new capacity, with increasing demand likely to come from emerging markets.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 18

1080948 | 301859358

Global Capital Goods In 2013: Stable Credit Quality In Uneven Conditions

Health care equipment

Health care equipment has historically been one of the less-cyclical, higher-margin segments of the capital goods industry, with strong growth patterns. Positive long-term trends both in mature countries and new economies benefit the largest and most diversified industrial issuers with exposure to the sector (General Electric Co., Siemens, Philips, and Danaher) and some of their smaller suppliers. The U.S. market is important for these companies, although general budgetary constraints and medical device taxes could offset the benefit of the increased medical coverage mandated by the Affordable Care Act. Health care spending will also likely remain subdued in European countries implementing austerity measures to restore state budgets. Meanwhile, emerging market demand is growing solidly, but competition from emerging market players has intensified, and pricing pressures will likely remain intense. Companies such as Siemens and Philips have experienced on average good growth rates during 2012, but that momentum may slow down over 2013. We consider, however, that the earnings profile of the health care business will likely remain high when compared with other business lines of large capital goods makers. Naturally, this will also depend on restructuring measures companies are taking in a timely fashion to align production footprints in emerging markets. And efforts to lower costs have to continue over time. We believe the success of individual companies will also have close links to product portfolio management and renewal in this generally high R&D-intensive segment. Despite all the economic hurdles globally for the world's capital goods makers, we expect their credit quality to be generally stable, with outliers in both directions, of course, depending on company- or market-specific conditions.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 19

1080948 | 301859358

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 20, 2013 20

1080948 | 301859358

You might also like

- A Strong Shekel and A Weak Construction Sector Are Holding Back Israel's EconomyDocument10 pagesA Strong Shekel and A Weak Construction Sector Are Holding Back Israel's Economyapi-228714775No ratings yet

- Outlook On Slovenia Revised To Negative On Policy Uncertainty Ratings Affirmed at 'A-/A-2'Document9 pagesOutlook On Slovenia Revised To Negative On Policy Uncertainty Ratings Affirmed at 'A-/A-2'api-228714775No ratings yet

- Euro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit RateDocument7 pagesEuro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit Rateapi-231665846No ratings yet

- Investing in Infrastructure: Are Insurers Ready To Fill The Funding Gap?Document16 pagesInvesting in Infrastructure: Are Insurers Ready To Fill The Funding Gap?api-228714775No ratings yet

- UntitledDocument13 pagesUntitledapi-228714775No ratings yet

- Standard & Poor's Perspective On Gazprom's Gas Contract With CNPC and Its Implications For Russia and ChinaDocument8 pagesStandard & Poor's Perspective On Gazprom's Gas Contract With CNPC and Its Implications For Russia and Chinaapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- Islamic Finance Slowly Unfolds in Kazakhstan: Credit FAQDocument6 pagesIslamic Finance Slowly Unfolds in Kazakhstan: Credit FAQapi-228714775No ratings yet

- UntitledDocument9 pagesUntitledapi-228714775No ratings yet

- UntitledDocument21 pagesUntitledapi-228714775No ratings yet

- Ireland Upgraded To 'A-' On Improved Domestic Prospects Outlook PositiveDocument9 pagesIreland Upgraded To 'A-' On Improved Domestic Prospects Outlook Positiveapi-228714775No ratings yet

- UntitledDocument9 pagesUntitledapi-228714775No ratings yet

- Spanish RMBS Index Report Q1 2014: Collateral Performance Continues To Deteriorate Despite Signs of Economic RecoveryDocument41 pagesSpanish RMBS Index Report Q1 2014: Collateral Performance Continues To Deteriorate Despite Signs of Economic Recoveryapi-228714775No ratings yet

- UntitledDocument25 pagesUntitledapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- Private BanksDocument11 pagesPrivate BanksCecabankNo ratings yet

- UntitledDocument14 pagesUntitledapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- UntitledDocument8 pagesUntitledapi-228714775No ratings yet

- What's Holding Back European Securitization Issuance?: Structured FinanceDocument9 pagesWhat's Holding Back European Securitization Issuance?: Structured Financeapi-228714775No ratings yet

- Latvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook StableDocument8 pagesLatvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook Stableapi-228714775No ratings yet

- Romania Upgraded To 'BBB-/A-3' On Pace of External Adjustments Outlook StableDocument7 pagesRomania Upgraded To 'BBB-/A-3' On Pace of External Adjustments Outlook Stableapi-228714775No ratings yet

- UntitledDocument14 pagesUntitledapi-228714775No ratings yet

- UntitledDocument11 pagesUntitledapi-228714775No ratings yet

- UntitledDocument53 pagesUntitledapi-228714775No ratings yet

- UntitledDocument9 pagesUntitledapi-228714775No ratings yet

- UntitledDocument14 pagesUntitledapi-228714775No ratings yet

- UntitledDocument8 pagesUntitledapi-228714775No ratings yet

- Outlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings AffirmedDocument9 pagesOutlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings Affirmedapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Electrical Components 2Document9 pagesElectrical Components 2Mark Emerson BernabeNo ratings yet

- 3.electromagnetic Theory NET-JRF VKSDocument31 pages3.electromagnetic Theory NET-JRF VKSSijil SalimNo ratings yet

- MODULE I - 10 Marks Basic Laboratory TechniquesDocument18 pagesMODULE I - 10 Marks Basic Laboratory TechniquesArun KumarNo ratings yet

- IEC Fuses 5x20 Low Breaking Capacity 5ST Time Lag: DimensionsDocument2 pagesIEC Fuses 5x20 Low Breaking Capacity 5ST Time Lag: DimensionsrNo ratings yet

- Notes on Heat Transfer Methods and EquationsDocument6 pagesNotes on Heat Transfer Methods and Equationsjme733k9100% (1)

- Performance Evaluation of An Oil Fired Boiler A Case Study in Dairy Industry.Document8 pagesPerformance Evaluation of An Oil Fired Boiler A Case Study in Dairy Industry.atul100% (8)

- Learn petroleum technology with IPIMSDocument4 pagesLearn petroleum technology with IPIMSphantom_archerNo ratings yet

- Analisis de Crudo B61Document1 pageAnalisis de Crudo B61Xavier DiazNo ratings yet

- Quat KrugerDocument52 pagesQuat Krugerruby0808No ratings yet

- OMEGA Air Circuit Breaker DetailsDocument137 pagesOMEGA Air Circuit Breaker DetailsSIVA NAGA SUDHEER SIDDANINo ratings yet

- Bridge Rectifier - Definition, Construction and WorkingDocument14 pagesBridge Rectifier - Definition, Construction and WorkingRamKumarNo ratings yet

- Bosch Injector Data SheetDocument124 pagesBosch Injector Data SheetThibaut Lrt56% (9)

- The Concept of Ev S Intelligent Integrated Station and Its Energy FlowDocument29 pagesThe Concept of Ev S Intelligent Integrated Station and Its Energy FlowHorváth PéterNo ratings yet

- Kumera Helical and Bevel Gear Units PDFDocument136 pagesKumera Helical and Bevel Gear Units PDFanto starlinNo ratings yet

- Came 1998Document18 pagesCame 1998pradeepsmart1988100% (1)

- wph11 01 Que 20230111Document28 pageswph11 01 Que 20230111Sanjeev NNo ratings yet

- EV Technology QPDocument3 pagesEV Technology QPvcetnaac c6No ratings yet

- Unit GC2 Element 6 - InternationalDocument14 pagesUnit GC2 Element 6 - InternationalSatya NaiduNo ratings yet

- Effect of Temperature and Pressure On The DensityDocument7 pagesEffect of Temperature and Pressure On The DensityDrSaurabh TewariNo ratings yet

- Final Examination in Thermodynamics IDocument3 pagesFinal Examination in Thermodynamics IChristopher AlcarazNo ratings yet

- Fly Ash Soil Blocks PDFDocument42 pagesFly Ash Soil Blocks PDFTahir KhalidNo ratings yet

- Sebp4195 76 01 Allcd - 003 PDFDocument965 pagesSebp4195 76 01 Allcd - 003 PDFFacturas hidrodieselNo ratings yet

- User Manual: T6DBG721N T6DBG720NDocument26 pagesUser Manual: T6DBG721N T6DBG720NViorica TrohinNo ratings yet

- Rod BaffelsDocument2 pagesRod BaffelsVenkatesh SivarchanaNo ratings yet

- An Assessment of Singapore Airlines Environmentally Sustainable Energy ManagementDocument15 pagesAn Assessment of Singapore Airlines Environmentally Sustainable Energy ManagementMamta AgarwalNo ratings yet

- Convair Traveler Vol. X 1958-59Document180 pagesConvair Traveler Vol. X 1958-59TateNo ratings yet

- Alfa Laval Koltek MH Valve enDocument8 pagesAlfa Laval Koltek MH Valve enjpsingh75No ratings yet

- The Petroleum (Refining Conversion Transmission and Midstream Storage) Act 2013Document80 pagesThe Petroleum (Refining Conversion Transmission and Midstream Storage) Act 2013African Centre for Media ExcellenceNo ratings yet

- Exercise-01 Check Your Grasp: O CH HO HODocument7 pagesExercise-01 Check Your Grasp: O CH HO HOChesta MalhotraNo ratings yet

- Parandoush 2017Document18 pagesParandoush 2017diego9723No ratings yet