Professional Documents

Culture Documents

Solution Homework 9

Uploaded by

calun12Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Homework 9

Uploaded by

calun12Copyright:

Available Formats

Homework Assignment 9 Chapter 14

14. Speculating with Stock Options. The stock price of Garner stock is $40. There is a call option on Garner stock that is at the money, with a premium of $2.00. There is a put option on Garner stock that is at the money, with a premium of $1.80. Why would investors consider writing this call option and this put option? Why would some investors consider buying this call option and this put option? ANSWER: If the investors expected that the stock price would remain somewhat stable, they could benefit from selling both options. They would receive more from premiums than their cost of fulfilling their obligations if the stock price remains close to its prevailing value. Some other investors may expect that the stock price will be very volatile, although they do not know which direction the price will move. Therefore, they expect that they will exercise only one of their options, but a large price movement could earn a large gain that would more than offset the premiums they paid for both options.

Problems

1. Writing Call Options. A call option on Illinois stock specifies an exercise price of $38. Todays price of the stock is $40. The premium on the call option is $5. Assume the option will not be exercised until maturity, if at all. Complete the following table: Assumed Stock Price at the Time the Call Option Is About to Expire $37 $39 $41 $43 $45 $48 ANSWER: Assumed Stock Price at the Time the Call Option Is About to Expire $37 $39 $41 $43 $45 $48 Net Profit or Loss per Share to Be Earned by the Writer (Seller) of the Call Option $5 $4 $2 $0 $2 $5 Net Profit or Loss per Share to Be Earned by the Writer (Seller) of the Call Option

2. Purchasing Call Options. A call option on Michigan stock specifies an exercise price of $55. Today the stocks price is $54 per share. The premium on the call option is $3. Assume the option will not be exercised until maturity, if at all. Complete the following table for a speculator who purchases the

calloption: Assumed Stock Price at the Time the Call Option Is About to Expire $50 $52 $54 $56 $58 $60 $62 ANSWER: Assumed Stock Price at the Time the Call Option Is About to Expire $50 $52 $54 $56 $58 $60 $62 Net Profit or Loss per Share to Be Earned by the Speculator $3 $3 $3 $2 $0 $2 $4 Net Profit or Loss per Share to Be Earned by the Speculator

3. Purchasing Put Options. A put option on Iowa stock specifies an exercise price of $71. Today the stocks price is $68. The premium on the put option is $8. Assume the option will not be exercised until maturity, if at all. Complete the following table for a speculator who purchases the put option (and currently does not own the stock): Assumed Stock Price at the Time the Put Option Is About to Expire $60 $64 $68 $70 $72 $74 $76 Net Profit or Loss per Share to Be Earned by the Speculator

ANSWER: Assumed Stock Price at the Time the Put Option Is About to Expire $60 $64 $68 $70 $72 $74 Net Profit or Loss per Share to Be Earned by the Speculator $3 $1 $5 $7 $8 $8

$76

$8

4. Writing Put Options. A put option on Indiana stock specifies an exercise price of $23. Today the stocks price is $24. The premium on the put option is $3. Assume the option will not be exercised until maturity, if at all. Complete the following table: Assumed Stock Price at the Time the Put Option Is About to Expire $20 $21 $22 $23 $24 $25 $26 ANSWER: Assumed Stock Price at the Time the Put Option Is About to Expire $20 $21 $22 $23 $24 $25 $26 Net Profit or Loss per Share to Be Earned by the Writer (Seller) of the Put Option $0 $1 $2 $3 $3 $3 $3 Net Profit or Loss per Share to Be Earned by the Writer (Seller) of the Put Option

5. Covered Call Strategy. a. Evanston Insurance Inc. has purchased shares of Stock E at $50 per share. It will sell the stock in six months. It considers using a strategy of covered call writing to partially hedge its position in this stock. The exercise price is $53, the expiration date is six months, and the premium on the call option is $2. Complete the following table. Profit or Loss per Share If a Covered Call Strategy Is Used Profit or Loss per Share If a Covered Call Strategy Is Not Used

Possible Price of Stock E in 6 Months $47 $50 $52 $55 $57 $60

ANSWER: Profit or Loss per Share If a Covered Call Strategy Is Used $1 $2 $4 $5 $5 $5 Profit or Loss per Share If a Covered Call Strategy Is Not Used $3 $0 $2 $5 $7 $10

Possible Price of Stock E in 6 Months $47 $50 $52 $55 $57 $60

b. Assume that each of the six stock prices in the first column in the table have an equal probability of occurring. Compare the probability distribution of the profits (or losses) per share when using covered call writing versus not using it. Would you recommend covered call writing in this example? Explain. ANSWER: There is a 50 percent chance that covered call writing will result in an additional $2 per share gain. There is a 16.7 percent chance that the two possible strategies will generate the same gain. There is a 33.3 percent chance that covered call writing will result in a lower gain. 9. Covered Call Strategy. Coral Inc. has purchased shares of stock M at $28 per share. It will sell the stock in six months. It considers using a strategy of covered call writing to partially hedge its position in this stock. The exercise price is $32, the expiration date is six months, and the premium on the call option is $2.50. Complete the following table: Possible Price of Stock M in 6 Months $25 $28 $33 $36 ANSWER: Possible Price of Stock M in 6 Months $25 $28 $33 $36 Profit or Loss per Share If a Covered Call Strategy Is Used $0.50 $2.50 $6.50 $6.50 Profit or Loss per Share If a Covered Call Strategy Is Used

You might also like

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- Chapter 1 - Practice QuestionsDocument3 pagesChapter 1 - Practice QuestionsSiddhant AggarwalNo ratings yet

- 3.-Chap-3 Assignment DTUTDocument2 pages3.-Chap-3 Assignment DTUTThanh Le0% (1)

- Bull Call SpreadDocument3 pagesBull Call SpreadpkkothariNo ratings yet

- 21127, Ahmad, Assignment 5, IFDocument5 pages21127, Ahmad, Assignment 5, IFmuhammad ahmadNo ratings yet

- FMI7e ch23Document53 pagesFMI7e ch23lehoangthuchienNo ratings yet

- Econ252 Midterm 1 Key Terms and ConceptsDocument7 pagesEcon252 Midterm 1 Key Terms and Conceptstariq_nuriNo ratings yet

- Bank Homework SolutionsDocument9 pagesBank Homework SolutionsLương Thế CườngNo ratings yet

- Father EssayDocument1 pageFather EssaybestthaneverNo ratings yet

- Arbitrage Opportunities for Blades IncDocument6 pagesArbitrage Opportunities for Blades Incrizwan aliNo ratings yet

- Determination of Forward and Futures Prices: Practice QuestionsDocument3 pagesDetermination of Forward and Futures Prices: Practice Questionshoai_hm2357No ratings yet

- Option Valuation ModelsDocument37 pagesOption Valuation ModelssakshiNo ratings yet

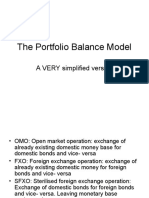

- 9.the Portfolio Balance ModelDocument40 pages9.the Portfolio Balance ModelVelichka DimitrovaNo ratings yet

- 3 Forces Driving New Marketing Realities and How They May ChangeDocument3 pages3 Forces Driving New Marketing Realities and How They May Changeammuajay100% (1)

- Bai PHI 401 Final ReportDocument29 pagesBai PHI 401 Final ReportSumaiya SimranNo ratings yet

- Min-Variance Portfolio & Optimal Risky PortfolioDocument4 pagesMin-Variance Portfolio & Optimal Risky PortfolioHelen B. EvansNo ratings yet

- Risk Management Strategies Using Option ApplicationsDocument15 pagesRisk Management Strategies Using Option ApplicationsTejas JoshiNo ratings yet

- Time Value of Money - Financial ManagementDocument8 pagesTime Value of Money - Financial Managementkamdica100% (2)

- Blades Inc. CaseDocument2 pagesBlades Inc. Caseplanet_sami0% (1)

- CASE STUDY Passion For The Outdoors and For PeopleDocument3 pagesCASE STUDY Passion For The Outdoors and For PeopleCupcake 1100% (1)

- Option MoneynessDocument26 pagesOption MoneynessVaidyanathan RavichandranNo ratings yet

- Function of Financial IntermediariesDocument5 pagesFunction of Financial Intermediariesraazoo19No ratings yet

- Excel Aptitude QuestionsDocument106 pagesExcel Aptitude QuestionsK.Rama Krishna33% (3)

- Blades, Inc. Case Decision To Expand InternationallyDocument8 pagesBlades, Inc. Case Decision To Expand InternationallyUniversitas KadiriNo ratings yet

- QA-21. Valuation of Wal-Mart's International BusinessDocument1 pageQA-21. Valuation of Wal-Mart's International Businesshy_saingheng_7602609No ratings yet

- Ch1-Multinational Financial Management-An OverviewDocument17 pagesCh1-Multinational Financial Management-An Overviewbenu50% (2)

- Currency Bid Rate Ask/Offer Rate: 1. 2. 3. 4. How Much CAD Received When Selling CHF10, 000,000? 5Document4 pagesCurrency Bid Rate Ask/Offer Rate: 1. 2. 3. 4. How Much CAD Received When Selling CHF10, 000,000? 5Dinhphung Le100% (1)

- Lí thuyết tacn2Document27 pagesLí thuyết tacn2Nguyễn Thị Ngọc AnhNo ratings yet

- TCS-Hedging Forex RiskDocument6 pagesTCS-Hedging Forex RiskAniket GuptaNo ratings yet

- Quiz Bomb FDDocument12 pagesQuiz Bomb FDTshering Pasang SherpaNo ratings yet

- Credit Creation in Commercial BanksDocument12 pagesCredit Creation in Commercial BanksprasanthmctNo ratings yet

- Skills For Big DataDocument4 pagesSkills For Big DataErfanNo ratings yet

- 01 Market TestDocument46 pages01 Market TestsantoshNo ratings yet

- CasesDocument7 pagesCasesMd Nazmus Sakib0% (1)

- Parkin 13ge Econ IMDocument16 pagesParkin 13ge Econ IMDina SamirNo ratings yet

- Chapter 2 New Practice QuestionsDocument3 pagesChapter 2 New Practice QuestionsHà Phạm ThuNo ratings yet

- HW Assignment Week 8 Student ID 1567033Document2 pagesHW Assignment Week 8 Student ID 1567033Lưu Gia BảoNo ratings yet

- 1.2 Doc-20180120-Wa0002Document23 pages1.2 Doc-20180120-Wa0002Prachet KulkarniNo ratings yet

- Revision Sources of FinanceDocument2 pagesRevision Sources of FinanceIsaack Mgeni100% (1)

- Solutions ExtraDocument36 pagesSolutions ExtraAkshay AroraNo ratings yet

- Blades Inc's exposure to Thai economic factorsDocument3 pagesBlades Inc's exposure to Thai economic factorsZ the officerNo ratings yet

- Managing human resources internationallyDocument3 pagesManaging human resources internationallyWasifNo ratings yet

- THREE-5548-Banking Law and PracticeDocument8 pagesTHREE-5548-Banking Law and PracticeMisbha AliNo ratings yet

- Chapter 13 The Stock MarketDocument7 pagesChapter 13 The Stock Marketlasha KachkachishviliNo ratings yet

- Problem Set 3-Group 9Document6 pagesProblem Set 3-Group 9WristWork Entertainment100% (1)

- Options McqsDocument15 pagesOptions McqsJust ForNo ratings yet

- 20 AmocanebibhDocument3 pages20 Amocanebibhlika77678No ratings yet

- ECO764A Financial Econometrics Practice SetDocument22 pagesECO764A Financial Econometrics Practice SetzalanipNo ratings yet

- Chapter 8 Iclicker Question and AnswersDocument5 pagesChapter 8 Iclicker Question and AnswersdaliaolNo ratings yet

- Call and PutDocument30 pagesCall and PutTae HeeNo ratings yet

- R59 Risk Management Applications of Option Strategies Q BankDocument10 pagesR59 Risk Management Applications of Option Strategies Q BankAdnan AshrafNo ratings yet

- Source DerDocument13 pagesSource DerLee Kang ToNo ratings yet

- Test Bank For Options Futures and Other Derivatives 8E - John C. HullDocument2 pagesTest Bank For Options Futures and Other Derivatives 8E - John C. HullSami11967% (3)

- FIN B488F-Tutorial Answers - Ch11 - Autumn 2022Document4 pagesFIN B488F-Tutorial Answers - Ch11 - Autumn 2022Nile SethNo ratings yet

- Derivatives Practice QuestionsDocument4 pagesDerivatives Practice QuestionsAdil AnwarNo ratings yet

- Financial Litigation Dividend and Stock Split CalculatorDocument5 pagesFinancial Litigation Dividend and Stock Split CalculatorAjeet YadavNo ratings yet

- High Dividend YieldDocument6 pagesHigh Dividend YieldErnie DaysNo ratings yet

- Solved Problems Resolved Exercises On OptionsDocument15 pagesSolved Problems Resolved Exercises On OptionsScribdTranslationsNo ratings yet

- Quiz 3 Options Arbitrage HedgingDocument2 pagesQuiz 3 Options Arbitrage HedgingThao CaoNo ratings yet

- Ankle Power PointDocument36 pagesAnkle Power Pointcalun12No ratings yet

- Organelle Structure and Function (A-Level Note)Document3 pagesOrganelle Structure and Function (A-Level Note)calun12No ratings yet

- RMT5Document17 pagesRMT5calun12No ratings yet

- Chapter 2 - SSMDocument36 pagesChapter 2 - SSMcalun12No ratings yet

- Default and Renegotiation A Dynamic Model of Debt PDFDocument58 pagesDefault and Renegotiation A Dynamic Model of Debt PDFcalun12No ratings yet

- Chapter 9 - Parity and Other Option RelatinshipDocument12 pagesChapter 9 - Parity and Other Option Relatinshipcalun12No ratings yet

- Financial Statement AnalysisDocument46 pagesFinancial Statement AnalysisAnonymous K8b1TFPyZNo ratings yet

- RMT8Document19 pagesRMT8calun12No ratings yet

- The Determinants of Capital Structure For Japanese Multinational and Domestic Corporations PDFDocument28 pagesThe Determinants of Capital Structure For Japanese Multinational and Domestic Corporations PDFcalun12No ratings yet

- Chapter 1Document19 pagesChapter 1calun12No ratings yet

- Chapter 3 - Insurance, Collars and Other StrategiesDocument41 pagesChapter 3 - Insurance, Collars and Other Strategiescalun12100% (1)

- Question Banks HCM 201-300 CauDocument112 pagesQuestion Banks HCM 201-300 Caucalun12No ratings yet

- Chapter 2 - An Introduction of Forward and OptionDocument38 pagesChapter 2 - An Introduction of Forward and Optioncalun12No ratings yet

- Chapter 8 - SwapsDocument37 pagesChapter 8 - Swapscalun12No ratings yet

- Fundamentals of Corporate Finance: by Robert Parrino, Ph.D. & David S. Kidwell, PH.DDocument57 pagesFundamentals of Corporate Finance: by Robert Parrino, Ph.D. & David S. Kidwell, PH.Dcalun12No ratings yet

- Chap 001Document41 pagesChap 001Phương HạnhNo ratings yet

- Turban Ec2012 PP 02Document52 pagesTurban Ec2012 PP 02dafes danielNo ratings yet

- 856 Ch01ARQDocument6 pages856 Ch01ARQtania_afaz2800No ratings yet

- Chapter 4 - Introduction To Risk ManagementDocument60 pagesChapter 4 - Introduction To Risk Managementcalun12100% (1)

- Group 2Document54 pagesGroup 2Vikas Sharma100% (2)

- Project Management Assignment 2Document11 pagesProject Management Assignment 2Melissa Paul75% (8)

- AdvancingDocument114 pagesAdvancingnde90No ratings yet

- BudgetingS15 FinalExam 150304 2Document9 pagesBudgetingS15 FinalExam 150304 2FrOzen HeArtNo ratings yet

- Basic Economic Questions ExplainedDocument20 pagesBasic Economic Questions ExplainedRiemann SolivenNo ratings yet

- Vault Guide To The Top Insurance EmployersDocument192 pagesVault Guide To The Top Insurance EmployersPatrick AdamsNo ratings yet

- Digests IP Law (2004)Document10 pagesDigests IP Law (2004)Berne Guerrero100% (2)

- Stars 1.06Document22 pagesStars 1.06ratiitNo ratings yet

- Lemon MaltDocument33 pagesLemon MaltUmar AsifNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

- Get Surrounded With Bright Minds: Entourage © 2011Document40 pagesGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiNo ratings yet

- Franchised Stores of New York, Inc. and Thomas Carvel v. Martin Winter, 394 F.2d 664, 2d Cir. (1968)Document8 pagesFranchised Stores of New York, Inc. and Thomas Carvel v. Martin Winter, 394 F.2d 664, 2d Cir. (1968)Scribd Government DocsNo ratings yet

- SHS Entrepreneurship Week 2Document12 pagesSHS Entrepreneurship Week 2RUSSEL AQUINO50% (2)

- CF Wacc Project 2211092Document34 pagesCF Wacc Project 2211092Dipty NarnoliNo ratings yet

- G.R. No. 161759, July 02, 2014Document9 pagesG.R. No. 161759, July 02, 2014Elaine Villafuerte AchayNo ratings yet

- ANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Document41 pagesANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Georgios XydeasNo ratings yet

- ERP at BPCL SummaryDocument3 pagesERP at BPCL SummaryMuneek ShahNo ratings yet

- SMDDocument2 pagesSMDKhalil Ur RehmanNo ratings yet

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerDocument11 pagesA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsNo ratings yet

- MM Case Study FinalDocument22 pagesMM Case Study FinalPrasanjeet DebNo ratings yet

- Hotel Functions & Rooms Division GuideDocument6 pagesHotel Functions & Rooms Division GuideSean PInedaNo ratings yet

- GPETRO Scope TenderDocument202 pagesGPETRO Scope Tendersudipta_kolNo ratings yet

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocument16 pagesNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- QSP 7.1. Control of Personnel (Preview)Document3 pagesQSP 7.1. Control of Personnel (Preview)Centauri Business Group Inc.No ratings yet

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDocument2 pagesDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNo ratings yet

- India's Top Startups: Freshdesk, Zomato and Myntra Rank as Top 3Document77 pagesIndia's Top Startups: Freshdesk, Zomato and Myntra Rank as Top 3Karthik BhandaryNo ratings yet

- Employee Training at Hyundai Motor IndiaDocument105 pagesEmployee Training at Hyundai Motor IndiaRajesh Kumar J50% (12)

- Application of Game TheoryDocument65 pagesApplication of Game Theorymithunsraj@gmail.com100% (2)

- Case Study 1Document9 pagesCase Study 1kalpana0210No ratings yet

- The Theory of Interest Second EditionDocument43 pagesThe Theory of Interest Second EditionVineet GuptaNo ratings yet