Professional Documents

Culture Documents

Achievement Test 1: Accounting Principles Chapters 1 and 2

Uploaded by

James MorganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Achievement Test 1: Accounting Principles Chapters 1 and 2

Uploaded by

James MorganCopyright:

Available Formats

Achievement Test 1: Chapters 1 and 2 Accounting Principles, 10e Weygandt, Kieso, & Kimmel

Name _________________________ Instructor ______________________ Section # _______ Date _________

Part Points Score

I 54

II 26

III 10

IV 10

Total 100

PART I MULTIPLE CHOICE (54 points) Instructions: Designate the best answer for each of the following questions. ____ 1. "GAAP" refers to: a. General Association of Accounting Practitioners. b. General Accounting and Auditing Principles. c. Generally Accepted Accounting Principles. d. Guidelines for American Accounting Procedures. ____ 2. The requirement that only transaction data capable of being expressed in terms of money be included in the accounting records relates to the: a. economic entity assumption. b. cost principle. c. monetary unit assumption. d. both b and c above. ____ 3. After a business transaction has been analyzed and entered in a journal, the next step in the recording process is to transfer the information to: a. ledger accounts. b. owners equity. c. the companys bank. d. financial statements. ____ 4. Management could determine the amounts due from customers by examining which ledger account? a. Supplies. b. Accounts Payable. c. Service Revenue. d. Accounts Receivable.

AT1- 2

Test Bank for Accounting Principles, Tenth Edition

____ 5. If liabilities increased by $20,000 and owners equity increased by $8,000 during a period of time, then total assets must change by what amount and direction during that same period? a. $28,000 increase. b. $28,000 decrease. c. $12,000 increase. d. $20,000 increase. ____ 6. Which of the following presents key aspects of the process of accounting in the correct chronological order? a. Recording, totaling, and auditing. b. Identifying, recording, and communicating. c. Totaling, auditing, and budgeting. d. Budgeting, recording, and communicating. ____ 7. Adams Company paid $700 cash in advance for insurance coverage which will begin in the following month. As a result of this event, a. owners equity decreased by $700. b. total assets decreased by $700. c. total assets remained the same. d. liabilities decreased by $700. ____ 8. Which of the following describes the process of identifying the economic events of an organization? a. Selecting the economic activities relevant to a particular organization. b. Quantifying events in dollars and cents. c. Keeping a chronological diary of particular events in an orderly and systematic manner. d. Preparing accounting reports, including financial statements. ____ 9. The current source of "GAAP" in the private sector is the: a. Securities Exchange Commission. b. Accounting Principles Board. c. Internal Revenue Service. d. Financial Accounting Standards Board. ____10. As of April 30, 2012, Jillson Company has assets of $90,000, and liabilities of $62,000. What is the owners equity for Jillson Company as of April 30, 2012? a. $152,000. b. $28,000. c. $90,000. d. $62,000. ____11. For which of the following accounts is the normal balance a credit? a. Prepaid Insurance. b. Accounts Receivable. c. Unearned Service Revenue. d. Rent Expense.

Achievement Test 1 AT1- 3

____12. Which of the following is false with regard to a general journal? a. It helps to prevent errors since the debit and credit amounts in an individual entry can be readily compared. b. It discloses in one place the complete effects of a transaction. c. It provides a chronological record of transactions. d. It tracks the increases and decreases in an individual account. ____13. Financial statements combining the operations of CVS and Walgreens would violate the: a. economic entity assumption. b. cost principle. c. monetary unit assumption. d. both b and c above. ____14. A debit will increase _______________, but decrease ______________. a. accounts payable; owner's capital b. accounts receivable; accounts payable c. revenues; accounts payable d. owner's capital; prepaid insurance ____15. Which of the following entries made to record the payment of $1,000 on account will cause the trial balance to be out of balance? a. Cash is debited for $1,000 and Service Revenue is credited for $1,000. b. Cash is debited for $100 and Accounts Payable is credited for $100. c. Both Cash and Accounts Payable are credited for $1,000. d. No entry is recorded. ____16. On August 1, 2013, Danny Markson buys a copier machine for his business and makes this purchase with and cash down payment and issues a note payable for the balance. When journalizing this transaction, he will: a. list the credit entries first, which is proper form for this type of transaction. b. use two journal entries. c. make a simple entry. d. make a compound entry. ____17. Limited liability is not enjoyed by the owner(s) of a: a. proprietorship. b. partnership. c. corporation. d. Both a and b, above. ____18. The Owners Capital column had a beginning total of $60,000 and an ending total of $110,000. If the owner withdrew $20,000 during the period for personal use, net income must have been: a. $70,000. b. $50,000. c. $170,000. d. $80,000.

AT1- 4

Test Bank for Accounting Principles, Tenth Edition

PART II JOURNAL ENTRIES (26 points) The ledger accounts given below, with an identification number for each, are used by Paulson Company. Instructions: Indicate the appropriate entries for the month of May by placing the appropriate identification number(s) in the debit and credit columns provided. Item 0 is given as an example. Write "none" if no entry is appropriate. 1. Cash 7. Salaries Payable 13. Service Revenue 2. Accounts Receivable 8. Accounts Payable 14. Equipment Expense 3. Supplies 9. Unearned Service Revenue 15. Advertising Expense 4. Prepaid Insurance 10. Notes Payable 16. Supplies Expense 5. Prepaid Advertising 11. Owners Capital 17. Rent Expense 6. Equipment 12. Owners Drawing 18. Salaries Expense Entry Account(s) Account(s) No. Entry Information Debited Credited 0. May 1 Owner K. Paulson invested $40,000 in the business. 1 11 1. May 4 Equipment was purchased at a cost of $7,000; a three-month, 10% note payable was signed for this amount. 2. May 5 Paid a supplier $1,500 cash on account. 3. May 8 Paid $1,800 in cash to Palmero Company for May rent. 4. May 10 Purchased supplies for $2,500 cash. The supplies are expected to last through July. 5. May 14 Paid $300 cash to the Daily News for advertisements run this past week. 6. May 16 Billed customers $8,000 for services rendered. 7. May 19 Received $5,000 from customers for services rendered during the week. 8. May 25 Additional supplies were purchased on account at a cost of $800 from Superior Supplies Company. These supplies will be used during June. 9. May 26 Received $11,000 from customers for services to be rendered early in June. 10. May 27 Paid the Weekly News $300 for an advertisement that will run the first week in June. 11. May 28 Received $4,000 on account. 12. May 30 Owner K. Paulson withdrew $500 for personal use. 13. May 30 K. Minor, K. Paulsons administrative assistant, was paid $1,800 cash for her salary.

Achievement Test 1 AT1- 5

PART III SHORT PROBLEMS (10 points) Instructions: Present the solutions, with appropriate supporting calculations, for each of the following independent problems. 1. Given the following information, compute the balance in the Owners Capital account at January 1, 2012 for Johnson Company. Owners CapitalDecember 31, 2012 $170,000 Owners investments during 2012 $30,000 Owners withdrawals during 2012 $80,000 Net income for 2012 $125,000

2. Given the following information, determine the three missing amounts. Owner's Equity Changes During the Year Investments $22,000 Drawings 10,000 Revenues ??? Expenses 57,000

Beginning of the Year Total Assets $62,000 Total Liabilities 23,000 Total Owner's Equity ???

End of the Year Total Assets ??? Total Liabilities 40,000 Total Owner's Equity 58,000

AT1- 6

Test Bank for Accounting Principles, Tenth Edition

PART IV TYPES OF ACCOUNTS (10 points) Instructions: Place a check in the appropriate columns to designate whether each of the following accounts: (1) has a debit or credit normal balance; and (2) is an asset, liability, or owner's equity account. (1) (2) Owner's Account Debit Credit Asset Liability Equity 1. Notes Payable 2. Rent Expense 3. Owners Capital 4. Supplies 5. Accounts Payable 6. Accounts Receivable 7. Owners Drawing 8. Unearned Service Revenue 9. Service Revenue 10. Prepaid Insurance

Achievement Test 1 AT1- 7

Solutions Achievement Test 1: Chapters 1 and 2 PART I MULTIPLE CHOICE (54 points) 1. c 2. c 3. a 4. d 5. a 6. b 7. c 8. a 9. d 10. b 11. c 12. d 13. a 14. b 15. c 16. d 17. d 18. a

PART II JOURNAL ENTRIES (26 points) Account(s) Debited 1 6 8 17 3 15 2 Account(s) Credited 11 10 1 1 1 1 13 Account(s) Debited 1 3 1 5 1 12 18 Account(s) Credited 13 8 9 1 2 1 1

0. 1. 2. 3. 4. 5. 6.

7. 8. 9. 10. 11. 12. 13.

PART III SHORT PROBLEMS (10 points)

1. Net income for 2012 ................................................................. Withdrawals during 2012 .......................................................... Investments during 2012 .......................................................... Net change in capital account.. Ending capital balance 12/31/2012........................................... Beginning capital balance 1/1/2012 2. Total owners equity, $39,000 (Beginning of year). Total assets, $98,000 (End of year). Revenues during the year, $64,000. PART IV TYPES OF ACCOUNTS (10 points) Debit 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Credit Asset Liability

$125,000 $(80,000) $ 30,000 $75,000 $170,000 $95,000

Owner's Equity

You might also like

- Hotel Industry - Portfolia AnalysisDocument26 pagesHotel Industry - Portfolia Analysisroguemba87% (15)

- Accounting Quiz 2 With AnswersDocument5 pagesAccounting Quiz 2 With AnswersSabah SiddiquiNo ratings yet

- Lecture Notes Lectures 1 9 Advanced Financial AccountingDocument22 pagesLecture Notes Lectures 1 9 Advanced Financial Accountingsir sahb100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Chapter 2 Problems and SolutionDocument19 pagesChapter 2 Problems and SolutionSaidurRahaman100% (1)

- Downloable Test Bank For Accounting Principles 7th Edition Weygandtch03Document47 pagesDownloable Test Bank For Accounting Principles 7th Edition Weygandtch03Jeiel SaguiboNo ratings yet

- THE ACCOUNTING RECORDING PROCESSDocument3 pagesTHE ACCOUNTING RECORDING PROCESSHansAxel100% (1)

- FPO Application GuideDocument33 pagesFPO Application GuideIsrael Miranda Zamarca100% (1)

- Accounting Principles CH 03 + 04 ExamDocument7 pagesAccounting Principles CH 03 + 04 ExamJames MorganNo ratings yet

- Accounting Achievement Test ReviewDocument7 pagesAccounting Achievement Test ReviewAldi HerialdiNo ratings yet

- BE309 Final Exam Due March 5Document3 pagesBE309 Final Exam Due March 5GrnEyz79100% (1)

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelNo ratings yet

- Multiple choice and accounting problemsDocument3 pagesMultiple choice and accounting problemssamuel debebeNo ratings yet

- Unit 3. Accounting For Merchandising BusinessesDocument33 pagesUnit 3. Accounting For Merchandising BusinessesYonas100% (1)

- PROCESS COSTING - Practice QuestionsDocument5 pagesPROCESS COSTING - Practice QuestionsabbasNo ratings yet

- Accounting Multiple Choice QuestionDocument4 pagesAccounting Multiple Choice QuestionDanish RehmanNo ratings yet

- Chap 4Document43 pagesChap 4Ramez Ahmed100% (2)

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Cash ManagementDocument11 pagesCash ManagementWonde Biru100% (1)

- Accounting for Merchandising EnterprisesDocument17 pagesAccounting for Merchandising EnterprisesTsegaye BelayNo ratings yet

- CH 2 LPPMDocument88 pagesCH 2 LPPMsemetegna she zemen 8ተኛው ሺ zemen ዘመን100% (1)

- Cost Accounting Interim ExamDocument5 pagesCost Accounting Interim Examgroup 1No ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- GT Accounting Basics Test QuestionsDocument4 pagesGT Accounting Basics Test QuestionsErvin CabangalNo ratings yet

- Accounting For Merchandising BusinessDocument27 pagesAccounting For Merchandising Businessarnel barawedNo ratings yet

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- Harambee University Accounting WorksheetDocument5 pagesHarambee University Accounting WorksheetBobasa S Ahmed100% (1)

- TB ch07Document27 pagesTB ch07carolevangelist4657No ratings yet

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument10 pagesCH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionssamahNo ratings yet

- Group Assignment - I (25%) comprehensive accounting cycleDocument3 pagesGroup Assignment - I (25%) comprehensive accounting cycleTereda100% (1)

- Journal Ledger & Trial BalanceDocument32 pagesJournal Ledger & Trial BalanceMr. Demon ExtraNo ratings yet

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Cost Questions For Review 2020Document16 pagesCost Questions For Review 2020omarNo ratings yet

- Adjusting Entries MCQs ExplainedDocument5 pagesAdjusting Entries MCQs ExplainedVivek Ratan100% (1)

- Unit 1F.MDocument146 pagesUnit 1F.Mhamdi muhumed100% (4)

- Quiz 3 Accounting Equation Without AnswerDocument5 pagesQuiz 3 Accounting Equation Without AnswerHello Kitty100% (1)

- Matching QuestionsDocument9 pagesMatching QuestionsNguyen Thanh Thao (K16 HCM)100% (1)

- Ocean Atlantic Co Is A Merchandising Business The Account BalaDocument2 pagesOcean Atlantic Co Is A Merchandising Business The Account BalaM Bilal SaleemNo ratings yet

- Exam For AccountingDocument16 pagesExam For AccountingLong TranNo ratings yet

- Foreign Currency TransactionsDocument4 pagesForeign Currency TransactionsJeanycanycs CongayoNo ratings yet

- Fa I MidDocument7 pagesFa I MidFãhâd Õró ÂhmédNo ratings yet

- Quiz 6 Journalizing Without AnswerDocument8 pagesQuiz 6 Journalizing Without AnswerJazzy MercadoNo ratings yet

- Comprehensive ProblemDocument11 pagesComprehensive Problemapi-295660192No ratings yet

- Home Office and Branch Accounting Part 2Document43 pagesHome Office and Branch Accounting Part 2John Stephen PendonNo ratings yet

- Exam Review Unit I - Chapters 1-3Document24 pagesExam Review Unit I - Chapters 1-3Aaron DownsNo ratings yet

- Enumeration:List Down The Correct Answers: Fundamentals of Accounting 2Document1 pageEnumeration:List Down The Correct Answers: Fundamentals of Accounting 2Nicky Rivera100% (1)

- Exercise 6-1 (Classification of Cost Drivers)Document18 pagesExercise 6-1 (Classification of Cost Drivers)Barrylou ManayanNo ratings yet

- Job Order Costing System Multiple Choice Questions MCQs Accounting For Management PDFDocument15 pagesJob Order Costing System Multiple Choice Questions MCQs Accounting For Management PDFNina Ricci AraracapNo ratings yet

- Cost Accounting Chapter 11 QuizDocument3 pagesCost Accounting Chapter 11 Quizzeel801No ratings yet

- Ch04 Completing The Accounting CycleDocument68 pagesCh04 Completing The Accounting CycleGelyn CruzNo ratings yet

- PDF - BASIC ACCOUNTING-CHAPTER-1 (Questions)Document3 pagesPDF - BASIC ACCOUNTING-CHAPTER-1 (Questions)James Ygn100% (3)

- Chapter 1 - Introduction ToDocument30 pagesChapter 1 - Introduction ToCostAcct1No ratings yet

- Assignment Chapter 5Document2 pagesAssignment Chapter 5Nati AlexNo ratings yet

- Individual AssignementDocument7 pagesIndividual Assignementgemechu67% (3)

- Comprehensive Accounting Cycle ProblemDocument2 pagesComprehensive Accounting Cycle Problemyikebermihreu2008No ratings yet

- Home Office and Branch Accounting Agency 1Document20 pagesHome Office and Branch Accounting Agency 1John Stephen PendonNo ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- Voucher System, Special Journals, and Subsidiary LedgersDocument9 pagesVoucher System, Special Journals, and Subsidiary LedgersCatherine Calero50% (2)

- Tai Lieu Ke Toan - Docx Khanh.Document20 pagesTai Lieu Ke Toan - Docx Khanh.copmuopNo ratings yet

- Accounting Exam Multiple Choice QuestionsDocument8 pagesAccounting Exam Multiple Choice QuestionsPrincess ArceNo ratings yet

- MCQDocument19 pagesMCQk_Dashy846580% (5)

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Document10 pagesThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNo ratings yet

- E - Business Chapter 4Document6 pagesE - Business Chapter 4James MorganNo ratings yet

- Cost Accounting 4/eDocument18 pagesCost Accounting 4/eJames MorganNo ratings yet

- IMChap 014Document22 pagesIMChap 014James MorganNo ratings yet

- IMChap 015Document25 pagesIMChap 015James MorganNo ratings yet

- Cost Accounting 4/eDocument18 pagesCost Accounting 4/eJames MorganNo ratings yet

- IMChap 018Document21 pagesIMChap 018James MorganNo ratings yet

- IMChap 017Document23 pagesIMChap 017James MorganNo ratings yet

- IMAppendixDocument11 pagesIMAppendixJames MorganNo ratings yet

- E Comm MC QDocument6 pagesE Comm MC QJames MorganNo ratings yet

- RSH Qam11 Ism Ch01Document7 pagesRSH Qam11 Ism Ch01James MorganNo ratings yet

- Yr1 Yr2 Yr3 Sales/year: (Expected To Continue)Document7 pagesYr1 Yr2 Yr3 Sales/year: (Expected To Continue)Samiksha MittalNo ratings yet

- AAEC 3301 - Lecture 5Document31 pagesAAEC 3301 - Lecture 5Fitrhiianii ExBrilliantNo ratings yet

- Pengiriman Paket Menggunakan Grab Expres 354574f4 PDFDocument24 pagesPengiriman Paket Menggunakan Grab Expres 354574f4 PDFAku Belum mandiNo ratings yet

- The Millennium Development Goals Report: United NationsDocument21 pagesThe Millennium Development Goals Report: United Nationshst939No ratings yet

- Arcelor Mittal MergerDocument26 pagesArcelor Mittal MergerPuja AgarwalNo ratings yet

- Get in Guaranteed: With Ticketmaster Verified TicketsDocument2 pagesGet in Guaranteed: With Ticketmaster Verified Ticketsoair2000No ratings yet

- Types of CooperativesDocument11 pagesTypes of CooperativesbeedeetooNo ratings yet

- Kobra 260.1 S4Document1 pageKobra 260.1 S4Mishmash PurchasingNo ratings yet

- Business PeoplesDocument2 pagesBusiness PeoplesPriya Selvaraj100% (1)

- ISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESDocument1 pageISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESeverly.No ratings yet

- Receipt Voucher: Tvs Electronics LimitedDocument1 pageReceipt Voucher: Tvs Electronics LimitedKrishna SrivathsaNo ratings yet

- 2021-09-21 Columbia City Council - Public Minutes-2238Document8 pages2021-09-21 Columbia City Council - Public Minutes-2238jazmine greeneNo ratings yet

- AGI3553 Plant ProtectionDocument241 pagesAGI3553 Plant ProtectionDK White LionNo ratings yet

- Practice Problems For Mid TermDocument6 pagesPractice Problems For Mid TermMohit ChawlaNo ratings yet

- Environment PollutionDocument6 pagesEnvironment PollutionNikko Andrey GambalanNo ratings yet

- Real Estate Project Feasibility Study ComponentsDocument2 pagesReal Estate Project Feasibility Study ComponentsSudhakar Ganjikunta100% (1)

- Eco - Grade 9 Question Bank 15-16Document13 pagesEco - Grade 9 Question Bank 15-16Vedic MantriNo ratings yet

- Managerial Economics: Cheat SheetDocument110 pagesManagerial Economics: Cheat SheetSushmitha KanasaniNo ratings yet

- Chapter 1-Introduction To Green BuildingsDocument40 pagesChapter 1-Introduction To Green Buildingsniti860No ratings yet

- "Potential of Life Insurance Industry in Surat Market": Under The Guidance ofDocument51 pages"Potential of Life Insurance Industry in Surat Market": Under The Guidance ofFreddy Savio D'souzaNo ratings yet

- Armstrong April Quarterly 2022Document108 pagesArmstrong April Quarterly 2022Rob PortNo ratings yet

- Jansen H SinamoDocument1 pageJansen H SinamoIndoplaces100% (2)

- Aec 2101 Production Economics - 0Document4 pagesAec 2101 Production Economics - 0Kelvin MagiriNo ratings yet

- Project 1Document20 pagesProject 1pandurang parkarNo ratings yet

- Department of Labor: Ncentral07Document70 pagesDepartment of Labor: Ncentral07USA_DepartmentOfLaborNo ratings yet

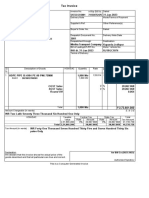

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- Aisa Business Kaha Hindi-1 PDFDocument20 pagesAisa Business Kaha Hindi-1 PDFAnonymous 2rX2W07100% (1)

- Palo Leyte Palo Leyte: Table 1Document5 pagesPalo Leyte Palo Leyte: Table 1samson benielNo ratings yet