Professional Documents

Culture Documents

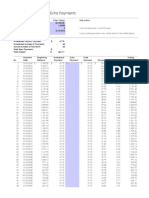

Geauga County RID Tax Calculation

Uploaded by

The News-HeraldCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Geauga County RID Tax Calculation

Uploaded by

The News-HeraldCopyright:

Available Formats

Geauga County / City of Chardon

TIF - Residential Incentive District

Options Summary

Option

Type

Rolling

Exemption %

Years

1 - 10

Remainder

100%

50%

Length

Revenue Loss

to County

> 50 years* $10,488,807.33 current legislation passed by City of Chardon

* based on per parcel exemption / buildout of 20 homes per year

Notes

Estimated R/E Tax Collection

using Residential Incentive District Exemptions

Assumptions:

#

Average

Homes

value

500 $250,000

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

New

Homes

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Effective

rate

56.22518 $

Total

Homes

20

40

60

80

100

120

140

160

180

200

220

240

260

280

300

320

340

360

380

400

420

440

460

480

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

500

Annual

Collection

4,919.70 $

Estimated Annual

Collection

$

98,394.07

$

196,788.13

$

295,182.20

$

393,576.26

$

491,970.33

$

590,364.39

$

688,758.46

$

787,152.52

$

885,546.59

$

983,940.65

$

1,082,334.72

$

1,180,728.78

$

1,279,122.85

$

1,377,516.91

$

1,475,910.98

$

1,574,305.04

$

1,672,699.11

$

1,771,093.17

$

1,869,487.24

$

1,967,881.30

$

2,066,275.37

$

2,164,669.43

$

2,263,063.50

$

2,361,457.56

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

$

2,459,851.63

County

portion

1,048.88

Option A

Estimated County

# Homes Exempted

Portion

Year 1-10-100% Year 11-30-50%

$

20,977.61

20

0

$

41,955.23

40

0

$

62,932.84

60

0

$

83,910.46

80

0

$

104,888.07

100

0

$

125,865.69

120

0

$

146,843.30

140

0

$

167,820.92

160

0

$

188,798.53

180

0

$

209,776.15

200

0

$

230,753.76

200

20

$

251,731.38

200

40

$

272,708.99

200

60

$

293,686.61

200

80

$

314,664.22

200

100

$

335,641.83

200

120

$

356,619.45

200

140

$

377,597.06

200

160

$

398,574.68

200

180

$

419,552.29

200

200

$

440,529.91

200

220

$

461,507.52

200

240

$

482,485.14

200

260

$

503,462.75

200

280

$

524,440.37

200

300

$

524,440.37

180

320

$

524,440.37

160

340

$

524,440.37

140

360

$

524,440.37

120

380

$

524,440.37

100

400

$

524,440.37

80

400

$

524,440.37

60

400

$

524,440.37

40

400

$

524,440.37

20

400

$

524,440.37

0

400

$

524,440.37

0

380

$

524,440.37

0

360

$

524,440.37

0

340

$

524,440.37

0

320

$

524,440.37

0

300

$

524,440.37

0

280

$

524,440.37

0

260

$

524,440.37

0

240

$

524,440.37

0

220

$

524,440.37

0

200

$

524,440.37

0

180

$

524,440.37

0

160

$

524,440.37

0

140

$

524,440.37

0

120

$

524,440.37

0

100

$

524,440.37

0

80

$

524,440.37

0

60

$

524,440.37

0

40

$

524,440.37

0

20

Exemption

Years 1 - 10

Years 11 - 30

Expired

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

20

40

60

80

100

120

140

160

180

200

220

240

260

280

300

320

340

360

380

400

420

440

460

480

%

100%

50%

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

City

20,977.61

41,955.23

62,932.84

83,910.46

104,888.07

125,865.69

146,843.30

167,820.92

188,798.53

209,776.15

220,264.95

230,753.76

241,242.57

251,731.38

262,220.18

272,708.99

283,197.80

293,686.61

304,175.41

314,664.22

325,153.03

335,641.83

346,130.64

356,619.45

367,108.26

356,619.45

346,130.64

335,641.83

325,153.03

314,664.22

293,686.61

272,708.99

251,731.38

230,753.76

209,776.15

199,287.34

188,798.53

178,309.72

167,820.92

157,332.11

146,843.30

136,354.50

125,865.69

115,376.88

104,888.07

94,399.27

83,910.46

73,421.65

62,932.84

52,444.04

41,955.23

31,466.42

20,977.61

10,488.81

Estimated RID Distribution

City Cumulative

County

$

20,977.61 $

$

62,932.84 $

$

125,865.69 $

$

209,776.15 $

$

314,664.22 $

$

440,529.91 $

$

587,373.21 $

$

755,194.13 $

$

943,992.66 $

$ 1,153,768.81 $

$ 1,374,033.76 $

10,488.81

$ 1,604,787.52 $

20,977.61

$ 1,846,030.09 $

31,466.42

$ 2,097,761.47 $

41,955.23

$ 2,359,981.65 $

52,444.04

$ 2,632,690.64 $

62,932.84

$ 2,915,888.44 $

73,421.65

$ 3,209,575.04 $

83,910.46

$ 3,513,750.46 $

94,399.27

$ 3,828,414.68 $

104,888.07

$ 4,153,567.70 $

115,376.88

$ 4,489,209.54 $

125,865.69

$ 4,835,340.18 $

136,354.50

$ 5,191,959.63 $

146,843.30

$ 5,559,067.88 $

157,332.11

$ 5,915,687.33 $

167,820.92

$ 6,261,817.98 $

178,309.72

$ 6,597,459.81 $

188,798.53

$ 6,922,612.84 $

199,287.34

$ 7,237,277.06 $

209,776.15

$ 7,530,963.66 $

230,753.76

$ 7,803,672.65 $

251,731.38

$ 8,055,404.03 $

272,708.99

$ 8,286,157.79 $

293,686.61

$ 8,495,933.94 $

314,664.22

$ 8,695,221.28 $

325,153.03

$ 8,884,019.81 $

335,641.83

$ 9,062,329.53 $

346,130.64

$ 9,230,150.45 $

356,619.45

$ 9,387,482.56 $

367,108.26

$ 9,534,325.86 $

377,597.06

$ 9,670,680.36 $

388,085.87

$ 9,796,546.05 $

398,574.68

$ 9,911,922.93 $

409,063.49

$ 10,016,811.00 $

419,552.29

$ 10,111,210.27 $

430,041.10

$ 10,195,120.72 $

440,529.91

$ 10,268,542.38 $

451,018.72

$ 10,331,475.22 $

461,507.52

$ 10,383,919.26 $

471,996.33

$ 10,425,874.49 $

482,485.14

$ 10,457,340.91 $

492,973.94

$ 10,478,318.52 $

503,462.75

$ 10,488,807.33 $

513,951.56

Co Cumulative

$

$

$

$

$

$

$

$

$

$

$

10,488.81

$

31,466.42

$

62,932.84

$

104,888.07

$

157,332.11

$

220,264.95

$

293,686.61

$

377,597.06

$

471,996.33

$

576,884.40

$

692,261.28

$

818,126.97

$

954,481.47

$ 1,101,324.77

$ 1,258,656.88

$ 1,426,477.80

$ 1,604,787.52

$ 1,793,586.05

$ 1,992,873.39

$ 2,202,649.54

$ 2,433,403.30

$ 2,685,134.68

$ 2,957,843.67

$ 3,251,530.27

$ 3,566,194.49

$ 3,891,347.52

$ 4,226,989.35

$ 4,573,120.00

$ 4,929,739.44

$ 5,296,847.70

$ 5,674,444.76

$ 6,062,530.64

$ 6,461,105.31

$ 6,870,168.80

$ 7,289,721.09

$ 7,719,762.19

$ 8,160,292.10

$ 8,611,310.82

$ 9,072,818.34

$ 9,544,814.67

$ 10,027,299.81

$ 10,520,273.75

$ 11,023,736.50

$ 11,537,688.06

Gen Fund

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

2,187.97

4,375.93

6,563.90

8,751.86

10,939.83

13,127.79

15,315.76

17,503.72

19,691.69

21,879.65

24,067.62

26,255.58

28,443.55

30,631.51

32,819.48

35,007.44

37,195.41

39,383.37

41,571.34

43,759.30

48,135.23

52,511.17

56,887.10

61,263.03

65,638.96

67,826.92

70,014.89

72,202.85

74,390.82

76,578.78

78,766.75

80,954.71

83,142.68

85,330.64

87,518.61

89,706.57

91,894.54

94,082.50

96,270.47

98,458.43

100,646.40

102,834.36

105,022.33

107,210.30

Aging

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

874.77

1,749.53

2,624.30

3,499.07

4,373.83

5,248.60

6,123.37

6,998.13

7,872.90

8,747.67

9,622.43

10,497.20

11,371.96

12,246.73

13,121.50

13,996.26

14,871.03

15,745.80

16,620.56

17,495.33

19,244.86

20,994.40

22,743.93

24,493.46

26,243.00

27,117.76

27,992.53

28,867.30

29,742.06

30,616.83

31,491.60

32,366.36

33,241.13

34,115.89

34,990.66

35,865.43

36,740.19

37,614.96

38,489.73

39,364.49

40,239.26

41,114.03

41,988.79

42,863.56

Health

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

175.16

350.33

525.49

700.65

875.82

1,050.98

1,226.14

1,401.30

1,576.47

1,751.63

1,926.79

2,101.96

2,277.12

2,452.28

2,627.45

2,802.61

2,977.77

3,152.94

3,328.10

3,503.26

3,853.59

4,203.91

4,554.24

4,904.57

5,254.89

5,430.06

5,605.22

5,780.38

5,955.54

6,130.71

6,305.87

6,481.03

6,656.20

6,831.36

7,006.52

7,181.69

7,356.85

7,532.01

7,707.18

7,882.34

8,057.50

8,232.66

8,407.83

8,582.99

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

County Breakdown

GCDD

Engineer

$

$

$

$

$

$

$

$

$

$

2,702.97 $

864.28

5,405.93 $

1,728.56

8,108.90 $

2,592.83

10,811.86 $

3,457.11

13,514.83 $

4,321.39

16,217.79 $

5,185.67

18,920.76 $

6,049.94

21,623.73 $

6,914.22

24,326.69 $

7,778.50

27,029.66 $

8,642.78

29,732.62 $

9,507.05

32,435.59 $

10,371.33

35,138.55 $

11,235.61

37,841.52 $

12,099.89

40,544.48 $

12,964.17

43,247.45 $

13,828.44

45,950.42 $

14,692.72

48,653.38 $

15,557.00

51,356.35 $

16,421.28

54,059.31 $

17,285.55

59,465.24 $

19,014.11

64,871.18 $

20,742.67

70,277.11 $

22,471.22

75,683.04 $

24,199.78

81,088.97 $

25,928.33

83,791.94 $

26,792.61

86,494.90 $

27,656.89

89,197.87 $

28,521.16

91,900.83 $

29,385.44

94,603.80 $

30,249.72

97,306.76 $

31,114.00

100,009.73 $

31,978.28

102,712.69 $

32,842.55

105,415.66 $

33,706.83

108,118.63 $

34,571.11

110,821.59 $

35,435.39

113,524.56 $

36,299.66

116,227.52 $

37,163.94

118,930.49 $

38,028.22

121,633.45 $

38,892.50

124,336.42 $

39,756.78

127,039.39 $

40,621.05

129,742.35 $

41,485.33

132,445.32 $

42,349.61

JFS

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

612.55

1,225.09

1,837.64

2,450.19

3,062.73

3,675.28

4,287.82

4,900.37

5,512.92

6,125.46

6,738.01

7,350.56

7,963.10

8,575.65

9,188.20

9,800.74

10,413.29

11,025.83

11,638.38

12,250.93

13,476.02

14,701.11

15,926.21

17,151.30

18,376.39

18,988.94

19,601.48

20,214.03

20,826.58

21,439.12

22,051.67

22,664.21

23,276.76

23,889.31

24,501.85

25,114.40

25,726.95

26,339.49

26,952.04

27,564.59

28,177.13

28,789.68

29,402.22

30,014.77

GCMH

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

1,049.93

2,099.86

3,149.79

4,199.72

5,249.65

6,299.58

7,349.51

8,399.44

9,449.37

10,499.30

11,549.23

12,599.16

13,649.08

14,699.01

15,748.94

16,798.87

17,848.80

18,898.73

19,948.66

20,998.59

23,098.45

25,198.31

27,298.17

29,398.03

31,497.89

32,547.82

33,597.75

34,647.68

35,697.61

36,747.54

37,797.47

38,847.40

39,897.33

40,947.25

41,997.18

43,047.11

44,097.04

45,146.97

46,196.90

47,246.83

48,296.76

49,346.69

50,396.62

51,446.55

Park

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

2,021.19

4,042.39

6,063.58

8,084.77

10,105.97

12,127.16

14,148.35

16,169.55

18,190.74

20,211.93

22,233.12

24,254.32

26,275.51

28,296.70

30,317.90

32,339.09

34,360.28

36,381.48

38,402.67

40,423.86

44,466.25

48,508.64

52,551.02

56,593.41

60,635.80

62,656.99

64,678.18

66,699.37

68,720.57

70,741.76

72,762.95

74,784.15

76,805.34

78,826.53

80,847.73

82,868.92

84,890.11

86,911.31

88,932.50

90,953.69

92,974.89

94,996.08

97,017.27

99,038.47

Estimated R/E Tax Collection

using Residential Incentive District Exemptions

Assumptions:

#

Average

Homes

value

500 $250,000

Year

55

New

Homes

0

Effective

rate

56.22518 $

Total

Homes

500

Annual

Collection

4,919.70 $

County

portion

1,048.88

Option A

Estimated Annual

Estimated County

# Homes Exempted

Collection

Portion

Year 1-10-100% Year 11-30-50%

$

2,459,851.63 $

524,440.37

0

0

$ 105,773,619.88 $

22,550,935.76

Exemption

Years 1 - 10

Years 11 - 30

Expired

500

City

100%

50%

Estimated RID Distribution

City Cumulative

County

Co Cumulative

$ 10,488,807.33 $

524,440.37 $ 12,062,128.43 $

Gen Fund

109,398.26 $

$ 10,488,807.33

$ 12,062,128.43 $

2,516,159.99 $ 1,005,981.51 $ 201,437.54 $

3,108,410.50 $

Total Estimated Collection - Non RID

$ 22,550,935.76 $

4,704,125.20 $ 1,880,748.04 $ 376,600.63 $

Difference

$ (10,488,807.33) $ (2,187,965.21) $ (874,766.53) $ (175,163.09) $

Total Estimated Collection - RID

Aging

43,738.33 $

Health

8,758.15 $

County Breakdown

GCDD

Engineer

135,148.28 $

43,213.89 $

JFS

30,627.32 $

GCMH

52,496.48 $

Park

101,059.66

993,919.38 $

704,428.30 $

1,207,419.06 $

2,324,372.15

5,811,376.14 $ 1,858,197.11 $

1,316,974.65 $

2,257,348.67 $

4,345,565.32

(2,702,965.64) $

(864,277.73) $

(612,546.35) $ (1,049,929.61) $ (2,021,193.17)

You might also like

- TUGAS 4 MATA KULIAH MANAJEMEN KEUANGANDocument4 pagesTUGAS 4 MATA KULIAH MANAJEMEN KEUANGANdaraNo ratings yet

- Atlanta NSP Agreement Financing Through FY 2050Document3 pagesAtlanta NSP Agreement Financing Through FY 2050Allie M GrayNo ratings yet

- Chapter 20. CH 20-06 Build A ModelDocument4 pagesChapter 20. CH 20-06 Build A ModelCarol Lee0% (1)

- Avila Guevara QuinonezDocument41 pagesAvila Guevara QuinonezjuliaNo ratings yet

- Mortgage CalculatorDocument3 pagesMortgage Calculatorno1remfanNo ratings yet

- A Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsDocument2 pagesA Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsFund for Democratic CommunitiesNo ratings yet

- ScribedDocument2 pagesScribedDavid PylypNo ratings yet

- Amended Belen Water and Sewer Rates OrdinanceDocument5 pagesAmended Belen Water and Sewer Rates OrdinanceVCNews-BulletinNo ratings yet

- Home Buying Project New 33Document6 pagesHome Buying Project New 33api-309256887No ratings yet

- For Ready-for-Occupancy (RFO) : ND THDocument4 pagesFor Ready-for-Occupancy (RFO) : ND THmaryajnetrinidad27No ratings yet

- Analyse Equip09Document10 pagesAnalyse Equip09Aqeel ChaudhryNo ratings yet

- Multi-Family Property EvaluationDocument6 pagesMulti-Family Property EvaluationKirill ZamanilNo ratings yet

- Q403 Fall 11Document2 pagesQ403 Fall 11Jamie WoodsNo ratings yet

- AT&T XR - RolinxDocument3 pagesAT&T XR - RolinxKondomboNo ratings yet

- Assigment 2Document14 pagesAssigment 2Felipe PinedaNo ratings yet

- Buc-Ee's Council Presentation - Rev1Document17 pagesBuc-Ee's Council Presentation - Rev1nkotissoNo ratings yet

- Loan Calculator With Extra Payments: Enter Values InstructionsDocument2 pagesLoan Calculator With Extra Payments: Enter Values Instructionsappus20056083No ratings yet

- Home Buying-2Document6 pagesHome Buying-2api-285577701No ratings yet

- Property Tax Reform PresentationDocument29 pagesProperty Tax Reform PresentationStatesman JournalNo ratings yet

- Present value calculations for problems involving multiple cash flows and interest ratesDocument42 pagesPresent value calculations for problems involving multiple cash flows and interest ratesAaron NatarajaNo ratings yet

- Question No: 01: Answer:: Net Proceeds From Sale of House 75,400Document5 pagesQuestion No: 01: Answer:: Net Proceeds From Sale of House 75,400Ahsan AliNo ratings yet

- Home Buying-2Document6 pagesHome Buying-2api-285577701No ratings yet

- Point of Sale Ordinance Info - 2011Document16 pagesPoint of Sale Ordinance Info - 2011Svetlana StolyarovaNo ratings yet

- 3420 Clandara Ave, Las Vegas, 89121 RentalDocument4 pages3420 Clandara Ave, Las Vegas, 89121 RentalLarry RobertsNo ratings yet

- Q401 Summer 11Document2 pagesQ401 Summer 11Jamie WoodsNo ratings yet

- TRC News and Notes 4-11-12Document1 pageTRC News and Notes 4-11-12James Van BruggenNo ratings yet

- Solution To QB QuestionsDocument3 pagesSolution To QB QuestionsSurabhi Suman100% (1)

- Meaford Haven Proforma Sept 2013Document7 pagesMeaford Haven Proforma Sept 2013api-204895087No ratings yet

- 2012 Tax Rate ReportDocument88 pages2012 Tax Rate ReportZoe GallandNo ratings yet

- Eastwood Residences Sample ComputationDocument1 pageEastwood Residences Sample ComputationAmelia At100% (1)

- Analyze The Potential Profit or Loss of Your Real Estate InvestmentDocument3 pagesAnalyze The Potential Profit or Loss of Your Real Estate InvestmentiskandarmalaysiaNo ratings yet

- Estimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Document10 pagesEstimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Terry MaynardNo ratings yet

- Description: BIR Form 1800Document11 pagesDescription: BIR Form 1800Vangie AntonioNo ratings yet

- Avida Settings Cavite Sample ComputationDocument1 pageAvida Settings Cavite Sample Computationjf7777No ratings yet

- BIR Form 1702 Filing GuideDocument18 pagesBIR Form 1702 Filing GuideBeatriceChuNo ratings yet

- Charlotte Web AMERICAS Market Beat Industrial 3page Q12012Document3 pagesCharlotte Web AMERICAS Market Beat Industrial 3page Q12012Anonymous Feglbx5No ratings yet

- Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDocument2 pagesDate of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDaniel HollandsNo ratings yet

- Index For Donor 21325Document8 pagesIndex For Donor 21325Timothy Mark MaderazoNo ratings yet

- FIN SolutionDocument5 pagesFIN SolutionAyman FergeionNo ratings yet

- Ekotek - Alfiano Fuadi3Document50 pagesEkotek - Alfiano Fuadi3Alfiano Fuadi0% (1)

- Buying A HouseDocument6 pagesBuying A Houseapi-311204677No ratings yet

- Description: BIR Form 1800Document10 pagesDescription: BIR Form 1800Dura LexNo ratings yet

- Q1 Merged PDFDocument20 pagesQ1 Merged PDFHibah RajaNo ratings yet

- Maple Tree Layout Price ListDocument1 pageMaple Tree Layout Price ListRanjit AnandNo ratings yet

- Duration & ConvexityDocument11 pagesDuration & ConvexityTHEANONo ratings yet

- Signa Tower II 5n (Studio)Document2 pagesSigna Tower II 5n (Studio)janicedeinlaNo ratings yet

- 0917BUS EconsnapshotDocument1 page0917BUS EconsnapshotThe Dallas Morning NewsNo ratings yet

- Federal Income Tax Rates History, Nominal Dollars, 1913-2013Document66 pagesFederal Income Tax Rates History, Nominal Dollars, 1913-2013Tax Foundation100% (1)

- Fed U.S. Federal Individual Income Tax Rates History, 1862-2013Document68 pagesFed U.S. Federal Individual Income Tax Rates History, 1862-2013Tax Foundation96% (23)

- PartbDocument1 pagePartbapi-291872490No ratings yet

- Covent Studio 23 42 SQMDocument2 pagesCovent Studio 23 42 SQMapi-270128285No ratings yet

- Fundamentals of Financial PlanningDocument6 pagesFundamentals of Financial PlanningJulius NgaregaNo ratings yet

- AaaaDocument6 pagesAaaaapi-310988494No ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Aug. 17 Grand Forks Subsidy DocumentsDocument2 pagesAug. 17 Grand Forks Subsidy DocumentsJoe BowenNo ratings yet

- DART Financial Outlook Review: March 23, 2010Document31 pagesDART Financial Outlook Review: March 23, 2010rodgermjonesNo ratings yet

- Classification Hearing FY2013Document38 pagesClassification Hearing FY2013trcNo ratings yet

- TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Document12 pagesTAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Ciarie Salgado0% (1)

- News-Herald Print Specs Ad SizesDocument2 pagesNews-Herald Print Specs Ad SizesThe News-Herald0% (3)

- ASHLAWN - Complaint Against City of Painesville (FILED)Document28 pagesASHLAWN - Complaint Against City of Painesville (FILED)The News-HeraldNo ratings yet

- Damus Habeas Corpus PetitionDocument21 pagesDamus Habeas Corpus PetitionThe News-HeraldNo ratings yet

- Comprehensive Plan For Lake CountyDocument3 pagesComprehensive Plan For Lake CountyThe News-HeraldNo ratings yet

- Harbor Crest Childcare Academy Pao 7084Document6 pagesHarbor Crest Childcare Academy Pao 7084The News-HeraldNo ratings yet

- 1740 N. Ridge Rd. Painesville Township Lease BrochureDocument4 pages1740 N. Ridge Rd. Painesville Township Lease BrochureThe News-HeraldNo ratings yet

- Better Flip Request For Interested BiddersDocument1 pageBetter Flip Request For Interested BiddersThe News-HeraldNo ratings yet

- Available Ad SizesDocument2 pagesAvailable Ad SizesThe Morning Journal0% (1)

- Wright v. City of EuclidDocument18 pagesWright v. City of EuclidsandydocsNo ratings yet

- Lake County Opioid Caseload 2013-PresentDocument2 pagesLake County Opioid Caseload 2013-PresentThe News-HeraldNo ratings yet

- Port Authority Letters of Interest To Replace McMahonDocument14 pagesPort Authority Letters of Interest To Replace McMahonThe News-HeraldNo ratings yet

- Quilts 2018 WinnersDocument3 pagesQuilts 2018 WinnersThe News-HeraldNo ratings yet

- Willoughby Hills Ordinance 2009-10Document2 pagesWilloughby Hills Ordinance 2009-10The News-HeraldNo ratings yet

- Lake County 2018 BudgetDocument74 pagesLake County 2018 BudgetThe News-HeraldNo ratings yet

- Willoughby Hills Ordinance 2018-11Document2 pagesWilloughby Hills Ordinance 2018-11The News-HeraldNo ratings yet

- 2016 Lake County Accidental Overdose Death ReportDocument4 pages2016 Lake County Accidental Overdose Death ReportThe News-HeraldNo ratings yet

- First Energy Resolution 2.7.18Document2 pagesFirst Energy Resolution 2.7.18The News-HeraldNo ratings yet

- Willoughby Hills Ordinance No. 2017-75Document3 pagesWilloughby Hills Ordinance No. 2017-75The News-HeraldNo ratings yet

- Creekside Farm SubdivisionDocument1 pageCreekside Farm SubdivisionThe News-HeraldNo ratings yet

- Yolimar Tirado Motion To DismissDocument8 pagesYolimar Tirado Motion To DismissThe News-HeraldNo ratings yet

- Richard Hubbard III Motion To DismissDocument7 pagesRichard Hubbard III Motion To DismissThe News-HeraldNo ratings yet

- NH Anniversary Form PDFDocument1 pageNH Anniversary Form PDFThe News-HeraldNo ratings yet

- Jack Thompson TestimonyDocument3 pagesJack Thompson TestimonyThe News-HeraldNo ratings yet

- Amiott Disciplinary Charges Finding 8-18-17Document5 pagesAmiott Disciplinary Charges Finding 8-18-17The News-HeraldNo ratings yet

- Feral Cat Ordinance 2017 (v3)Document5 pagesFeral Cat Ordinance 2017 (v3)Anonymous h4rj255ANo ratings yet

- Lake County CCW Stats Since Law StartedDocument14 pagesLake County CCW Stats Since Law StartedThe News-HeraldNo ratings yet

- Willoughby Officer-Involved Shooting BCI Investigative SynopsisDocument36 pagesWilloughby Officer-Involved Shooting BCI Investigative SynopsisThe News-HeraldNo ratings yet

- NH Wedding Form PDFDocument1 pageNH Wedding Form PDFThe News-HeraldNo ratings yet

- New Mentor Feral Cat LegislationDocument7 pagesNew Mentor Feral Cat LegislationThe News-HeraldNo ratings yet

- NH Engagement Form PDFDocument1 pageNH Engagement Form PDFThe News-HeraldNo ratings yet