Professional Documents

Culture Documents

February IPC

Uploaded by

Steph R. de la TorreOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

February IPC

Uploaded by

Steph R. de la TorreCopyright:

Available Formats

Mexico IPC Index: HOLT Scorecard & Model Portfolio Strategies

February 2011

Jim Murphy HOLT Sales jim.murphy@credit-suisse.com (212) 325 0073 Pablo Cossaro HOLT Sector Specialist, LATAM pablo.cossaro@credit-suisse.com (212) 538 5906

Adam Steffanus HOLT Investment Products & Analytics adam.steffanus@credit-suisse.com (312) 345 6193 Ian Smith HOLT Investment Products & Analytics ian.smith@credit-suisse.com (312) 345 6184

HOLT Scorecard

HOLT Factors, Illustrated

Computer Hardware Market Cap : 165.514 USD

Price: 126.00 (November 9, 2009) Warranted Price : 165.66 USD (31%)

Valuation (Percent to Best)

Operations

Momentum

Momentum

HOLT Investment Products & Analytics

Page 2

Overall HOLT Scorecard Score

4.1

4.4

4.6

GRUPO MEXICO (GMEXICOB)

4.4

3.9

3.5

AMERICA MOVIL (AMXL)

4.1

3.9

3.6

FEMSA (FMSAUBD)

2.6

3.7

4.9

ALFA (ALFAA)

4.0

3.1

4.1

MEXICHEM (MEXCHEM)

2.0

4.5

4.3

CONTROLADORA COMERCIAL MEXICANA (COMEUBC)

3.9

2.4

4.5

BOLSA MEXICANA DE VALORES (BOLSAA)

Operations

2.3

4.4

3.5

GRUPO AEROPORTUARIO DEL PACIFICO (GAPB)

3.0

2.7

4.4

INDUSTRIAS PENOLES (PENOLES)

3.7

2.1

4.3

EMBOTELLADORAS ARCA (ARCA)

4.9

2.3

2.9

GENOMMA LAB INTERNACIONAL (LABB) BANCO COMPARTAMOS (COMPARTO)

2.9

3.1

3.8

Data Date March 1, 2011, Scorecard score change relative to January 17th scores

5.0 1.8 3.2

Valuation GRUMA (GRUMAB) GRUPO BIMBO (BIMBOA) WALMEX (WALMEXV) GRUPO TELEVISA (TLVACPO) DESARROLLADORA HOMEX (HOMEX) GRUPO AEROPORTUARIO DEL SURESTE (ASURB) ORGANIZACION SORIANA (SORIANAB) CONSORCIO ARA (ARA) CORPORACION GEO (GEOB) TELMEX (TELMEXL) GRUPO COMERCIAL CHEDRAUI (CHDRAUIB)

2.2

4.3

1.9

INDUSTRIAS CH (ICHB) GRUPO CARSO (GCARSOA1) KIMBERLY-CLARK DE MEXICO (KIMBERA) BANORTE (GFNORTEO) TV AZTECA (TVAZTCACPO) GRUPO MODELO (GMODELOC)

1.9

3.3

2.8

URBI DESARROLLOS URBANOS (URBI) INBURSA (GFINBURO)

1.9

3.2

1.8

CEMEX (CMXCPO) EMPRESAS ICA (ICA) AXTEL (AXTELCPO) GRUPO ELEKTRA (ELEKTRA)

-1 4.6 4.3 3.6 2.8 2.0 2.7 2.1 2.6 2.0 3.3 2.5 3.6 3.0 3.0 3.6 3.0 1.3 1.5 2.5 0.00 1.00 2.00 2.0 1.8 1.4 3.00 4.00 1.6 3.0 2.6 1.8 5.00 6.00 7.00 8.00 9.00 2.4 2.2 2.7 3.0 2.3 2.8 4.1 2.8 3.5 2.1 3.5 3.0 4.3 4.1 2.5 2.5 2.1 3.7 3.2 3.1 1.9 2.9 3.4 3.2 2.7 2.6

Momentum

1.7 2.2 1.9 2.5 2.5

HOLT Scorecard IPC Index February 2011

Change from Prior Month Overall Score

HOLT Investment Products & Analytics

Page 3

10.00

11.00

12.00

13.00

14.00

15.00

(3.00)

(2.00)

(1.00)

Overall HOLT Scorecard Score -1 0 1 2 3 4 5 3.3 4.7 3.4 CYDSA (CYDSASAA) 3.3 4.6 2.9 BIO-PAPPEL (PAPPEL) 3.4 3.8 3.5 GRUPO MEXICANO DE DESARROLLO (GMD) 4.1 3.5 2.8 3.3 3.9 3.1 VITRO (VITROA) 4.7 MEGACABLE HOLDINGS (MEGACPO) COCA-COLA FEMSA (KOFL) GRUPO HERDEZ (HERDEZ) FINANCIERA INDEPENDENCIA (FINDEP) CORPORACION MOCTEZUMA (CMOCTEZ) GRUPO CONTINENTAL (CONTAL) 2.1 SARE HOLDING (SAREB) PROMOTORA Y OPERADORA DE INFRAESTRUCTURA (PINFRA) GRUPO GIGANTE (GIGANTE) GRUPO FAMSA (GFAMSAA) CIA MINERA AUTLAN (AUTLANB) QUALITAS COMPANIA DE SEGUROS (QCPO) ALSEA (ALSEA) GRUPO SIMEC (SIMECB) GRUPO MARTI (GMARTI) 1.7 Operations 3.9 2.3 3.6 4.3 3.3 3.4 3.5

Data Date March 1, 2011, Scorecard score change relative to January 17th scores

GRUPO AEROPORTUARIO DEL CENTRO NORTE (OMAB)

1.7

3.6

Valuation

4.7 3.6 3.6 4.1 4.3 1.7 3.5 2.4 3.0 2.7 2.0 2.7 2.8 2.2 3.3 2.7 1.9 2.3 2.8 1.7 2.3 1.6 2.8 2.6 3.1

2.4 2.3 2.1 3.3 3.0 Change from Prior Month Overall Score 2.4 3.2 3.3 2.8 2.7 2.6 Momentum

IRT (non-IPC) Members February 2011

CARSO INFRAESTRUCTURA Y CONSTRUCCION (CICSAB1) GRUPO POCHTECA (POCHTECB) IDEAL (IDEALB1)

2.3 2.1 2.1 1.3 1.7 1.00 3.00 2.3 5.00 7.00 9.00

HOLT Investment Products & Analytics

Page 4

-3.00

-1.00

11.00

13.00

15.00

Overall HOLT Scorecard Score 0 1 2 3 4 5 -1 4.6

GRUPO MEXICO (GMEXICOB)

4.2 3.8

3.3

AMERICA MOVIL (AMXL)

3.1

4.3

4.2 4.4 4.1

MEXICHEM (MEXCHEM)

4.8

3.6

CYDSA (CYDSASAA)

3.6

4.9

2.9 2.9

ALFA (ALFAA)

3.8

3.3

4.2

FEMSA (FMSAUBD)

4.4

4.4

CONTROLADORA COMERCIAL MEXICANA (COMEUBC)

3.6

2.3 2.7

BIO-PAPPEL (PAPPEL)

4.5

BOLSA MEXICANA DE VALORES (BOLSAA)

4.6 2.5 2.4

4.4

4.0 3.7

EMBOTELLADORAS ARCA (ARCA)

3.7

2.5

GRUPO AEROPORTUARIO DEL PACIFICO (GAPB) INDUSTRIAS PENOLES (PENOLES) GRUPO MEXICANO DE DESARROLLO (GMD) GRUPO HERDEZ. (HERDEZ)

3.3 4.3 2.8 3.6

4.5 3.7 3.6

3.2 3.0 3.3

2.4

2.9

4.9

GENOMMA LAB INTERNACIONAL (LABB)

3.1

3.9

3.2

GRUMA (GRUMAB)

3.6

2.3

4.2

COCA-COLA FEMSA (KOFL)

3.7

3.7

Operations

2.6

VITRO (VITROA) BANCO COMPARTAMOS (COMPARTO)

2.0

5.0

3.0 2.7

3.8

3.4

CORPORACION MOCTEZUMA (CMOCTEZ) MEGACABLE HOLDINGS (MEGACPO)

3.9

1.4

4.5

Data Date March 1, 2011, Scorecard score change relative to January 17th scores

3.4 4.0 2.4

GRUPO AEROPORTUARIO DEL CENTRO NORTE (OMAB) GRUPO BIMBO (BIMBOA)

3.3

1.8

4.6

Valuation

3.8

GRUPO TELEVISA (TLVACPO) WALMEX (WALMEXV) FINANCIERA INDEPENDENCIA (FINDEP)

3.0 2.1 3.4

2.7 3.0 1.5

4.3 4.5

3.7

2.5

3.1

DESARROLLADORA HOMEX (HOMEX)

3.5

3.5

2.3

GRUPO AEROPORTUARIO DEL SURESTE (ASURB) CORPORACION GEO (GEOB) GRUPO COMERCIAL CHEDRAUI (CHDRAUIB) ORGANIZACION SORIANA (SORIANAB) GRUPO CONTINENTAL (CONTAL) GRUPO CARSO (GCARSOA1) CONSORCIO ARA (ARA) TELMEX (TELMEXL) INDUSTRIAS CH (ICHB) BANORTE (GFNORTEO) KIMBERLY-CLARK DE MEXICO (KIMBERA) TV AZTECA (TVAZTCACPO) GRUPO MODELO (GMODELOC)

4.1 2.9

2.1 2.5

2.9 3.6 3.0 4.0 2.6 2.8 2.4 2.2 2.5 3.2 3.6 3.2 3.6 4.1

Momentum

HOLT Scorecard IRT February 2011

3.1 2.8 4.2 2.5 3.0 2.5 4.2 2.9

2.9 2.1 3.5 2.2 2.5 2.1 2.5 2.5 2.2 2.1

2.6

2.2

URBI DESARROLLOS URBANOS (URBI) PROMOTORA Y OPERADORA DE INFRAESTRUCTURA (PINFRA) SARE HOLDING (SAREB) CIA MINERA AUTLAN (AUTLANB) INBURSA (GFINBURO) GRUPO GIGANTE (GIGANTE) GRUPO SIMEC (SIMECB) GRUPO FAMSA (GFAMSAA) QUALITAS COMPANIA DE SEGUROS (QCPO) CEMEX (CMXCPO) GRUPO MARTI (GMARTI) ALSEA (ALSEA) EMPRESAS ICA (ICA) GRUPO ELEKTRA (ELEKTRA) GRUPO POCHTECA (POCHTECB) AXTEL (AXTELCPO) CARSO INFRAESTRUCTURA Y CONSTRUCCION. (CICSAB1)

3.6

3.2 1.4 4.4

3.1 2.3 1.7 1.8 3.2 2.3 2.8 2.7 2.2 2.0 1.9 2.5 2.1 2.0 1.4 2.8 1.8 1.9 1.9 2.2 1.7 1.9

1.9 3.7

Change from Prior Month Overall Score

1.9 2.3 3.6 3.2 1.4 2.8 1.9 1.5 2.6 2.4 1.3 3.0 3.0

2.7 3.4 2.9 2.7 1.9

2.0

2.2 1.8 1.8 1.4

1.2

HOLT Investment Products & Analytics

Page 5

IDEAL (IDEALB1)

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

10.00

11.00

12.00

13.00

14.00

15.00

(3.00)

(2.00)

(1.00)

Disclosure and Notice

�This material has been prepared by individual traders or sales personnel of Credit Suisse Securities (USA) LLC ("Credit Suisse") and not by the Credit Suisse research department. It is

provided for informational purposes, is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. It is intended only to provide observations and views of individual traders or sales personnel, which may be different from, or inconsistent with, the observations and views of Credit Suisse research department analysts, other Credit Suisse traders or sales personnel, or the proprietary positions of Credit Suisse. Observations and views expressed herein may be changed by the trader or sales personnel at any time without prior notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. The information set forth above has been obtained from or based upon sources believed to be reliable, but Credit Suisse does not represent or warrant its accuracy or completeness and is not responsible for losses or damages arising out of errors, omissions or changes in market factors. This material does not purport to contain all of the information that an interested party may desire and, in fact, may provides only a limited view of a particular security or market. Credit Suisse may participate or invest in transactions with issuers of securities that participate in the markets referred to herein, perform services for or solicit business from such issuers, and/or have a position or effect transactions in the securities or derivatives thereof. Also, Credit Suisse may have accumulated, be in the process of accumulating or accumulate long or short positions in the subject security or related securities. This material does not constitute objective research under FSA rules.

�To obtain a copy of the most recent Credit Suisse research on any company mentioned please contact your sales representative or go to http://www.creditsuisse.com/researchandanalytics.

with the benefit of hindsight. The backtesting of performance differs from the actual account performance because the investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved. Alternative modeling techniques or assumptions might produce significantly different results and prove to be more appropriate. Past hypothetical backtest results are neither an indicator nor a guarantee of future returns. Actual results will vary from the analysis.

�FOR IMPORTANT DISCLOSURES on companies covered in Credit Suisse Investment Banking Division research reports, please see www.credit-suisse.com/researchdisclosures. �Backtested, hypothetical or simulated performance results have inherent limitations. Simulated results are achieved by the retroactive application of a backtested model itself designed

�The HOLT methodology does not assign ratings to a security. It is an analytical tool that involves use of a set of proprietary quantitative algorithms and warranted value calculations, collectively called the HOLT valuation model, that are consistently applied to all the companies included in its database. Third-party data (including consensus earnings estimates) are systematically translated into a number of default variables and incorporated into the algorithms available in the HOLT valuation model. The source financial statement, pricing, and earnings data provided by outside data vendors are subject to quality control and may also be adjusted to more closely measure the underlying economics of firm performance. These adjustments provide consistency when analyzing a single company across time, or analyzing multiple companies across industries or national borders. The default scenario that is produced by the Credit Suisse HOLT valuation model establishes the baseline valuation for a security, and a user then may adjust the default variables to produce alternative scenarios, any of which could occur. The HOLT methodology does not assign a price target to a security. The default scenario that is produced by the HOLT valuation model establishes a warranted price for a security, and as the third-party data are updated, the warranted price may also change. The default variables may also be adjusted to produce alternative warranted prices, any of which could occur. Additional information about the HOLT methodology is available on request. �CFROI, CFROE, HOLT, HOLTfolio, HOLTSelect, HS60, HS40, ValueSearch, AggreGator, Signal Flag and Powered by HOLT are trademarks or registered trademarks of Credit Suisse Group AG or its affiliates in the United States and other countries. �HOLT is a corporate performance and valuation advisory service of Credit Suisse 2011 Credit Suisse Group AG and its subsidiaries and affiliates. All rights reserved �January 1, 2011

HOLT Investment Products & Analytics

Page 6

You might also like

- Psychology Final TaskDocument4 pagesPsychology Final TaskSteph R. de la TorreNo ratings yet

- Eustress and FlowDocument2 pagesEustress and FlowSteph R. de la TorreNo ratings yet

- The Architecture of Complex Weighted NetworksDocument6 pagesThe Architecture of Complex Weighted Networksluciano_sampaio_2No ratings yet

- Mean-Field Theory For Scale-Free Random NetworksDocument15 pagesMean-Field Theory For Scale-Free Random NetworksNathaniel MyersNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Teletón (Mexico)Document4 pagesTeletón (Mexico)jhonnyNo ratings yet

- Listado de Precios Abril 2020 panes galletas budinesDocument1 pageListado de Precios Abril 2020 panes galletas budineselsebasoto100% (1)

- Retc 2004Document1,333 pagesRetc 2004gaosrock1234No ratings yet

- Promotor Por Tienda DiciembreDocument27 pagesPromotor Por Tienda DiciembreaxelNo ratings yet

- E08 Tablas Dinã¡micas AbarrotesDocument12 pagesE08 Tablas Dinã¡micas AbarrotesThaily CastañoNo ratings yet

- Ratigs 16,17 y 18 Octubre 2009 Valle de MexicoDocument3 pagesRatigs 16,17 y 18 Octubre 2009 Valle de MexicotvespectaculosNo ratings yet

- Mexican TV Stations M3U PlaylistDocument3 pagesMexican TV Stations M3U Playlistandrew SRNo ratings yet

- Sample BbvaDocument6 pagesSample Bbvafransipq3No ratings yet

- Detalle ConsumoDocument16 pagesDetalle ConsumoMVALDIVIA0507No ratings yet

- Planilla Nokia Mobile Tribe Septiembre (Respuestas)Document43 pagesPlanilla Nokia Mobile Tribe Septiembre (Respuestas)Jansel PachonNo ratings yet

- CinépolisDocument6 pagesCinépolismemowebberNo ratings yet

- NullDocument114 pagesNullapi-24920014No ratings yet

- 0 ParDocument22 pages0 ParMuhammad Syafiq Abdul LatiffNo ratings yet

- Balanza Ypasa Octrubre 2021Document30 pagesBalanza Ypasa Octrubre 2021Ivan MarinNo ratings yet

- Tambos 01-03Document36 pagesTambos 01-03licettttNo ratings yet

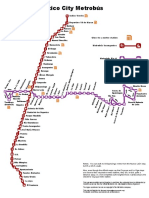

- Map of The Mexico City MetrobusDocument1 pageMap of The Mexico City MetrobusBender RodriguezNo ratings yet

- APILAC-067-18 USO DE SUELO-ModelDocument1 pageAPILAC-067-18 USO DE SUELO-ModelGuillermo López BlackmoreNo ratings yet

- LlamadasDocument883 pagesLlamadasJavier AlemanNo ratings yet

- Iva AuditadoDocument360 pagesIva Auditadoفاريلا فرنانداNo ratings yet

- Report of sales and collections including company, date, time, number, value and sellerDocument27 pagesReport of sales and collections including company, date, time, number, value and sellerDiana Andrade MedinaNo ratings yet

- 41313Document5 pages41313felipe chaverra agudeloNo ratings yet

- Inventario Kiosko Rinde Gas 22 de Julio Del 2021Document14 pagesInventario Kiosko Rinde Gas 22 de Julio Del 2021Alejandro CastilloNo ratings yet

- Hold 12 Julio Del 2023Document222 pagesHold 12 Julio Del 2023JOSE PEREZNo ratings yet

- Lista de Precios CompletaDocument2 pagesLista de Precios Completafranklin111291No ratings yet

- Sector 79Document3 pagesSector 79puebla201No ratings yet

- Cerveceria AlmacenDocument2 pagesCerveceria Almacenjose angel kinil cenNo ratings yet

- Seguimiento de Precios de La Canasta Básica 07 de AgostoDocument2 pagesSeguimiento de Precios de La Canasta Básica 07 de AgostoSallyNo ratings yet

- VariadosDocument38 pagesVariadosandrew SR100% (1)

- La Sandunga by Traditional (Mexico) Sheet TabDocument4 pagesLa Sandunga by Traditional (Mexico) Sheet TabPomoxis AnnularisNo ratings yet