Professional Documents

Culture Documents

MC Chapter 4

Uploaded by

Charmaine MagdangalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MC Chapter 4

Uploaded by

Charmaine MagdangalCopyright:

Available Formats

1. The value of a common stock today depends on: a. Number of shares outstanding and the number of shareholders b.

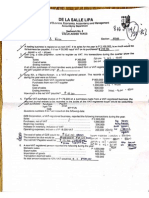

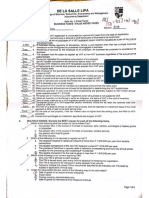

The Wall Street analysts c. The expected future dividends and the discount rate d. Present value of the future earnings per share 2. The value of the stock a. Increases as the dividend growth rate increases b. Increases as the required rate of return decreases c. Increases as the required rate of return increases d. Both A and B 3. Which of the following formulas regarding earnings to price ratio is true: a. EPS/Po = r[1+(PVGO/Po] b. EPS/Po = r[1 - (PVGO/Po)] c. EPS/Po = [r+(PVGO/Po)] d. EPS/Po =[r(1+(PVGO/Po)]/r 4. If the Vol. 100s is reported as 10,233 in the Wall Street Journal quotation, then the trading volume for that day of trading is: a. 10,233 shares b. 102,330 shares c. 1,023,300 shares d. 10,233,000 shares 5. Great Lakes Co. is currently paying a dividend of $2.20 per share. The dividends are expected to grow at 25% per year for the next four years and then grow 5% per year thereafter. Calculate the expected dividend in year 6. a. $5.37 b. $2.95 c. $5.92 d. $8.39 6. Mcom Co. is expected to pay a dividend of $4 per share at the end of year one and the dividends are expected to grow at a constant rate of 4% forever. If the current price of the stock is $25 per share calculated the required rate of return or the market capitalization rate for the firms' stock. a. 4% b. 16% c. 20% d. None of the above. 7. MJ Co. pays out 60% of its earnings as dividends. Its return on equity is 20%. What is the stable dividend growth rate for the firm? a. 3% b. 5% c. 8% d. 12% 8. The NetTech Co. has just paid a dividend of $1 per share. The dividends are expected to grow at 20% per year for the next three years and at the rate of 5% per year

thereafter. If the required rate of return on the stock is 15%(APR), what is the current value of the stock? a. $18.14 b. $15.20 c. $12.51 d. None of the above 9. Y2K Technology Corporation has just paid a dividend of $0.40 per share. The dividends are expected to grow at 30% per year for the next two years and at 5% per year thereafter. If the required rate of return in the stock is 15% (APR), calculate the current value of the stock. a. $1.420 b. $6.33 c. $5.63 d. None of the above 10. Parcel Corporation is expected to pay a dividend of $5 per share next year, and the dividends pay out ratio is 50%. If the dividends are expected to grow at a constant rate of 8% forever and the required rate of return on the stock is 13%, calculate the present value of the growth opportunity. a. $23.08 b. $64.10 c. $100 d. None of the above. ANSWERS: 1. C 2. D 3. B 4. Answer: C Solution: Trading volume = 10,233 * 100 = 1,023,300 5. Answer: A Solution: Div6=2.2 * (1.25^4) * (1.05^2) = 5.92 6. Answer: C Solution: r = (4/25) + 0.04 = 20% 7. Answer: C Solution: g = (1 - 0.6)*20 = 8% 8. Answer: B Solution: P = (1.2/1.15) + (1.44/1.15^2) + (1.728/1.15^3) + (1.8144/((1.15^3)/ (0.15 0.05)) = 15.20 9. Answer: B Solution: Po = [(0.4 *1.3)/1.15] + [(0.4 * 1.3^2)/(1.15^2)] + [(0.4 * 1.3^2*1.06)/ ((1.15^2 * (0.15 0.05))] = $6.33 10. Answer: A Solution: EPS= (5/0.5)=$10; No Growth Value = 10/0.13 = 76.92 Growth Value = 5/(0.13-0.08) = 100 PVGO = 100-76.92 = 23.08

You might also like

- Stock valuation problems using dividend discount modelDocument1 pageStock valuation problems using dividend discount modelJosine JonesNo ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Holding Period & Expected Return With AnswersDocument2 pagesHolding Period & Expected Return With AnswersSiddhant AggarwalNo ratings yet

- Chapter 04 Working Capital 1ce Lecture 050930Document71 pagesChapter 04 Working Capital 1ce Lecture 050930rthillai72No ratings yet

- Chapter 3 Valuation and Cost of CapitalDocument92 pagesChapter 3 Valuation and Cost of Capitalyemisrach fikiruNo ratings yet

- Capital Budgeting MethodsDocument3 pagesCapital Budgeting MethodsRobert RamirezNo ratings yet

- Early in 2010 Inez Marcus The Chief Financial Officer ForDocument2 pagesEarly in 2010 Inez Marcus The Chief Financial Officer ForAmit PandeyNo ratings yet

- Stock ValuationDocument17 pagesStock ValuationNor Hazliana63% (8)

- Cost Accounting and Management AccountingDocument11 pagesCost Accounting and Management AccountingCollins AbereNo ratings yet

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocument7 pagesChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNo ratings yet

- Exam 3 February 2015, Questions and Answers Exam 3 February 2015, Questions and AnswersDocument15 pagesExam 3 February 2015, Questions and Answers Exam 3 February 2015, Questions and Answersben yiNo ratings yet

- Quiz Acctng 603Document10 pagesQuiz Acctng 603LJ AggabaoNo ratings yet

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- CH 11Document51 pagesCH 11Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Time Value Money Calculations University NairobiDocument2 pagesTime Value Money Calculations University NairobiDavidNo ratings yet

- FM 10.1 Working Cap - IntroDocument31 pagesFM 10.1 Working Cap - IntroKishlay SinghNo ratings yet

- Securities and MarketsDocument51 pagesSecurities and MarketsBilal JavedNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsMiguel Cortez100% (1)

- AIS CH 10 Flashcards - QuizletDocument5 pagesAIS CH 10 Flashcards - QuizletArmen CordovaNo ratings yet

- Marginal CostingDocument30 pagesMarginal Costinganon_3722476140% (1)

- Test Bank - TVM1Document29 pagesTest Bank - TVM1appleNo ratings yet

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocument8 pagesAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Capital MArket MCQDocument11 pagesCapital MArket MCQSoumit DasNo ratings yet

- AIS Chapter 6 ControlsDocument2 pagesAIS Chapter 6 ControlsRaul Oreo JrNo ratings yet

- Cash Management ProceduresDocument9 pagesCash Management ProceduresNigussie BerhanuNo ratings yet

- ValuationDocument23 pagesValuationishaNo ratings yet

- Stock ValuationDocument79 pagesStock ValuationRodNo ratings yet

- I M Pandey Financial Management Chapter 28Document3 pagesI M Pandey Financial Management Chapter 28Rushabh VoraNo ratings yet

- Test BankDocument33 pagesTest BankShiva Sankar100% (2)

- C Chapter03Document36 pagesC Chapter03King Mercado100% (1)

- Time Value of MoneyDocument59 pagesTime Value of MoneyjagrenuNo ratings yet

- 195caiib Quematerial PDFDocument6 pages195caiib Quematerial PDFmd_prvz_lkwNo ratings yet

- Acctg Integ 3b Prelim ExamDocument6 pagesAcctg Integ 3b Prelim ExamKathrine Gayle BautistaNo ratings yet

- TP ExampleDocument3 pagesTP ExampleWasik Abdullah MomitNo ratings yet

- CH 11Document48 pagesCH 11Pham Khanh Duy (K16HL)No ratings yet

- Basic Notes For Borrowing CostDocument5 pagesBasic Notes For Borrowing CostIqra HasanNo ratings yet

- Kibrom Abrha Completed PaperDocument61 pagesKibrom Abrha Completed Papermubarek oumer100% (1)

- Lecture 1 - Intro To EbankingDocument18 pagesLecture 1 - Intro To Ebankingtagashii100% (3)

- The Revenue Cycle: Sales To Cash Collections: FOSTER School of Business Acctg.320Document37 pagesThe Revenue Cycle: Sales To Cash Collections: FOSTER School of Business Acctg.320Shaina Shanee CuevasNo ratings yet

- Stocks Investment Test BankDocument9 pagesStocks Investment Test BankAnonymous w7nIv4XzhNo ratings yet

- Capital Budgeting Process ExplainedDocument35 pagesCapital Budgeting Process ExplainedAnjo PadillaNo ratings yet

- WCM QuestionsDocument13 pagesWCM QuestionsjeevikaNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- Finance Chapter 18Document35 pagesFinance Chapter 18courtdubs100% (1)

- 5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument37 pages5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsLiyana ChuaNo ratings yet

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNo ratings yet

- Review Problems Managerial AccountingDocument3 pagesReview Problems Managerial Accountingukandi rukmanaNo ratings yet

- Chapter Three CVP AnalysisDocument65 pagesChapter Three CVP AnalysisBettyNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- Quiz.2.TimevalueofMoney - Answer 1Document6 pagesQuiz.2.TimevalueofMoney - Answer 1anhNo ratings yet

- 13 x11 Financial Management ADocument7 pages13 x11 Financial Management AamirNo ratings yet

- CPT Math StatsDocument63 pagesCPT Math StatsVivek Vincent86% (7)

- Activity Based CostingDocument30 pagesActivity Based Costinghardik1302No ratings yet

- Common Stocks Valuation Practice Questions Chapters 10-15Document18 pagesCommon Stocks Valuation Practice Questions Chapters 10-15prashantgargindia_93No ratings yet

- Multiple Choice - Stock ValuatingDocument9 pagesMultiple Choice - Stock ValuatingĐào Ngọc Pháp0% (1)

- FinalDocument5 pagesFinalMotor Racer0% (2)

- IBA Second Term Exam (A) Spring 2016 Financial ManagementDocument6 pagesIBA Second Term Exam (A) Spring 2016 Financial ManagementHaneefa Soomro0% (1)

- The Following Questions Are Worth 3 Points Each. Provide The Single Best ResponseDocument9 pagesThe Following Questions Are Worth 3 Points Each. Provide The Single Best ResponsePaul Anthony AspuriaNo ratings yet

- Sample Quiz 2 Fin 819Document8 pagesSample Quiz 2 Fin 819mehdiNo ratings yet

- Written Report - What We Do and Do Not Know About FinanceDocument10 pagesWritten Report - What We Do and Do Not Know About FinanceCharmaine MagdangalNo ratings yet

- ReactionDocument1 pageReactionCharmaine MagdangalNo ratings yet

- Corporate RestructuringDocument9 pagesCorporate RestructuringCharmaine MagdangalNo ratings yet

- Value Added TaxDocument3 pagesValue Added TaxCharmaine MagdangalNo ratings yet

- Daddy's Girl - A Daughter's Love for Her FatherDocument2 pagesDaddy's Girl - A Daughter's Love for Her FatherCharmaine MagdangalNo ratings yet

- Biological Asset: Dairy Cattle A. Agricultural Produce: Milk B. by ProductsDocument2 pagesBiological Asset: Dairy Cattle A. Agricultural Produce: Milk B. by ProductsCharmaine MagdangalNo ratings yet

- Read!Document3 pagesRead!Charmaine MagdangalNo ratings yet

- Business Tax - VatDocument4 pagesBusiness Tax - VatCharmaine MagdangalNo ratings yet

- DocumentDocument1 pageDocumentCharmaine MagdangalNo ratings yet

- Fair Market Values of Bees: A. ExportsDocument3 pagesFair Market Values of Bees: A. ExportsCharmaine MagdangalNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1Angelo Otañes GasatanNo ratings yet

- ApplicationDocument2 pagesApplicationCharmaine MagdangalNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1Angelo Otañes GasatanNo ratings yet

- KWSNDDocument1 pageKWSNDCharmaine MagdangalNo ratings yet

- ReactionDocument2 pagesReactionCharmaine MagdangalNo ratings yet

- GovresDocument10 pagesGovresCharmaine MagdangalNo ratings yet

- ("Valstybės Žinios" (Official Gazette), 2004, No. 180-6694)Document5 pages("Valstybės Žinios" (Official Gazette), 2004, No. 180-6694)andihaxhillariNo ratings yet

- Biological Asset: Dairy Cattle A. Agricultural Produce: Milk B. by ProductsDocument2 pagesBiological Asset: Dairy Cattle A. Agricultural Produce: Milk B. by ProductsCharmaine MagdangalNo ratings yet

- Activity Immediate Completion Predecessors Time (Week)Document10 pagesActivity Immediate Completion Predecessors Time (Week)Charmaine MagdangalNo ratings yet

- ("Valstybės Žinios" (Official Gazette), 2004, No. 180-6694)Document5 pages("Valstybės Žinios" (Official Gazette), 2004, No. 180-6694)andihaxhillariNo ratings yet

- ReactionDocument2 pagesReactionCharmaine MagdangalNo ratings yet

- InventoryDocument53 pagesInventoryCharmaine MagdangalNo ratings yet

- Inventory ManagementDocument52 pagesInventory ManagementCharmaine Magdangal50% (2)

- Employee BenefitsDocument1 pageEmployee BenefitsCharmaine MagdangalNo ratings yet

- Hesus NazarenoDocument12 pagesHesus NazarenoCharmaine MagdangalNo ratings yet

- KN Yb 1000Document13 pagesKN Yb 1000taharNo ratings yet

- Temperarura4 PDFDocument371 pagesTemperarura4 PDFmario yanezNo ratings yet

- Mathematics T (954/1) Functions QuizDocument1 pageMathematics T (954/1) Functions QuizmasyatiNo ratings yet

- Charger Energic Plus (Catalog)Document24 pagesCharger Energic Plus (Catalog)sugar44No ratings yet

- Indicate The Answer Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIndicate The Answer Choice That Best Completes The Statement or Answers The QuestionHasan EserNo ratings yet

- Area Under The CurveDocument3 pagesArea Under The CurveReyland DumlaoNo ratings yet

- Fontargen AJ PDFDocument282 pagesFontargen AJ PDFantonyNo ratings yet

- Connection Design Steel Base Plate Bs5950 v2015 01Document4 pagesConnection Design Steel Base Plate Bs5950 v2015 01Anonymous j9PxwnoNo ratings yet

- Network Termination Unit STU4: Suppor Ting SHDSL - BisDocument2 pagesNetwork Termination Unit STU4: Suppor Ting SHDSL - BisНатальяNo ratings yet

- Explanation Text About RainbowDocument11 pagesExplanation Text About RainbowBagas FatihNo ratings yet

- Homework Lesson 6-10Document9 pagesHomework Lesson 6-10Valerie YenshawNo ratings yet

- Sisweb Sisweb Techdoc Techdoc Print Pag - pdf1Document91 pagesSisweb Sisweb Techdoc Techdoc Print Pag - pdf1MatiussChesteerNo ratings yet

- CCR Load Calculator 2014-03-13Document35 pagesCCR Load Calculator 2014-03-13Danielle FowlerNo ratings yet

- Flight Planning For ATTDocument106 pagesFlight Planning For ATTTienek Lee100% (1)

- Drive Fundamentals and DC Motor CharacteristicsDocument6 pagesDrive Fundamentals and DC Motor CharacteristicsKawooya CharlesNo ratings yet

- Dell Emc Data Domain Dd3300 Faq: Frequently Asked QuestionsDocument14 pagesDell Emc Data Domain Dd3300 Faq: Frequently Asked QuestionseriquewNo ratings yet

- Valve Selection Guide For WWTPDocument11 pagesValve Selection Guide For WWTPsf wNo ratings yet

- Survey Whole Circle BearingDocument19 pagesSurvey Whole Circle BearingVin GaragiNo ratings yet

- ST RDDocument2 pagesST RDBalteshwar SinghNo ratings yet

- Queries With TableDocument14 pagesQueries With TableAkhileshNo ratings yet

- This Study Resource Was: Titration Level 1Document4 pagesThis Study Resource Was: Titration Level 1Camaya RumbleNo ratings yet

- LRFD Design ExampleDocument698 pagesLRFD Design ExampleCesar RomeroNo ratings yet

- Probset 8Document7 pagesProbset 8Adrian PamintuanNo ratings yet

- GR/KWH, KG/HR or Tons/Month.: ScopeDocument5 pagesGR/KWH, KG/HR or Tons/Month.: ScopeThaigroup CementNo ratings yet

- NCERT Solutions For Class 8 Maths Chapter 14 - FactorizationDocument25 pagesNCERT Solutions For Class 8 Maths Chapter 14 - FactorizationSATAMANYU BHOLNo ratings yet

- UCE802 Earthquake SyllabusDocument2 pagesUCE802 Earthquake Syllabuskullu88No ratings yet

- V Single Vane Pumps: 1 - "F3" 2 - Pump TypeDocument14 pagesV Single Vane Pumps: 1 - "F3" 2 - Pump TypeJose Leandro Neves FerreiraNo ratings yet

- PQT MJ07Document6 pagesPQT MJ07Raguraman BalajiNo ratings yet

- Introduction to Nautilus 8 Mold Qualification and Design of Experiments SoftwareDocument66 pagesIntroduction to Nautilus 8 Mold Qualification and Design of Experiments SoftwareJohn SuperdetalleNo ratings yet

- Dynamic Programming Algorithm Explained in ECE 551 LectureDocument11 pagesDynamic Programming Algorithm Explained in ECE 551 Lectureadambose1990No ratings yet