Professional Documents

Culture Documents

DFGDFG

Uploaded by

Amit SaxenaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DFGDFG

Uploaded by

Amit SaxenaCopyright:

Available Formats

S No Date 1 11/4/2013 2 3 4 5 6 7 8 9 22/04/2013 22/04/2013 30/04/2013 30/04/2013 12/6/2013 11/5/2013 21/05/2013 13/06/2013

M/s Gauri`s 19,DD Puram Bareilly Tin No-09909105746 Purchase List for The Period 01-04-1013 to 30-06-2013 Goods Vat Sat Amount Amount Amount Total Party Name Tin No Bill No Item Name Code Qty G S Clothing,47/51 ist Floor 09945400891 265 Readymade 65 37529.30 1501.19 375.37 39406.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 405 Readymade 22 9571.96 382.87 95.80 10051.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 404 Readymade 93 64673.00 2586.92 646.73 67907.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 549 Readymade 62 31185.50 1247.42 311.96 32745.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 548 Readymade 105 56835.21 2273.40 568.45 59677.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 614 Readymade 45 14011.65 560.47 140.10 14712.00 Old General Ganj Kanpur Shree SSD Garments 09150030135 581 Readymade 46 25810.55 1032.42 258.11 27301.00 Lucknow Shree SSD Garments 09150030135 622 Readymade 36 24798.80 991.95 247.99 26239.00 Lucknow Rays Enterprises 09976800990 28 Readymade 60 26210.00 1048.40 262.10 27521.00 Suraj Kund Road Meerut Total M/s Gauri`s 19,DD Puram Bareilly Tin No-09909105746 Goods Amount Vat 5% 408345.00 20417.25 65215.74 14531.65 79747.39 20417.25 59330.14 290625.97 11625.04 2906.61 305559.00

Total Sales

Total 428762.25

24306 65215.74

ITC Caried for previous ITC on Purchase Total ITC Tax on Sales ITC Carried Forward

S No Date 1 23/07/2013 2 3 4 5 6 7 8 9 10 11 12 13 12/8/2013 14/08/2013 20/08/2013 30/08/2013 9/9/2013 14/09/2013 18/09/2013 28/09/2013 29/07/2013 29/07/2013 3/9/2013 3/9/2013

M/s Gauri`s 19,DD Puram Bareilly Tin No-09909105746 Purchase List for The Period 01-07-1013 to 30-09-2013 Goods Vat Sat Amount Amount Amount Total Party Name Tin No Bill No Item Name Code Qty G S Clothing,47/51 ist Floor 09945400891 685 Readymade 126 61185.66 2447.45 611.91 64245.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 860 Readymade 40 36956.03 1478.24 369.50 38804.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 894 Readymade 34 28432.64 1137.30 284.36 29854.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 955 Readymade 79 64017.12 2560.64 640.03 67217.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 1056 Readymade 61 46825.78 1873.03 468.19 49167.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 1236 Readymade 68 57027.27 2281.09 570.24 59879.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 1310 Readymade 15 13633.35 545.34 136.35 14315.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 1420 Readymade 54 46783.10 1871.34 467.77 49122.00 Old General Ganj Kanpur G S Clothing,47/51 ist Floor 09945400891 1612 Readymade 103 87925.65 3517.03 879.02 92322.00 Old General Ganj Kanpur Shree SSD Garments 09150030135 768 Readymade 83 58240.00 2329.60 582.40 61152.00 Lucknow Shree SSD Garments 09150030135 767 Readymade 72 35431.20 1417.25 354.31 37703.00 Lucknow Jai Baba Trading Co. 09472801195 3199 Readymade 6 4417.98 176.72 44.18 4639.00 Meerut Jai Baba Trading Co. 09472801195 3200 Readymade 10 8807.50 352.30 88.08 9368.00 Meerut Total 549683.28 21987.32 5496.34 577787.00 M/s Gauri`s 19,DD Puram Bareilly Tin No-09909105746 Goods Amount Vat 5% 289060.00 14453.00 59330.14 27483.66 86813.80 14453.00 72360.80

303513

Total Sales

Total 303513.00

ITC Caried for previous ITC on Purchase Total ITC Tax on Sales ITC Carried Forward

S No Date Party Name 1 9/10/2013 Jai Baba Trading Co. Meerut 2 21/10/2013 Jai Baba Trading Co. Meerut 3 11/10/2013 Rays Enterprises Suraj Kund Road Meerut 4 31/10/2013 Rays Enterprises Suraj Kund Road Meerut 5 24/12/2013 Jai Baba Trading Co. Meerut 6 12/10/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur 7 18/10/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur 8 19/10/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur 9 30/10/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur 10 9/11/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur 11 28/11/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur 12 20/12/2013 G S Clothing,47/51 ist Floor Old General Ganj Kanpur Total

M/s Gauri`s 19,DD Puram Bareilly Tin No-09909105746 Purchase List for The Period 01-10-2013 to 31-12-2013 Goods Vat Sat Amount Amount Amount Total Tin No Bill No Item Name Code Qty 09472801195 5671 Readymade 7 7257.25 290.29 72.57 7680.00 09472801195 09976800990 09976800990 09472801195 09945400891 09945400891 09945400891 09945400891 09945400891 09945400891 09945400891 6436 Readymade 114 Readymade 141 Readymade 1828 Readymade 1739 Readymade 1877 Readymade 1938 Readymade 2207 Readymade 2371 Readymade 2741 Readymade 3011 Readymade 7 28 22 10 68 14 67 33 39 29 11 7257.25 19292.00 16403.00 7631.10 57847.89 15259.07 68480.06 35046.10 46963.52 31399.87 12840.10 290.29 771.68 656.12 305.24 2313.92 610.36 2739.20 1401.84 1878.54 1255.99 513.60 72.57 192.92 164.03 76.31 578.48 152.59 684.80 350.46 469.64 314.00 128.40 7670.00 20257.00 17223.00 8013.00 60740.00 16022.00 71904.00 36798.00 49312.00 32970.00 13482.00

325677.21 13027.09

3256.77

342071.00

Total Sales

M/s Gauri`s 19,DD Puram Bareilly Tin No-09909105746 Goods Amount Vat 5% 623343.81 31167.19 72360.80 16283.86 88644.66 31167.19 57477.47

Total 654511.00

ITC Caried for previous ITC on Purchase Total ITC Tax on Sales ITC Carried Forward

2. 3. 4. 5. 6. 7. ai. ii. iii. iv. v.

Schedule B Form as here by substituted UPVAT - XXIV PAN-AQTPM8725D Department of Commercial Taxes, Government of Uttar Pradesh [See Rule-45(2) of the UPVAT Rules, 2008] Return of Tax Period -1st Quarter Assessment Year 2013-2014 Tax Period Ending on 30-09-2013 Designation of Assessing Authority Assistant Commissioner Name of Circle / Sector Sector-8 Name / address of the dealer M/s Gauri's,19,DD Puram Bareilly Taxpayer's Identification Number [TIN] 09909105746 Details of Purchase [in Rs.] VAT Goods Purchase in own a/c against tax invoice (annexure-A Part-I) Purchase in own a/c from person other than registered dealer Purchase of exempted goods Purchase from Ex.U.P. Purchase in Principal's A/c (a) U.P Principal's A/c (a-i) Purchase against tax invoice (annexure-A Part-II) (a-ii) Other purchases (b) Ex. U.P. principal Any other purchase Total Less - purchase return (annexure A-1) Net amount of purchase Non VAT Goods Purchase from registered dealers Purchase from person other than registered dealer Purchase of exempted goods Purchase from Ex.U.P. Purchase in Principal's A/c (a) U.P Principal's A/c (b) Ex. U.P Principal Any other purchase Total Less - purchase return (annexure A-1) Net amount of purchase Grand Total Capital Goods purchased from within the state Purchase against tax invoice (Annexure A-2) Purchase from person other than registered dealer Total Purchase through commission agent for which certificate in form VI has been received Sl.No. Certificate No. Date Total

549683.28 Nil 0.00 Nil Nil Nil Nil Nil 549683.28 0.00 549683.28 Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil 549683.28 Nil Nil Nil

vi. vii. viii. bi. ii. iii. iv. v. vi. vii. viii. ci ii. d-

8. Computation of tax on purchase Sl.No. VAT Goods i. ii. iii. Additional Tax Non VAT Goods vi. 17.23 Nil Rate of tax 1.00 4.00 12.50 Total(Rounded off value:) Commodity Turnover of Purchase Nil Nil Nil Nil

vii. viii. ix. x. 9. ai. ii. iii. iv.

20.00 26.55 32.50 --Total(Rounded off value:) Grand Total Details of Sale VAT Goods Turnover of sale in own a/c against tax invoice (annexure-B Part-I) Turnover of sale in own a/c other than in column -i Turnover of sale of exempted goods Sales in Principal's A/c (a) U.P Principal's A/c (a-i) Sales against tax invoice (annexure-B Part II) (a-ii) Other sales (b) Ex. U.P. principal Interstate sale against form 'C' Interstate sale without form 'C' Sale in course of export out of India Sale in course of import Sale outside state Consignment sale /Stock Transfer Any other sale Total Less - sales return (annexure B-1) Net amount of sales Non VAT Goods Taxable turnover of sale Exempted turnover of sale Tax paid turnover of goods Sale in Principal's A/c (a) U.P Principal's A/c (b) Ex. U.P Principal Any other sale Total Less - sales return (annexure B-1) Net amount of sales Grand Total Sales through commission agent for Sl.No. Certificate No. Total

Nil Nil Nil Nil Nil Nil 0.00 289060.00 0.00 Nil Nil Nil Nil Nil Nil Nil Nil Nil 289060.00 Nil 289060.00 Nil Nil Nil Nil Nil Nil Nil Nil 289060.00 Date

v. vi. vii. viii. ix. x. xi. xii xiii bi. ii. iii. iv. v. vi vii c-

10. Computation of tax on sale Sl.No. VAT Goods i. ii. iii. Additional Tax i ii iii NONVAT Goods vii. vi. vii. viii. ix. x. Rate of tax 1.00 4.00 12.50 1.00 1.50 4% (Form D) 17.23 20.00 26.55 32.50 --Commodity Sale amount Nil 289060.00 Nil 289060.00 0.00 Nil Nil Nil Nil Nil Nil

Total(Rounded off value:) [VAT and Non VAT] Grand Total 11. Installment of compounding scheme, if any 12. Amount of T.D.S. 13. Tax Payable [in rupees] i. Tax on purchase ii. Tax on sale iii. iv. T.D.S. amount 14. Detail of ITC i. ii. iii iv. ITC brought forward from previous tax period Itc Claimed During The Tax Period Adjustment Against Tax Payable ITC carried forward to the next tax period, if any

Nil 289060.00

Nil 14453.00 Nil Total Nil 14453.00

59330.14 27483.66 72360.80

15. Net Tax i. Total tax payable (serial no. 13) ii. ITC adjustment [14(iii)](a+b) iii. 16. Detail of tax deposited A- Tax deposited in Bank / Treasury Name of the Bank/ Branch State Bank of India Total B- By adjustment against adjustment vouchers Adjustment Voucher No. Total C- Total tax deposited (A+B) T.C. Number Date 14453.00 14453.00

Date

Amount of Tax

Nil In figures Nil In words Nil Annexure- 1 - Annexure A / A-1 / A-2 / B / B - 1 whichever is applicable 2 - Treasury Challan number......................./ date ........................... DECLARATION I Sandeep Maheshwari [i.e. proprietor, director, partner etc. as provided in rule-32(6)], do hereby declare and verify that, to the best of my knowledge and belief all the statements and figures given in this return are true and complete and nothing has been willfully omitted or wrongly stated. Signature: Status: Properiotor

Date: Place: Bareilly

Schedule B Form as here by substituted UPVAT - XXIV PAN-AQTPM8725D Department of Commercial Taxes, Government of Uttar Pradesh [See Rule-45(2) of the UPVAT Rules, 2008] Return of Tax Period -3rd Quarter Assessment Year 2013-2014 2. Tax Period Ending on 31-12-2013 3. Designation of Assessing Authority Assistant Commissioner

4. Name of Circle / Sector Sector-8 5. Name / address of the dealer M/s Gauri's,19,DD Puram Bareilly 6. Taxpayer's Identification Number [TIN] 09909105746 7. ai. ii. iii. iv. v. Details of Purchase [in Rs.] VAT Goods Purchase in own a/c against tax invoice (annexure-A Part-I) Purchase in own a/c from person other than registered dealer Purchase of exempted goods Purchase from Ex.U.P. Purchase in Principal's A/c (a) U.P Principal's A/c (a-i) Purchase against tax invoice (annexure-A Part-II) (a-ii) Other purchases (b) Ex. U.P. principal Any other purchase Total Less - purchase return (annexure A-1) Net amount of purchase Non VAT Goods Purchase from registered dealers Purchase from person other than registered dealer Purchase of exempted goods Purchase from Ex.U.P. Purchase in Principal's A/c (a) U.P Principal's A/c (b) Ex. U.P Principal Any other purchase Total Less - purchase return (annexure A-1) Net amount of purchase Grand Total Capital Goods purchased from within the state Purchase against tax invoice (Annexure A-2) Purchase from person other than registered dealer Total Purchase through commission agent for which certificate in form VI has been received Sl.No. Certificate No. Date

325677.21 Nil 0.00 Nil

vi. vii. viii. bi. ii. iii. iv. v.

Nil Nil Nil Nil 325677.21 0.00 325677.21 Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil 325677.21 Nil Nil Nil

vi. vii. viii. ci ii. d-

Total 8. Computation of tax on purchase Sl.No. VAT Goods i. ii. iii. Additional Tax Non VAT Goods vi. 17.23 Nil Rate of tax 1.00 4.00 12.50 Total(Rounded off value:) Commodity Turnover of Purchase Nil Nil Nil Nil

vii. viii. ix. x.

20.00 26.55 32.50 --Total(Rounded off value:) Grand Total

Nil Nil Nil Nil Nil Nil

9. ai. ii. iii. iv.

v. vi. vii. viii. ix. x. xi. xii xiii bi. ii. iii. iv.

v. vi vii c-

Details of Sale VAT Goods Turnover of sale in own a/c against tax invoice (annexure-B Part-I) Turnover of sale in own a/c other than in column -i Turnover of sale of exempted goods Sales in Principal's A/c (a) U.P Principal's A/c (a-i) Sales against tax invoice (annexure-B Part II) (a-ii) Other sales (b) Ex. U.P. principal Interstate sale against form 'C' Interstate sale without form 'C' Sale in course of export out of India Sale in course of import Sale outside state Consignment sale /Stock Transfer Any other sale Total Less - sales return (annexure B-1) Net amount of sales Non VAT Goods Taxable turnover of sale Exempted turnover of sale Tax paid turnover of goods Sale in Principal's A/c (a) U.P Principal's A/c (b) Ex. U.P Principal Any other sale Total Less - sales return (annexure B-1) Net amount of sales Grand Total Sales through commission agent for which certificate in form V has been received Sl.No. Certificate No. Total

0.00 623343.81 0.00

Nil Nil Nil Nil Nil Nil Nil Nil Nil 623343.81 Nil 623343.81 Nil Nil Nil Nil Nil Nil Nil Nil 623343.81

Date

10. Computation of tax on sale Sl.No. VAT Goods i. ii. iii. Additional Tax Rate of tax 1.00 4.00 12.50 Commodity Sale amount Nil 623343.81

i ii iii NONVAT Goods vii. vi. vii. viii. ix. x.

1.00 1.50 4% (Form D) 17.23 20.00 26.55 32.50 --Total(Rounded off value:) [VAT and Non VAT] Grand Total

Nil 623343.81 0.00 Nil Nil Nil Nil Nil Nil Nil 623343.81

11. Installment of compounding scheme, if any 12. Amount of T.D.S. 13. Tax Payable [in rupees] i. Tax on purchase ii. Tax on sale iii. iv. T.D.S. amount Nil 31167.19 Nil Total 14. Detail of ITC i. ii. iii iv. ITC brought forward from previous tax period Itc Claimed During The Tax Period Adjustment Against Tax Payable ITC carried forward to the next tax period, if any 72360.80 16283.86 57477.47 Nil 31167.19

15. Net Tax i. Total tax payable (serial no. 13) ii. ITC adjustment [14(iii)](a+b) iii. 16. Detail of tax deposited A- Tax deposited in Bank / Treasury Name of the Bank/ Branch State Bank of India Total B- By adjustment against adjustment vouchers Adjustment Voucher No. Total C- Total tax deposited (A+B) 31167.19 31167.19

T.C. Number

Date

Date

Amount of Tax

Nil In figures Nil In words Nil Annexure- 1 - Annexure A / A-1 / A-2 / B / B - 1 whichever is applicable 2 - Treasury Challan number......................./ date ........................... DECLARATION

I Sandeep Maheshwari [i.e. proprietor, director, partner etc. as provided in rule-32(6)], do hereby declare and verify that, to the best of my knowledge and belief all the statements and figures given in this return are true and complete and nothing has been willfully omitted or wrongly stated. Date: Signature: Place: Bareilly Status: Properiotor

TPM8725D

549683.28 Nil 0.00 Nil Nil Nil Nil Nil 549683.28 0.00 549683.28 Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil 549683.28 Nil Nil Nil Value of

Tax Nil Nil Nil Nil Nil

Nil Nil Nil Nil Nil Nil 0.00 289060.00 0.00 Nil Nil Nil Nil Nil Nil Nil Nil Nil 289060.00 Nil 289060.00 Nil Nil Nil Nil Nil Nil Nil Nil 289060.00 Value of

Tax Nil 11562.40 Nil 2890.60 0.00 Nil Nil Nil Nil Nil Nil

Nil 14453.00 Nil Nil

Nil 14453.00 Nil 14453.00

59330.14 27483.66 14453.00 72360.80

14453.00 14453.00 0.00

Amount of Tax 0.00 Nil

of Tax

pplicable .........................

o hereby declare ven in this return are

tor

TPM8725D

325677.21 Nil 0.00 Nil

Nil Nil Nil Nil 325677.21 0.00 325677.21 Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil 325677.21 Nil Nil Nil Value of Goods Purchased

Tax Nil Nil Nil Nil Nil

Nil Nil Nil Nil Nil Nil

0.00 623343.81 0.00

Nil Nil Nil Nil Nil Nil Nil Nil Nil 623343.81 Nil 623343.81 Nil Nil Nil Nil Nil Nil Nil Nil 623343.81

Value of Goods Sold

Tax Nil 24933.75

Nil 6233.44 0.00 Nil Nil Nil Nil Nil Nil Nil 31167.19 Nil Nil

Nil 31167.19 Nil 31167.19

72360.80 16283.86 31167.19 57477.47

31167.19 31167.19 0.00

Amount of Tax 0.00 Nil

of Tax

pplicable .........................

o hereby declare ven in this return are

tor

You might also like

- Bestseller ADocument1 pageBestseller AAmit SaxenaNo ratings yet

- Index: Specific Project No. 1Document3 pagesIndex: Specific Project No. 1Amit SaxenaNo ratings yet

- Quotation: The Manager IPE LucknowDocument1 pageQuotation: The Manager IPE LucknowAmit SaxenaNo ratings yet

- PhytoremediationDocument43 pagesPhytoremediationAmit SaxenaNo ratings yet

- Western Green Mamba: Water MoccasinDocument2 pagesWestern Green Mamba: Water MoccasinAmit SaxenaNo ratings yet

- PankajDocument1 pagePankajAmit SaxenaNo ratings yet

- Tin No. 09750018120 Megha Engineering DetailsDocument1 pageTin No. 09750018120 Megha Engineering DetailsAmit SaxenaNo ratings yet

- Rishi Kumar Agrawal: DATEDocument2 pagesRishi Kumar Agrawal: DATEAmit SaxenaNo ratings yet

- PriyaDocument1 pagePriyaAmit SaxenaNo ratings yet

- Physics Project ON Semi Conductors: Session 2014-15Document4 pagesPhysics Project ON Semi Conductors: Session 2014-15Amit SaxenaNo ratings yet

- Bestseller ADocument1 pageBestseller AAmit SaxenaNo ratings yet

- NpaDocument7 pagesNpaAmit SaxenaNo ratings yet

- Backwell: 19-A, Shahadana Colony, BareillyDocument1 pageBackwell: 19-A, Shahadana Colony, BareillyAmit SaxenaNo ratings yet

- Bob AtamDocument8 pagesBob AtamAmit SaxenaNo ratings yet

- Samsung Consumer Survey BareillyDocument3 pagesSamsung Consumer Survey BareillyAmit SaxenaNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- Questionnaire DellDocument15 pagesQuestionnaire Dellkumarrohit352100% (2)

- Report GuidelinesDocument2 pagesReport GuidelinesBhoomikaSehgalNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- Manju 10.9.14Document2 pagesManju 10.9.14Amit SaxenaNo ratings yet

- PriyaDocument1 pagePriyaAmit SaxenaNo ratings yet

- Entrepreneurship Development A4Document44 pagesEntrepreneurship Development A4paroothiNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- Manoj Bhojwani ResumeDocument1 pageManoj Bhojwani ResumeAmit SaxenaNo ratings yet

- GHJGHJDocument2 pagesGHJGHJAmit SaxenaNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- DFGDFGDocument9 pagesDFGDFGAmit SaxenaNo ratings yet

- Renewable Nonrenewable ResourcesDocument16 pagesRenewable Nonrenewable ResourcesAmit SaxenaNo ratings yet

- MS Access2007Document14 pagesMS Access2007Amit SaxenaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Release Notes Fontexplorer X Pro 3.5.3 For Windows Fontexplorer X Pro - Font Management From The Font ExpertsDocument4 pagesRelease Notes Fontexplorer X Pro 3.5.3 For Windows Fontexplorer X Pro - Font Management From The Font ExpertspomopNo ratings yet

- Standard Textile Company v. Orchard Brands Corp., DBA LinenSourceDocument10 pagesStandard Textile Company v. Orchard Brands Corp., DBA LinenSourcePatent LitigationNo ratings yet

- Murray, Divorce 1Document17 pagesMurray, Divorce 1theoarticlesNo ratings yet

- Quarterly: Sabbath School LessonDocument28 pagesQuarterly: Sabbath School LessonBrian S. MarksNo ratings yet

- MAE 308 Fluid Mechanics Lecture 9 Key ConceptsDocument21 pagesMAE 308 Fluid Mechanics Lecture 9 Key Conceptssong perezNo ratings yet

- Barrett M107a1 Military Deployment Kit FdeDocument2 pagesBarrett M107a1 Military Deployment Kit Fdeblazerman3No ratings yet

- Part Ii - Financial Performance (Steps) : Total Current AssetsDocument14 pagesPart Ii - Financial Performance (Steps) : Total Current AssetsCYRUS GLENN GUEVARRANo ratings yet

- Serrano v. Central BankDocument4 pagesSerrano v. Central BankWilfredo MolinaNo ratings yet

- Rule 110 of The Revised Criminal ProcedureDocument2 pagesRule 110 of The Revised Criminal ProcedureMohammad Shoraym CasanguanNo ratings yet

- Oedipus Court Script 2Document9 pagesOedipus Court Script 2api-248696825No ratings yet

- PC 102 WorkflowBasicsGuide enDocument272 pagesPC 102 WorkflowBasicsGuide enSANDEEP KNo ratings yet

- Management representation letter for auditDocument16 pagesManagement representation letter for auditRahul Laddha100% (1)

- Csa 1585 BCDocument3 pagesCsa 1585 BCRodolfo CabreraNo ratings yet

- Nato Past, Present, Future PDFDocument15 pagesNato Past, Present, Future PDFQuazi SaimonNo ratings yet

- The Sanctum of She'Kar v1.4Document9 pagesThe Sanctum of She'Kar v1.4Ваня РиковNo ratings yet

- App-V 5 0 Infrastructure - Installation Administration and Troubleshooting Lab Manual v11Document71 pagesApp-V 5 0 Infrastructure - Installation Administration and Troubleshooting Lab Manual v11sunildwivedi10No ratings yet

- Ringwood Manor: See AlsoDocument3 pagesRingwood Manor: See AlsoGo AwayNo ratings yet

- Vehicle Hiring Policy - CR 2021Document3 pagesVehicle Hiring Policy - CR 2021Prashant AtreNo ratings yet

- Typhoon LawinDocument2 pagesTyphoon LawinNur MNNo ratings yet

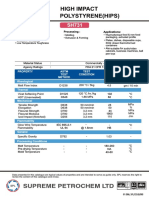

- HIPS (Supreme) Sh731Document2 pagesHIPS (Supreme) Sh731avi.singh849291No ratings yet

- Journal To Final AccountsDocument38 pagesJournal To Final Accountsguptagaurav131166100% (5)

- (Final) PI of Street Lamp Post - Yekalon JohnnyDocument2 pages(Final) PI of Street Lamp Post - Yekalon JohnnyHarold de MesaNo ratings yet

- Exercises and Answers Q1 To 4 - Ledger Account For Accruals and PrepaymentsDocument1 pageExercises and Answers Q1 To 4 - Ledger Account For Accruals and PrepaymentsNayaz EmamaulleeNo ratings yet

- Sandeep Kumar - Offer Letter PDFDocument5 pagesSandeep Kumar - Offer Letter PDFSandeep Kumar0% (1)

- ANSYS Mechanical APDL Command ReferenceDocument1,880 pagesANSYS Mechanical APDL Command ReferenceAnirudhreddy Safal100% (7)

- Lexium 32 & Motors - VW3M5103R30Document2 pagesLexium 32 & Motors - VW3M5103R30Anita IonelaNo ratings yet

- 365 SummaryDocument1 page365 SummaryS MulaNo ratings yet

- 8Document123 pages8Charmaine Reyes FabellaNo ratings yet

- Sprint Communications Company LP v. Vonage Holdings Corp., Et Al - Document No. 345Document2 pagesSprint Communications Company LP v. Vonage Holdings Corp., Et Al - Document No. 345Justia.comNo ratings yet

- Best Tennis Racquet IntermediateDocument10 pagesBest Tennis Racquet Intermediatefdg nvbNo ratings yet