Professional Documents

Culture Documents

Companies Looking at Llps As New Holding Ways

Uploaded by

Ganesh ChhetriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Companies Looking at Llps As New Holding Ways

Uploaded by

Ganesh ChhetriCopyright:

Available Formats

Companies Looking at LLPs as new holding ways

The Indian government allowed the formation of Llps in India through an Act of Parliament in 2009. While it was originally meant to enefit entrepreneurial ventures y doing away with unlimited lia ility and giving etter ta! treatment" its worth as a holding company was reali#ed over time. $everal ig usiness houses are considering holding at least a part of their sta%e in flagship companies through limited lia ility partnership &Llp' firms" see%ing oth to save ta!es and smoothen succession planning. (urrently" most Indian promoters hold sta%es in their company through a clutch of private limited firms that are lia le to pay ta!es such as the dividend distri ution ta! and minimum alternate ta!. Llp firms in India are e!empt from such ta!es" ma%ing them an attractive holding vehicle for corporate houses. )y transferring their sta%e to Llp firms" holding companies can reduce ta! lia ilities such as dividend distri ution ta! and minimum alternate ta!. Also" Llp companies can help in ma%ing the process of succession within a company smoother. *At least a do#en usiness houses have as%ed us for advice on how they could utili#e the Llp structure in the promoter group holding"+ said ,inesh -ana ar" deputy chief e!ecutive officer and chairman of ta!ation at -P./ India Pvt. Ltd. 0e refused to identify the usiness houses" citing client confidentiality. The ta! savings from adopting an Llp structure could e considera le" according to 1.(. 0egde" mergers and ac2uisitions and ta! leader at consulting firm ,eloitte Touche Tohmatsu India Pvt. Ltd. *As per the present law and factoring for different situations li%e surcharge and cess" there could e a difference of 334 in ta! rates in case of Llp" as the company has to pay surcharge and also a dividend distri ution ta!"+ The concept of Llp firms was rought to India through the enactment of the Limited Lia ility Partnership Act y Parliament in 2009. An Llp firm is defined y the ministry of corporate affairs &.(A' as an alternative usiness vehicle that provides the enefits of limited lia ility" ut allows its mem ers the fle!i ility of organi#ing the internal structure as a partnership ased on a mutual agreement. According to the .(A we site dedicated to disseminating details a out the Llp format" the structure was introduced to *ena le professional e!pertise and entrepreneurial initiative to com ine" organi#e and operate in a fle!i le manner+. 5ver time" people have reali#ed the enefits that can accrue to a company6s holding structure through Llps. Aravali Polymers" one of the holding firms of 7I0 Ltd that sold a sta%e to 8eliance Industries Ltd &8IL' on .onday" had een classified as a private limited firm on the )om ay $toc% 7!change &)$7' until the 9une 2uarter. In its announcement on .onday" Aravali Polymers was categori#ed as an Llp firm" which will help it save ta!es. In August" .u%esh Am ani:controlled 8IL re;igged its promoters6 shareholding y transferring a <=.3>4 sta%e from <2 promoter group entities to ?3 such companies.

The ac2uirer firms included 2> Llps" all of which were formed in the 9une 2uarter. The 3.0@9 illion shares transferred would e valued at 8s9>"<0?.23 crore ased on the closing price of 8IL6s shares on the )$7 on Tuesday. *Though the ta! enefits are o vious" a lot of ac%:end planning also went into the restructuring that would help smoothen out succession within the group"+ a person familiar with 8IL6s plans said. Without divulging how e!actly any future succession process would ecome easier with Llp firms holding the promoters6 sta%e" the person" who did not want to e identified" said the re;ig had een structured in such a manner that any *log;am+ at the holding firm:level" arising out of any potential dispute in the future etween successors" would not have any impact on the operational firm" which is 8IL. According to /irish Aanvari" e!ecutive director at -P./" since any transfer of shares during a succession would e seen as a transfer etween the partners of the firm" it would also e e!empt from any ta!ation. 9ayant Tha%ur" a chartered accountant at .um ai: ased 9ayant . Tha%ur and (o." said a lot of companies would loo% at the Llp holding structure although there were certain grey areas that needed clarity. *1orms such as allowing foreign investment into Llps and 8eserve )an% of India6s guidelines on Llps are still eing wor%ed out. $o there may e some issues when it comes to Llps securing an% credit or settling legal disputes in a court of law" compared with a private limited firm" where regulations are well:defined"+ said Tha%ur. As%ed if firms will continue to enefit if the government ever decided to ta! Llp firms as well to shore up its revenue ase" analysts said it wouldn6t ma%e much of a difference. *The worst that can happen is that the ta! advantages would e lost" ut it would not ma%e much difference to the ownership pattern or the way in which the company operates"+ Tha%ur said. Aanvari said ta!ing Llps at par with private limited firms would go against the government6s philosophy ehind introducing them in the first place. *The Llp form was allowed in India to help promoters conduct usiness without fear of unlimited lia ility and facilitate etter pass: through ta!ation treatment. 8eliance 8ealty is the managing partner of 8eliance 8ealty LLP. It will manage the activities of 8eliance 8ealty LLP and its usiness on ehalf of all the partners. This shall involve oth a pro;ect:specific role and an administrative role" said a note circulated to prospective investors. 8eliance (apital Asset .anagement P.$" a su sidiary of 8eliance (apital and also the investment manager to 8eliance .utual Bund" is the advisor to the realty fund. The fund was launched a few wee%s ago. CAll profits and losses would e shared in a ratio as set out in the partnership agreements and all partners have similar rights. 8eliance 8ealty LLP has an independent governance committee. The provisions pertaining to e!it mechanism forms an important part of the partnership agreement. The said e!it mechanism not only facilitates an e!it for a partner without undue restrictions" ut also ensures that the interests of other remaining partners are duly and ade2uately safeguarded"C said a 8eliance /roup spo%esperson. 0owever" the person did not disclose the amount mo ilised y the fund so far.

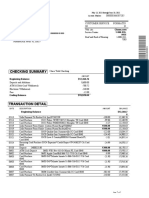

$hareholding elonging to 8ILD CPromoter and Promoter GroupC

Total Shares held

Shares pledged or otherwise encumbered

No.Name of the Shareholder 1um er

As a 4 As a 4 of of 4 of grand grand Total total 1um er total shares &A' E &A' E held &)' E &)' E &(' &(' =.? =.3> <.9< <.9< <.F@ <.F@ <.>< <.?F <.29 <.2@ 2.@3 3.F> : : : : : : : : : : : : : : : : : : : : : : : : : : : : : : : : : : : :

-an%hal Investments And Trading (ompany Private Limited

3=F"=90"9@2 3<="?3?"F33 32>"0=3">99 32>"0=3">99 32="@3="3?F 32="@3<"3?F 320"=>3"00< 33F"9>F"33< 30?"<><"0?9 30="900"0>0 F3"099"09< ?0"=09"=3F

2 )huvanesh 7nterprises Llp < A;itesh 7nterprises Llp = )adri (ommercials Llp @ A hayaprada 7nterprises Llp ? Trilo%esh (ommercials Llp Petroleum Trust &Through Trustees Bor > $ole )eneficiary:.G$ 8eliance Industrial Investments And 0oldings Ltd.' F Barm 7nterprises Limited 9 Taran 7nterprises Llp 30 Pitam ar 7nterprises Llp 33 Adisesh 7nterprises Llp 32 8ishi%esh 7nterprises Llp

3< Pavana 7nterprises Llp 3= $mt.- , Am ani 3@ $hree;i (omtrade Llp 3? $hri%rishna Tradecom Llp 3> -amala%ar 7nterprises Llp 3F 1agothane Agrofarms Private Limited 39 $hri.. , Am ani 20 $mt.1ita Am ani 23 .s.Isha . Am ani 22 .aster A%ash . Am ani 2< 8eliance Welfare Association 2= 1arahari 7nterprises Llp 2@ 8eliance Industrial Infrastructure Limited 2? .aster Anant . Am ani 2> 2F $aumya Binance And Leasing (ompany Private Limited 7!otic Investments And Trading (ompany Pvt Ltd

<@"?><"=00 >"<<3"0>= ?"?>>"@00 ?"?>>"@00 ?"<>0"03? @"?00"000 <"?3@"F=? <"<9F"3=? <"<?="<90 <"<?<"390 2"@0@"=?F ?3?"F=0 3>2"000 300"000 23"200 32"9FF @"300 2"@@0 900 F?3 F=@ ?00 <00 200 300

3.3 0.2< 0.23 0.23 0.2 0.3> 0.33 0.33 0.3 0.3 0.0F 0.02 0.03 0 0 0 0 0 0 0 0 0 0 0 0

: : : : : : : : : : : : : : : : : : : : : : : : :

: : : : : : : : : : : : : : : : : : : : : : : : :

: : : : : : : : : : : : : : : : : : : : : : : : :

29 (arat 0oldings And Trading (o Pvt Ltd <0 7%ansha 7nterprise Private Limited <3 Amudha Aenture (apital Private Limited <2 1eutron 7nterprises Private Limited << Butura (ommercials Private Limited <= 8elcom Aenture (apital Private Limited <@ ,eccan Binvest Private Limited <? 8eliance (onsultancy $ervices Private Limited

<> (ha%radev 7nterprises Llp

<F (ha%radhar (ommercials Llp <9 (ha%resh 7nterprises Llp =0 (hhatra hu; 7nterprises Llp =3 ,evarshi (ommercials Llp =2 0arinarayan 7nterprises Llp =< 9anardan (ommercials Llp == -aruna (ommercials Llp =@ $amar;it 7nterprises Llp =? $hripal 7nterprises Llp => $richa%ra (ommercials Llp =F $var 7nterprises Llp =9 $ynergy $ynthetics Private Limited @0 Tattvam 7nterprises Llp @3 Aasuprada 7nterprises Llp @2 Aishatan 7nterprises Llp Total

300 300 300 300 300 300 300 300 300 300 300 300 300 300 300

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

: : : : : : : : : : : : : : : :

: : : : : : : : : : : : : : : :

: : : : : : : : : : : : : : : :

3"=?<"9?3"9>> =@.<3

You might also like

- Chapter 3:-Forms of Business OrganizationDocument7 pagesChapter 3:-Forms of Business OrganizationErnee ZolkafleNo ratings yet

- Topic 1. Bahaya MataDocument18 pagesTopic 1. Bahaya MatadmegahNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- 6 Types of CompaniesDocument4 pages6 Types of CompaniesPankaj TaleleNo ratings yet

- Assignment Business LawDocument14 pagesAssignment Business LawOriyomiNo ratings yet

- Model Questions&Answers POMDocument160 pagesModel Questions&Answers POMkakka22No ratings yet

- Types of Business Entities in IndiaDocument5 pagesTypes of Business Entities in IndiaAdeem AshrafiNo ratings yet

- TCS Corporate Finance AnalysisDocument14 pagesTCS Corporate Finance AnalysisDivam AroraNo ratings yet

- South Korea's corporate law systemDocument8 pagesSouth Korea's corporate law systemManuel Valdés GarcíaNo ratings yet

- Acknowledgement: Shukla, RPEC Sec 78 Mohali For Allowing Me To Undergo Training at Karvy StockDocument52 pagesAcknowledgement: Shukla, RPEC Sec 78 Mohali For Allowing Me To Undergo Training at Karvy StockPreet JosanNo ratings yet

- Screenshot 2023-12-19 at 14.31.57Document27 pagesScreenshot 2023-12-19 at 14.31.579mxkkyqnhrNo ratings yet

- Corporate governance models and theories exploredDocument27 pagesCorporate governance models and theories exploredindependent_girl@ymailNo ratings yet

- Review of Literature: Author Info Arnoudwaboot Anjan V ThakorDocument9 pagesReview of Literature: Author Info Arnoudwaboot Anjan V ThakorAnonymous nTxB1EPvNo ratings yet

- Shell Companies Final DraftDocument17 pagesShell Companies Final DraftRitwik PrakashNo ratings yet

- Running Head: Business Management TechniquesDocument37 pagesRunning Head: Business Management TechniquesRajshekhar BoseNo ratings yet

- SMU Law Corporate Law Reading List W11Document4 pagesSMU Law Corporate Law Reading List W11gohweixueNo ratings yet

- Ratios Made Simple: A beginner's guide to the key financial ratiosFrom EverandRatios Made Simple: A beginner's guide to the key financial ratiosRating: 4 out of 5 stars4/5 (5)

- Name and Address of CompanyDocument19 pagesName and Address of CompanyDinesh AilaniNo ratings yet

- How the new Act protects investors in the marketDocument9 pagesHow the new Act protects investors in the marketAshutosh MishraNo ratings yet

- Archives: Case AnalysisDocument4 pagesArchives: Case Analysissushant_shaantNo ratings yet

- Assignment - CG & BEDocument4 pagesAssignment - CG & BErajesh laddhaNo ratings yet

- Objective of The StudyDocument68 pagesObjective of The StudyArchie SrivastavaNo ratings yet

- Governance Failure at SatyamDocument19 pagesGovernance Failure at SatyamAnil KardamNo ratings yet

- Swot Analysis of Tata Motor'sDocument17 pagesSwot Analysis of Tata Motor'sSourav Ssingh0% (1)

- Calendar of Events: The Copies of Replies Made To IRDA Attached Along WithDocument5 pagesCalendar of Events: The Copies of Replies Made To IRDA Attached Along WithTarun Kumar SinghNo ratings yet

- Law LLP PaperDocument6 pagesLaw LLP PaperGaurav ChopraNo ratings yet

- Overview On The TATA Motors SubsidiariesDocument52 pagesOverview On The TATA Motors SubsidiariesvaishalikatkadeNo ratings yet

- The Indian Company's Act 2013 PDFDocument9 pagesThe Indian Company's Act 2013 PDFAnwesha GhoshNo ratings yet

- Company LawDocument45 pagesCompany Lawshaikhnazneen100% (1)

- 77THRHR38Document16 pages77THRHR38caltonmupandeNo ratings yet

- Managing Financial Resources & DecisionsDocument23 pagesManaging Financial Resources & DecisionsShaji Viswanathan. Mcom, MBA (U.K)No ratings yet

- Partnership LawDocument24 pagesPartnership LawNoorhidayah Sunarti100% (1)

- Glasnost in the Indian EconomyDocument7 pagesGlasnost in the Indian EconomyShashi Bhushan SonbhadraNo ratings yet

- Company lawDocument20 pagesCompany lawHimanshu mishraNo ratings yet

- Corporate FinanceDocument20 pagesCorporate FinanceNeha JainNo ratings yet

- Bharti Mobile - 2Document76 pagesBharti Mobile - 2Prabhat SharmaNo ratings yet

- Seminar 03Document5 pagesSeminar 03Lenuța PapucNo ratings yet

- Article 56 of The Adopted Model Articles For Private Companies Provide That All Shares Should Be Fully Paid UpDocument6 pagesArticle 56 of The Adopted Model Articles For Private Companies Provide That All Shares Should Be Fully Paid UpDanielNo ratings yet

- The Bse (Corporatisation and Demutualisation) SCHEME, 2005 Logo Stock ExchangeDocument28 pagesThe Bse (Corporatisation and Demutualisation) SCHEME, 2005 Logo Stock ExchangeBhavesh YadavNo ratings yet

- HGCY) DaewooPresentationDocument37 pagesHGCY) DaewooPresentationNishad PatilNo ratings yet

- Limited Liability Partnership As A Better Alternative To IncorporationDocument16 pagesLimited Liability Partnership As A Better Alternative To IncorporationruchitssNo ratings yet

- Creating A Business PlanDocument19 pagesCreating A Business PlanJosephinDynaNo ratings yet

- Limited Liability Partnership - FAQDocument14 pagesLimited Liability Partnership - FAQtarun.mitra1985492350% (2)

- CODE:BBA 1004: November Semester 2011Document36 pagesCODE:BBA 1004: November Semester 2011Happii MikoNo ratings yet

- Environmental RegulationsDocument33 pagesEnvironmental RegulationsNarinder AhujaNo ratings yet

- (Industrial Management) Forms of Business Organization: DR Akash AgarwalDocument21 pages(Industrial Management) Forms of Business Organization: DR Akash AgarwalANKIT TIWARINo ratings yet

- Chapter Two Small Business ManagementDocument19 pagesChapter Two Small Business ManagementhashmudeNo ratings yet

- company law semesterDocument31 pagescompany law semestersparsh kaushalNo ratings yet

- Project KMMLDocument95 pagesProject KMMLJijo ThomasNo ratings yet

- Religare Company ProfileDocument2 pagesReligare Company ProfilerevathisudhaNo ratings yet

- Project On Insurance SectorDocument73 pagesProject On Insurance SectorAamir KhanNo ratings yet

- Limited Liability Partnership (LLP) : An: Alternative Form of Business Introduced in PakistanDocument4 pagesLimited Liability Partnership (LLP) : An: Alternative Form of Business Introduced in PakistanSadaf Ashraf KhanNo ratings yet

- Business: Jump ToDocument10 pagesBusiness: Jump ToRakesh ThoutamNo ratings yet

- Thesis Ratio AnalysisDocument8 pagesThesis Ratio Analysisclaudiabrowndurham100% (2)

- Companies Act and Patent Application StepsDocument9 pagesCompanies Act and Patent Application StepsDevraj Singh ShekhawatNo ratings yet

- D86e1tectura NoticeDocument4 pagesD86e1tectura NoticeGanesh ChhetriNo ratings yet

- Innovative Retention Methods in Longitudinal Research: A Case Study of The Developmental Trends StudyDocument14 pagesInnovative Retention Methods in Longitudinal Research: A Case Study of The Developmental Trends StudyGanesh ChhetriNo ratings yet

- Energy Brent Crude OilDocument2 pagesEnergy Brent Crude OilGanesh ChhetriNo ratings yet

- MPPSC State Service Exam Result 2018Document20 pagesMPPSC State Service Exam Result 2018TopRankersNo ratings yet

- Classroom StudentDocument37 pagesClassroom StudentGanesh ChhetriNo ratings yet

- Amity Business SchoolDocument3 pagesAmity Business SchoolTarang MaheshwariNo ratings yet

- Personal Data Form: Educational QualificationDocument5 pagesPersonal Data Form: Educational QualificationGanesh ChhetriNo ratings yet

- A6704final Placement CapitalViaDocument3 pagesA6704final Placement CapitalViaGanesh ChhetriNo ratings yet

- A6704final Placement CapitalViaDocument3 pagesA6704final Placement CapitalViaGanesh ChhetriNo ratings yet

- HRD Key Organisational Processes in A Knowledge EconomyDocument25 pagesHRD Key Organisational Processes in A Knowledge EconomyNasir MuhammadNo ratings yet

- 1254201461208378Document3 pages1254201461208378Ganesh ChhetriNo ratings yet

- Basics of Quantum MechanicsDocument43 pagesBasics of Quantum MechanicsIvan MishelNo ratings yet

- Amity Business SchoolDocument3 pagesAmity Business SchoolTarang MaheshwariNo ratings yet

- 1197Document64 pages1197Ganesh ChhetriNo ratings yet

- 048a6calendar of Events-2014-15 (Updated)Document2 pages048a6calendar of Events-2014-15 (Updated)Ganesh ChhetriNo ratings yet

- Fa7b5Orientation Programme MBA SPL MBA Class of 2014.Doc-FDocument2 pagesFa7b5Orientation Programme MBA SPL MBA Class of 2014.Doc-FAbhishekThakranNo ratings yet

- Shell InoDocument13 pagesShell Inoericdravenll6427No ratings yet

- HR Roles Effectiveness and HR Contributions Effectiveness: Comparing Evidence From HR and Line ManagersDocument6 pagesHR Roles Effectiveness and HR Contributions Effectiveness: Comparing Evidence From HR and Line ManagersGanesh ChhetriNo ratings yet

- Trailer 002Document30 pagesTrailer 002Ganesh ChhetriNo ratings yet

- Virus Behavior Under Win NT PDFDocument10 pagesVirus Behavior Under Win NT PDFGanesh ChhetriNo ratings yet

- Svetlana Boym - Nostalgia and Its DicontentsDocument12 pagesSvetlana Boym - Nostalgia and Its DicontentsChiara Zwicky SarkozyNo ratings yet

- Computer Viruses - From An Annoyance To A Serious Threat: White Paper September 2001Document30 pagesComputer Viruses - From An Annoyance To A Serious Threat: White Paper September 2001Ganesh ChhetriNo ratings yet

- UCM263366Document43 pagesUCM263366Ryan DuffyNo ratings yet

- Trailer 002Document30 pagesTrailer 002Ganesh ChhetriNo ratings yet

- How To Perform A One-Way ANOVA in SPSSDocument8 pagesHow To Perform A One-Way ANOVA in SPSSSwamy RakeshNo ratings yet

- Sig 2 TailedDocument1 pageSig 2 TailedVânia ParreiraNo ratings yet

- A Study On Employees' Perception Towards Compensation Management System in Selected Branches of Sbi of Ujjain DistrictDocument4 pagesA Study On Employees' Perception Towards Compensation Management System in Selected Branches of Sbi of Ujjain DistrictGanesh ChhetriNo ratings yet

- Employee Attitude Survey-SafDocument2 pagesEmployee Attitude Survey-Safpardhu_scribdNo ratings yet

- Intex FinalDocument53 pagesIntex FinalGanesh ChhetriNo ratings yet

- Awtc RT CurDocument15 pagesAwtc RT CurGanesh ChhetriNo ratings yet

- Money: Money Is Any Object That Is Generally Accepted As Payment For Goods and Services and Repayment ofDocument50 pagesMoney: Money Is Any Object That Is Generally Accepted As Payment For Goods and Services and Repayment ofChetan Ganesh RautNo ratings yet

- McKinsey On Marketing Organizing For CRMDocument7 pagesMcKinsey On Marketing Organizing For CRML'HassaniNo ratings yet

- Commercial Law New (Updated)Document95 pagesCommercial Law New (Updated)Ahmad Hamed AsekzayNo ratings yet

- King Abdul Aziz University: IE 255 Engineering EconomyDocument11 pagesKing Abdul Aziz University: IE 255 Engineering EconomyJomana JomanaNo ratings yet

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiNo ratings yet

- MITS5001 Project Management Case StudyDocument6 pagesMITS5001 Project Management Case Studymadan GaireNo ratings yet

- Case Study On Citizens' Band RadioDocument7 pagesCase Study On Citizens' Band RadioরাসেলআহমেদNo ratings yet

- Kingfisher CaseDocument6 pagesKingfisher CaseAditi SoniNo ratings yet

- Human Resource Management: Unit - IDocument6 pagesHuman Resource Management: Unit - IpavanstvpgNo ratings yet

- Estado Bancario ChaseDocument2 pagesEstado Bancario ChasePedro Ant. Núñez Ulloa100% (1)

- Questionnaire On Influence of Role of Packaging On ConsumerDocument5 pagesQuestionnaire On Influence of Role of Packaging On ConsumerMicheal Jones85% (13)

- Comparative Study On Consumer Preference of Domestic Companys and MNCs Selected FMCG GoodsDocument9 pagesComparative Study On Consumer Preference of Domestic Companys and MNCs Selected FMCG GoodsarcherselevatorsNo ratings yet

- Overview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallDocument20 pagesOverview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallCharles MK ChanNo ratings yet

- Squash StickDocument56 pagesSquash StickDanah Jane GarciaNo ratings yet

- mgmt09 Tif08Document30 pagesmgmt09 Tif08Sishi WangNo ratings yet

- of OlayDocument14 pagesof OlaySneha KhapardeNo ratings yet

- Introduction to Accounting EquationDocument1 pageIntroduction to Accounting Equationcons theNo ratings yet

- Reactions of Capital Markets To Financial ReportingDocument25 pagesReactions of Capital Markets To Financial ReportingnarmadaNo ratings yet

- Indian Securities Market ReviewDocument221 pagesIndian Securities Market ReviewSunil Suppannavar100% (1)

- Comparative Analysis of Marketing Strategies in Financial ServicesDocument69 pagesComparative Analysis of Marketing Strategies in Financial ServicesSanjana BansodeNo ratings yet

- EUR Statement: Account Holder Iban Bank Code (SWIFT/BIC)Document3 pagesEUR Statement: Account Holder Iban Bank Code (SWIFT/BIC)jahan najahNo ratings yet

- SBR Open TuitionDocument162 pagesSBR Open TuitionpatrikosNo ratings yet

- ISM - PrimarkDocument17 pagesISM - PrimarkRatri Ika PratiwiNo ratings yet

- Question Paper Mba 2018Document15 pagesQuestion Paper Mba 2018Karan Veer SinghNo ratings yet

- Cash Receipt Cycle: Step Business Activity Embedded Control Forms Risk InformationDocument10 pagesCash Receipt Cycle: Step Business Activity Embedded Control Forms Risk InformationJudy Ann EstradaNo ratings yet

- Barriers To Entry: Resilience in The Supply ChainDocument3 pagesBarriers To Entry: Resilience in The Supply ChainAbril GullesNo ratings yet

- Budget LineDocument6 pagesBudget Linegyan|_vermaNo ratings yet

- IKEA PresentationDocument20 pagesIKEA PresentationAvinash2458No ratings yet

- Tax Deductions and DDT for CompaniesDocument23 pagesTax Deductions and DDT for Companieskarishmapatel93No ratings yet

- Presentation CoinTech2u EnglishDocument15 pagesPresentation CoinTech2u EnglishbellatanamasNo ratings yet