Professional Documents

Culture Documents

SOX

Uploaded by

Anjani DantuluriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SOX

Uploaded by

Anjani DantuluriCopyright:

Available Formats

From my perspective, the Sarbanes Oxley act is successful abiding with its standards.

This act has achieved the protection of public from celestial scandals which would have been took place if this act was not set and enforced. This law sets the standards for the public companies which acknowledges the liability and accountability to investors. The SOX is been successful in closing up the loopholes in the prior law, Securities act of 1933. The act of 1933 mainly focuses on the protection of investors from public companies with respect to fraud, misrepresentation, financial transactions etc. Under 1933 act the limitations of putting the standards to small public companies has generated these historical scandals, World Coms and Enron. However the major impact of these scandals have forced the Congress officials to introduce SOX act to keep public investors safe and secure. Even though the private companies are exempt from SOX act, these private companies are encouraged to absorb the SOX act to bench mark their companies standards to the public companies in order to keep themselves competitive. Above all, SOX creates a new generation of benchmark ethical standards and corporate culture. Moreover, this act have succeeded in ensuring the protection of investors through a flexible set of rules. World Coms and Enron are similar in cases: Both companies have committed securities fraud These companies have not followed the ethical standards These companies have fallen down because of their respective CEO and CFO decisions. World Coms and Enron have took advantage of the complex rules under the accounting laws.

World Coms and Enron are different in cases: World Coms is mostly have failed due the top level management decisions to increase revenue however Enron was failed because of its management self-interest for profits.

Taking a Look at a Sarbanes-Oxley Overview

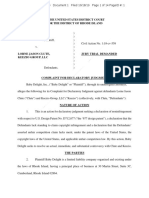

In response to a loss of confidence among American investors reminiscent of the Great Depression, President George W. Bush signed the Sarbanes-Oxley Act into law on July 30, 2002. SOX, as the law was quickly dubbed, is intended to ensure the reliability of publicly reported financial information and bolster confidence in U.S. capital markets. SOX contains expansive duties and penalties for corporate boards, executives, directors, auditors, attorneys, and securities analysts. Although most of SOX's provisions are mandatory only for public companies that file a Form 10-K with the Securities and Exchange Commission (SEC), many private and nonprofit companies are facing market pressures to conform to the SOX standards. Privately held companies that fail to reasonably adopt SOX-type governance and internal control structures may face increased difficulty in raising capital, higher insurance premiums, greater civil liability, and a loss of status among potential customers, investors, and donors.

The politics of SOX

SOX passed through both houses of Congress on a wave of bipartisan political support not unlike that which accompanied the passage of the U.S. Patriot Act after the terrorist attacks of 2001. Public shock greased the wheels of the political process. Congress needed to respond decisively to the Enron media fallout, a lagging stock market, and looming reelections. SOX passed in the Senate 99 0 and cleared the House with only three dissenting votes. Because political support for SOX was overwhelming, the legislation was not thoroughly debated. Thus, many SOX provisions weren't painstakingly vetted and have since been questioned, delayed, or slated for modification. For the past 70 years, U.S. securities laws have required regular reporting of results of a company's financial status and operations. SOX now focuses on the accuracy of what's reported and the reliability of the information-gathering processes. After SOX, companies must implement internal controls and processes that ensure the accuracy of reported results. Prior to SOX, the Securities Act of 1933 was the dominant regulatory mechanism. The 1933 Act requires that investors receive relevant financial information on securities being offered for public sale, and it prohibits deceit, misrepresentations, and other fraud in the sale of securities. The SEC enforces the 1933 Act requiring corporations to register stock and securities they offer to the public. The registration forms contain financial statements and other disclosures to enable investors to make informed judgments in purchasing securities. The SEC requires that the information companies provide be accurate and certified by independent accountants. A loophole under prior law SOX provides that publicly traded corporations of all sizes must meet its requirements. However, not all securities offerings must be registered with the SEC. Some exemptions from the registration requirement include:

Private offerings to a limited number of persons or institutions Offerings of limited size Intrastate offerings Securities of municipal, state, and federal governments

The SEC exempts these small offerings to help smaller companies acquire capital more easily by lowering the cost of offering securities to the public. In contrast, SOX provides that publicly traded corporations of all sizes must meet certain specific requirements depending on the size of the corporation. New ammunition for aggrieved investors SOX now gives public companies specific directives as to how financial information offered to the public must be compiled, yet, it stops short of giving investors a right to sue companies privately for failing to meet these standards. Rather, with the exception of SOX Section 306 (dealing with stock trading during pension fund blackout periods), investors must wait for the SEC and Justice Department to bring actions against companies for SOX violations. Investors can't hire their own lawyers to initiate action on their behalf. Although there's no "private right" to sue directly under SOX, shareholders and litigants are in a much stronger position after SOX than under the old federal and state statutes. Prior to SOX, federal and state laws didn't establish

specific standards for corporations in compiling the information they fed to the public in their financial reports. In the event that investors were damaged or defrauded, the investors themselves were responsible for persuading judges the information they had received wasn't truthful or accurate, without reference to any specific standards. Aggrieved investors had only an amorphous body of analogous facts from prior court cases to try to convince courts to apply their specific situation. Now plaintiffs may strengthen their claims and arguments by referencing the standards set forth in SOX.

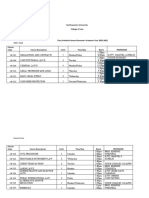

You might also like

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- Sox 2002Document2 pagesSox 2002commoNo ratings yet

- ROLF Efficiency of SECDocument16 pagesROLF Efficiency of SECSandeep SinghNo ratings yet

- Ans:-The Determinants of Structure of Financial Markets AreDocument3 pagesAns:-The Determinants of Structure of Financial Markets Aresajeev georgeNo ratings yet

- Akshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleDocument27 pagesAkshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleBhavya KapoorNo ratings yet

- Securities and Exchange Commission: Sarbanes-Oxley ActDocument10 pagesSecurities and Exchange Commission: Sarbanes-Oxley ActLedayl MaralitNo ratings yet

- Mutual Fund: Securities Exchange Act of 1934Document2 pagesMutual Fund: Securities Exchange Act of 1934Vienvenido DalaguitNo ratings yet

- Basic Facts of Sox LawDocument2 pagesBasic Facts of Sox LawnamuNo ratings yet

- Three Models of Financial RegulationDocument16 pagesThree Models of Financial RegulationRamjunum RandhirsinghNo ratings yet

- 10 - SoxDocument2 pages10 - Soxreina maica terradoNo ratings yet

- VCPEFdeskbook - SecuritiesLawOverview (Morgan Lewis)Document6 pagesVCPEFdeskbook - SecuritiesLawOverview (Morgan Lewis)pyrosriderNo ratings yet

- SEC Regulations and Philippine Securities LawsDocument9 pagesSEC Regulations and Philippine Securities LawsMarie Frances SaysonNo ratings yet

- Lesson 1 Governance Additional NotesDocument6 pagesLesson 1 Governance Additional NotesCarmela Tuquib RebundasNo ratings yet

- Securities Law-An Introduction and OverviewDocument6 pagesSecurities Law-An Introduction and Overviewmuneebmateen01No ratings yet

- 1615 H Street NW - Washington, DC - 20062Document12 pages1615 H Street NW - Washington, DC - 20062api-249785899No ratings yet

- Good Governance and Social ResponsibilityDocument5 pagesGood Governance and Social ResponsibilityjustjadeNo ratings yet

- The Times They Are A-Changin': What Does The JOBS Act Mean For Theater and Film Producers?Document4 pagesThe Times They Are A-Changin': What Does The JOBS Act Mean For Theater and Film Producers?securitiesattnyNo ratings yet

- Ass 2Document5 pagesAss 2albert cumabigNo ratings yet

- SEC Crowdfunding Rulemaking Under The JOBS Act - An Opportunity Lost S GuzikDocument29 pagesSEC Crowdfunding Rulemaking Under The JOBS Act - An Opportunity Lost S GuzikCrowdfundInsiderNo ratings yet

- Crowdfunding Regulation SummaryDocument25 pagesCrowdfunding Regulation SummaryAnonymous ukqEbKTNo ratings yet

- UntitledDocument4 pagesUntitledapi-249785899No ratings yet

- Chapter 1Document3 pagesChapter 1Douglas SlainNo ratings yet

- Chapter 12 IMSMDocument19 pagesChapter 12 IMSMZachary Thomas CarneyNo ratings yet

- Coase Versus The CoasiansDocument48 pagesCoase Versus The CoasiansGabyNo ratings yet

- BIP 390 Investment Banking RegulationsDocument38 pagesBIP 390 Investment Banking RegulationsDuc Bui100% (2)

- Anticipative and Statistical Analysis of Insider TradingDocument5 pagesAnticipative and Statistical Analysis of Insider TradingRahull DandotiyaNo ratings yet

- Frequently Asked Questions About Initial Public OfferingsDocument35 pagesFrequently Asked Questions About Initial Public Offeringsniaz_ahmed27No ratings yet

- Guide To SEC Registration of Hedge FundsDocument19 pagesGuide To SEC Registration of Hedge FundsSEC Compliance Consultants100% (3)

- Two Systems For Corporate Governance v04.00Document11 pagesTwo Systems For Corporate Governance v04.00preethamdNo ratings yet

- Sarbanes Oxley ActDocument3 pagesSarbanes Oxley ActRomnick PascuaNo ratings yet

- Coase Vs CoasiansDocument47 pagesCoase Vs CoasiansDiogo AugustoNo ratings yet

- Nvestor Rotection in The Hilippines: by Pranjal MehtaDocument28 pagesNvestor Rotection in The Hilippines: by Pranjal MehtaAnurag DashNo ratings yet

- Classic Securities RegulationDocument58 pagesClassic Securities RegulationhstansNo ratings yet

- AGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and StockholdersDocument65 pagesAGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and Stockholdersrachellesg75% (12)

- Chap 012Document20 pagesChap 012Hemali MehtaNo ratings yet

- The Contemporary World: Chomsky and The Media, Teams Up With Co-Director Jennifer Abbott and WriterDocument4 pagesThe Contemporary World: Chomsky and The Media, Teams Up With Co-Director Jennifer Abbott and WriterJasmine Gonzaga MangonNo ratings yet

- Corporate America and SarbanesDocument2 pagesCorporate America and SarbanesMohammad Nowaiser MaruhomNo ratings yet

- Assignment On Sarbanes Oaxley Act 10Document5 pagesAssignment On Sarbanes Oaxley Act 10Haris MunirNo ratings yet

- Assignment On Sarbanes Oaxley Act 2Document4 pagesAssignment On Sarbanes Oaxley Act 2Haris MunirNo ratings yet

- Exit Liquidity and Majority Rule Appraisals Role in Corporate LawDocument45 pagesExit Liquidity and Majority Rule Appraisals Role in Corporate Lawashwin1596No ratings yet

- US Tax Classification of TrustsDocument21 pagesUS Tax Classification of TrustsKinnari CoketaNo ratings yet

- Accounting Ethics - The Sarbanes-Oxley Act (Sox)Document1 pageAccounting Ethics - The Sarbanes-Oxley Act (Sox)sadwi fitryNo ratings yet

- Financial Reporting and The Securities and Exchange CommissionDocument18 pagesFinancial Reporting and The Securities and Exchange CommissionJordan YoungNo ratings yet

- Hedge Funds and Private Equity FundsDocument13 pagesHedge Funds and Private Equity FundsMarketsWikiNo ratings yet

- Oxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesDocument21 pagesOxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesposttoamitNo ratings yet

- 1615 H Street NW - Washington, DC - 20062Document11 pages1615 H Street NW - Washington, DC - 20062api-249785899No ratings yet

- Chap 8 SolutionsDocument8 pagesChap 8 SolutionsMiftahudin MiftahudinNo ratings yet

- Fulltext StampedDocument28 pagesFulltext StampedGanchimeg TaivanbaatarNo ratings yet

- Sarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingDocument4 pagesSarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingRavi MarwahNo ratings yet

- Case StudyDocument17 pagesCase StudyAmit RajoriaNo ratings yet

- Understanding Dodd-Frank Wall Street Reform ActDocument3 pagesUnderstanding Dodd-Frank Wall Street Reform ActCL AhNo ratings yet

- United States Securities RegulationDocument14 pagesUnited States Securities RegulationAntonia AmpireNo ratings yet

- Piercing the Corporate Veil in the UAEDocument12 pagesPiercing the Corporate Veil in the UAEWINFRED NYOKABINo ratings yet

- Petition For Rule Making - Committee On Disclosure of Corporate Political SpendingDocument11 pagesPetition For Rule Making - Committee On Disclosure of Corporate Political SpendingVanessa SchoenthalerNo ratings yet

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- CrowdEngine Scott Anderson WebinarDocument6 pagesCrowdEngine Scott Anderson WebinarCrowdFunding BeatNo ratings yet

- Corporate LawDocument12 pagesCorporate LawWINFRED NYOKABINo ratings yet

- Going Public - DIY IPO'sDocument6 pagesGoing Public - DIY IPO'sThomas HoyNo ratings yet

- What Is SOX Compliance - 2021 Requirements, Controls and More UpGuardDocument15 pagesWhat Is SOX Compliance - 2021 Requirements, Controls and More UpGuardNicole Romero EspínolaNo ratings yet

- ImmigrantsDocument2 pagesImmigrantsAnjani DantuluriNo ratings yet

- Term PaperDocument3 pagesTerm PaperAnjani DantuluriNo ratings yet

- Case Brief 3Document3 pagesCase Brief 3Anjani DantuluriNo ratings yet

- Syllabus Evening (1) English SyllabusDocument1 pageSyllabus Evening (1) English SyllabusAnjani DantuluriNo ratings yet

- Market SegmentDocument21 pagesMarket SegmentAnjani DantuluriNo ratings yet

- Carr Question Page 130Document1 pageCarr Question Page 130Anjani DantuluriNo ratings yet

- PTA Skeleton ArgumentDocument20 pagesPTA Skeleton ArgumentPeteNo ratings yet

- Ensuring Good Moral Character in the Legal ProfessionDocument5 pagesEnsuring Good Moral Character in the Legal ProfessionCloieRjNo ratings yet

- Abella Vs ComelecDocument4 pagesAbella Vs Comelecsamantha.tirthdas2758100% (1)

- Northwestern University College of LawDocument5 pagesNorthwestern University College of LawNorma ArquilloNo ratings yet

- CLEA Moot, 2016 - Best Memo - RespondentDocument43 pagesCLEA Moot, 2016 - Best Memo - RespondentAmol Mehta100% (2)

- CA-G.R. SP Nos. 70014 and 104604 DECISIONDocument68 pagesCA-G.R. SP Nos. 70014 and 104604 DECISIONBLP Cooperative90% (20)

- Glassmann v. City of Walker - Document No. 3Document1 pageGlassmann v. City of Walker - Document No. 3Justia.comNo ratings yet

- AFCC Court Cancer Metastacizes: A Guide To Destroying ChildrenDocument10 pagesAFCC Court Cancer Metastacizes: A Guide To Destroying ChildrenJournalistABC100% (3)

- Right of LegationDocument1 pageRight of LegationBrian DuelaNo ratings yet

- Discuss About Vienna Convention On Sale of GoodsDocument4 pagesDiscuss About Vienna Convention On Sale of GoodsMITHUN.U ReddyNo ratings yet

- Manila Doctors College v. Emmanuel M. Olores Case on Reinstatement BackwagesDocument1 pageManila Doctors College v. Emmanuel M. Olores Case on Reinstatement BackwagesLara CacalNo ratings yet

- Introduction to India's Constitution: Key HighlightsDocument58 pagesIntroduction to India's Constitution: Key HighlightsSonali PatilNo ratings yet

- R.A. No. 10022Document47 pagesR.A. No. 10022Sonny MorilloNo ratings yet

- 365 Final Case PDFDocument5 pages365 Final Case PDFBrettNo ratings yet

- EthicsDocument192 pagesEthicsJay P. CuevasNo ratings yet

- Henderson Franklin Welcomes Intellectual Property Expert Edward Livingston and Expands Services To SarasotaDocument0 pagesHenderson Franklin Welcomes Intellectual Property Expert Edward Livingston and Expands Services To SarasotaPR.comNo ratings yet

- Equitable Savings Bank v. PalcesDocument2 pagesEquitable Savings Bank v. PalcesHezroNo ratings yet

- Baby Delight v. Clute - ComplaintDocument16 pagesBaby Delight v. Clute - ComplaintSarah BursteinNo ratings yet

- Dr Batiquin Liability for Rubber Glove Piece in PatientDocument1 pageDr Batiquin Liability for Rubber Glove Piece in PatientLang Banac LimoconNo ratings yet

- Clarence Briggs BankruptcyDocument76 pagesClarence Briggs Bankruptcytom cleary100% (1)

- Regional Trial Court: People of The PhilippinesDocument4 pagesRegional Trial Court: People of The PhilippinesEzra Denise Lubong RamelNo ratings yet

- In Re Ms55, Inc., Debtor. Jeffrey Hill, Trustee v. Akamai Technologies, Inc., A Delaware Corporation, 477 F.3d 1131, 10th Cir. (2007)Document12 pagesIn Re Ms55, Inc., Debtor. Jeffrey Hill, Trustee v. Akamai Technologies, Inc., A Delaware Corporation, 477 F.3d 1131, 10th Cir. (2007)Scribd Government DocsNo ratings yet

- Metrobank/UCPB v. SLGT, Dylanco, ASB Devt (GR 175181): Mortgage Nullity Does Not Extend to Entire BuildingDocument1 pageMetrobank/UCPB v. SLGT, Dylanco, ASB Devt (GR 175181): Mortgage Nullity Does Not Extend to Entire BuildingAlyanna BarreNo ratings yet

- Traumatic Realism The Demands of Holocaust RepresentationDocument16 pagesTraumatic Realism The Demands of Holocaust RepresentationabijosNo ratings yet

- PLUNDERDocument10 pagesPLUNDERManilyn Beronia PasciolesNo ratings yet

- Agency AgreementDocument2 pagesAgency Agreementchetanfin100% (1)

- Pablito Murao Vs People of The PhilippinesDocument10 pagesPablito Murao Vs People of The Philippinesrgomez_940509No ratings yet

- Constitutional Law AssignmentDocument6 pagesConstitutional Law AssignmentKaran KapoorNo ratings yet

- #PFR Syllabus Dean Mawis 2023-24Document61 pages#PFR Syllabus Dean Mawis 2023-24Dianalyn QuitebesNo ratings yet

- CA Affirms RTC Ruling Ordering Petitioners to Vacate Property and Restore Possession to Legal HeirsDocument7 pagesCA Affirms RTC Ruling Ordering Petitioners to Vacate Property and Restore Possession to Legal HeirsReese PeraltaNo ratings yet