Professional Documents

Culture Documents

ACCFA v. Alpha Insurance and Surety Co., Inc., 24 SCRA 151

Uploaded by

Jeimuel SilvestreCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCFA v. Alpha Insurance and Surety Co., Inc., 24 SCRA 151

Uploaded by

Jeimuel SilvestreCopyright:

Available Formats

Republic of the Philippines SUPREME COURT Manila EN BANC G.R. No.

L-24566 July 29, 1968

AGRICULTURAL CREDIT & COOPERATIVE FINANCING ADMINISTRATION (ACCFA), plaintiff-appellant, vs. ALPHA INSURANCE & SURETY CO., INC., defendant-appellee, RICARDO A. LADINES, ET AL., third party-defendants-appellees. Deogracias E. Lerma and Esmeraldo U. Guloy for plaintiff-appellant. L. L. Reyes for defendant-appellee. Geronimo F. Abellera for third party defendants-appellees. REYES, J.B.L., J.: Appeal, on points of law, against a decision of the Court of First Instance of Manila, in its Case No. 43372, upholding a motion to dismiss. At issue is the question whether or not the provision of a fidelity bond that no action shall be had or maintained thereon unless commenced within one year from the making of a claim for the loss upon which the action is based, is valid or void, in view of Section 61-A of the Insurance Act invalidating stipulations limiting the time for commencing an action thereon to less than one year from the time the cause of action accrues. Material to this decision are the following facts: 1wph1.t According to the allegations of the complaint, in order to guarantee the Asingan Farmers' Cooperative Marketing Association, Inc. (FACOMA) against loss on account of "personal dishonesty, amounting to larceny or estafa of its Secretary-Treasurer, Ricardo A. Ladines, the appellee, Alpha Insurance & Surety Company had issued, on 14 February 1958, its bond, No. PFID-15-58, for the sum of Five Thousand Pesos (P5,000.00) with said Ricardo Ladines as principal and the appellee as solidary surety. On the same date, the Asingan FACOMA assigned its rights to the appellant, Agricultural Credit Cooperative and Financing Administration (ACCFA for short), with approval of the principal and the surety. During the effectivity of the bond, Ricardo Ladines converted and misappropriated, to his personal benefit, some P11,513.22 of the FACOMA funds, of which P6,307.33 belonged to the ACCFA. Upon discovery of the loss, ACCFA immediately notified in writing the survey company on 10 October 1958, and presented the proof of loss within the period fixed in the bond; but despite repeated demands the surety company refused and failed to pay. Whereupon, ACCFA filed suit against appellee on 30 May 1960.

Defendant Alpha Insurance & Surety Co., Inc., (now appellee) moved to dismiss the complaint for failure to state a cause of action, giving as reason that (1) the same was filed more than one year after plaintiff made claim for loss, contrary to the eighth condition of the bond, providing as follows: . EIGHT LIMITATION OF ACTION No action, suit or proceeding shall be had or maintained upon this Bond unless the same be commenced within one year from the time of making claim for the loss upon which such action, suit or proceeding, is based, in accordance with the fourth section hereof. (2) the complaint failed to show that plaintiff had filed civil or criminal action against Ladines, as required by conditions 4 and 11 of the bond; and (3) that Ladines was a necessary and indispensable party but had not been joined as such. At first, the Court of First Instance denied dismissal; but, upon reconsideration, the court reversed its original stand, and dismissed the complaint on the ground that the action was filed beyond the contractual limitation period (Record on Appeal, pages 56-59). Hence, this appeal. We find the appeal meritorious. A fidelity bond is, in effect, in the nature of a contract of insurance against loss from misconduct, and is governed by the same principles of interpretation: Mechanics Savings Bank & Trust Co. vs. Guarantee Company, 68 Fed. 459; Pao Chan Wei vs. Nemorosa, 103 Phil. 57. Consequently, the condition of the bond in question, limiting the period for bringing action thereon, is subject to the provisions of Section 61-A of the Insurance Act (No. 2427), as amended by Act 4101 of the pre-Commonwealth Philippine Legislature, prescribing that

SEC. 61-A A condition, stipulation or agreement in any policy of insurance, limiting the time for commencing an action thereunder to a period of less than one year from the time when the cause of action accrues is void. Since a "cause of action" requires, as essential elements, not only a legal right of the plaintiff and a correlative obligation of the defendant but also "an act or omission of the defendant in violation of said legal right" (Maao Sugar Central vs. Barrios, 79 Phil. 666), the cause of action does not accrue until the party obligated refuses, expressly or impliedly, to comply with its duty (in this case, to pay the amount of the bond). The year for instituting action in court must be reckoned, therefore, from the time of appellee's refusal to comply with its bond; it can not be counted from the creditor's filing of the claim of loss, for that does not import that the surety company will refuse to pay. In so far, therefore, as condition eight of the bond requires action to be filed within one year from the filing of the claim for loss, such stipulation contradicts the public policy

expressed in Section 61-A of the Philippine Insurance Act. Condition eight of the bond, therefore, is null and void, and the appellant is not bound to comply with its provisions. In Eagle Star Insurance Co. vs. Chia Yu, 96 Phil. 696, 701, this Court ruled: .1wph1.t It may perhaps be suggested that the policy clause relied on by the insurer for defeating plaintiff's action should be given the construction that would harmonize it with section 61-A of the Insurance Act by taking it to mean that the time given the insured for bringing his suit is twelve months after the cause of action accrues. But the question then would be: When did the cause of action accrue? On that question we agree with the court below that plaintiff's cause of action did not accrue until his claim was finally rejected by the insurance company. This is because, before such final rejection, there was no real necessity for bringing suit. As the policy provides that the insured should file his claim, first, with the carrier and then with the insurer, he had a right to wait for his claim to be finally decided before going to court. The law does not encourage unnecessary litigation. The discouraging of unnecessary litigation must be deemed a rule of public policy, considering the unrelieved congestion in the courts. As a consequence of the foregoing, condition eight of the Alpha bond is null and void, and action may be brought within the statutory period of limitation for written contracts (New Civil Code, Article 1144). The case of Ang vs. Fulton Fire Insurance Co., 2 S.C.R.A. 945 (31 July 1961), relied upon by the Court a quo, is no authority against the views herein expressed, since the effect of Section 61-A of the Insurance Law on the terms of the Policy or contract was not there considered. The condition of previous conviction (paragraph b, clause 4, of the contract) having been deleted by express agreement and the surety having assumed solidary liability, the other grounds of the motion to dismiss are equally untenable. A creditor may proceed against any one of the solidary debtors, or some or all of them simultaneously (Article 1216, New Civil Code). WHEREFORE, the appealed order granting the motion to dismiss is reversed and set aside, and the records are remanded to the Court of First Instance, with instructions to require defendant to answer and thereafter proceed in conformity with the law and the Rules of Court. Costs against appellee. So ordered. Concepcion, C.J., Dizon, Makalintal, Zaldivar, Sanchez, Castro, Angeles and Fernando, JJ., concur.

You might also like

- ACCFA v. Alpha IncDocument5 pagesACCFA v. Alpha IncAnonymous nYvtSgoQNo ratings yet

- ACCFA vs Alpha InsuranceDocument2 pagesACCFA vs Alpha InsuranceSebastian GarciaNo ratings yet

- Insurance - Notice of LossDocument70 pagesInsurance - Notice of LossannamariepagtabunanNo ratings yet

- ACCFA V Alpha InsDocument2 pagesACCFA V Alpha InsArtemisTzyNo ratings yet

- ACCFA v. Alpha Insurance DigestDocument2 pagesACCFA v. Alpha Insurance Digestviva_33No ratings yet

- 33.10 Agricultural Credit vs. Alpha InsuranceDocument6 pages33.10 Agricultural Credit vs. Alpha InsuranceA.No ratings yet

- Insurance Policy Prescription PeriodDocument3 pagesInsurance Policy Prescription PeriodChanel GarciaNo ratings yet

- 01 - Philippine First Insurance Co., Inc. v. Maria Carmen Hartigan, Et. Al., 7 SCRA 252Document8 pages01 - Philippine First Insurance Co., Inc. v. Maria Carmen Hartigan, Et. Al., 7 SCRA 252Alexylle Garsula de ConcepcionNo ratings yet

- Accfa Vs AlphaDocument2 pagesAccfa Vs AlphaJohn Ramil RabeNo ratings yet

- Commercial LawDocument140 pagesCommercial Lawjim peterick sisonNo ratings yet

- Guaranty Full CasesDocument35 pagesGuaranty Full CasesMsIc GabrielNo ratings yet

- Supreme Court rules on insurance rebate caseDocument5 pagesSupreme Court rules on insurance rebate caseErnie GultianoNo ratings yet

- Puno (C.J., Chairperson), Carpio, Corona Petition Denied, Assailed Decision AffirmedDocument10 pagesPuno (C.J., Chairperson), Carpio, Corona Petition Denied, Assailed Decision AffirmedAaron CarinoNo ratings yet

- Ang v. FultonDocument7 pagesAng v. FultonAnonymous nYvtSgoQNo ratings yet

- 4 Prescriptive Period of Filing of ClaimsDocument5 pages4 Prescriptive Period of Filing of ClaimsJaymee Andomang Os-agNo ratings yet

- Saura v. Phil. International Co., 8 SCRA 143 118 Phil. 150 (1963)Document4 pagesSaura v. Phil. International Co., 8 SCRA 143 118 Phil. 150 (1963)KristineSherikaChyNo ratings yet

- Sun Insurance Office Ltd. Vs CADocument6 pagesSun Insurance Office Ltd. Vs CAiamnumber_fourNo ratings yet

- Insurance Report - OutlineDocument3 pagesInsurance Report - OutlineKristine PacariemNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument4 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivechristopher d. balubayanNo ratings yet

- Manila Surety and Fidelity Co V AlmedaDocument4 pagesManila Surety and Fidelity Co V AlmedaRhenfacel ManlegroNo ratings yet

- Magdalena Estate vs. Rodriguez, 18 SCRA 967Document6 pagesMagdalena Estate vs. Rodriguez, 18 SCRA 967rowela jane paanoNo ratings yet

- 2 Provrem Central Sawmill Vs Alto SuretyDocument10 pages2 Provrem Central Sawmill Vs Alto Suretyasde12ke1mNo ratings yet

- UCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Document17 pagesUCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Jaja Ordinario Quiachon-AbarcaNo ratings yet

- Insurance Claim RulingDocument6 pagesInsurance Claim RulingJessica Magsaysay CrisostomoNo ratings yet

- Summit Guaranty and Insurance Co. vs. Arnaldo, G.R. No. L - 48546, 1988Document4 pagesSummit Guaranty and Insurance Co. vs. Arnaldo, G.R. No. L - 48546, 1988Nikko AlelojoNo ratings yet

- Equitable Ins. & Casualty Co. vs. Rural InsuranceDocument2 pagesEquitable Ins. & Casualty Co. vs. Rural InsuranceMan2x SalomonNo ratings yet

- 60 SCRA 714 - Business Organization - Corporation Law - Rule On Moral Damages When It Comes To CorporationsDocument4 pages60 SCRA 714 - Business Organization - Corporation Law - Rule On Moral Damages When It Comes To CorporationsRock StoneNo ratings yet

- Insurance Policy Prescriptive PeriodDocument5 pagesInsurance Policy Prescriptive PeriodKim MontanoNo ratings yet

- Affidacit Fine and Probation1Document4 pagesAffidacit Fine and Probation1kbarn389No ratings yet

- Insurance Company Waives Exclusionary Condition by Accepting PremiumDocument4 pagesInsurance Company Waives Exclusionary Condition by Accepting PremiumJames WilliamNo ratings yet

- Tio Khe Chio Vs CADocument3 pagesTio Khe Chio Vs CAJayson AzuraNo ratings yet

- Supreme Court Rules on Appointment of Receiver for Insolvent Insurance CompanyDocument14 pagesSupreme Court Rules on Appointment of Receiver for Insolvent Insurance CompanyJM EnguitoNo ratings yet

- Civil Digest CompiledDocument10 pagesCivil Digest CompiledAmira acacNo ratings yet

- ACCFA v. Alpha Insurance & Surety Co IncDocument1 pageACCFA v. Alpha Insurance & Surety Co Incd2015memberNo ratings yet

- Insurance Claim Filing DeadlineDocument2 pagesInsurance Claim Filing Deadlineshookt panboiNo ratings yet

- PALAY, INC vs CLAVE Dispute Over Land Contract CancellationDocument5 pagesPALAY, INC vs CLAVE Dispute Over Land Contract CancellationJA BedrioNo ratings yet

- A. Heirs of Loreto C. Maramag v. Eva Verna de Guzman Maramag, Et Al, G.R. No. 181132, June 5, 2009Document5 pagesA. Heirs of Loreto C. Maramag v. Eva Verna de Guzman Maramag, Et Al, G.R. No. 181132, June 5, 2009Kitem Kadatuan Jr.No ratings yet

- Laura Colantuno Steven Colantuno, H/W v. Aetna Insurance Company, 980 F.2d 908, 3rd Cir. (1992)Document5 pagesLaura Colantuno Steven Colantuno, H/W v. Aetna Insurance Company, 980 F.2d 908, 3rd Cir. (1992)Scribd Government DocsNo ratings yet

- Plaridel Surety & Insurance Co. vs. Artex Development CompanyDocument9 pagesPlaridel Surety & Insurance Co. vs. Artex Development CompanyAnonymous WDEHEGxDhNo ratings yet

- Manila Surety Fidelity Co. vs AlmedaDocument4 pagesManila Surety Fidelity Co. vs AlmedaSheila RosetteNo ratings yet

- Insurance Policy Limitation Period Ruled Void Under Philippine LawDocument4 pagesInsurance Policy Limitation Period Ruled Void Under Philippine LawRobert Jayson UyNo ratings yet

- K.V. Faylona For Petitioners-Appellants. L. L. Reyes For Respondents-AppelleesDocument4 pagesK.V. Faylona For Petitioners-Appellants. L. L. Reyes For Respondents-Appelleeswenny capplemanNo ratings yet

- Oblicon DoctrineDocument73 pagesOblicon Doctrineleziel.santosNo ratings yet

- Saura Import and Export INc Case 15184Document3 pagesSaura Import and Export INc Case 15184Alvin-Evelyn GuloyNo ratings yet

- Abel 4Document12 pagesAbel 4abbywinsterNo ratings yet

- 11-Regina L. Edillon vs. Manila Bankers Life Insurance Corporation, G.R. No. L-34200, 30 September 1982Document4 pages11-Regina L. Edillon vs. Manila Bankers Life Insurance Corporation, G.R. No. L-34200, 30 September 1982Jopan SJNo ratings yet

- Petitioner Vs Vs Respondents Buñag Kapunan Migallos & Perez Arturo D. Vallar and Antonio C. Pesigan Reloj Law OfficeDocument11 pagesPetitioner Vs Vs Respondents Buñag Kapunan Migallos & Perez Arturo D. Vallar and Antonio C. Pesigan Reloj Law OfficeaifapnglnnNo ratings yet

- Makati Tuscany Corp. V CADocument3 pagesMakati Tuscany Corp. V CAMADEE VILLANUEVANo ratings yet

- Tio Khe Chio vs. Court of AppealsDocument2 pagesTio Khe Chio vs. Court of AppealsCarla DomingoNo ratings yet

- 4 Ang v. Fulton FireDocument7 pages4 Ang v. Fulton FireEmary GutierrezNo ratings yet

- Doctrines RemediesDocument9 pagesDoctrines RemediesSai RosalesNo ratings yet

- Department of Agriculture's non-suabilityDocument143 pagesDepartment of Agriculture's non-suabilityAilynne Joy Rojas LimNo ratings yet

- Sun Insurance Office LTDDocument4 pagesSun Insurance Office LTDChelle OngNo ratings yet

- Eagle Star vs. Chia Yu-DigestDocument2 pagesEagle Star vs. Chia Yu-DigestMan2x SalomonNo ratings yet

- Supreme Court upholds insurer's right to rescind policy for non-disclosure of additional insuranceDocument38 pagesSupreme Court upholds insurer's right to rescind policy for non-disclosure of additional insuranceacesmaelNo ratings yet

- Legal Rate of Interest in Insurance ClaimsDocument3 pagesLegal Rate of Interest in Insurance ClaimsAmicus CuriaeNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- Notice of AppealDocument1 pageNotice of AppealJeimuel SilvestreNo ratings yet

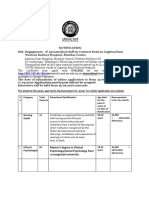

- Reg NCR - Wo 18-2013Document26 pagesReg NCR - Wo 18-2013Jeimuel SilvestreNo ratings yet

- Affidavit of Support (Philippines)Document1 pageAffidavit of Support (Philippines)bertspamintuan88% (25)

- Pubbid022718ncr (ND) CompressedDocument17 pagesPubbid022718ncr (ND) CompressedJeimuel SilvestreNo ratings yet

- Ra 10591 BsaDocument13 pagesRa 10591 BsaWarlito D CabangNo ratings yet

- Affidavit of Support and GuaranteeDocument1 pageAffidavit of Support and GuaranteeJeimuel Silvestre100% (1)

- Sample Petition For AdoptionDocument7 pagesSample Petition For AdoptionJeimuel SilvestreNo ratings yet

- Object: Final Notice Before Legal ActionDocument1 pageObject: Final Notice Before Legal ActionJeimuel SilvestreNo ratings yet

- Joint Affidavit of AdoptionDocument2 pagesJoint Affidavit of AdoptionJeimuel SilvestreNo ratings yet

- SupportDocument6 pagesSupportNivla YacadadNo ratings yet

- Ra 10591 BsaDocument13 pagesRa 10591 BsaWarlito D CabangNo ratings yet

- Last Holographic WillDocument2 pagesLast Holographic WillJenny Reyes50% (4)

- Seatwork No. 1 Administrative Law / Law On Public Officers / Elections Atty. Anatoly Namayan Estrella Saturday 4:00 - 7:00Document1 pageSeatwork No. 1 Administrative Law / Law On Public Officers / Elections Atty. Anatoly Namayan Estrella Saturday 4:00 - 7:00Jeimuel SilvestreNo ratings yet

- 3 - Civil LawDocument17 pages3 - Civil LawJeimuel SilvestreNo ratings yet

- Paz Garcia V Macaraig JRDocument2 pagesPaz Garcia V Macaraig JRJeimuel SilvestreNo ratings yet

- Philippine passport affidavitDocument1 pagePhilippine passport affidavitJettmar Aswigue TalipingNo ratings yet

- Oposa Vs FactoranDocument1 pageOposa Vs FactoranlookalikenilongNo ratings yet

- 2011 Political Law Bar Exam Q&ADocument21 pages2011 Political Law Bar Exam Q&ARaq KhoNo ratings yet

- 2012 Civil Law ReviewDocument10 pages2012 Civil Law ReviewJeimuel SilvestreNo ratings yet

- Navarro v. CADocument9 pagesNavarro v. CAJeimuel SilvestreNo ratings yet

- Commercial Suggested Answers 1990 2006 WordDocument102 pagesCommercial Suggested Answers 1990 2006 WordJeimuel SilvestreNo ratings yet

- Rule 119Document14 pagesRule 119Jeimuel SilvestreNo ratings yet

- Civil Law Review ProfDocument1 pageCivil Law Review ProfJeimuel SilvestreNo ratings yet

- 1994-2006 Bar Exam Question in TaxationDocument138 pages1994-2006 Bar Exam Question in TaxationJeimuel SilvestreNo ratings yet

- Applications Sent by Post Will Not Be AcceptedDocument4 pagesApplications Sent by Post Will Not Be AcceptedMunshi KamrulNo ratings yet

- in This Case, Upon The Execution of The Deed of Donation and The Acceptance of Such Donation inDocument2 pagesin This Case, Upon The Execution of The Deed of Donation and The Acceptance of Such Donation inJepoy FranciscoNo ratings yet

- People vs. TevesDocument6 pagesPeople vs. TevesnathNo ratings yet

- CathleenDocument8 pagesCathleenJeanLotusNo ratings yet

- Registration FeeDocument1 pageRegistration FeeanakinNo ratings yet

- Classification of Law: International, Municipal, Public & PrivateDocument18 pagesClassification of Law: International, Municipal, Public & PrivateMrutyunjay SaramandalNo ratings yet

- 7 Andres-v-MantrustDocument1 page7 Andres-v-MantrustluigimanzanaresNo ratings yet

- Ja Franc AcbayDocument6 pagesJa Franc AcbayEder EpiNo ratings yet

- Setting Up a Legal Business Credit ProfileDocument7 pagesSetting Up a Legal Business Credit ProfileMaryUmbrello-Dressler83% (12)

- Notification Assam Apex Bank Assistant Branch Manager Assistant Manager PostsDocument2 pagesNotification Assam Apex Bank Assistant Branch Manager Assistant Manager PostsSunil SinghNo ratings yet

- Equal Employment Opportunity Laws in PakistanDocument9 pagesEqual Employment Opportunity Laws in Pakistansajid bhattiNo ratings yet

- SP5309AcaraJenayah EVIDENCE2Document14 pagesSP5309AcaraJenayah EVIDENCE2dkhana243No ratings yet

- Article 1590 and 1591Document3 pagesArticle 1590 and 1591MariaHannahKristenRamirezNo ratings yet

- Pre Trial BriefDocument21 pagesPre Trial BriefRonna Faith MonzonNo ratings yet

- Ho vs. NarcisoDocument3 pagesHo vs. NarcisoRochelle Ann ReyesNo ratings yet

- 3 Estafa - Gallardo vs. PeopleDocument7 pages3 Estafa - Gallardo vs. PeopleAtty Richard TenorioNo ratings yet

- JARDINE DAVIES INC. vs. CA and FAR EAST MILLS DIGESTDocument4 pagesJARDINE DAVIES INC. vs. CA and FAR EAST MILLS DIGESTruelNo ratings yet

- Implied Warranty of Habitability Applies to NYC HousingDocument9 pagesImplied Warranty of Habitability Applies to NYC HousingPaul CantrellNo ratings yet

- Partnerships: Termination and Liquidation: Chapter OutlineDocument51 pagesPartnerships: Termination and Liquidation: Chapter OutlineJordan Young100% (1)

- 97.2 Inchausti vs. SolerDocument1 page97.2 Inchausti vs. SolerRosh Lepz100% (1)

- Labor Law OutlineDocument40 pagesLabor Law OutlineDave CadalsoNo ratings yet

- Corpus Juris Secundum On Grand JuryDocument2 pagesCorpus Juris Secundum On Grand JurycelticfyrNo ratings yet

- Affidavit of SinglenessDocument7 pagesAffidavit of SinglenessGlenn Lapitan CarpenaNo ratings yet

- Case Study Critique 1Document4 pagesCase Study Critique 1Pablo VaNo ratings yet

- Lesson 2 - Philippine Constitution, Preamble and Bill of RightsDocument12 pagesLesson 2 - Philippine Constitution, Preamble and Bill of RightsMary Joy CuetoNo ratings yet

- Giron v. COMELEC (Title of Bills) - Draft - CEREZODocument2 pagesGiron v. COMELEC (Title of Bills) - Draft - CEREZOmichikoNo ratings yet

- IbDocument2 pagesIbSrinivasa Reddy KarriNo ratings yet

- Buffalo Rose Motion To DismissDocument8 pagesBuffalo Rose Motion To DismissNickNo ratings yet

- 05 - Overview of Demurrage and Despatch - NewDocument4 pages05 - Overview of Demurrage and Despatch - NewBiswajit Q MalakarNo ratings yet

- The Non Master File (NMF) Report, Form #09.058Document143 pagesThe Non Master File (NMF) Report, Form #09.058Sovereignty Education and Defense Ministry (SEDM)100% (5)