Professional Documents

Culture Documents

Central Bank Function

Uploaded by

Neeta MossesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Bank Function

Uploaded by

Neeta MossesCopyright:

Available Formats

1. Bank of Note Issue: The central bank has the sole monopoly of note issue in almost every country.

Th e currency notes printed and issued by the central bank become unlimited legal t ender throughout the country. In the words of De Kock, "The privilege of note-issue was almost everywhere asso ciated with the origin and development of central banks." However, the monopoly of central bank to issue the currency notes may be partial in certain countries. For example, in India, one rupee notes are issued by the Ministry of Finance and all other notes are issued by the Reserve Bank of India. The main advantages of giving the monopoly right of note issue to the central ba nk are given below: (i) It brings uniformity in the monetary system of note issue and note circulati on. (ii) The central bank can exercise better control over the money supply in the c ountry. It increases public confidence in the monetary system of the country. (iii) Monetary management of the paper currency becomes easier. Being the suprem e bank of the country, the central bank has full information about the monetary requirements of the economy and, therefore, can change the quantity of currency accordingly. (iv) It enables the central bank to exercise control over the creation of credit by the commercial banks. (v) The central bank also earns profit from the issue of paper currency. (vi) Granting of monopoly right of note issue to the central bank avoids the pol itical interference in the matter of note issue. 2. Banker, Agent and Adviser to the Government: The central bank functions as a banker, agent and financial adviser to the gover nment, (a) As a banker to government, the central bank performs the same functions for the government as a commercial bank performs for its customers. It maintains the accounts of the central as well as state government; it receives deposits from government; it makes short-term advances to the government; it collects cheques and drafts deposited in the government account; it provides foreign exchange res ources to the government for repaying external debt or purchasing foreign goods or making other payments, (b) As an Agent to the government, the central bank collects taxes and other pay ments on behalf of the government. It raises loans from the public and thus mana ges public debt. It also represents the government in the international financia l institutions and conferences, (c) As a financial adviser to the lent, the central bank gives advise to the gov ernment on economic, monetary, financial and fiscal ^natters such as deficit fin ancing, devaluation, trade policy, foreign exchange policy, etc. 3. Bankers' Bank: The central bank acts as the bankers' bank in three capacities:

(a) custodian of the cash preserves of the commercial banks; (b) as the lender of the last resort; and (c) as clearing agent. In this way, th e central bank acts as a friend, philosopher and guide to the commercial banks As a custodian of the cash reserves of the commercial banks the central bank mai ntains the cash reserves of the commercial banks. Every commercial bank has to k eep a certain percentage of its cash balances as deposits with the central banks . These cash reserves can be utilised by the commercial banks in times of emerge ncy. The centralization of cash reserves in the central bank has the following advant ages: (i) Centralised cash reserves inspire confidence of the public in the banking sy stem of the country. (ii) Centralised cash reserves provide the basis of a larger and more elastic cr edit structure than if these amounts were scattered among the individual banks. (iii) Centralised reserves can be used to the fullest possible extent and in the most effective manner during the periods of seasonal strains and financial emer gencies. (iv) Centralised reserves enable the central bank to provide financial accommoda tion to the commercial banks which are in temporary difficulties. In fact the ce ntral bank functions as the lender of the last resort on the basis of the centra lised cash reserves. (v) The system of contralised cash reserves enables the central bank to influenc e the creation of credit by the commercial banks by increasing or decreasing the cash reserves through the technique of variable cash-reserve ratio. (vi) The cash reserves with the central bank can be used to promote national wel fare. 4. Lender of Last Resort: As the supreme bank of the country and the bankers' bank, the central bank acts as the lender of the last resort. In other words, in case the commercial banks a re not able to meet their financial requirements from other sources, they can, a s a last resort, approach the central bank for financial accommodation. The cent ral bank provides financial accommodation to the commercial banks by rediscounti ng their eligible securities and exchange bills. The main advantages of the central bank's functioning as the lender of the last resort are : (i) It increases the elasticity and liquidity of the whole credit structure of t he economy. (ii) It enables the commercial banks to carry on their activities even with thei r limited cash reserves. (iii) It provides financial help to the commercial banks in times of emergency. (iv) It enables the central bank to exercise its control over banking system of the country.

5. Clearing Agent: As the custodian of the cash reserves of the commercial banks, the central bank acts as the clearing house for these banks. Since all banks have their accounts with the central bank, the central bank can easily settle the claims of various banks against each other with least use of cash. The clearing house function of the central bank has the following advantages: (i) It economies the use of cash by banks while settling their claims and counte r-claims. (i) It reduces the withdrawals of cash and these enable the commercial banks to create credit on a large scale. (ii) It keeps the central bank fully informed about the liquidity position of th e commercial banks.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDocument2 pagesUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- Assignment 3 - Financial Accounting - February 4Document7 pagesAssignment 3 - Financial Accounting - February 4Ednalyn PascualNo ratings yet

- 40k Elss Mutual FundDocument1 page40k Elss Mutual FundSachin Khamitkar100% (1)

- Sample Questionnaire On Customer Satisfaction in BanksDocument6 pagesSample Questionnaire On Customer Satisfaction in Banks01.nazia591179% (39)

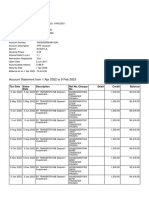

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemailvipinck123No ratings yet

- 8 - 8 - 31 - 2023 12 - 00 - 00 Am - 2023Document2 pages8 - 8 - 31 - 2023 12 - 00 - 00 Am - 2023Larry GatlinNo ratings yet

- Золото граждан СССРDocument104 pagesЗолото граждан СССРtoefl.prepNo ratings yet

- An Overview of The Changing Financial-Services Sector: Ayesha Afzal Assistant ProfessorDocument13 pagesAn Overview of The Changing Financial-Services Sector: Ayesha Afzal Assistant ProfessorFizzah ZahidNo ratings yet

- CSs List For Upload On WebsiteDocument153 pagesCSs List For Upload On WebsitePrincespragti PatilNo ratings yet

- Tax Invoice: Must Ask and Record Receiver Name or Leave CardDocument1 pageTax Invoice: Must Ask and Record Receiver Name or Leave CardGoran KovacevicNo ratings yet

- NRB RemitDocument56 pagesNRB Remitনীল রহমানNo ratings yet

- Ppf... Vasu StatementDocument2 pagesPpf... Vasu StatementVasu AmmuluNo ratings yet

- Accounting 9 (Cambridge) : Monthlytest - OCTOBER 2020Document9 pagesAccounting 9 (Cambridge) : Monthlytest - OCTOBER 2020Mohamed MubarakNo ratings yet

- Application Form Account Opening02052023021208Document5 pagesApplication Form Account Opening02052023021208Free FireNo ratings yet

- Chapter 3 Money MarketDocument17 pagesChapter 3 Money MarketJuanito Dacula Jr.No ratings yet

- Pledge of SharesDocument8 pagesPledge of Sharesshubhamgupta04101994No ratings yet

- HDFC Bank Credit CardDocument1 pageHDFC Bank Credit CardRamesh BabuNo ratings yet

- Strickland Inc Owes Heartland Bank 200 000 Plus 18 000 of Accrued PDFDocument1 pageStrickland Inc Owes Heartland Bank 200 000 Plus 18 000 of Accrued PDFFreelance WorkerNo ratings yet

- University of Central Punjab University of Central Punjab University of Central PunjabDocument1 pageUniversity of Central Punjab University of Central Punjab University of Central PunjabHaris MalikNo ratings yet

- CH11Document31 pagesCH11Marwa HassanNo ratings yet

- FI Assignment No 01Document17 pagesFI Assignment No 01Shivani BalaniNo ratings yet

- Address ProofDocument4 pagesAddress ProofYash GaurkarNo ratings yet

- Latest Banking PDFDocument20 pagesLatest Banking PDFvarunNo ratings yet

- Application Form For Cheque Book and Debit Card IssuanceDocument2 pagesApplication Form For Cheque Book and Debit Card IssuanceAltoheed channelNo ratings yet

- Activity 07Document4 pagesActivity 07Mahra AlMazroueiNo ratings yet

- Sabeetha Final ProjectDocument52 pagesSabeetha Final ProjectPriyesh KumarNo ratings yet

- The True Impact of TRIDDocument2 pagesThe True Impact of TRIDDanRanckNo ratings yet

- And Structured Notes Functionality: IRS KEYDocument1 pageAnd Structured Notes Functionality: IRS KEYVikram SuranaNo ratings yet

- Certification For Robinsons Sites - MARCH 2018Document3 pagesCertification For Robinsons Sites - MARCH 2018Jr AdiaoNo ratings yet

- Types of Monetary PolicyDocument4 pagesTypes of Monetary PolicyJEET7676No ratings yet