Professional Documents

Culture Documents

Mauricio López Rojon A01330465

Uploaded by

gujahjuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mauricio López Rojon A01330465

Uploaded by

gujahjuptaCopyright:

Available Formats

Mauricio Lpez Rojon A01330465

GUIA 23-Use the follo in! financial "ata for Moose #rintin! $orporation to calculate the cash flo fro% operations &$'() usin! the in"irect %etho"*

+et inco%e ,225 -ncrease in accounts recei.a/le 55 0ecrease in in.entor1 33 0epreciation 65 0ecrease in accounts pa1a/le 25 -ncrease in a!es pa1a/le 15 0ecrease in "eferre" ta2es 10 #urchase of ne e3uip%ent 65 0i.i"en"s pai" 45

A) -ncrease in cash of ,153* B) -ncrease in cash of ,245* C) -ncrease in cash of ,143* D) 0ecrease in cash of ,105* 24-Use the follo in! infor%ation to calculate cash flo s fro% operations usin! the in"irect %etho"*

67+et -nco%e ,128000 670epreciation 92pense 18000 67Loss on sale of %achiner1 500 67-ncrease in Accounts Recei.a/le 28000 670ecrease in Accounts #a1a/le 18500 67-ncrease in -nco%e ta2es pa1a/le 500 67Repa1%ent of :on"s 38000

Mauricio Lpez Rojon A01330465

A) -ncrease in cash of ,48500* B) -ncrease in cash of ,;8500* C) 0ecrease in cash of ,58500* D) -ncrease in cash of ,108500* 25-<he follo in! infor%ation is fro% the /alance sheet of =il.erstone $o%pan1>

+et -nco%e for 5?1?05 to 5?31?05> ,58000 Account -n.entor1 #repai" e2p* Accu%* 0epr* Accounts pa1a/le :on"s pa1a/le :alance 5?31?05 ,18450 ,18400 ,;45 ,625 ,550

:alance 5?01?05 ,28000 ,18200 ,500 ,425 ,650

Usin! the in"irect %etho"8 calculate the cash flo fro% operations for =il.erstone $o%pan1 as of 5?31?05> A) -ncrease in cash of ,58025* B) -ncrease in cash of ,58125* C) -ncrease in cash of ,48425* D) <he in"irect %etho" cannot /e calculate" fro% the infor%ation pro.i"e"*

26-0arth $orporation@s %ost recent inco%e state%ent sho s net sales of ,680008 an" 0arth@s %ar!inal ta2 rate is 40 percent* <he total e2penses reporte" ere ,382008 all of hich ere pai" in cash* -n a""ition8 "epreciation e2pense as reporte" at ,500* A further e2a%ination of the %ost recent /alance sheets re.eals that accounts recei.a/le "urin! that perio" increase" /1 ,18000* <he cash flo fro% operatin! acti.ities reporte" /1 0arth shoul" /e>

Mauricio Lpez Rojon A01330465

A) ,18200* B) ,28000* C) ,28200* D) ,18000* 24-Usin! the follo in! financial "ata for +ails8 9tc*8 calculate the net chan!e in cash usin! the in"irect %etho"* +et -nco%e 0ecrease in Accounts recei.a/le 0epreciation e2pense -ncrease in in.entor1 -ncrease in "eferre" ta2es #urchase of e3uip%ent 0i.i"en"s pai" A) 0ecrease in cash of ,118425* B) -ncrease in cash of ,138145* C) 0ecrease in cash of ,138045* D) -ncrease in cash of ,128445* 25-Usin! the in"irect %etho"8 calculate net cash flo usin! the follo in! infor%ation>

,158000 200 120 45 50 28000 150

+et -nco%e ,438000 -ncrease in Accounts recei.a/le 358500 0epreciation e2pense 350 -ncrease in #repai" e2pense 108450 0ecrease in inco%e ta2es pa1a/le 45 =ale of furniture 200 -ncrease in co%%on stocA 25

Mauricio Lpez Rojon A01330465

A) 0ecrease in cash of ,28450* B) -ncrease in cash of ,158450* C) -ncrease in cash of ,658250* D) 0ecrease in cash of ,28600*

2;-Usin! the follo in! infor%ation8 hat is the fir%Bs cash flo fro% operationsC +et inco%e 0ecrease in accounts recei.a/le 0epreciation -ncrease in in.entor1 -ncrease in accounts pa1a/le 0ecrease in a!es pa1a/le -ncrease in "eferre" ta2es #rofit fro% the sale of fi2e" assets 0i.i"en"s pai" out A) 165* B) 145* C) 152* D) 155* 30-An e2a%ination of the cash receipts an" pa1%ents of Da.ier $orporation re.eals the follo in!> $ash pai" to suppliers for purchase of %erchan"ise ,58000 $ash recei.e" fro% custo%ers $ash pai" for purchase of e3uip%ent 148000 228000 ,100 30 25 14 10 5 14 5 35

Mauricio Lpez Rojon A01330465

0i.i"en"s pai" $ash recei.e" fro% issuance of preferre" stocA -nterest recei.e" on short-ter% in.est%ents Ea!es pai" Repa1%ent of loan to the /anA $ash fro% sale of lan" Da.ier@s reporte" cash flo fro% operations ill /e> A) -,68000* B) -,58000* C) ,68000* D) ,58000*

28000 108000 18000 48000 58000 128000

31-A fir% has net cash sales of ,385008 earnin!s after ta2es &9A<) of ,180008 "epreciation e2pense of ,5008 cost of !oo"s sol" &$(F=) of ,185008 an" cash ta2es of ,500* Also8 in.entor1 "ecrease" /1 ,1008 an" accounts recei.a/le increase" /1 ,300* Ehat is the fir%Bs cash flo fro% operationsC A) ,18200* B) ,18500* C) ,28000* D) ,18300* 32-Go"i Lein8 s%all /usiness consultant8 is currentl1 orAin! ith RG Lan"scapin!8 a sole proprietorship* =he is tr1in! to e"ucate the o ner on the i%portance of %onitorin! cash flo s* (peratin! infor%ation as of the en" of the %ost recent %onth appears /elo >

$ash fro% sale of trucA of ,48000* $ash salaries pai" of ,148000* $ash fro% custo%ers of ,458000* 0epreciation e2pense of ,58500*

Mauricio Lpez Rojon A01330465

-nterest on /anA line of cre"it of ,18000* $ash pai" to suppliers of ,228000* (ther cash e2penses8 inclu"in! rent8 of ,68300* +o ta2es "ue*

Usin! this infor%ation8 Lein calculates the cash flo fro% operations for the %onth at> A) ,118200* B) -,300* C) ,48200* D) -,18300* 33-Use the follo in! "ata fro% 0eltaBs co%%on size financial state%ent to ans er the 3uestion> 9arnin!s after ta2es 93uit1 $urrent assets $urrent lia/ilities =ales <otal assets H H H H 15I 40I 60I 30I

H ,300 H ,18400

Ehat is 0eltaBs total-"e/t-to-e3uit1 ratioC A) 1*0* B) 2*0* C) 1*5* D) 2*5* 34-Gohnson $orp* ha" the follo in! financial results for the fiscal 2004 1ear> $urrent ratio 2*00

Mauricio Lpez Rojon A01330465

JuicA ratio

1*25

$urrent lia/ilities ,1008000 -n.entor1 turno.er 12 Fross profit I 25

<he onl1 current assets are cash8 accounts recei.a/le8 an" in.entor1* <he /alance in these accounts has re%aine" constant throu!hout the 1ear* Gohnson@s net sales for 2004 ere> A) ,3008000* B) ,;008000* C) ,180008000* D) ,182008000* 35-Aztec Corporation Common Sized Income Statement =ales $(F= (peratin! e2pense -nterest e2pense -nco%e ta2 +et inco%e =ales 100I 65 15 5 5 10 ,;00

Aztec Corporation Common Size Balance Sheet $ash Accounts recei.a/le -n.entor1 'i2e" assets <otal assets =hort-ter% "e/t 5I 20 25 50 100I 20I

Mauricio Lpez Rojon A01330465

Lon!-ter% "e/t $o%%on e3uit1 0e/t K e3uit1 <otal assets

30 50 100I ,400

:ase" on the "ata !i.en a/o.e8 "eter%ine AztecBs 3uicA ratio an" total asset turno.er* <otal Asset <urno.er 1*2; 1*12 1*12

JuicA Ratio A) B) C) D) 1*25 1*25 2*50

2*50 1*2; 36-:ase" on the "ata !i.en a/o.e8 "eter%ine AztecBs ti%es interest earne" ratio an" !ross profit %ar!in* <i%es -nterest 9arne" Ratio A) B) C) D) 4*0D 5*0D 4*0D 5*0D

Fross #rofit Mar!in

35I 20I 20I 35I

34-Use the follo in! "ata fro% 0eltaBs co%%on size financial state%ent to ans er the 3uestion>

Mauricio Lpez Rojon A01330465

9arnin!s after ta2es 93uit1 $urrent assets $urrent lia/ilities =ales <otal assets

H 15I H 40I H 60I H 30I H ,300 H ,18400

Ehat is 0eltaBs after-ta2 return on e3uit1C A) 5*0I* B) ;*6I* C) 12*0I* D) 15*0I* 35-Use the follo in! "ata fro% 0eltaBs co%%on size financial state%ent to ans er the 3uestion> 9arnin!s after ta2es 93uit1 $urrent assets $urrent lia/ilities =ales <otal assets H H H H 15I 40I 60I 30I

H ,300 H ,18400

Ehat is 0eltaBs after-ta2 profit %ar!inC A) 5*0I* B) ;*6I* C) 15*0I* D) 12*0I* 3;-Assu%e that J-<ell -ncorporate" is in the co%%unications in"ustr18 hich has an a.era!e recei.a/les turno.er ratio of 16 ti%es* -f the J-<ell@s recei.a/les turno.er is less than that of the in"ustr18 J-<ell@s a.era!e recei.a/les collection perio" is most likely> A) 12 "a1s*

Mauricio Lpez Rojon A01330465

B) 16 "a1s* C) 25 "a1s* D) 20 "a1s* 40-Use the follo in! "ata to calculate return on e3uit1 &R(9)*

9arnin!s :efore -nterest an" <a2 ? =ales H 25I =ales?<otal Assets H 1*25 9arnin!s :efore <a2?9arnin!s /efore interest an" ta2 H 0*50 <otal Assets ? 93uit1 H 1*5 9arnin!s After <a2 ? 9arnin!s :efore <a2 H 0*6

A) 34*5I* B) 22*5I* C) 62*5I* D) 25I* 41-A co%pan1Bs financial state%ents sho the follo in! "ata &in %illions)>

9:-< H ,1*2 -nterest 92pense H ,0*2 =ales H ,20*0 Assets H ,15*0 93uit1 H ,4*5 <a2 Rate H 40I

<he co%pan1Bs return on e3uit1 &R(9) is closest to: A) 6*4I* B) 5*3I* C) 5*0I* D) 16*4I*

Mauricio Lpez Rojon A01330465

42-Usin! the follo in! "ata8 fin" the return on e3uit1 &R(9)* Net Income ,2 A) 25I* B) 100I* C) 20I* D) 4I* 43-Fi.en the follo in! infor%ation a/out a fir% hat is its return on e3uit1 &R(9)C An asset turno.er of 1*2 An after ta2 profit %ar!in of 10I A financial le.era!e %ultiplier of 1*5 A) 0*0;* B) 0*15* C) 0*12* D) 0*10* 44--f a co%pan1 has a net profit %ar!in of 15 percent8 an asset turno.er ratio of 4*5 an" a R(9 of 15 percent8 hat is the e3uit1 %ultiplierC A) 0*264* B) 0*523* C) 2*664* D) 3*135* Total Assets ,10 Sale Equit s y ,10 ,5

Mauricio Lpez Rojon A01330465

45-Ehat is a co%pan1@s e3uit1 if their return on e3uit1 &R(9) is 12 percent8 an" their net inco%e is 10 %illionC A) 182008000* B) 1280008000* C) 12080008000* D) 5383338333* 46-<he e3uit1 %ultiplier for a fir% ith a total "e/t ratio e3ual to 45 percent is> A) 1*5152 ti%es* B) 0*54;5 ti%es* C) 0*65;4 ti%es* D) 2*2222 ti%es* 44-A fir%@s financial state%ents reflect the follo in!> +et profit %ar!in =ales -nterest pa1%ents A.!* assets 93uit1 A.!* orAin! capital 0i.i"en" pa1out rate 15I ,1080008000 ,182008000 ,1580008000 ,1180008000 ,5008000 35I

Mauricio Lpez Rojon A01330465

Ehich of the follo in! is the closest esti%ate of the fir%@s sustaina/le !ro th rateC A) 5I* B) 10I* C) ;I* D) 11I* 45-(snat 9nterprise ha" the follo in! financial "ata>

(peratin! profit %ar!in 10I $urrent ratio 2*5 <otal asset turno.er 2*4 -nterest e2pense rate 6I Le.era!e %ultiplier 2*0 <a2 retention rate 0*50

Ehat is (snat@s return on e3uit1C A) 13*0I B) 14*4I C) 15*0I D) 25*5I* 4;--f the in.entor1 turno.er ratio is 48 hat is the a.era!e nu%/er of "a1s the in.entor1 is in stocAC A) 40 "a1s* B) 25 "a1s* C) 36 "a1s* D) 52 "a1s* 50-Assu%e a fir% ith a "e/t to e3uit1 ratio of 0*50 an" "e/t e3ual to ,35 %illion %aAes a co%%it%ent to ac3uire ra %aterials ith a present .alue of ,12 %illion o.er the ne2t 3 1ears* 'or purposes of anal1sis the /est esti%ate of the "e/t to e3uit1 ratio shoul" /e> A) 0*641* B) 0*343* C) 0*500*

Mauricio Lpez Rojon A01330465

D) 0*543* 51-<he RLR $o%pan1 has a "i.i"en" pa1out rate of 40 percent* -f its return on e3uit1 is 15 percent8 hat is RLRBs sustaina/le !ro th rateC A) ;I* B) 6I* C) 12I* D) 15I* 52-Usin! a 365-"a1 1ear8 if a fir% has net annual sales of ,2508000 an" a.era!e recei.a/les of ,15080008 hat is its average collection perio"C A) 1*4 "a1s* B) 0*6 "a1s* C) 21;*0 "a1s* D) 46*5 "a1s* 53-An anal1st has !athere" the follo in! infor%ation a/out a co%pan1>

$ost of !oo"s sol" e3uals 65 percent of sales -n.entor1 of ,4508000 =ales of ,1 %illion

Ehat is the .alue of this fir%@s a.era!e in.entor1 processin! perio" usin! a 365-"a1 1earC A) 0*4 "a1s* B) 0*4 "a1s* C) 1*4 "a1s*

Mauricio Lpez Rojon A01330465

D) 252*4 "a1s* 54- <he :u"!et $o%pan1 ha" net inco%e of ,2 %illion for the perio"* <here ere 1 %illion shares of ei!hte" co%%on stocA outstan"in! for the entire perio"* -f there are 2008000 options outstan"in! ith an e2ercise price of ,308 hat is the /asic earnin! per share an" the "ilute" earnin!s per share for :u"!et co%%on stocA if the a.era!e price per share o.er the perio" as ,40C :asic 9#= MMMMMMMM 0ilute" 9#= MMMMMMM 55-'or the 1ear en"e" 31 0ece%/er 20048 An!e $o%pan1 ha" net inco%e of , 185008000* <he co%pan1 ha" an a.era!e of 4008000 shares of co%%on stocA outstan"in!8 308000 shares of con.erti/le preferre"8 an" no other potentiall1 "iluti.e securities* 9ach share of preferre" pa1s a "i.i"en" of ,10 per share8 an" each is con.erti/le into fi.e shares of the co%pan1Ns co%%on stocA* $alculate the co%pan1Ns /asic an" "ilute" 9#=* :asic 9#= MMMMMMMMMMM 0ilute" 9#= MMMMMMMMM 56-<ell $o%pan1 reporte" net inco%e of , 450 000 for the 1ear en"e" 31 0ece%/er 2005* <he co%pan1 ha" an a.era!e of 500 000 shares of co%%on stocA outstan"in!* -n a""ition the co%pan1 has onl1 one potentiall1 "iluti.e securit1> , 100 000 of 4I con.erti/le /on"s8 con.erti/le into a total of 10 000 shares* Assu%in! a ta2 rate of 30 percent8 calculate <ellNs /asic an" "ilute" 9#=* :asic 9#= MMMMMMMMMM 0ilute" 9#= MMMMMMMMM

You might also like

- Case 03 - The Lazy Mower - SolutionDocument7 pagesCase 03 - The Lazy Mower - SolutionDũngPham67% (3)

- Concise trial balance correctionsDocument9 pagesConcise trial balance correctionsArcherAcs86% (7)

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementAravind 9901366442 - 990278722433% (3)

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Document50 pagesSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Entendiendo El Estado de ResultadoDocument105 pagesEntendiendo El Estado de ResultadodidioserNo ratings yet

- ABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysisDocument16 pagesABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysissamuel_dwumfourNo ratings yet

- W 10 Midterm1 SolutionDocument13 pagesW 10 Midterm1 SolutionSehoon OhNo ratings yet

- Course Outline: International Islamic University MalaysiaDocument11 pagesCourse Outline: International Islamic University MalaysiaAmGad SHarifNo ratings yet

- Mcs Merged Doc 2009.Document137 pagesMcs Merged Doc 2009.Nimish DeshmukhNo ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsmuradkasassbekNo ratings yet

- BUS785 in Class Work No. 1 First Name - Last NameDocument5 pagesBUS785 in Class Work No. 1 First Name - Last Namedineshmech225No ratings yet

- Financial Analysis 105-115Document10 pagesFinancial Analysis 105-115deshpandep33No ratings yet

- Accounting Group Study 1Document13 pagesAccounting Group Study 1ahmustNo ratings yet

- Chapter 6advacDocument17 pagesChapter 6advacXiamMarieCortezNo ratings yet

- Exp 0000Document9 pagesExp 0000ImranzahidyNo ratings yet

- ATTEMP ALL QUESTIONS: Circle Only The Correct AnswerDocument8 pagesATTEMP ALL QUESTIONS: Circle Only The Correct AnswerPrince Tettey NyagorteyNo ratings yet

- Amity AssignmentDocument16 pagesAmity AssignmentAnkita SrivastavNo ratings yet

- Ajara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi MargDocument32 pagesAjara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi Margpramesh1010No ratings yet

- Assignment Drive Program Semester Subject Code & Name Bba203 & Financial Accounting BK Id Credit & MarksDocument4 pagesAssignment Drive Program Semester Subject Code & Name Bba203 & Financial Accounting BK Id Credit & MarksSmu DocNo ratings yet

- Guía de EjerciciosDocument34 pagesGuía de EjerciciosLindsay RommyNo ratings yet

- Current State of Internal Control System in Local GovernmentDocument12 pagesCurrent State of Internal Control System in Local GovernmentLee Ja NelNo ratings yet

- Patrick SomuahDocument115 pagesPatrick SomuahJohn Bates BlanksonNo ratings yet

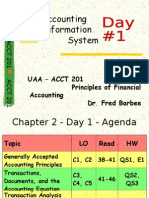

- Accounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeDocument55 pagesAccounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeyenzelNo ratings yet

- 126 Resource MAFA May 1996 May 2001Document267 pages126 Resource MAFA May 1996 May 2001Erwin Labayog MedinaNo ratings yet

- Coca Cola Case StudyDocument10 pagesCoca Cola Case Studyangels_birdsNo ratings yet

- Bus 330A: Corporate Finance I FALL 2012, AUBG Quiz 4 (B) Solution Guide Problem 1 (5 Points)Document2 pagesBus 330A: Corporate Finance I FALL 2012, AUBG Quiz 4 (B) Solution Guide Problem 1 (5 Points)Andreea VladNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- 02 Advanced AccountingDocument9 pages02 Advanced AccountinglibraolrackNo ratings yet

- Module 06 Tute Ans Macro Concepts - 2014s1Document2 pagesModule 06 Tute Ans Macro Concepts - 2014s1visha183240No ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- Guidance Manual FinalDocument27 pagesGuidance Manual FinalrosdobNo ratings yet

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniNo ratings yet

- Domondon Taxation Bar Exam Answers Part 2Document15 pagesDomondon Taxation Bar Exam Answers Part 2Shiela ValdezNo ratings yet

- Utual UND: Ssignmen T ONDocument9 pagesUtual UND: Ssignmen T ONMahbubul Bari ShiblyNo ratings yet

- Job Order Cost System: Richmond-Lady-Boat-Show-Price PDFDocument33 pagesJob Order Cost System: Richmond-Lady-Boat-Show-Price PDFLadyromancerWattpadNo ratings yet

- POF Week 6 SBDocument38 pagesPOF Week 6 SBpartyycrasherNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument14 pagesUniversity of Mauritius: Faculty of Law and ManagementKlaus MikaelsonNo ratings yet

- MCA CONTINUOUS ASSESSMENT INTERNAL TEST- I REGULATIONS – 2009 I SEMESTER (2011-2014) MC9215 ACCOUNTING AND FINANCIAL MANAGEMENTDocument5 pagesMCA CONTINUOUS ASSESSMENT INTERNAL TEST- I REGULATIONS – 2009 I SEMESTER (2011-2014) MC9215 ACCOUNTING AND FINANCIAL MANAGEMENTanglrNo ratings yet

- UploadedFile 130364571293527064Document73 pagesUploadedFile 130364571293527064salujahimanshu1691No ratings yet

- Model Questions - Jaiib Principles of Banking - Module A & BDocument7 pagesModel Questions - Jaiib Principles of Banking - Module A & BatgsganeshNo ratings yet

- 7.0 Does Debt Policy MatterDocument22 pages7.0 Does Debt Policy MatterSanaFatimaNo ratings yet

- David Sm13e CN 07Document19 pagesDavid Sm13e CN 07Koki MostafaNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- Working Capital Policy and ManagementDocument64 pagesWorking Capital Policy and ManagementsevillaarvinNo ratings yet

- POKHARA UNIVERSITY FINANCE COURSEWORKDocument4 pagesPOKHARA UNIVERSITY FINANCE COURSEWORKrenutimilsena1439No ratings yet

- Alm-Course Outlines-For Two DaysDocument40 pagesAlm-Course Outlines-For Two Daysrashed03nsuNo ratings yet

- Yonus Brother GroupeDocument15 pagesYonus Brother Groupeasadkabir23No ratings yet

- Chapter 07, 08, 09 Non Current AssetsDocument8 pagesChapter 07, 08, 09 Non Current Assetsali_sattar15No ratings yet

- MCQ BANKING, FINANCE AND ECONOMY TEST 1Document7 pagesMCQ BANKING, FINANCE AND ECONOMY TEST 1Anubrata KarmakarNo ratings yet

- Assignment 1Document2 pagesAssignment 1Lina AnastasiaNo ratings yet

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorDocument5 pagesConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969No ratings yet

- Categories of RatiosDocument6 pagesCategories of RatiosNicquainCTNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Drycleaning Plant Revenues World Summary: Market Values & Financials by CountryFrom EverandDrycleaning Plant Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Rural Livestock AdministrationFrom EverandRural Livestock AdministrationNo ratings yet

- Totalizing Fluid Meter & Counting Devices World Summary: Market Values & Financials by CountryFrom EverandTotalizing Fluid Meter & Counting Devices World Summary: Market Values & Financials by CountryNo ratings yet

- Reading 37 Activo Fijo PreguntasDocument7 pagesReading 37 Activo Fijo PreguntasdidioserNo ratings yet

- The Statement of Cash Flows QuestionsDocument19 pagesThe Statement of Cash Flows Questionsdidioser0% (1)

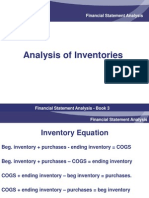

- Reading 35: Analysis of InventoriesDocument9 pagesReading 35: Analysis of InventoriesdidioserNo ratings yet

- CH 01Document32 pagesCH 01didioserNo ratings yet

- CH 03Document51 pagesCH 03Rizka YulianaNo ratings yet

- Inventario Con PreguntasDocument61 pagesInventario Con PreguntasdidioserNo ratings yet

- Preguntas TipoDocument52 pagesPreguntas TipodidioserNo ratings yet

- CH 02Document74 pagesCH 02didioserNo ratings yet

- WJP Index Report 2012 The Most Corrupted CountriesDocument246 pagesWJP Index Report 2012 The Most Corrupted CountriesmaduradasNo ratings yet

- Activo Fijo Con PreguntasDocument67 pagesActivo Fijo Con PreguntashfiehfhejfhneifNo ratings yet

- Sample Business Plan TemplateDocument19 pagesSample Business Plan TemplateHafidz Al Rusdy100% (1)

- Management Control Systems: Class 2Document18 pagesManagement Control Systems: Class 2didioserNo ratings yet

- Class1 110812Document21 pagesClass1 110812didioserNo ratings yet

- Star WarsDocument143 pagesStar WarsdidioserNo ratings yet