Professional Documents

Culture Documents

01.marketing Finance Question Set

Uploaded by

PriyahemaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01.marketing Finance Question Set

Uploaded by

PriyahemaniCopyright:

Available Formats

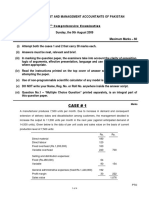

Distribution of 50 marks Exam Paper- 30 marks Group Assignment and attendance - 20 marks Format of Exam Paper Question 1 -Compulsory

- Practical- 10 marks Any two out of balance four questions Question 2) a) Practical - 5 marks b) Theory - 5 marks Question 3) a) Practical - 5 marks b) Theory - 5 marks Question 4) a) Practical - 5 marks b) Theory - 5 marks Question 5) a) Practical - 5 marks b) Theory - 5 marks Topics for group assignment 1) Impact of marketing policies on a firms a) working capital, b) credit policy, c) credit rating, d) credit recovery 2) Optimal stock holding 3) Break even analysis 4) Marketing decisions like pricing, product mix, expansion, etc 5) Marketing investment appraisal using DCF techniques 6) Appraisal of distribution channels, advertisement strategy 7) Leasing and bill discounting concepts 8) Brand valuation. 1) Budgetary Control 2) Impact of Marketing Policies on Firms Overall Receivables Management 3) Marketing Analysis and Cost Control 4) Marketing Performance Evaluation 5) Pricing 6) Stock out and loss of profit,

Budgetary Control 1) From the following information you are required to prepare a sales budget for the next year: Budgeted sales for the current year Product Calcutta Patna Gauhati A 6000 @ Rs. 10 8000 @ Rs.10 5000 @ Rs.10 B 3000 @ Rs.15 10000 @ Rs.15 3000 @ Rs.15 C 2000 @ Rs.20 12000 @ Rs.20 4000 @ Rs.20 After careful analysis and study the following suggestions are presented. a) Sales of Product A can be increased by 30%, 40% and 80% in Calcutta, Patna and Gauhati respectively. b) Sales of Product B can be increased by 20% in Patna and 40% in Gauhati, but will be reduced by 20% in Calcutta c) Sales of Product C can be increased by 20% in Calcutta. 40% in Patna and 50% in Gauhati, provided that the budget committee approves a price reduction. d) The following prices are changed by the budget committee Product A will be increased by 20% Product B will be increased by 10% Product C will be reduced by 10%. 2) The budget officer of A,B,C Ltd in consultation with other members of budget committee decides to compile a budget for selling and distribution costs based on the selling and distribution cost budget of the current year. Selling and distribution cost budget for the current year is Particulars Direct Selling Expenses Salesmans Salaries Salesmans commission Entertainment and car exp Sales Office Expenses Salaries to Staff Rent Rates etc General Expenses Advertising Expenses Press and Radio Shop Window display Distribution Expenses Warehouse Wages Drivers Wages General Expenses North(Rs.) 4,800 4,950 2,500 3,600 200 800 4,000 1,000 2,400 1,800 600 South(Rs.) 7,200 7,950 2,700 5,400 300 1000 5,000 1,500 3,600 2,400 800 Total(Rs.) 12,000 12,900 5,200 9,000 500 1800 9,000 2,500 6,000 4,200 1,400

The following changes over the current budget were also considered necessary during the next budget period. a) Salesmans salary to be increased by 10% and one more salesman at Rs. 200 per month is to be employed in South Division. b) Salesmans commission will be increased from 5% to 6% on sales, entertaining and car expenses will be increased by 10%. c) Salaries to staff will be increased by 10%, two clerks(one for each division) are to be employed each to be paid Rs. 150 per month d) Rent, rates and general expenses will go up by 5%. e) Advertising through Press and Radio will be increased by 30% and shop display by 10%. f) Warehouse mens and drivers wages will be increased by 10% and all other distribution expenses will be increased by 5%. g) The sales during the next year estimated are to be Rs. 1,30,000 and Rs. 1,90,000 for the north and south division respectively. Prepare a selling and distribution cost budget for the next year.

3) XY Co Ltd manufactures two products X and Y and sells them through two divisions East and West. For the submission of sales budget to the budget committee the following information has been made available: Budgeted sales for the current year: Product East West X 4,000 @ Rs.9 6,000 @ Rs. 9 Y 3,000 @ Rs. 21 15,000 @ Rs. 21 Adequate market studies reveal that product X is popular but under-priced. It is observed that if the price of X is increased by Re. 1, it will still find a ready market. On the other hand Y is over-priced and the market could absorb more if sales price of Y be reduced by Re. 1. The management has agreed to do so. For the information based on these price changes and reports from salesman, the following estimates have been prepared by divisional managers. Percentage increase in sales over current budget is Product East West X +10% +5% Y +20% +10% With the help of intensive advertisement campaign the following additional sales over the above estimated sales are possible. Product East (Units) West (Units) X 600 700 Y 400 500 Prepare a Sales Budget.

4) A theatre with some surplus accommodation proposes to extend its catering facilities to provide light meals to it patrons. The management board is prepared to make initial funds available to cover capital costs. It requires that these be repaid over a period of five years at a rate of interest of 14% and discounting factors at this rate are indicated below Year Discounting Factor 0 1 1 0.88 2 0.77 3 0.67 4 0.59 5 0.52

The capital costs are estimated at Rs. 60,000 for equipment that will have a life of five years and no residual value. Running costs of staff, etc., will be Rs. 20,000 in the first year, increasing by Rs. 2,000 in each subsequent year. The board proposes to charge Rs. 5,000 per annum for lighting, heating and other property expenses and wants a nominal Rs. 2,500 per annum to cover any unforeseen contingencies. Apart from this, the board is not looking for any profit, as such, from the extension of these facilities, because it believes that this will enable more theatre seats to be sold. It is proposed that costs should be recovered by setting prices for the food at double the direct costs. It is not expected that the full sales level will be reached until Year 3. The proportions of the level estimated to be reached in Years 1 and 2 are 35% and 65% respectively. You are required to calculate the budgeted sales needed to be achieved in each of the five years to meet the boards targets. Ignore taxation and inflation.

Impact of Marketing Policies on Firms Overall Receivables Management Q 5) a) Opening Accounts receivable Rs 40,000 b) Closing Accounts receivable Rs 30,000 c) Credit sales for 12 months Rs 3,50,000 Calculate age of the receivable. Q 6) A Companys collection pattern is as follows: 10% of the sales in the same month 20% of the sales in the 2nd month 40% of the sales in the 3rd month 30% of the sales in the 4th month The sales of the company for the year 1991 are as follows: Month First Qtr First 20,000 Second 20,000 Third 20,000 Total 60,000 Working days 90 Second Qtr 10,000 20,000 30,000 60,000 90 Third Qtr 15,000 20,000 25,000 60,000 90 Forth Qtr 22,500 20,000 17,500 60,000 90

Calculate Quarterly average age of receivable and comment upon the results: Q 7) A firm is interested in expanding the market by providing credit facilities. It has two types of customers in these markets, i) A segment in which 15% bad debt is expected. ii) B segment in which 20% of the debts are doubtful or bad. Expected additional Sales: A) Rs 30,000 B) Rs 80,000 The cost of goods sold including selling cost will be 50% of sales. The collection cost is 10% in (A) segment and 20% in (B) segment. Find out whether it is feasible to expand markets in these two segments.

Q 8) A company currently has an annual turnover of Rs 10lakhs and an average collection period of 45 days. The company wants to experiment with a more liberal credit policy on the ground that increase in collection period will generate additional sales. From the following information, kindly indicate which of the policies you would like the company to adopt: Credit policy Increase in Increase in sales Percentage Collection Period Rs. Default 1 15days 50,000 2% 2 30days 80,000 3% 3 40days 1,00,000 4% 4 60days 1,25,000 6% The selling price of the product is Rs 5, average cost per unit at current level is Rs 4 and the variable cost per unit is Rs 3 The current bad debt is 1% and the required rate of return on investment is 20% A year can be taken to comprise of 360 days.

Marketing Analysis and Cost Control 9) Indigo Co. Ltd, manufactures 3 products X, Y and Z and sell them direct through their salesmen in 3 zone A,B & C. The overall control on distribution & sale is done centrally at head- quarters which, is also responsible for sales promotion. The analysis of sales & cost of sales & distribution expenses for the year are as follows: Sales (Rs) S&D expenses allocated Directly (Rs) Zone A Product X 75,000 5,190 Product Y 50,000 5,300 Product Z 25,000 2,660 1,50,000 Zone B Product X Product Y Product Z 13,150

1,00,000 1,00,000 50,000 2,50,000

7,110 1,685 5,240 14,035

Zone C Product X Product Y Product Z

25,000 20,000 55,000 1,00,000

2,100 1,685 7,375 11,160

S&D expenses at headquarters are as follows: Office expenses Rs 10,500 Advertisement Rs 15,000 Other expenses Rs 13,500 Advertisement costs are allocated to zone & products on the basis of sales. The other two items of expenses are apportioned equally to the zones or the products while computing the profit or loss for the zone or the product as the case may be Cost of sales are: Product X 85% of sales Product Y 80% of sales Product Z 75% of sales Tabulate above information to present comparative profit or loss statement for each zone & for each product & offer your recommendations.

10) A company produces a single product in three sizes A, B and C. The following expenses incurred on marketing are sought to be traced to the sizes using the indicated bases. Expenses Amount Basis Salaries 10,000 Direct charge. Commission 6,000 Sales turnover. Sales office expenses 2,096 No. of orders. Advertising:- General 5,000 Sales turnover. Advertising:- Specific 22,500 Direct charge. Packing 3,000 Total volume in units of products sold. Delivery expenses 4,000 Total volume in units of Products sold. Warehouse expenses 1,000 Total volume in units of Products sold. Credit collection expense 1,296 No. of orders. The following data are also available:Total Size A Size B Size C 1) No of salesmen 10 4 5 1 2) Units sold 10,400 3,400 4,000 3,000 3) No of orders 1,600 700 800 100 4) % of specific adv. 100% 30% 40% 30% 5) Sales turnover 2,00,000 58,000 80,000 62,000 6) Volume of per unit of _ 5 8 17 finished product.

11)The anticipated sales of Electronic Corporation Ltd is Rs. 4,00,000 and unit price of a product is Rs. 20 each. The cost of Direct material is Rs. 9; labour cost is Rs. 3/- each and other variable expenses at Rs. 3 per unit. The company is earning a net profit of 5% and to improve the profitability following proposals were discussed in the Executive Committee meeting: a) The present administrative setup is on the regional basis and it was felt that centralization will reduce the fixed cost by Rs. 12,000 b) The production manager has agreed that he will try to work on a cost reduction programme which will reduce the cost by Re. 1 per unit but there will be little impact on the quality which will be negligible to the customer. The Sales Manager opposed the two proposals and suggests that it may be possible to increase the number of units sold by 20%provided the selling price is reduced by 5%. Alternatively, if the selling price is increased by 10%, the sales number of units will be reduced by 5%. As the Manager of the Company, discuss in detail the various pros and cons of the proposals, and also put forward any other proposal to improve the situation.

12)Devi and Company has made the following estimates in respect of incremental sales against three product lines, that can be realized for each advertising rupee spent: Incremental rupee sales for each rupee spent on advertisement Line A Rs. 6 Line B Rs. 12 Line C Rs. 10 The following figures are available about the average performance of the three product lines over the past several years. Line A 3,00,000 1,80,000 Line B 1,80,000 1,35,000 Line C 2,50,000 2,05,000

Sales Variable Expenses

(Rs.) (Rs.)

You are requested to recommend by showing the profit volume ratios and incremental contribution, the product line on which the company should concentrate its advertising programme, if Rs. 5000 is available for advertisement in a year. There is no change in fixed costs.

Marketing Performance Evaluation 13) Foamstar Ltd, a company selling a washing machine, has estimated the market capacity as 50, 000 units a year, divided evenly over five sales area-East, South, North and Centre. The Managing Director has set a sales objective of between 50% and 80% of this potential. The sales force is divided into five equal areas and the objective is expected to be achieved by using salesmen in the following manner. Number of salesmen used/area Market share expected % 5 50 6 58 7 65 8 71 9 76 10 78 11 80 All the products are manufactured at one location at ex-factory cost of 8,400 each and are sold at a standardized price of Rs.10,000 each. The transportation and installation cost varies in relation to the distance from the factory as follows: Sales Area Variable transportation/Installation cost/unit East 1,000 West 900 South 800 North 750 Centre 700 35 Salesmen will be employed at an average cost of Rs.1,00,000 per anum each. The Marketing Director indicated that even with additional salesmen increase beyond 6500 per area would be difficult unless additional expenditure are incurred in advertising and sales incentives as below: Sales Per Area Additional Expenditure 6501-7000 Rs.10,000 for every 100 units sold beyond 6500 7001-7500 Rs.50,000 plus 15,000 for every 100 units sold beyond 7000 7501-8000 Rs.1,25,000 plus Rs.20,000 for every 100 units Sold beyond 7500 units Given that there must be at least five salesmen in each areas, you are required to do the following: a) Calculate the highest total contribution possible using 35 salesmen. b) Advise whether increasing the sales force would improve the total contribution.

14) Ambika Condiments bring about 2 productsSuchi & Ruchi which are popular in market. The management has the option to alter the sales-mix of the 2 products from out of the following combinations Option Suchi(Units) Ruchi(Units) I 800 600 II 1,600 III 1,300 IV 1,100 500 The per unit production cost/sales data are : Suchi(Rs.) Ruchi(Rs.) Direct Material 25 30 Direct Labour 20 24 Selling Price 75 90 Variable O/H 100% of Direct Labour, Common Fixed Overhead for both Products Rs. 10000 You are required to 1) Prepare a marginal cost statement for the two products 2) Evaluate the options and identify the most profitable sales mix. 15) Dream Works Ltd manufactures a standard product, the marginal cost(per unit) of which are as follows: Direct Material Rs.160 Direct Wages Rs.120 Variable Overheads Rs.20 Total Rs.300 Its Annual Budget includes the following: Output 40,000 units. Fixed Overheads: Production Rs.80,00,000 Administration Rs.48,00,000 Marketing Rs.40,00,000 Total Rs.1,68,00,000 Contribution Rs.2,00,00,000 Recently, the top management of the organization has started thinking in terms of revising its budget and some alternatives in the form of proposals(stated below) were discussed in the last board meeting Proposal 1 The organization expects a profit of Rs.48,00,000 and wants to know the selling price to be quoted for the purpose. It is estimated that a) an increase in advertising expenditure of Rs.9,44,000 would result in 10% increase in sales and b) Fixed production overheads and marketing overheads would increase by Rs.2,00,000 & Rs.1,36,000 respectively. Proposal 2 The organization expects that, with an additional advertising expenditure sales would go up by 20% and a profit margin of 15% would be obtained. Under the circumstances, fixed overheads and marketing are expected to increase by Rs.3,20,000 & Rs.2,00,000 respectively. The organization wants to know the additional expenditure on advertisement required with a view to achieving the result. You are required to draw up forecast statements for each of these alternatives and determine the selling price per unit.

Cost-Plus Pricing: This the most common method used for pricing. Under this method, the price is set to cover all costs(materials, labour & overheads). It takes the full cost into consideration including all the overheads and adds the profit margin to the total. Full cost, cost plus, cost based and absorption costing are the terms by which this is called. Q 16) An ancillary industry has received an order from a large industry for the manufacture of one lakh components @ Rs 600 for 1000 numbers for which there is a rising demand. The raw materials required are mild steel strips and spring steel strips which will be drawn in press for making components by using tools and dies. Calculate the estimated cost of production and margin of profit if any from the following data and submit your recommendations as to whether the order should be accepted or not. i) 0.3 M. tonne and 0.2 M. tonne of mild steel strip and spring steel strip respectively are required to complete the order. These strips are available in the form of coils. ii) Raw materials: a) Mild steel 1) Rs 2100 per M.tonne if purchased in quantities of more than one M. tonne 2) Rs 2,200 per M. tonne if purchased in quantities of less than one M.tonne. b) Spring steel 1) Rs 4,200 per M. tonne if purchased in quantities of more than one M. tonne 2) Rs 4,500 per M.tonne if purchased in quantities of less than one M. tonne. iii) Manufacturing period 2 months for one lakh no. of components. iv) Wages Rs 4,500 per month. v) Capital cost of existing press (capacity exists)(assume depreciation 10% per annum) Rs 1.2 lakhs. vi) Additional special equipments required Rs 2,000 (depreciation 10% per annum) vii) Estimated cost of manufacture of special tools and dies Rs 30,000 (Life is estimated to cover manufacture of one million components) viii) Recurring expenses for grinding of tools and dies to complete the order Rs 1,000 ix) Cleaning 5 paise for each component. x) Supervision and overhead expenses of the shop Rs 1,000 per month. xi) Share of other service and administrative section Rs 1,500 per month. xii) Selling and distribution expenses 5% of the total cost. xiii) Provision of rejection by customer 11%.

Marginal Cost pricing Under this method fixed costs are ignored and prices are determined on the basis of marginal cost. Marginal cost is the change in total costs that results from production of additional unit of a product or service. Q 17) Look Ahead Ltd., want to fix proper selling prices for their products A and B which they are newly introducing in the market. Both these products will be manufactured in Department D which is considered as a profit centre. The estimated data are as under : Particulars A B Annual production (units) 1,00,000 2,00,000 Direct materials per unit (Rs) 15 14 Direct Labour per unit (Rs) 9 6 (Direct labour hour rate Rs 3) The proportion of overheads other than interest, chargeable to the two products are as under: Factory overheads (50% fixed) 100% of direct wages. Administrative overheads (100% fixed) 10% of factory cost. Selling and distribution overheads (50% variable) Rs 3 and Rs 4 respectively per unit of products A and B. The fixed capital investment in the department is Rs 50 lakhs. The working capital requirement is equivalent to 6 months stock of cost of sales of both the products. For this project a term loan amounting to 40 lakhs has been obtained from Financial Institutions at an Interest rate of 14% per annum. 50% of the working capital needs are met by bank borrowing carrying interest at 18% per annum. The department is expected to give a return of 20% on its capital employed. You are required to : a) Fix the selling prices of products A and B such that the contribution per direct labour hour is the same of both the products. b) Prepare a statement showing in detail the over-all profit that would be made by the department.

Pricing for target rate of return Under this method, in determining the product price, a profit at certain percentage of capital employed is added to the total cost. Sales = Total costs + [Desired % return on capital x Capital employed) Q 18) Machine tool Manufactures Ltd., have received an enquiry for the supply of 2,00,000 numbers of special type of machine parts. Capacity exists for the manufacture of the machine parts but a fixed investment of Rs 80,000 and working capital to the extent of Rs 25% of sales value will be required if the job is undertaken. The costs are estimated as follows: Raw material- 20,000 kgs. @ Rs 2.30 per kg. Labour hours Direct 18,000 of which 2,000 would be overtime hours payable at double the labour rate- Re 1 per hour. Factory overhead- Re 1 per direct Labour hour. Selling & Distribution expenses Rs 23,000. Materials recovered at the end of the operation is estimated at Rs 2,000. The company expects a net return of 25% on capital employed. You are the management Accountant of the company. The Managing Director requests you to prepare a cost and price statement indicating the price which should be quoted to the customer. Q 19) Repographics Ltd manufactures a document reproducing machine which has a variable cost structure as follows: Rs. Material 40 Labour 10 Overhead 4 Selling Price 90 Sales during the current year are expected to be Rs. 13,50,000 and fixed overhead Rs. 1,40,000 Under a wage agreement, an increase of 10% is payable to all direct workers from the beginning of the forthcoming year, while material costs are expected to increase by 7.5%; variable overhead costs by 5% and fixed overhead costs by 3% You are required to calculate: (a) The new selling Price if the current P/V ratio is to be maintained; and (b) The Quantity to be sold during the forthcoming year to yield the same amount of profit as the current year assuming the selling price to remain at Rs. 90.

Q 20) A company buys and sells a product whose demand over the past few years has fluctuated between 8,000 and 17,000 units per month. Its selling price is Rs. 60/- per unit. Data for the last year were: Month Orders Received Purchases (000 units) (000 units) 1 16 11 2 14 10 3 14 16 4 13 14 5 10 12 6 15 12 7 10 14 8 9 16 9 17 17 10 12 16 11 10 12 12 12 15 At the beginning of the month 1 there was a stock of 1000 units and there were no unfilled orders to customers. Arrangements with the supplier are that (a) There is a standing order of 12,000 units per month at a price of Rs. 35 per unit. (b) If more are needed in any month the price of the extra items is Rs. 40/- per unit. (c) If fewer are needed in any month, the quantity ordered can be reduced in lots of 1,000 units at a penalty of Rs. 9/- per unit. (d) For any change from the standing order, two months notice must be given(such that a request for a change in month 3 must be notified in month 1 and so on) Other data: (i) The cost of stockholding is Rs. 3/- per unit per month based on and charged in the month of sale. (ii) If the company is out of stock, it must reduce the price to the customer by 10% of the selling price for each month of delivery delay. (iii) Stock carried forward is valued at Rs. 35/- per unit. (iv) Fixed cost is Rs. 1,00,000 per month. You are required to calculate the net profit for the company for the past year Q 21) Ladies Latest is the popular chain stores selling a wide range of high quality fashionable outfits. One particular outfit is bought in at Rs. 80 and sold at Rs. 130. Average holding costs per season per outfit work out at Rs. 5 and it costs Rs. 800 to order and receive goods into stock. The manufacturers require the order in advance and once a batch has been made, it is not possible to place a repeat order. Further, it is not possible for delivery to be staggered over the fashion season. When a customer buys an outfit, any alterations or adjustments are made to make it a best fit and she collects the outfit a day or so later. Generally, if an outfit is out of

stock in one stores, it can be readily obtained from another branch in an matter of hours. However, if the chain stores as a whole runs out of an item, then not only is the profit not earned, but Rs. 20 or so profit that comes from the extras the customers buy is also lost. Should the chain stores overbuy for the season, it is expected that the stores will be able to dispose of the surplus at Rs. 50 each. The pattern of past sales of a comparative outfit shows the following probability distribution for the chain stores as a whole: Output sold Probability 1,100 0.30 1,200 0.40 1,300 0.20 1,400 0.10 Bearing in mind the penalties per over the under-ordering, you are required to determine in advance the number of outfits to order to maximize expected profits

You might also like

- 1.budgeting QuestionDocument4 pages1.budgeting QuestionPriyahemaniNo ratings yet

- 1Document8 pages1Snehak KadamNo ratings yet

- Cost Accounting 2008wDocument7 pagesCost Accounting 2008wMustaqim QureshiNo ratings yet

- Problems in EBITDocument4 pagesProblems in EBITtj0000780% (5)

- Marginal Costing ProblemsDocument12 pagesMarginal Costing ProblemsPratik ShitoleNo ratings yet

- Marginal Costing and Break-Even AnalysisDocument6 pagesMarginal Costing and Break-Even AnalysisPrasanna SharmaNo ratings yet

- MC ProblemsDocument6 pagesMC ProblemsParikshit SurekaNo ratings yet

- IMT 07 Working Capital Management M2Document7 pagesIMT 07 Working Capital Management M2solvedcareNo ratings yet

- SMA Notes (Imp. Problems)Document26 pagesSMA Notes (Imp. Problems)Naresh GuduruNo ratings yet

- Project Appraisal & Finance ProblemsDocument3 pagesProject Appraisal & Finance ProblemsBhargav Tej PNo ratings yet

- 4.MKTGPerformance QuestionDocument2 pages4.MKTGPerformance QuestionPriyahemaniNo ratings yet

- Business - Analysis Dec-11Document3 pagesBusiness - Analysis Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- PricingDocument7 pagesPricingarshdeep1990No ratings yet

- Cost and Management AccountingDocument6 pagesCost and Management AccountingTIMOREGHNo ratings yet

- Calculate the following:- Raw material cost- Labor cost - Variable production overheads- Fixed production overheads- Cost of productionDocument7 pagesCalculate the following:- Raw material cost- Labor cost - Variable production overheads- Fixed production overheads- Cost of productionWaseim khan Barik zaiNo ratings yet

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- Cost and Management Accounting QuestionsDocument13 pagesCost and Management Accounting QuestionsSandeepSinghNo ratings yet

- Assignment QuestionsDocument32 pagesAssignment Questionspratik panchalNo ratings yet

- Sales and production budgetsDocument7 pagesSales and production budgetsMedhaNo ratings yet

- Study Material of FMDocument22 pagesStudy Material of FMPrakhar SahuNo ratings yet

- EBIT ProblemsDocument8 pagesEBIT ProblemsAmal JoseNo ratings yet

- Accounting For Managers: S. No. Questions 1Document5 pagesAccounting For Managers: S. No. Questions 1shilpa mishraNo ratings yet

- CacDocument4 pagesCacaskermanNo ratings yet

- Rs. Rs. RS.: Indian Metals & Ferro Alloys Limited Indian Metals & Ferro Alloys LimitedDocument8 pagesRs. Rs. RS.: Indian Metals & Ferro Alloys Limited Indian Metals & Ferro Alloys LimitedKUMAR ABHISHEKNo ratings yet

- Managerial AccountingDocument1 pageManagerial Accountingacuna.alexNo ratings yet

- 185f8question BankDocument18 pages185f8question Bank55amonNo ratings yet

- Costing Test Book ProblemsDocument29 pagesCosting Test Book ProblemsSameer Krishna100% (1)

- Costing FM Model Paper - PrimeDocument17 pagesCosting FM Model Paper - Primeshanky631No ratings yet

- Financial Forecasting and BudgetingDocument9 pagesFinancial Forecasting and BudgetingPRINCESS HONEYLET SIGESMUNDONo ratings yet

- SSC Finals ExaminationDocument8 pagesSSC Finals ExaminationSonia RamosNo ratings yet

- MS7-Accounts Receivable Additional ExercisesDocument2 pagesMS7-Accounts Receivable Additional ExercisesVensen FuentesNo ratings yet

- 9 Comprehensive Examination: Case # 1Document4 pages9 Comprehensive Examination: Case # 1Sajid AliNo ratings yet

- The Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Document9 pagesThe Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Amal VinothNo ratings yet

- Marginal Costing (CVP Analysis) Unit IIDocument25 pagesMarginal Costing (CVP Analysis) Unit IIrahul shrivastavaNo ratings yet

- MCS Practical For StudentsDocument10 pagesMCS Practical For StudentsrohitkoliNo ratings yet

- Hcs MFG Makes Its Product For 60 and Sells ItDocument2 pagesHcs MFG Makes Its Product For 60 and Sells ItAmit PandeyNo ratings yet

- Assignment Budgeting 1 WorksheetDocument9 pagesAssignment Budgeting 1 WorksheetSultan Bin OboodNo ratings yet

- CVP Analysis and Absorption vs Variable CostingDocument3 pagesCVP Analysis and Absorption vs Variable CostingBenjamin0% (1)

- ACCA f5 - 2014 - Jun - QDocument7 pagesACCA f5 - 2014 - Jun - QGavin ChongNo ratings yet

- HW 2.2 Afm SendDocument10 pagesHW 2.2 Afm SendAbiodun OlokodanaNo ratings yet

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocument15 pagesMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad EstoqueNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Bep AnalysisDocument13 pagesBep Analysisanujain1990No ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingstandalonembaNo ratings yet

- Asad NotesDocument15 pagesAsad NotesassadjavedNo ratings yet

- Chapter 07 TF MC With AnswersDocument7 pagesChapter 07 TF MC With AnswersKlomoNo ratings yet

- Budgeted Receipts from Credit SalesDocument18 pagesBudgeted Receipts from Credit SalesLúa PhạmNo ratings yet

- Financial AssumptionsDocument13 pagesFinancial AssumptionsnorlieNo ratings yet

- Assignment 3Document14 pagesAssignment 3BlairChoiNo ratings yet

- Budgets and forecasts for business planningDocument4 pagesBudgets and forecasts for business planningSai SumanNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Costing & FM J 2021Document147 pagesCosting & FM J 2021Priya RajNo ratings yet

- Seminar 11answer Group 10Document75 pagesSeminar 11answer Group 10Shweta Sridhar40% (5)

- KTQT LMS1 27 - 08Document14 pagesKTQT LMS1 27 - 08Khánh Vy Hà VũNo ratings yet

- DCF Problems PGDM Tri 4Document3 pagesDCF Problems PGDM Tri 4pratik waliwandekarNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Execution Excellence: Making Strategy Work Using the Balanced ScorecardFrom EverandExecution Excellence: Making Strategy Work Using the Balanced ScorecardRating: 4 out of 5 stars4/5 (1)

- Delivery NoteDocument1 pageDelivery NotePriyahemaniNo ratings yet

- Form 30Document2 pagesForm 30Sriraghuraman Gopal Rathnam0% (1)

- Form 30Document2 pagesForm 30Sriraghuraman Gopal Rathnam0% (1)

- Personnel FinanceDocument41 pagesPersonnel FinancePriyahemaniNo ratings yet

- MFM Marketing DecisionsDocument35 pagesMFM Marketing DecisionsPriyahemaniNo ratings yet

- FX Risk ExposureDocument74 pagesFX Risk ExposurePriyahemaniNo ratings yet

- Final - SEC ADR Guidelines Tracking of S & P Nasdaq and Listing Requirements RevisedDocument36 pagesFinal - SEC ADR Guidelines Tracking of S & P Nasdaq and Listing Requirements RevisedPriyahemaniNo ratings yet

- SMEDA Fruit Juice ProcessingDocument41 pagesSMEDA Fruit Juice ProcessingImran Qasim Jora100% (1)

- Case Study-Ashok Food ProductsDocument1 pageCase Study-Ashok Food ProductsPriyahemaniNo ratings yet

- QM in FinanceDocument65 pagesQM in FinancePriyahemaniNo ratings yet

- 4.MKTGPerformance QuestionDocument2 pages4.MKTGPerformance QuestionPriyahemaniNo ratings yet

- Rbi Fema PDFDocument22 pagesRbi Fema PDFPriyahemani100% (1)

- Business Reports and Letter WritingDocument11 pagesBusiness Reports and Letter WritingPriyahemaniNo ratings yet

- FX Risk ExposureDocument74 pagesFX Risk ExposurePriyahemaniNo ratings yet

- Project Work of Financial Management SemDocument1 pageProject Work of Financial Management SemPriyahemaniNo ratings yet

- LAW Fera Fema Ver 1Document67 pagesLAW Fera Fema Ver 1PriyahemaniNo ratings yet

- Debt FinancingDocument23 pagesDebt FinancingPriyahemaniNo ratings yet

- FDI Project ReportDocument44 pagesFDI Project ReportPriyahemaniNo ratings yet

- Indian Auto Ancillary Industry March 2011Document8 pagesIndian Auto Ancillary Industry March 2011PriyahemaniNo ratings yet

- FDI Project ReportDocument44 pagesFDI Project ReportPriyahemaniNo ratings yet

- ThesisDocument29 pagesThesisapi-27626709100% (1)

- Devils DenDocument3 pagesDevils DenMisti Walker100% (1)

- 2022 03 Logistec Investor Presentation Short VersionDocument34 pages2022 03 Logistec Investor Presentation Short VersionT TtNo ratings yet

- ECO202-Practice Test - 15 (CH 15)Document4 pagesECO202-Practice Test - 15 (CH 15)Aly HoudrojNo ratings yet

- Daw-Compro Oct 2023Document27 pagesDaw-Compro Oct 2023oktafianrinaldyNo ratings yet

- Understanding the Stock Market (40 charactersDocument2 pagesUnderstanding the Stock Market (40 charactersMara CaiboNo ratings yet

- Deluxe Auto Case Study on Incorporating InflationDocument4 pagesDeluxe Auto Case Study on Incorporating InflationAryan SharmaNo ratings yet

- Saudi Arabia EconomicsDocument14 pagesSaudi Arabia Economicsahmadia20No ratings yet

- Bangladesh Bank Report (Final)Document14 pagesBangladesh Bank Report (Final)chatterjee1987100% (4)

- Supplier Development PlanDocument9 pagesSupplier Development PlanWilliamNo ratings yet

- Solved Mrs Carr Made The Following Interest Payments Determine The ExtentDocument1 pageSolved Mrs Carr Made The Following Interest Payments Determine The ExtentAnbu jaromiaNo ratings yet

- Apc 301 Week 8Document2 pagesApc 301 Week 8Angel Lourdie Lyn HosenillaNo ratings yet

- UTS Pengantar Akutansi 2Document3 pagesUTS Pengantar Akutansi 2Pia panNo ratings yet

- Superfood Annual Report - Presentation of DocumentsDocument4 pagesSuperfood Annual Report - Presentation of Documentsapi-279228567No ratings yet

- International Finance - MG760-144 Week 9 - Chapter 14 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolDocument4 pagesInternational Finance - MG760-144 Week 9 - Chapter 14 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolKiranNo ratings yet

- Case Analysis Boom and BustDocument3 pagesCase Analysis Boom and BustErikApuRa100% (1)

- Assignment SPCMDocument8 pagesAssignment SPCMRaghuNo ratings yet

- Toeic Assignment IDocument4 pagesToeic Assignment Icaca 2No ratings yet

- United States Securities and Exchange Commission FORM 20-F: Yandex N.V. Index To Consolidated Financial StatementsDocument287 pagesUnited States Securities and Exchange Commission FORM 20-F: Yandex N.V. Index To Consolidated Financial StatementsYeli LiuNo ratings yet

- WASH Assistant Oral Interview - Garowe - UNICEFDocument5 pagesWASH Assistant Oral Interview - Garowe - UNICEFali muhamed yare100% (13)

- World Bank Uganda Poverty Assessment Report 2016Document178 pagesWorld Bank Uganda Poverty Assessment Report 2016The Independent MagazineNo ratings yet

- Letter For Advance Tax On SalaryDocument1 pageLetter For Advance Tax On SalarywaqarNo ratings yet

- The Dubai ShopDocument2 pagesThe Dubai ShopHaries Bugarin GarciaNo ratings yet

- Tutorial 5 (Class)Document3 pagesTutorial 5 (Class)fujinlim98No ratings yet

- Finance Manager Property Accountant in Boston MA Resume Donna McDonaldDocument2 pagesFinance Manager Property Accountant in Boston MA Resume Donna McDonaldDonnaMcDonaldNo ratings yet

- Business and Finance Solution FinalDocument8 pagesBusiness and Finance Solution FinalRashid Ali JatoiNo ratings yet

- Threat of New Entrants (Barriers To Entry)Document4 pagesThreat of New Entrants (Barriers To Entry)Sena KuhuNo ratings yet

- Fu-Wang Foods Ltd. Financial Calculations (2009 - 2013)Document46 pagesFu-Wang Foods Ltd. Financial Calculations (2009 - 2013)BBACSE113100% (3)

- Methods of BudgetingDocument30 pagesMethods of BudgetingShinjiNo ratings yet

- Plagiarism Scan Report: Plagiarised Unique Words CharactersDocument2 pagesPlagiarism Scan Report: Plagiarised Unique Words CharactersFaizan AminNo ratings yet