Professional Documents

Culture Documents

Financial Statement Analysis

Uploaded by

Ethen AudiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis

Uploaded by

Ethen AudiCopyright:

Available Formats

Financial Statement Analysis:

Introduction The process of reviewing and evaluating a company's financial statements (such as the balance sheet or profit and loss statement), thereby gaining an understanding of the financial health of the company and enabling more effective decision making. Financial statements record financial data; however, this information must be evaluated through financial statement analysis to become more useful to investors, shareholders, managers and other interested parties.

Advantages of financial statement analysis The different advantages of financial statement analysis are listed below: The most important benefit if financial statement analysis is that it provides an idea to the investors about deciding on investing their funds in a particular company. Another advantage of financial statement analysis is that regulatory authorities like IASB can ensure the company following the required accounting standards. Financial statement analysis is helpful to the government agencies in analyzing the taxation owed to the firm. Above all, the company is able to analyze its own performance over a specific time period.

Limitations of financial statement analysis In spite of financial statement analysis being a highly useful tool, it also features some limitations, including comparability of financial data and the need to look beyond ratios. Although comparisons between two companies can provide valuable clues about a companys financial health, alas, the differences between companies accounting methods make it, sometimes, difficult to compare the data of the two. Besides, many a times, sufficient data are on hand in the form of foot notes to the financial statements so as to restate data to a comparable basis. Or else, the analyst should remember the lack of data comparability before reaching any clear-cut conclusion. However, even with this limitation, comparisons between the key ratios of two companies along with industry averages often propose avenues for further investigation.

ITC Limited Key Financial Ratio Mar '13 Investment Valuation Ratios Face Value 1.00 Dividend Per Share 5.25 Operating Profit Per Share (Rs) 13.45 Net Operating Profit Per Share (Rs) 37.84 Free Reserves Per Share (Rs) -Bonus in Equity Capital 89.91 Profitability Ratios Operating Profit Margin (%) 35.54 Profit Before Interest And Tax 31.88 Margin (%) Gross Profit Margin (%) 32.88 Cash Profit Margin (%) 26.63 Adjusted Cash Margin (%) 26.63 Net Profit Margin (%) 24.05 Adjusted Net Profit Margin (%) 24.05 Return On Capital Employed (%) 48.18 Return On Net Worth (%) 33.28 Adjusted Return on Net Worth (%) 33.28 Return on Assets Excluding 28.21 Revaluations Return on Assets Including 28.21 Revaluations Return on Long Term Funds(%) 48.18 Liquidity And Solvency Ratios Current Ratio 1.22 Quick Ratio 0.66 Debt Equity Ratio -Long Term Debt Equity Ratio -Debt Coverage Ratios Interest Cover 124.56 Total Debt to Owners Fund 0.00 Financial Charges Coverage Ratio 133.76 Financial Charges Coverage Ratio 95.99 Post Tax Mar '12 Mar '11 Mar '10 Mar '09

1.00 4.50 11.41 32.09 22.50 90.87 35.55 31.99 32.77 26.10 26.10 23.97 23.97 46.95 32.88 32.07 23.97 24.04 46.95 1.08 0.51 --131.91 0.00 109.56 79.84

1.00 4.45 9.30 27.29 19.07 91.81 34.08 30.05 30.97 25.17 25.17 22.91 22.91 44.94 31.36 30.34 20.55 20.62 44.95 1.08 0.50 0.01 0.01 123.30 0.01 100.46 73.25

1.00 10.00 16.06 48.63 34.73 85.85 33.02 28.97 29.74 23.98 23.98 21.30 21.30 42.64 28.98 28.29 36.69 36.84 42.64 0.92 0.39 0.01 0.01 82.46 0.01 73.42 52.72

1.00 3.70 13.04 39.70 34.27 86.84 32.84 28.37 29.17 24.22 24.22 21.18 21.18 34.60 23.85 23.26 36.24 36.39 34.75 1.42 0.61 0.01 0.01 168.97 0.01 112.17 81.02

Management Efficiency Ratios Inventory Turnover Ratio Debtors Turnover Ratio Investments Turnover Ratio Fixed Assets Turnover Ratio Total Assets Turnover Ratio Asset Turnover Ratio Average Raw Material Holding Average Finished Goods Held Number of Days In Working Capital Profit & Loss Account Ratios Material Cost Composition Imported Composition of Raw Materials Consumed Selling Distribution Cost Composition Expenses as Composition of Total Sales Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit Dividend Payout Ratio Cash Profit Earning Retention Ratio Cash Earning Retention Ratio Adjusted Cash Flow Times

4.53 27.82 4.53 1.80 1.34 1.45 --31.26 41.90 11.99 -12.73 65.42 59.08 34.58 40.92 0.01

6.53 26.50 6.53 1.81 1.34 1.44 168.12 40.51 12.56 39.59 13.03 6.67 10.44 66.35 59.59 31.98 39.06 0.01

6.05 23.91 6.05 1.69 1.34 1.40 184.53 40.67 13.97 40.72 13.34 6.80 13.32 80.24 70.91 17.06 26.99 0.02

6.04 24.31 6.04 1.58 1.33 1.32 193.81 36.33 -13.69 38.45 12.03 6.66 12.68 109.63 95.34 -12.31 2.64 0.02

5.26 21.32 5.26 1.44 1.09 1.14 185.08 64.35 62.19 45.80 12.98 7.12 14.85 50.06 42.84 48.67 56.23 0.05

Enduring Enduring Value

Name Roll No Room No Semester Subject Topic : : : : : : Md Ejaj 726 34 VI (Six) Financial Market and Operations ITC Limiteds Financial Statement Analysis Dr. Mohd Hanif St. Xaviers College

Professors Name College

: :

Well-established distribution networks, intense competition between the organized and unorganized segments characterize the FMGC sector. It is expected to grow by over 60% by 2010. That will translate into an annual growth of 10% over a 5-year period. It has been estimated that FMCG sector will rise from around Rs 56,500 crores in 2005 to Rs 92,100 crores in 2010.Hair care, household care, male grooming, female hygiene, and the chocolates andconfectio nery categories are estimated to be the fastest growing segments, says an HSBC report. Though the sector witnessed a slower growth in 2002-2004, it has been able to make a fine recovery since then. For example, Indian Tobacco Company Limited (ITC) has shown a healthy growth in the last quarter. An estimated double-digit growth over the next few years shows that the good times are likely to continue. Growth Prospects With the presence of 12.2% of the world population in the villages of India, the Indian rural FMCG market is something no one can overlook. Increased focus on farm sector will boost rural income, hence providing better growth prospects to the FMCGcompanies. Better infrastructure facilities will improve their supply chain. FMCG sector is also likelyto benefit from growing demand in the market. Because of the low per capitaconsumption for almost all the products in the country, FMCG companies have immense possibilities for growth. And if the companies are able to change the mindset of the consumers, i.e. if they are able to take the consumers to branded products and offer new generation products, they would be able to generate higher growth in the near future. It is expected that the rural income will rise in 2007, boosting purchasing power in the country side. However, the demand in urban areas would be the key growth driver over the long term. Also, increase in the urban population, along with increase in income levels and the availability of new categories, would help the urban areas maintain their position in terms of consumption .At present, urban India accounts for 66% of total FMCG consumption, with rural India accounting for the remaining 34%. However, rural India accounts for more than 40%consumption in major FMCG categories such as personal care, hot beverages. In urban areas, home and personal care category, including skin care, household care and feminine hygiene, will keep growing at relatively attractive rates. Within the foods segment, it is estimated that processed foods, bakery, and dairy are long-term growth categories in both rural and urban areas

Mar '13 Particular Sources Of Funds Total Share Capital Equity Share Capital Share Application Money Preference Share Capital Reserves Revaluation Reserves Networth Secured Loans Unsecured Loans Total Debt Total Liabilities 12 mths

Mar '12 12 mths

Mar '11 12 mths

Mar '10 12 mths

Mar '09 12 mths

790.18 790.18 0.00 0.00 21,497.67 0.00 22,287.85 0.00 66.40 66.40 22,354.25 Mar '13 12 mths

781.84 781.84 0.00 0.00 17,957.00 53.05 18,791.89 1.77 77.32 79.09 18,870.98 Mar '12 12 mths

773.81 773.81 0.00 0.00 15,126.12 53.34 15,953.27 1.94 97.26 99.20 16,052.47 Mar '11 12 mths

381.82 381.82 0.00 0.00 13,628.17 54.39 14,064.38 0.00 107.71 107.71 14,172.09 Mar '10 12 mths

377.44 377.44 0.00 0.00 13,302.55 55.09 13,735.08 11.63 165.92 177.55 13,912.63 Mar '09 12 mths

Application Of Funds Gross Block Less: Accum. Depreciation Net Block Capital Work in Progress Investments Inventories Sundry Debtors Cash and Bank Balance Total Current Assets Loans and Advances Fixed Deposits Total CA, Loans & Advances Deffered Credit Current Liabilities Provisions Total CL & Provisions Net Current Assets Miscellaneous Expenses Total Assets Contingent Liabilities

16,679.17 5,469.83 11,209.34 1,487.79 7,060.29 6,600.20 1,163.34 3,615.00 11,378.54 2,881.47 0.00 14,260.01 0.00 6,404.43 5,258.75 11,663.18 2,596.83 0.00 22,354.25 2,122.83

13,926.34 4,819.66 9,106.68 2,572.06 6,316.59 5,637.83 986.02 140.50 6,764.35 1,952.54 2,678.43 11,395.32 0.00 6,108.60 4,411.07 10,519.67 875.65 0.00 18,870.98 2,533.61

12,765.82 4,420.75 8,345.07 1,333.40 5,554.66 5,267.53 907.62 98.77 6,273.92 2,173.89 2,144.47 10,592.28 0.00 5,668.10 4,104.84 9,772.94 819.34 0.00 16,052.47 2,228.40

11,967.86 3,825.46 8,142.40 1,008.99 5,726.87 4,549.07 858.80 120.16 5,528.03 1,929.16 1,006.12 8,463.31 0.00 4,619.54 4,549.94 9,169.48 -706.17 0.00 14,172.09 258.73

10,558.65 3,286.74 7,271.91 1,214.06 2,837.75 4,599.72 668.67 68.73 5,337.12 2,150.21 963.66 8,450.99 0.00 4,121.59 1,740.49 5,862.08 2,588.91 0.00 13,912.63 261.36

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Weygandt Accounting Principles 10e PowerPoint Ch09Document66 pagesWeygandt Accounting Principles 10e PowerPoint Ch09billy93No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Debt Validation 01 UccDocument2 pagesDebt Validation 01 UccKNOWLEDGE SOURCENo ratings yet

- Application for Vehicle Title BondDocument1 pageApplication for Vehicle Title BondNotarys To GoNo ratings yet

- LBP V BelleDocument6 pagesLBP V BelleJoshua Quentin TarceloNo ratings yet

- A Free Guide To Structured Products by SPGODocument18 pagesA Free Guide To Structured Products by SPGObenmurisonNo ratings yet

- Account Statement PDFDocument2 pagesAccount Statement PDFVidhnesh SoniNo ratings yet

- Low Cost Housing - JournalDocument8 pagesLow Cost Housing - JournalAshutoshKumarNo ratings yet

- Tax Q&A - Employment IncomeDocument5 pagesTax Q&A - Employment IncomeHadifli100% (1)

- Bid StandardDocument119 pagesBid StandardFau JohnNo ratings yet

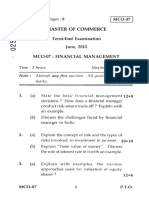

- MCO-7 June12Document7 pagesMCO-7 June12BinayKPNo ratings yet

- Dairy Farm (25 Animal)Document38 pagesDairy Farm (25 Animal)Ali HasnainNo ratings yet

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Document3 pagesAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandNo ratings yet

- 0452 w17 QP 23 PDFDocument20 pages0452 w17 QP 23 PDFMuhammad Faiz AzmiNo ratings yet

- Basis Point: 1 Definition 2 PermyriadDocument2 pagesBasis Point: 1 Definition 2 PermyriadAnonymous 7TgOAhNJKQNo ratings yet

- CP Chapter 2 - 201819 1Document8 pagesCP Chapter 2 - 201819 1Jerome JoseNo ratings yet

- Sollutions To Cost of CapitalDocument5 pagesSollutions To Cost of CapitalBirat SharmaNo ratings yet

- Measuring Lending Profitability at The Loan Level: An IntroductionDocument5 pagesMeasuring Lending Profitability at The Loan Level: An IntroductionLakshminarayana PonangiNo ratings yet

- Chapter-12: Tender No PLM/PHDPL-AUG Technical Specifications - Combined Station WorksDocument8 pagesChapter-12: Tender No PLM/PHDPL-AUG Technical Specifications - Combined Station WorksAjay HawaldarNo ratings yet

- Account Group Tree for South City GroupDocument113 pagesAccount Group Tree for South City GroupSabyasachiNo ratings yet

- Money MarketDocument25 pagesMoney MarketUrvashi SinghNo ratings yet

- Ch02 - Conceptual FrameworkDocument31 pagesCh02 - Conceptual FrameworkAhmad SaputraNo ratings yet

- BCom Financial Management Elective SyllabusDocument2 pagesBCom Financial Management Elective SyllabusNikhil KarkhanisNo ratings yet

- Wealth Statement Under Section 116 of The Income Tax Ordinance, 2001Document6 pagesWealth Statement Under Section 116 of The Income Tax Ordinance, 2001PTI OfficialNo ratings yet

- BASIX-BSFL Social Rating ReportDocument17 pagesBASIX-BSFL Social Rating Reportakhi_lesh001No ratings yet

- MCK - Commercial Payments in Asia-Pacific PREEZDocument40 pagesMCK - Commercial Payments in Asia-Pacific PREEZAndrey PritulyukNo ratings yet

- MH, GUJ & MP Textile Policy ComparisionDocument16 pagesMH, GUJ & MP Textile Policy Comparisionsureshganji06No ratings yet

- 2 7Document35 pages2 7Kiran VaykarNo ratings yet

- Commercial Bank - Definition, Function, Credit Creation and SignificancesDocument19 pagesCommercial Bank - Definition, Function, Credit Creation and SignificancesAhmar AbbasNo ratings yet

- Futures Options and Swaps PPT MBA FINANCEDocument11 pagesFutures Options and Swaps PPT MBA FINANCEBabasab Patil (Karrisatte)No ratings yet