Professional Documents

Culture Documents

Ftxmys Pilot Paper

Uploaded by

aqmal16Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ftxmys Pilot Paper

Uploaded by

aqmal16Copyright:

Available Formats

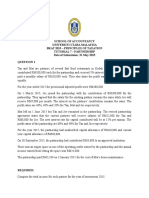

FOUNDATIONS IN ACCOUNTANCY

Foundations in Taxation (Malaysia)

Pilot Paper

Time allowed: Writing: 2 hours This paper is divided into two sections: Section A ALL TEN questions are compulsory and MUST be attempted Section B ALL NINE questions are compulsory and MUST be attempted Tax rates and allowances are on pages 24

Do NOT open this paper until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

PaperFTX(MYS)

SUPPLEMENTARY INSTRUCTIONS 1 2 3 Calculations and workings should be made to the nearest RM. All apportionments should be made to the nearest whole month. All workings should be shown.

TAX RATES AND ALLOWANCES The following tax rates, allowances and values to be used in answering the questions.

Income tax rates Resident individuals Chargeable income RM First 2,500 (0 2,500) Next 2,500 (2,501 5,000) Next 15,000 (5,001 20,000) Next 15,000 (20,001 35,000) Next 15,000 (35,001 50,000) Next 20,000 (50,001 70,000) Next 30,000 (70,001 100,000) Exceeding 100,000 Resident company Paid up ordinary share capital First RM500,000 RM2,500,000 or less 20% More than RM2,500,000 25% Non-residents Company Individual

Rate % 0 1 3 7 12 19 24 26

Cumulative tax RM 0 25 475 1,525 3,325 7,125 14,325

Excess over RM500,000 25% 25% 25% 26%

Personal reliefs and allowances Self Disabled self, additional Medical expenses expended for parents (maximum) Medical expenses expended on self, spouse or child with serious disease, including up to RM500 for medical examination (maximum) Basic supporting equipment for disabled self, spouse, child or parent (maximum) Purchase of sports equipment (maximum) Fees expended for skills or qualifications (maximum) Expenses on books for personal use (maximum) Spouse relief Disabled spouse, additional Child (each) Child higher rate (each) Disabled child (each) Disabled child additional (each) Life insurance premiums and contributions to approved funds (maximum) Deferred annuity premiums (maximum) Medical and/or education insurance premiums for self, spouse or child (maximum) Purchase of a personal computer (maximum) Broadband subscription (maximum) Deposit for a child into the National Education Savings Scheme (maximum) Rebates Chargeable income not exceeding RM35,000 Individual Rate for an individual entitled to a deduction in respect of a spouse or former wife RM 400 800 RM 9,000 6,000 5,000 5,000 5,000 300 5,000 1,000 3,000 3,500 1,000 4,000 5,000 4,000 6,000 1,000 3,000 3,000 500 3,000

Value of benefits in kind Car scale Cost of car (when new) RM Up to 50,000 50,001 to 75,000 75,001 to 100,000 100,001 to 150,000 150,001 to 200,000 200,001 to 250,000 250,001 to 350,000 350,001 to 500,000 500,001 and above Prescribed annual value of private usage of car RM 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000

The value of the car benefit equal to half the prescribed annual value (above) is taken if the car provided is more than five (5) years old. Where a driver is provided by the employer, the value of benefit per month is fixed at RM600.

Other benefits RM per month Household furnishings, apparatus and appliances Semi-furnished with furniture in the lounge, dining room, or bedroom 70 Semi-furnished with furniture as above plus air-conditioners and/or curtains and carpets 140 Fully furnished premises 280 Domestic help 400 Gardener 300

Capital allowances Industrial buildings Plant and machinery general Motor vehicles and heavy machinery Office equipment, furniture and fittings Initial allowance (IA) Rate % 10 20 20 20 Annual allowance (AA) Rate % 3 14 20 10

Real property gains tax Disposal by companies and other than companies Date of disposal Disposal within two years after date of acquisition Disposal in the third year after date of acquisition Disposal in the fourth year after date of acquisition Disposal in the fifth year after date of acquisition or thereafter Note: An exemption is granted which reduces the effective rate to 5% where the disposal takes place within five years of the date of acquisition and to nil thereafter. Rate % 30 20 15 5

Sales and service tax Sales tax Service tax Rate % 10 6

Section A ALL TEN questions are compulsory and must be attempted Please use the space provided on the inside cover of the Candidate Answer Booklet to indicate your chosen answer to each multiple choice question.

Trisha, an expatriate from Egypt, was employed by a company in Malaysia. She commenced employment on 1 January 2011 and worked in the company for four months and ceased employment on 30 April 2011. She returned to Egypt on the same date. During her stay she was physically present in Malaysia and she never returned to Malaysia in 2011. Her salary was RM2,500 per month. She was not married. How much is Trishas income tax liability for the year of assessment 2011? A B C D Nil RM2,600 RM260 RM175

(3 marks)

Rosliza legally adopted a child during the year of 2011. The child was two years old and the childs expenses were maintained by her during the year of assessment 2011. What is the amount of child relief Rosliza can claim for her adopted child for the year of assessment 2011? A B RM4,000 RM1,000 (1 mark)

Hari and Mei Lee run a florist shop as a partnership. The agreed profit sharing ratio was 25:75. On 1 July 2011, the partners agreed to change the profit sharing ratio and the profits were to be shared equally. The provisional divisible income for the year of assessment 2011 was RM20,000. What is the share of divisible income that would be allocated to each partner for the year of assessment 2011? A B C D Hari: RM5,000; Mei Lee: RM5,000 Hari: RM10,000; Mei Lee: RM10,000 Hari: RM7,500; Mei Lee: RM12,500 Hari: RM12,500; Mei Lee: RM7,500

(3 marks)

Germaine is a musical composer, and during the year ended 31 December 2011 she earned royalties amounting to RM22,000 from her musical composition. It was confirmed that this income was not part of her emoluments in the exercise of her official duties. What is the amount of royalty income assessable to tax for Germaine for the year of assessment 2011? A B C D RM2,000 RM22,000 RM10,000 RM12,000

(2 marks)

5 Flora Sdn Bhd received an additional assessment in respect of the year of assessment 2009 arising from a tax audit on 1 March 2011. The companys tax manager does not agree with the additional assessment issued and wants to lodge an objection against the assessment. By what date must Flora Sdn Bhd lodge an objection against the additional assessment for the year of assessment 2009? A 30 March 2011 B 28 April 2011 (1 mark)

6 Amazon Sdn Bhd commenced leased rental for a passenger vehicle that was to be used by the companys managing director. The following details relate to the year of assessment 2011 based on the financial year ended 31 December 2011: RM 165,000 110,000

BMW on the road price Total lease rentals paid during the year

What is the amount of lease rentals paid during the year that are available for tax deduction for Amazon Sdn Bhd for the year of assessment 2011? A B C D RM60,000 RM165,000 RM50,000 RM100,000

(2 marks)

Triton Sdn Bhd has an accounting year end of 31 December, and on 1 January 2011 acquired a van for RM90,000 which was registered as a commercial vehicle licensed to transport goods. The company acquired the van on hire purchase and paid a deposit of RM10,000. The capital portion paid during the year in addition to the deposit was RM80,000 and the interest portion paid was RM1,000. What is the qualifying expenditure that can be claimed for capital allowances purposes in respect of the van for the year of assessment 2011? A B C D RM50,000 RM80,000 RM91,000 RM90,000

(3 marks)

Which one of the following statements is TRUE? A B C When a reduced assessment is issued to a taxpayer, it generally means that the taxpayer is required to pay additional taxes. Unutilised capital allowances carried forward are available for set-off against any business source income and not only for the same business source. Unabsorbed business losses carried forward are available for set-off against the same business source only and not against any other business source income.

D Interest income derived by a non-resident person is subject to withholding tax at the rate of 15% of the gross income. (2 marks)

Tunis Sdn Bhd was incorporated on 1 January 2011 to provide management and consultancy services. What is the minimum threshold for the management and consultancy services for the purposes of applying for a service tax licence under the service tax legislation? A B C D Nil threshold RM150,000 RM300,000 RM3,000,000

(2 marks)

10 Snow Sdn Bhd recently moved into its new business premises and will be changing its address. Under the Income Tax Act, 1967, by what date must Snow Sdn Bhd notify the Director General Inland Revenue of the change of address? A B Within one month Within three months (1 mark)

Section B ALL NINE questions are compulsory and MUST be attempted

Sanjay ran a luxury car business and due to cashflow problems, decided to close down his business on 31 March 2011. The current year adjusted loss for the year of assessment 2011 was computed to be RM10,000. He commenced employment on 1 April 2011 as a director in a hotel in Malaysia. Details relating to Sanjays income, benefits and expenditure for the year to 31 December 2011 are as follows: RM 130,000 20,000

Income Salary Bonus

Benefits provided by employer Car benefit New MPV costing 120,000 Car provided from 1 April 2011 Leave passage local trip to Penang 3,100 Domestic help provided by employer from 1 April 2011 salary 4,500 Expenditure Contributions to the Employees Provident Fund Life insurance premiums self 12,100 3,100

Sanjay received total interest of RM3,000 for the year of assessment 2011 which was made up of interest on fixed deposit of RM350 from a Malaysian bank and interest of RM2,650 from a loan to his sister for the year of assessment 2011. Required: Compute Sanjays chargeable income and income tax payable for the year of assessment 2011.

Notes: (1) You should indicate by the use of the word nil any item referred to in the question for which no adjusting entry needs to be made in the tax computation. (2) Marks will be awarded for the use of accurate technical terms to describe the figures comprising the stages in the computation of chargeable income. (15 marks)

2 Divine Sdn Bhd is in the business of operating a houseboat in a resort and closes its accounts to 31 December annually. Relevant information of the companys profit and loss account for the year ended 31 December 2011 is shown below:RM 1,600,000 (800,000) 800,000 10,000 810,000

RM Sales Less: Cost of sales Gross profit Add: Other income Dividend income remitted from China Less: Expenses Foreign exchange loss trade related and realised 50,000 Leave passage for directors overseas trip 6,000 Professional fees for company secretary 5,000 Depreciation 13,000 Entertainment of suppliers 12,000 Other deductible expenses 144,000 Profit before tax

(230,000) 580,000

Additional notes relevant to the tax computation are as follows: i) During the year ended 31 December 2011, the company acquired office furniture comprising table and chairs costing RM100,000. It was confirmed that each asset costs more than RM1,000 and the claim for small value assets does not apply. The residual expenditure for the brought forward assets was nil. ii) Unabsorbed losses brought forward from the previous year of assessment was RM10,000. iii) The companys issued paid-up share capital is RM2,000,000. Required: Compute the chargeable income and the income tax payable of Divine Sdn Bhd for the year of assessment 2011.

Notes: (1) You should indicate by the use of the word nil any item referred to in the question for which no adjusting entry needs to be made in the tax computation. (2) Marks will be awarded for the use of accurate technical terms to describe the figures comprising the stages in the computation of chargeable income. (15 marks)

3 Su San acquired an office building on 12 January 2009 for investment purposes for RM820,000. She incurred renovation expense of RM20,400 as part of the buildings enhancement cost and also paid stamp duty of RM18,600. The total quit rent and assessment per year is RM800. In 2010, she received an insurance compensation of RM10,000 arising from damage to the building. She disposed of the office building and signed a sales and purchase agreement on 12 September 2011 based on a valuation of RM900,000. The valuation fee was RM2,000 and the agency commission fee for the disposal was RM1,000. Required: Compute the chargeable gain subject to real property gains tax arising to Su San from the disposal of the office building. Clearly show the disposal price and the acquisition price taking into account all necessary adjustments.

Note: (1) You are not required to compute the real property gains tax. (2) You should indicate by the use of the word nil any item referred to in the question for which no adjusting entry needs to be made in the computation. (10 marks)

4 Greenhill Sdn Bhd is a manufacturing company and closes its accounts annually on 31 December. The company acquired a factory building for RM1,500,000 during the year of assessment 2010. In 2011, the company extended the factory building and incurred the following capital expenditure: RM 10,000 18,000 102,000 130,000

Levelling of land Design fee for factory Construction cost for factory extension Required:

Determine the qualifying building expenditure and calculate the industrial building allowance for the years of assessment 2010 and 2011 for (a) The original factory building acquired in 2010; and (b) The extension made to the factory building in 2011. (4 marks) (6 marks) (10 marks)

10

Skysoft Sdn Bhd manufactures computer covers for computers. The company is licensed for sales tax purposes and its products are subject to sales tax at 10%. The selling price of each product is RM10 and cost of each product is RM8. Relevant details relating to sales are as follows:

January 2011 Gross sales value for the month Payments received February 2011 Gross sales value for the month Payments received March 2011 Gross sales value for the month Payments received April 2011 Gross sales value for the month Payments received Required:

RM 1,000,000 110,000 1,000,000 55,000 900,000 120,000 700,000 90,000

Calculate the amount of sales tax payable by Skysoft Sdn Bhd, and state the due date to remit the sales tax for each of the taxable period/periods shown above. (6 marks)

6 Lara, a Malaysian, was seconded to his employers Thailand office on 1 January 2008. The nature of his job required to him to perform duties both in Malaysia and in Thailand. Laras secondment ended and he returned to Malaysia on 30 September 2010. Based on the travel schedule prepared based on his passport, the following information was obtained: Year No of days in Malaysia 2006 95 days 2007 365 days 2008 190 days 2009 185 days 2010 90 days 2011 0 days 2012 365 days Required: (6 marks) Resident status / Non-resident Resident Resident Resident To be determined To be determined Expected to be resident

Determine, with reasons, Laras tax resident status for the years of assessment 2010 and 2011.

11

7 Ira owned a hilltop house in Kuala Lumpur which she rents out to a tenant who is an expatriate. This was the only property she owned. Details of her rental income and expenditure for the year ended 31 December 2011 are shown below. RM RM 24,000

Gross income from rental

Less: Expenditure Quit rent and assessment 1,600 Interest on housing loan (see note 1 below) 3,200 Replacement of old air-conditioner 500 New fridge for expatriate tenant (see note 2 below) 1,500 Agents commission for collection of rent 1,200 Net income

(8,000) 16,000

Note 1: The above interest includes cheque book charges of RM200. Note 2: Ira brought the fridge for the first time for her house in Kuala Lumpur. Required Calculate the statutory income arising from the rental income for the year of assessment 2011.

Note: You should indicate by the use of the word nil any item referred to in the question for which no adjusting entry needs to be made in the computation. (6 marks)

8 Below is information with regards to Star Sdn Bhds tax matters. New employee One new employee commenced employment on 1 March 2011. The new employee is likely to be chargeable to tax. Instalment scheme and tax payable for the year of assessment 2011 RM 100,000 300,000

Initial tax estimate notified to the Inland Revenue Board Final tax liability per tax computation to the Inland Revenue Board Required

(a) State the due date for Star Sdn Bhd to notify the Inland Revenue Board (IRB) of an employee who has commenced employment and is likely to be chargeable to income tax. (1 mark) (b) State the due date for Star Sdn Bhd to remit the employees schedular tax deduction (STD) deducted from the employees March 2011 salary. (1 mark) (c) Compute the penalty for the excessive difference between the estimated tax and final tax payable for the year of assessment 2011 by Star Sdn Bhd. (4 marks) (6 marks)

12

9 (a) Martha is a retired Government servant and her income for the year of assessment 2011 is shown below. RM Interest income from loan extended to friends company 300 Pension from the Government (no other pension) 12,000 Franked dividend from local listed company (net) (taxable) 750 Dividend from shares invested in overseas company 2,000 Required State whether the above income is taxable or tax exempt. (2 marks)

(b) Below is an extract from page 2 of a tax return for an individual without business (FORM BE) Part C: Statutory Income and Total Income C1 Employment C2 Dividends C1 C2 C3 C4 C5 Amount (RM)

C3 Interest and discounts C4 Rents, royalties and premiums C5 Pensions, annuities and other periodical payments Required

In your answer booklet, state the amounts that would be entered in boxes C2, C3, and C5 only. Indicate 0 if there is no amount to be inserted in the box. Note: you should show all workings. (4 marks) (6 marks)

End of Question Paper

13

Answers

14

Pilot Paper FTX (MYS) Foundations in Taxation (Malaysia)

Answers and marking scheme

Notes: (1) All references to legislation or public rulings shown in square brackets are for information only and do not form part of the answer expected from candidates. (2) Marks indicated with a * are awarded for the allocation of the appropriate description to the figure calculated, not for the figure itself. Section A 1 B Trisha was physically present in Malaysia only for 120 days during the year of assessment 2011. She was a non-resident [under Section 7 of the Income Tax Act, 1967] and will not be entitled to any personal relief and also not entitled to the scale rates to calculate her income tax liability. She will be taxed as a non-resident at a flat rate of 26% on the gross income. Therefore, her income tax is RM2,600 [(RM2,500 x 4 = RM10,000) x 26%]. Marks

2 B Rosliza is entitled to claim child relief of RM1,000 for the year of assessment of 2011 even if the child is adopted. She is entitled to claim child relief for the adopted child as long as the adoption was carried out legally. 3 C Haris share is RM7,500 and Mei Lees share is RM12,500 for the year of assessment 2011. Share of divisible income from 1 June 2011 to 30 June 2011 (6 months) 6/12 x 20,000 = RM10,000 Profit sharing ratio 25:75 1 July 2011 to 31 December 2011 (6 months) 6/12 x 20,000 = RM10,000 Profit sharing ratio 50:50 Total for each partner for year of assessment 2011 Hari RM 2,500 5,000 7,500 Mei Lee RM 7,500

5,000 12,500 3

4 A An exemption of RM20,000 is available to be set-off against royalty income from musical composition [under paragraph 32D of Schedule 6 of ITA, 1967]. Therefore, the amount assessable to income tax for the royalty income for the year of assessment is RM2,000 (RM22,000 RM20,000) 5 A A taxpayer who wishes to lodge an appeal against any assessment has to do so within 30 days of the date of issue of the assessment with the Director General Inland Revenue. Therefore, the company has to lodge an appeal against the additional assessment for the year of assessment 2009 on or before 30 March 2011. 6 C The maximum amount available for a tax deduction is RM50,000. This is because [under Section 39(1)(k) of the ITA, 1967], where the on-the-road cost of the vehicle exceeds RM150,000 then the maximum lease rentals allowable as a deduction is restricted to RM50,000. In the case where the on-the-road cost of the vehicle is below RM150,000 then the claim can be restricted to RM100,000 or the actual cost of the vehicle if it is lower than RM100,000.

7 D Triton Sdn Bhd can claim capital allowances for the amount of deposits and capital portion of the instalments paid during the year of assessment 2011. There is no restriction on the cost as the van is a licensed commercial vehicle. The qualifying expenditure for the van, that is available for the claim of capital allowances, is RM90,000. 8 D Generally, when a reduced assessment is issued to a taxpayer, it means that the taxpayer is assessed on income that is lower compared to the original or additional assessment raised earlier and under normal circumstances, the taxpayer will be due for a refund of the excess tax paid. There will be no additional taxes to be paid under normal circumstances when a reduced assessment is issued. Unutilised capital allowances carried forward is available for set-off only against the same business source and not against any other business source. Unabsorbed losses carried forward is available for set-off against any business source and is not restricted to the same business source. Therefore, statements A, B and C are false. Interest income derived by a non-resident person is subject to a withholding tax of 15%. Therefore, statement D is true.

15

9 A Nil threshold. There is no minimum threshold amount for any person who is in the business of providing management and consultancy services. This means even if there is a billing for RM1, there is a requirement to apply for a service tax licence before providing such services. This is provided for under Group G other service providers of the second schedule of the Service Tax Regulations [under Service Tax Act, 1975]. 10 B Snow Sdn Bhd will be required to notify the Director General Inland Revenue by notice in writing within three months of change of address.

Marks

1 20

Section B 1 Sanjay Tax computation for the year of assessment 2011

RM RM Employment income Salary and bonus 150,000 Car benefit as per table annual value 5,000 Car used from 1 April to 31 December 2011= 9 months 5,000 x 9/12 3,750 Leave passage (local trip) Nil Domestic help (400 x 9) 3,600 Adjusted/statutory income from employment 157,350 Interest income (3,000 350) 2,650 Aggregate income 160,000 Less: Current year adjusted loss from business (10,000) Total income 150,000 Less: Personal reliefs Personal relief 9,000 Employees Provident Fund (EPF) contributions (restricted to maximum) 6,000 (15,000) Chargeable income 135,000 Tax liability: Tax on first RM100,000 14,325 Tax on next RM35,000 x 26% 9,100 Tax charged /payable 23,425

0.5 1 2 1 2 *0.5 1.5 *0.5 1.5 *0.5 1 1.5

*0.5

15

16

2 Divine Sdn Bhd Tax computation for year of assessment 2011 RM RM Profit before tax 580,000 Add/(Less) Dividend income from China (foreign source income is exempt) (10,000) Foreign exchange loss trade and realised Nil Leave passage 6,000 Professional fees for company secretary 5,000 Depreciation 13,000 Entertainment expenses (50% x 12,000) 6,000 Adjusted income 600,000 Less: Capital allowances Current year assets Cost/Qualifying Expenditure 100,000 Initial allowance 20% x 100,000 20,000 Annual allowance 10% x 100,000 10,000 (30,000) Statutory income 570,000 Less: Unabsorbed losses brought forward (10,000) Aggregate income/chargeable income 560,000 Tax liability Tax on first RM500,000 at 20% 100,000 Tax on excess of RM60,000 at 25% 15,000 Tax charged/payable 115,000 Tutorial note: For a SME (small and medium enterprise) company with issued share capital of RM2,500,000 or less, the scaled tax rates are available.

Marks

0.5 1.5 1 1 1 1 2 *0.5 0.5 1 1

*0.5 1.5 *0.5

1.5

15

3 Su San Computation of chargeable income RM Disposal consideration Less: Permitted expenditure Enhancement costs renovation expense Incidental costs: Valuation fees Agents commission Disposal price RM 900,000 (20,400) (2,000) (1,000) 876,600 0.5 1.5 1 1 0.5 1.5 1 1

Less: Acquisition consideration 820,000 Less: Insurance compensation for damage to office building (10,000) Add: Incidental expenses relating to acquisition: Quit rent and assessment (not eligible for deduction) Nil Stamp duty 18,600 Acquisition price (828,600) Chargeable gain 48,000 Less: Schedule 4 exemption for individual Higher of the following: (i) 10% of Chargeable gain 10% x RM48,000 4,800 (ii) RM10,000 10,000 (10,000) Chargeable gain 38,000

2 10

17

4 Greenhill Sdn Bhd Industrial building allowance (a) Industrial building allowance (IBA)

Marks

Assets acquired in 2010 RM RM Qualifying building expenditure 1,500,000 Less: IBA for YA 2010 Initial allowance 10% 150,000 Annual allowance 3% 45,000 (195,000) Residual expenditure 1,305,000 Less: IBA for YA 2011 Annual allowance 3% x 1,500,000 (45,000) Residual expenditure 1,260,000 (b) Assets acquired in 2011 Qualifying building expenditure for factory extension Levelling of land non-qualifying relates to land 0 Design fee for factory 18,000 Construction cost of factory 102,000 Qualifying building expenditure 120,000 Less: IBA for YA 2011 Initial allowance 10% 12,000 Annual allowance 3% 3,600 (15,600) Residual expenditure 104,400

0.5 1 1

1.5 4

1 1 1

1.5 1.5 6 10

Skysoft Sdn Bhd Sales tax

Taxable period Amount of sales tax Payment due date for sales tax RM January 2011 1,000,000 February 2011 1,000,000 Total for taxable period 2,000,000 Sales tax 10% x 2,000,000 200,000 Due on or before 28 March 2011 March 2011 900,000 April 2011 700,000 Total for taxable period 1,600,000 Sales tax 10% x 1,600,000 160,000 Due on or before 28 May 2011

0.5 0.5 1+1 0.5 0.5 1+1 6

Lara Resident status Basis He was in Malaysia for 90 days during the year of assessment 2010 and was resident in three out of the immediately four preceding basis years [under Section 7(1)(c) of ITA, 1967], ie he was resident for the years of assessment 2007, 2008 and 2009. 1+ 1 1

Year of assessment Resident status 2010 Resident

2011 Resident He was resident in the following year of assesment (year of assessment 2012) and was resident in the immediately three preceding basis years [under Section 7(1)(d) of ITA, 1967], ie he was resident for the years of assessment 2008, 2009 and 2010.

1+1 1

18

7 Ira Rental Income RM RM Gross rental income 24,000 Less: Allowable expenses Quit rent and assessment 1,600 Interest on housing loan (3,200200) 3,000 Maintenance expenses Replacement of old air-conditioner 500 New fridge for expatriate tenant 0 Agents commission for collection of rent 1,200 (6,300) Adjusted income/statutory income from rental under s 4(d) of the ITA, 1967 17,700 8 Bright Sdn Bhd Compliance

Marks 0.5 0.5 1 1.5 1.5 1

(a) The due date for Star Sdn Bhd to notify the Inland Revenue Board of an employee who has commenced employment and is likely to be chargeable to income tax , is within a month of commencement of employment. Therefore, the due date would be one month from 1 March 2011, ie on or before 31 March 2011. (b) The due date for Star Sdn Bhd to remit the schedular tax deducted to the Inland Revenue Board is by the 10th of the following month. Therefore, the due date for the schedular tax deducted relating to the March 2011 salary to be remitted to the Inland Revenue Board is on or before 10 April 2011. (c) Penalty for the excessive difference Final tax as per tax computation submitted Estimated tax Difference Less: 30% of final tax (30% x 300,000) Excess RM 300,000 100,000 200,000 (90,000) 110,000

1 1.5

Penalty at 10% thereon 10% x 110,000 11,000

1.5 4 6

9 (a) Martha Self-assessment tax return entries RM Taxable/Exempt Interest income from loan extended to friends company 300 Taxable Pension from the Government 12,000 Tax Exempt Franked dividend from local listed company (net) 750 Taxable Dividend from shares invested in overseas company 2,000 Tax Exempt (b) Box C2 RM1,000 Net dividends RM750 Tax deducted 25% x 1,000 RM250 Gross amount (RM750/0.75) RM1,000 Box C3 RM300 Box C5 RM0 Tutorial note: The gross dividend amount of RM1,000 is determined as follows:

0.5 0.5 0.5 0.5 2 2 1 1

Gross dividend income = Net dividend income x 1 = RM750 x 1 = RM750 x 1 = RM1,000 (1-CT*) (1-0.25) 0.75 *CT Where CT is the current years tax rate for corporations (which is currently 25%). 19 4 6

You might also like

- Ftxmys 2012 Jun QDocument13 pagesFtxmys 2012 Jun Qaqmal16No ratings yet

- FOUNDATIONS IN ACCOUNTANCY TAXATIONDocument12 pagesFOUNDATIONS IN ACCOUNTANCY TAXATIONaqmal16No ratings yet

- 2009 June QuestionsDocument10 pages2009 June QuestionsFatuma Coco BuddaflyNo ratings yet

- Tax ComputationDocument13 pagesTax ComputationEcha Sya0% (1)

- F6 (MYS) Specimen Qs Dec 2015Document22 pagesF6 (MYS) Specimen Qs Dec 2015rayyan darwishNo ratings yet

- 9mys 2009 Dec QDocument11 pages9mys 2009 Dec QKelly Tan Xue LingNo ratings yet

- F6mys 2013 Dec QDocument16 pagesF6mys 2013 Dec Qsyed6143No ratings yet

- P6mys 2011 Dec QDocument10 pagesP6mys 2011 Dec QJayden Ooi Yit ChunNo ratings yet

- Malaysian Taxation ComputationDocument11 pagesMalaysian Taxation Computationaqilah_abidin_10% (1)

- Malaysian Tax FrameworkDocument11 pagesMalaysian Tax FrameworkDylan Ngu Tung HongNo ratings yet

- F6mys 2007 Dec PPQDocument19 pagesF6mys 2007 Dec PPQAnslem TayNo ratings yet

- Acca Tx-Mys 2019 JuneDocument14 pagesAcca Tx-Mys 2019 JuneChoo LeeNo ratings yet

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument20 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTang Swee ChanNo ratings yet

- Fundamentals Level – Skills Module Taxation (MalaysiaDocument12 pagesFundamentals Level – Skills Module Taxation (MalaysiaBeeJuNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- F6 Pilot PaperDocument19 pagesF6 Pilot PaperSoon SiongNo ratings yet

- Part B: Write An Essay That Explains The Self-Assessment System (SAS) Related To A Company's Income Tax Return and Tax EstimateDocument3 pagesPart B: Write An Essay That Explains The Self-Assessment System (SAS) Related To A Company's Income Tax Return and Tax EstimateChai MargaretNo ratings yet

- School of Accountancy Universiti Utara Malaysia Bkat 2013 - Principles of Taxation Tutorial 7 - Partnership Date of Submission: 31 May 2015Document3 pagesSchool of Accountancy Universiti Utara Malaysia Bkat 2013 - Principles of Taxation Tutorial 7 - Partnership Date of Submission: 31 May 2015Thanaa LakshimiNo ratings yet

- Advanced Taxation (Malaysia) Exam GuideDocument11 pagesAdvanced Taxation (Malaysia) Exam GuideAtiqah DalikNo ratings yet

- 2016-01 BA203 TAX1 - Assignment QDocument7 pages2016-01 BA203 TAX1 - Assignment QEugene WongNo ratings yet

- Acca Tx-Mys 2019 SeptemberDocument13 pagesAcca Tx-Mys 2019 SeptemberChoo LeeNo ratings yet

- EXAMPLE TAX TOPIC 3 Atxd 223 PDFDocument20 pagesEXAMPLE TAX TOPIC 3 Atxd 223 PDFKaraokeNo ratings yet

- Acca TX Mys DEC 2019 Sample QuestionsDocument24 pagesAcca TX Mys DEC 2019 Sample QuestionsShazwanieSazaliNo ratings yet

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011No ratings yet

- f6pkn 2011 Dec QDocument11 pagesf6pkn 2011 Dec Qabby bendarasNo ratings yet

- KC 3 Pilot PaperDocument9 pagesKC 3 Pilot Paperxanax_1984No ratings yet

- Addendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument19 pagesAddendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForKhoo Kah JinNo ratings yet

- Tutorial 3 WHT DiscussDocument6 pagesTutorial 3 WHT DiscussAqila Syakirah IVNo ratings yet

- Dec 06Document13 pagesDec 06Kelly Tan Xue LingNo ratings yet

- T 5 Business Expenses PT 2 2015Document15 pagesT 5 Business Expenses PT 2 2015DarshiniNo ratings yet

- SRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSDocument2 pagesSRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSHarish NaikNo ratings yet

- Malaysian Taxation Lecture 2 Employment Income 1Document35 pagesMalaysian Taxation Lecture 2 Employment Income 1Hafizah Mat NawiNo ratings yet

- DTC Example Question Stage 1Document3 pagesDTC Example Question Stage 1aqilah_abidin_1No ratings yet

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNo ratings yet

- Tax InformationDocument14 pagesTax InformationSravan Kumar KoorapatiNo ratings yet

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingNo ratings yet

- Case Study April 2012 - LatestDocument20 pagesCase Study April 2012 - LatestChocolera PeaCeNo ratings yet

- Far100 110Document12 pagesFar100 110itssfatinNo ratings yet

- Sr Accountant Job in DubaiDocument9 pagesSr Accountant Job in DubaiEll EssNo ratings yet

- Sample Exercise: 1 WWW - Tallyacademy.inDocument3 pagesSample Exercise: 1 WWW - Tallyacademy.inMak AkNo ratings yet

- Tutorial 9 - PIT1 QuestionDocument5 pagesTutorial 9 - PIT1 QuestionHien Bach Thi Tra QTKD-3KT-18No ratings yet

- Revision (CA MCQ)Document2 pagesRevision (CA MCQ)Ee LynnNo ratings yet

- Check Off MAI DocsDocument8 pagesCheck Off MAI DocsAhmed Omar AmineNo ratings yet

- Training Key PointsDocument9 pagesTraining Key Pointsstarlegalconsultancy4No ratings yet

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliNo ratings yet

- P6mys 2016 Jun QDocument15 pagesP6mys 2016 Jun QAtiqah DalikNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Income Tax Note 02Document4 pagesIncome Tax Note 02Hashani Anuttara AbeygunasekaraNo ratings yet

- Taxation Suggested Solution: LessDocument9 pagesTaxation Suggested Solution: LesskannadhassNo ratings yet

- F6 2000 Jun QDocument11 pagesF6 2000 Jun QDylan Ngu Tung HongNo ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- Assessment 1 - Written or Oral QuestionsDocument7 pagesAssessment 1 - Written or Oral Questionswilson garzonNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- QP F2 May 2013Document20 pagesQP F2 May 2013kazimkorogluNo ratings yet

- 56 Incom Tax CalculatorDocument6 pages56 Incom Tax Calculatorspecky123No ratings yet

- Accounting IAS Past Paper Series 4 2010Document9 pagesAccounting IAS Past Paper Series 4 2010Sam SamNo ratings yet

- Income Tax 2013 BookletDocument108 pagesIncome Tax 2013 BookletSabrina LeeNo ratings yet

- Accounting Level 3/ Series 4 2008 (3001)Document19 pagesAccounting Level 3/ Series 4 2008 (3001)Hein Linn Kyaw100% (1)

- Accounting (IAS) Level 3/series 4-2009Document14 pagesAccounting (IAS) Level 3/series 4-2009Hein Linn KyawNo ratings yet

- DocumentDocument16 pagesDocumentaqmal16No ratings yet

- Ftxmys 2012 Jun ADocument7 pagesFtxmys 2012 Jun Aaqmal16No ratings yet

- Ffa f3 SG 2012Document13 pagesFfa f3 SG 2012aqmal16No ratings yet

- Ffa f3 SG 2012Document13 pagesFfa f3 SG 2012aqmal16No ratings yet

- Ftxmys Examreport j12Document4 pagesFtxmys Examreport j12aqmal16No ratings yet

- FTX Mys SG d12 j13Document14 pagesFTX Mys SG d12 j13aqmal16No ratings yet

- Exam Docs Dipifr 2012Document2 pagesExam Docs Dipifr 2012aqmal16No ratings yet

- Ftxmys Examreport j12Document4 pagesFtxmys Examreport j12aqmal16No ratings yet

- Foundations in Financial ManagementDocument17 pagesFoundations in Financial ManagementchintengoNo ratings yet

- Ftxmys 2011 Dec ADocument7 pagesFtxmys 2011 Dec Aaqmal16No ratings yet

- Ftxmys 2011 Dec ADocument7 pagesFtxmys 2011 Dec Aaqmal16No ratings yet

- Ftxmys Pilot PaperDocument19 pagesFtxmys Pilot Paperaqmal16No ratings yet

- FFM SG 2013Document10 pagesFFM SG 2013aqmal16No ratings yet

- Exam Docs Dipifr 2012Document2 pagesExam Docs Dipifr 2012aqmal16No ratings yet

- Lcci PT 4 Months S1alcDocument1 pageLcci PT 4 Months S1alcaqmal16No ratings yet

- Notes For Income tax-IIDocument10 pagesNotes For Income tax-IIDr.M.KAMARAJ M.COM., M.Phil.,Ph.D100% (1)

- Apt CWDocument10 pagesApt CWFAIZ muhammadNo ratings yet

- Republic Vs Iac: None of Which Is Present in This CaseDocument11 pagesRepublic Vs Iac: None of Which Is Present in This CaseFrancis Coronel Jr.No ratings yet

- Costa Crociere S.p.A. salary statement for October 2019Document1 pageCosta Crociere S.p.A. salary statement for October 2019Milkovic DinoNo ratings yet

- Girnar Insurance Brokers Private Limited: Salary Slip For The Month of February - 2023Document2 pagesGirnar Insurance Brokers Private Limited: Salary Slip For The Month of February - 2023karanmitroo1No ratings yet

- ICGAB Syllabus ChangeDocument9 pagesICGAB Syllabus ChangeAminul HaqNo ratings yet

- Projects Topics - Law of Taxation - 1Document6 pagesProjects Topics - Law of Taxation - 1AnshuSinghNo ratings yet

- VA - Sankalp Parihar - 142Document13 pagesVA - Sankalp Parihar - 142Sankalp PariharNo ratings yet

- Taxation LawDocument7 pagesTaxation LawAliNo ratings yet

- 84881793Document6 pages84881793Joel Christian MascariñaNo ratings yet

- Tax Alert BIR Ruling 142-2011Document3 pagesTax Alert BIR Ruling 142-2011Ia Bolos0% (1)

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- Applied Direct Taxation Objective Questions and AnswersDocument11 pagesApplied Direct Taxation Objective Questions and AnswersAbhijit HoroNo ratings yet

- Taxation Management: Prof. Naveed Iqbal CHDocument14 pagesTaxation Management: Prof. Naveed Iqbal CHBader ZiaNo ratings yet

- Ordinary Allowable Deductions 1Document19 pagesOrdinary Allowable Deductions 1Jester LimNo ratings yet

- Tax July 21 SugesstedDocument28 pagesTax July 21 SugesstedShailjaNo ratings yet

- Philtax All InupdateDocument86 pagesPhiltax All InupdateKayezel Kriss75% (4)

- COMMISSIONER OF INTERNAL REVENUE vs. PHILIPPINE AIRLINES, INCDocument1 pageCOMMISSIONER OF INTERNAL REVENUE vs. PHILIPPINE AIRLINES, INCLean Gela MirandaNo ratings yet

- Cover LetterDocument3 pagesCover Letterapi-358201396No ratings yet

- Lumbera NotesDocument41 pagesLumbera Notesthinkbeforeyoutalk67% (3)

- CFAP 5 ATAX Model PaperDocument5 pagesCFAP 5 ATAX Model PaperMuhammad Usama SheikhNo ratings yet

- Train Law: Rodrigo DuterteDocument5 pagesTrain Law: Rodrigo DuterteSheila Mae AramanNo ratings yet

- Income Taxation SchemesDocument2 pagesIncome Taxation SchemesLeonard Cañamo100% (4)

- Tax Compilation 2Document85 pagesTax Compilation 2Michelle Valdez AlvaroNo ratings yet

- Abhishek Blackbook FinalDocument95 pagesAbhishek Blackbook Final8784No ratings yet

- BBA - JNU - 104 - Legal Framework PDFDocument211 pagesBBA - JNU - 104 - Legal Framework PDFJTSalesNo ratings yet

- Definition of Assessee' - Section 2 (7) of Income TaxDocument7 pagesDefinition of Assessee' - Section 2 (7) of Income Taxekta singhNo ratings yet

- SMT Harleen Kaur Bhatiavs Principal Commissionerof IncomDocument23 pagesSMT Harleen Kaur Bhatiavs Principal Commissionerof IncomKaran GannaNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- On Gains On Foreign Exchange TransactionsDocument1 pageOn Gains On Foreign Exchange TransactionsArianneParalisanNo ratings yet