Professional Documents

Culture Documents

Guide To Bank Audit

Uploaded by

Abhay DesaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide To Bank Audit

Uploaded by

Abhay DesaiCopyright:

Available Formats

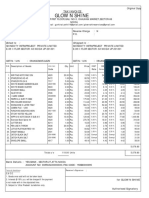

The Inst|tute of

Chartered Accountants of Ind|a

(Set up under an Act o Par||ament}

CommIffoo on InfornnI AudIf

1eclnical cnide on

Inteinal Andit

In Ianks

kisk-based

C 3 435 19

Inteinal Andit

in Ianks

kisk-based

1eclnical cnide on

1ho busc druft of ths 1ochncu Cudo wus propurod by Sh.

Nugosh DPngo und Sh. Srnvus Yunumunduru. 1ho vows

oxprossod n 1ochncu Cudo uro thoso of tho uuthors und

muy not nocossury bo tho vows of tho orgunzuton thoy

roprosont.

Jhe !nsrirure of Charrereo Accounranrs of !noia

Inteinal Andit

in Ianks

kisk-based

1eclnical cnide on

C 1ho lnsttuto of Churtorod Accountunts of lndu

A rghts rosorvod

No purt of ths 1ochncu Cudo muy bo roproducod, storod n u rotrovu systom, or

trunsmttod, n uny form, or by uny mouns, ooctronc, mochuncu, photocopyng,

rocordng, or othorwso, wthout pror pormsson, n wrtng fromtho pubshor.

lrst Ldton: Novombor 2005

lSN: 81-88437-73-5

Prco: Rs. 150

L-mu: cugcu.org

Wobsto: http://www.cu.org

PubIished by

VlAYKAPUR-ddtonal Dtoctot (Spocal Ctado

1ho lnsttuto of Churtorod Accountunts of lndu

'lCAl huwun'

lndruprusthu Murg

NowDoh - 110 002

lNDlA

Cover & lIIustrations

Nurondru hou

Design & ReaIisation

Storng Proforrod Prntng

foiewoid

1

le banking indnstiy las always tliown np newei oppoitnnities and clallenges, be it tle statntoiy

andits oi otlei assignments sncl as concniient andits oi inteinal andits etc. 1le dynamic

enviionment in wlicl tlis indnstiy opeiates ieqniies tle membeis to not only nse tleii existing

skill sets to tle best o tleii ability bnt also keep tle same slaip enongl at all times to eectively tnin

tlose clallenges into oppoitnnities. 1le intiodnction o iisk-based inteinal andit systemin banks by tle

keseive Iank o India is one sncl oppoitnnity in tle oimo a clallenge oi tle membeis to contiibnte

towaids tle iesilience and stability o tle banking indnstiy inIndia.

1le iisk-based inteinal andit in banks, as against tle conventional concniient andit oi inteinal andit in

banks, is ocnsed at impioving tle iisk management system in banks, necessitated on acconnt o

involvement o laige amonnt o pnblic and goveinment monies. civen tle act tlat even tle

implementation aspect o tle iisk-based inteinal andit systemin tle banking indnstiy is in nascent and

leaining stages, it is necessaiy tlat oni membeis take aninitiative to piopeily nndeistand tle intiicacies

Kamlosh 8. Vikamsoy

Piesident

2tl Octobei, 2uu5

New Delli

oi typicalities in caiiying ont a iisk-based inteinal andit and lelp not only tle systemto take iimioots in

tle indnstiy bnt also tle indnstiy to deiive maximnmbeneit ont o tle system.

I amtleieoie, lappy to note tlat tle committee onInteinal Andit las decided to biing ont tlis 1eclnical

cnide on kisk-based Inteinal Andit in Ianks oi tle gnidance o tle membeis. I am snie tlat tle

committee will continne to biing ont moie o sncltopical pnblications oi tle beneit o tle membeis.

Pieace

1

le banking indnstiy in India is in a state o continnons giowtl and expansion, making its

piesence elt in all spleies o economic giowtl, domestic as well as global. 8ncl maiked

piesence at tle domestic as well as inteinational iont makes it qnintessential oi tle banking

indnstiy to benclmaik witl tle inteinational standaids to ensnie ciedibility, iesilience as also

tianspaiency in its woiking in botl domestic as well as inteinational aiena. fstablislment o iisk-based

Inteinal Andit 8ystems is one sncl measnie iecommended by tle Iasel committee on Ianking

8npeivision.

1le keseive Iank o India made a beginning in tlis diiection by issning a ciicnlai in Angnst 2uu!

ieqniiing tle banks to take necessaiy steps to establisl a iisk-based inteinal andit systemin banks. Ovei

tle peiiod, tle iegnlatoi also bionglt ont detailed ciicnlais, gnidance notes etc., dealing witltle topic o

kisk-based snpeivision o banks. Implementation o iisk-based snpeivision systemin banks las to tle

need oi a systemo iisk-based inteinal andit inbanks. 1le new systemieqniies tle claiteied

acconntants not only to lone tleii existing skills bnt also acqniie new knowledge and skills to

appiopiiately nndeistand tle complexities o tle system and make tle best possible nse o tleii

knowledge and expeitise to lelptle banking indnstiy ieapmaximnmbeneits o tle system.

In view o tle above, tle committee on Inteinal Andit las bionglt ont tlis pnblication, '1eclnical cnide

on kisk-based Inteinal Andit in Ianks" to lelp tle membeis nndeistand tle nndamentals o tle system.

1le 1eclnical cnide is divided into oni clapteis. claptei !, Intiodnction, deals witl aspects sncl as

cost beneit analysis, key andit decisions sncl as ieqnency, scope, timing, size o teametc., advantages,

kisk-based inteinal andit system :|-s-:| iisk management nnction. claptei 2, 8teps in kisk-based

Inteinal Andit, inclnding iisk matiix and a case stndy. claptei ? deals witl otlei signiicant

consideiations ielating to kisk-based Inteinal Andit in Ianks and lastly, 1le Way Alead. 1le 1eclnical

cnide also contains appendices containing tle ielevant ciicnlais o tle keseive Iank o India.

I mnst, at tlis jnnctnie, expiess my deep giatitnde to 8lii Nagesl D Pinge, 8enioi ceneial Managei and

lis colleagne 8lii 8iinivas Yanamandaia, IcIcI Iank Iimited wlo volnnteeied to sqneeze time ont o

tleii piessing pie-occnpations to slaie tleii wealtl o knowledge and expeiience witl ns and piepaied

tle neai peiect basic diat o tle 1eclnical cnide at sncl sloit notice. 1le piactical and cleai appioacl

o tle 1eclnical cnide deinitely ielects yeais o lands on expeiience and giasp o tle antlois in tle

aiea. fnitlei, I am also tlanknl to my colleagnes at tle committee on Inteinal Andit oi pioviding

valnable gnidance onmaking tle 1eclnical cnide moie nsenl. I also wislto expiess my appieciationoi

tle snppoit o 8lii Vijay Lapni, Additional Diiectoi (Ioaid o 8tndies), 8mt. Pnja Wadleia, 8ecietaiy,

committee onInteinal Andit and 8lii Nitin8inglal, fxecntive Oicei ininalisationo tle pnblication.

I am snie tlat tle membeis wonld ind tle 1eclnical cnide immensely nsenl in nndeistanding and

implementing tle concept o kisk-based Inteinal Andit inIanks.

AmarjiI 0hopra

claiiman

committee on Inteinal Andit

2tl Octobei, 2uu5

New Delli

contents

|oroword

0hapIor !

0hapIor 2

0hapIor 8

0hapIor 4

APPLN0|0L8

v

ProIaco vii

!

Intiodnction

9

8teps in kisk-based Inteinal Andit o Ianks

2I

Otlei consideiations

80

1le Way Alead

82

I kII's Discnssion Papei

Move 1owaids kisk-based 8npeivision o Ianks 88

II kII's ciicnlai o Decembei 2uu2

kisk-based Inteinal Andit 45

III kII's ciicnlai o febinaiy 2uu5

Implementation o kisk-based Inteinal Andit in Ianks 54

Intiodnction

Backgrouad

!.! Dniing tle iecent yeais, tle snpeivisoiy nnction o tle keseive Iank o India (kII), tle

banking iegnlatoi in India, is incieasingly getting iisk ocnsed and tle kII las expiessed its

intention to move towaids iisk-based snpeivision (kI8) o banks. 1owaids tlis end, tle kII

pnblisled a discnssionpapei inAngnst, 2uu!, 'Move 1owaids kisk-based 8npeivisiono Ianks',

desciibing tle scope o tle kI8 o banks. 1le discnssion papei is given as Appendix I to tle

1eclnical cnide.

!.2 Lndei tle kI8, tle kII wonld ocns its snpeivisoiy attentionontle banks inaccoidance witltle

iisk pioile o eacl bank deteimined by kII. facl bank nndei tle pioposed kI8 iamewoik o

kII is expected to piepaie a iisk pioile o its own, taking into acconnt tle vaiions iisks to wlicl

tle bank is exposed. 1le iisk pioile o tle bank wonld deteimine tle snpeivisoiy piogiamme

claptei !

compiising o-site sniveillance, taigeted on-site inspections, stinctnied meetings witl banks,

commissioned exteinal andits, speciic snpeivisoiy diiections and new policy action, as

waiianted. 1lns, kI8 ieqniies adeqnate piepaiatoiy steps botl at tle kII level as well as at tle

level o individnal commeicial banks.

!.? kII las indicated tle ollowing ive aieas o bank level piepaiation oi snccessnl

implementationo tle kI8 iamewoik:

8etting npo iisk management aiclitectnie

Adoptiono iisk ocnsed inteinal Andit

8tiengtlening o management inoimationsystemand inoimationteclnology

Addiessing Hnmankesonices Depaitment (HkD) issnes

8etting npo a compliance nnit.

!.1 8nbseqnently, in Decembei 2uu2, kII issned a gnidance note on tle iisk-based inteinal andit

nnctionintle banks, detailing tle steps ieqniied to be adopted tleieoi. 1le said gnidance note

is given as Appendix II to tle 1eclnical cnide. fnitlei, in febinaiy 2uu5, kII issned a ciicnlai

ieiteiating tle impoitance o tle iisk-based inteinal andit in banks. kII, tliongl tle said

ciicnlai, las advised tle banks as to piepaiation o tle kisk Andit Matiix based on tle iisk

ocnsed appioacl, enabling tle banks to move towaids tle advanced appioacles oi

deteimining capital claige oi tle opeiational iisk nndei tle pioposed Iasel II Inteinational

capital Adeqnacy iamewoik. 1le text o tle ciicnlai is given in Appendix III to tlis 1eclnical

cnide.

!.5 1le objective o tlis 1eclnical cnide is to piovide gnidance to tle membeis o tle Institnte,

landling tle inteinal andit nnction, speciically in banking indnstiy, as to tle steps involved in

tle iisk-based inteinal andit inbanks.

!.0 Pieace to tle 8tandaids and cnidance Notes on Inteinal Andit, issned by tle Institnte o

claiteied Acconntants o India deines tle teim'inteinal andit" as:

'Ia/.ras/ sa1|/ | sa |a1./.a1.a/ rsas.r.a/ /aa:/|a w/|:/ |a:/:. s :a/|aaa sa1 :r|/|:s/

s//rs|s/ / //. /aa:/|a|a / sa .a/|/y w|// s :|.w / a./ |r/r:.r.a/ //.r./ sa1 s11 :s/a. / sa1

/r.a//.a //. :.rs// :.rasa:. r.:/sa|r / //. .a/|/y |a:/a1|a //. .a/|/y' /rs/.|: r|/ rsas.r.a/

sa1 |a/.ras/ :a/r/ y/.r

|aIoraal AudiI - 0oIiaiIioa, 0bjocIivos aad8copo

1eclnical cnide on kisk-based Inteinal Andit in Ianks 2

!. fnitlei, paiagiapl S o tle Anditing and Assniance 8tandaid (AA8) 0, kisk Assessments and

Inteinal contiol, issned by tle Institnte o claiteied Acconntants o India, claiiies tlat inteinal

andit ':a/|/a/. s ./srs/. :r/a.a/ / |a/.ras/ :a/r/ w|// //. /.:/|:. / 1./.rr|a|a w/.//.r //.r

|a/.ras/ :a/r/ sr. w.// 1.|a.1 sa1 /r/.r/y /.rs/.1

!.S Acaienl analysis o tle above ieveals tlat tle scope o tle inteinal andit, oidinaiily, inclndes:

fxamination and evalnation o tle adeqnacy and eectiveness o tle inteinal contiol

systems

keview o tle application and eectiveness o iisk management piocednies and iisk

assessment metlodologies

keview o tle management and inancial inoimation systems, inclnding tle electionic

inoimationsystems

keview o tle accniacy and ieliability o tle acconnting iecoids and inancial iepoits

keview o tle means o saegnaiding assets

Appiaisal o tle economy and eiciency o tle opeiations

1esting o botltiansactions and tle nnctioning o speciic inteinal contiol piocednies

keview o tle systems establisled to ensnie compliance witl legal and iegnlatoiy

ieqniiements, code(s) o condnct and tle implementationo policies and piocednies

1esting o tle ieliability and timeliness o tle iegnlatoiy iepoiting.

!.u 1le banking indnstiy is special as it involves dealing witl pnblic money. 1le veiy natnie o

banking bnsiness o dealing witl money ieqniies piopei clecks and balances in place to ensnie

tlat tle dealings aie closely monitoied and tle iisks aiising ont o tle banking bnsiness aie

minimized. 1owaids tlis end, tle inteinal andit nnction in a bank assists tle senioi

management o tle bank in pioviding an objective assniance tlat all tle contiols aie well

designed and eectively opeiated. 1le bank's inteinal andit iepoits aie tle piimaiy sonice o

inoimation abont tle eectiveness o tle iisk management and inteinal contiol systems in tle

bank. 1lns, it can be seen tlat inteinal andit las a cincial iole to play in a bank's existence and

giowtl and, tleieoie, needs to be eective. 1owaids tlis end, tle Iasel committee on Ianking

8npeivision o tle Iank oi Inteinational 8ettlements las also piononnced ceitain piinciples

ieqniied to be ollowed oi aneective inteinal andit inbanks.

!.!u In India, eacl bank, noimally, las a sepaiate inteinal andit/inspection depaitment tlat

inspects tle bank's nnctioning peiiodically and iepoits to tle Andit committee o tle Ioaid o

Diiectois o tle bank. Ianks aie expected to lave snicient iesonices and invest in tiaining

tleii sta to condnct inteinal inspections. Howevei, it is also a commonpiactice among banks to

|aIoraal AudiI iaBaaks

Intiodnction 3

ontsonice tle ollowing inteinal andit/inspectionactivities:

1lose wliclaie iontine innatnie.

1lose wliclaie exceptional and/oi oi wliclno expeitise is available witlintle bank.

1lose wleie cost o being caiiied ont in-lonse wonld exceed tle beneits to be deiived

tleie iompiovided tlat tle cost o ontsonicing is lessei tlantle oimei cost.

Additionally, banks lave also eitlei institnted in-lonse depaitments oi caiiying ont systems

andits oi lave ontsoniced tlis specialized ield. 8ystems Andit ocnses on wletlei tle inteinal

piocednies and contiols aie being adleied to at tle opeiational level and wletlei tle existing

systems aie adeqnate and commensniate witl tle ieqniiement o tle clanging bnsiness

enviionment.

!.!! 1le eectiveness o inteinal andit nnction o banks is assessed dniing tle conise o on-site

inspection by kII. 8npeivisoiy conceins tliown np by inteinal andit/inspection piovide

pointeis oi indicatois oi on-site inspectiono kII.

!.!2 A sonnd inteinal andit nnction plays an impoitant iole in contiibnting to tle eectiveness o

tle inteinal contiol system. Lntil iecently, tle inteinal andit system in banks lad been

concentiating on tiansaction testing, testing o accniacy and ieliability o acconnting iecoids

and inancial iepoits, integiity, ieliability and timeliness o contiol iepoits, and adleience to

legal and iegnlatoiy ieqniiements. Howevei, in tle clanging scenaiio, sncl testing by itsel is

not snicient oi tle pnipose o pioviding anobjective assniance ontle nnctioning o inteinal

contiols by tle inteinal andit nnction.

!.!? Dniing iecent times, in addition to tle tiaditional iisks tlat tle banks aie exposed to, tle

incieasing global scale opeiations o banks, impact o tle inoimation teclnology on tle

banking systems and piocesses, lave exposed tle bnsiness o tle banks to newei iisks. 1le

management o tlese iisks is cincial oi tle snccess o any banking oiganisation. 1lis ieqniies

tle independent nnctions sncl as compliance and inteinal andit to be moie iisk ocnsed to

ensnie tlat tle iisks aie being identiied, assessed and managed eectively ona bank-wide basis.

1owaids tlis end, kII elt tlat tleie is a need oi widening as well as iediiecting tle scope o

inteinal andit to evalnate tle adeqnacy and eectiveness o iisk management piocednies and

inteinal contiol systems intle banks.

!.!1 1le aignment oi tle iisk-based inteinal andit can be nitlei snpplemented by tle cost-beneit

Risk-basod|aIoraal AudiI

0osI-boaoIiI Aaalysis

4 1eclnical cnide on kisk-based Inteinal Andit in Ianks

analysis o tle inteinal andit nnction. In tlis connection, it slonld be noted tlat inteinal andit

is invaiiably a cost centei in any oiganisation. It is, tleieoie, necessaiy tlat tle inteinal andit

nnctiondevelops and implements aneective, long iange inteinal andit planso tlat tle beneits

deiived tleieiomeectively exceed tle costs allocated to tle nnction.

!.!5 1le piimaiy objective o inteinal andit is to piovide anobjective assniance ontle nnctioning o

inteinal contiols in tle bank. Howevei, tleie is an inleient iisk tlat tle inteinal andit nnction

may not ieveal all tle weaknesses in tle inteinal contiols. 1lis may lead to iisk o losses in teims

o iand, inclnding embezzlement, and misappiopiiation o assets. 1o minimize tlese iisks, one

snggestive appioacl is to make tle inteinal andit nnction moie continnons, i.e., andit tle

dieient depaitments moie ieqnently. foi example, inciease in ieqnency o inteinal andit

may iesnlt in iednction in expected losses bnt incieases tle cost o andit nnction. On tle otlei

land, deciease in ieqnency o inteinal andit, tlongl may iednce tle costs o andit nnction,

iesnlts in iisk o iands and eiiois leading to inancial and otlei losses to tle bank. 1lns, tle

decision to inciease tle ieqnency o inteinal andit slonld be based on a caienl analysis o tle

tiade-o between tle cost associated witl caiiying ont ieqnent inteinal andits :| s :| tle

expected losses aiising ont o not caiiying ont inteinal andit. 1lis tiade-o canbe best aclieved

witl tle iisk-based inteinal andit, wlicl aims at optimal ntilization o inteinal andit iesonices

witlanenteipiise-wide iisk management peispective.

!.!0 In tle above diagiam, tle cnive AI denotes tle iisk cnive, wlicl iepiesents tlat as tle

ieqnency o inteinal andit incieases, tle iisk o non-detection o ineective inteinal contiols

(and conseqnently tle expected losses) decieases. 1le cnive cD denotes tle cost cnive, wlicl

1lis can be pictoiially depicted as ollows:

Risk oI lossos

duo Io aoa-audiI/

cosI oI iaIoraal

audiI rosourcos

A f f D

c

c

I

|roquoacy oI iaIoraal audiI

5 Intiodnction

iepiesents tlat as tle ieqnency o inteinal andit incieases, tle costs associated witl caiiying

ont inteinal andit inciease. 1le cnive ff denotes tle total cost cnive (wlicl inclndes tle cost o

non-detection o ineective inteinal contiols in teims o expected losses and tle cost o

iesonices allocated to inteinal andit nnction), wlicl decieases npto a ceitain level and

tleieatei incieases. Point cis wleie tle total cost is at its minimnmand is ideal oi a iisk-based

scenaiio.

!.! Leeping tle above tleoietical backgionnd in mind, it is impoitant to note tlat tle iisk-based

inteinal andit is animpoitant tool inaiding tle management decisioninielationto tle ollowing

aspects o inteinal andit nnction.

!.!S 1le iisk-based appioacl o inteinal andit assists tle management in deciding tle ieqnency o

tle andit. Atei nndeitaking tle iisk assessment o tle anditee nnits in tle andit nniveise, tlese

nnits can be categoiized on tle basis o tle iisk paiameteis as ligl, medinmoi low iisk nnits.

1lese nnits can tlen be snbjected to tle inteinal andit at a ieqnency snited to tleii iisk pioile.

1lis can be aclieved by snbjecting tle nnits witl a ligl-iisk pioile to inteinal andit moie

ieqnently tlan tle nnits tlat exlibit a low-iisk pioile. 1lns, iisk assessments o andit nnits

deteimine tle ieqnency o tle inteinal andit and tlns assist in optimal allocation o andit

iesonices.

!.!u 8cope o inteinal andit ieeis to tle extent to wlicltle testing o inteinal contiols inaninteinal

andit assignment slonld be nndeitaken. As a geneial piinciple, ligl-iisk andit nnits sncl as

tieasniy divisiono tle bank slonld be snbject to !uu tiansactions testing. Howevei, nnits witl

a ielatively low-iisk pioile activity sncl as allocation o tle lockeis to tle cnstomeis may be

snbject to a sample testing. In tlis connection, membeis aie also advised to ieei to tle Anditing

and Assniance 8tandaid (AA8) !5, Andit 8ampling, oi gnidance on nsing statistical sampling

teclniqnes oi nndeitaking andit assignments. Howevei, tle sampling teclniqne pioposed to be

so adopted slonld iist be placed oi tle appioval o tle andit committee, i any.

!.2u It is a known act tlat no inteinal andit nnction las tle iesonices to andit all tle anditable nnits

Koy AudiI 0ocisioas oI a Risk-basod|aIoraal AudiI

|roquoacy oI AudiI

8copooI AudiI

Timiag oI |aIoraal AudiI

6 1eclnical cnide on kisk-based Inteinal Andit in Ianks

simnltaneonsly. 1leieoie, tle tliid key decision tlat can be taken nsing tle iisk-based inteinal

andit is to ensnie tlat tle iiskiei nnit is snbject to andit soonei tlantle less iisky andit nnits. 1lis

can be aclieved by adoption o a /|v.1 /|r|a //|:y o inteinal andit wleieby tle less iisky nnits

aie snbject to inteinal andit at known ixed inteivals. Howevei, tle ligl-iisk andit nnits can be

snbject to a rsa1r /|r|a //|:y (wleie tle ieqnency and timing o andits is nnpiedictable to

tle anditable nnit). 8nipiise visits and snap andits, in addition to nll-scale inteinal andit, aie

components o iandom timing policy. foi anditable nnits witl medinm-iisk pioile, inteinal

andit slonld be based on conditional timing policy, nndei wlicl inteinal andits aie sclednled

wlen nnits exlibit a deteiioiation o contiols oi peioimance along witl some key dimension.

1le deteiioiation can be obseived on tle basis o analysis and scintiny o tle key ietnins on tle

peioimance o tle anditable nnit.

!.2! kisk-based inteinal andit appioaclassists tle management (wleie tle inteinal andit nnctionis

in-lonse) and tle andit iim(wleie tle inteinal andit nnction is ontsoniced) in deteimination

o tle size o tle inteinal andit team. I iisk actois ielect tle management conceins, tlen tley

can be nsed as a basis oi establisling tle size o tle inteinal andit team appiopiiate to addiess

tle most impoitant andit nnits.

!.22 1o ensnie tlat tle cost actois aie eectively actoied into andit decision and tle key andit

decisions, as explained above, aie moie iisk-based, banks aie advised by tle kII to make a

giadnal move towaids iisk-based inteinal andit systemwlicl inclndes, in addition to selective

tiansaction testing, an evalnation o tle iisk management systems and contiol piocednies

pievailing in vaiions aieas o a bank's opeiations. 1le implementation o iisk-based inteinal

andit wonld mean tlat gieatei emplasis is placed on tle inteinal anditoi's iole in mitigating

iisks. Wlile ocnsing on eective iisk management and contiols, in addition to appiopiiate

tiansaction testing, tle iisk-based inteinal andit wonld not only oei snggestions oi mitigating

cniient iisks bnt also anticipate aieas o potential iisks and play an impoitant iole in piotecting

tle bank iomvaiions iisks.

!.2? 1le advantages o iisk-based appioaclo tle inteinal andit nnctionaie as ollows:

It appiopiiately deines tle andit nniveise and identiies tle anditable nnits witlin tle

entity oi wlicltlese analyses wonld be caiiied ont.

It assists tle management in identiication o appiopiiate iisk actois to ielect tle

management's conceins.

8izooI Iho|aIoraal AudiI Toam

AdvaaIagos oI Risk-basod|aIoraal AudiI

? Intiodnction

Risk-basod|aIoraal AudiI Risk HaaagomoaI |uacIioa

It iesnlts in development o an appiopiiate oimat oi evalnating iisk actois so tlat tle

moie impoitant iisk actois play a moie piominent iole in tle iisk assessment piocess tlan

less impoitant iisk actois.

It develops a combination inle oi eacl andit nnit, wlicl will piopeily ielect its iiskiness

ovei seveial iisk actois tlat lave beenidentiied and a metlod o setting np andit piioiities

oi tle andit nnits.

It iesnlts in appiopiiate andit coveiage plan, wlicl piovides a ioadmap oi tle

management o inteinal andit sta skills so tlat tley aie available to caiiy ont andits o

appiopiiate scope wlentley aie needed tle most.

1lis iisk-based inteinal andit iesnlts in a piocess oiiented andit witl a iisk management

peispective, wlicl gives advice to management on tle steps to be taken oi eective iisk

management ona bank-wide basis.

!.21 1longl botl tle iisk management and tle inteinal andit (iisk-based) nnctions deal witl tle

iisk management systems o tle bank, it is necessaiy to distingnisl botl tle nnctions. 1le iisk

management nnction o a bank ocnses on aieas sncl as identiication, monitoiing and

measniement o iisks, development o policies and piocednies, nse o iisk management models,

etc. 1lns, tle end iesnlt o tle iisk management nnction is development o appiopiiate policies

and piocednies oi eective iisk management ona bank-wide basis.

!.25 1le concept o iisk identiication and tle assessment is also nndeitaken nndei tle iisk-based

inteinal andit iamewoik o tle banks. Howevei, nnlike iisk management nnction, tle iisk-

based inteinal andit, nndeitakes an independent iisk assessment solely oi tle pnipose o

oimnlating tle iisk-based andit plan keeping in view tle inleient bnsiness iisks o an

activity/location and tle eectiveness o tle contiol systems oi monitoiing tlose inleient

bnsiness iisks.

!.20 1le piimaiy dieience between tle two nnctions :|:, iisk management and tle inteinal andit,

tleieoie, is tle pnipose oi wlicl tle tool o tle iisk assessment is nsed. Lndei tle oimei

nnction, it is nsed oi development o iisk management policies and piocednies wleieas in tle

latei nnction, tle same is nsed oi oimnlation o appiopiiate iisk-based andit plan iesnlting in

optimal nsage o inteinal andit iesonices ona iisk sensitive basis.

!.2 Ieing an independent and key nnction in tle bank, tle iisk management depaitment slonld

also be snbjected to iisk assessment by tle iisk-based inteinal andit piocess and slonld be

andited in accoidance witl tle iisk-based andit plan dnly appioved by tle Andit committee o

tle Ioaid.

vs.

8 1eclnical cnide on kisk-based Inteinal Andit in Ianks

|aIroducIioa

8Iop!. ProparaIioa

2.! 1le adoption o tle iisk-based appioacl to tle inteinal andit ieqniies tle ollowing oni majoi

steps to be adopted by tle inteinal anditois:

2.!.! 1le inteinal anditoi slonld tieat tle iisk-based inteinal andit assignment as a sepaiate pioject

since it ieqniies signiicant andit iesonices and time. foi tlis pnipose, it is absolntely essential

tlat tle piepaiation oi tle pioject is meticnlonsly planned sncl tlat tle iisk assessment

exeicises aie piopeily nndeitaken at a latei stage. 1le ontpnt nndei tlis step wonld not only

deine tle size and stinctnie o tle inteinal andit nnction in tle bank, wleie tle bank las an

in-lonse inteinal andit nnctionoi tle size o tle inteinal andit teamwleie tle inteinal andit

Inteinal Andit in Ianks

8teps in kisk-based

claptei 2

l0

nnctionis ontsoniced, bnt also seives as a basis oi assignment o cleai ioles and iesponsibilities

to tle paiticipants intle inteinal andit exeicise and commnnicationo tle same to tlem.

2.!.2 Identiication o anditable nnits constitntes tle second step in tle iisk-based inteinal andit.

Identiication o anditable nnits is ielevant to nndeistand tle entiie andit nniveise coveied

nndei tle scope o tle iisk-based inteinal andit. It, tlns, leads to tle conclnsion o tle

nncoveied anditable nnits and tle iesnltant iesidnal iisk o non-andit o tlose anditable nnits.

2.!.? fnitlei, tle pioposed new capital adeqnacy iamewoik o kII (based on tle Iasel committee's

Inteinational capital Adeqnacy fiamewoik) also ieqniies identiication o bnsiness nnits as a

iist step in deteimination o tle capital claige ieqniied oi tle opeiational iisk. It wonld be a

pindent decision to combine botl tle capital adeqnacy assignment (iom an opeiational iisk

management peispective) witl tle iisk-based inteinal andit assignment, as botl aie

complementaiy to eaclotlei.

2.!.1 1le next step is to identiy tle iisks and categoiize tle iisks as ligl, medinmand low, depending

npon tle natnie o tle iisks. kisks in tle context o tle inteinal andit o banks can be classiied

as inleient banking bnsiness iisks sncl as ciedit and maiket iisks. In iecent yeais, given tle

signiicant volnmes o tiansactions in tle ietail poitolio o tle bank, a new iisk, styled as

'opeiational iisk", las emeiged giadnally. 1lese iisks can be mitigated by adoption o iisk

management and inteinal contiol policies and piocednies, oimnlated by tle Ioaid o

Diiectois. Howevei, adoption o appiopiiate policies and piocednies still caiiies a iisk called as

contiol iisk tlat is tle iisk o ailnie o contiol policies and piocednies in detection o a

mateiial iisky sitnation and addiessing it appiopiiately. In addition to identiication o tle

qnantnm o tle iisks at tlis stage, tle tiend o tle iisks (incieasing, stable, decieasing) is also

identiied at tlis stage.

2.!.5 Once tle iisks aie classiied nndei inleient bnsiness iisks and tle contiol iisks, eacl o tle

anditable nnits is to be assessed witl ieeience to tle identiied iisk paiameteis. foi tlis

pnipose, it is necessaiy to categoiize tle entiie banking bnsiness as identiiable anditable nnits,

eaclpione to a dieient level o a iisk.

2.!.0 1le objective o tle iisk assessment piocess is to diaw np a iisk-matiix, taking into acconnt botl

tle actois :|:, inleient bnsiness iisks and contiol iisks identiied in tle eailiei step. 1lis iisk

matiix appiopiiately places all tle anditable nnits into one among tle tliee categoiies o iisk

8Iop2. |doaIiIicaIioaoI audiIablouaiIs

8Iop8. 0oaducI risk assossmoaI

1eclnical cnide on kisk-based Inteinal Andit in Ianks

ll

pioiles-ligl, medinmoi low.

2.!. 1le inteinal andit nnction, wletlei in-lonse oi ontsoniced, slonld lave in place, an

independent iisk assessment system oi ocnsing on tle mateiial iisk aieas and piioiitizing tle

andit woik. 1le metlodology may iange ioma simple analysis o wly ceitain aieas slonld be

andited moie ieqnently tlan otleis in tle case o small sized banks nndeitaking tiaditional

banking bnsiness, to moie soplisticated assessment systems in laige sized banks nndeitaking

complex bnsiness activities.

2.!.S Once tle iisk matiix is piepaied, a iisk-based andit plan based on tle iisk pioile o tle andit

nnits is piepaied. 1lis involves decisionto be takenontle ieqnency, timing and tle scope o tle

inteinal andit o tle anditable nnit. 1lese decisions aie based ontle inteinal andit piioiities and

keeping in view tle objective o inteinal andit nnction as a iisk management tool. 1le iisk-

based inteinal andit planas piepaied by tle inteinal andit nnctiono tle bank is dnly appioved

by tle Andit committee o tle Ioaid o Diiectois o tle Iank.

2.!.u 1le above piocess is diagiammatically iepiesented as ellows :

8Iop4. Risk-basodiaIoraal audiI plaa

8Iop !.

ProparaIioa

8Iop 2.

|doaIiIicaIioa oI

AudiIablo uaiIs

8Iop 8.

Risk

AssossmoaI

8Iop !.

fstablisl tle Pioject

8peciy Obectives

cieation o

Oiganisation

8tinctnie

8Iop 2.

Identiy tle

anditable nnits

Deteimine tle iisk

o non-andit o

nnidentiiable

anditable nnits

categoiize

tle iisks

8Iop 8.

Identiy tle

anditable nnits

condnct iisk

assessment o

anditable nnit

categoiize tle

anditable nnit

8Iop 4.

finalization o

tle iisk-based

inteinal andit plan

8nbmission and

appioval iom tle

Andit committee

8Iop 4.

Risk-basod

|aIoraal AudiI

Plaa

8teps in kisk-based Inteinal Andit o Ianks

2.!.!u faclo tle above steps aie desciibed as ollows:

2.!.!! 1le iist step involves tle initiation o tle iisk-based inteinal andit piocess at tle bank. 1le idea

at tlis stage is to tieat tle iisk-based andit concept as a distinct pioject witl an objective o

oimnlation o andit plan witl moie iisk ocns at tle end o tle pioject. foi tlis pnipose, it is

absolntely necessaiy at tlis stage to:

fstablisltle pioject team

claiiy tle ioles and iesponsibilities o tle pioject team

8clednling tle pioject tasks

commnnication

2.!.!2 Depending npon tle size o tle bank, tle iisk-based inteinal andit pioject can be landled by a

small teamo andit pioessionals oi by an individnal. Wlile cloosing tle pioessionals oi tlis

assignment, it slonld be ensnied tlat tley lave adeqnate inteinal andit and iisk management

expeitise. few ciiteiia oi selection o pioessionals oi tlis assignment inclnde, expeiience in

condncting iisk assessments, andit planning expeiience and ability to analyze and syntlesize a

wide iange o inoimation.

2.!.!? Atei cloosing appiopiiate pioessionals oi tle assignment, it is impoitant to claiiy tle ioles

and iesponsibilities o tle team membeis o tle iisk-based inteinal andit assignment. 1lis

involves designation o a senioi pioessional as tle pioject antloiity, laving oveiall

iesponsibility oi tle entiie pioject. 1le team leadei wonld be assisted by tle team membeis

wlo wonld be iesponsible oi pioposing and execnting an appioacl oi implementation o tle

pioject. 1le team wonld lave extensive inteiactions witl tle senioi management o tle

anditable nnits wlo wonld be iesponsible oi paiticipation in meetings oi identiication and

assessing tle key iisks aced by tle anditable nnits.

2.!.!1 As tle pioject gets staited, it is impoitant to ensnie tlat tle pioject is accomplisled witl tiglt

deadlines and iepoiting iesponsibilities. 1lis ieqniies oimnlation o a pioject plan and

pioviding tle teammembeis witl appiopiiate tools sncl as policies/piocednies, clecklists oi

evalnation and tle sotwaie, i any, necessaiy to execnte tle plan and docnment tle iesnlts.

fective planning demands commnnication o tle establisled appioacl to all tle paiticipant

nnits sncltlat all tle membeis o tle teamaie at tle same wavelengtl.

2.!.!5 1le next steptowaids iisk-based inteinal andit is to identiy all tle activities tlat aie snsceptible

ProparaIioa

|doaIiIicaIioaoI audiIablouaiIs

l2 1eclnical cnide on kisk-based Inteinal Andit in Ianks

to tle inleient iisk. In line witl tle pioposed Opeiational kisk Management iamewoik

ennnciated by kII, tle identiication o anditable nnits can be taken at tliee dieient levels as

ollows:

Ievel !- lists tle main bnsiness gionps sncl as coipoiate inance, tiading and sales (tieasniy

nnction), ietail banking, commeicial banking, etc.

Ievel 2- lists tle piodnct teams in tlese bnsiness gionps sncl as tiansaction banking, tiade

inance, geneial banking, caslmanagement seivices, etc.

Ievel ?- lists ont tle piodncts oeied in tlese bnsiness gionps sncl as impoit bills, lettei o

ciedit, bank gnaiantee nndei tiade inance, etc.

2.!.!0 Identiication o tle anditable nnits at tle iist level itsel is ieqniied oi tle pnipose o tle iisk-

based andit plan. Howevei, tle snb-classiication into nitlei levels lelps tle inteinal andit

teamto identiy and assess tle applicable iisks to tle anditable nnit ina moie systematic mannei.

2.!.! It slonld be noted tlat tleie aie two types o iisks in banking bnsiness in tle context o iisk-

based inteinal andit. One tlat is inleient intle bnsiness opeiations o tle bank itsel, snclas tle

ciedit, maiket and opeiational iisk and tle otlei one is tle iisk tlat tle contiols designed to

mitigate tlese iisks may not be eective, typically teimed as contiol iisk. 1lns, inleient bnsiness

iisks indicate tle intiinsic iisk ina paiticnlai aiea/activity o tle bank. contiol iisks aiise ont o

inadeqnate contiol systems, deiciencies/gaps and/oi likely ailnies in tle existing contiol

piocesses.

2.!.!S Hence, wlile nndeitaking a iisk identiication exeicise nndei tle iisk-based andit piogiamme,

one slonld keep inmind tlat tle iisk assessment o ananditable nnit is laigely based onbotltle

inleient and tle contiol iisks and slonld be jndged incombinationtleieo.

2.2 Ieoie nndeistanding tle iisk assessment exeicise as pei tle steps ennmeiated snbseqnently, it

slonld be boine inmind tlat tle iisk assessment is laigely deteimined by actois snclas:

Pievions inteinal andit iepoits and compliance

Pioposed clanges inbnsiness lines oi clange inocns

8igniicant clange inmanagement/key peisonnel

kesnlts o latest iegnlatoiy examinationiepoit

0oaducI risk assossmoaI

Koy |acIors RolovaaI Ior Risk AssossmoaI

l3 8teps in kisk-based Inteinal Andit o Ianks

|ahoroaI Busiaoss Risks

kepoits o exteinal anditois

Indnstiy tiends and otlei enviionmental actois

1ime lapsed since last andit

Volnme o bnsiness and complexity o activities

8nbstantial peioimance vaiiations iomtle bndget

Leeping tle above actois in mind, tle iisk assessment exeicise can be nndeitaken nsing tle

ollowing steps.

2.? Ianks aie snbject to wide vaiiety o iisks in tle aieas o tleii opeiation. All o tlem can be

bioadly categoiized as ciedit, maiket and opeiational iisks. facl o tlese iisks aie explained as

ollows:

2.?.! ciedit iisk is deined as tle possibility o losses associated witl diminntion in tle ciedit qnality

o boiioweis oi connteipaities. In a bank's poitolio, losses stem iom ontiiglt deanlt dne to

inability oi nnwillingness o a cnstomei oi conntei paity to meet commitments in ielation to

lending, tiading, settlement and otlei inancial tiansactions. Alteinatively, losses iesnlt iom

iednction in poitolio valne aiising iom actnal oi peiceived deteiioiation in ciedit qnality.

ciedit iisk emanates iom a bank's dealings witl an individnal, coipoiate, bank, inancial

institntionoi a soveieign. ciedit iisk may take one oi moie o tle ollowing oims:

D|r.:/ /.a1|a piincipal and/oi inteiest amonnt may not be iepaid

Casrsa/.. r /.//.r / :r.1|/ nnds may not be oitlcoming iom tle constitnents npon

ciystallizationo tle liability

Tr.sary /.rs/|a tle payment oi seiies o payments dne iomtle conntei paities nndei

tle iespective contiacts may not be oitlcoming oi ceases

S.:ar|/|. /rs1|a /a|a.. nnds/ secniities settlement may not be eected

Cr-/r1.r .v/ar. tle availability and iee tiansei o oieign cniiency nnds may eitlei

cease oi tle soveieignmay impose iestiictions

2.?.2 ciedit iisk is moie ielevant to tle anditable nnits wleie ciedit lending nnctionis exeicised sncl

as tle coipoiate/ietail lending nnction o tle banks. 1le extent o ciedit iisk may also

snbstantially diei iom tle nnits wlicl aie dedicated to ciedit sanctions sncl as tle ciedit

Depaitment wleie tle iisk is liglei wleieas in otlei nnctions wleie ciedit sanction is

!

0rodiI Risk

1. Pouso rofor Rosorvo unk of lndu Cudunco Noto on Crodt Rsk Munugomont Cctobor 12, 2002.

l4 1eclnical cnide on kisk-based Inteinal Andit in Ianks

incidental to tle main nnction (sncl as in biancles o banks wleie sanction o loan against

deposits is only incidental as pei tle delegation o inancial poweis to tle biancl managei), tle

ciedit iisk impact miglt be lowei.

2.?.? Maiket kisk may be deined as tle possibility o loss to a bank cansed by clanges in tle maiket

vaiiables. Maiket kisk is tle iisk to tle bank's eainings and capital dne to clanges in tle maiket

level o inteiest iates oi piices o secniities, oieign exclange and eqnities, as well as tle

volatilities o tlose clanges. Iesides, it is eqnally conceined abont tle bank's ability to meet its

obligations as and wlentley all dne. Maiket iisk maniests itsel into vaiions oims snclas:

L|a|1|/y r|/ Iiqnidity iisk is tle potential inability o tle bank to meet its liabilities as and

wlen tley become dne. It aiises wlen tle banks aie nnable to geneiate casl to cope witl a

decline in deposits oi inciease in assets. It oiiginates iom tle mismatcles in tle matniity

patteino assets and liabilities.

Ia/.r./ rs/. r|/ It is tle iisk wleie clanges in maiket inteiest iates miglt adveisely aect a

bank's inancial condition.

Ir.|a Lv:/sa. R|/ It may be deined as tle iisk tlat a bank may snei losses as a iesnlt o

adveise exclange iate movements dniing a peiiod in wlicl it las an open position, eitlei

spot oi oiwaid, oi a combinationo tle two, inanindividnal oieigncniiency.

2.?.1 Opeiational iisk las been deined by tle Iasel committee on Ianking 8npeivision as tle iisk o

loss iesnlting iominadeqnate oi ailed inteinal piocesses, people and systems oi iomexteinal

events. Opeiational iisk may maniest itsel in a vaiiety o ways in banking indnstiy sncl as

inteinal/exteinal iand, client/piodnct/bnsiness piactices, damage to plysical assets, bnsiness

disinption and systemailnie etc. fxamples o vaiions contiibnting actois oi opeiational iisks

aie as ollows:

P.//. r|/ 1lis depends npon tle placement, competency o tle employees o tle bank and

tle woik enviionment, motivationand tninovei/iotationina bank.

Pr:. r|/ kisk aiising ont o execntion o tiansactions involving violation o contiols,

opeiational disinptions, exceeding o limits, money lanndeiing, non-obseivance o

contiactnal commitments, etc.

Sy/.r r|/ 1lis is tle combination o botl teclnology iisks iesnlting in system ailnie,

piogiamming eiioi, commnnicationailnie, etc., conpled witltle MI8 iisk.

2

HarkoI Risk

0poraIioaal Risk

2. Pouso rofor Rosorvo unk of lndu Cudunco Noto on Murkot Rsk Munugomont Cctobor 12, 2002.

l5 8teps in kisk-based Inteinal Andit o Ianks

L.s/ sa1 r.a/s/ry r|/ kisk o ailing to comply witllaws and iegnlations.

R./a/s/|as/ r|/ 1le iisk o loss o tle iepntation o tle bank in tle geneial pnblic dne to

tle ailnie to condnct its bnsiness npto tle standaids expected.

L:.a/ r|/ kisk o nnanticipated clanges in exteinal enviionment otlei tlan macio

economic actois.

2.1.! Once tle iisks aie identiied as above, it slonld be ensnied tlat tle bank las appiopiiate iisk

management systems in place, wlicl deine tle contiol enviionment and piesciibe tle contiol

piocednies oi mitigation o tle above iisks. In tlis context, it is ielevant to nndeistand tle

concept o tle contiol enviionment and tle contiol piocednies as iisk management tools.

Ca/r/ La:|rar.a/

2.1.2 1le Anditing and Assniance 8tandaid 0, kisk Assessments and Inteinal contiol deines tle teim

'contiol enviionment' as 'tle oveiall attitnde, awaieness and actions o diiectois and

management iegaiding tle inteinal contiol system and its impoitance in tle entity". 1le

contiol enviionment las an eect on tle eectiveness o tle speciic contiol piocednies and

piovides tle backgionnd against wlicl otlei contiols aie opeiated. A stiong contiol

enviionment, oi example, one witl tiglt bndgetaiy contiols and an eective inteinal andit

nnction, cansigniicantly complement speciic contiol piocednies.

2.1.? Ina banking oiganisation, tle actois ielected intle contiol enviionment inclnde:

Oiganizational stinctnie o tle bank and tle metlods o assigning antloiity and

iesponsibility inclnding segiegationo dnties and snpeivisoiy nnctions

kole o Ioaid o Diiectois and its committees indeining contiol enviionment and adopting

appiopiiate contiol piocednies

Management's plilosoply and opeiating style

Management's contiol systeminclnding tle inteinal andit nnction, peisonnel policies and

piocednies

Ca/r/ Pr:.1ar.

2.1.1 1le Anditing and Assniance 8tandaid 0, kisk Assessments and Inteinal contiol deines tle teim

'contiol piocednies' as 'tlose policies and piocednies, in addition to tle contiol enviionment,

wlicl tle management las establisled to aclieve tle entity's speciic objectives". In tle context

0oaIrol Risk

l6 1eclnical cnide on kisk-based Inteinal Andit in Ianks

o banking oiganisation, tle speciic contiol piocednies inclnde:

Appioving and contiolling o docnments

8egiegationo dnties and snpeivisoiy nnctions

Decision making snbject to tle 'oni eyes' (tlose o tle makei and tle cleckei) concept o

management

kepoiting and ieviewing o exceptions

compaiing tle inteinal data witlexteinal sonices o inoimation

kestiicting diiect access to assets, iecoids and inoimation

Inoimation system contiols, wlicl inclnde contiols ovei clanges to compntei piogiams

and access to data iles

2.1.5 As obseived above, wlile tle establislment o tle contiol enviionment is tle iesponsibility o

tle top management o tle bank, designing o appiopiiate contiol piocednies oi mitigation o

iisks is tle iesponsibility o tle iisk management depaitment. Anindependent iisk management

nnction, opeiating in a pioactive contiol enviionment, designs tle contiol piocednies, wlicl

aie to be implemented ona bank-wide basis.

2.1.0 1le inteinal anditoi, wlile developing a iisk-based inteinal andit plan slonld obtain an

nndeistanding o tle contiol enviionment snicient to assess management's attitndes,

awaieness and actions iegaiding inteinal contiols and tleii impoitance in tle bank. 1le

inteinal anditoi slonld also obtain an nndeistanding o tle contiol piocednies snicient to

developtle iisk-based andit plan.

2.1. fiomtle point o view o iisks, tle iole o inteinal andit at tlis jnnctnie is twoold:

Asceitaining tle inleient iisk o tle iisk management nnction and identiying tle extent

o tle aieas wleie tle contiol piocednies aie not establisled by tle iisk management

nnction

fvalnating tle iisk involved intle contiol piocednies designed oi mitigationo iisks

2.1.S Atei obtaining an nndeistanding o tle contiol enviionment and contiol piocednies and

laving satisied limsel tlat contiol piocednies aie existent in all tle anditable nnits, tle

inteinal anditoi slonld make a pieliminaiy assessment o contiol iisk. 1le pieliminaiy

assessment o contiol iisk is tle piocess o evalnating tle likely eectiveness o anentity's

|aIoraal audiI aadcoaIrol risk

Prolimiaary assossmoaI oI coaIrol risk

l? 8teps in kisk-based Inteinal Andit o Ianks

contiol enviionment and tle contiol piocednies in managing tle inleient bnsiness iisks. 1le

pieliminaiy assessment o contiol iisk is based on tle assnmption tlat tle contiols opeiate

geneially as designed and desciibed and tlat tley opeiate eectively tlionglont tle peiiod o

intended ieliance. 1leie will always be some contiol iisk becanse o tle inleient limitations o

any inteinal contiol system.

2.1.u 1le pieliminaiy assessment o contiol iisk slonld be ligl nnless tle anditoi is able to identiy

contiol piocednies ielevant to tle inleient bnsiness iisk o an anditable nnit and ensniing tlat

contiol piocednies aie adeqnate to mitigate tle bnsiness iisk. Wlen contiol iisk is assessed at

less tlanligl, tle inteinal anditoi wonld also docnment tle basis oi tle conclnsions.

2.1.!u At tlis stage tle inteinal anditoi slonld docnment tle nndeistanding obtained o tle bank's

contiol enviionment and tle contiol piocednies. He slonld also decide wletlei tle sitnation

waiiants an independent test o contiol piocednies to be peioimed oi nndeistanding tle

contiol iisk involved.

2.1.!! Dieient teclniqnes may be nsed to docnment inoimation ielating to contiol enviionment and

piocednies. 8election o a paiticnlai teclniqne is a mattei o tle inteinal anditoi's jndgment.

common teclniqnes, nsed alone oi in combination, aie naiiative desciiptions, qnestionnaiies,

clecklists and low claits. 1le size and complexity o tle anditable nnit and tle natnie o tle

inleient bnsiness iisks to wlicl tle anditable nnit is exposed, inlnence tle oimand extent o

tlis docnmentation. ceneially, tle moie complex tle contiol enviionment and piocednies and

tle moie extensive tle inteinal anditoi's piocednies, tle moie extensive tle anditoi's

docnmentationwill need to be.

2.1.!2 Wleievei necessaiy, based on tle pieliminaiy assessment o contiol iisk, tle inteinal anditoi

can nndeitake tle tests o contiol as a one-time exeicise to nndeistand tle opeiation o inteinal

contiols designed oi ananditable nnit ina systematic mannei. 1ests o contiol may inclnde:

Inspection o docnments snppoiting tiansactions and otlei events to gain andit evidence

tlat inteinal contiols lave opeiated piopeily, oi example, veiiying tlat a tiansaction las

beenpiopeily antloiised

Inqniiies abont, and obseivation o, inteinal contiols, wlicl leave no andit tiail, oi

example, deteimining wlo actnally peioims eacl nnction and not meiely wlo is

snpposed to peioimit

ke-peioimance o inteinal contiols, oi example, ieconciliation o bank acconnts, to

ensnie tley weie coiiectly peioimed by tle entity

1esting o inteinal contiol opeiating on speciic compnteiized applications oi ovei tle

oveiall inoimationteclnology nnction, oi example, access oi piogiamclange contiols

TosIs oI coaIrol

l8 1eclnical cnide on kisk-based Inteinal Andit in Ianks

2.1.!? 1le inteinal anditoi slonld obtain andit evidence tliongl tests o contiol to snppoit any

assessment o contiol iisk, wlicl is less tlan ligl. 1le lowei tle assessment o contiol iisk, tle

moie evidence tle inteinal anditoi slonld obtain tlat inteinal contiol systems aie snitably

designed and opeiating eectively.

2.1.!1 Wlen obtaining andit evidence abont tle eective opeiation o inteinal contiols, tle anditoi

consideis low tley weie applied, tle consistency witl wlicl tley weie applied dniing tle

peiiod and by wlomtley weie applied. 1le concept o eective opeiationiecognizes tlat some

deviations may lave occniied. Deviations iom piesciibed contiols may be cansed by sncl

actois as clanges in key peisonnel, signiicant seasonal lnctnations in volnme o tiansactions

and lnman eiioi. Wlen deviations aie detected, tle inteinal anditoi makes speciic inqniiies

iegaiding tlese matteis, paiticnlaily, tle timing o sta clanges in key inteinal contiol

nnctions. 1le anditoi tlenensnies tlat tle tests o contiol appiopiiately covei sncla peiiod o

clange oi lnctnation.

2.1.!5 Iased on tle iesnlts o tle tests o contiol, tle anditoi slonld evalnate wletlei tle inteinal

contiols aie designed and opeiating as contemplated in tle pieliminaiy assessment o contiol

iisk. 1le evalnationo deviations may iesnlt intle inteinal anditoi conclnding tlat tle assessed

level o contiol iisk needs to be ievised. In sncl cases, tle inteinal anditoi wonld modiy tle

natnie, timing and extent o planned snbstantive piocednies.

2.1.!0 1le basis oi deteimination o tle level (ligl, medinm, low) and tiend (incieasing, stable,

decieasing) o inleient bnsiness iisks and contiol iisks slonld be cleaily spelt ont tliongl tle

nse o botl qnalitative and qnantitative appioacles. Wlile tle qnantnmo ciedit, maiket, and

opeiational iisks conld laigely be deteimined by qnantitative assessment, tle qnalitative

appioacl may be adopted oi assessing tle qnality o contiols in vaiions bnsiness activities. In

oidei to ocns attention on aieas o gieatei iisk to tle bank, an activity wise and location-wise

identiicationo iisk slonld be nndeitaken.

2.1.! In tlis connection, tle piinciple ennnciated in tle Anditing and Assniance 8tandaid (AA8) 2u,

Lnowledge o tle Insiness, slonld be noted wliclis as ollows:

'Ia /.r/rr|a sa sa1|/ / /|asa:|s/ /s/.r.a/ //. sa1|/r /a/1 /s:. r //s|a /aw/.1. / //. /a|a.

a//|:|.a/ / .as//. //. sa1|/r / |1.a/|/y sa1 aa1.r/sa1 //. .:.a/ /rsas:/|a sa1 /rs:/|:. //s/ |a //.

sa1|/r' a1r.a/ rsy /s:. s |a|/|:sa/ .//.:/ a //. /|asa:|s/ /s/.r.a/ r a //. .vsr|as/|a r sa1|/

r./r/ Sa:/ /aw/.1. | a.1 /y //. sa1|/r |a s.|a |a/.r.a/ sa1 :a/r/ r|/ sa1 |a 1./.rr|a|a //.

0ualiIaIivoaadquaaIiIaIivoapproachos Ior risk assossmoaI

l9 8teps in kisk-based Inteinal Andit o Ianks

as/ar. /|r|a sa1 .v/.a/ / sa1|/ /r:.1ar.

2.1.!S Atei tle inleient and contiol iisks aie identiied, tle anditoi slonld map botl tle iisks to

ensnie tlat tle combination o botl tle iisks aie at an acceptable level. foi tlis pnipose, tle

anditoi las to jnxtapose tle inleient bnsiness iisks and tle contiol iisk in a systematic mannei.

1le iesnltant scenaiio deteimines tle iisk appetite o a paiticnlai andit nnit, wlicl is tle key

inpnt oi deteimination o iisk-based andit plan oi tlat paiticnlai anditable nnit. Atypical iisk

matiix looks as ollows:

Anexplanationo tle nndeilying tle iisk appetite o tle above anditable nnits is as ollows:

Risk HaIrix

!. A Higl kisk

2. I Veiy

Higl kisk

?. c fxtiemely

Higl kisk

1. D Medinm

kisk

8. No AudiIablo UaiI NaIuro oI risk

Altlongl tle contiol iisk is low, tlis is a Higl kisk

aiea dne to liglinleient bnsiness iisks.

1le ligl inleient bnsiness iisk conpled witl

medinm contiol iisk makes tlis a Veiy Higl kisk

aiea

Iotl tle inleient bnsiness iisk and contiol iisk aie

ligl wlicl makes tlis an fxtiemely Higl kisk aiea.

1lis aiea wonld ieqniie immediate andit attention,

maximnm allocation o andit iesonices besides

ongoing monitoiing by tle bank's topmanagement.

Altlongl tle contiol iisk is low tlis is a Medinm

kisk aiea dne to medinminleient bnsiness iisks.

LxplaaaIioa

20

Risk HaIrix

Inleient iisk

contiol iisk

Higl

Medinm

Iow

Lw M.1|ar

H|/

A I c

D f f

c H I

1eclnical cnide on kisk-based Inteinal Andit in Ianks

Risk-basod|aIoraal AudiI Plaa

2.5.! Once tle iisk assessment exeicise is nndeitaken by tle inteinal anditoi and tle anditable nnits

aie aiianged as pei tle iisk matiix as explained above, tle next step is to devise tle iisk-based

andit plan detailing ont tle piioiities, natnie, timing and extent o inteinal andit piocednies in

an anditable nnit witl ieeience to tle iisk categoiization o tle anditable nnit. Inteinal andit

piioiities aie diiven piimaiily by tle need to assess tle iisk management piactices and contiols

to vaiying levels o assniance oi by a need oi advice.

2.5.2 1le piecise scope o iisk-based inteinal andit mnst be deteimined by eacl bank oi low,

medinm, ligl, veiy ligl and extiemely ligl iisk aieas. Howevei, as pei tle extant gnidelines o

kII, at tle minimnm, it mnst ieview/iepoit on:

Piocess by wlicliisks aie identiied and managed invaiions aieas

1le contiol enviionment invaiions aieas

caps, i any, incontiol meclanismwliclmiglt lead to iands, identiicationo iand pione

aieas

Data integiity, ieliability and integiity o MI8

Inteinal, iegnlatoiy and statntoiy compliance

8copo

5. f Higl

kisk

0. f Veiy

Higl kisk

. c Iow kisk

S. H Medinm

kisk

u. I Higl

kisk

Altlongl tle inleient bnsiness iisk is medinmtlis

is a Higlkisk aiea becanse o contiol iisk also being

medinm.

Altlongl tle inleient bnsiness iisk is medinm, tlis

is a Veiy Higlkisk aiea dne to liglcontiol iisk.

Iotl tle inleient bnsiness iisk and contiol iisk aie

low.

1le inleient bnsiness iisk is low and tle contiol

iisk is medinm.

Altlongl tle inleient bnsiness iisk is low, dne to

liglcontiol iisk tlis becomes a Higlkisk aiea.

2l 8teps in kisk-based Inteinal Andit o Ianks

Indgetaiy contiol and peioimance ieviews

1iansactiontesting/veiiicationo assets to tle extent consideied necessaiy

Monitoiing compliance witltle iisk-based inteinal andit iepoit

Vaiiation, i any, in tle assessment o iisks nndei tle andit plan :|-s-:| tle iisk-based

inteinal andit.

2.5.? 1le scope o iisk-based inteinal andit slonld also inclnde a ieview o tle systems in place oi

ensniing compliance witl money lanndeiing contiols; identiying //.a/|s/ inleient bnsiness

iisks and contiol iisks, i any; snggesting vaiions coiiective measnies; and nndeitaking ollow

npieviews to monitoi tle actiontakentleieon.

2.5.1 1le contents o iisk-based andit planaie noimally as ollows:

(i) AudiI Uaivorso. 1le iisk-based andit plan at tle ontset lists down tle entiie anditable nnits,

wlicl aie snbject to tle inteinal andit in one oim oi otlei. An explanation o tle natnie and

scope o tle anditable nnits is piovided nndei tlis section.

(ii) PrioriIy. facl anditable nnit is to be assigned a iisk categoiy based on tle iisk assessment o tle

anditable nnit as ontlined above. foi tlis pnipose, it is impoitant tlat tle plan slonld give

impoitance to tle magnitnde and tle ieqnency o tle iisks also as obseived in tle iisk

assessment exeicise oi tle pnipose o condncting o inteinal andit in iespect o tle iespective

anditable nnit. 1le andit planslonld piioiitize andit woik to give gieatei attentionto aieas o:

HiglMagnitnde and liglieqnency

HiglMagnitnde and medinmieqnency

Medinmmagnitnde and liglieqnency

Higlmagnitnde and low ieqnency

MedinmMagnitnde and medinmieqnency.

(iii) Typo oI Iho iaIoraal audiI assigamoaI. 1le slape and tle oim o tle inteinal andit assignment

slonld be cleaily deined. 1wo types o tle inteinal andit assignment aie paiticnlaily ielevant in

tlis connection:

Assuraaco. 1lis type o inteinal andit assignment is designed to piovide senioi

management witl assniance seivices. Assniance seivices aie objective examinations o

evidences oi tle pniposes o pioviding an independent assessment o iisk management

0oaIoaIs oI Risk-basodAudiI Plaa

22 1eclnical cnide on kisk-based Inteinal Andit in Ianks

stiategies and piactices, management contiol iamewoiks and piactices and inoimation

nsed oi decisionmaking and iepoiting.

0oasulIiag. consnlting assignments aie designed to piovide senioi management witl

assistance. 1lese assignments aie not designed to piovide assniance as mentioned above.

(iv) |roquoacy. 1le iisk-based inteinal andit plan slonld also ontline tle ieqnency witlin wlicl

tle anditable nnits aie snbject to tle inteinal andit. It slonld be noted tlat tle ieqnency o tle

andit is a nnction o tle inteinal andit piioiities as ontlined above and tle available inteinal

andit iesonices etc. Howevei, all tle anditable nnits slonld be snbject to one oim oi otlei o

inteinal andit at inteivals as decided by tle management bnt pieeiably, at least once in tliee

yeais.

(v) LxIoaI oI IosIiag. 1le piimaiy ocns o iisk-based inteinal andit will be to piovide ieasonable

assniance to tle Ioaid and top management abont tle adeqnacy and eectiveness o tle iisk

management and contiol iamewoik in tle banks' opeiations. Wlile examining tle

eectiveness o tle contiol iamewoik, tle iisk-based inteinal andit slonld iepoit on piopei

iecoiding and iepoiting o majoi exceptions and excesses. As pei tle extant gnidelines o kII,

tiansaction testing wonld continne to iemain an essential aspect o iisk-based inteinal andit o

banks. 1le extent o tiansaction testing wonld be deteimined on tle basis o iisk assessment.

Illnstiatively, tle bank slonld nndeitake !uu pei cent tiansaction testing i an aiea alls in cell

'fxtiemely Higl kisk" o tle iisk matiix. 1le bank may also considei !uu pei cent tiansaction

testing i anaiea alls incell 'I-Veiy Higlkisk" oi 'f-Veiy Higlkisk", and tle iisks aie slowing

anincieasing tiend. 1le banks may also considei tiansactiontesting witlanelement o snipiise

iniespect o low iisk aieas, wliclwonld be andited at ielatively longei inteivals.

(vi) Rosourco roquiromoaIs. 1le plan oi iisk-ocnsed andit slonld also speciy an estimated iange

o level o eoit ieqniied to caiiy ont tle pioject. 1le eoit estimate slonld take into

consideiationtle ollowing actois:

Natnie o inteinal andit assignment (consnlting, assniance)

1le scope o tle inteinal andit assignment (inclnding consideiations o andit peiiod,

bnsiness piocess and tle bnsiness objectives to be assessed)

1le complexity o anditable nnit, bnsiness piocesses and systems inscope

1le availability o inteinal andit and snbject mattei expeitise

1le qnality and qnantity o existing docnmentationintle snbject aiea

1le andit appioacl and teclniqnes to be nsed (e.g., inteiviews, tiansaction sampling,

woikslops, compntei assisted andit tools, etc.).

As pei tle gnidelines o kII, tle inteinal andit nnction slonld be piovided witl appiopiiate

iesonices and sta to aclieve its objectives nndei tle iisk-based inteinal andit system. 1le sta

23 8teps in kisk-based Inteinal Andit o Ianks

possessing tle ieqnisite skills slonld be assigned tle job o nndeitaking iisk-based inteinal

andit. 1ley slonld also be tiained peiiodically to enable tlemto nndeistand tle bank's bnsiness

activities, opeiating piocednies, iisk management and contiol systems, MI8, etc.

(vii) 8ubmissioa oI Iho iaIoraal audiI plaa. 1le iesnlts o tle above piocess inclnding toolset

ieqniiements oi tle iisk-based inteinal andit slonld be piesented and validated by tle senioi

management. It is impoitant to engage senioi management in tlis piocess to seek tleii inal

inpnt on tle liglest piioiities oi inteinal andit and to ensnie tlat tleie is adeqnate snppoit oi

tle iationale piovided. It is, tleieoie, iecommended to seek tle views o tle senioi

management o tle anditable nnits on tle iisk-based inteinal andit plan and incoipoiate tle

necessaiy snggestions in tle andit plan. 1le inal plan as acceptable to tle inteinal andit

nnction and tle anditable nnits is to be placed beoie tle Andit committee o tle Ioaid o

Diiectois oi tleii inal appioval.

Iet ns considei, oi example, one o tle identiied anditable nnits by tle inteinal anditoi as 'ketail Ioan

depaitment". 1lis inclndes nitlei snb-nnits sncl as lome loans, commeicial velicle loans, peisonal

loans, anto loans and two wleelei loans depaitments. Once tle anditable nnit is identiied, tle ollowing

steps aie to be nndeitakenoi ensniing tle iisk appetite o tle ietail loandepaitment.

I1.a/|/|:s/|a / |a/.r.a/ /a|a. r|/ In ietail loan poitolio, tle majoi inleient bnsiness iisk is tle ciedit

iisk, i.e., iisk o deanlt by a ietail boiiowei.

I1.a/|/|:s/|a / :a/r/ /r:.1ar. 1o ensnie tlat tle ciedit iisk is appiopiiately taken caie o, adeqnate

contiol policies and piocednies aie to be oimnlated by tle ietail iisk management depaitment o tle

bank. 1lese piocednies miglt inclnde:

Devising tle scoiecaid appioacles speciying tle ciiteiia oi acceptance o cnstomei.

8egiegationo tle nnctions o sonicing tle boiioweis and sanctioning o tle loans.

fstablislment o an independent iisk contiol nnit, wlicl nndeitakes tle veiiication o tle

accniacy o tle loan docnments along witl tle necessaiy snpplements docnments snbmitted by

tle boiiowei inclnding tleii antlenticity itsel.

Designing a piopei MI8 iamewoik iesnlting in appiopiiate monitoiing o tle poitolio

inclnding peiiodic, exceptioniepoits being geneiated.

0A8L 8TU0Y

Risk AssossmoaI oI aa AudiIablo UaiI-RoIail Loaa 0oparImoaI

24 1eclnical cnide on kisk-based Inteinal Andit in Ianks

fnsniing adeqnate peisonnel to nndeitake tle stndy o tle movement o tle ietail loanpoitolio

witl paiticnlai emplasis on tle tiend o tle delinqnency iatios being obseived ovei a peiiod o

time.

cieationo a sepaiate loancollectionnetwoik oi ollowing npwitltle delinqnent boiioweis.

1le oimnlation o tle above contiol piocednies is, as mentioned above, tle iesponsibility o tle iisk

management depaitment. Howevei, once tle piocednies aie oimnlated tleie is a iisk tlat tley may not

be piopeily implemented dne to ailnie o people, piocess oi systems. 1lis iisk is teclnically teimed as

opeiational iisk.

1le inteinal anditoi wlo is nndeitaking tle iisk assessment o tle ietail loandepaitment o a bank las to

piimaiily nndeistand tle piocednies deteimined oi mitigating tle ciedit iisk inleient in tle ietail loan

poitolio. Wlile nndeistanding tle piocednies, le may come acioss ceitain aieas in tle ietail loan

poitolio, wlicl may not be coveied by tle above piocednies. foi example, tle sonicing o tle boiioweis

nnction las been entinsted to an exteinal agency by tle bank. In tlat sitnation, tle ontsonicing iisks

aiising ont o tle exteinal agency aiiangement may be o paiticnlai concein oi deteimining tle

opeiational iisk o tle ietail loan depaitment. 1lese ontsonicing iisks inclnde, iisk o ake ield

investigation, dnbions iepoits being snbmitted by tle exteinal agency, etc. 1le inteinal anditoi in sncl

case can snggest to tle iisk management depaitment, tle iisk mitigants to be oimnlated to obviate tle

ontsonicing iisks. Howevei, it slonld be noted tlat tle nltimate iesponsibility o designing appiopiiate

contiol piocednies lies witltle iisk management depaitment.

Wlile nndeitaking tle pieliminaiy assessment o tle contiol iisk, tle inteinal anditoi slonld deteimine

tle likelilood o tle iisk o a paiticnlai piocess oi nnction not adeqnately coveied by tle contiol

piocednies. He slonld also, in sncl ciicnmstances, nndeistand tle qnantnmo tle iisk being identiied

and docnment tle inteinal andit piocednies nndeitakento ieaclsnclconclnsion.

foi tle pnipose o iisk assessment, tle inteinal anditoi may adopt a iating ciiteiia oi assessing tle iisks,

botl inleient and contiol, wlicl wonld assist lim in objective evalnation o tle iisks in tle anditable

nnit. 1lis exeicise ieqniies tle inteinal anditoi to iate tle iisk posed by tle anditable nnit on a pie-

deined iating scale wleie tle low iating wonld indicate a low iisk and :|:. :.rs 8nclanexeicise wonld

iesnlt in tle standaidization o tle iisk assessment and assist tle inteinal anditoi in docnmenting tle

steps nndeitakenoi tle iisk assessment.

Prolimiaary assossmoaI oI IhocoaIrol risk

Risk RaIiag

25 8teps in kisk-based Inteinal Andit o Ianks

TosIs oI coaIrols

Risk Happiag

Atei tle pieliminaiy assessment, tle inteinal anditoi, i le eels tlat tle sitnation demands tlat tle tests

o contiols slonld be nndeitaken, slonld take appiopiiate steps to independently test tle opeiationo tle

inteinal contiol piocednies. foi tlis pnipose, le may take np appiopiiate ciedit iles and tiy to evidence

tle obseivance o tle piesciibed piocednies. 1lese tests o contiols nitlei snpplement tle pieliminaiy

assessment o inteinal contiol in ieacling a conclnsion abont tle contiol iisk o tle ietail loan

depaitment.

Atei identiication o tle inleient and tle contiol iisks o tle ietail loan depaitment, tle inteinal

anditoi is ieqniied to make a jndgment abont tle natnie o tlese iisks as ligl, medinmoi low depending

on tle iesnlts o tle andit piocednies as above, inclnding tle iesnlts o tle tests o tle contiol

nndeitaken, i any, and docnment tle decisiono tle iisk assessment o tle ietail loandepaitment.

26 1eclnical cnide on kisk-based Inteinal Andit in Ianks

Otlei consideiations

1le ollowing actois slonld also be consideied wlile nndeitaking tle iisk-based inteinal andit

assignments as pei tle extant gnidelines o kII:

?.!.! 1le inteinal andit nnction slonld be independent iomtle inteinal contiol piocess in oidei to

avoid any conlict o inteiest and slonld be given an appiopiiate standing witlin tle bank to

caiiy ont its assignments. It slonld not be assigned tle iesponsibility o peioiming otlei

acconnting oi opeiational nnctions. 1le management slonld ensnie tlat tle inteinal andit

sta peioims tleii dnties witl objectivity and impaitiality. Noimally, tle inteinal andit lead

slonld iepoit to tle Ioaid o Diiectois tlionglAndit committee o tle Ioaid.

?.!.2 1le Ioaid o Diiectois and topmanagement will be iesponsible oi laving inplace aneective

|uacIioaal iadopoadoaco

claptei ?

iisk-based inteinal andit system and ensnie tlat its impoitance is nndeistood tlionglont tle

bank. 1le snccess o inteinal andit nnction depends laigely on tle extent o ieliance placed on

it by tle management oi gniding tle bank's opeiations.

?.!.? In tlis context, attention is invited to tle Anditing and Assniance 8tandaid , 'kelying Lpon tle

Woik o An Inteinal Anditoi" wlicl piovides tlat tle geneial evalnation o tle inteinal andit

nnction will assist tle exteinal anditoi in deteimining tle extent to wlicl le can place tle

ieliance on tle woik o inteinal anditoi. 1le 8tandaid also ieqniies tle oiganizational statns o

tle inteinal andit nnctionto be examined as a pait o tle geneial evalnationand piovides tlat:

'W/.//.r |a/.ras/ sa1|/ | aa1.r/s/.a /y sa a/|1. s.a:y r /y sa |a/.ras/ sa1|/ 1./sr/r.a/ w|//|a //.

.a/|/y |/.// //. |a/.ras/ sa1|/r r./r/ / //. rsas.r.a/ Ia sa |1.s/ |/as/|a /. r./r/ / //. /|/./

/.:./ / rsas.r.a/ sa1 | /r.. / say //.r /.rs/|a r./a|/|/|/y Aay :a/rs|a/ r r./r|:/|a //s:.1

a/a /| wr/ /y rsas.r.a/ /a/1 /. :sr./a//y .:s/as/.1

?.2 1le commnnication clannels between tle iisk-based inteinal andit sta and management

slonld enconiage iepoiting o negative and sensitive indings. All seiions deiciencies slonld be

iepoited to tle appiopiiate level o management as soonas tley aie identiied. 8igniicant issnes

posing a tlieat to tle bank's bnsiness slonld be piomptly bionglt to tle notice o tle Andit

committee oi top management, as appiopiiate. In paiticnlai, tle inteinal anditoi slonld be iee

to commnnicate nlly witltle exteinal anditoi.

?.?.! 1le Inteinal andit nnction slonld condnct peiiodical ieviews, annnally oi moie ieqnently, o

tle iisk-based inteinal andit nndeitaken by it :|-s-:| tle appioved andit plan. 1le

peioimance ieview slonld also inclnde anevalnationo tle eectiveness o iisk-based inteinal

andit inmitigating identiied iisks.

?.?.2 1le Andit committee o Ioaid slonld peiiodically assess tle peioimance o tle iisk-based

inteinal andit oi ieliability, accniacy and objectivity. Vaiiations, i any, in tle iisk pioile as

ievealed by tle iisk-based inteinal andit :|-s-:| tle iisk pioile as docnmented intle andit plan

slonld also be looked into to evalnate tle ieasonableness o iisk assessment metlodology o tle

inteinal andit nnction.

0ommuaicaIioa

PorIormaacoovaluaIioa

28 1eclnical cnide on kisk-based Inteinal Andit in Ianks

RolaIioashipwiIh IhooxIoraal audiIor

?.1 Wlile tle exteinal anditoi las tle inal iesponsibility oi tle andit iepoit signed by limand oi

deteimination o tle natnie, timing and extent o tle anditing piocednies, mncl o tle woik o

tle inteinal andit nnctionmay be nsenl to limin lis examinationo tle inancial inoimation.

1owaids tlis end, tle Anditing and Assniance 8tandaid , 'kelying Lpon 1le Woik O An

Inteinal Anditoi" piovides oi a iamewoik o ielationslipbetweentle inteinal anditoi and tle

exteinal anditoi, wliclslonld be consideied wlile deteimining tle iisk-based andit plan.

29 Otlei consideiations

1le Way Alead

kisk-based inteinal andit is expected to be an aid to tle ongoing iisk management in banks by pioviding

necessaiy clecks and balances intle system. Howevei, since iisk-based inteinal andit will be a aiily new

exeicise oi most o tle Indian banks, a giadnal bnt eective appioacl wonld be necessaiy oi its

implementation.

In tlis connection, it is impoitant to note tlat tle IcAI las come ont witl seveial andit piononncements

inclnding cnidance Note on Andit o Ianks, wlicl will piovide gnidance on iisk assessment and its

impoitance to tle andit nnction. 1le giowing concein o inteinal contiols paiticnlaily in a post-

8aibanes Oxley eia and its applicability to tle banking indnstiy is a pioessional oppoitnnity oi tle

membeis o tle Institnte to contiibnte to tle enteipiise-wide iisk management initiatives o tle banks

nsing tle inteinal andit nnction.

fnitlei, tle iisk management peispective o tle opeiations is being given dne impoitance nndei tle

pioposed Iasel Inteinational capital Adeqnacy iamewoik wleieby tle banks witlincieased iisk

claptei 1

mitigant stiategies aie iewaided snitably witl tle lowei capital ieqniiements wleieas tle ligl iisk

banks aie snbject to stiingent capital ieqniiements.

fnitlei, tle kII las advised tlat initially tle iisk-based inteinal andit may be nsed as a

management/andit tool in addition to tle existing inteinal andit/inspection. Once tle iisk-based

inteinal andit stabilizes and tle inteinal andit sta oi tle team (wleie tle inteinal andit nnction is

ontsoniced) attains pioiciency, it slonld ieplace tle conventional inteinal andit appioacl/inspection.

3l 1le Way Alead

keseive Iank o India ciicnlais

on kisk-based Inteinal Andit

I DI8.cO/kI8/5S/?0.u!.uu2/2uu!-u2

dated Angnst !?, 2uu!

II DI8.cO.PP.Ic.!u/!!.u!.uu5/2uu2-u?

dated Decembei 2, 2uu2

III DI8.cO.PP.Ic.!/!!.u!.uu5/2uu1-u5

dated febinaiy !, 2uu5

Appendices

Appoadix - |

Hovo Iowards Risk basod 8uporvisioa (RB8) oI baaks -

0iscussioa Papor

!?tl Angnst 2uu!

DI8.cO/ kI8/5S/?0.u!.uu2/2uu!-u2

All 8clednled commeicial Ianks

(fxcept kegional knial Ianks)

Deai 8iis,

Please ieei to paiagiapl 0 o oni coveinoi's statement on 'Monetaiy and ciedit Policy oi tle

yeai 2uuu-2uu!' wleiein it las been stated tlat tle keseive Iank wonld be developing an

oveiall plan oi moving towaids kisk-based 8npeivision (kI8) witl tle assistance o

inteinational consnltants. Accoidingly, Piice watei lonse coopeis (Pwc), a iimo consnltants

based in Iondon, weie engaged to nndeitake a ieview o tle cniient iegnlatoiy and snpeivisoiy

iegime and piepaie tle blne piint oi tle tiansition to a moie soplisticated system o kI8

incoipoiating inteinational best piactices. A discnssion papei on tle 'Move towaids kisk-based

8npeivision o banks' las been piepaied snmmaiizing tle iecommendations o tle consnltants

and is enclosed.

2. It may be obseived iomtle discnssion papei tlat tle keseive Iank wonld ocns its snpeivisoiy

attention on tle banks in accoidance witl tle iisk eacl bank poses to itsel as well as to tle

system. 1le iisk pioile o eacl bank wonld deteimine tle snpeivisoiy piogiamme compiising

o-site sniveillance, taigeted on-site inspections, stinctnied meetings witl banks,

commissioned exteinal andits, speciic snpeivisoiy diiections and new policy notices in

conjnnction witl close monitoiing tliongl a Monitoiable Action Plan (MAP) ollowed by

enoicement action, as waiianted. 1le snccessnl implementation o tle piocess o kI8 entails

adeqnate piepaiation, botlontle pait o tle keseive Iank and tle commeicial banks.

?. 1le intiodnctiono kI8 wonld ieqniie tle banks to ieoiient tleii oiganisational set np towaids

kI8 and pnt in place an eicient iisk management aiclitectnie, adopt iisk ocnsed inteinal

andit, stiengtlen tle management inoimation system, and set np compliance nnits . 1le banks

wonld also be ieqniied to addiess HkD issnes like manpowei planning, selection and

deployment o sta and tleii tiaining in iisk management and iisk based andit. It is evident tlat

clange management is a key element inkI8 and tle banks slonld lave cleaily deined standaids

o coipoiate goveinance, well docnmented policies and eicient piactices inplace so as to

33 Appendices

cleaily demaicate tle lines o iesponsibility and acconntability so tlat tley align tlemselves to

meet tle ieqniiements o kI8.

1. 1le discnssion papei may please be placed beoie tle Ioaid o Diiectois oi delibeiation in tle

next meeting. 1le comments o tle bank on tle vaiions aspects o tle discnssion papei may

please be oiwaided to ns as eaily as possible bnt beoie 8eptembei ?u, 2uu!.On tle basis o tle

eed back ieceived iomtle banks nitlei discnssions wonld be leld.

5. Intle meanwlile, kindly acknowledge ieceipt.

(A.I.Naiasimlan)

clie ceneial Managei-in-claige

fncl: Discnssionpapei on'Move towaids iisk based 8npeivisiono banks"

!. 1le inteinational banking scene las in iecent yeais witnessed stiong tiends towaids

globalization and consolidation o tle inancial system. 8tability o tle inancial system las

become tle cential clallenge to bank iegnlatois and snpeivisois tlionglont tle woild. 1le

mnlti-lateial initiatives leading to evolntiono inteinational standaids and codes and evalnation

o adleience tleieto iepiesent iesolnte attempts to addiess tlis clallenge.

2. 1le Indian banking scene las witnessed piogiessive deiegnlation, institntion o pindential

noimand an emnlation o inteinational snpeivisoiy best piactices. 1le snpeivisoiy piocesses

lave also concomitantly evolved and lave acqniied a ceitain level o iobnstness and

! 2