Professional Documents

Culture Documents

Clarkson Questions

Uploaded by

sharonulyssesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Clarkson Questions

Uploaded by

sharonulyssesCopyright:

Available Formats

Why has Clarkson Lumber borrowed increasing amounts despite its consistent profitability? How has Mr.

Clarkson met the financing needs of the company during the period 1993-1995? Has the financial strength of the company improved or deteriorated? How attractive is it to take the trade discounts? Do you agree with Mr. Clarksons estimate of the companys loan requirements? How much will he need to finance the expected expansion in sales to $ 5.5 Million in 1996 and to take all trade discounts? As Mr. Clarksons financial advisor, would you urge him to go ahead with, or to reconsider, his anticipated expansion and his plans for additional debt financing? As the banker, would you approve Mr. Clarksons loan, and if so, what conditions would you put on the loan?

Clarkson Lumber Company Solutions

Questions: 1.What problems does Clarkson Lumber face? 2.Why does Mr. Clarkson have to borrow money to support this profitable business? 3.Is a line of credit of $ 750,000 sufficient to meet the firms future financial needs? 4.As a banker, would you approve Mr. Clarksons loan request, and if so, what conditions would you put on the loan? 1. The Problem Defined: The Clarkson Lumber Company has been expanding rapidly for several years. Increases in working capital requirements have outgrown the capacity of the firm to generate funds from internal sources. Also, part of the funds were used to buy out a partner, further increasing financial pressure. The firm has foregone taking discounts on accounts payable and is borrowing

increasing amounts from the bank so as to maintain its expansion. Mr. Clarksons decision today is whether to expand and , if so, how to raise new funds. He is seeking a new bank connection from which he can borrow larger amounts. In turn, the bank must estimate the amount of funds actually needed by Mr. Clarkson, the probable repayment schedule, the nature and degree of the risks incurred and the appropriate terms of such a bank loan.

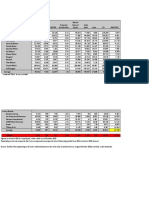

2. Why Borrow? See statement of changes in cashflows from1993 through 1995 in Table TN-A Points to Note: The RAPID INCREASE in Accounts Receivables, Inventory, and Plant & Equipment have mainly been responsible for Clarksons urgent need for funds. The Buyout of Clarksons partner has added fuel to the fire. A major reason for the increase in accounts receivables and inventories since 1993 has been the RISING SALES VOLUME. Also, the Collection period has increased from 38 days at year-end 1993 to 49 days at year-end 1995. See Table TN-B. What combination creates a voracious appetite for external financing? 1.Rapid Sales growth, PLUS 2.A Long Cash Cycle PLUS 3.A Low Profit Retention. Refer to Table TN-D. Clarkson Lumbers financial condition has weakened since 1993. The trade credit has been stretched from 35 days to 54 days; the current ratio has declined from 2.5 to 1.2, and total liabilities as a % of total assets has soared from 45 % to 72 %. Were profitability to decline due to adverse circumstances, this situation will worsen.

3. Is $ 750,000 sufficient? The answer depends on the degree to which Clarkson relies on using trade credit as a source of funds. As exhibit 2 shows, Clarkson has waited for about 35 to 54 days to pay his suppliers. If Mr. Clarkson is offered a discount of 2 % for a payment made in 10 days and he does not pay until 50 days, what interest rate is he forgoing ? On a purchase of $ 1000, he either pays $ 980 in 10 days or $ 1,000 in 50 days. He thus pays $ 20 for the use of $ 980 for 40 days which is 2.04 % for 40 days, or about 18.6 % annual. This cost may be overstated. Clarkson may be taking part of his discounts and extending other payables beyond 50 days out; such a policy would reduce costs shown. Also, if Mr. Clarkson could delay payment on his purchases for more than 50 days without incurring punitive action, the cost is over stated. In a similar vein, Mr. Clarkson may offer his customers a 2 % discount for payment in 10 days, net 30 days. Collection periods on a/c receivables has been 38 to 49 days. This cost comes to 31 % annual ( HW: calculate this #) Assumptions: 1. Mr. Clarkson will reduce his payables period to 10 days and take the 2 % purchase discount, and 2. Mr. Clarkson will pay his suppliers in 48 days, as per his practice in 1994 and 1995. 3. Sales Volume will be $ 5.5 million in 1996. 4. The historical relations between 1993-1995 will continue in 1996. Table TN-E shows a projected income statement for 1996 and Table TN-F shows a projected balance sheet. Observe that Clarkson needs to borrow $ 971, 000 at the end of 1996 and his PEAK loan requirements may be higher due to :

1) he may need to finance a larger volume of current assets during his seasonal peak, which occurs well before the end of the year, and 2) at this time, he will have accumulated only a portion of his total retained earnings for the year. The plan of action proposed by Mr. Clarkson poses MAJOR DIFFICULTIES. Several alternatives are available: 1.Get MORE bank credit 2.Slow Down his projected rate of expansion, or 3.Continue to rely heavily on trade credit and pay off bills slowly. In the third case, if Mr. Clarkson waits 50 days to pay off his bills, he will have a/c payable of $ 580,000 outstanding reducing his bank borrowings well below 4 750,000 but will the bank lend now ??? DECISIONS, DECISIONS: See Figure TN-A for a mapping of major alternatives. Mr. Clarkson can expand his operations rapidly but can he increase profits as rapidly ? To do so, he will need more financing unless he relies on high cost trade credit. Continued expansion at a rate that cannot be financed proportionately from retained earnings can leave hin in a vulnerable high risk position. Clarkson NEEDS bank financing in larger amounts for longer terms than he realizes. Float equity? It is NOT clear that slowing down the rate of expansion will lower profits. Increasing scale has not improved operating margins or the return on invested capital during 1993-95 ( See Table TN-G). Clarkson can earn high returns on the same volume of operations simply by taking more of his purchase discounts. With less aggression, he may be able to charge higher prices or avoid giving quantity discounts on sales, thus increasing profits. Such a policy may leave him in a more flexible

financial positionand probably subject him to less overall risk. 4. What does the BANKER do? Does the bank wish to make a long-term loan to Mr. Clarkson? Until the expansion rate is curbed, there is little hope of the bank loan being repaid, and a greater prob. of a future request to increase the loan amount. Is Mr. Clarkson a very valuable Long-term customer ?? if so, the bank will lend but with severe restrictions. Now, the bank is betting heavily on Mr. Clarkson as a manager and as a person, and it will look to long-term profits to repay the loan. In case earnings collapse, a lien on accounts receivables and inventories will be imposed. What is the prob. that Mr. Clarkson will comply with the loan?? Undoubtedly, a sizable increase in a projected bank loan will be accompanied by a number of restrictive covenants.

You might also like

- Clarkson Lumber WAC AnalysisDocument6 pagesClarkson Lumber WAC Analysismehreen samiNo ratings yet

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- ClarksonDocument2 pagesClarksonYang Pu100% (3)

- Group 3 - Clarkson Write UpDocument7 pagesGroup 3 - Clarkson Write UpCarlos Eduardo Ventura GonçalvesNo ratings yet

- Clarkson Lumber Case 1 Write UpDocument9 pagesClarkson Lumber Case 1 Write UpStefan Radisavljevic100% (1)

- WilliamsDocument20 pagesWilliamsUmesh GuptaNo ratings yet

- Clarkson LumberDocument3 pagesClarkson Lumbermds89No ratings yet

- Clarkson Lumber Case Study - SolDocument5 pagesClarkson Lumber Case Study - SolWaqar Azeem73% (11)

- Wilson Lumber financing options and loan decisionDocument3 pagesWilson Lumber financing options and loan decisionShubham KumarNo ratings yet

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- Clarkson TemplateDocument7 pagesClarkson TemplateJeffery KaoNo ratings yet

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- Clarkson LumberDocument6 pagesClarkson Lumbercypherious67% (3)

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Lecture 6 Clarkson LumberDocument8 pagesLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Clarkson Lumber Co (Calculations) For StudentsDocument18 pagesClarkson Lumber Co (Calculations) For StudentsShahid Iqbal100% (5)

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Clarkson Lumber SolutionDocument8 pagesClarkson Lumber Solutionpawangadiya1210No ratings yet

- A Tale of Two Hedge FundsDocument17 pagesA Tale of Two Hedge FundsS Sarkar100% (1)

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Clarkson Lumber Financial AnalysisDocument7 pagesClarkson Lumber Financial AnalysisSharon RasheedNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Wilson Lumber Company1Document5 pagesWilson Lumber Company1fica037No ratings yet

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNo ratings yet

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayNo ratings yet

- Clarkson Lumber CompanyDocument6 pagesClarkson Lumber Companymalishka1025No ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Clarkson Lumber CaseDocument27 pagesClarkson Lumber CaseGovardan SureshNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoNo ratings yet

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- Cases RJR Nabisco 90 & 91 - Assignment QuestionsDocument1 pageCases RJR Nabisco 90 & 91 - Assignment QuestionsBrunoPereiraNo ratings yet

- Case 11 Group 1 PDFDocument56 pagesCase 11 Group 1 PDFRumana ShornaNo ratings yet

- Stone Container CorporationDocument5 pagesStone Container Corporationalice123h21No ratings yet

- Massey Questions 1-4Document4 pagesMassey Questions 1-4Samir IsmailNo ratings yet

- Case 16 Group 56 FinalDocument54 pagesCase 16 Group 56 FinalSayeedMdAzaharulIslamNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- Burton SensorsDocument7 pagesBurton SensorsMOHIT SINGHNo ratings yet

- Wilson Lumber - Group 8Document10 pagesWilson Lumber - Group 8Alexandra Ermakova100% (1)

- Williams CEO evaluates $900M financing offer and long-term strategyDocument1 pageWilliams CEO evaluates $900M financing offer and long-term strategyYun Clare Yang0% (1)

- Case 35 Deluxe CorporationDocument6 pagesCase 35 Deluxe CorporationCarmelita EsclandaNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Deluxe Corporation's Debt Policy AssessmentDocument7 pagesDeluxe Corporation's Debt Policy Assessmentankur.mastNo ratings yet

- Exhibit 1Document2 pagesExhibit 1Natasha PerryNo ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- Winfield Refuse. - Case QuestionsDocument1 pageWinfield Refuse. - Case QuestionsthoroftedalNo ratings yet

- CORPORATE FINANCIAL MANAGEMENT AT LOEWEN GROUPDocument13 pagesCORPORATE FINANCIAL MANAGEMENT AT LOEWEN GROUPAmit SurveNo ratings yet

- Sealed Air Corporation's Leveraged Recapitalization (A)Document10 pagesSealed Air Corporation's Leveraged Recapitalization (A)Ramji100% (1)

- Updated Stone Container PaperDocument6 pagesUpdated Stone Container Paperonetime699100% (1)

- Sure CutDocument1 pageSure Cutchch917No ratings yet

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Last Case FinallyyyDocument2 pagesLast Case FinallyyyRiezel PepitoNo ratings yet

- Clarkson Lumber CaseDocument1 pageClarkson Lumber Casesanzpa5No ratings yet

- Mark XDocument10 pagesMark XJennifer Ayers0% (2)

- Wilson Lumber Case Group 5Document10 pagesWilson Lumber Case Group 5Falah HindNo ratings yet

- SFM Group8 Stone Containers (A)Document4 pagesSFM Group8 Stone Containers (A)Gautam PatilNo ratings yet

- Mr. Butler's Loan Requirements for Lumber Company ExpansionDocument6 pagesMr. Butler's Loan Requirements for Lumber Company ExpansionamanNo ratings yet

- Massey Ferguson CaseDocument6 pagesMassey Ferguson CaseMeraSultan100% (1)

- Working Capital ManagementDocument1 pageWorking Capital ManagementchristiansmilawNo ratings yet

- RondellDocument14 pagesRondellsharonulyssesNo ratings yet

- Caterpillar Case AnalysisDocument2 pagesCaterpillar Case AnalysissharonulyssesNo ratings yet

- Managing Financial RiskDocument36 pagesManaging Financial RisksharonulyssesNo ratings yet

- FFC Ratio Analysis and Financial PerformanceDocument6 pagesFFC Ratio Analysis and Financial PerformancesharonulyssesNo ratings yet

- Ad-Lider Case AnalysisDocument10 pagesAd-Lider Case AnalysissharonulyssesNo ratings yet

- Pillsbury Cookie Case StudyDocument7 pagesPillsbury Cookie Case Studysharonulysses80% (5)

- College of Accountancy and Business Administration: Partnership Operation Changes in CapitalDocument6 pagesCollege of Accountancy and Business Administration: Partnership Operation Changes in CapitalVenti AlexisNo ratings yet

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700Document30 pagesEpicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700nerz8830No ratings yet

- 1600 FinalDocument4 pages1600 FinalReese QuinesNo ratings yet

- Interest LessonDocument12 pagesInterest LessonKatz EscañoNo ratings yet

- Philippine Laws on Credit TransactionsDocument5 pagesPhilippine Laws on Credit TransactionsCamille ArominNo ratings yet

- Notes and Solutions of The Math of Financial Derivatives Wilmott PDFDocument224 pagesNotes and Solutions of The Math of Financial Derivatives Wilmott PDFKiers100% (1)

- 03 DevMath 04 TXT - Ebook Earning and Saving MoneyDocument22 pages03 DevMath 04 TXT - Ebook Earning and Saving Money2qncki2bwbckaNo ratings yet

- Important InfoDocument6 pagesImportant InfoPraveen BabuNo ratings yet

- Co Act On Loans Accepted & GivenDocument43 pagesCo Act On Loans Accepted & GivendkdineshNo ratings yet

- MONEY AND CREDIT Imp QuestionsDocument13 pagesMONEY AND CREDIT Imp QuestionsKartik MishraNo ratings yet

- Notification No. 15/2021-Central Tax (Rate)Document2 pagesNotification No. 15/2021-Central Tax (Rate)santanu sanyalNo ratings yet

- Mergers, Acquisitions and RestructuringDocument34 pagesMergers, Acquisitions and RestructuringMunna JiNo ratings yet

- IIBPS PO DI English - pdf-38 PDFDocument11 pagesIIBPS PO DI English - pdf-38 PDFRahul GaurNo ratings yet

- Working Capital Management AbstractDocument14 pagesWorking Capital Management AbstractPriyanka GuptaNo ratings yet

- Cs White Paper Family Office Dynamic Pathway To Successful Family and Wealth Management Part 2 - enDocument36 pagesCs White Paper Family Office Dynamic Pathway To Successful Family and Wealth Management Part 2 - enKrishna PrasadNo ratings yet

- Bloomberg Energy Cheat SheetDocument2 pagesBloomberg Energy Cheat Sheetanup782No ratings yet

- ResultsDocument16 pagesResultsURVASHINo ratings yet

- FeeReceipt 102021006401 20210915Document1 pageFeeReceipt 102021006401 20210915Harshit SinghNo ratings yet

- Summary-AHM 510 PDFDocument70 pagesSummary-AHM 510 PDFSiddhartha KalasikamNo ratings yet

- Elliott WaveDocument7 pagesElliott WavePetchiramNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- A Brief History of BankingDocument42 pagesA Brief History of Bankingtasaduq70% (1)

- Asset Liability Management in BanksDocument8 pagesAsset Liability Management in Bankskpved92No ratings yet

- Departamento de Matemáticas: Mathematics - 3º E.S.ODocument2 pagesDepartamento de Matemáticas: Mathematics - 3º E.S.OketraNo ratings yet

- DematclosureDocument1 pageDematclosureVishal YadavNo ratings yet

- Management Accounting Overhead VariancesDocument12 pagesManagement Accounting Overhead VariancesNors PataytayNo ratings yet

- Axis Bank - FINANCIAL OVERVIEW OF AXIS BANK & COMPARATIVE STUDY OF CURRENT ACCOUNT AND SAVING ACCDocument93 pagesAxis Bank - FINANCIAL OVERVIEW OF AXIS BANK & COMPARATIVE STUDY OF CURRENT ACCOUNT AND SAVING ACCAmol Sinha56% (9)

- Rep 0108122609Document104 pagesRep 0108122609Dr Luis e Valdez ricoNo ratings yet