Professional Documents

Culture Documents

Ijrcm 3 Evol 1 Issue 2 Art 6

Uploaded by

sindhukotaruCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ijrcm 3 Evol 1 Issue 2 Art 6

Uploaded by

sindhukotaruCopyright:

Available Formats

VOLUME NO. 1 (2011), ISSUE N O.

2 (J UNE )

ISSN 2231-4245

IIN NT TE ER RN NA AT TIIO ON NA AL L JJO OU UR RN NA AL LO OF FR RE ES SE EA AR RC CH H IIN NC CO OM MM ME ER RC CE E,, E EC CO ON NO OM MIIC CS SA AN ND DM MA AN NA AG GE EM ME EN NT T CONTENTS

Sr. No.

TITLE & NAME OF THE AUTHOR (S)

INTERNATIONAL FINANCIAL REPORTING STANDARD ADOPTION, IMPLICATION ON MANAGEMENT ACCOUNTING AND TAXATION IN NIGERIAN ECONOMY FOLAJIMI FESTUS ADEGBIE MODERN PORTFIOLIO THEORY (MPT) AND FINANCIAL ECONOMICS: A THEORY OF LESSER TURF? DR. ANDREY I. ARTEMENKOV THE IMPACT OF STOCK MARKET OPERATIONS ON THE NIGERIA ECONOMY:A TIME SERIES ANALYSIS (1 !1"2##!) DR. OFURUM CLIFFORD OBIYO & TORBIRA, LEZAASI LENEE PERFORMANCE APPRAISAL SYSTEM ON COMPANY PAY ROLL EMPLOY, SENIOR, MIDDLE % LO&ER MANAGEMENT (A STUDY &ITH REFERENCE TO INTERNATIONAL TO'ACO COMPANY LTD(, GHA)IA'AD) DR. RAGHVENDRA DWIVEDI & KUSH KUMAR CREDIT POLICY AND ITS EFFECT ON LI+UIDITY: A STUDY OF SELECTED MANUFACTURING COMPANIES IN NIGERIA STEPHEN A. OJEKA CREDIT RISK MANAGEMENT IN STATE 'ANK OF INDIA " A STUDY ON PERCEPTION OF S'I MANAGER,S IN -ISAKHAPATNAM )ONE DR. P. VENI & P. SREE DEVI THE ARCHAEOLOGY OF RECESSION: DILEMMA 'ET&EEN CI-ILI)ATION AND CULTURE / T&O DIFFERENT APPROACHES OF &EST AND EAST &HILE COM'ATING GREAT DEPRESSION DR. V. L. DHARURKAR & DR. MEENA CHANDAVARKAR TRANSFORMING A RETAIL CENTRE INTO A 'RAND THROUGH PROFESSIONAL MALL MANAGEMENT DR. N. H. MULLICK & DR. M. ALTAF KHAN IMPACT OF EXCHANGE RATE -OLATILITY ON RE-ENUES: A CASE STUDY OF SELECTED IT COMPANIES FROM 2##* "2## K. B. NALINA & DR. B. SHIVARAJ DETERMINING &ORKING CAPITAL SOL-ENCY LE-EL AND ITS EFFECT ON PROFITA'ILITY IN SELECTED INDIAN MANUFACTURING FIRMS KARAMJEET SINGH & FIREW CHEKOL ASRESS FUTURE NUTRITION % FOOD OF INDIA / THE A+UA"CULTURE: AN EN-IRONMENTAL MANAGEMENT % CULINARY PARADIGM PERSPECTI-E STUDY FOR A SUSTAINA'LE NATIONAL STRATEGY DR. S. P. RATH, PROF. BISWAJIT DAS, PROF. SATISH JAYARAM & CHEF SUPRANA SAHA A STUDY OF NON"FUND 'ASED ACTI-ITES OF MPFC " &ITH SPECIAL REFRENCE TO CAUSES OF FAILURE AND PRO'LEMS DR. UTTAM JAGTAP & MANOHAR KAPSE CRM IN 'ANKING: PERSPECTI-ES AND INSIGHTS FROM INDIAN RURAL CUSTOMERS ARUN KUMAR, DEEPALI SINGH & P. ACHARYA DETERMINANTS OF INCOME GENERATION OF &OMEN ENTREPRENEURS THROUGH SHGS REVATHI PANDIAN AGRICULTURAL CREDIT: IMPACT ASSESSMENT DR. RAMESH. O. OLEKAR MICRO FINANCE AND SELF" HELP GROUPS / AN EXPLORATORY STUDY OF SHI-AMOGA DISTRICT MAHESHA. V & DR. S. B. AKASH INFORMAL SMALL SCALE 'RICK"KILN ENTERPRISES IN GUL'ARGA UR'AN AREA / AN ECONOMIC ANALYSIS SHARANAPPA SAIDAPUR EXTENT OF UNEMPLOYMENT AMONG THE TRI'AL AND NON"TRI'AL HOUSEHOLDS IN THE RURAL AREAS OF HIMACHAL PRADESH: A MULTI"DIMENSIONAL APPROACH DR. SARBJEET SINGH &OMEN SELF HELP GROUPS IN THE UPLIFTMENT OF TSUNAMI -ICTIMS IN KANYAKUMARI DISTRICT DR. C. SIVA MURUGAN & S. SHAKESPEARE ISREAL FOREIGN 'ANKS IN INDIA / EMERGING LEADER IN 'ANKING SECTOR DR. C. PARAMASIVAN AN EMPIRICAL E-ALUATION OF FINANCIAL HEALTH OF FERTILI)ER INDUSTRY IN INDIA SARBAPRIYA RAY A STUDY ON EMPLOYEE A'SENTEEISM IN INDIAN INDUSTRY: AN O-ER-IE& R. SURESH BABU & DR. D. VENKATRAMARAJU LONG MEMORY MODELLING OF RUPEE"DOLLAR EXCHANGE RATE RETURNS: A RO'UST ANALYSIS PUNEET KUMAR THE US ECONOMY IN THE POST CRISIS SCENARIO / HOLDING LITTLE CAUSE FOR CHEER C. BARATHI & S. PRAVEEN KUMAR IMPLEMENTATION OF * S IN 'ANKS YADUVEER YADAV, GAURAV YADAV & SWATI CHAUHAN RE+UEST FOR FEED'ACK

Page No.

1% 2% 3% $% *% 6% .% !% % 1#% 11% 12% 13% 1$% 1*% 16% 1.% 1!% 1 % 2#% 21% 22% 23% 2$% 2*%

1 6 13 1! 2* 31 3! $2 $. *2 *. 6* 6 .! !1 !. 1 ! 1#6 11# 11$ 11 12$ 131 13* 1$

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

Indexed & Listed at: Ulrich's Periodicals Directory , ProQuest, U.S.A., The American Economic Associations electronic bibliography, EconLit, U.S.A. as well as in Cabells Directories of Publishing Opportunities, U.S.A.

Circulated all over the world & Google has verified that scholars of more than sixty-six countries/territories are visiting our journal on regular basis. round !loor" Buildin# $o% &'(&-)-&" Devi Bhawan Ba*ar" JA AD+RI , &-. ''-" /a0unana#ar" +aryana" I$DIA

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

CHIEF PATRON

PROF( K( K( AGGAR&AL

)hancellor" 2in#aya3s 4niversity" Delhi !ounder 5ice-)hancellor" uru obind Sin#h Indraprastha 4niversity" Delhi 67% Pro 5ice-)hancellor" uru Ja0bheshwar 4niversity" +isar

PATRON

SH( RAM 'HAJAN AGGAR&AL

67% State Minister for +o0e 8 9ouris0" overn0ent of +aryana 5ice-President" Dadri 6ducation Society" )har:hi Dadri President" )hinar Synte7 2td% ;9e7tile Mills<" Bhiwani

COCO-ORDINATOR

DR( 'HA-ET

!aculty" M% M% Institute of Mana#e0ent" Maharishi Mar:andeshwar 4niversity" Mullana" A0bala" +aryana

ADVISORS

PROF( M( S( SENAM RAJU

Director A% )% D%" School of Mana#e0ent Studies" I% %$%O%4%" $ew Delhi

PROF( M( N( SHARMA

)hair0an" M%B%A%" +aryana )olle#e of 9echnolo#y 8 Mana#e0ent" =aithal

PROF( S( L( MAHANDRU

Principal ;Retd%<" Mahara1a A#rasen )olle#e" Ja#adhri

EDITOR

PROF( R( K( SHARMA

Dean ;Acade0ics<" 9ecnia Institute of Advanced Studies" Delhi

COCO-EDITOR

DR( SAM'HA- GARG

!aculty" M% M% Institute of Mana#e0ent" Maharishi Mar:andeshwar 4niversity" Mullana" A0bala" +aryana

EDITORIAL ADVISORY BOARD

DR( AM'IKA )UTSHI

!aculty" School of Mana#e0ent 8 Mar:etin#" Dea:in 4niversity" Australia

DR( -I-EK NATRAJAN

!aculty" 2o0ar 4niversity" 4%S%A%

DR( RAJESH MODI

!aculty" /anbu Industrial )olle#e" =in#do0 of Saudi Arabia

PROF( SIKANDER KUMAR

)hair0an" Depart0ent of 6cono0ics" +i0achal Pradesh 4niversity" Shi0la" +i0achal Pradesh

PROF( SANJI- MITTAL

4niversity School of Mana#e0ent Studies" uru obind Sin#h I% P% 4niversity" Delhi

PROF( RAJENDER GUPTA

)onvener" Board of Studies in 6cono0ics" 4niversity of Ja00u" Ja00u

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

ii

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

PROF( NA&A' ALI KHAN

Depart0ent of )o00erce" Ali#arh Musli0 4niversity" Ali#arh" 4%P%

PROF( S( P( TI&ARI

Depart0ent of 6cono0ics 8 Rural Develop0ent" Dr% Ra0 Manohar 2ohia Avadh 4niversity" !ai*abad

DR( ASHOK KUMAR CHAUHAN

Reader" Depart0ent of 6cono0ics" =uru:shetra 4niversity" =uru:shetra

DR( SAM'HA-NA

!aculty" I%I%9%M%" Delhi

DR( MOHENDER KUMAR GUPTA

Associate Professor" P% J% 2% $% overn0ent )olle#e" !aridabad

DR( -I-EK CHA&LA

Associate Professor" =uru:shetra 4niversity" =uru:shetra

DR( SHI-AKUMAR DEENE

Asst% Professor" overn0ent !% % )olle#e )hit#uppa" Bidar" =arnata:a

ASSOCIATE EDITORS

PROF( A'HAY 'ANSAL

+ead" Depart0ent of Infor0ation 9echnolo#y" A0ity School of 6n#ineerin# 8 9echnolo#y" A0ity 4niversity" $oida

PAR-EEN KHURANA

Associate Professor" Mu:and 2al $ational )olle#e" /a0una $a#ar

SHASHI KHURANA

Associate Professor" S% M% S% =halsa 2ubana irls )olle#e" Barara" A0bala

SUNIL KUMAR KAR&ASRA

5ice-Principal" Defence )olle#e of 6ducation" 9ohana" !atehabad

DR( -IKAS CHOUDHARY

Asst% Professor" $%I%9% ;4niversity<" =uru:shetra

TECHNICAL ADVISORS

AMITA

!aculty" 6%)%)%" Safidon" Jind

MOHITA

!aculty" /a0una Institute of 6n#ineerin# 8 9echnolo#y" 5illa#e adholi" P% O% adhola" /a0unana#ar

FINANCIAL ADVISORS

DICKIN GOYAL

Advocate 8 9a7 Adviser" Panch:ula

NEENA

Invest0ent )onsultant" )ha0ba#hat" Solan" +i0achal Pradesh

LEGAL ADVISORS

JITENDER S( CHAHAL

Advocate" Pun1ab 8 +aryana +i#h )ourt" )handi#arh 4%9%

CHANDER 'HUSHAN SHARMA

Advocate 8 )onsultant" District )ourts" /a0unana#ar at Ja#adhri

SUPERINTENDENT

SURENDER KUMAR POONIA

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

iii

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

CALL FOR MANUSCRIPTS

>e invite unpublished novel" ori#inal" e0pirical and hi#h ?uality research wor: pertainin# to recent develop0ents 8 practices in the area of )o0puter" Business" !inance" Mar:etin#" +u0an Resource Mana#e0ent" eneral Mana#e0ent" Ban:in#" Insurance" )orporate overnance and e0er#in# paradi#0s in allied sub1ects% 9he above 0entioned trac:s are only indicative" and not e7haustive% Anybody can sub0it the soft copy of his@her 0anuscript 0123456 in M%S% >ord for0at after preparin# the sa0e as per our sub0ission #uidelines duly available on our website under the headin# #uidelines for sub0ission" at the e0ail addresses" 417894:;<5(8;=(41 or 41784:;<59=504>(<85%

GUIDELINES FOR SUBMISSION OF MANUSCRIPT

1( CO-ERING LETTER FOR SU'MISSION: D036?: @@@@@@@@@@@@@@@@@@@@@@@@ TA6 E?438; IJR)M Sub1ectA SBC54DD481 87 M01BD<;4E3 41 3A6 A;60 87 (6(=( C85EB36;FF4101<6FM0;G6341=FHRMFG616;0> M010=65613F83A6;, E>60D6 DE6<472)% D60; S4;FM0?05" Please find 0y sub0ission of 0anuscript titled BCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC3 for possible publication in your 1ournal% I hereby affir0 that the contents of this 0anuscript are ori#inal% !urther0ore it has neither been published elsewhere in any lan#ua#e fully or partly" nor is it under review for publication anywhere% I affir0 that all author ;s< have seen and a#reed to the sub0itted version of the 0anuscript and their inclusion of na0e ;s< as co-author ;s<% Also" if our@0y 0anuscript is accepted" I@>e a#ree to co0ply with the for0alities as #iven on the website of 1ournal 8 you are free to publish our contribution to any of your 1ournals% N056 87 C8;;6DE81?41= AB3A8;A Desi#nationA AffiliationA Mailin# addressA Mobile 8 2andline $u0ber ;s<A 6-0ail Address ;s<A D% INTRODUCTION: Manuscript 0ust be in British 6n#lish prepared on a standard A( si*e paper settin#% It 0ust be prepared on a sin#le space and sin#le colu0n with &E 0ar#in set for top" botto0" left and ri#ht% It should be typed in &D point )alibri !ont with pa#e nu0bers at the botto0 and centre of the every pa#e% MANUSCRIPT TITLE: 9he title of the paper should be in a &D point )alibri !ont% It should be bold typed" centered and fully capitalised% AUTHOR NAME(S) % AFFILIATIONS: 9he author ;s< full na0e" desi#nation" affiliation ;s<" address" 0obile@landline nu0bers" and e0ail@alternate e0ail address should be in &D-point )alibri !ont% It 0ust be centered underneath the title% A'STRACT: Abstract should be in fully italici*ed te7t" not e7ceedin# D.' words% 9he abstract 0ust be infor0ative and e7plain bac:#round" ai0s" 0ethods" results and conclusion% (

-% (% .%

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

iv

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

F% G% H% I% &'% &&% &D%

ISSN 2231-4245

KEY&ORDS: Abstract 0ust be followed by list of :eywords" sub1ect to the 0a7i0u0 of five% 9hese should be arran#ed in alphabetic order separated by co00as and full stops at the end% HEADINGS: All the headin#s should be in a &' point )alibri !ont% 9hese 0ust be bold-faced" ali#ned left and fully capitalised% 2eave a blan: line before each headin#% SU'"HEADINGS: All the sub-headin#s should be in a H point )alibri !ont% 9hese 0ust be bold-faced" ali#ned left and fully capitalised% MAIN TEXT: 9he 0ain te7t should be in a H point )alibri !ont" sin#le spaced and 1ustified% FIGURES %TA'LES: 9hese should be si0ple" centered" separately nu0bered 8 self e7plained" and titles 0ust be above the tables@fi#ures% Sources of data should be 0entioned below the table@fi#ure% It should be ensured that the tables@fi#ures are referred to fro0 the 0ain te7t% E+UATIONS: 9hese should be consecutively nu0bered in parentheses" hori*ontally centered with e?uation nu0ber placed at the ri#ht% REFERENCES: 9he list of all references should be alphabetically arran#ed% It 0ust be sin#le spaced" and at the end of the 0anuscript% 9he author ;s< should 0ention only the actually utilised references in the preparation of 0anuscript and they are supposed to follow H0;H0;? S32>6 87 R676;61<41=% 9he author ;s< are supposed to follow the references as per followin#A All wor:s cited in the te7t ;includin# sources for tables and fi#ures< should be listed alphabetically% 4se ;6?(< for one editor" and ;6?(D) for 0ultiple editors% >hen listin# two or 0ore wor:s by one author" use --- ;D'77<" such as after =ohl ;&IIG<" use --- ;D''&<" etc" in chronolo#ically ascendin# order% Indicate ;openin# and closin#< pa#e nu0bers for articles in 1ournals and for chapters in boo:s% 9he title of boo:s and 1ournals should be in italics% Double ?uotation 0ar:s are used for titles of 1ournal articles" boo: chapters" dissertations" reports" wor:in# papers" unpublished 0aterial" etc% !or titles in a lan#ua#e other than 6n#lish" provide an 6n#lish translation in parentheses% 4se endnotes rather than footnotes% 9he location of endnotes within the te7t should be indicated by superscript nu0bers% PLEASE USE THE FOLLO&ING FOR STYLE AND PUNCTUATION IN REFERENCES:

'88GD

Bowerso7" Donald J%" )loss" David J%" ;&IIF<" J2o#istical Mana#e0ent%J 9ata Mc raw" +ill" $ew Delhi% +un:er" +%2% and A%J% >ri#ht ;&IF-<" J!actors of Industrial 2ocation in Ohio"J Ohio State 4niversity%

C813;4CB3481D 38 C88GD Shar0a 9%" =watra" % ;D''H< 6ffectiveness of Social Advertisin#A A Study of Selected )a0pai#ns" )orporate Social Responsibility" 6dited by David )rowther 8 $icholas )apaldi" Ash#ate Research )o0panion to )orporate Social Responsibility" )hapter &." pp DHG--'-%

J8B;10> 01? 83A6; 0;34<>6D

Sche0enner" R%>%" +uber" J%)% and )oo:" R%2% ;&IHG<" J eo#raphic Differences and the 2ocation of $ew Manufacturin# !acilities"J Journal of 4rban 6cono0ics" 5ol% D&" $o% &" pp% H--&'(%

C8176;61<6 E0E6;D

)handel =%S% ;D''I<A J6thics in )o00erce 6ducation%J Paper presented at the Annual International )onference for the All India Mana#e0ent Association" $ew Delhi" India" &I,DD June%

U1EBC>4DA6? ?4DD6;303481D 01? 3A6D6D

&6CD436

=u0ar S% ;D''F<A J)usto0er 5alueA A )o0parative Study of Rural and 4rban )usto0ers"J 9hesis" =uru:shetra 4niversity" =uru:shetra%

O1>416 ;6D8B;<6D Always indicate the date that the source was accessed" as online resources are fre?uently updated or re0oved%

=el:ar 5% ;D''I<A 9owards a $ew httpA@@epw%in@epw@user@viewabstract%1sp

$atural

as

Policy"

6cono0ic

and

Political

>ee:ly"

5iewed

on

!ebruary

&G"

D'&&

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

CREDIT RISK MANAGEMENT IN STATE 'ANK OF INDIA " A STUDY ON PERCEPTION OF S'I MANAGER,S IN -ISAKHAPATNAM )ONE DR( P( -ENI PROFESSOR DEPARTMENT OF COMMERCE AND MANAGEMENT ANDHRA UNI-ERSITY -ISAKHAPATNAM / *3# ##3 P( SREE DE-I LECTURER IN MANAGEMENT DRA-IDIAN UNI-ERSITY KUPPAM, CHITTOOR" *1. $2* A'STRACT

Cred ! r "# $%&%'e$e&! " &(! %& )(**+!,e+",e-* .r(d/0!. I! " % )1,(-e+! $e2 %&d )(r'%& 3%! (&+1 de2 */&0! (&. C($$(&+"e&"e d 0!%!e" !,%! .e(.-e re".(&" 4-e *(r !%r'e!" /&der 4/" &e""+'r(1!, %re -- "/ !ed !( %ddre"" )r "#2 &,ere&! !( 0red ! %&d !" $%&%'e$e&!. Cred ! r "# $%&%'e$e&! ",(/-d !,ere*(re 4e "e.%r%!ed *(r$ %&d "/** 0 e&!-5 4e &de.e&de&! (* !,e 4/" &e"" - &e". R "# M%&%'e$e&! 0%& 4e de* &ed %" "5"!e$%! 0 de&! * 0%! (& %&d %&%-5" " (* !,e 6%r (/" -("" e7.("/re" *%0ed 45 % * r$8 &d 6 d/%- %&d !,e 4e"! $e!,(d" (* !re%! &' !,e de&! * ed -("" e7.("/re" 0(&" "!e&! 1 !, !,e * r$"28 &d 6 d/%-"2 (49e0! 6e". T,e 0,( 0e (* %..r(.r %!e "!r%!e' e" *(r 0(&!r(- (* 0red ! r "# 45 &d 6 d/%- 4%&#" de.e&d" (& !,e r .r (r ! e" %&d r "#+%..e! !e". I! e&0($.%""e" de" '& &' .(- 0 e" *(r e6er5 $%9(r %".e0! (* 0red ! %d$ & "!r%! (& !( e&"/re !,%! 0red ! de.-(5$e&! %&d !,e %00($.%&5 &' r "#+$%&%'e$e&! .r(0e""e" %re 0(&!r(--ed 1 !, & !,e #&(1& r "#8re!/r& .%r%$e!er". He&0e !,e .re"e&! "!/d5 *(0/"ed (& !,e 0red ! %..r(6%- .r(0e"" & SBI, $%&%'er2" %1%re&e"" !(1%rd" 0red ! r "# $%&%'e$e&! %&d r "# 0(&!r(- "!r%!e' e". T,e $%9(r re"e%r0, * &d &'" %re 4%"ed (& !,e .r $%r5 d%!%. T,e d%!e ,%" 4ee& 0(--e0!ed 45 /" &' e-%4(r%!e :/e"! (&&% re" *(r 4%&# $%&%'er" 1(r# &' & S!%!e B%&# (* I&d % (* V "%#,%.%!&%$ 3(&e. T,e re"e%r0,er de&! * e" 0red ! " !,e re%- %0! 6 !5 !,%! ",(/-d 4e $%&%'ed !( 'e&er%!e .r(* !%4 - !5 45 #ee. &' !,e !,ree 0%rd &%- .r &0 .-e" (* 4%&# &' & $ &d ;L :/ d !5, S(-6e&05 %&d Pr(* !%4 - !5<. W !, !,e !, && &' (* ".re%d" & !,e dere'/-%!ed %&d - 4er%- 3ed e0(&($5, r "# $%&%'e$e&! ,%" 4e0($e %-- !,e $(re 0r/0 %-. S( .r(.er $e0,%& "$ ",(/-d 4e ./! & .-%0e *(r %&! 0 .%! (& %&d de&! * 0%! (& (* r "#", !('e!,er 1 !, % "/ !%4-e $e0,%& "$ !( de%- 1 !, "/0, r "#" & %& e** 0 e&! %&d .r(+%0! 6e $%&&er. M%9(r !5 (* !,e re".(&de&!" "!r(&'-5 *e-! !,%! !,e "5"!e$ *(--(1ed & !,e 4%&#" &eed % re6 e1 & !er$ (* " $.- *5 &' 6%r (/" *(r$" /"ed %&d .r(0ed/re" *(--(1ed *(r "%&0! (& &' -(%&. I! " "/''e"!ed !,%! !,e 4%&# ",(/-d e"!%4- ", (6er%-0red ! - $ !" %! !,e -e6e- (* &d 6 d/%- 4(rr(1er"80(/&!er.%r! e", %&d 'r(/." (* 0(&&e0!ed 4(rr(1er"80(/&!er.%r! e" & (&e &d/"!r5.

KEY&ORDS

)redit" SBI" 5isa:hapatna0" Ris:" !inance%

INTROUDUCTION

n &IHH" the Basel )apital Accord has beco0e the #lobal standard by which the financial soundness of ban:s is assessed%& 9he Basel 0ethodolo#y re?uires ban:s to 0aintain a 0ini0u0 ratio of capital to total ris:-ad1usted assets , that is" the total for all of a ban:3s assets" after the a0ount of each asset has been 0ultiplied by the relevant ris: wei#htin# of H per cent% 9he Basel )o00ittee3s new capital fra0ewor: proposals will have i0portant i0plications for developed and developin# countries ali:e% 9he Basel )o00ittee developed a si0ple ris: 0easure0ent fra0ewor: that assi#ned all ban: assets to one of four ris:-wei#htin# cate#ories" ran#in# fro0 *ero to &'' per cent" dependin# on the credit ris: of the borrower% 9hus" the Basel )o00ittee is already wor:in# on the scope of application of the Accord" capital and capital ade?uacy" ris: e7posure and assess0ent% 9he Ris: Mana#e0ent has co0e at the central sta#e in the $ew Basel )apital Accord%

CREDIT RISK MANAGEMENT IN 'ANKS

9he post-liberali*ation years have seen si#nificant pressure on ban:s in India with a few ban:s repeatedly showin# si#ns of distress% One of the pri0ary reasons for this has been the lac: of effective )redit Ris: Mana#e0ent syste0s and practices in Indian ban:s% >ith an increasin#ly co0petitive and volatile ban:in# environ0ent here to stay" a co0prehensive and inte#rated ris: 0ana#e0ent syste0 will soon beco0e synony0ous with survival for ban:s% In #eneric ter0s" Ris: Mana#e0ent can be defined as syste0atic identification and analysis of the various loss e7posures faced by a fir0@individual and the best 0ethods of treatin# the identified loss e7posures consistent with the fir0s3@individuals3 ob1ectives% 67tendin# the sa0e analo#y" SBI defined Kthe credit ris: 0ana#e0ent as a process that puts in place syste0s and procedures enablin#%E Identify and 0easure the ris: involved in a credit perception" both at the individual transaction and portfolio level% 6valuate the i0pact of e7posure on Ban:3s Balance Sheet@Profit% Assess the capability of ris:-0iti#ators to hed#e@insure ris:s" and Desi#n an appropriate ris: 0ana#e0ent strate#y to arrest Bris: 0i#ration3 leadin# to deterioration in the credit-?uality@default ris:% 9he choice of appropriate strate#ies for control of credit ris: by individual ban:s depends on their priorities and ris:-appetites% It enco0passes desi#nin# policies for every 0a1or aspect of credit ad0inistration to ensure that credit deploy0ent and the acco0panyin# ris:-0ana#e0ent processes are controlled within the :nown ris:@return para0eters% )redit ris: 0ana#e0ent is not an Boff-the-shelf product% It is a Bwhole-ti0e3 and Bor#ani*ation-wide3 function% )o00on-sense dictates that people responsible for tar#ets under business-#rowth are ill suited to address Bris:3 inherent to credit and its 0ana#e0ent% )redit ris: 0ana#e0ent should therefore be separated for0 and sufficiently be independent of the business lines%D

O'JECTI-ES OF THE STUDY

&% 9o e7a0ine credit approval process in State Ban: of India% D% 9o study the branch 0ana#er3s awareness towards credit ris: 0ana#e0ent syste0 in State Ban: of India% -% 9o study the ris: control strate#ies followed by the 0ana#ers% (% 9o su##est appropriate 0easures to SBI%

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-&

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

METHODOLOGY

9he present study is based on both pri0ary and secondary data% 9he pri0ary data for the study are collected by usin# elaborate ?uestionnaires for ban: 0ana#ers wor:in# in State Ban: of India of 5isa:hapatna0 *one% 9he data on ris: 0ana#e0ent perception and practices relatin# to the credit ris: 0ana#e0ent" ris: control strate#ies and credit approval process were obtained throu#h responses to ?uestionnaires and in personal interviews with senior credit" treasury e7ecutives and ban: 0ana#ers of State Ban: of India% 9he secondary data has been collected throu#h RBI bulletins" SBI 0onthly 0a#a*ines" various research articles etc% 9he study has ta:en into consideration of ban: 0ana#ers in State Ban: of India of 5isa:hapatna0 *one% 9he study covered the various Mandalas in 5isa:hapatna0 *one% 9he sa0ple is drawn fro0 the ban:s which are spread over the *one% 9he total sa0ple of (' respondents was selected the respondent 0ana#ers by usin# convenient rando0 sa0plin# techni?ue%

CREDIT APPRO-AL PROCESS IN S'I

State Ban: of India should :eep in place an approved and docu0ented analytical fra0ewor: that helps credit officers inA Assessin# relative ris:s to a units3 cash flow% Jud#in# whether a unit is able to #enerate sufficient cash flows fro0 internal operations to service the debt% Measurin# the sufficiency of the Bcredit , 0iti#ators3 in arrestin# deterioration in credit , ?uality and approvin# credit% Secondly" such a docu0ent helps SBI in 0aintainin# unifor0ity and consistency of standards in #rantin# credit across the or#ani*ation% 9he approved docu0ent should address issues li:e Identification of borrower% Identification of associates , #roupsL co00on ownershipL fa0ily tiesL stron# connectin# lin:s% +istorical analysis of the unit , balance sheet" profit and loss accountL cash flow and trendsL assess0ent of 0ana#erial co0petence , pro0oter3s bac:#round@trac: record@econo0ic and social status@ability to absorb unanticipated financial costs@technical co0petence@propensity to :eep up the pro0ises@repay the loans@transparency in operations etc% )urrent position of the unit , i0pact of ris: associated with non-financial infor0ation na0ely internal factors , li:e scale of econo0ies" technolo#y adopted" inco0e-elasticities" superior resources" product differentiation" and e7ternal factors , li:e #overn0ent policies" do0estic and international co0petition" technolo#y develop0ent" shift in consu0er behaviour etc%" on the unit3s co0petitive position in the #iven 0ar:et and in turn the reliability of its pro1ected cash flowsL stress bein# on factors that will drive future financial perfor0ance and hence analysis preferably on K#one-concernE linesL valuation of assets in balance sheet at 0ar:et price under distress sale conditions and acceptable short-falls there under% !uture position of the unit , co0petitiveness" products" 0ana#e0ent depth" forecasts and cash flowsL analysis on the lines of K#oin#-concernLE SBI3s ability to fund the loan vis-M-vis its capital ade?uacy% Prescription of bench0ar: financial ratios% 67ceptions under bench0ar: ratios 0ay also be defined% 6sti0atin# credit-re?uire0ents and dispensation 0ode% Securities , third party #uarantees@#uarantee of pro0otersL financial securitiesL in case of ter0 loans-char#e on fi7ed assetsL infrastructure pro1ects , char#e on borrowers ri#hts and future cash flows throu#h appropriate covenantsL collaterals as a certain percenta#e of facility% 5aluation 0ethod of fi7ed securities proposed% Docu0entation , re?uired covenants to cover the proposed securitiesL le#al status of the borrowers% 2endin# under consortiu0 arran#e0ents , independent assess0ent of ris:s@to fall in line with the leader3s assess0ent and reco00endations% Pricin# of loansA credit ratin#@assessin# ris:-return relationshipL profitability of overall relationshipL factorin# all the i0bedded costs into price% Sanctionin# of hi#h value loans-credit-co00ittees@#rid concept to pool all the available wisdo0 in to credit decisions% Sanctionin# of ad hoc@te0porary additional li0its periodL interestL other precautions% Once credit-#rantin# process is defined and put in operation" top-0ana#e0ent should ensure that loan proposals co0in# for sanction are provided with sufficient infor0ation that results in a sound credit decision% It should result in a clear shift fro0 a Kbusiness-is-safe-and-secured syndro0eE to Kris: is identified" 0easured" priced and is acceptable%E 9hus" it is often noticed in or#ani*ations that in absence of clear cut instructions" people often tend to overloo: even i0portant issues under the presu0ption that others are ta:in# care of% 9o obviate it" a well-drafted 0echanis0 of 0onitorin# loan accounts with a clear de0arcation of roles and responsibilities of branches and ad0inistrative offices on the followin# lines%

PERCEPTION ON ROLE OF CREDIT RISK MANAGEMENT

In the le7icon of Ban:ers of the previous decades" inter0ediation occurred when ban:s too: in funds fro0 depositors and then lent the funds to businesses and individuals" holdin# such loans in their boo:s until the loans 0atured" were rolled over or went belly up% )redit ris: was the 0a1or ris: incurred by the ban:s since interest rate ris: could be 0ana#ed by 0a:in# sure the contractual interest rates on the loans vary with the cost of fund% Over the past &. years" however" traditional inter0ediation has chan#ed dra0atically% A variety of products" includin# loan securiti*ation" and the #reater ris: e7posures to which the borrowers are sub1ected" have transfor0ed the levels of credit ris: for the ban:s and increased the need to 0ana#e the ris: in a 0ore sophisticated 0anner% )redit ris: is 0ost si0ply defined as the potential that a ban: borrower or counterparty will fail to 0eet its obli#ations in accordance with the a#reed ter0s% 9he #oal of credit ris: 0ana#e0ent is to 0a7i0i*e a ban:3s ris: ad1usted rate of return by 0aintainin# credit ris: e7posure within acceptable para0eters% Ban:s need to 0ana#e credit ris: in individual loans or transaction as well as credit ris: inherent in the portfolio% 9hey should also consider the relationship between credit ris: and other ris:s% 9he effective 0ana#e0ent of credit ris: is a critical co0ponent of a co0prehensive approach to ris: 0ana#e0ent and essential to the lon#-ter0 success of any ban:in# or#ani*ation% >ith rapid econo0ic chan#es and the openin# up of the Indian econo0y" the ran#e of industries and services as well as the levels of co0petition" the threat of obsolescence of technolo#y@product and the cost structure of the econo0y" is under#oin# e7tensive transfor0ation% Because of this" the financial ris: to individual business" industries and even individuals has increased si#nificantly% Both the nu0bers of start-ups and ban:ruptcies are increasin# rapidly% In this environ0ent" the credit ris: of traditional lenders li:e ban:s has increased #reatly% At the sa0e ti0e the intense co0petition is reducin# the spread between inco0e and cost% 9he level of non-perfor0in# assets of ban:s has increased beyond acceptable levels% 9he introduction of new products li:e securiti*ed assets" in the 0ar:et" has created a new di0ension of credit ris:% 4nder the circu0stances" Indian ban:s need to underta:e% )o0prehensive review of their processes for identification of credit ris:" credit assess0ent and scorin#" credit ad0inistration and capital allocations to 0eet re#ulatory nor0s% In the 0ana#e0ent of credit ris: #enerally a scientific ?uantitative 0odel is not available as a basis or the ratin# syste0 in 0ost ban:s% 9he ratin# syste0s do not truly reflect the credit ris: because they incorporate wei#hta#es for various control and 0onitorin# factors" which do not necessarily convey a credit ris:% 6ven where ris: para0eters are included" so0e of the :ey financial para0eters li:e return on capital e0ployed" turnover" efficiency etc%" which reflect ris:" are o0itted for the ratin# purposes" eventhou#h so0e of these factors are considered while assessin# the credit need% !re?uently" conflictin# outco0es are thrown up in #radin# based on the internal ratin#s of the ban:s and the Inco0e Reco#nition and Asset )lassification nor0s specified by Reserve Ban: of India% 9hus" ta:in# into account all" the factors suitable and appropriate #round rules and para0eters are proposed for a credit ris: ratin# 0odel for Indian ban:s%

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-D

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

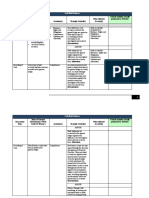

TA'LE(1 THE IMPLEMENTATION OF CREDIT RISK ASSESSMENT IN S'I Y60;D N8( 87 R6DE81?613D P6;<6130=6 &IH' D .%'' &II' & D%.' D''' -G ID%.' /et to be introduced ' ' T830> $# 1##(## FIGURE: 1

ISSN 2231-4245

0%

5%

2.5%

1980 1990 2000 Yet to be introduced

92.5%

!ro0 this conceptual understandin# the present study has been thou#htfully directed to include focus on i0ple0entation of credit ris: assess0ent% 9able%& interestin#ly describes that" hi#hest nu0ber of respondents ;-G< with percenta#e effectiveness of ID%. was observed for the year D'''" whereas only D to & respondents opined with . to D%. per cent for the year &IH' and &II'% 9hus" the response is interpreted as the effective i0ple0entation of credit ris: assess0ent in SBI was done fro0 D'''" which has #iven an opportunity to SBI to assess the ris: by followin# various traditional approaches and ratin# 0odels% In the well developed ris: 0ana#e0ent syste0" there has to be a credit ris: co00ittee consistin# of personnel at the senior 0ana#e0ent level can assist the ris: 0ana#e0ent co00ittee of the board% +ence" the credit ris: co00ittee should periodically review the credit ris: #rantin# criteria and how the ban:3s credit sanction process is functionin# and put up the review to the board% TA'LE(2 SEPARATE CREDIT RISK COMMITTEE REPORTING TO THE 'OARD R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es -I IG%.' $o & D%.' T830> $# 1##(## FIGURE: 2

2.5%

Yes No 97.5%

A#ainst this the present study has been thou#htfully directed to focus on the 0aintenance of separate credit ris: co00ittee reportin# to the board% 9able%D revealed that" there is hi#hest nu0ber of respondents ;-I< with percenta#e effectiveness of IG%. was observed with positive response and only one respondent has #iven his opinion in ne#ative with a percenta#e of D%.% 9hus" the response is interpreted as the effective 0ana#e0ent of credit ris: co00ittee reportin# to the board in SBI to assess the position of credit flow and 0ana#e the ris: accordin#ly% >ith the vast functions of ban:in# institutions" the total assets of a ban: are classified under the four #roups such as loss assets" doubtful assets" sub-standard assets and standard assets on the basis of ti0e period durin# which the assets re0ain $PA and in case of ter0 loans the duration which the principal and interest re0ain overdue% On the basis of the ?uality of the assets" prospects of the reali*ation of the security and the erosion overti0e in the value of security char#ed to the ban:s" the ban:s should 0a:e ade?uate provisions for such assets% 9hus" the period of review of provisions depends on the ti0e period of $PAs and ter0 loans%TA'LE(3 THE PERIOD OF RE-IE& OF PRO-ISIONS P6;48?D N8( 87 R6DE81?613D P6;<6130=6 Nuarterly D' .'%'' +alf-/early & D%.' Annually &I (G%.' T830> $# 1##(## FIGURE: 3

47.5% 50% 2.5%

Quarterly Half -Yearly Annually

A#ainst this conceptual understandin# the respondents fro0 the sa0ple or#ani*ation for the study were contacted to #ive their perception on the period of review of provisions% As per the opinion of respondents it is understood that there is hi#hest nu0ber of respondents ;D'< with percenta#e effectiveness of .'

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

--

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

was observed for ?uarterly review" the ne7t hi#her nu0ber of respondents ;&I< with percenta#e effectiveness of (G%. was observed for annual review and only one respondent opined for half-yearly review with a percenta#e of D%.% 9he response is interpreted as the period of review of provisions is for ?uarterly and annual in SBI to facilitate easy assess0ent of $PAs% In the 0ana#e0ent of credit ris:" Ban:s should establish overall credit li0its at the level of individual borrowers@counter-parties" and #roups of connected counter-parties@borrowers" #roups of borrowers in one industry or type of activity% 6stablish0ent of e7posure li0its on individual borrowers" a pro0oter #roup or set of associate concerns and on e7posure to an industry or econo0ic sector is an i0portant part of credit ris: 0ana#e0ent process% 9hese li0its can be related to the si*e of capital of the lendin# ban:% !or instance" it can stipulated that e7posure to a sin#le co0pany or a borrower should not e7ceed D. per cent of the Ban:3s capital" e7posure to a sin#le #roup should not e7ceed .' per cent of the Ban:3s capital and e7posure to a sin#le industry should not e7ceed &' per cent of the Ban:3s total advances% TA'LE($ LIMITS LAID RELATING TO CONCENTRATION OF RISK &ITH SPECIFIC GROUPS OF 'ORRO&ERS R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es -G ID%.' $o G%.' T830> $# 1##(## FIGURE: $

7.5%

Yes

No

92.5%

A#ainst this understandin# to elicit the respondents opinion fro0 the sa0ple or#ani*ation on li0its laid relatin# to concentration of ris: with specific #roups of borrowers are ascertained as that" there is hi#hest nu0ber of respondents ;-G< with percenta#e effectiveness of ID%. was observed with positive response and the re0ainin# - respondents with a percenta#e of G%. are opined with ne#ative response% 9he response is analy*ed as the effective li0its laid relatin# to concentration of ris: with specific #roups of borrowers in SBI" which has 0ade the borrowers restricted in their borrowin# capacity% >ith the #rowin# trend of credit flow" the 0ana#e0ent of credit ris: has beco0e co0plicated to convert ratin#s for different ris: factors into identifiable prices" ban:s have to develop a concept of ris: free return% Ris: is nor0ally defined as a variability of the rate of return% 9he ris: ad1usted price of credit for a unit can beA( rO P IQnOQdO >here I P ris: free rate of return nO P ad1ust0ent for industrial ris: or fir0 ris:s% dO P ad1ust0ent for 0ana#e0ent ris:% !or lar#e advances the decision of ratin# and pricin# of credit should ideally be ta:en by a #roup of people who would individually rate the proposal and thereafter a co0bination would #ive the fair and unbiased price of ris: for a proposal% 9he individual ratin# of each 0e0ber would depend on his perception% TA'LE(* CREDIT PRICING RELATING TO LE-EL OF RISK R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es -I IG%.' $o & D%.' T830> $# 1##(## FIGURE: *

2.5%

Yes No 97.5%

!ro0 this the present study has been directed to focus on credit pricin# relatin# to level of ris:% 9able%. interestin#ly describes that there is hi#hest nu0ber of respondents ;-I< with a percenta#e effectiveness of IG%. was observed with positive response" whereas only one respondent with the percenta#e of D%. was opined as ne#ative response% 9herefore" the response is interpreted as the effective relationship of credit pricin# to level of ris: in SBI" which has ta:en initiative by SBI" to have a fresh loo: at the pricin# 0echanis0 is a step in the ri#ht direction% In the 0ana#e0ent of credit ris: there has to be a clearly defined set of processes which are in con1unction with a well defined policy% 9his policy is deter0ined and approved by a credit ris: 0ana#e0ent board constituted by the top 0ana#e0ent of the or#ani*ation% 9he e7pected results of syste0atic 0ana#e0ent of credit ris: will be possible for an or#ani*ation when it follows the procedure% 9he results will be 0ore effective and i0ple0entable under any conte7t when a well-defined policy holds water% One such 0ost i0portant policy docu0ent to be prepared by a financial institution li:e SBI is on loans of various types% It 0ust be clearly understood that the effectiveness of wor:in# of ban:in# institutions will be e7clusively on their perfor0ance in deposits and advances% +ence" it is i0portant to concentrate on analy*in# certain issues related to these factors so as to arrive at 0eanin#ful understandin# of credit ris: 0ana#e0ent in any or#ani*ation% 9he present study has been thou#htfully directed to include focus on ascertainin# respondent responses on the loan policy% 9able%F describes that al0ost &'' per cent of respondents opined that sa0ple or#ani*ation followed 0eticulously their procedure for a well-defined loan policy docu0ent% It is observed fro0 the data that none of the respondents was unaware of the initiative by SBI in this re#ard% +ence" it can be interpreted that the de#ree of transparency at all levels of hierarchy is positively ensured in the or#ani*ation% Awareness and involve0ent of e0ployees at all levels is a hi#hli#htin# feature in the sa0ple or#ani*ation% Ban:s 0ust receive sufficient infor0ation to enable a co0prehensive assess0ent of the true ris: profile of the borrower% 9his should includeA

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-(

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

9he purpose of the credit 9he sources of the repay0ent 9he nature and a##re#ate a0ount of ris: of the borrower% 9he nature of collateral and its sensitivity to 0ar:et develop0ents and enforceability% 9he borrowers past repay0ent history" e7istin# liabilities or obli#ations" current capacity to repay and future cash flow pro1ections% !or business loans" the borrower3s business e7pertise" the status of the industry or sector and the borrower3s position within that sector% !air assess0ent based 0ar:et reports of the inte#rity of the owners@0ana#e0ent of the enterprise" or of the borrower in case of individual loans% +ence" the ris: profile of credit portfolio 0onitored re#ularly% SI(N8( 1(

TA'LE(6 ROLE OF CREDIT RISK MANAGEMENT IN STATE 'ANK OF INDIA (N I $#) S30365613D P6;<6130=6 87 R6DE81D6 Respondents opinion on loan policy docu0ent approved by the Board YES NO &'' " 2( Respondents opinion on Ris: Profile of )redit Portfolio 0onitored re#ularly &'' " A#ainst this conceptual understandin# the respondents fro0 the sa0ple or#ani*ation opined on the 0onitorin# of credit portfolio of ris: profile as that al0ost &'' per cent of respondents were with positive response that is in SBI there is re#ular 0onitorin# of credit portfolio of ris: profile% 9herefore" none of respondents was unaware of the initiative by SBI in this re#ard% Awareness of 0ana#ers at all levels of 0onitorin# is a hi#hli#htin# feature in State Ban: of India% RISK CONTROL STRATEGIES 6ach corporation operates in an e7ternal environ0ent where actions or influences beyond its control 0ay i0pact the success of the or#ani*ation% 9his environ0ent 0ay vary substantially fro0 0ar:et-to-0ar:et" country-to-country" as well as by product or service offered to custo0ers% An operative approach towards the identification of ris: re?uires accurate and ti0ely infor0ation fro0 a variety of disparate sources% 9his #enerally involves substantial invest0ent in research tar#eted at e7ternal constituencies such as 0ar:ets" custo0ers" vendors" co0petitors" re#ulators" analysts" investors" technolo#y" econo0ies and political syste0s% 9he analysis perfor0ed 0ust evaluate e7ternal factors in the conte7t of the corporation3s current and future strate#ic plan" to ensure that business #oals are appropriate and achievable% It 0ust also focus upon the functional aspects of the business that is products" services" 0anufacturin#" distribution" transportation" innovation" process 0ana#e0ent" or#ani*ation structure and other issues critical to the operations of the corporation% !inally" e7ternal factor i0pact upon the financial structure and perfor0ance of the corporation 0ust be evaluated%. PERCEPTION ON RISK CONTROL STRATEGIES Ris: control strate#ies have been laid down by the Reserve Ban: of India for the #uidance of the ban:s" Indian ban:s have not #enerally enunciated specific internal #uidelines% 6ven in the absence of such co0prehensive #uidelines" ris: li0its have been prescribed for specific activities by the ban: 0ana#e0ent% In the 0ana#e0ent of ris: there has to be a clearly defined set of processes such as ris: ta:in# and ris: control that is ris: 0ana#ers and ris: ta:ers report to different controllers thus ensurin# independence and se#re#ation of ris: 0ana#e0ent functions% 9he controllers in turn report to the top 0ana#e0ent level where con#ruence is established% 6ither the top level ris: 0ana#e0ent co00ittee based on the ris: policy approves the ris: li0its :eepin# in view the ban:s ris: ta:in# capacity and the ris: appetite% 9hus" ris: ta:in# and ris: control #o hand in hand% TA'LE(. MANAGER SEGREGATES THE RISK TAKING AND RISK CONTROL R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es -HD%.' $o ' ' )o0bined G &G%.' T830> $# 1##(## FIGURE: 6

17.5% 0% Yes No Combined 82.5%

!ro0 the 9able%G to elicit the respondents opinion the present study has been thou#htfully directed to include focus on the se#re#ation of ris: ta:in# and ris: control% 9herefore" there is hi#hest nu0ber of respondents ;--< with percenta#e effectiveness of HD%. was observed with positive response" whereas G respondents with percenta#e of &G%. was responded ne#atively% 9herefore" the response is described as the SBI positioned both ris: ta:in# and ris: control separately to 0a:e the assess0ent easily% Ris: control #uidelines should concentrate on specific strate#ies and procedures% 9hey should consider what the Ban:3s specific underlyin# e7posures are and ensure that these are 0onitored durin# the entire lifeti0e of the e7posure% 9herefore" the approvals were 0ade in accordance with the Ban:3s written #uidelines% TA'LE(! RISK CONTROL STRATEGIES IN STATE 'ANK OF INDIA (N I $#) SI(N8( S30365613D P6;<6130=6 87 R6DE81D6 1( )lear >ritten down Ris: )ontrol #uidelines followed by SBI YES NO &'' " A#ainst this the present study has been thou#htfully directed to focus on written down ris: control #uidelines% 9able%H e7plain that al0ost &'' per cent of respondents opined that sa0ple or#ani*ation followed the ris: control #uidelines% It is e7a0ined fro0 the data that none of the respondents was unaware of the ris: control #uidelines in SBI% +ence" it can be interpreted that the de#ree of clear written down #uidelines at all levels of ris: is positively ensured in the or#ani*ation% Ris: wei#htin# based on ris: wei#htin# of country in which ban: is incorporated and it is based on assess0ent of individual ban: with clai0s of ori#inal 0aturity RF 0onths% )lai0s on ban:s of a short ori#inal 0aturity would receive wei#htin# that is one cate#ory 0ore favourable than the usual ris: wei#ht on the ban:3s clai0% TA'LE( RISK &EIGHTS ARE SAME FOR ALL THE YEARS R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es D& .D%.' $o &I (G%.' T830> $# 1##(##

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-.

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

FIGURE: .

ISSN 2231-4245

47.5% Yes No 52.5%

!ro0 this conceptual understandin# the respondents fro0 the sa0ple or#ani*ation for the study were contacted to #ive their perception on the ris: wei#hts are si0ilar for the years% 9herefore" there is hi#her nu0ber of respondents ;D&< with percenta#e effectiveness of .D%. was observed with positive response and sli#htly lower nu0ber of respondents ;&I< with percenta#e of 0inute chan#e (G%. was observed with ne#ative response% 9hus" the response is e7plained as the ris: wei#hts 0ay be sa0e to so0e e7tent for all the years" this has #iven an opportunity to SBI to 0easure the a0ount of ris: basin# on the wei#hts assi#ned% Ris: wei#htin# of ban:s should be de-lin:ed fro0 that of the soverei#n I which they are incorporated as this syste0 penali*es ban:s with better ?uality asset portfolio incorporated in low rated countries" while benefitin# wea:er financial institutions in hi#hly rated countries% Instead" preferential ris: wei#hts in the ran#e of D' per cent to .' per cent on a #rade scale could be assi#ned on the basis of ris: assess0ent by do0estic ratin# a#encies% TA'LE(1# RESPONDENTS OPINION A'OUT ALL THE 'ANKS FOLLO&S SAME RISK &EIGHTS R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es -HD%.' $o & D%.' $o idea F &.%'' T830> $# 1##(## FIGURE: !

15% 2.5% Yes No No idea

82.5%

A#ainst this conceptual understandin#" respondents have opined that there is hi#hest nu0ber of respondents ;--< with percenta#e effectiveness of HD%. was e7a0ined with positive response" whereas F respondents with &. per cent was observed that they do not have any idea and only one respondent with D%. per cent was opined with ne#ative response% +ence" the response is interpreted as all the ban:s follow sa0e ris: wei#hts" which 0ade SBI to assess the ris: ?uic:ly for all the branches% 9he 0id office is particularly critical because it would perfor0 the ris: 0ana#e0ent functions which 0ay include settin# of ris: 0odelin# and 0onitorin# para0eters" real ti0e 0onitorin# of ris: para0eters" reportin# of e7ceptions" 0onitorin# reali*ed and un-reali*ed profits and losses" cash flows and accruals" and scrutini*in# cost of carry to 0ini0i*e the ris:% TA'LE(11 THE CONCEPT OF MID OFFICE FOR RISK MANAGEMENT HAS 'EEN INTRODUCED R6DE81D6 N8( 87 R6DE81?613D P6;<6130=6 /es -G ID%.' $o D .%'' $o idea & D%.' T830> $# 1##(## FIGURE(

2.5%

5%

Yes No No idea

92.5%

A#ainst this it is understood as per the perception of respondents that there is hi#hest nu0ber of respondents ;-G< with percenta#e effectiveness of ID%. was observed with positive response" whereas D respondents with . per cent responded ne#atively and only one respondent with D%. per cent do not have any idea about the concept% 9herefore" the response is analy*ed as the i0ple0entation of the 0id office is for ris: 0ana#e0ent in SBI to 0onitor and control all the activities of ris:% !inancial derivatives are i0portant ris: 0ana#e0ent tools with tan#ible benefits fro0 their use% +owever" li:e all tools it is i0portant that the user understands the tools and uses it to 0eet specific ris: 0ana#e0ent ob1ectives based on an analysis and understandin# of the ris:s% >hile the ris:s are 0ore co0ple7 they are in no way different fro0 those associated traditional instru0ents such as credit ris:s" 0ar:et ris:s and operatin# ris:s etc% !inancial derivatives serve the useful purpose of 0ana#in# ris:s selectively and even in unbundlin# ris:s fro0 traditional instru0ents and activities% 9hey only need to be understood as their co0position" stren#ths and li0itations are well :nown% 9hus" the lar#e ban:s and corporations are 0a1or players in the derivatives 0ar:et" it is the s0aller ban:s and fir0s with #reater vulnerability to ris:s who need to protect the0selves usin# derivative products because of their s0aller capital base%

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-F

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

TA'LE(12 THE KIND OF DERI-ATI-ES ARE USED TO MANAGE THE CREDIT RISK K41?D 87 D6;4H034H6D N8( 87 R6DE81?613D P6;<6130=6 Options & D%.' !orwards ' ' !uture contracts ' ' Swaps ' ' All of the above &I (G%.' $one of the above D' .'%'' T830> $# 1##(## FIGURE(1#

0% 2.5% 0% 0% Options Forw ards Future contracts 50% 47.5% Sw aps All of the above None of the above

ISSN 2231-4245

!ro0 this conceptual understandin# the respondents fro0 the sa0ple or#ani*ation for the study were contacted to #ive their perception on the :ind of derivatives were used to 0ana#e the credit ris: in SBI% As per the opinion of respondents it is understood that there are hi#hest nu0ber of respondents ;D'< with percenta#e of .' was observed without followin# derivatives in their ris: assess0ent" whereas there is a sli#htly lower nu0ber of respondents ;&I< with percenta#e of (G%. are able to follow all :inds of derivatives in their ris: assess0ent and only one respondent with D%. per cent is aware of usin# option :ind of derivative in their ris: assess0ent% 9hus" the response is analy*ed as that not followin# at 0a7i0u0 level the various :inds of derivatives and at 0ini0u0 level could be followin# derivatives approach in SBI to 0easure and 0onitor various :inds of ris:s% 4lti0ately" it is concluded that the perfor0ance of State Ban: of India at the level of *onal office" head office and branch level is very satisfactory in 0ana#in#" 0onitorin#" controllin# and assessin# the ris:%

SUGGESTIONS

)redit is the real activity that should be 0ana#ed to #enerate profitability by :eepin# the three cardinal principles of ban:in# in 0ind K2i?uidity" Solvency and ProfitabilityE% >ith the thinnin# of spreads in the dere#ulated and liberali*ed econo0y" ris: 0ana#e0ent has beco0e all the 0ore crucial% So proper 0echanis0 should be put in place for anticipation and identification of ris:s" to#ether with a suitable 0echanis0 to deal with such ris:s in an efficient and pro-active 0anner% 9o be successful" )redit Ris: Mana#e0ent de0ands that every credit 0ana#er should #et a#itated with ?uestions li:e , K+ave all the ris:s identifiedSE K+ave the odds chan#edSE K+ave so0e ris:s vanished and new ones ta:en their placeSE etc%" that 0ay pave way for a proactive shufflin# of the credit portfolio% 9his beco0es feasible if only every one beco0es Bris:-conscious3% It is obvious that Bris:-consciousness3 enable the or#ani*ations to raise ri#ht ?uestions at ri#ht ti0e resultin# in ri#ht actions% Ma1ority of the respondents stron#ly felt that the syste0 followed in the ban:s need a review in ter0 of si0plifyin# various for0s used and procedures followed for sanctionin# loan% So0e of the respondents advice their ban:s to adopt the new 0odels in their credit flow based on para0eters% )redit defaults can be avoided and can be covered by developin# the credit derivatives 0ar:et and tradin# of these instru0ents can be per0itted sub1ect to certain rules and re#ulations% It is su##ested that in credit #rantin# application" appraisal" sanction" disburse0ent" control activities are strictly observed% Diversion of funds to be chec:ed and need based assess0ent to be arrived to eli0inate ele0ent of ris: in the ban:% 9he applications of borrowers which are sent by branches to head offices credit cell depart0ent such as RA)P) and SM6))) should be observed :eenly without arisin# any ris:% Ban: 0ust operate within sound well-defined credit #rantin# criteria% 9hese criteria should indicate the ban: tar#et 0ar:et and a thorou#h understandin# of the borrower as well as the purpose and structure of credit and its source of repay0ent% It is su##ested that the ban: should establish overall credit li0its at the level of individual borrowers@counterparties" and #roups of connected borrowers@counterparties in one industry%

REFERENCE

&% )e0 =aracada# and Michael > 9aylor" K9oward a $ew lobal Ban:in# StandardA 9he Basel )o00ittee3s ProposalsE" D''D" I)!AI Boo:s% D% Murthy %R%=%" K)redit Ris: Mana#e0ent in a Mar:et Driven 6cono0yA 9he Acid 9est for Ban:sE" Deep and Deep Publications Pvt% 2td%" $ew Delhi" D''.% -% Sar:ar A%=%" KApplication and I0plications of $ew Prudential $or0s for Ban:sE" Deep and Deep Publications Pvt% 2td%" $ew Delhi" D''.% (% Asho: Baner1ee" K9he )ost of )redit , Re-e7a0inedE" Deep and Deep Publications Pvt% 2td%" $ew Delhi" D''.% .% =enneth J% 2e Stran#e" KRis: Mana#e0ent and Ris: !inancin# AlternativesE" Deep and Deep Publications Pvt% 2td%" $ew Delhi" D''.%

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-G

www%i1rc0%or#%in

VOLUME NO: 1 (2011), ISSUE NO. 2 (J UNE )

ISSN 2231-4245

REQUEST FOR FEEDBACK

ED36656? % M8D3 R6DE6<36? R60?6;" At the very outset" International Journal of Research in )o00erce and Mana#e0ent ;IJR)M< appreciates your efforts in showin# interest in our present issue under your :ind perusal% I would li:e to ta:e this opportunity to re?uest to your #ood self to supply your critical co00ents 8 su##estions about the 0aterial published in this issue as well as on the 1ournal as a whole" on our 6-0ails i%e% 417894:;<5(8;=(41 or 41784:;<59=504>(<85 for further i0prove0ents in the interest of research% If your #ood-self have any ?ueries please feel free to contact us on our 6-0ail 41784:;<59=504>(<85% +opin# an appropriate consideration% >ith sincere re#ards 9han:in# you profoundly A<0?654<0>>2 28B;D Sd@C8"8;?41038;

INTERNATIONAL JOURNAL OF RESEARCH IN COMMERCE, ECONOMICS % MANAGEMENT

A Monthly Double-Blind Peer Reviewed Refereed Open Access International e-Journal - Included in the International Serial Directories

-H

www%i1rc0%or#%in

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- All Finacle CommandsDocument39 pagesAll Finacle Commandssindhukotaru100% (2)

- BPI vs. Sps. SantiagoDocument3 pagesBPI vs. Sps. SantiagoAlecsandra ChuNo ratings yet

- Abs CDSDocument32 pagesAbs CDSMatt WallNo ratings yet

- Credit Risk at Sbi Project Report Mba FinanceDocument103 pagesCredit Risk at Sbi Project Report Mba FinanceBabasab Patil (Karrisatte)100% (3)

- Analysis of Housing Finance Schemes of HDFC Bank ICICI Bank PNB SBI BankDocument85 pagesAnalysis of Housing Finance Schemes of HDFC Bank ICICI Bank PNB SBI BanksindhukotaruNo ratings yet

- Fria Law 5 QuizDocument7 pagesFria Law 5 QuizWilsonNo ratings yet

- Understanding Rural Banking BehaviorDocument62 pagesUnderstanding Rural Banking BehaviorsindhukotaruNo ratings yet

- Financial Inclusion PDFDocument62 pagesFinancial Inclusion PDFchandruxg50% (4)

- Money ControlDocument1 pageMoney ControlsindhukotaruNo ratings yet

- ACCT 352 Chap016pptDocument32 pagesACCT 352 Chap016pptsindhukotaruNo ratings yet

- Taxation in IndiaDocument45 pagesTaxation in IndiasindhukotaruNo ratings yet

- Incorporation of CompaniesDocument19 pagesIncorporation of CompaniesDanesh AjayNo ratings yet

- Performance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalDocument72 pagesPerformance Analysis of Top 5 Banks in India HDFC Sbi Icici Axis Idbi by SatishpgoyalsindhukotaruNo ratings yet

- E-Filing of ReturnsDocument13 pagesE-Filing of ReturnsAjmeelNo ratings yet

- AStudyOnCompositionOfNPAsOfPublicSectorBanksInIndia (116 121)Document6 pagesAStudyOnCompositionOfNPAsOfPublicSectorBanksInIndia (116 121)Rohit YadavNo ratings yet

- Understanding Valuation MDrake-COlingerDocument29 pagesUnderstanding Valuation MDrake-COlingersindhukotaruNo ratings yet

- Accounting For Deferred TaxesDocument4 pagesAccounting For Deferred Taxes87rakeshNo ratings yet

- 32 IncomeTax Version2011 01Document29 pages32 IncomeTax Version2011 01sindhukotaruNo ratings yet

- CA Feb 2014 PDFDocument18 pagesCA Feb 2014 PDFsindhukotaruNo ratings yet

- CA Feb 2014 PDFDocument18 pagesCA Feb 2014 PDFsindhukotaruNo ratings yet

- Chap 016Document46 pagesChap 016sindhukotaruNo ratings yet

- CA Feb 2014 PDFDocument18 pagesCA Feb 2014 PDFsindhukotaruNo ratings yet

- Generation and Screening of Project Ideas Project ManagementDocument25 pagesGeneration and Screening of Project Ideas Project ManagementUtsav Mahendra100% (3)

- Understanding Financial StatementsDocument30 pagesUnderstanding Financial StatementsTeh PohkeeNo ratings yet

- Lesson I. Simple and Compound InterestDocument6 pagesLesson I. Simple and Compound InterestKaren BrionesNo ratings yet

- Capital Markets - DD - Spring2019 - FinalDocument39 pagesCapital Markets - DD - Spring2019 - Finalyang AlfredNo ratings yet

- Ap - Invoices - All: Posted - Fla GDocument3 pagesAp - Invoices - All: Posted - Fla GsaravananNo ratings yet

- Programmazione e Controllo Esercizi Capitolo 11Document31 pagesProgrammazione e Controllo Esercizi Capitolo 11Jamie Shaula ColladoNo ratings yet

- Public Finances in EMU - 2011Document226 pagesPublic Finances in EMU - 2011ClaseVirtualNo ratings yet

- Act 553 Insurance Act 1996Document141 pagesAct 553 Insurance Act 1996Adam Haida & CoNo ratings yet

- Kohat Cement Company, Presentation Slides Mc100205161Document31 pagesKohat Cement Company, Presentation Slides Mc100205161aftab33% (3)

- January 2012 Finance Report - Roman Larson For School BoardDocument4 pagesJanuary 2012 Finance Report - Roman Larson For School BoardRoman Michael Gregory LarsonNo ratings yet

- Nature and Characteristics of Credit Transactions - DepositDocument12 pagesNature and Characteristics of Credit Transactions - Depositviva_33No ratings yet

- PNB Scam: How Nirav Modi Defrauded Punjab National Bank of Rs 11400 CroreDocument6 pagesPNB Scam: How Nirav Modi Defrauded Punjab National Bank of Rs 11400 CroreRhythm KhetanNo ratings yet

- True / False Questions: Liquidity RiskDocument25 pagesTrue / False Questions: Liquidity Risklatifa hnNo ratings yet

- ROMMSDocument190 pagesROMMSspandanNo ratings yet

- ACI Dealing Certificate: SyllabusDocument12 pagesACI Dealing Certificate: SyllabusKhaldon AbusairNo ratings yet

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyNo ratings yet

- Z What Is A MortgageDocument3 pagesZ What Is A MortgageDanica BalinasNo ratings yet

- Presented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorDocument18 pagesPresented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorHari KrishnaNo ratings yet

- Ashton Tate Limited ANSWERDocument4 pagesAshton Tate Limited ANSWERJoseph HallNo ratings yet

- Chp8 3edition PDFDocument21 pagesChp8 3edition PDFAbarajithan RajendranNo ratings yet

- Contracts IIDocument8 pagesContracts IISushmaSuresh100% (1)

- Liquidity Preference TheoryDocument8 pagesLiquidity Preference TheoryjacksonNo ratings yet

- Exotic Options: - Digital and Chooser OptionsDocument8 pagesExotic Options: - Digital and Chooser OptionsKausahl PandeyNo ratings yet

- Siebert - The Half and The Full Debt CycleDocument10 pagesSiebert - The Half and The Full Debt CycleMarcosNo ratings yet

- Chapter 10a - Long Term Finance - BondsDocument6 pagesChapter 10a - Long Term Finance - BondsTAN YUN YUNNo ratings yet

- Download Audit of Sales and Collection Cycle ChapterDocument28 pagesDownload Audit of Sales and Collection Cycle ChapterfitriNo ratings yet

- Rules of The Law Society of NamibiaDocument26 pagesRules of The Law Society of NamibiaAndré Le Roux100% (2)