Professional Documents

Culture Documents

Moody's Credit Outlook For City of Boston

Uploaded by

matthewbrown76Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moody's Credit Outlook For City of Boston

Uploaded by

matthewbrown76Copyright:

Available Formats

MAY 1, 2014

U.S. PUBLIC FINANCE

CREDIT FOCUS

Boston Well-Positioned to Maintain Superior Credit Quality with Strong Tax Base and Specialized Employment Sectors

Summary

Aaa Stable

RATINGS

Boston (City of) MA

General Obligation

KEY INDICATORS

2011 2012 2013

As the economic center of New England, Boston (Aaa stable) is well-positioned to maintain its strong credit profile with a growing tax base and durable sectors such as government and higher education. The city has also proven it can successfully address fiscal challenges and manage elevated liabilities related to retirement benefits. Key factors in the citys stability are: Consistent property tax growth. The tax base has grown in eight of the last 10 years, resulting in a steady increase in tax revenue under Proposition 2 1/2, driven by thriving real estate development. Strong presence of higher education, state and local government, and health care sectors. Large and stable institutions contribute to lower unemployment, spur infrastructure investment and support high-tech and start-up firms. Conservative and responsive fiscal oversight. The city has produced annual operating surpluses since 2001, with exceptions in only two years. The city has also maintained strong reserve levels (averaging 30.1% of revenues from 2008-13) that strengthens its ability to manage declining state aid and higher union-related expenses. Proactive management of large pension and other post-employment benefits (OPEB) liabilities. The city plans an aggressive funding schedule to pay down its entire unfunded pension liability by 2025, 15 years before a state-imposed deadline and far sooner than many local government peers. Management has reduced OPEB liabilities through plan changes and increased payments into a trust.

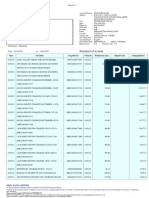

Assessed Value $86.8 $88.5 $92.2 ($billions) Available Fund 27.1% 27.3% 28.1% Balance as % of Revenue Adjusted Net Pension $5.2 $5.2 $5.9 Liability ($billions) 3-Year Ave. ANPL as 4.92% 4.97% 5.70% % of Equalized Value

Analyst Contacts:

BOSTON +1.212.553.1653

Nicholas Lehman +1.617.371.2940 Analyst nicholas.lehman@moodys.com NEW YORK +1.212.553.1653

Geordie Thompson +1.212.553.0321 Vice President -Senior Credit Officer/Manager geordie.thompson@moodys.com Naomi Richman +1.212.553.0014 Managing Director - Public Finance naomi.richman@moodys.com

U.S. PUBLIC FINANCE

Consistent increase in property tax revenue driven by strong new growth

The roots of Bostons steady property tax revenue growth are threefold: increasing assessed values, the ability under state law to increase the tax levy regardless of valuation declines, and a surge in new growth even during the recession and recovery. The citys assessed values continue to grow year over year. In the last 10 years, Boston has only experienced two years of declines, in 2010 and 2011, when values fell 3.5% and 0.5%, respectively. In 2014, the assessed value increased by a sound 8.3%. The five-year average (2010-2014) is a more modest 1.7% due to the two down years, but it remains reflective of a steady growth trend. Secondly, despite operating under the long-established tax levy limitation of Proposition 2 1/2, Boston and other Massachusetts local governments benefit from the mechanics of the cap, which limits the levy, not the tax rate. Therefore, even in those years that values fall, the city is able to raise the levy by 2.5% over the previous year. The 2.5% annual increase allows for consistent revenue growth (see Exhibit 1) and provides realistic budget projections.

EXHIBIT 1

Fiscal Year Property Tax Levy Growth Provides Steady Revenue increase

Prop. 2 1/2 Growth $100 $90 $80 $70 ($ millions) $60 $50 $40 $30 $20 $10 $0 2003 Source: City of Boston 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 New Growth

Lastly, new development projects continue to add to the tax rolls in the form of new growth, which provides additional tax revenue above the 2.5% limit each year (see Exhibit 1). Even through the recession and weak national recovery, the city benefited from annual new growth close to the $32 million 10-year average. In fiscal 2014, the city is poised to benefit from $53.1 million of new growth, one of the largest increases in over 10 years. The current increase is attributable to some large projects coming on line and increased revenue due to expiring 121A tax reduction agreements. Development and redevelopment efforts remain strong throughout the citys neighborhoods, with the Boston Redevelopment Authoritys current pipeline of 244 projects, covering over 59 million square feet, valued at $23 billion. There is approximately 4 million square feet under construction, including the former Filenes building in the Downtown Crossing district and the New Balance headquarters in Brighton. In addition, multifamily housing will be a key driver over the near term with permit levels at a six-year high when measured on a 12-month moving average. Ground has been broken on the $630 million Millennium Tower and the $175 million AVA Theater District apartment complex, which highlight the rise in construction payroll through 2016.

For research publications that reference Credit Ratings, please see the ratings tab on the issuer/entity page on www.moodys.com for the most updated Credit Rating Action information and rating history.

MAY 1, 2014

CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

U.S. PUBLIC FINANCE

Dampening the expansion trend is Bostons high business and living costs, which could limit new growth figures in the future. Below-average population growth will cause the city to underperform in some economic statistics.

Economy bolstered by strong higher education, state and local government, and healthcare sectors

Boston remains a center for life sciences, finance, business and professional services, with a concentration of hospital and higher education facilities that continue to act as an economic stimulus. Seven of the top 10 employers are in the healthcare sector; Massachusetts General Hospital is the citys largest single employer.

EXHIBIT 2

Employment base anchored by health care and higher education

Top 10 largest employers # of employees

Massachusetts General Hospital Brigham & Women's Hospital Boston University Children's Hospital Boston Beth Isreal Deaconess Medical Center Fidelity Investments Liberty Mutual Holding Co. Inc. State Street Bank and Trust Co. Boston Medical Center Tufts Medical Center

Source: City of Boston

23,983 15,043 9,783 9,424 8,765 7,600 7,125 5,600 5,598 5,266

In Massachusetts, the healthcare sector employs 21% of the states highly educated workforce. Despite our overall negative outlook for the sector, it will continue to provide stability to Bostons employment base given the strengths of the particular institutions in the city. In December 2013, the citys unemployment rate of 6.2% was below the state and US jobless rates. Also bolstering the economy is the presence of some of the most widely-recognized higher education institutions in the world. There are 35 universities and colleges in the city, with more than 152,000 students, representing over 23% of the citys 2012 population. The institutions are regularly investing in infrastructure, such as Northeastern Universitys new $80 million dormitory and the recent groundbreaking on a $225 million science and engineering building. The environment also supports high-tech and startup firms that benefit from access to large venture capital opportunities. As the state capital, Boston also benefits from multiple government institutions, which employ over 77,000 federal, state and municipal workers.

Conservative and responsive fiscal management provides proactive management of budget pressures

For over 10 years, the city has shown a commitment to maintaining structurally balanced operations and healthy reserve levels to address fiscal challenges and promote a healthy financial profile. The city has produced annual operating surpluses in 11 out of the last 13 years (see Exhibit 3). The two operating deficits in fiscal 2010 and 2011 were due in part to recessionary pressures not uncommon across the state and nation.

3 MAY 1, 2014 CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

U.S. PUBLIC FINANCE

EXHIBIT 3

Boston Consistently Delivers Surpluses

Revenues $2,750,000 Expenditures

$2,500,000

$2,250,000

$2,000,000

$1,750,000

$1,500,000 2001 Source: City of Boston

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

The historic operating performance reflects moderate, but consistent surpluses year over year, a challenge to a large city where education, public safety and employee benefits represent the majority of expenditures. Boston has effectively managed a $134 million decline since 2008 in net state aid (see Exhibit 4), the citys second-largest revenue source accounting for 19% of 2013 revenues. To help offset unforeseen challenges, the city has maintained sufficient available reserve levels averaging $721 million, or 30.1% of revenues, over the last six years (2008-2013), compared to the median of 20% of revenues for Massachusetts local governments rated Aaa by Moodys and 28% for Aaa-rated cities nationwide.

EXHIBIT 4

Fiscal Year State Assessments have Decreased Net State Aid by $134M since 2008

Net State Aid - *FY14 budget and FY15/16 projections 400 350 300 250

Millions

200 150 100 50 0 2008 2009 2010 2011 2012 2013 2014* 2015* 2016*

Source: City of Boston

Given its past prudent management, the city is well-positioned to overcome future challenges in maintaining structural balance. Chief among these are state assessments, employee wages, health benefits and pension costs. An increase in state assessments reflects ongoing budget pressure from charter school tuition costs, which continue to rise and reduce the net state aid the city receives each year. Going forward, the citys budget projections include additional declines in state aid given the state legislatures recent increase to the cap on charter school enrollment.

MAY 1, 2014

CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

U.S. PUBLIC FINANCE

Additional near-term challenges loom as well. In December 2013, the city council approved an arbitrators ruling that the Boston Police Patrolmens Association receive a contract that contains increases totaling 25.4% ($88 million), covering 2010-16. Last month the Boston Police Superior Officers Federation and Boston Police Superior Detectives came to similar terms as the Patrolmens contract. In addition, a recently announced pending contract with firefighters includes an 18.8% ($92.4 million) pay increase covering 2011-17. Collective bargaining reserves from prior years will cover the retroactive pay, but the fiscal 2015 and 2016 budgets will be pressured by the above average salary increases. In a positive development, the combination of the arbitration award and other voluntary contract and pending settlements will place over 98% (over 16,000 employees) of the citys unionized workforce under contract through 2016, providing city management with stable costs over the near term. The city has managed union settlements similar to the ones with the police and fire associations throughout the citys history. The city also successfully negotiated a four-year agreement beginning in fiscal 2012 with all city unions, stabilizing many of the health insurance cost drivers, including co-pay changes, premium shifts and the implementation of mandatory Medicare for all eligible retirees. However, the cost of health insurance over the medium to long term will remain a challenge to the citys financial position. Budget pressure from annual pensions costs will continue as the city budgets for double digit increases to meet an aggressive funding schedule that is discussed in detail in the following section. A two-year budget forecast from March of this year identified gaps of $10 million in 2015 and $50 million in 2016. Since then, a balanced budget for 2015 was submitted to the city council on April 9, 2014. The remaining 2016 budget gap is manageable, representing less than 2% of revenues, and management has an established history of balancing current year operating budgets by maintaining tight expenditure control measures on all departments.

Continued active management is key to addressing large long-term liabilities

Bostons unfunded liabilities for pension and other post-employment benefits (OPEB) are substantial and will continue to be a drag on its high quality credit position. The city is actively managing these liabilities on both an annual and long-term basis. The city contributes to the State-Boston Retirement System (SBRS), a cost-sharing multi-employer pension plan. As reported on January 1, 2012, the plan had an Unfunded Actuarial Accrued Liability (UAAL) of $2.8 billion. Using a more conservative discount rate, we calculate an adjusted net pension liability (ANPL) of $5.9 billion. Bostons ANPL is significant on a nominal basis and relative to the citys operating budget. In 2013, the citys ANPL was 2.64 times greater than the citys general fund revenues and equal to 5.7% of equalized value. The state requires the city to fully fund its share of the pension plans annual required contribution (ARC), which the city projects to increase by an annual average of 11.9% through 2016. The rapidly increasing payments are attributable to an aggressive funding schedule: the city expects to pay down the entire unfunded liability by 2025, 15 years before the maximum funding deadline of 2040 allowed by the state. In fiscal 2013, the citys pension contribution was 5.3% of its budget. Given the citys aggressive commitment to reaching the full funding date, the annual rise in pension costs will be a key budget challenge, although the city estimates it will save a total of $1.6 billion in retirement contributions relative to the extended 2040 funding date (see Exhibit 5 and 6). The city plans to manage escalating pension costs through conservative budgeting of departmental expenditures as well as improving local revenue receipts.

MAY 1, 2014

CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

U.S. PUBLIC FINANCE

EXHIBIT 5

Funding Schedule up to 2040 State Deadline

UAAL $500 $450 $400 $350 $ in Millions $300 $250 $200 $150 $100 $50 $0 2015 2017 2030 2016 2031 2038 2034 2019 2020 2035 2013 2032 2028 2024 2036 2037 2021 2040 2025 2039 2018 2022 2033 2026 2027 2029 2023 2041 2014 Employer Contributions $2,000 $1,800 $1,600 $1,400 $1,000 $800 $600 $400 $200 $0 Millions $1,200

Source: Pension plan actuarial valuations

EXHIBIT 6

Bostons Current Funding Schedule

UAAL $600 $500 $ in Millions $400 $300 $200 $100 $0 2035 2032 2036 2037 2040 2025 2039 2018 2022 2033 2026 2027 2041 2014 2015 2030 2038 2034 2042 2017 2029 2023 2016 2019 2031 2043 2013 2020 2021 2028 2024 Employer Contributions $2,000 $1,800 $1,600 $1,400 $1,000 $800 $600 $400 $200 $0 Millions $1,200

Source: Pension plan actuarial valuations

In addition, Boston has substantially reduced its OPEB liability through plan changes and increased payments into an established OPEB trust. The city implemented health plan design changes in 2012 that helped reduce its OPEB UAAL to $2.1 billion in 2013, a substantial decline from $5.6 billion in 2007. The city plans to continue making annual pay-as-you-go contributions, which represented 81% of the $187 million ARC in 2013. It also plans annual deposits of $40 million from either recurring revenues or reserves (based on operating budget performance) into the OPEB trust, which has a current balance of $272 million. The 2013 combined fixed costs of pension, OPEB and debt service represented $441 million, or 17% of expenditures, a level that has remained stable over the past three years. Despite the large unfunded liabilities, the citys proactive approach to addressing the liabilities (notably, the aggressive pension funding date) represents the sound fiscal management of a highly-rated government. The ability to maintain a balanced operating budget with the rising costs will be a key factor in the citys rating in the future.

MAY 1, 2014

CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

U.S. PUBLIC FINANCE

Moodys Related Research

Rating Update:

Moodys assigns Aaa to Boston, MAs GO Bonds, outlook stable, March 2014 US Local Governments The new stable will be an era of constrained resources, but the worst is over, December 2013 (160299) US Higher Education, Not-for-Profits and Independent Schools, November 2013 (160659) US Not-for-Profit Hospitals Revenue growth will decline; Margins to contract on physician and IT investments, November 2013 (160569) US Local Government General Obligation Debt, January 2014 (162757)

2014 Outlooks:

Rating Methodologies:

To access any of these reports, click on the entry above. Note that these references are current as of the date of publication of this report and that more recent reports may be available. All research may not be available to all clients.

MAY 1, 2014

CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

U.S. PUBLIC FINANCE

Report Number: 169935

Author Nicholas Lehman

Production Specialist Cassina Brooks

2014 Moodys Corporation, Moodys Investors Service, Inc., Moodys Analytics, Inc. and/or their licensors and affiliates (collectively, MOODYS). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. (MIS) AND ITS AFFILIATES ARE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODYS (MOODYS PUBLICATIONS) MAY INCLUDE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MOODYS DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODYS OPINIONS INCLUDED IN MOODYS PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODYS PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODYS ANALYTICS, INC. CREDIT RATINGS AND MOODYS PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODYS PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODYS PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODYS ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODYS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. MOODYS CREDIT RATINGS AND MOODYS PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS FOR RETAIL INVESTORS TO CONSIDER MOODYS CREDIT RATINGS OR MOODYS PUBLICATIONS IN MAKING ANY INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODYS PRIOR WRITTEN CONSENT. All information contained herein is obtained by MOODYS from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided AS IS without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODYS is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing the Moodys Publications. To the extent permitted by law, MOODYS and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if MOODYS or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODYS. To the extent permitted by law, MOODYS and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODYS or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODYS IN ANY FORM OR MANNER WHATSOEVER. MIS, a wholly-owned credit rating agency subsidiary of Moodys Corporation (MCO), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MISs ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading Shareholder Relations Corporate Governance Director and Shareholder Affiliation Policy. For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODYS affiliate, Moodys Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moodys Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to wholesale clients within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODYS that you are, or are accessing the document as a representative of, a wholesale client and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to retail clients within the meaning of section 761G of the Corporations Act 2001. MOODYS credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail clients. It would be dangerous for retail clients to make any investment decision based on MOODYS credit rating. If in doubt you should contact your financial or other professional adviser.

MAY 1, 2014

CREDIT FOCUS: BOSTON WELL-POSITIONED TO MAINTAIN SUPERIOR CREDIT QUALITY WITH STRONG TAX BASE AND SPECIALIZED EMPLOYMENT SECTORS

You might also like

- Anatomy of Successful US Cities: Special CommentDocument12 pagesAnatomy of Successful US Cities: Special Commentapi-63385278No ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- PM - Slash Seize and SellDocument11 pagesPM - Slash Seize and SellAjah HalesNo ratings yet

- 2015 2016 FPI Briefing Book 1.0Document72 pages2015 2016 FPI Briefing Book 1.0Casey SeilerNo ratings yet

- John Liu Budget TestimonyDocument4 pagesJohn Liu Budget TestimonyCeleste KatzNo ratings yet

- Joint Tax Hearing-Ron DeutschDocument18 pagesJoint Tax Hearing-Ron DeutschZacharyEJWilliamsNo ratings yet

- 0910 BudgetDocument346 pages0910 BudgetValerie F. LeonardNo ratings yet

- IBO Budget AnalysisDocument17 pagesIBO Budget Analysishangman0000No ratings yet

- Executive Budget FY 18 Briefing BookDocument140 pagesExecutive Budget FY 18 Briefing BookMatthew HamiltonNo ratings yet

- Plan To Payoff Lab Debt 2009Document16 pagesPlan To Payoff Lab Debt 2009Peter MartinNo ratings yet

- City of Oakland Budget Facts 2011Document6 pagesCity of Oakland Budget Facts 2011oaklocNo ratings yet

- OND Choeneck ING PLLC: MemorandumDocument17 pagesOND Choeneck ING PLLC: MemorandumrkarlinNo ratings yet

- Review of The Financial Plan of The City of New York: Report 10-2016Document36 pagesReview of The Financial Plan of The City of New York: Report 10-2016Nick ReismanNo ratings yet

- Miami Dade County, Florida Appropriations General Obligation Joint Criteria Miscellaneous Tax Moral ObligationDocument7 pagesMiami Dade County, Florida Appropriations General Obligation Joint Criteria Miscellaneous Tax Moral ObligationTim ElfrinkNo ratings yet

- Testimony of Christine C. Quinn, Speaker, New York City Council On The Governor's Executive Budget For State Fiscal Year 2011-2012Document4 pagesTestimony of Christine C. Quinn, Speaker, New York City Council On The Governor's Executive Budget For State Fiscal Year 2011-2012NYCCouncilNo ratings yet

- Quick Start Report - 2011-12 - Final 11.5.10Document50 pagesQuick Start Report - 2011-12 - Final 11.5.10New York SenateNo ratings yet

- Hamilton (County Of) OH: Aa3 Rating Applies To $124.7 Million of Go Debt, Including Current OfferingDocument5 pagesHamilton (County Of) OH: Aa3 Rating Applies To $124.7 Million of Go Debt, Including Current OfferingdeanNo ratings yet

- Pennsylvania Credit TrendsDocument27 pagesPennsylvania Credit TrendsPAindyNo ratings yet

- 2011 Facts&figuresDocument2 pages2011 Facts&figuresSandra WhalenNo ratings yet

- BiennialBudgetPresentation Monday121613Document12 pagesBiennialBudgetPresentation Monday121613normanomtNo ratings yet

- FISCAL YEAR 2012 BUDGET OF THE U.S. GOVERNMENT (Moving From Rescue To Rebuilding)Document10 pagesFISCAL YEAR 2012 BUDGET OF THE U.S. GOVERNMENT (Moving From Rescue To Rebuilding)Sarya Massri MubarakNo ratings yet

- OMB FY2011 Budget Overview 3pp 09-01-31Document3 pagesOMB FY2011 Budget Overview 3pp 09-01-31api-25909546No ratings yet

- 2017 HighlightsDocument152 pages2017 HighlightsFOX45No ratings yet

- Budget Response FY 2012 FINALDocument17 pagesBudget Response FY 2012 FINALCeleste KatzNo ratings yet

- Kansas, Tax Reform, and Economic Growth: Louis R. Woodhill March 1, 2012Document13 pagesKansas, Tax Reform, and Economic Growth: Louis R. Woodhill March 1, 2012api-34406941No ratings yet

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesNo ratings yet

- Executive Office of The President: Council of Economic AdvisersDocument14 pagesExecutive Office of The President: Council of Economic AdviserslosangelesNo ratings yet

- IDC Historic Rehabilitation Tax Credit Report - March 16, 2011Document16 pagesIDC Historic Rehabilitation Tax Credit Report - March 16, 2011robertharding22No ratings yet

- State of The State 2010Document43 pagesState of The State 2010CapitolConfidentialNo ratings yet

- Rep Paul Ryan On Obamas 2012 Budget and BeyondDocument19 pagesRep Paul Ryan On Obamas 2012 Budget and BeyondKim HedumNo ratings yet

- TIF in KCMODocument17 pagesTIF in KCMOJamie FerrisNo ratings yet

- Enacted Budget Report 2020-21Document22 pagesEnacted Budget Report 2020-21Luke ParsnowNo ratings yet

- 09.07.12 JPM Fiscal Cliff White PaperDocument16 pages09.07.12 JPM Fiscal Cliff White PaperRishi ShahNo ratings yet

- Bolivia's Economic Transformation: Macroeconomic Policies, Institutional Changes and ResultsDocument23 pagesBolivia's Economic Transformation: Macroeconomic Policies, Institutional Changes and ResultsCenter for Economic and Policy Research100% (1)

- Federal Government's Fiscal Health: An Unsustainable PathDocument12 pagesFederal Government's Fiscal Health: An Unsustainable PathJacquesVacaNo ratings yet

- Senate Budget Provides Tax Relief, Eliminates The GEA, Helps Small Business, and Invests in Infrastructure Throughout UpstateDocument3 pagesSenate Budget Provides Tax Relief, Eliminates The GEA, Helps Small Business, and Invests in Infrastructure Throughout UpstateGeorgeAmedoreNo ratings yet

- B.C. Budget 2012: HighlightsDocument4 pagesB.C. Budget 2012: Highlightsjoe7831No ratings yet

- Research DocumentDocument4 pagesResearch DocumentRachel E. Stassen-BergerNo ratings yet

- The Nation'S Fiscal Outlook: Balancing The Budget in The Near-TermDocument14 pagesThe Nation'S Fiscal Outlook: Balancing The Budget in The Near-Termapi-19777944No ratings yet

- The Job Recovery Package For The State of Arizona - : Executive SummaryDocument17 pagesThe Job Recovery Package For The State of Arizona - : Executive SummaryArizonaGuardianNo ratings yet

- 09-18-09 OSPB Letter To Agencies PDFDocument2 pages09-18-09 OSPB Letter To Agencies PDFArizonaMilitiaNo ratings yet

- Crowding Out What MattersDocument10 pagesCrowding Out What MattersZachary JanowskiNo ratings yet

- Nov 2010 Financial Plan InstructionsDocument2 pagesNov 2010 Financial Plan InstructionsCeleste KatzNo ratings yet

- The People's Budget Proposal For 2012 From The Largest US Congressional Caucus, The Progressive Caucus - The CPC FY2012 BudgetDocument12 pagesThe People's Budget Proposal For 2012 From The Largest US Congressional Caucus, The Progressive Caucus - The CPC FY2012 BudgetgonzodaveNo ratings yet

- CRFB Reacts To The Presidents FY 2012 Budget 0Document4 pagesCRFB Reacts To The Presidents FY 2012 Budget 0Committee For a Responsible Federal BudgetNo ratings yet

- Federal Deficits and DebtDocument10 pagesFederal Deficits and DebtSiddhantNo ratings yet

- CRFB Analysis of Jan 2011 BaselineDocument7 pagesCRFB Analysis of Jan 2011 BaselineCommittee For a Responsible Federal BudgetNo ratings yet

- FY2011 Budget Press ReleaseDocument3 pagesFY2011 Budget Press ReleaseCommittee For a Responsible Federal BudgetNo ratings yet

- China's New Growth Order: Andrew ShengDocument3 pagesChina's New Growth Order: Andrew Shengapi-274406520No ratings yet

- American Association of State Colleges & Universities: 2012 State Outlook (2011)Document8 pagesAmerican Association of State Colleges & Universities: 2012 State Outlook (2011)Melonie A. FullickNo ratings yet

- Burgum BudgetDocument3 pagesBurgum BudgetRob PortNo ratings yet

- 35-09 (State Budget Testimony)Document8 pages35-09 (State Budget Testimony)Zvnnyv1019No ratings yet

- CBOmemo Jan 04Document2 pagesCBOmemo Jan 04Committee For a Responsible Federal BudgetNo ratings yet

- MRIS Q2 2008 Trends in HousingDocument24 pagesMRIS Q2 2008 Trends in HousingbakwaasoramaNo ratings yet

- Gregoire's 2013-2015 Budget ProposalDocument5 pagesGregoire's 2013-2015 Budget ProposalMatt DriscollNo ratings yet

- Fiscal Year 2032 Budget HighlightsDocument30 pagesFiscal Year 2032 Budget HighlightsEddie O'BrienNo ratings yet

- Weekly Trends March 24, 2016Document4 pagesWeekly Trends March 24, 2016dpbasicNo ratings yet

- Issues and Answers: 2016 Session of The General AssemblyDocument4 pagesIssues and Answers: 2016 Session of The General Assemblyapi-320886833No ratings yet

- Rule ComplaintDocument21 pagesRule Complaintmatthewbrown76No ratings yet

- HFT Survey v1Document6 pagesHFT Survey v1matthewbrown76No ratings yet

- MassMutual LetterDocument4 pagesMassMutual Lettermatthewbrown76No ratings yet

- HFT Survey Letter 3.25.14Document1 pageHFT Survey Letter 3.25.14matthewbrown76No ratings yet

- Islamic Studies Ss 1 2nd Term Week 2Document6 pagesIslamic Studies Ss 1 2nd Term Week 2omo.alaze99No ratings yet

- StarBus - UTC Online 4.0Document1 pageStarBus - UTC Online 4.0Jitendra BhandariNo ratings yet

- FR Configurator2 Installation Manual: 1. Compatible Operating SystemDocument2 pagesFR Configurator2 Installation Manual: 1. Compatible Operating SystemRafael GagoNo ratings yet

- Neil Keenan History and Events TimelineDocument120 pagesNeil Keenan History and Events TimelineEric El BarbudoNo ratings yet

- GN12 WTIA Comparison of Welding Inspector Qualifications and CertificationsDocument4 pagesGN12 WTIA Comparison of Welding Inspector Qualifications and Certificationskarl0% (1)

- Pi SC4000 17-06 enDocument1 pagePi SC4000 17-06 enAlexandre RogerNo ratings yet

- DPC Cookie GuidanceDocument17 pagesDPC Cookie GuidanceshabiumerNo ratings yet

- 10-Cisa It Audit - BCP and DRPDocument27 pages10-Cisa It Audit - BCP and DRPHamza NaeemNo ratings yet

- Swap RevisedDocument36 pagesSwap RevisedrigilcolacoNo ratings yet

- Carbon Monoxide Safety GuideDocument2 pagesCarbon Monoxide Safety Guidewasim akramNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiraj PNo ratings yet

- Abhivyakti Yearbook 2019 20Document316 pagesAbhivyakti Yearbook 2019 20desaisarkarrajvardhanNo ratings yet

- Early Education of Rizal UsitaDocument13 pagesEarly Education of Rizal Usitajuriel velascoNo ratings yet

- Chapter06 ProblemsDocument2 pagesChapter06 ProblemsJesús Saracho Aguirre0% (1)

- SENSE AND SENSIBILITY ANALYSIS - OdtDocument6 pagesSENSE AND SENSIBILITY ANALYSIS - OdtannisaNo ratings yet

- Niva Bupa Health Insurance Company LimitedDocument1 pageNiva Bupa Health Insurance Company LimitedSujanNo ratings yet

- Scourge of The Sword Coast BookDocument85 pagesScourge of The Sword Coast BookDaniel Yasar86% (7)

- The Meaning of The CrossDocument3 pagesThe Meaning of The CrossJade Celestino100% (1)

- Criminal Law Ii Notes: Non-Fatal Offences Affecting Human BodyDocument43 pagesCriminal Law Ii Notes: Non-Fatal Offences Affecting Human BodyWai LingNo ratings yet

- Philippines Supreme Court Rules Surviving Brother May Seek Declaration of Deceased Brother's Null MarriageDocument9 pagesPhilippines Supreme Court Rules Surviving Brother May Seek Declaration of Deceased Brother's Null MarriageMarvin CeledioNo ratings yet

- Public Disorders: Art. 153 Revised Penal Code. Tumults and Other Disturbances of Public OrderDocument5 pagesPublic Disorders: Art. 153 Revised Penal Code. Tumults and Other Disturbances of Public Orderjeysonmacaraig100% (2)

- 0 PDFDocument1 page0 PDFIker Mack rodriguezNo ratings yet

- Business Cards Policy 01.04.18 Ver 2.0Document4 pagesBusiness Cards Policy 01.04.18 Ver 2.0Narayana ATLLCNo ratings yet

- UNM Findings Letter - FinalDocument37 pagesUNM Findings Letter - FinalAlbuquerque JournalNo ratings yet

- Love Is AliveDocument3 pagesLove Is Alivesteven harrisNo ratings yet

- Form OAF YTTaInternationalDocument5 pagesForm OAF YTTaInternationalmukul1saxena6364No ratings yet

- Fisker v. Aston MartinDocument29 pagesFisker v. Aston Martinballaban8685No ratings yet

- Camper ApplicationDocument4 pagesCamper ApplicationClaire WilkinsNo ratings yet

- Summary - Best BuyDocument4 pagesSummary - Best BuySonaliiiNo ratings yet

- History of Freemasonry Throughout The World Vol 6 R GouldDocument630 pagesHistory of Freemasonry Throughout The World Vol 6 R GouldVak AmrtaNo ratings yet

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobFrom EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobRating: 4.5 out of 5 stars4.5/5 (36)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthFrom Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthRating: 5 out of 5 stars5/5 (51)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverFrom EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverRating: 4.5 out of 5 stars4.5/5 (186)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceFrom EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceRating: 5 out of 5 stars5/5 (22)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersFrom EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersRating: 4.5 out of 5 stars4.5/5 (94)

- The 7 Habits of Highly Effective PeopleFrom EverandThe 7 Habits of Highly Effective PeopleRating: 4 out of 5 stars4/5 (2564)

- The First Minute: How to start conversations that get resultsFrom EverandThe First Minute: How to start conversations that get resultsRating: 4.5 out of 5 stars4.5/5 (55)

- Leadership Skills that Inspire Incredible ResultsFrom EverandLeadership Skills that Inspire Incredible ResultsRating: 4.5 out of 5 stars4.5/5 (11)

- Spark: How to Lead Yourself and Others to Greater SuccessFrom EverandSpark: How to Lead Yourself and Others to Greater SuccessRating: 4.5 out of 5 stars4.5/5 (130)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsFrom EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsRating: 4.5 out of 5 stars4.5/5 (52)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0No ratings yet

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsFrom EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsRating: 4.5 out of 5 stars4.5/5 (48)

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowFrom EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowRating: 4.5 out of 5 stars4.5/5 (27)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkFrom EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkRating: 4.5 out of 5 stars4.5/5 (12)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- The ONE Thing: The Surprisingly Simple Truth Behind Extraordinary Results: Key Takeaways, Summary & Analysis IncludedFrom EverandThe ONE Thing: The Surprisingly Simple Truth Behind Extraordinary Results: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (124)

- The Introverted Leader: Building on Your Quiet StrengthFrom EverandThe Introverted Leader: Building on Your Quiet StrengthRating: 4.5 out of 5 stars4.5/5 (35)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (410)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsFrom EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsRating: 4.5 out of 5 stars4.5/5 (27)

- Sustainability Management: Global Perspectives on Concepts, Instruments, and StakeholdersFrom EverandSustainability Management: Global Perspectives on Concepts, Instruments, and StakeholdersRating: 5 out of 5 stars5/5 (1)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionFrom Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionNo ratings yet