Professional Documents

Culture Documents

Business Optimization and Simulation: Computer Lab Module 4 Portfolio Optimization

Uploaded by

M.MSZOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Optimization and Simulation: Computer Lab Module 4 Portfolio Optimization

Uploaded by

M.MSZCopyright:

Available Formats

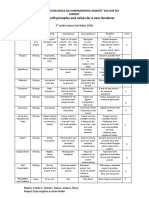

Bachelor in Business Administration - Year 2012/13

Business Optimization

and Simulation

C o m p u t e r L a b M o d u l e 4

P o r t f o l i o O p t i m i z a t i o n

1

Problem Description

Description:

An investment fund has 1 million euros that it wishes to invest

(during a year) in three assets:

A share index, gold or bonds

The historical returns associated to these three assets are:

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Index

Gold

Bonds

0,11 -0,09 0,04 0,14 0,19 -0,15 -0,27 0,37 0,24 -0,07 0,07 0,19 0,33 -0,05 0,22 0,23 0,06 0,32 0,19 0,05 0,09 -0,35 0,25 -0,1

0,11 0,08 -0,14 0,14 0,44 0,66 0,64 0 -0,22 0,18 0,31 0,59 0,99 -0,25 0,04 -0,11 -0,15 -0,12 0,16 0,22 -0,02 -0,12 0,22 0,13

0,05 0,07 0,07 0,04 0,04 0,07 0,08 0,06 0,05 0,05 0,07 0,1 0,11 0,15 0,11 0,09 0,1 0,08 0,06 0,05 0,06 0,04 0,03 0,04

Prepare a recommendation for the fund indicating the

Percentage of available funds to invest in each asset

2

Problem Description

The model:

Decision variables

x

1

= proportion to invest in shares

x

2

= proportion to invest in gold

x

3

= proportion to invest in bonds

Data treatment

From the data we compute the yearly returns of each asset:

where p

t

denotes the prices of the assets at the end of each year

From these values we obtain the average returns, r, and the

covariance matrix, S

3

Problem Description

The model:

Markowitz formulation:

where ! is the risk-aversion coefcient

Formulate and solve in Excel

4

Problem Solution

Solution:

If the fund manager is risk-neutral (! = 0), then

He/she should invest all their money in gold, the asset with the

largest expected return

The expected return for this asset is 16% (per year), while its

expected volatility is 31%

If the investor is very risk-averse (! very large), then

Most of the available funds should be invested in bonds (! 97%)

The remaining funds should be allocated to the share index (!

1%) and to gold (! 2%)

The expected return for this investment is 7.1%, while the

expected volatility is 2.8%

5

Problem Solution

Solution:

An intermediate investor (! = 5) should invest

! 10% in shares, ! 19% in gold, and ! 71% in bonds

The expected return for this investment is 8.8%, while the

expected volatility is 6.5%

Sensitivity:

When the estimates for the expected returns change slightly,

the composition of the portfolio is signicantly affected

Something similar, although on a smaller scale, can be observed

for the estimates of the volatility components

6

You might also like

- Econ161A Winter2015 ExamFinalDocument16 pagesEcon161A Winter2015 ExamFinalKensan Flipmagic Jr.No ratings yet

- Excel MPTDocument23 pagesExcel MPTBokonon22No ratings yet

- Final Market: Towards A New Hierarchy of Risks ?Document19 pagesFinal Market: Towards A New Hierarchy of Risks ?Morningstar FranceNo ratings yet

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHANo ratings yet

- Opalesque NewManagers July 2012Document45 pagesOpalesque NewManagers July 2012Peter UrbaniNo ratings yet

- Prmia 20111103 NyholmDocument24 pagesPrmia 20111103 NyholmLameuneNo ratings yet

- Investment ManagementDocument16 pagesInvestment ManagementMartin KukovskiNo ratings yet

- Bim JP 2011Q1Document7 pagesBim JP 2011Q1dekicisNo ratings yet

- CPIS FINAL Damyan Milushev N0664026Document13 pagesCPIS FINAL Damyan Milushev N0664026Kalin DrazhevNo ratings yet

- ACCT 2552 Week 11: Capital Expenditure DecisionsDocument16 pagesACCT 2552 Week 11: Capital Expenditure DecisionsjusthaveacoolNo ratings yet

- Mr. Madoff 'S Amazing Returns: An Analysis of The Split-Strike Conversion StrategyDocument30 pagesMr. Madoff 'S Amazing Returns: An Analysis of The Split-Strike Conversion StrategyDieter SostNo ratings yet

- Chapter 10: Risk and Return: Lessons From Market History: Corporate FinanceDocument18 pagesChapter 10: Risk and Return: Lessons From Market History: Corporate FinancePháp NguyễnNo ratings yet

- Exercices Risk Management-1Document6 pagesExercices Risk Management-1Anis Adinizam0% (1)

- SAPM Portfolio Construction and AnalysisDocument10 pagesSAPM Portfolio Construction and Analysiskartikay GulaniNo ratings yet

- Chapter 10: Risk and Return: Lessons From Market History: Corporate FinanceDocument15 pagesChapter 10: Risk and Return: Lessons From Market History: Corporate Financeirwan hermantriaNo ratings yet

- Opalesque New Managers May 2012Document51 pagesOpalesque New Managers May 2012Peter Urbani0% (1)

- Raghuram Rajan - Fin Devt and RiskDocument20 pagesRaghuram Rajan - Fin Devt and Riska65b66incNo ratings yet

- INA Resit Exam AnalysisDocument10 pagesINA Resit Exam AnalysisPhạm Minh QuânNo ratings yet

- Instructor: Course: Semester: Coursework 1 - SolutionsDocument7 pagesInstructor: Course: Semester: Coursework 1 - SolutionsZaur NazarliNo ratings yet

- 2013 Paper F9 QandA SampleDocument41 pages2013 Paper F9 QandA SampleSajid AliNo ratings yet

- Exam in International Finance, October 9, 2008Document3 pagesExam in International Finance, October 9, 2008ernetasNo ratings yet

- ACI DealingDocument210 pagesACI DealingDarshana Shasthri Nakandala0% (1)

- Banco Sabadell CEO Discusses Economic Outlook and Bank FundamentalsDocument35 pagesBanco Sabadell CEO Discusses Economic Outlook and Bank FundamentalsseyviarNo ratings yet

- 15.401 Finance TheoryDocument24 pages15.401 Finance TheoryMohamed ElmahgoubNo ratings yet

- A Simple Model of Interbank Trading With Tiered RemunerationDocument8 pagesA Simple Model of Interbank Trading With Tiered Remunerationmusyokabenjamin257No ratings yet

- Đ Bích Trâm 1632300129 HW Week 4Document8 pagesĐ Bích Trâm 1632300129 HW Week 4GuruBaluLeoKingNo ratings yet

- CapStrTheo&Policy Assignment PiyushDocument28 pagesCapStrTheo&Policy Assignment PiyushPiyush ChandakNo ratings yet

- Bafi3184 - Businee Finance: Case StudyDocument22 pagesBafi3184 - Businee Finance: Case Studytuan lyNo ratings yet

- CasesDocument45 pagesCasesMaggie ChenNo ratings yet

- Exam IA 27032012 - Example For BBDocument6 pagesExam IA 27032012 - Example For BBJerry K FloaterNo ratings yet

- FNCE 401v7 Assignment 1 InstructionsDocument8 pagesFNCE 401v7 Assignment 1 InstructionsDavid Eaton50% (2)

- Quiz 1 FI - PaperDocument4 pagesQuiz 1 FI - PaperZaheer Ahmed Swati100% (1)

- Portfolio Optimization Project 2 FIN 653 Professor Natalia Gershun Group Members: Reynold D'silva Hanxiang Tang Wen GuoDocument11 pagesPortfolio Optimization Project 2 FIN 653 Professor Natalia Gershun Group Members: Reynold D'silva Hanxiang Tang Wen GuoNiyati ShahNo ratings yet

- Aegon Gtaa PresDocument23 pagesAegon Gtaa PresRohit ChandraNo ratings yet

- Lecture 1.1 CQF 2010 - BDocument52 pagesLecture 1.1 CQF 2010 - BGuillaume PosticNo ratings yet

- Comparing Gold ETFs and Mutual FundsDocument11 pagesComparing Gold ETFs and Mutual FundsAkash PoddarNo ratings yet

- Finance 208 Seminar in Financial InstitutionsDocument56 pagesFinance 208 Seminar in Financial InstitutionsXyreen PazNo ratings yet

- Final Review Session SPR12RปDocument10 pagesFinal Review Session SPR12RปFight FionaNo ratings yet

- MAF2001 Midterm S2018Document13 pagesMAF2001 Midterm S2018Mishael DavidNo ratings yet

- 2201AFE VW Week 8 Some Lessons From Capital Market HistoryDocument47 pages2201AFE VW Week 8 Some Lessons From Capital Market HistoryVut BayNo ratings yet

- Credit Bank's FINTECHDocument4 pagesCredit Bank's FINTECHBritneyLovezCandyNo ratings yet

- Edu 2008 11 Fete ExamDocument22 pagesEdu 2008 11 Fete ExamcalvinkaiNo ratings yet

- Kieso 6Document54 pagesKieso 6noortiaNo ratings yet

- Instructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Document8 pagesInstructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Mathew SawyerNo ratings yet

- Optimize Steel Production CostsDocument8 pagesOptimize Steel Production CostsCameron BelangerNo ratings yet

- Hedge Funds: Quantitative InsightsFrom EverandHedge Funds: Quantitative InsightsRating: 3.5 out of 5 stars3.5/5 (3)

- CH 06Document54 pagesCH 06Gisilowati Dian PurnamaNo ratings yet

- Bank Group Ratios 2011-2012Document3 pagesBank Group Ratios 2011-2012adtyshkhrNo ratings yet

- Bubble Value at Risk: A Countercyclical Risk Management ApproachFrom EverandBubble Value at Risk: A Countercyclical Risk Management ApproachNo ratings yet

- Laboratory Work Nr. 3: Time Series and ForecastingDocument10 pagesLaboratory Work Nr. 3: Time Series and ForecastingNataliaNo ratings yet

- Strategic asset allocation, factor models, and model errorDocument4 pagesStrategic asset allocation, factor models, and model errorTram Gia PhatNo ratings yet

- BarCap Credit Research 110312Document32 pagesBarCap Credit Research 110312Henry WangNo ratings yet

- Investment Plan - Orion FIDocument35 pagesInvestment Plan - Orion FIelieNo ratings yet

- Opalesque New Managers March 2012Document37 pagesOpalesque New Managers March 2012Peter UrbaniNo ratings yet

- Spin Offs SGDocument72 pagesSpin Offs SGuser121821No ratings yet

- Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612Document20 pagesSelector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612SelectorFundNo ratings yet

- Corporate Finance NotesDocument29 pagesCorporate Finance NotesMikkel SchrøderNo ratings yet

- Australian Stock Market Drivers. A Graphical Analysis by Rock Star Consulting GroupDocument10 pagesAustralian Stock Market Drivers. A Graphical Analysis by Rock Star Consulting Groupbob panicNo ratings yet

- Tutorial 7 (A-B) (Week 8) SolutionsDocument6 pagesTutorial 7 (A-B) (Week 8) SolutionsmichaelsennidNo ratings yet

- Stroboscopy For Benign Laryngeal Pathology in Evidence Based Health CareDocument5 pagesStroboscopy For Benign Laryngeal Pathology in Evidence Based Health CareDoina RusuNo ratings yet

- Analyze and Design Sewer and Stormwater Systems with SewerGEMSDocument18 pagesAnalyze and Design Sewer and Stormwater Systems with SewerGEMSBoni ClydeNo ratings yet

- Mpu 2312Document15 pagesMpu 2312Sherly TanNo ratings yet

- SiloDocument7 pagesSiloMayr - GeroldingerNo ratings yet

- Nagina Cotton Mills Annual Report 2007Document44 pagesNagina Cotton Mills Annual Report 2007Sonia MukhtarNo ratings yet

- WWW - Commonsensemedia - OrgDocument3 pagesWWW - Commonsensemedia - Orgkbeik001No ratings yet

- Qad Quick StartDocument534 pagesQad Quick StartMahadev Subramani100% (1)

- Dermatology Study Guide 2023-IvDocument7 pagesDermatology Study Guide 2023-IvUnknown ManNo ratings yet

- Rubric 5th GradeDocument2 pagesRubric 5th GradeAlbert SantosNo ratings yet

- Physics Derived Units and Unit Prefixes Derived UnitDocument15 pagesPhysics Derived Units and Unit Prefixes Derived UnitJohnRenzoMolinarNo ratings yet

- DBMS Architecture FeaturesDocument30 pagesDBMS Architecture FeaturesFred BloggsNo ratings yet

- EN 12449 CuNi Pipe-2012Document47 pagesEN 12449 CuNi Pipe-2012DARYONO sudaryonoNo ratings yet

- IELTS Speaking Q&ADocument17 pagesIELTS Speaking Q&ABDApp Star100% (1)

- Ultra Slimpak G448-0002: Bridge Input Field Configurable IsolatorDocument4 pagesUltra Slimpak G448-0002: Bridge Input Field Configurable IsolatorVladimirNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYNo ratings yet

- Peran Dan Tugas Receptionist Pada Pt. Serim Indonesia: Disadur Oleh: Dra. Nani Nuraini Sarah MsiDocument19 pagesPeran Dan Tugas Receptionist Pada Pt. Serim Indonesia: Disadur Oleh: Dra. Nani Nuraini Sarah MsiCynthia HtbNo ratings yet

- Vector 4114NS Sis TDSDocument2 pagesVector 4114NS Sis TDSCaio OliveiraNo ratings yet

- Reading Comprehension Exercise, May 3rdDocument3 pagesReading Comprehension Exercise, May 3rdPalupi Salwa BerliantiNo ratings yet

- Three Comparison of Homoeopathic MedicinesDocument22 pagesThree Comparison of Homoeopathic MedicinesSayeed AhmadNo ratings yet

- Price List PPM TerbaruDocument7 pagesPrice List PPM TerbaruAvip HidayatNo ratings yet

- U2 All That You Can't Leave BehindDocument82 pagesU2 All That You Can't Leave BehindFranck UrsiniNo ratings yet

- Draft SemestralWorK Aircraft2Document7 pagesDraft SemestralWorK Aircraft2Filip SkultetyNo ratings yet

- Training Customer CareDocument6 pagesTraining Customer Careyahya sabilNo ratings yet

- Cab&Chaissis ElectricalDocument323 pagesCab&Chaissis Electricaltipo3331100% (13)

- History of Microfinance in NigeriaDocument9 pagesHistory of Microfinance in Nigeriahardmanperson100% (1)

- Revision Worksheet - Matrices and DeterminantsDocument2 pagesRevision Worksheet - Matrices and DeterminantsAryaNo ratings yet

- Listening Exercise 1Document1 pageListening Exercise 1Ma. Luiggie Teresita PerezNo ratings yet

- Assembly ModelingDocument222 pagesAssembly ModelingjdfdfererNo ratings yet

- H I ĐĂNG Assigment 3 1641Document17 pagesH I ĐĂNG Assigment 3 1641Huynh Ngoc Hai Dang (FGW DN)No ratings yet

- PHY210 Mechanism Ii and Thermal Physics Lab Report: Faculty of Applied Sciences Uitm Pahang (Jengka Campus)Document13 pagesPHY210 Mechanism Ii and Thermal Physics Lab Report: Faculty of Applied Sciences Uitm Pahang (Jengka Campus)Arissa SyaminaNo ratings yet