Professional Documents

Culture Documents

Accounting 364 Syllabus Holbrook

Uploaded by

Sinan Ali Bana0 ratings0% found this document useful (0 votes)

39 views6 pagesThis is a syllabus for Professor Holbrook at UT Austin. It is for Spring 2014.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is a syllabus for Professor Holbrook at UT Austin. It is for Spring 2014.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views6 pagesAccounting 364 Syllabus Holbrook

Uploaded by

Sinan Ali BanaThis is a syllabus for Professor Holbrook at UT Austin. It is for Spring 2014.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Course ACC 364, Fundamentals of Taxation

Professor Terri Holbrook, CPA, MST

Term Spring 2014

Meetings

Section #02719, MW 2:00-3:30pm, GSB 3.104

Section #02715, MW 3:30-5:00pm, UTC 1.116

Office and hours 4M.208; MW 5:00-6:00pm, or by appointment

Professor contact Terri.Holbrook@mccombs.utexas.edu phone 512-471-2888

Teaching Asst Jenny Wood j.wood.10880@gmail.com

Course

Description

This course is directed at upper level business students, as an introductory tax

course to expose them to a broad range of tax concepts. Emphasis will be on

Federal income taxation and the importance of taxation in the business decision-

making process.

Prerequisite ACC 311 or 311H, and 312 or 312H, with a grade of at least C- in each

Learning

Objectives

After completing this course, students should have:

1. An appreciation for the roll of taxes in todays economic environment, tax

policy, and the source of Federal tax law;

2. An understanding of tax planning in business decisions, and the impact of

taxes on various transactions;

3. Learned the basic terms, concepts and theories of federal taxation as

applied to property transactions;

4. An appreciation for the Federal tax rules that apply to various forms of

business organizations including C corporations and flow-through entities;

5. The ability to apply Federal tax rules and regulations to the individual

taxpayer, and to calculate an individuals Federal taxable income and tax

liability.

General Course Information

Course Policies

Grading Criteria

Students will be evaluated through a combination of a project, exams, and a

qualitative professionalism grade. Points will be allocated as follows:

First exam (200 points)

Second exam (200 points)

Final exam (250 points)

Individual tax return project (100 points)

Group presentation (150 points)

Professionalism; described below (100 points)

Total Points 1,000

Based upon this point system, final course grades will be assigned to reflect a

students mastery of the material as demonstrated by performance. Plus or

minus grading will be used for final course grades and I expect a normal

distribution around an average GPA of 3.3.

Exams

1. The exams will be administered during the dates and times specified in

this syllabus calendar. (Note that they are in the evening.) Please

reserve these times so that you do not have a conflict during a

scheduled exam. If a conflict exists due to another scheduled class or

exam, you must notify me and we will arrange a make-up time, in

advance of the regularly scheduled exam. In an extraordinary event

(death in immediate family, illness requiring hospitalization, etc.), contact

me before the exam and I will resolve on an individual basis.

2. All exams will test the material covered since the last exam; however,

due to the integrated nature of tax law, there may be a comprehensive

element to each exam. The format of the exams will be a combination of

problems, short answer, essay and multiple choice.

3. I will inform you in advance of the exam what materials you may bring

with you to use as resources. Always bring a calculator, but laptops,

tablets, cell phones or other PDA devices are not allowed in exams.

Required Text

and

supplemental

resources

Principles of Taxation for Business and Investment Planning, 2014 Edition, Sally

M. Jones and Shelley C. Rhoades-Catanach, (Irwin/McGraw-Hill)

Other required readings and resources to be posted on Canvas or provided to

students in class.

Outside Reading

and Homework

There is assigned reading in the text for each class meeting and you are

expected to come prepared to discuss the material.

Discussion questions and problems are assigned from the text at the end of

each covered chapter. These problems will not be collected or graded, but

are designed to assist you in learning the material that will be tested. The

solutions to these problems will be provided and I strongly suggest you take

advantage of these exercises to help you learn the material and prepare for

the exams.

Tax Return

A Federal Individual income tax return (Form 1040) will be assigned and

completed in groups. All information will be provided for you to prepare the

return, including a list of the forms and schedules required. These forms are

available at www.irs.gov in fill-out and print format. Tax preparation software is

NOT permitted.

Group

Presentation

Students will work in groups on a project that will be assigned mid-semester

and presented to the class at semester end. This project will incorporate tax

research, comprehension and analysis, critical thinking, technical writing,

creative presentation development and communication skills.

Professionalism

In calculating your final grade, 100 points will come from your display of

professionalism in my class. This discretionary evaluation will be based upon

the following:

Class attendance

Participating in class discussions

Evidence of preparedness by responding to class questions

Courteous consideration of classmates

Respecting classmates by not distracting others with your laptop, etc.

Turning off all cell-phones and PDAs

Contributing to the learning environment of the classroom

Class Attendance

You are expected to attend all classes and absences will be noted. It is in your

best interest to attend class and be prepared. If you must miss a class, it is

your responsibility to contact another student to get the lecture notes, class

handouts and any material that you miss.

Classroom

Citizenship

Please turn off all cell phones, PDAs and iPods during class. Laptops or

Tablets may be used only to take notes and if they are not distracting to others.

If I discover them being used for other purposes, you will not be permitted to

bring into class for the remainder of the semester.

Communication

I will communicate important information from time to time via announcements

on Canvas. Please check Canvas announcements regularly or elect to forward

these announcements to your email address.

Academic

Integrity

The McCombs School of Business has no tolerance for acts of scholastic

dishonesty. The responsibilities of both students and faculty with regard to

scholastic dishonesty are described in detail in the Policy Statement on

Scholastic Dishonesty for the McCombs School of Business:

By teaching this course, I have agreed to observe all of the faculty

responsibilities described in that document. By enrolling in this class, you have

agreed to observe all of the student responsibilities described in that document.

If the application of that Policy Statement to this class and its assignments is

unclear in any way, it is your responsibility to ask me for clarification. Policy on

Scholastic Dishonesty: Students who violate University rules on scholastic

dishonesty are subject to disciplinary penalties, including the possibility of

failure in the course an/or dismissal from the University. Since dishonesty

harms the individual, all students, and the integrity of the University, policies on

scholastic dishonesty will be strictly enforced. You should refer to the Student

Judicial Services website at http://deanofstudents.utexas.edu/sjs/ or the

General Information Catalog to access the official University policies and

procedures on scholastic dishonesty as well as further elaboration on what

constitutes scholastic dishonesty.

Student

Grievance

Procedures

If you have a complaint regarding your grade on an exam, please discuss with

me as soon as possible after the exam. I will not consider any grade changes if

brought to my attention more than three days after exams are returned to you.

If a student has a grade grievance on his/her final course grade, the student

must follow the specified procedures established by the University.

Drop/Add,

Withdrawal or

Incomplete policy

Please refer to the academic calendar for the last day to drop/add a course

without financial or academic penalty. It is the student's responsibility to handle

withdrawal requirements from any class. You must do the proper paperwork to

ensure that you will not receive a final grade of "F" in a course if you choose not

to attend the class once you are enrolled.

If a student fails to complete this course for illness or other reason deemed

adequate, I will use my discretion to assign a grade of I (Incomplete). This will

be handled on an individual basis.

Religious Holy

Days

Absences on religious holidays listed in the University calendar are recognized

as excused absences. Nevertheless, students are fully responsible for all

material presented during their absence. If such a religious holiday falls on an

exam date, please notify me as early as possible. I will handle on an individual

basis.

Students with

disabilities

The University of Texas at Austin provides upon request appropriate academic

accommodations for qualified students with disabilities. For more information,

contact the Office of the Dean of Students at 471-6259, 471-4641 TTY.

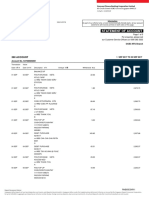

Course Schedule

*May change throughout semester with notice to class.

DATE TOPIC TEXT PROBLEMS

Overview of Taxation

Jan 13

Intro to Taxation; Types of

taxes, taxing jurisdictions

Ch 1 Ch 1Qu 4,7,10,13

AP 7,TPC 1

Jan 15

Tax policy; standards for a good

tax

Ch 2 Ch 2 Qu 3,7,14 AP

3, TPC

Jan 20

Martin Luther King Holiday

Jan 22

Taxes, cash flows and NPV;

fundamentals of tax planning

Ch 3 & 4 Ch 3 Qu 3,5 AP 3,

TPC 1,2

Ch 4 Qu 1,6,14 AP

3,4,14 TPC 4

Taxation of Property Transactions

Jan 27

Acquisition of property;

capitalized vs. expensed costs

Ch 7 Qu 8,13,16 AP 4,5

TPC 1,2

Jan 29

Cost recovery of capitalized

assets

Ch 7

Feb 3

Asset dispositions Ch 8 Qu 11 AP

1,6,7,13,20,32,35,44

Feb 5

Capital vs. ordinary character of

gain/loss

Ch 8

Feb 10

Nontaxable exchanges Ch 9 Qu 7,10,15 AP

1,6,12,18,26,

Feb 12

Exam 1 (6:00-8:30pm)

Chapters 1-4,7-9

Taxation of Individuals

Feb 17

Individual taxable income Ch 14 Qu 5,15 AP 6,15,29

TPC 1

Feb 19

Computing individual tax liability Ch 14

Feb 24

Compensation; fringe benefits;

stock options

Ch 15 Ch 15 Qu 5,9,11 AP

3,5,11,12,24

Feb 26

Retirement planning Ch 15

Mar 3

Taxation of financial assets Ch 16 Qu 1 AP

2,16,20,27,30,31,34

AP 36,38

Mar 5

Real estate; passive activities;

transfer tax system

Ch 16

Mar 10

Spring Break

Mar 12

Spring Break

Mar 17

Personal activities-income and

deductions

Ch 17 Qu 5,9 AP

2,4,5,16,28,

Mar 19

Personal expenses with tax

significance

Ch 17

Mar 24

Exam 2 (6:00-8:30pm)

Chaps 14-17

Income tax returns

due March 28

Taxation of Business Entities

Mar 26

Taxable income from business

operations

Ch 6 Qu 9,12,13 AP

3,5,6,10,30,32,33

Mar 31

Book vs. tax accounting Ch 6

April 2

Sole proprietorships;

employment taxes

Ch 10 Qu 8,9 AP

7,13,14,20,23,24

April 7

Flow-through entities Ch 10

April 9

Corporate taxable income and

corporate tax liability

Ch 11 AP 3,4,6,12,19, TPC

2

April 14

Choice of business entity Ch 12 Qu 3,11 AP 5,11

April 16

Multi-state and international tax

issues

Ch 13 Qu 2,3,11 AP

2,7,8,19,24

April 21

TBD

April 23

Group presentations

April 28

Group presentations

April 30

Group presentations

May 7-13

Final Exam date TBD

Chaps 6, 10-13

You might also like

- Acct. 203 SyllabusDocument6 pagesAcct. 203 SyllabuslinkatcalNo ratings yet

- Federal Taxation: ACCT 456 Fall Semester 2014Document4 pagesFederal Taxation: ACCT 456 Fall Semester 2014jyraEB9390No ratings yet

- UT Dallas Syllabus For Aim2301.003.11s Taught by Todd Kravet (tdk091000)Document6 pagesUT Dallas Syllabus For Aim2301.003.11s Taught by Todd Kravet (tdk091000)UT Dallas Provost's Technology GroupNo ratings yet

- 2050spring15 SyllabusDocument7 pages2050spring15 SyllabusJimNo ratings yet

- RE 4500 SyllabusDocument5 pagesRE 4500 SyllabusBob MillerNo ratings yet

- UT Dallas Syllabus For Acct6332.501.11f Taught by Meredith Xu (mlx110030)Document7 pagesUT Dallas Syllabus For Acct6332.501.11f Taught by Meredith Xu (mlx110030)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Acct6352.ppa.11f Taught by Steven Solcher (sjs107020)Document11 pagesUT Dallas Syllabus For Acct6352.ppa.11f Taught by Steven Solcher (sjs107020)UT Dallas Provost's Technology GroupNo ratings yet

- Financial Statements SyllabusFall2016Document6 pagesFinancial Statements SyllabusFall2016MD PrasetyoNo ratings yet

- ACCY 312 Syllabus Spring-2020Document8 pagesACCY 312 Syllabus Spring-2020dsfsdfsdNo ratings yet

- CJ 101 Introduction to Criminal Justice Course SyllabusDocument7 pagesCJ 101 Introduction to Criminal Justice Course SyllabusAanyh MrhmNo ratings yet

- Bsad60pencakfall2021 - TaggedDocument8 pagesBsad60pencakfall2021 - Taggedgia chaseNo ratings yet

- 2701 E Isabelle DianeDocument6 pages2701 E Isabelle DianeRachit KauraNo ratings yet

- Butler Personal Finance SyllabusDocument3 pagesButler Personal Finance Syllabuss516680No ratings yet

- Econ 306 SyllabusDocument6 pagesEcon 306 SyllabusVen DezelNo ratings yet

- Brain and Behavior (PSYC 3322-002)Document4 pagesBrain and Behavior (PSYC 3322-002)MalathisekharNo ratings yet

- Syllabus - Principles of Business (Bmgt-101-019) : Text: Understanding Business, Nickels, Mchugh, Mchugh, 9Document9 pagesSyllabus - Principles of Business (Bmgt-101-019) : Text: Understanding Business, Nickels, Mchugh, Mchugh, 9Herica PereiraNo ratings yet

- ECO 2013 Principles of Macroeconomics (3 cr.) Fall 2020Document5 pagesECO 2013 Principles of Macroeconomics (3 cr.) Fall 2020Paul basilyousNo ratings yet

- Finance 3040 Syllabus Spring 2020Document5 pagesFinance 3040 Syllabus Spring 2020ShowdwnNo ratings yet

- Economics 2150ADocument6 pagesEconomics 2150Akidz-pcNo ratings yet

- UT Dallas Syllabus For Ba3360.5e1.11f Taught by Monica Brussolo (Meb049000)Document6 pagesUT Dallas Syllabus For Ba3360.5e1.11f Taught by Monica Brussolo (Meb049000)UT Dallas Provost's Technology GroupNo ratings yet

- Debt Instruments & Markets SyllabusDocument6 pagesDebt Instruments & Markets SyllabustnmartistNo ratings yet

- Edition, Wirtz, Chew, and Lovelock, PearsonDocument3 pagesEdition, Wirtz, Chew, and Lovelock, PearsonmanagementclassNo ratings yet

- ACC 312 - Fundamentals of Managerial Accounting - AtiaseFDocument6 pagesACC 312 - Fundamentals of Managerial Accounting - AtiaseFGul AsfNo ratings yet

- CS 2305 - UT Dallas - SyllabusDocument7 pagesCS 2305 - UT Dallas - SyllabusTrí Minh CaoNo ratings yet

- Course SyllabusDocument9 pagesCourse SyllabusBen HesseNo ratings yet

- Econ 201: Principles of MacroeconomicsDocument7 pagesEcon 201: Principles of MacroeconomicsAitizaz UmerNo ratings yet

- Bus 345 Ab1 Course Outline Winter (Tue CRN 10214) - K LownieDocument4 pagesBus 345 Ab1 Course Outline Winter (Tue CRN 10214) - K LownieGunni GillNo ratings yet

- FINE4050 - Winter2016 COurse OutlineDocument11 pagesFINE4050 - Winter2016 COurse OutlineChiranNo ratings yet

- Syllabus 2016Document6 pagesSyllabus 2016Suryakant Kaushik0% (1)

- ECMC40 Syllabus 2012 Lec 01Document5 pagesECMC40 Syllabus 2012 Lec 01Adele BreakNo ratings yet

- ACC 373 - Introduction To Auditing and Assurance Services PDFDocument8 pagesACC 373 - Introduction To Auditing and Assurance Services PDFAlex ChanNo ratings yet

- Syllabus ACC 359/ ACC 387.1 Managerial/Cost Accounting Spring 2011Document5 pagesSyllabus ACC 359/ ACC 387.1 Managerial/Cost Accounting Spring 2011Dharma Triadi YunusNo ratings yet

- Acctg 103 Syllabus - 2014Document8 pagesAcctg 103 Syllabus - 2014patelp4026No ratings yet

- SyllabusDocument3 pagesSyllabusKat OskoueiNo ratings yet

- ACCT 372 - Syllabus - Fall 2017upateoct10sep9tup-1Document11 pagesACCT 372 - Syllabus - Fall 2017upateoct10sep9tup-1Alex ChanNo ratings yet

- MBA 8135 - Corporate Finance: Course Syllabus Spring Semester 2011Document8 pagesMBA 8135 - Corporate Finance: Course Syllabus Spring Semester 2011lilbouyinNo ratings yet

- A401 - 02 - Fall 2016Document6 pagesA401 - 02 - Fall 2016Josh ChangNo ratings yet

- Econometrics Course SyllabusDocument6 pagesEconometrics Course Syllabusnguyen_tridung2No ratings yet

- FIN 370 201 Fall 2016 Syllabi - LUDocument5 pagesFIN 370 201 Fall 2016 Syllabi - LUdrhugh3891No ratings yet

- University of Alberta School of Business Department of Accounting, Operations and Information SystemsDocument6 pagesUniversity of Alberta School of Business Department of Accounting, Operations and Information SystemsBryce CoNo ratings yet

- BA2300 Syl W14 003Document7 pagesBA2300 Syl W14 003boywonder1990No ratings yet

- FINA 365 Fall 2016 SyllabusDocument6 pagesFINA 365 Fall 2016 SyllabusKent NguyenNo ratings yet

- UT Dallas Syllabus For Acct6365.501.11f Taught by Samuel Cheng (sxc109021)Document6 pagesUT Dallas Syllabus For Acct6365.501.11f Taught by Samuel Cheng (sxc109021)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Chem2323.002.09f Taught by Jung-Mo Ahn (Jxa041100)Document6 pagesUT Dallas Syllabus For Chem2323.002.09f Taught by Jung-Mo Ahn (Jxa041100)UT Dallas Provost's Technology GroupNo ratings yet

- Act 474 PDFDocument8 pagesAct 474 PDFAlex ChanNo ratings yet

- Rutgers Microeconomics Course OverviewDocument5 pagesRutgers Microeconomics Course OverviewAhmed MahmoudNo ratings yet

- Learn Financial Accounting BasicsDocument3 pagesLearn Financial Accounting BasicsirquadriNo ratings yet

- UT Dallas Syllabus For Engr3300.002.11f Taught by Jung Lee (jls032000)Document5 pagesUT Dallas Syllabus For Engr3300.002.11f Taught by Jung Lee (jls032000)UT Dallas Provost's Technology GroupNo ratings yet

- Accounting Information Systems AC 330 Section A Course Syllabus Spring 2012Document6 pagesAccounting Information Systems AC 330 Section A Course Syllabus Spring 2012FikaCharistaNo ratings yet

- Course Syllabus Business Law 280: Business Law I Professor Dosanjh Spring 2004Document7 pagesCourse Syllabus Business Law 280: Business Law I Professor Dosanjh Spring 2004Kyle MagallanesNo ratings yet

- Cisa 101 Summer SyllabusDocument5 pagesCisa 101 Summer SyllabusJenni Davis LundNo ratings yet

- RSM437H Course OutlineDocument10 pagesRSM437H Course OutlineJoe BobNo ratings yet

- Instructor: Office Hours: by Contact Info: Hmclary@vcu - Edu Class Day & Time: Monday at 7:00 PM ClassroomDocument8 pagesInstructor: Office Hours: by Contact Info: Hmclary@vcu - Edu Class Day & Time: Monday at 7:00 PM ClassroomMorgan AllenNo ratings yet

- UT Dallas Syllabus For cs3345.002.11f Taught by Greg Ozbirn (Ozbirn)Document9 pagesUT Dallas Syllabus For cs3345.002.11f Taught by Greg Ozbirn (Ozbirn)UT Dallas Provost's Technology GroupNo ratings yet

- Fin 320 SyllabusDocument12 pagesFin 320 Syllabusnicholas FARTINGSONNo ratings yet

- Syllabus - Math For Business - BBus - Nguyen Thi Thu Van PDFDocument7 pagesSyllabus - Math For Business - BBus - Nguyen Thi Thu Van PDFMai TrầnNo ratings yet

- Cloud Computing SyllabusDocument5 pagesCloud Computing SyllabuskrishnanandNo ratings yet

- Head Clerk (Surrogate): Passbooks Study GuideFrom EverandHead Clerk (Surrogate): Passbooks Study GuideNo ratings yet

- A Real Mom's Guide To Saving Money on College TuitionFrom EverandA Real Mom's Guide To Saving Money on College TuitionRating: 5 out of 5 stars5/5 (1)

- REPORT-KUBURA ALIDU - EditedDocument1 pageREPORT-KUBURA ALIDU - Editeddelimacassie1190No ratings yet

- Bab 3 Tingkatan 5MATEMATIK PENGGUNAAN INSURANSDocument14 pagesBab 3 Tingkatan 5MATEMATIK PENGGUNAAN INSURANSGobi KrishnanNo ratings yet

- CBE History Dolar Exchange Rate July-Dec-2019Document15 pagesCBE History Dolar Exchange Rate July-Dec-2019Abebe GebeyehuNo ratings yet

- NN2919750178302 InvoiceDocument2 pagesNN2919750178302 InvoiceSohaib DurraniNo ratings yet

- Transaction HistoryDocument7 pagesTransaction Historychubbygamer02No ratings yet

- Taxation of Hire Purchase Suspensive Sale TransactionsDocument30 pagesTaxation of Hire Purchase Suspensive Sale TransactionsJeremiah NcubeNo ratings yet

- CT Ant - Approved Quotation Repiping of WaterlineDocument1 pageCT Ant - Approved Quotation Repiping of Waterlinejohn philip OcapanNo ratings yet

- Application For Registration: Taxpayer Identification Number (TIN)Document4 pagesApplication For Registration: Taxpayer Identification Number (TIN)Alex RespicioNo ratings yet

- SOA-0000000001180nnbbs87 - 1680000202603 - ITEMIZED (1) - UnlockedDocument3 pagesSOA-0000000001180nnbbs87 - 1680000202603 - ITEMIZED (1) - UnlockedWarren David SabarezNo ratings yet

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- Payslip 2 2023-1Document1 pagePayslip 2 2023-1Cybe CityNo ratings yet

- Download full Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual pdfDocument54 pagesDownload full Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual pdfstephen.crawford258100% (2)

- RptKnowyourPayment PDFDocument2 pagesRptKnowyourPayment PDFrani sharmaNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- 2023 11 24 - StatementDocument16 pages2023 11 24 - Statementdemiralexandru94No ratings yet

- Aid ListDocument8 pagesAid ListseraphinetruthNo ratings yet

- Classified As Internal Use OnlyDocument2 pagesClassified As Internal Use OnlyIbukunNo ratings yet

- NITT Student Mess Account StatementDocument2 pagesNITT Student Mess Account StatementSabari StunnerNo ratings yet

- MIDTERM Long Quiz - Theories Answer KeyDocument2 pagesMIDTERM Long Quiz - Theories Answer KeyKristine NunagNo ratings yet

- Special Journals TemplateDocument6 pagesSpecial Journals TemplateJoana TrinidadNo ratings yet

- 360 ACCOUNT-6001-Sep-17Document6 pages360 ACCOUNT-6001-Sep-17Pohn Myint HanNo ratings yet

- 020 Island Power Corp V CirDocument2 pages020 Island Power Corp V CirNorman ManaloNo ratings yet

- Net Pay 25,021.51: Confidential Payslip Fold LineDocument1 pageNet Pay 25,021.51: Confidential Payslip Fold LineTumelo MoloiNo ratings yet

- Final Attendee ListDocument7 pagesFinal Attendee ListMelissa Herald NewmanNo ratings yet

- Irc ViDocument265 pagesIrc VihenrydpsinagaNo ratings yet

- 15k BTC DorksDocument256 pages15k BTC DorksRos Diana55% (11)

- SEB-ISO-20022 Specification ENDocument76 pagesSEB-ISO-20022 Specification ENPerla GonzalezNo ratings yet

- Portfolio Statement for Elasto IndiaDocument17 pagesPortfolio Statement for Elasto IndiaAmit KumarNo ratings yet

- Accrual Basis Accounting vs. Cash Basis AccountingDocument2 pagesAccrual Basis Accounting vs. Cash Basis AccountingMukandionaNo ratings yet

- Business and Transfer Taxation Chapter 9 Discussion Questions AnswerDocument3 pagesBusiness and Transfer Taxation Chapter 9 Discussion Questions AnswerKarla Faye LagangNo ratings yet