Professional Documents

Culture Documents

Employee Benefits Final

Uploaded by

Kunal TejwaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Benefits Final

Uploaded by

Kunal TejwaniCopyright:

Available Formats

Human Resource

Management

Submitted By

Priyanka Punjabi

Sunita Punjabi

Rahul Rane

Dannis SAyyed

Omkar Sawant

Mihir Shah

MMS - C

13-Mar-14

Human Resource Management -

Employee Benefits

Human Resource Management - Employee Benefits

MET Institute Of Management Page 2

Human Resource Management - Employee Benefits

MET Institute Of Management Page 3

Company overview

Ashok Piramal Group of Companies

Ashok Piramal Group has a presence in diverse business sectors, from textiles to real

estate and engineering to entertainment. Each company operates independently and

has its own set of directors and shareholders. Every company in the Group while

working towards their individual objectives, shares the Group's collective vision and

philosophy. The groups success lies in creating niche models that ensures each

company features among the top 5 in the industry they operate.

Morarjee Textiles is a leader in premium shirting and high fashion printed fabric in the

domestic as well as global arena and boasts of all the leading apparel brands as its

clients.The real estate company, Peninsula Land Ltd was the first company in Mumbai

to develop a cotton textile mill land after it was opened up for development. This

development changed the face of Central Mumbai and transformed it into the most

preferred business district.

The engineering business under PMP Auto Components Private Ltd includes auto

components and cutting tools business. Two major acquisitions in Europe in the last two

years in the wiping systems, have catapulted PMP Autos growth and today it

commands a 7% of the market share in Europe in the wiping systems business.

The Group is on an accelerated growth path and in keeping with its vision, promises to

create maximum value for its shareholders.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 4

Vision:

Investing in Growth Globally.

We will touch the lives of at least one in five people on the globe, thereby creating

enormous value for all our stakeholders.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 5

Introduction

Employee benefits include various types of non-wage compensation provided

to employees in addition to their normal wages or salaries. In instances where an

employee exchanges (cash) wages for some other form of benefit is generally referred

to as a 'salary packaging' or 'salary exchange' arrangement. In most countries, most

kinds of employee benefits are taxable to at least some degree.

Examples of these benefits include: housing (employer-provided or employer-paid),

group insurance (health, dental, life etc.), disability income protection, retirement

benefits, daycare, tuition reimbursement, sick leave, vacation (paid and non-

paid), social security, profit sharing, funding of education, and other specialized

benefits.

The purpose of employee benefits is to increase the economic security of staff

members, and in doing so, improve worker retention across the organization. As such, it

is one component of reward management.

The term perks is often used colloquially to refer to those benefits of a more

discretionary nature. Often, perks are given to employees who are doing notably well

and/or have seniority. Common perks are take-home vehicles, hotel stays, free

refreshments, leisure activities on work time (golf, etc.), stationery, allowances for lunch,

andwhen multiple choices existfirst choice of such things as job assignments and

vacation scheduling. They may also be given first chance at job promotions when

vacancies exist.

Once you have great employees on board, how do you keep them from jumping ship?

One way is by offering a good benefits package.

Many small-business owners mistakenly believe they cannot afford to offer benefits. But

while going without benefits may boost your bottom line in the short run, than penny-

wise philosophy could strangle your business's chances for long-term prosperity. "There

are certain benefits good employees feel they must have," says Ray Silverstein, founder

of PRO, President's Resource Organization, a small-business advisory network.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 6

Heading the list of must-have benefits is medical insurance, but many job applicants

also demand a retirement plan, disability insurance and more. Tell these applicants no

benefits are offered, and often top-flight candidates will head for the door.

The positive side to this coin: Offer the right benefit, and your business may just jump-

start its growth. "Give employees the benefits they value, and they'll be more satisfied,

miss fewer workdays, be less likely to quit, and have higher commitment to meeting the

company's goals," says Joe Lineberry, a senior vice president at Aon Consulting, a

human resources consulting firm. "The research shows that when employees feel their

benefits needs are satisfied, they're more productive."

Importance of employee benefits:

Helps in retaining performing employees

Increases the goodwill of the firm in the markets

Improves the ability of the firm to attract new talent

Reduced labor turnover

Motivates the employees to give their best for the organization

Helps in improving the various aspects of the employee life

The company ensures that the employees are always motivated

Human Resource Management - Employee Benefits

MET Institute Of Management Page 7

Various types of Employee Benefits

Contingent and Deferred

Benefits

Payment for Time Not

worked

Other Benefits

Pension Maternity Leave Travel Allowances

Life insurance Child Care Leave Company Car and

Subsidies

Health Insurance Sick Leave Employee meal allowances

Tuition aid Benefit Casual Leave Child care facilities

Suggestion Award Earned Leave Residential allowances and

facilities

Provident fund Quarantine Medical Checkups

Disability Insurance Half Time Financial Assistance

Gratuity Study Leave Education

Human Resource Management - Employee Benefits

MET Institute Of Management Page 8

Leaves and Holidays

The employees of any government, non-government or private organization are entitled

to certain types of leaves during their work tenures to help them maintain a proper work-

life balance. Various studies have emphasized the importance of improving the balance

between work and life balance in the daily life for both the employers and employees. It

helps not only to ensure health and happiness for the people but also to help build

productive businesses.

The employees can utilize various types of leaves to take time out for activities that are

important to them including spending time with friends and family, taking part in sports

and recreation, volunteering, or even undertaking further study among others. Let us

have a look at the various types of leaves that employees can avail in India under

different circumstances.

1. Holidays: These are the leaves that are always paid for and no deductions are

made from the salary of the employees. There are the following types of holidays in

India:

National Holidays: These are the fixed holidays that we have in India on the 26th

of January, 15th of August, and 2nd of October every year.

Weekly Holidays: There are either one or two weekly holidays at the end of the

week for all the employees depending upon the organizational policy.

Festivals: Various religious and regional festivals also account for holidays in

India. There are very few festivals like Christmas, which fall on the same date

every year. However, the exact dates of some festivals depend on the lunar

calendar and are subject to change on the sighting of the moon. Each company

can devise its own policy regarding how many festivals it will give a paid leave for,

every year.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 9

According to the Factories Act, 1948, an adult worker shall have a weekly paid

holiday as per the terms of the company

2. Earned Leave or Privilege Leave: The type of leave which the employees earn

as they work for an organisation for a specified number of days. The privilege leave is

sanctioned to the employees without any salary deductions. This type of leave requires

prior approval from the employer except in cases of emergency. The employees are

usually allowed to accumulate their privilege leaves and even encash them in case they

are not availed. The number of privilege leaves admissible may vary on the basis of

industry and region.

3. Casual Leave: The type of leave that is granted for short durations and can

ordinarily be taken with prior information to the employer except in cases when

informing the employer is not possible. Across industries and organizations, there are

different rules for the number of days that casual leaves can be taken at a stretch

varying between three to five to seven days. As a rule, official holidays are not counted

when calculating the number of casual leaves if they fall during the period of casual

leave.

4. Sick Leave or Medical Leave: An employee can call in sick if he is not in a state

to come to office for work. Usually, an employee is entitled to sick leave only after a

stipulated period of employment in an organization. The number of sick leaves

permissible may vary from organization to organization and as a matter of fact, no prior

intimation is required for availing this type of leave. A medical certificate from a

registered medical practitioner may be required to testify the sickness if the sick leave is

being extended for a long period of time.

5. Maternity Leave: This provision is especially available for those women

employees who plan to have a baby. The duration of paid maternity leave is 26 months

and this can be further extended with 16 months of unpaid leave. No deductions can be

Human Resource Management - Employee Benefits

MET Institute Of Management Page 10

made from the leave account of the female employee. This type of leave can also be

taken in case of miscarriage or abortion but the leave limit in such cases is shorter.

6. Quarantine Leave: This type of leave is granted to an employee only if there is

an infectious disease in the family or household of the employee that can be hazardous

to the health of other people in the organization.

7. Half Pay Leave: Generally available to government servants only, this type of

leave is credited to the leave account only after the completion of one year of service in

the organization. As the name suggests, the employee is entitled to half of a days

salary during such a leave.

8. Study Leave or Sabbatical Leave: An employee may be granted a study or

sabbatical leave to enable him to update his knowledge and experience in a way that he

will be of greater use to the Institute after re-joining.

Apart from the various leaves mentioned above, certain sectors and industries also

have provisions for commuted leave, leave not due, paternity leave, extraordinary leave,

childcare leave, hospital leave, special disability leave, and child adoption leave. The

duration of all these types of leaves and the circumstances under which they become

due are subject to specific company policies.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 11

Health & Safety

Employees safety and health should be taken care of in order to protect the employee

against accidents, unhealthy working conditions and to protect workers capacity. In

India, the Factories Act 1948, stipulated certain requirements regarding working

conditions with a view to provide a safe working environment. These provisions relate to

cleanliness, disposal of waste and effluents, ventilation and temperature, dust and

fume, artificial humidification, overcrowding, lighting, drinking water, public utility and

spittoons. Provisions relating to safety measures include fencing of machinery, work on

or near machinery in motion, employment of young persons on dangerous machines,

striking gear and devices for cutting off power, self-acting machines, easing of new

machinery, probation of employment of women and children near cotton openers, hoist

and lifts, explosive or inflammable dust, gas, etc. Precautions in case of fire, power to

require specifications of defective parts to test of stability, safety of buildings and

machinery, etc.

Medical Checkups : organizations provide free medical checkups to their

employees in various fields like complete medical checkup, dental checkup,

cholesterol and blood pressure check etc.

Yoga : Companies provide training in yoga to the employees so that they can

handle the stress involved the job effectively. This is typically done for employees

in high pressure jobs like sales and customer grievance.

Gym and Spa : Many companies have inhouse gym for the staff members where

they can exercise and stay fit if it is difficult for them to go to a gym outside the

office hours. Many companies also provide spa facilities to the employee to help

them relieve stress and tension

Maternity Assistance: Certain companies provide special gynecologist

assistance to the pregnant employees during their maternity leaves. They ensure

that the health of the employee and the child is safe. This may even extend

beyond the birth of the child through regular health checks

Human Resource Management - Employee Benefits

MET Institute Of Management Page 12

Insurance

While all employees serve an important function in the businesses where they work,

certain key employees are vital to business success. Businesses often purchase

insurance to cover the loss of these employees. Loss can occur as a result of death,

disability or certain illnesses. Business owners think of purchasing key employee

insurance as a type of risk management. Banks often require businesses purchase key

employee insurance before granting loans. If the business loses the key employee, it

may not recover the loan money.

Life Insurance:

Key employees contribute talent and knowledge to their companies that do not have a

clear monetary value. Because of this, insurance companies employ one of three

methods for determining the amount of life insurance necessary to cover a key

employee in the event that he dies. The replacement cost method takes into account

the total cost of replacing the employee, including costs associated with decreased

profits, hiring and training, and his current salary. The contribution to earnings method

determines the percentage this key employee contributes to gross earnings of the

business. The simplest method, called the multiples of income method, simply multiplies

the employees current salary five or seven times. If his salary were $200,000 per year,

the business would need to purchase $1 million of life insurance to cover him.

Disability Insurance:

When a key employee becomes disabled due to injury or other traumatic event and

cannot work, the business is likely to suffer. Key employee disability insurance covers

expenses, such as rent or mortgage on the business, employee salaries and benefits,

utilities, taxes, legal fees, maintenance fees. The coverage lasts 12 to 18 months;

enough time to locate, hire and train a replacement. Insurance companies determine

the amount of monthly coverage by analyzing the direct monetary benefit the employee

Human Resource Management - Employee Benefits

MET Institute Of Management Page 13

brings the company and the cost to find a replacement.

Health Insurance:

Many businesses purchase health insurance for all employees, but smaller start-up

businesses, or those with tight budgets, may only be able to afford health insurance for

key employees. Business owners may wish to purchase specialized health insurance

for a key employee that covers only catastrophic illness. This type of insurance does not

cover preventive health doctor visits, prescriptions or other conditions that traditional

insurance covers, so may cost less. It only covers devastating illnesses, such as

cancer, AIDS and other conditions that require very expensive treatments. Business

owners may still choose to purchase traditional insurance for all employees, but add this

catastrophic illness insurance for key employees for added risk management.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 14

Retirement Benifits

Pension:

The minimum eligibility period for receipt of pension is 10 years. A Central Government

servant retiring in accordance with the Pension Rules is entitled to receive

superannuation pension on completion of at least 10 years of qualifying service.

In the case of Family Pension the widow is eligible to receive pension on death of her

spouse after completion of one year of continuous service or before even completion of

one year if the Government servant had been examined by the appropriate Medical

Authority and declared fit for Government service.

W.e.f 1.1.2006, Pension is calculated with reference to average emoluments namely,

the average of the basic pay drawn during the last 10 months of the service or last

basic pay drawn whichever is beneficial. Full pension with 10/20 years of qualifying

service is 50% of the average emoluments or last basic pay drawn whichever is

beneficial. Before 1.1.2006, for qualifying service of less than 33 years, amount of

pension was proportionate to the actual qualifying service broken into completed half-

year periods. For example, if total qualifying service is 30 years and 4 months (i.e. 61

half-year periods), pension will be calculated as under:-

Pension amount = R/2(X)61/66

where R represents average reckonable emoluments for last 10 months of qualifying

service or the last pay drawn as opted by the govt servant.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 15

Minimum pension presently is Rs. 3500 per month. Maximum limit on pension is 50% of

the highest pay in the Government of India (presently Rs. 45,000) per month. Pension

is payable up to and including the date of death.

Commutation of Pension

A Central Government servant has an option to commute a portion of pension, not

exceeding 40% of it, into a lump sum payment with effect from 1.1.1996. No medical

examination is required if the option is exercised within one year of retirement. If the

option is exercised after expiry of one year, he/she will have to under go medical

examination by the specified competent authority.

Lump sum payable is calculated with reference to the Commutation Table constructed

on an actuarial basis. The monthly pension will stand reduced by the portion

commuted and the commuted portion will be restored on the expiry of 15 years from the

date of receipt of the commuted value of pension. Dearness Relief, however, will

continue to be calculated on the basis of the original pension (i.e. without reduction of

commuted portion).

The formula for arriving for commuted value of Pension (CVP) is

CVP = 40 % (X) Commutation factor* (X)12

* The commutation factor will be with reference to age next birthday on the date on

which commutation becomes absolute as per the New Table as Annexure to this

Deptt's O.M. No. 38/37/08- P&PW(A) dated 2.9.2008

Death/Retirement Gratuity

Retirement Gratuity:

Human Resource Management - Employee Benefits

MET Institute Of Management Page 16

This is payable to the retiring Government servant. A minimum of 5 years qualifying

service and eligibility to receive service gratuity/pension is essential to get this one time

lump sum benefit. Retirement gratuity is calculated @ 1/4th of a months Basic Pay plus

Dearness Allowance drawn before retirement for each completed six monthly period of

qualifying service. There is no minimum limit for the amount of gratuity. The retirement

gratuity payable is 16 times the Basic Pay, subject to a maximum of Rs. 10 lakhs.

Death Gratuity:

This is a one-time lump sum benefit payable to the widow/widower or the nominee of a

permanent or a quasi-permanent or a temporary Government servant, including CPF

beneficiaries, dying in harness. There is no stipulation in regard to any minimum length

of service rendered by the deceased employee. Entitlement of death gratuity is

regulated as under:

Qualifying Service Rate

Less than one year 2 times of basic pay

One year or more but less than 5 years 6 times of basic pay

5 years or more but less than 20 years 12 times of basic pay

20 years of more Half of emoluments for every completed 6

monthly period of qualifying service

subject to a maximum of 33 times of

emoluments.

Maximum amount of Death Gratuity admissible is Rs. 10 lakhs w.e.f. 1.1.2006

Service Gratuity:

A retiring Government servant will be entitled to receive service gratuity (and not

Human Resource Management - Employee Benefits

MET Institute Of Management Page 17

pension) if total qualifying service is less than 10 years. Admissible amount is half

months basic pay last drawn for each completed 6 monthly period of qualifying service.

There is no minimum or maximum monetary limit on the quantum. This one time lump

sum payment is distinct from and is paid over and above the retirement gratuity.

Issue of No Demand Certificate:

Dues owed by the retiring employees on account of Licence Fee for Government

accommodation, advances, over payment of pay and allowances are required to be

assessed by the Head of Office and intimated to the Accounts Officer two months in

advance of the date of retirement so that these are recovered from retirement gratuity

before payment. For this purpose the Licence Fee for those in occupation of

Government accommodation is taken into account up to the end of the permissible

period for which accommodation can be retained after retirement under the Rules on

normal rent. The recovery of Licence Fee beyond that period is the responsibility of the

Directorate of Estates. If, for any reason final dues cannot be assessed on time, then

10% of gratuity is withheld from gratuity

General Provident Fund and Incentives:

As per General Provident Fund (Central Services) Rules, 1960, all temporary

Government servants after a continuous service of one year, all re-employed

pensioners (Other than those eligible for admission to the Contributory Provident Fund)

and all permanent Government servants are eligible to subscribe to the Fund. A

subscriber, at the time of joining the fund is required to make a nomination, in the

prescribed form, conferring on one or more persons the right to receive the amount that

may stand to his credit in the fund in the event of his death, before that amount has

become payable or having become payable has not been paid. A subscriber shall

subscribe monthly to the Fund except during the period when he is under suspension.

Subscriptions to the Provident Fund are stopped 3 months prior to the date of

superannuation. Rates of subscription shall not be less than 6% of subscribers

emoluments and not more than his total emoluments. Rate of interest on GPF

Human Resource Management - Employee Benefits

MET Institute Of Management Page 18

accumulations with effect from 1.4.2009 is 8% compounded annually and the rate of

interest will vary according to notifications of the Government. The Rules provide for

drawal of advances/ withdrawals from the Fund for specific purposes.

Deposit Linked Insurance Revised Scheme:

Under the GPF Rules, on the death of subscriber, the person entitled to receive the

amount standing to the credit of the subscriber shall be paid an additional amount equal

to the average balance in the account during the 3 years immediately preceding the

death of the subscriber subject to certain conditions provided in the relevant Rule. The

additional amount payable under that Rule shall not exceed Rs. 60,000/-. To get this

benefit, the subscriber should have put in at least 5 years service at the time of his/her

death.

Contributory Provident Fund:

The Contributory Provident Fund Rules (India), ,1962 are applicable to every non-

pensionable servant of the Government belonging to any of the services under the

control of the President. A subscriber, at the time of joining the Fund is required to

make a nomination in the prescribed Form conferring on one or more persons the right

to receive the amount that may stand to his credit in the Fund in the event of his death,

before that amount has become payable or having become payable has not been paid.

A subscriber shall subscribe monthly to the Fund when on duty or Foreign Service but

not during the period of suspension. Rates of subscription shall not be less than 10% of

the emoluments and not more than his emoluments. The employers contribution at that

percentage prescribed by the Government will be credited to the subscribers account

and this is 10%. Rate of interest with effect from 1.4.2009 is 8% compounded annually.

The Rules provide for drawal of advances/ withdrawals from the CPF for specific

purposes. As in GPF Rules, the CPF Rules also provide for Deposit Linked Insurance

Revised Scheme.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 19

Leave Encashment:

Encashment of leave is a benefit granted under the CCS (Leave) Rules and not a

pensionary benefit. Encashment of Earned Leave/Half Pay Leave standing at the credit

of the retiring Government servant is admissible on the date of retirement subject to a

maximum of 300 days. There is no provision under the Rule for payment of interest on

delayed payment of Leave Encashment.

Central Government Employees Group Insurance Scheme:

A portion of monthly contributions paid while in service is credited in a Saving Fund, on

which interest accrues. A Government servant while entering service has to apply in

Form No. 4 of the above Scheme to the Head of Office, who shall issue a sanction for

the payment of subscribers accumulation in the Savings Fund segment together with

interest and arrange for its disbursement, soon after retirement. Payments under this

Scheme are made in accordance with the Table of Benefit which takes in to account

interest up to the date of cessation of service. Insurance cover benefit under this

Scheme is available to the family in the event of death of the subscriber. No interest is

payable on account of delayed payments under this Scheme.

Superannuation:

An organizational pension program created by a company for the benefit of its

employees.

Also referred to as a "company pension plan". Funds deposited in a superannuation

account will grow typically without any tax implications until retirement or withdrawal.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 20

Voluntary Retirement Scheme (VRS)

In the present globalised scenario, right sizing of the manpower employed in an

organisation has become an important management strategy in order to meet the

increased competition. The voluntary retirement scheme(VRS) is the most humane

technique to provide overall reduction in the existing strength of the employees.

It is a technique used by companies for trimming the workforce employed in the

industrial unit. It is now a commonly method used to dispense off the excess manpower

and thus improve the performance of the organisation. It is a generous,tax-free

severance payment to persuade the employees to voluntarily retire from the company. It

is also known as 'Golden Handshake' as it is the golden route to retrenchment.

In India, the Industrial Disputes Act,1947 puts restrictions on employers in the matter of

reducing excess staff by retrenchment, by closures of establishment and the

retrenchment process involved lot of legalities and complex procedures. Also, any plans

of retrenchment and reduction of staff and workforce are subjected to strong opposition

by trade unions. Hence, VRS was introduced as an alternative legal solution to solve

this problem.

It allowed employers including those in the government undertakings, to offer voluntary

retirement schemes to off-load the surplus manpower and no pressure is put on any

employee to exit. The voluntary retirement schemes were also not subjected to not

vehement opposition by the Unions, because the very nature of its being voluntary and

not using any compulsion. It was introduced in both the public and private sectors.

Public sector undertakings, however, have to obtain prior approval of the government

before offering and implementing the VRS.

A business firm may opt for a voluntary retirement scheme under the following

Human Resource Management - Employee Benefits

MET Institute Of Management Page 21

circumstances:-

Due to recession in the business.

Due to intense competition, the establishment becomes unviable unless

downsizing is resorted to.

Due to joint-ventures with foreign collaborations.

Due to takeovers and mergers.

Due to obsolescences of Product/Technology.

Though the eligibility criteria for VRS varies from company to company, but usually,

employees who have attained 40 years of age or completed 10 years of service are

eligible for voluntary retirement.The scheme applies to all employees including workers

and executives, except the directors of a company. The employee who opts for

voluntary retirement is entitled to get forty five days emoluments for each completed

year of service or monthly emoluments at the time of retirement multiplied by the

remaining months of service before the normal date of service,whichever is less.

Along with these benefits, the employees also get their provident fund and gratuity

dues. Compensation received at the time of voluntary retirement is exempt from tax

under section 10 (10C) of the Income Tax Act, 1961 upto the prescribed amount upon

fulfilling certain stipulated conditions. However,the retiring employee should not be

employed in another company or concern belonging to the same management.

The companies can frame different schemes of voluntary retirement for different classes

of their employees. However, these schemes have to conform to the guidelines

prescribed inrule 2BA of the Income-tax Rules. The guidelines for the purposes

of section 10( 10C ) of the Income-tax Act have been laid down in the rule 2BA of

the Income-tax Rules. The guidelines provide that the scheme of voluntary retirement

framed by a company should be in accordance with the following requirements,

namely :

It applies to an employee of the company who has completed ten years of

Human Resource Management - Employee Benefits

MET Institute Of Management Page 22

service or completed 40 years of age

It applies to all employees (by whatever name called), including workers and

executives of the company excepting Directors of the company

The scheme of voluntary retirement has been drawn to result in overall reduction

in the existing strength of the employees of the company

The vacancy caused by voluntary retirement is not to be filled up, nor the retiring

employee is to be employed in another company or concern belonging to the

same management

The amount receivable on account of voluntary retirement of the employees,

does not exceed the amount equivalent to one and one-half months salary for

each completed year of service or monthly emoluments at the time of retirement

multiplied by the balance months of service left before the date of his retirement

on superannuation. In any case, the amount should not exceed rupees five lakhs

in case of each employee, and

The employee has not availed in the past the benefit of any other voluntary

retirement scheme.

Some companies offer very attractive package of benefits to the employees who opt for

VRS. For example, the VRS scheme may also include providing counselling to

employees about their future managing of funds received under the scheme; offering

rehabilitation facilities to them etc.

A company may make the following announcements while implementing a voluntary

retirement scheme:-

The reasons behind downsizing the organisation.

The eligibility criteria for voluntary retirement scheme.

The age limit and the minimum service period of employees who can apply for

the scheme.

The benefits that are offered to the employees who offer to retire voluntarily.

The rights of the employer to accept or reject any application for voluntary

Human Resource Management - Employee Benefits

MET Institute Of Management Page 23

retirement.

The date up to which the scheme is open.

The income tax benefits and income tax incidence related to the scheme.

It should also indicate that the employees who opt for voluntary retirement and

accept the benefits under such scheme shall not be eligible in future for

employment in the organisation.

Voluntary Retirement Schemes have been legally found to be giving no problem to

employers, employees and their unions. But, the retrenchment plans of an organization

must be compatible to its strategic plans. Its procedure and reasons for introduction

must be discussed with all management staff including top management. One need to

identify departments or employees to whom VRS is applicable and thereby formulate its

terms and conditions and also state the benefits that would be available to those who

took VRS.

Such information should be made available to every employee of the organization,

mentioning the period during which the scheme will be open. Also,existing employees

might face insecurity because of fear of losing their job too. One of the possible

drawback of the VRS is that the efficient employees would leave the company while the

inefficient may stay back. Thus it is the /responsibility of the employer to motivate them

and remove their apprehensions and fears

Human Resource Management - Employee Benefits

MET Institute Of Management Page 24

Employee Welfare Benefits

1. Travelling Allowance : The company reimburses the travelling expenses of the

employees as per the company policy. (maximum 800 Rs per month) For

managers at the higher level of the hierarchy, the company usually provides for a

car allowance and even for company cars. The fuel and the driver expenses in

these cases is paid up by the company as per its policies and is included in the

CTC of the employee. The organization can even provide pick and drop services

for employees. Generally major organizations provide these services to the

women in the organization in case they are needed to work till late in the office.

2. Employee meal allowance : The company reimburses the amount spent on

refreshment and snacks upto a certain limit. For employees who are on sales

call, the company usually reimburses all their expenses spent towards client

management which will include the amount spent on any meetings etc.

3. Residential allowance : The company can offer residential quarters for its

employees and its family to recide. The company also provides for rent for the

accommodation of the employee. Many a times, domestic help is also provided.

This facility is typically provided for outstation employees to ensure that the

change in the location of residence is not a thing to worry about.

4. Child Care Benefits : Many companies ensure that they provide special

importance to the development of the kids of their employees. Starting right from

educational loans to special areas for child recreation within the office areas,

Human Resource Management - Employee Benefits

MET Institute Of Management Page 25

companies do ensure that the concerns regarding the children isnt a reason for

good employees for leaving their organization.

5. Loans : inhouse loan facilities are given to the employees at a subsidized rate of

interest. The loans can cover various needs that requires high investment like

cars, marriage, education, etc. The loans can be given on either advanced salary

basis or the principal amount can be deducted on a monthly basis from the salary

of the employee over a certain period of time.

6. Employee Counseling: Organizations provide counseling service to the

employees regarding their personal problems through professional counselors.

Employee counseling reduces absenteeism, turnover, tardiness etc. They even

provide guidance in identifying the key competencies of employees and thus in

their overall career development.

7. Holidays and vacations: As a measure of staff welfare and in pursuance of

governments policy, a few large organizations established holiday homes at a

number of hill stations, health resorts, and other centers with low charges of

accommodation, so as to encourage employees use this facility for rest and

recuperation in a pleasant environment.

8. Education and Study benefits: Major companies provide further education to

their employees and sponsor it. The executive MBA programmes of various

companies is well known. The company stipulates the minimum number of years

an employee needs to work in the organization before he can avail of this benefit.

In majority of firms, the duration is 5 years.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 26

Ethical Implications of an Employee Incentive Program.

A well-built incentive program motivates employees to accomplish organizational

objectives by rewarding them in ways beyond just salary. For example, offering

employees a commission on the sales they make pushes them to maintain high sales

revenue, benefiting employees and the business as a whole. But incentive programs

also introduce a host of ethical issues that businesses must consider.

Manipulative Programs

An employee incentive program requires funds or resources, so an obvious ethical

concern is whether those funds and resources might serve employees better if the

organization chose a different means of rewarding staff. For example, instead of funding

an incentive program, a company might give its employees an across-the-board raise.

In other words, a companys use of employee incentives might be, or appear,

manipulative rather than mutually beneficial.

Negative Effects

Potential negative consequences are also an ethical concern. For example, suppose an

employee incentive program designates a performance threshold -- such as a sales

number -- above which an employee will earn significantly more money in bonuses.

Striving to meet that threshold might be a constant source of stress for employees --

especially if the base take-home pay is low. The unintended result is lower worker

morale, which undermines the purpose of the employee incentive program. While no

company can predict all the outcomes of an incentive program, careful analysis on a

Human Resource Management - Employee Benefits

MET Institute Of Management Page 27

periodic basis allows a company to adjust the program as necessary to minimize

negative effects.

Fair Distribution

Another ethical problem arises if an employee incentive program doesn't distribute

benefits fairly. For example, the nature of some employees responsibilities might make

it easier for them to earn rewards. Other employees never get the chance to gain similar

benefits, so resentment builds and morale plummets. For this reason, a business must

carefully evaluate its incentive program to ensure all workers have equal access to

potential benefits.

Gaming the System

Unethical employees might find ways to game the system. For example, if the program

rewards production numbers rather than quality, some employees might cut corners to

boost their rewards. Careful design of a program can forestall obvious forms of abuse,

but sooner or later, loopholes will emerge, requiring the business to reevaluate and

perhaps overhaul its program.

Human Resource Management - Employee Benefits

MET Institute Of Management Page 28

Trends

Human Resource Management - Employee Benefits

MET Institute Of Management Page 29

Employee Best Practices

SAS:

While its long been debated whether happy workers are indeed more engaged and

productive than their discontented comrades, and whether organizations that invest

themselves in more generous practices get rewarded with greater profitability, SASs

performance provides irrefutable proof that it does. Some of the most distinguished

employee benefits include

1. Massive gymnasium featuring tennis and basketball courts, a weight room, and a

heated pool

2. An on-site health care clinic, staffed by physicians, nutritionists, physical

therapists, and psychologists also is entirely free

3. Deeply discounted child care is available, in addition to no-cost work-life

counseling which helps employees more effectively manage the stresses of

everyday life

4. Common work areas are routinely filled with snacks and treats.

5. Maternity consultations

6. Baby sitting

Google

Over years, the technological giant has been rated as the best employer in the world.

The reason for that lies not just in the pay structure of the company but also in the way

the company pampers its employees to work effectively. With employee benefit

schemes that reflect innovation and understanding the psyche of customers, google has

Human Resource Management - Employee Benefits

MET Institute Of Management Page 30

undoubtedly become the dream organization for all employees. Certain schemes

include:

1. Cafeterias with free meals

2. Gym and spa

3. Music instruments

4. Cycles and electric scooters for moving within the huge campus

5. Personalized work stations (employees can even get their pets to office)

6. Grooming facilities in campus

7. Outdoor and indoor games

8. Swimming pools

9. Family rooms

10. On site health care

Human Resource Management - Employee Benefits

MET Institute Of Management Page 31

Annexure

Leaves & Holidays

1. What are the various types of leaves that your employees are entitled for?

2. Do you provide for option to carry forward or encash those leaves?

3. Is any overtime allowance given to employees?

4. Is there an annual leave calendar for planning leaves in advance?

5. Is there any form of encouragement given for low absentism?

6. Are there any paid holidays for the employees and their family?

7. Is there provision of company guesthouse or tie-ups with holiday resorts for

subsidized travel options?

8. Are there company picnics & recreation trips?

9. How do you tackle problem of employees extending their leaves or taking

additional leaves?

Provident fund

1. What type of provident fund options do you have for your employees?

2. What is the percentage of company and the employee contribution towards the

same?

Health and safety standards

1. What is the additional coverage/compensation for on-the-job accidents or health

hazards related to occupation?

2. Does the company have in-house medical facilities?

3. Do you provide gym or club memberships or in-house gym & yoga facility?

Human Resource Management - Employee Benefits

MET Institute Of Management Page 32

4. Are there health & safety workshops conducted?

Insurance related

1. Do you provide insurance benefits? If yes, what all type of insurance?

2. Does the company provide group or individual schemes?

3. Does the company charge the contribution of the insurance premium from the

employees salary?

4. Are the insurance benefits such as health and medical benefits extendable to the

family members of the company?

Retirement options

1. What steps does your company take to provide social security for the employees

after retirement?

2. What are the various retirement benefits given to them?

3. Do you provide gratuity for loyal employees?

4. Does your company provide VRS option?

5. What are the VRS benefits offered to them?

Fringe Benefits

Do you provide any fringe benefits?

Concluding question

If we were to ask your employees what 3 things they love that the company does

for them, what would be the most likely answer?

Human Resource Management - Employee Benefits

MET Institute Of Management Page 33

Bibliography

Human Resource Management K. Aswathappa

Personnel and Human Resource Management by P. Subba Rao

Human Resource Management by Gary Dessler

Managing Human Resources by Luis R. Gomez-Mejia, David B. Balkin, Robert L. Cardy

http://www.ashokpiramalgroup.com/

http://www.fastcompany.com/3004953/how-sas-became-worlds-best-place-work

http://computer.howstuffworks.com/googleplex4.html

You might also like

- Retention Strategies in ITESDocument12 pagesRetention Strategies in ITESmunmun4No ratings yet

- Tata HR PracticesDocument10 pagesTata HR Practicesjyoti_prakash_11No ratings yet

- The Nestle HR Policy PDF 2012 PDFDocument8 pagesThe Nestle HR Policy PDF 2012 PDFKelvinNo ratings yet

- Employee Referral Scheme NewDocument1 pageEmployee Referral Scheme NewAlbert ThomasNo ratings yet

- Induction and Orientation Lect 5Document28 pagesInduction and Orientation Lect 5imadNo ratings yet

- Business - Gov.au: Succession Plan Template and GuideDocument16 pagesBusiness - Gov.au: Succession Plan Template and GuideMax MaraNo ratings yet

- Internship LetterDocument1 pageInternship Letterraoumer786100% (1)

- Employee CompensationDocument13 pagesEmployee CompensationSaba PervezNo ratings yet

- Referral PolicyDocument2 pagesReferral PolicyDipikaNo ratings yet

- Mata Employee Handbook v12016Document23 pagesMata Employee Handbook v12016Mohd Roduan OthmanNo ratings yet

- HR Policy GuidelinesDocument220 pagesHR Policy GuidelinesSaqib Jillani100% (1)

- Distinctive HR Policies and Procedures at SASDocument26 pagesDistinctive HR Policies and Procedures at SASc10missy100% (2)

- Employee RecognitionDocument3 pagesEmployee RecognitionDennis R. DagdagNo ratings yet

- 2 (1) - HR PresentationDocument49 pages2 (1) - HR Presentationpranav100% (1)

- Citibank HR PolicyDocument4 pagesCitibank HR PolicyAnshik JainNo ratings yet

- Increment Policy - 2018Document4 pagesIncrement Policy - 2018Abdul MalikNo ratings yet

- KCP Staff HandbookDocument31 pagesKCP Staff HandbookJacob OluwaseunNo ratings yet

- Gain Sharing ApproachesDocument21 pagesGain Sharing ApproachessaifulNo ratings yet

- Characteristics of Employee BenefitsDocument4 pagesCharacteristics of Employee BenefitsMaitreyee Paralkar-VichareNo ratings yet

- OSPL - Employee Handbook 01012014 - v1.0Document25 pagesOSPL - Employee Handbook 01012014 - v1.0cklconNo ratings yet

- IIL Leave PolicyDocument8 pagesIIL Leave PolicyJohn PatelNo ratings yet

- HR PolicyDocument13 pagesHR PolicyVeera Mani S0% (2)

- Employee Recognition Policy Background Paper - FDocument6 pagesEmployee Recognition Policy Background Paper - FNeerajNo ratings yet

- Functions of Human Resource Department of State Bank of PakistanDocument40 pagesFunctions of Human Resource Department of State Bank of PakistanInfinityIcon100% (8)

- Employee Attraction and Retention PolicyDocument5 pagesEmployee Attraction and Retention PolicyMatthew GlennNo ratings yet

- Employee Probationary Period PolicyDocument3 pagesEmployee Probationary Period PolicyEmma De La LunaNo ratings yet

- HR Policy and Procedures Manual November 2015 + PDFDocument66 pagesHR Policy and Procedures Manual November 2015 + PDFJoseph Raymund BautistaNo ratings yet

- Induction - HR Presentation - FNLDocument21 pagesInduction - HR Presentation - FNLChidhuro OwenNo ratings yet

- ..... Resignation and Termination of Emplyoment PolicyDocument4 pages..... Resignation and Termination of Emplyoment PolicySaida LagyalNo ratings yet

- Award Recognition Policy SampleDocument13 pagesAward Recognition Policy SampleAnkur100% (2)

- Employee Reward and Recognition Policy For EmployeesDocument10 pagesEmployee Reward and Recognition Policy For EmployeesRavneet DhaliwalNo ratings yet

- HR PLanningDocument31 pagesHR PLanningRamNo ratings yet

- Employee Handbook: Policy & Procedure Reference ManualDocument38 pagesEmployee Handbook: Policy & Procedure Reference ManualRanjeet BahadurNo ratings yet

- MyBenefits@Philips LeafletDocument2 pagesMyBenefits@Philips Leafletsubodhtaneja100% (1)

- Employee HandbookDocument77 pagesEmployee HandbookRajaNo ratings yet

- Cisco Global BenefitsDocument12 pagesCisco Global BenefitsamaranthNo ratings yet

- SEHA - Employee HandbookDocument54 pagesSEHA - Employee Handbookasimasim123100% (1)

- IDBI Intech HR PolicyDocument31 pagesIDBI Intech HR PolicyDeep Lofghter50% (2)

- Exit PolicyDocument16 pagesExit PolicyRangunwalaNo ratings yet

- HR Manual 2008Document135 pagesHR Manual 2008NEERAJ PATHAKNo ratings yet

- Promotions of EmployeeDocument5 pagesPromotions of EmployeeEnnieNo ratings yet

- HR PolicyDocument6 pagesHR PolicyAmbientNo ratings yet

- Recruitment Policy 2Document29 pagesRecruitment Policy 2Pinki AgarwalNo ratings yet

- HR BudgetDocument2 pagesHR BudgetEngr Mainul Habib TanzimNo ratings yet

- Incentive PlanDocument9 pagesIncentive PlanSaxa Man GNo ratings yet

- A Study On Employee Morale in Administrative Level at Metropolitan Transport Corporation Limited, ChennaiDocument34 pagesA Study On Employee Morale in Administrative Level at Metropolitan Transport Corporation Limited, ChennaiSoni Singh67% (3)

- Infosys HR PolicyDocument5 pagesInfosys HR Policyevk870% (1)

- Leave Policy - GTSDocument7 pagesLeave Policy - GTSSupreet SinghNo ratings yet

- Strategic Human Resource ManagementDocument23 pagesStrategic Human Resource ManagementKshitij ThakurNo ratings yet

- Employee Referral Policy 133Document3 pagesEmployee Referral Policy 133shagungupta44100% (1)

- Purpose: Transfer and RelocationDocument3 pagesPurpose: Transfer and RelocationiamgodrajeshNo ratings yet

- The Nestle HR Policy PDF 2012Document8 pagesThe Nestle HR Policy PDF 2012Nguyen Hoang Minh QuocNo ratings yet

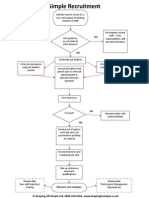

- Simple Recruitment Process FlowchartDocument1 pageSimple Recruitment Process FlowchartJyothi Raghu ReddyNo ratings yet

- Objective:: HR Policy Manual Ref: Hr/Pol//Ers Topic: Employee Referral Scheme Page 1 of 3Document3 pagesObjective:: HR Policy Manual Ref: Hr/Pol//Ers Topic: Employee Referral Scheme Page 1 of 3Rupesh Kumar MallickNo ratings yet

- A&P Salary Adjustment TemplateDocument2 pagesA&P Salary Adjustment TemplateSachin SaxenaNo ratings yet

- The Nestlé Human Resources PolicyDocument8 pagesThe Nestlé Human Resources PolicyInderdeep Singh ThakurNo ratings yet

- 15 ExitpolicyDocument5 pages15 ExitpolicyKaran JoshiNo ratings yet

- Maternity and Paternity Leave-Policy OF ADOBEDocument5 pagesMaternity and Paternity Leave-Policy OF ADOBEVishal JwellNo ratings yet

- Customer Profitability & Customer Relationship Management at RBC-FullDocument23 pagesCustomer Profitability & Customer Relationship Management at RBC-FullKunal TejwaniNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesKunal TejwaniNo ratings yet

- Customer Profitability & Customer Relationship Management at RBC-FullDocument23 pagesCustomer Profitability & Customer Relationship Management at RBC-FullKunal TejwaniNo ratings yet

- Group 3 ZaraDocument26 pagesGroup 3 ZaraKunal Tejwani100% (1)

- Asian PaintsDocument39 pagesAsian Paintsamar_saxena6085789% (9)

- NIRMA SHUDH Salt1Document79 pagesNIRMA SHUDH Salt1VIPULPATHAK33% (3)

- RBi Export CreditDocument9 pagesRBi Export Creditvinil2002inNo ratings yet

- Global Is at Ion and HRMDocument10 pagesGlobal Is at Ion and HRMKunal TejwaniNo ratings yet

- Service MarketingDocument38 pagesService MarketingKunal TejwaniNo ratings yet

- Presentation 6Document10 pagesPresentation 6Kunal TejwaniNo ratings yet

- International Product and Service Strategies: Dana-Nicoleta LascuDocument24 pagesInternational Product and Service Strategies: Dana-Nicoleta LascukalyanidhakeNo ratings yet

- AR R12 Reversing A Remitted or Cleared ReceiptDocument3 pagesAR R12 Reversing A Remitted or Cleared ReceiptDharan Dhiwahar ManoharanNo ratings yet

- Market Research & Marketting ResearchDocument2 pagesMarket Research & Marketting ResearchGurprasad SinghNo ratings yet

- Minimum Wage 2014-2015Document3 pagesMinimum Wage 2014-2015Anand ChinnappanNo ratings yet

- WBI01 01 Que 20160526Document20 pagesWBI01 01 Que 20160526Farhad AhmedNo ratings yet

- Juntunen Sanna-MariDocument67 pagesJuntunen Sanna-MariKnow yourselfNo ratings yet

- Conceptual Framework For Financial Reporting Chapter 8Document44 pagesConceptual Framework For Financial Reporting Chapter 8Anonymous qcJWZHmNo ratings yet

- EFTA Philippines FTA Factsheet 2021 - 230413 - 015527Document3 pagesEFTA Philippines FTA Factsheet 2021 - 230413 - 015527Evardone CirylNo ratings yet

- Stock Market Course ContentDocument12 pagesStock Market Course ContentSrikanth SanipiniNo ratings yet

- Income Statement Practice ProblemsDocument6 pagesIncome Statement Practice ProblemsmikeNo ratings yet

- Chapter 16 - Intro To Managerial AccountingDocument46 pagesChapter 16 - Intro To Managerial AccountingEvan Horn0% (1)

- RFBT RC ExamDocument9 pagesRFBT RC Examjeralyn juditNo ratings yet

- SM Assignment PDFDocument21 pagesSM Assignment PDFSiddhant SethiaNo ratings yet

- Learning Activity 5.2 Concept ReviewDocument4 pagesLearning Activity 5.2 Concept ReviewJames CantorneNo ratings yet

- Review of Related LiteratureDocument9 pagesReview of Related LiteratureNoel San MiguelNo ratings yet

- From Complexity To SimplicityDocument48 pagesFrom Complexity To SimplicityJuanCamiloNo ratings yet

- Recruiter TrainingDocument35 pagesRecruiter Trainingshree recruiter100% (1)

- Responsibilities:: Christine Jane S. DarlucioDocument2 pagesResponsibilities:: Christine Jane S. DarlucioMarian LorenzoNo ratings yet

- Scopia Capital Presentation On Forest City Realty Trust, Aug. 2016Document19 pagesScopia Capital Presentation On Forest City Realty Trust, Aug. 2016Norman OderNo ratings yet

- Advance Financial Management - Stocks Valuation Self Test ProblemDocument2 pagesAdvance Financial Management - Stocks Valuation Self Test ProblemWaqar AhmadNo ratings yet

- Agrotech Business ModelDocument53 pagesAgrotech Business ModelAriful Hassan Saikat100% (1)

- Formula: Working Capital Current Assets Current LiabilitiesDocument15 pagesFormula: Working Capital Current Assets Current LiabilitiesbugsbugsNo ratings yet

- Activity Based Costing (Abc) - Concept in Foundry IndustryDocument6 pagesActivity Based Costing (Abc) - Concept in Foundry Industrytushak mNo ratings yet

- What Is The Entrepreneurial Process?Document2 pagesWhat Is The Entrepreneurial Process?MemeowwNo ratings yet

- Ug Brochure Masters Union MarchDocument32 pagesUg Brochure Masters Union Marchjawadwafa795No ratings yet

- RBL Mitc FinalDocument16 pagesRBL Mitc FinalVivekNo ratings yet

- Inventory ModelDocument43 pagesInventory Modelndc6105058No ratings yet

- INBTable 1Document519 pagesINBTable 1anaysukenkarNo ratings yet

- Roll# 37 ThalNayZarLinn SM IC Chapter 05Document13 pagesRoll# 37 ThalNayZarLinn SM IC Chapter 05Thal Nay Zar SoeNo ratings yet

- Simple Job ApplicationDocument2 pagesSimple Job ApplicationSamantha Aguilar MoralesNo ratings yet