Professional Documents

Culture Documents

Dbir 2004 Eng

Uploaded by

Irina NeacsuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dbir 2004 Eng

Uploaded by

Irina NeacsuCopyright:

Available Formats

!

@#

Doing Business

in Romania

2004

In the preparation of this guide, every effort has been made to offer

current, correct and clearly expressed information. However, the

information in the text is intended to afford general guidelines only.

This guide is distributed with the understanding that Ernst & Young

is not responsible for the result of any actions taken on the basis

of information in this publication, nor for any errors or omissions

contained herein. Ernst & Young is not attempting through this work

to render legal, accounting or tax advice. Readers are encouraged

to consult with professional advisors for advice concerning specic

matters before making any decision. This book reects information

current as of 1 March 2004.

Ernst & Young, a global leader in professional services, is committed

to restoring the publics trust in professional services rms and in

the quality of nancial reporting. Its 103,000 people in more than

140 countries around the globe pursue the highest levels of integrity,

quality and professionalism to provide clients with solutions based

on nancial, transactional, and risk-management knowledge in Ernst

& Youngs core services of audit, tax, and corporate nance. Ernst

& Young practices also provide legal services in those parts of the

world where permitted. Further information about Ernst & Young

and its approach to a variety of business issues can be found at

www.ey.com/perspectives. Ernst & Young refers to all the members of

the global Ernst & Young organisation.

This guide is one in a series of country proles prepared for use by

clients and professional staff. Additional copies may be obtained from:

Venkatesh Srinivasan, Partner

Head of Tax Division

Ernst & Young SRL

Forum 2000 Building, 4

th

Floor

75 Dr. N. Staicovici Street

Sector 5, 050557 Bucharest

Romania

Phone: (40) 21 402 4000

Fax: (40) 21 410 7052

E-mail: ofce@ro.ey.com

Web: www.ey.com

Doing Business

in Romania

2004 edition

Ernst & Young Romania is a member of Ernst & Young Southeast Europe

that unies the practices of nine countries in the region including

Greece, Turkey, Bulgaria and Moldova.

Contents

Country Overview 1

Geographical overview 2

Population and language 2

Political and legal environment 3

The reform process and economic development 5

Romanias proposed accession to the European Union 8

Business Overview 11

Types of business presence 12

Accounting, auditing and reporting 14

Investment legislation 16

Foreign exchange regulations 22

Financial services industry 23

Capital markets 25

Labour force and employment regulations 26

Work regulations for foreigners 28

Intellectual property 29

Industrial property 30

Competition legislation 30

Environmental legislation 30

Taxation in Romania 31

Corporate taxes at a glance 32

Taxes on corporate income and gains 33

Withholding taxes 40

Value added tax 41

Customs duty 43

Excise duty 45

Local taxes 46

Stamp duty 47

Individual taxation 47

Fiscal sanctions 54

Ernst & Young in Romania 55

Appendix: Treaty Withholding Tax Rates 57

DOI NG BUSI NESS I N ROMANI A

Country Overview

1

2

Romania is a country of about

238,000 square km located

on the western shore of the

Black Sea in Southeast Europe.

Moldova and Ukraine border

Romania to its north, while

Hungary and Yugoslavia to its

west and Bulgaria to its south.

The country is roughly divided

into three areas: the central and

northwestern region comprising

Transylvania, Crisana, and

Banat and encompassing the

Carpathian mountains; the

southern region comprising the

Wallachian Plain with the river

Danube forming the countrys

southern border; lastly, the

eastern region comprises the

Moldavian Plain bordering

Geographical overview

As per the Census of

18 March 2002, Romanias

population was 21,698,181,

with an average density of 91

inhabitants per square km. Of

the total population, 91% are

ethnic Romanians and 6.7% are

Hungarians. Other minorities

include Rroma (1.1%), German

(0.2%), and Ukrainian (0.3%).

The Romanian language is

the common language used

throughout most of the country.

In the northwest and central

Population and language

Moldova and the Ukraine. The

capital city is Bucharest with a

population of nearly 2 million.

Other large cities include

Constanta, Iasi, Cluj-Napoca,

Timisoara, Galati, Brasov

and Craiova. Romania has a

continental European climate,

with warm summers and cold

winters.

regions, Hungarian and German

are also commonly spoken.

Moreover, under the recently

amended Constitution, ethnic

minorities are now allowed to use

their mother tongue in certain

circumstances (e.g. in court).

DOI NG BUSI NESS I N ROMANI A 3

Romania is a Constitutional

Republic. The present

Constitution was adopted by the

Parliament on 21 November 1991

and was subsequently amended

and ratied by Law 429/2003,

such amendment being effective

as of 29 October 2003. The

Romanian Constitution conrms

among its aims a multi-party

system, a free-market economy

and the respect of human rights.

Legislative power is vested in

a bicameral Parliament that is

made up of a lower house of 345

seats (Chamber of Deputies)

and an upper house of 140 seats

(Senate). Parliamentary elections

are held every 4 years while

presidential elections are held

every 5 years.

The President is elected by

direct universal vote and has

powers that are limited by the

Constitution. The President is

required to:

: act in compliance with the

provisions of the Constitution;

: nominate the Prime Minister

following consultation with the

majority party;

: promulgate laws passed by the

Parliament;

: co-operate with the National

Security Council on

relevant issues.

COUNTRY OVERVI EW

Political and legal environment

Under the Constitution, private

property is equally guaranteed

and protected by the Romanian

State. Foreign nationals and

stateless persons may obtain

the right of ownership over land

under the conditions resulting

from Romanias accession into

the European Union or by virtue

of domestic laws and other

international treaties to which

Romania has become a party.

All statutory provisions pertaining

to civil, commercial, criminal,

administrative and tax matters

are enacted by the Parliament.

International treaties are binding

only if ratied by the Parliament.

Since the revolution in 1989, the

reformation and harmonisation

of laws with EU standards has

become a key driver in Romanias

efforts of joining the EU. The

association treaty signed with the

EU in 1993 stipulates Romanias

obligation to adopt the regulations

issued by EU bodies and to

integrate them into domestic

legislation. The signing of this

treaty was followed by Romanias

ofcial request for accession into

the EU, which was presented in

June 1995. The formal deadline

envisaged by Romania for full

membership into the EU is 2007.

In 1994, Romania ratied the

European Convention for the

Protection of Human Rights and

Fundamental Freedoms. In

accordance with the relevant

ratication law, Romania has

agreed to enforce the rights

guaranteed by this convention,

including among other things the

right of individual petition, and

to recognise the competence

of the European Court of

Human Rights. To this end, any

Romanian citizen may bring a

case against the Romanian State

before the European Court, the

rulings of which are binding upon

the Romanian State.

Through the legislative initiatives

of the recent years, many of the

laws that are typical for a market

economy have been enacted

and have led to the relative

stabilisation of Romanias legal

system. The laws concerning

dispute resolution and related

procedures are well established

in Romania. The concept of

arbitration is also widely spread.

4

The court system is organised

at the national, county and local

levels and is divided into civil and

criminal. The High Court is the

highest judicial forum of Romania.

Unlike the US Supreme Court,

the Romanian High Court

cannot exercise judicial review,

adjudicating on the conformity

of laws with the Constitution

and other regulations of the

Parliament to the same effect.

This competence is attributed

to the Constitutional Court of

Romania. Moreover, judicial

precedent does not constitute a

recognised source of law.

DOI NG BUSI NESS I N ROMANI A 5

Type of economy

Since the beginning of 1990,

Romania has had a free

market economy countered

by a continuous government

presence in the industrial sector.

Successive governments have

made strides in liberalising and

privatising the economy.

Romania sits at the crossroads

of many traditional commercial

routes that allow access to a

further 200 million consumers

within a 1,000 km radius of

Bucharest. The main focus

of these routes is the Danube

River and the port of Constanta,

the largest port on the Black

Sea, which is currently linked

to the North Sea through a new

permanent navigation route

formed by the Rhein-Main-

Danube Canal. The country

boasts of a workforce which is

experienced in areas such as

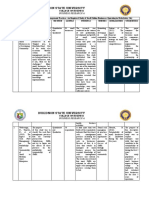

Particulars 2004 2003 Change

GDP (%) 5.2 4.8 + 0.4

Ination rate (%) 9.0 14.0 - 5.0

Cons. Budget Decit (%) 3.0 2.7 + 0.3

Domestic Demand (%) 5.5 5.1 + 0.4

Unemployment (in thousands) 700 720 - 20

COUNTRY OVERVI EW

The reform process and economic development

engineering and manufacturing

and is relatively cheaper

compared to most other Eastern

European countries. There is

a large industrial infrastructure

in many of the countrys leading

cities, which together with the

countrys considerable natural

resources possess substantial

potential for exploitation and

development.

General economic trends

Like many countries in Eastern

Europe and the former Soviet

Union, Romania has been

struggling to switch its previous

central economy into a

market economy. Successive

governments have found it very

difcult to turn the economy

around because of the lack of

hard currency and because of

the inability to secure external

funding of the country due to

its high budget decits, mainly

accrued from the continuous

nancing of loss-making state

industries. It has been hard to

change many of the old economic

and nancial mechanisms, as

well as the bureaucratic culture

that was inherent in many of the

old institutions. In the last 3 to

4 years the overall economic

environment has improved and

the indicators look healthier.

The table below illustrates

the main economic indicators

(estimates) for the year 2004 in

comparison with the year 2003.

6

Leading industries

Romanias main industries are

primarily manufacturing and

engineering. The country also

possesses energy resources

and substantial surfaces

of agricultural land. Most

areas of the economy remain

underdeveloped and offer great

potential, particularly in the

industrial, agricultural and tourism

sectors. The technology sector

continues to play an increasingly

important role in the economy

due to the employees high level

of education versus their low

employment costs.

Preferred sectors which attracted

foreign investment in the recent

years have included oil and gas

exploitation, car manufacturing,

metallurgy, banking and

nance, food processing, heavy

engineering, telecommunications,

commercial construction and

consumer goods production.

Investors have shown a

willingness to invest in newly

privatised industries as well as in

green-eld investments.

Government-owned

industries and privatisation

Strategic interest activities

are established in national

companies where the State

holds the majority or the entire

share capital. The main areas

of interest comprise the postal

services, radio communications,

airport services, coal activities, oil

and gas, harbour, water supply,

electricity, energy, nuclear,

defence and tobacco activities.

The Romanian Government

has declared its commitment to

privatise state-owned companies.

In executing this commitment,

the relevant privatisation strategy

is being formed, approved and

executed by the competent

Ministries in cooperation with the

State designated Privatisation

Authority (APAPS) on a yearly

basis. Most of the companies to

be privatised are listed on the

two Romanian capital markets

(i.e. Bucharest Stock Exchange

and RASDAQ). The privatisation

process is often carried out

on these markets through

electronic auctions, public selling

offers and/or rm commitment

underwriting. Moreover, in cases

of large companies undergoing

privatisation, where the State

holds the majority stake, direct

negotiations constitute a common

practice.

In 2003, privatisations and

restructurings marked an

outstanding progress with the

government selling three major

state enterprises, namely Roman,

Tractorul and ARO, and tendering

for sale the countrys largest

oil company, Petrom. More

activity is expected in this eld

over the forthcoming months

as the countrys two distributors

of natural gas (Distrigaz Nord

and Distrigaz Sud) as well as

two more electricity distributors

(Banat and Dobrogea) are

undergoing privatisation. The

privatisations in the energy sector

are anticipated to attract large

foreign investments.

Regional and international

trade agreements and

associations

Romania has been a contracting

party to the World Trade

Organisation (former General

Agreement for Tariffs and

Trade) since 1971. In 1994, the

Romanian Parliament ratied the

Marrakech Agreement, which

established the World Trade

Organisation.

Law 20/1993 ratied the

European Agreement that

established Romanias

association with the European

Union.

Law 19/1993 ratied the

European Free Trade Agreement

(EFTA) concluded with Romania.

Romania is also a party to the

Central European Free Trade

Agreement (CEFTA) since 1997,

which establishes different

customs facilities depending on

the merchandise trade exchanges

existing between Romania and

DOI NG BUSI NESS I N ROMANI A 7

COUNTRY OVERVI EW

Particulars Imports Exports

FOB 2003 (USD million) 22,155.3 17,618.0

CIF 2003 (USD million) 24,003.1 N/A

Variation 2003 2002 (%) + 34.4 + 27.0

Itemised structure

(% of total imports/exports)

Industrial supplies 40.4

Capital goods 22.1

Current use goods 13.7

Fuels and lubricants 10.8

Transport equipment 7.1

Food and beverages 5.7

Industrial supplies 31.9

Capital goods 9.8

Fuels and lubricants 6.5

Transport equipment 7.3

Food and beverages 2.8

Main sources/destinations

(% of total imports/exports)

Italy 19.5

Germany 14.8

Russian Federation 8.3

France 7.3

Turkey 3.8

Hungary 3.6

Austria 3.5

United Kingdom 3.3

China 2.7

USA 2.3

Italy 24.2

Germany 15.7

France 7.3

United Kingdom 6.7

Turkey 5.1

The Netherlands 3.6

USA 3.5

Hungary 3.5

Austria 3.2

Greece 2.4

Source: National Institute for Statistics

the Czech and Slovak Republics,

Hungary, Poland and Slovenia.

Furthermore, Romania is a

member of other trade groups,

such as the P16 and the General

System for Trade Preferences,

and has signed bilateral free

trade agreements with the

Republic of Moldova, Turkey and

Israel.

Up to date, Romania has entered

into over 80 agreements for the

avoidance of double taxation and

the prevention of tax evasion on

income and capital (treaties).

A table of such treaties signed

by Romania is presented in the

appendix section of this guide.

Romania is also a member

of the International Monetary

Fund (IMF), the World Bank

(i.e. of the International Bank for

Reconstruction and Development

IBRD, and of the International

Finance Corporation IFC),

and the European Bank for

Reconstruction and Development

(EBRD).

Major trading partners

and leading imports

and exports

Imports/Exports

The following table contains a

comparative illustration of the

import/export ows of Romania

for the years 2002 and 2003,

and highlights both the main

categories of circulated goods

as well as the main sources/

destinations, respectively.

8

Evolution of negotiations

1

The negotiations for Romanias

accession to EU were ofcially

launched on 15 February 2000,

on the occasion of the

Intergovernmental Conference on

Accession.

Since then, Romania opened and

provisionally closed 22 of the 31

acquis chapters, as follows:

: in 2000: Small and medium-

sized enterprises (Ch. 16),

Science and research

(Ch. 17), Education and

training (Ch. 18), External

relations (Ch. 26), Common

foreign and security policy

(Ch. 27), Statistics (Ch. 12),

Telecommunications and

information technologies

(Ch. 19) and Culture and

audio-visual policy (Ch. 20);

: in 2001: Company Law

(Ch. 5), Consumers and health

protection (Ch. 5) and Fisheries

(Ch. 8);

: in 2002: Economic and

Monetary Union (Ch. 11),

Social policy and employment

(Ch. 13), Industrial policy

(Ch. 15), Telecommunications

and IT (Ch. 19), Culture and

audio-visual (Ch. 20), Customs

Union (Ch. 25) and Institutions

(Ch. 30); and

Romanias proposed accession to the European Union

: in 2003: Free Movement of

goods (Ch. 1), Free movement

of capital (Ch. 4), Taxation

(Ch. 10), Free movement of

persons (Ch. 2), Transport

(Ch. 9) and Financial Control

(Ch. 28).

The remaining 8 chapters

(i.e. Ch. 3 Free movement of

services, Ch. 6 Competition,

Ch. 7 Agriculture, Ch. 14

Energy, Ch. 21 Regional policy

and co-ordination of structural

instruments, Ch. 22

Environmental protection,

Ch. 24 Justice and home

affairs, Ch. 29 Financial

and budgetary provisions) are

regarded as difcult chapters,

with nancial implications,

requiring a high level of domestic

preparations.

Romanias objective is to

conclude the EU accession

negotiations in 2004, to sign the

Treaty of Accession in 2005, with

a view to full EU accession on

1 January 2007.

Current status

2

In the eld of free movement

of services, important progress

has been made, especially in

the eld of nancial services

(banking, insurance and nancial

securities).

In the eld of competition,

the Competition Law and

State Aid law were amended.

The legislative development

continued with the adoption of

the secondary legislation in the

eld of anti-trust, as well as in the

State aid eld.

In the agricultural eld, a large

part of the acquis communautaire

has been transposed in

the Romanian legislation.

Important milestones are the

implementation of the community

acquis at a higher pace, the focus

on adopting commercial and

quality standards, food safety and

public health, creation of the IT

market system and the customs

veterinary and phytosanitary

control, development of

the agricultural market and

strengthening the producers

association.

The energy market has been

exposed to privatisation in 2004.

The government states that the

State Budget for 2004 ensures

the necessary nancial resources

for the implementation of the

community legislation in the

eld of crude oil and petroleum

products stocks, nuclear safety

and coal sector restructuring

process.

1 Source: www.mie.ro

2 Source: The Status of Romanias Accession Negotiations to the EU Vasile Puca, Minister Delegate Chief Negotiator of

Romania with the EU, speech in The Joint Parliamentary Committee Romania-EU-Brussels, 5 April 2004

DOI NG BUSI NESS I N ROMANI A 9

The institutional framework

for regional policy and co-

ordination of structural

instruments was designed and

normative acts were adopted

with a view to ensure, starting

with 2004, the stafng of the

structures with responsibilities

in this eld. The Ministry of

Public Finance was designated

as Managing Authority for the

Community Support Framework

and for the Cohesion Fund.

The Romanian Government

is currently concerned with

the strengthening of the

administrative capacity in order to

ensure an efcient and effective

absorption and management of

the community funds.

At present, the level

of transposition of the

environmental acquis into the

national legislation has been

signicantly improved. Measures

were taken for strengthening

the administrative capacity and

allocating the necessary nancial

resources. The implementation

of the new legislation and plans

in key sectors (water quality,

waste management and industrial

pollution) is enhanced.

In the eld of justice and home

affairs, the amendment of the

Constitution in October 2003

created the bases for reform in

the eld of justice, which will be

completed by adopting a number

of additional laws.

A legislative package for the

reform of the judiciary (currently

subject to public debate) is to be

adopted by June 2004

(i.e. Law on judicial organisation,

Law on the statute of magistrates,

Law on the Superior Council

of the Magistracy). Preventive

measures country wide

concerning the security and

border control, the connection

to the early warning system and

the raise of exigency have been

intensied. A peer review mission

of the Commission and the

Member States took place at the

beginning of April in Bucharest.

The mission noticed the status

of preparation and encouraged

Romania to continue the reforms

in the eld.

Regarding the nancial and

budgetary provisions, Romania

has made progress as regards

the calculation of the nancial

ows to and from the EU

Budget. A primary evaluation of

Romanias contribution to the EU

budget was drawn up. Romanias

answers to the questionnaire

forwarded by the European

Commission for assessing the

administrative capacity regarding

the acquis implementation for

this chapter was submitted at the

beginning of March 2004.

COUNTRY OVERVI EW

10

Key areas to develop

3

As recommended by the

Commission of the European

Communities in the 2003 Regular

Report on Romanias progress

towards accession, Romania

still needs to develop a strategy

to address reform of the policy

and legislative process. The

judicial system needs to improve

the management of cases and

the consistency of judgements,

as well as to increase the

independence of the judiciary.

Also, Romania must enhance

its attention to developing the

overall capacity of the public

administration to implement

and enforce the legislation

harmonised with the acquis.

Although certain progress in

establishing new institutional

structures required by the

acquis has been attained,

this continues to represent a

major constraint on Romanias

accession preparations and to

address this issue will require a

comprehensive, structural reform

of both the public administration

and the judicial system. These

concerns also apply to the

management of EU nancial

assistance.

Also, restructuring and

privatisation in key sectors,

such as energy, mining and

transport, must be brought

forward. This would greatly

support the establishment of

a functioning market economy

and the development of

Romanias capacity to cope

with competitive pressure and

market forces within the Union.

The Romanian Governments

committment is that, by the date

of accession, Romania will fully

comply with all Copenhagen

accession criteria. After the

conclusion of the accession

negotiations, additional

measures are envisaged to

achieve the commitments

undertaken during the

negotiations.

3 Source: 2003 Regular Report on Romanias progress towards accession

DOI NG BUSI NESS I N ROMANI A

Business Overview

11

12

There are no specic

investment approvals required

for establishing a business

in Romania. The procedure

requires the fullment of certain

legal formalities including a

delegated judges decision and

registration with the Romanian

Trade Registry and the Local

Fiscal Administration.

Limited Liability Company

The minimum equity capital

requirement for a limited liability

company (Romanian: Societate

cu Raspundere Limitata or SRL)

is currently ROL 2,000,000 and

the minimum value per part is

currently ROL 100,000. The

maximum number of equity

partners in such a company is 50.

An SRL is managed by one or

more administrators who may

have full or limited powers and

who may be either Romanian or

foreign nationals. There is no

distinction in Romania between

companies operating with or

without foreign share capital.

Joint Stock Company

The minimum share capital

requirement for a joint-stock

company (Romanian: Societate

pe Actiuni or SA) is ROL

25,000,000 and the minimum

nominal value per share is

currently ROL 1,000. When an

SA is established, at least 30% of

the subscribed share capital, or

100% in respect of contributions

in kind, must be immediately

contributed upon formation of

the company and all subscribed

share capital must be fully paid

in within 12 months of formation.

Shares must be held by a

minimum of 5 shareholders at all

times (there is no maximum) and

can be open to either public or

private subscription.

One or more Board of Directors

members, who may or may not

be shareholders of the company,

govern the daily operations of

the SA. Board members should

convene a meeting at least once

per month to decide on the topics

of the agenda, with decisions being

taken on the basis of the majority of

votes given by those members of

the Board who are present.

Representative office

Representative ofces can be

formed by foreign companies

in Romania to carry out

preparatory or ancillary

activities such as advertising

or market research on behalf

of their parent organisation.

Representative ofces cannot

carry out commercial activities in

Romania. In order to register a

Representative ofce, company

ofcials should apply to the

Department of Foreign Trade

within the Ministry of Trade and

Industry and pay an annual fee of

USD 1,200 to receive the licence.

Branches of foreign legal

entities

Branches of foreign legal entities

can be registered to carry

on commercial operations in

Romania.

A branch is subject to corporate

prots tax in the same manner as

other Romanian legal entities, but

currently no branch remittance

tax applies in Romania. The

use of branches is not widely

spread, given the poor legislation

Types of business presence

DOI NG BUSI NESS I N ROMANI A 13

governing such vehicle type

as opposed to the clear and

extensive provisions existing for

SRLs and SAs.

Partnership

Under Romanian law,

partnerships may be either

limited partnerships or general

partnerships, as follows:

: general partnership the

partnerships obligations are

guaranteed by the capital and

by the unlimited joint liability of

all partners;

: limited partnership the

partnerships obligations are

guaranteed by the capital and

by the unlimited joint liability of

all unlimited partners; limited

partners are liable only up

to the value of their share

contribution.

The most signicant characteristic

of a general partnership is the

unlimited joint and several liability

of general partners for the debts

of the partnership. A limited

partnership is similar to a general

partnership except that it has

one or more limited partners who

are liable for the debts of the

partnership only up to the amount

of their capital contributions.

In Romania, partnerships are

not ow-through entities for

tax purposes. Tax is applied

at the entity level rather than

on the individual partner level.

Partnerships are not a preferred

medium for doing business in

Romania.

Consortium

The Romanian legislation allows

for the conclusion of a joint

venture agreement (Romanian:

contract de asociatiune in

participatiune). Under this

agreement, parties act together

for the accomplishment of a

common business goal. This

form of doing business in

Romania does not lead to

the creation of a legal entity.

Generally, one party is in charge

with the bookkeeping of the joint

venture.

Trust

The Romanian legislation does

not recognise the concept of a

trust.

Economic Interest Grouping

(EIG)

An EIG can be dened as an

association of two or more

individuals or legal entities, which

is set up for a denite period

of time, with its main scope

consisting in the development

of its members activity and only

secondary in the development

of the EIG itself. An EIG may not

have more than 20 members.

A key feature of EIGs is the

unlimited joint liability of its

members and the fact that it

may not, directly or indirectly,

own shares in one of its member

companies, or another EIG.

Equally, an EIG is not allowed

to issue shares, bonds or other

negotiable instruments.

European Economic Interest

Grouping (EEIG)

An EEIG is an association of

two or more individuals or legal

entities, set up for either a denite

or an indenite period of time,

its main scope consisting in the

development of its members

activity and only secondary in the

development of the EEIG itself.

This entity may be set up in

any EU Member State, but may

function in Romania by means

of subsidiaries, branches,

representative ofces or other

entities without legal personality,

provided that the domestic

legislation is being observed.

The subsidiaries and branches

of an EEIG are subject to

registration following the same

procedure as EIGs, namely

with the Trade Registry in the

jurisdiction in which the branches

or subsidiaries will be located.

Entities commonly used by

foreign investors

Limited liability companies (SRLs)

are the most popular vehicles for

carrying on business activities

in Romania by local and foreign

investors, because of the low

administrative requirements, the

greater exibility compared to

other types of companies and the

low initial capital requirements.

However, the number of joint-

stock companies (SAs) and their

attractiveness to investors is

increasing in Romania.

BUSI NESS OVERVI EW

14

Accounting

Harmonised accounting

The Ministry of Finance approved

new accounting regulations in

2001 (i.e. Order 94/2001) with

a view to harmonise the former

Romanian accounting rules

with both the Directive IV of the

Economic European Community

and the International Accounting

Standards (IAS). The purpose

is that, by scal year 2006, all

Romanian companies except

small enterprises should apply

IAS rules in their accounting. The

implementation process for this

project is gradual.

During 2003 2005, companies

satisfying two of the requirements

presented in the table below are

required to prepare harmonised

nancial statements.

During the rst year of

application, taxpayers must

draw up separate nancial

statements according to the

Romanian Accounting Standards

and the harmonised accounting

regulations. The nancial

statements prepared according

to the harmonised accounting

regulations must be audited

and submitted to the territorial

units of the Ministry of Finance

by 30 November of the year

following the one to which the

reporting refers.

Accounting, auditing and reporting

Year ending

31 December

Turnover in

prior year

Total book

value of

assets for

prior year

Employees

during prior

year (average

number)

EUR million EUR million No. persons

2003 7.3 3.65 150

2004 7.3 3.65 50

2005 7.3 3.65 50

Simplied harmonised

accounting standards

As of 1 January 2003,

simplied accounting standards

harmonised with the European

Directives (Order 306/2002)

are also applicable to micro-

enterprises and to companies

not applying the Accounting

standards harmonised with

Directive IV of the Economic

European Community and with

the International Accounting

Standards, as approved by Order

94/2001, based on the criteria

mentioned in the section above.

Simplied nancial statements

that need to be produced by

companies applying these

accounting standards at year-end

refer to the following:

: the balance sheet;

: the profit and loss account;

: the accounting policies and

the notes to the accounts; and

(optionally)

: the cash-flow statement.

Auditing

Statutory audits to be performed

by external auditors are not yet

mandatory under Romanian

law, except in the case of

companies which are required

to apply the Accounting

regulations harmonised with the

Directive IV of the Economic

European Community and with

the International Accounting

Standards, as approved by Order

94/2001.

However, externally audited

nancial statements are a

pre-requisite for companies

with the intention to go public.

Independent audits for banks and

other nancial institutions are

also mandatory.

In other cases, the compulsory

audit function is performed by

internal auditors (censors),

in accordance with the

Audit Norms issued by the

Romanian Accounting Experts

DOI NG BUSI NESS I N ROMANI A 15

the scal authorities the latest by

the 25

th

of the following month.

The return captures the prots tax

due quarterly and the withholding

and salary taxes as well as

any other taxes payable by the

company, whenever applicable.

Half-year reporting

The half-year reporting comprises

the balance sheet, the prot and

loss account, the appendix and

the administration report and has

to be led with the Department

of Public Finance until 31 July of

every year.

Annual nancial statements

The annual nancial statements

comprise the balance sheet,

the prot and loss account, the

appendix and the administration

report. All of the above have to be

certied by internal auditors and

led with the Department of Public

Finance in Bucharest or any other

competent county (depending on

where the headquarters of the

taxpayer are located).

The deadline for submission of

the nancial statements to the

Romanian tax authorities is:

: 90 days following the end

of the financial year for

companies applying the

simplified harmonised

accounting standards

(Order 306/2002);

: 120 days following the end

of the financial year for

companies applying the

harmonised accounting

standards (Order 94/2001).

VAT return

Taxpayers must le VAT returns

with the tax authorities on a

monthly basis, specifying the

taxable amount and the tax

due. The tax return must be

led and the respective VAT

paid by the 25

th

of the following

month. Taxpayers with an annual

turnover of less than

EUR 100,000 le their VAT

returns with the tax authorities on

a quarterly basis.

Social security returns

Social security returns are led

with the local Department of

Labour and Social Security in the

district in which the employer has

its headquarters, within 25 days

following the end of the month for

which contributions (i.e. Social

Security Fund, Health Funds,

Unemployment Funds) are due.

and Chartered Accountants

Association (CECCAR). Limited

liability companies with more than

15 shareholders as well as joint

stock companies are required to

appoint censors.

Accounting evidence

According to the accounting

regulations, companies should

maintain the following accounting

registers:

: Journal recordings should

be made in chronological order

for all operations carried out by

the company.

: Counting Report recordings

should depict all assets and

liabilities of an entity-taxpayer.

: General Ledger in which the

recordings from the Journal are

made on a monthly basis. On

the basis of this register, the

monthly trial balances are drawn

up.

Furthermore, companies

also need to prepare monthly

trial balances and Sales and

Purchases Journals (for VAT

purposes). Fixed Asset Registers

are also required under the

depreciation laws.

Reporting

The main returns and statements

that must be submitted

periodically to the Romanian

authorities are:

Monthly tax return

Such returns have to be

submitted on a monthly basis to

BUSI NESS OVERVI EW

16

Investment incentives

Under the direct investment

regulations, investments are

encouraged by offering equal

opportunities to foreign as well

as to Romanian investors.

In general, incentives are

intended to enhance the

economic development of

the country, particularly the

acceleration of industrialisation

in disfavoured zones, as well as

the development of small and

medium enterprises, oil and gas

industries and micro-enterprises.

Under the direct investment

legislation (Emergency

Ordinance 92/1997, as

amended), legal entities and

individuals may invest in Romania

under a variety of forms. The

regulation denes certain types

of investments and provides a

level playing eld for foreign as

well as domestic investors. The

regulation establishes the general

legal framework regarding

guarantees and rights to be

granted to investors and direct

investments made in Romania.

To a large extent, tax incentives

(for investments) were cancelled

during 2000. However, certain

tax facilities are still available to

investments in free trade zones,

disfavoured zones and industrial

parks, as well as to small and

medium enterprises (see below).

Investment legislation

For most of the tax incentives

the legislation has specied that,

if an investor ceases production

or voluntarily liquidates the

company before the expiration

of twice the period for which

tax incentives were granted, all

previous exemptions enjoyed will

be retroactively cancelled.

Investments with a

significant impact on the

economy

Law 332/2001 regarding the

promotion of investments with a

signicant impact on the economy

provides certain tax incentives for

direct investments that exceed

the equivalent of USD 1 million

(or the equivalent in ROL or

other convertible currencies)

and which are contributing to the

development and modernisation

of Romanias economic

infrastructure, creating a positive

spin-off effect in economy and

creating new working places.

Under this law, direct investments

in a Romanian company, which

are to be effectively accomplished

within a maximum of 30 months

from the date of the statistical

registration with the Ministry of

Economy and Trade, will benet

of the following tax incentives:

: exemption from payment of

customs duties for certain

DOI NG BUSI NESS I N ROMANI A 17

new technological tools,

installations, equipment,

measuring and control devices,

automation equipment and

software products imported

into Romania (manufactured

within maximum 1 year before

the importation date and

without being used prior to

their entering into Romania),

as specifically provided in a

list approved by the Ministry of

Economy and Trade and the

Ministry of Public Finance;

: for investments realised until

31 December 2006, one-

off allowance of 20% of the

investment value, granted as a

reduction of the taxable base

for profits tax purposes in the

month when the investment

was made;

: use of accelerated

depreciation, without prior

approval from the tax

authorities (depreciation in

the first year of activity of up

to 50% of the entry value of

the fixed assets, applicable

for all fixed assets, except for

buildings);

: local authorities may grant an

exemption or reduction of the

land tax for land related to the

afore-mentioned investments

for the execution period

until commissioning, up to a

maximum of 3 years from the

beginning of the works.

In the event an investment

qualies for incentives under

several laws, the investor has to

opt explicitly for a single regime

of facilities. Investors choosing

to benet of incentives under one

specic law must waive the right

to benet of incentives provided

for the same investment by other

legal provisions.

In case of voluntary liquidation

of the companies which carried

out the investment before the

lapse of 10 years, the investor

can be liable to pay all taxes and

duties in relation to which the

incentives were granted for the

entire operating period, together

with late payment interest.

Such amounts are to be paid

with priority from the liquidation

proceeds.

Separately, investors will also

be liable to pay the equivalent

of incentives granted together

with late payment interest

stipulated by the law if the goods

imported under the customs

duty exemption provided by the

law are alienated within a period

shorter than 2 years from the

date of acquisition or entrance

into the country.

Small and medium-sized

enterprises (SMEs)

Romanian law denes a SME

qualifying for tax incentives as

a company that has less than

250 employees, whose annual

turnover does not exceed

EUR 8 million and whose

capital is 100% private (not

in state ownership). As an

additional condition, a company

qualies as SME for as long

as any of its shareholders with

an individual participation of

at least 25% is not employing

more than 250 employees.

Banking companies, insurance

BUSI NESS OVERVI EW

18

companies, companies managing

investment funds, security trading

companies as well as companies

performing foreign trade activities

exclusively do not qualify as

SMEs.

Presently, no incentives are

available for SMEs. However,

the certicates for deferral of

VAT exigibility obtained under

the provisions of Law 345/2002

(in force until 31 December

2003) are still valid for the

period they were granted. Such

certicates were issued for

purchases of industrial machines,

transportation means necessary

for the performance of productive

activities, technological tools,

installations, equipment,

measurement and control

devices, automation equipment

and software products,

manufactured within maximum 1

year before purchase and which

have never been used.

Micro-enterprises

To qualify for a micro-enterprise

regime the following conditions

should be satised as

at 31 December of the prior year:

: the enterprise has as object of

activity production of goods,

supply of services and/or trade

activities;

: the enterprise should have at

least 1 employee but not more

than 9;

: the annual turnover obtained

should not exceed

EUR 100,000; and

: the capital is 100% private

and the shareholder of such

company should not employ

more than 250 people.

Qualifying enterprises will pay

a tax of 1.5% applied on any

source income, except certain

items of revenues specically

provided (e.g. income from

stock variations, income from

provisions, etc.). The tax is paid

quarterly, by the 25

th

of the rst

month following the reporting

quarter.

Companies complying with the

above conditions and taxed under

the general prots tax legislation

may opt for the income taxation.

In such cases companies should

submit a declaration exercising

their option until 31 January.

Disfavoured zones

Emergency Ordinance 24/1998

regulates disfavoured zones, as

these are dened individually by

Government Decisions. Such

zones are for a duration of at

least 3 but not more than 10

years, with the possibility of

extension.

Currently, there are 38

disfavoured zones established in

the country mostly with a duration

of 10 years, especially in the

mining areas of the country.

A wide range of incentives has

been granted to investments in

disfavoured zones, which include:

: customs duty exemption for

imported raw materials and

components, necessary for the

realisation of own production in

DOI NG BUSI NESS I N ROMANI A 19

the area, except for imports of

meat-related raw materials;

: profits tax exemption for profits

related to new investments,

for the period during which

the disfavoured zone status

exists only for legal entities

which obtained the permanent

certificate of investor in a

disfavoured zone before

1 July 2002;

: access to a special

development fund set up by

the government in accordance

with Emergency Ordinance 59/

1997 as amended, with funds

collected by the Romanian

government from sales of

state-owned companies; and

: income tax exemption for

allowances received by

individuals for their one-off

relocation to disfavoured zones

for purposes of employment.

Industrial parks

Based on Government

Ordinance 65/2001, industrial

parks are seen as strictly

delimited areas where research

and development, industrial

production and technological

development activities are

performed.

An industrial park may be set up

based on an association between

the authorities of the central

and local public administration

and companies, research and

development institutes and/or

other interested partners. An

industrial park is administered by

a Romanian legal entity, called

the administrator-company. No

shareholder company using the

utilities and/or the infrastructure

of the industrial park can hold

direct or indirect control over the

administrator-company.

The following incentives are

granted for the setting up and

development of industrial parks:

: exemption from taxes due on

conversion of agricultural land

to be used to the benefit of

industrial parks;

: for investments in constructions

or construction rehabilitation,

internal infrastructure and in

the utilities network, realised

until 31 December 2006, one-

off allowance of 20% of the

investment value, granted as a

reduction of the taxable base

for profits tax purposes;

: buildings, constructions and

land located inside industrial

parks are respectively exempt

from building tax and land tax;

: other incentives which may be

granted, in compliance with

the law, by the local public

administrative authorities.

Scientific and technological

parks

Based on Government

Ordinance 14/2002, as amended

by Law 50/2003 scientic and

technological parks are seen as

strictly delimited areas where

education and research activities

are performed, as well as the

technological implementation of

the results for the purpose of their

utilisation in economy.

A scientic and technological

park may be set up based

on a partnership agreement

between an accredited university

and/or another research

and development unit and

a consortium of companies,

associations or individuals,

Romanian or foreign. Upon set-

up, a scientic and technological

park needs to be authorised by

The Ministry of Education and

Research, who is further entitled

to monitor the activities of the

scientic and technological park.

The park is administered by a

Romanian company, designated

by the consortium, called the

administrator-company.

The following incentives are

granted for the setting up and

development of scientic and

technological parks:

: advantageous conditions

regarding location and

usage of infrastructure and

communications, with deferral

of payments, ensured or

facilitated by the administrator

for a determined period of

operation;

: discounts or gratuities for

certain services supplied by

administrator;

: exemption from taxes due on

conversion of agricultural land

to be used to the benefit of

industrial parks;

: buildings, constructions and

land located inside scientific

and technological parks are

respectively exempt from

building tax and land tax.

BUSI NESS OVERVI EW

20

Free trade zones

Law 84/1992, as amended,

regulates the Free Trade Zones

regime. Currently, there are 7

free trade zones in operation in

Romania, located in Constanta

Sud-Agigea (at the Black Sea,

including the harbour area),

Sulina, Galati, Braila, Giurgiu

(along the Danube river),

Basarabi and Curtici-Arad (on the

Romanian-Hungarian border).

The range of activities that can

be carried out within a specic

free trade zone by individuals

or entities respectively, are

determined by law and should

be licensed by the administrative

authority of the zone.

The following incentives are

available within free trade zones:

: profits tax exemption until

30 June 2007, for taxpayers

who, by 1 July 2002, performed

in the free trade zone

investments amounting to a

minimum of USD 1 million in

depreciable tangible assets

used in the processing industry.

This exemption does not apply

in case a change of more

than 25% in the shareholding

structure takes place within

one year;

: profits obtained from activities

performed inside free trade

zones on a licence basis

are subject to a reduced

profits tax rate of 5%, until

31 December 2004;

: excise duty exemption for

goods introduced in the free

trade zone;

: exemption from customs duties

for goods introduced within the

zone depending on the specific

operations taking place, for

as long as the goods are not

imported into Romania; and

: VAT exemption for operations

performed within the free trade

zone.

Mining

Mining Law 85/2003 regulates

the mining activities in

Romania to ensure maximum

transparency for mining activities

and fair competition, without

discrimination by the property

type or origin of the capital, and

nationality of operators.

Mining exploitations are

carried out based on a mining

concession granted by the

National Agency for Mineral

Resources (NAMR) for a period

of at least 20 years with an

extension clause in exchange

for a mining royalty and an

annual surface tax. Each mining

concession is established through

a Government Decision and

its provisions will remain valid

throughout the entire concession

period.

Foreign legal entities are liable

to set up a company in Romania

within 90 days from obtaining

the mining concession. Such

company will be maintained

throughout the licence period.

DOI NG BUSI NESS I N ROMANI A 21

The titleholder of the licences

may benet from the following

incentives:

: exemption from the payment

of customs duties for the

importation of goods required

for the performance of mining

activities;

: exemption from the payment

of customs duties for newly

imported equipment and

installations, which are not

produced in the country but

are needed for environmental

rehabilitation; and

: other incentives that may be

granted by the local public

administrative authorities in

accordance with the law.

The incentives granted to the

titleholders are maintained

throughout the concession

period.

Oil and gas incentives

Petroleum Law 134/1995

regulates operations involving

oil and gas reserves within

Romania. Oil and gas operations

are carried out through

exploitation concessions or

exploration permits. Foreign

operators should create a

Romanian branch or company

within 90 days of obtaining the oil

and gas concession, which will be

maintained throughout the entire

period. Titleholders of an oil and

gas concession are liable to pay

a petroleum royalty to the State

Budget.

Titleholders of an oil and gas

concession benet from the

following tax incentives provided

by the law:

: exemption from payment

of duties on imports made

by the titleholders or their

subcontractors, relating to

assets required for the conduct

of petroleum operations;

: exemption from payment of

duties for imported household

and personal goods acquired

by the expatriate personnel

of the titleholder, its affiliated

companies and foreign

subcontractors; the goods so

exempt must be designated in

the annexes to the agreement.

In addition, foreign titleholders

benet from the following

incentives:

: to receive proceeds derived

from the export of their share

of petroleum in hard currency,

and retain such hard currency

abroad after payment of

liabilities to the Romanian

state; and

: in the event the sale of

petroleum to which the

titleholder is entitled takes

place in Romania, the

titleholder has the right to

convert the ROL amounts

obtained into foreign currency,

and dispose freely of such

hard currency amounts which

can be remitted abroad after

payment of obligations towards

the Romanian State.

BUSI NESS OVERVI EW

The incentives granted to

the titleholders of petroleum

agreements under this law

must be determined for

each agreement and remain

unchanged for the entire duration

of the agreement.

22

Currency

Romanias monetary unit is the

Romanian LEU (ROL). The

foreign exchange policy of the

National Bank of Romania

(NBR) had been partially

controlled, resulting in an almost

continuous over-valuation of the

domestic currency until 1997.

Subsequently, the currency has

been managed under a oat

system, whereby the NBR sets

targets for the exchange rate

and its devaluation. At times, the

NBR intervenes in the market

whenever these targets are

threatened or whenever there is

increased volatility.

The NBR has stated that it

may move from exchange rate

targeting to a policy of explicit

ination targeting during 2004, if

conditions are appropriate

(i.e. an ination rate below 10%

and stronger wage discipline in

state-owned enterprises).

The currency regime in Romania

is not governed by a currency

law, but rather by a Currency

Regulation issued by the National

Bank (Regulation 1/2004).

Foreign exchange control

In Romania, transactions

between resident companies

or between resident companies

and resident individuals must

be made in ROL, with certain

exceptions. Transactions between

Foreign exchange regulations

residents and non-residents must

be made in foreign currency,

with certain exceptions relating

to payment of Romanian taxes,

payments made by individual

non-residents during their stay

in Romania and payments

made by Romanian residents to

non-residents in form of prots,

dividends, interest or other

income, as explicitly provided by

the regulations. In the free trade

zones, most transactions must be

made in foreign currency.

Certain transactions that are

deemed by law to be capital

transfers require the prior

approval of the National Bank of

Romania (NBR). Such approval

will no longer be required

for certain capital transfers

(i.e. operations with securities

and other instruments usually

transacted in the monetary

market) by the time of Romanias

accession to the European Union.

Residents and non-residents may

open foreign-currency accounts

in Romanian banks or foreign

banks authorised to operate in

Romania. Residents may open

accounts in banks located abroad

only if they obtain the prior NBRs

approval, with certain exceptions.

The currency market is a free

market, but the reasons for

purchases of foreign currencies

must be disclosed. Under

Emergency Ordinance 92/1997,

foreign investors may transfer the

following items to their countries,

provided applicable taxes

are paid: benets, dividends,

proceeds from sales of shares,

proceeds from liquidations of

companies, and certain other

items relating to Romanian

investments.

DOI NG BUSI NESS I N ROMANI A 23

Romanian banking, insurance,

securities and investment fund

activities are subject to special

laws, which regulate the terms

of conducting their business

operations, authorising the

operators on the market and

establishing the capital limits

for carrying out these types of

activities.

Since 1990, the Romanian

banking system has undergone a

major restructuring process. The

key elements of this restructuring

process have been the following:

: transformation of the National

Bank of Romania into what

is now effectively the nations

Central Bank;

: opening up of the banking

system to private and foreign

banks; and

: privatisation of state-owned

banks.

More than 60% of the banks

currently operating in Romania

are privately owned. In these

private banks, over 50% of the

ownership belongs to foreign

shareholders.

Banking

Central bank

The National Bank of Romania,

the countrys central bank, is the

sole issuer of notes and coins to

be used as legal tender on the

territory of Romania.

Financial services industry

The main objective of the NBR

is to ensure stability of the

domestic currency with a view to

maintaining price stability. To this

end, the NBR implements and

is responsible for the monetary,

foreign exchange, lending and

payment policies, as well as for

bank licensing and prudential

supervision within the general

policy of the Government of

Romania. The NBR co-operates

with the public authorities as

well as with foreign nancial

and banking institutions in its

capacity as a member of these

bodies. The NBR designs

and implements the foreign

exchange and monetary policies

by using specic procedures

and instruments; it discounts,

pledges, acquires or sells

claims and securities, it grants

loans and it opens deposit

accounts for keeping the banks

minimum reserves. The NBR

draws up and implements the

regulations governing currency

operations, and supervises the

implementation of the foreign

exchange regime in Romania.

Pursuant to the law, the NBR

may grant loans to banks, with

no longer than a 90-day maturity,

against collateral under certain

terms and conditions. Moreover, it

sets the modalities for performing

operations with banks, such

as opening accounts, payment

systems, clearing, depository and

payment services, and mitigating

and hedging risk. Operations with

the General Account of Treasury

(including government securities

operations) are jointly agreed

upon between the NBR and the

Ministry of Finance.

The NBR establishes and keeps

the ofcial reserves, and is

authorised to carry out operations

in gold and foreign assets.

The Board of Directors consisting

of 9 members, out of which 4

are executives, the governor, the

rst vice-governor, and two vice-

governors, heads the NBR. The

Parliament of Romania appoints

the members of the Board for a

six-year term. The statutory audit

committees are charged with

checking the observance of the

legal norms during the NBR asset

valuation and the drawing up of

the balance sheet and the prot-

and-loss account, as well as the

revenue and expenditure budget

execution.

Banking regulators

Law 58/1998, as amended,

regulates the Banking system.

This law establishes the

general rules and conditions of

conducting banking activities.

Under this law the NBR

establishes certain regulations

with regard to bank licensing

and operational requirements

in respect to the application of

the monetary, foreign exchange,

credit, payments and banking

prudential supervision policies.

BUSI NESS OVERVI EW

24

It also refers to fund transfers,

conditions under which the NBR

may revoke the licence granted

to banks, bank mergers and

divestments. The application

of the current law is supported

by specic norms issued by the

NBR in respect to conditions

existing in the economy and the

general economic policy of the

government.

The privatisation process of the

banking industry is regulated

by Government Decision 458/

1997, as amended, which

makes reference, inter alia, to

the privatisation procedures and

the beneciaries of the amounts

resulting from sell-offs.

Insurance

The insurance industry is

regulated mainly by Law

136/1995 regarding insurance

and reinsurance, and by

Law 32/2000 regarding insurance

companies and supervision of

insurance. The implementation

and supervision of the law

as well as the control of the

observance of its dispositions are

incumbent upon the Insurance

Supervisory Commission, aiming

at safeguarding the rights of the

insured persons and promoting

the stability of the insurance

activity in Romania.

The law permits the

establishment of insurance

companies in one of the following

legal forms:

: joint-stock companies;

: mutual funds (companies);

: subsidiaries of foreign

insurance companies set up

as Romanian legal entities

authorised by the Insurance

Supervisory Commission; and

: branches of foreign insurance

companies authorised by

the Insurance Supervisory

Commission.

The paid up share capital (or, as

the case may be, the freely paid

up reserve fund) cannot be lower

than:

a) ROL 15 billion for the activity of

general insurance, excluding

compulsory insurance;

b) ROL 30 billion for the activity of

general insurance;

c) ROL 21 billion for the activity of

life insurance; and

d) the sum of values provided at

letter a) and c) or b) and c), as

the case may be, depending

on the insurance activities

performed.

The Romanian insurance market

is evolving as regards both the

number, as well as quality of

operators and from a regulatory

perspective. Currently, there are

around 50 registered insurance

companies in Romania, which

are authorised by the industrys

regulatory body, the Insurance

Supervisory Commission.

DOI NG BUSI NESS I N ROMANI A 25

Stock exchange and

regulating authority

The Romanian securities

markets are functioning

according to the Romanian

Securities and Exchanges

Ordinance (Emergency Law

28/2002 approved and amended

by Law 525/2002), the Law

on commodities, services

and derivatives markets

(Ordinance 69/1997 approved

and amended by Law 129/2000)

as well as Emergency Ordinance

26/2002 regarding the collective

investment bodies. The main

regulations are applied in practice

according to the instructions and

norms issued by the National

Securities Commission (CNVM)

that is empowered to act as the

markets main rule maker and

watchdog.

The main securities markets in

Romania are the Bucharest Stock

Exchange (BSE) and the over-

the-counter RASDAQ market.

Additionally, the Monetary,

Financial and Commodities

Exchange in Sibiu (BMFMS)

should be mentioned as

Romanias rst nancial futures

and options exchange.

The BSE was established in 1995

with Canadian assistance and

uses an entirely computerised

trading system integrating the

brokers (connected to the Stock

Exchange by remote terminals)

the shareholder registry and the

Capital markets

clearing and settlement system.

The trading system is an order-

driven system that automatically

matches the orders. In its rst

trading session (in November

1995) shares of six listed

companies were traded. As of

November 2003, 62 companies

organised on two tiers were

listed on the BSE that had a total

market capitalisation of close to

USD 3,471 million. The BSE has

two ofcial indexes which are the

BET, based on the basket of the

ten most liquid stocks listed on

the rst tier, and an overall index

the BET Composite.

The RASDAQ has been

operational since 1996, using an

electronic quote-driven trading

system (Portal) developed by the

NASDAQ Stock Market of the

United States with the initial aim

of providing a trading ground for

the shares of companies which

were privatised under the Mass

Privatisation programme. As of

October 2003, 4,489 companies

were listed on the RASDAQ and

the market capitalisation was

around USD 2,210 million.

Established in 1994, BMFMS

currently provides the possibility

to trade futures and options

contracts in the most important

currencies (ROL/USD, ROL/EUR,

EUR/USD, etc.) and on BSEs

index BET.

BUSI NESS OVERVI EW

26

The employment relationship

between employers and

employees is governed by the

Labour Code (Law 53/2003),

which entered into force on

1 March 2003.

Applicability

The Labour Code covers

Romanian employees with

employment contracts who

perform services in Romania or

abroad for a Romanian employer,

as well as foreign individuals

with employment contracts who

perform services to a Romanian

employer in Romania.

Working relationship

Types of employment contracts

The law regulates individual

employment contracts with an

indenite duration as being the

general form of employment

relationships. In addition,

other forms of employment are

stipulated, such as:

: individual employment contract

with a definite duration,

: temporary employment,

: part-time employment,

: flexible working arrangements

(home-based work).

Under the Labour Code, service

agreements (Romanian:

conventii civile de prestari

servicii) are not considered as

employment.

Labour force and employment regulations

Special clauses in the

individual employment

contract

Before or upon conclusion of

a new or amendment of an

existing employment contract

the employer has the obligation

to inform the employee about

the general terms regulating the

employment relationship (term

of the agreement, leave periods,

allowances, etc.). Along with

the general terms an individual

employment contract may also

include special clauses, such as:

: non-competition clauses

by which the employee

undertakes the obligation

to refrain from competitive

activities against the employer.

For the application of this

clause the law also provides

for a negotiable consideration,

which is payable to the

employee and which equals at

least 25% of the salary.

: mobility clause by which

the employee accepts to

perform his duties under the

employment agreement in

different locations. In case

of existence of such clause

the employee is entitled

to additional out of base

allowances, which can be in

cash or in kind.

: confidentiality clause a

clause by which the employee

undertakes the obligation

not to disclose confidential

information obtained in the

DOI NG BUSI NESS I N ROMANI A 27

BUSI NESS OVERVI EW

course of the employment.

Usually, the term of such

obligation goes beyond the

duration of the employment.

Furthermore, an individual may

only be employed if he/she

provides a medical certicate.

Failure to provide such a

certicate renders the contract

void.

General register of employees

Employers are obliged to keep

a general register of employees,

which must be registered with

the relevant public authority

within 10 working days from

the date of commencement of

the employment. The general

register of employees contains

all information regarding the

employees data and employment

records.

The registers are intended to

replace the current employees

workbooks. However, until

31 December 2006, employers

will be required to keep the

former workbooks with the

general register of employees, as

a proof of work seniority.

Working hours and paid

holidays

Normal working days have an

8-hour duration in regards to

full time employment. Maximum

working hours per week cannot

exceed 48 hours, including

overtime. According to the law,

overtime is to be settled with paid

leave or a minimum 75% bonus

calculated on the base salary.

The standard working week is

Monday to Friday, followed by

two resting days, Saturday and

Sunday.

In addition to the statutory

holidays, employees are entitled

to a minimum of 20 weekdays

annual paid vacation.

Work security and healthcare

The employer is liable to take

necessary measures ensuring

the security and health of its

employees. The employer is

obliged to ensure the access of

employees to health check-ups.

Moreover, the employer is

responsible to insure all its

employees against work

accidents and work-related

diseases in accordance with the

specic regulations.

Professional training

The employer needs to ensure

that adequate professional

training is being offered to the

employees on a continuous

basis. In this respect, the

employer must set up an annual