Professional Documents

Culture Documents

Real Property Gains Tax 2014

Uploaded by

ElleNGCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Property Gains Tax 2014

Uploaded by

ElleNGCopyright:

Available Formats

Real Property Gains Tax (RPGT) In Malaysia

Real Property Gains Tax (RPGT) is a form of Capital Gains Tax that is imposed on the disposal

of property in Malaysia. It was suspended temporarily in 2008-2009, and reintroduced in

2010. In 2014, RPGT was increased for the 5th straight year since 2009. So how is it

calculated, and what does it impact?

Based on the Real Property Gain Tax Act 1976, RPGT is a tax on chargeable gains derived

from disposal of property. A chargeable gain is the profit when the disposal price is more

than purchase price of the property. What most people dont know is that RPGT is also

applicable in the procurement and disposal of shares in companies where 75% of their

tangible assets are in properties, a.k.a. Real Property Companies (RPC). RPGT applies to both

residents and non-residents.

You will be only be taxed on the positive net capital gains which is disposal price less the

purchased price less the miscellaneous charges such as;( stamp duty, legal fees,

advertisement charges ,etc). Additionally, a waiver on the taxable amount is granted to

individuals (but not companies). The holding period is from the date on the S&P agreement

till to the disposal date. For a simple and a quick calculation, the formula is;

Chargeable Gain = Disposal Price - Purchased Price

Net Chargeable Gain

= Chargeable gain - Exemption Waiver (RM10,000 or 10% of Chargeable Gain,whichever is

higher)

Tax payable = RPGT rate (based on holding period)* Net Chargeable Gain

RPGT Exemptions

Good news! There are exemptions allowed for RPGT. Among the exemptions are:

1) Exemption on gains from the disposal of one residential property once in a lifetime to

individual (Please utilize this once in lifetime opportunity wisely!)

2) Exemption on gains arising from the disposal of real property between family members

(e.g. husband and wife, parents and children and grandparents and grandchildren)

3) 10% of profits OR RM10,000 per transaction (whichever is higher) is not taxable

Budget 2014

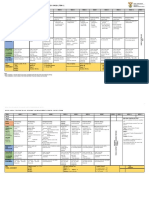

Accordance with the Budget 2014 announcement, the rates for RPGT has been increased.

Governments reason for the hike is mainly to reduce speculative activities on housing prices

and real estate market. Government believes that hiking up RPGT enable the Rakyat to

purchase affordable new houses. However in long term, hike in RPGT rates will slow down

the sales of the secondary markets (sub-sales) and also might reduce property investments

by local and foreign property investors. The following is the RPGT rates effective from 1st

January 2014.

You might also like

- Managerial Economics Assignment No: 1 Name: Sharada Raut PRN: 09020446006Document6 pagesManagerial Economics Assignment No: 1 Name: Sharada Raut PRN: 09020446006sharadararautNo ratings yet

- Nigeria Tax & Fiscal RegulationsDocument9 pagesNigeria Tax & Fiscal RegulationsAparna SinghNo ratings yet

- 12 BBTX4203 T8Document18 pages12 BBTX4203 T8puvillanNo ratings yet

- Taxes in IndiaDocument14 pagesTaxes in Indiajinalshah21097946No ratings yet

- Act 4.1Document3 pagesAct 4.1Tiffany HwangNo ratings yet

- Nota RPGT LatestDocument8 pagesNota RPGT LatestSiva NanthaNo ratings yet

- Nigeria Property Tax in Federal Capital TerritoryDocument3 pagesNigeria Property Tax in Federal Capital TerritoryMark allenNo ratings yet

- Tax Considerations On Transfers of Unlisted Shares of StockDocument3 pagesTax Considerations On Transfers of Unlisted Shares of StockCarmel LouiseNo ratings yet

- Angela Jano - 2C1Document2 pagesAngela Jano - 2C1Angela Bea JanoNo ratings yet

- The Taxperts GroupDocument2 pagesThe Taxperts GrouptaxpertsNo ratings yet

- (LECTURE NOTES) TOPIC #6 - Individual Tax Planning and ManagementDocument19 pages(LECTURE NOTES) TOPIC #6 - Individual Tax Planning and Managementcourse shtsNo ratings yet

- 20 Types of Taxes in India: B.Tech Information Security & Cloud TechnologyDocument13 pages20 Types of Taxes in India: B.Tech Information Security & Cloud Technologygaurav singhNo ratings yet

- 20 Types of Taxes in IndiaDocument5 pages20 Types of Taxes in IndiaShreekumarNo ratings yet

- 20 Tax Free Incomes in IndiaDocument8 pages20 Tax Free Incomes in IndiaRaj PatoliyaNo ratings yet

- Taxes in Real Estate SaleDocument5 pagesTaxes in Real Estate SaleJorgeNo ratings yet

- PSE Reit Listing RulesDocument2 pagesPSE Reit Listing RulesE ENo ratings yet

- Belmonte TAX Quiz. WITH PART 1docxDocument11 pagesBelmonte TAX Quiz. WITH PART 1docxRheyne Robledo-MendozaNo ratings yet

- Other Percentage TaxDocument2 pagesOther Percentage TaxMonique G. BugnosenNo ratings yet

- Tax Code Notations Part IDocument31 pagesTax Code Notations Part IJonaliza O. BellezaNo ratings yet

- Percentage TaxDocument4 pagesPercentage TaxPATRICK JAMES BALOGBOG ROSARIONo ratings yet

- Lesson 1 Tax Administration Tutorial NotesDocument8 pagesLesson 1 Tax Administration Tutorial Notes4mggxj68cyNo ratings yet

- Forecast in Taxation Law: Atty. Raegan L. CapunoDocument47 pagesForecast in Taxation Law: Atty. Raegan L. CapunoFrance SanchezNo ratings yet

- Oing Business in GuatemalaDocument16 pagesOing Business in GuatemalaJorge Luis Can MonroyNo ratings yet

- MSME Awareness of TRAIN Law ImpactsDocument6 pagesMSME Awareness of TRAIN Law ImpactsAzzia Morante LopezNo ratings yet

- Understanding Real Estate TaxationDocument4 pagesUnderstanding Real Estate TaxationCashmoney AlaskaNo ratings yet

- Property Taxes in The PHLDocument8 pagesProperty Taxes in The PHLvictor odtohanNo ratings yet

- TaxationDocument3 pagesTaxationErwin MacaspacNo ratings yet

- 2023 Pre Week Tax by LumberaDocument19 pages2023 Pre Week Tax by LumberaYeye Farin PinzonNo ratings yet

- Philippines Taxation GuideDocument8 pagesPhilippines Taxation GuideCindy-chan DelfinNo ratings yet

- Investment and Interest Rate Rentals and Minimum WagesDocument17 pagesInvestment and Interest Rate Rentals and Minimum WagesJenalyn BustineraNo ratings yet

- Overview of The Philippine Tax System TaxationDocument13 pagesOverview of The Philippine Tax System TaxationKylie Luigi Leynes BagonNo ratings yet

- Changes in New Direct Tax Cod1Document10 pagesChanges in New Direct Tax Cod1Somit ParNo ratings yet

- VatDocument274 pagesVatzaneNo ratings yet

- Alana - Self-Assessment Module 3Document3 pagesAlana - Self-Assessment Module 3kate trishaNo ratings yet

- Author Ayan Ahmed Blog Capital Gain in FranceDocument5 pagesAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDNo ratings yet

- Aec 209 Act 02Document4 pagesAec 209 Act 02Jaried SumbaNo ratings yet

- Quick Sell Repossessed Properties FNB: WWW - Quicksell.co - ZaDocument9 pagesQuick Sell Repossessed Properties FNB: WWW - Quicksell.co - ZaChristian MakandeNo ratings yet

- Summary of Thailand-Tax-Guide and LawsDocument34 pagesSummary of Thailand-Tax-Guide and LawsPranav BhatNo ratings yet

- Corporate Tax in SingaporeDocument23 pagesCorporate Tax in SingaporeMaria Bulgaru100% (1)

- Direct Tax CodeDocument8 pagesDirect Tax CodeImran HassanNo ratings yet

- Capital Gains Tax ArticleDocument5 pagesCapital Gains Tax ArticleErnest O'BrienNo ratings yet

- VAT Law Essentials in 40 CharactersDocument78 pagesVAT Law Essentials in 40 CharactersgoerginamarquezNo ratings yet

- Direct Taxes ExplainedDocument10 pagesDirect Taxes ExplainedAbhishek DixitNo ratings yet

- The Regular Corporate Income TaxDocument4 pagesThe Regular Corporate Income TaxReniel Renz AterradoNo ratings yet

- IT Return Guidelines v2.0Document15 pagesIT Return Guidelines v2.0Hasan MurtazaNo ratings yet

- Tradewise Tax PNL ReportDocument71 pagesTradewise Tax PNL Reportchitranjan JegadeesanNo ratings yet

- ARENA COM5011 AssignmentDocument6 pagesARENA COM5011 AssignmentJaried SumbaNo ratings yet

- Compulsory Registration: RequirementDocument4 pagesCompulsory Registration: RequirementNur Iszyani PoadNo ratings yet

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocument10 pagesCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaNo ratings yet

- TiStory d020220160519 JorgensenDocument24 pagesTiStory d020220160519 JorgensenShamir GuptaNo ratings yet

- Bar Review Lecture - VATDocument71 pagesBar Review Lecture - VATIsagani DionelaNo ratings yet

- Hong Kong Taxation Reform: From An Offshore Financial Center PerspectiveDocument10 pagesHong Kong Taxation Reform: From An Offshore Financial Center Perspectivegp8hohohoNo ratings yet

- RPGT: Understanding Malaysia's Real Property Gains TaxDocument29 pagesRPGT: Understanding Malaysia's Real Property Gains TaxAimi AzemiNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAman Machra100% (2)

- Special Topics in Corporate Income TaxationDocument159 pagesSpecial Topics in Corporate Income TaxationLadybird MngtNo ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- South African Tax Thesis TopicsDocument6 pagesSouth African Tax Thesis Topicsdnr68wp2100% (2)

- Indonesia Daily: UpdateDocument7 pagesIndonesia Daily: UpdateyolandaNo ratings yet

- Samsung AC InvoiceDocument1 pageSamsung AC Invoiceavinash.tripathiNo ratings yet

- Hotel NewsDocument88 pagesHotel NewsnickiminajNo ratings yet

- MOD Registeration FormDocument1 pageMOD Registeration FormSajid Ur RehmanNo ratings yet

- Edited ProjectDocument55 pagesEdited ProjectAmrutha BineshNo ratings yet

- 14.54 International Economics Handout 6: 1 A Monetary ModelDocument7 pages14.54 International Economics Handout 6: 1 A Monetary ModelMartin ZapataNo ratings yet

- Questions COSTDocument5 pagesQuestions COSTDonita BinayNo ratings yet

- Full Download Essentials of Life Span Development 2nd Edition Santrock Test BankDocument35 pagesFull Download Essentials of Life Span Development 2nd Edition Santrock Test Banksultryjuliformykka100% (23)

- Ark Innovation Etf Arkk HoldingsDocument2 pagesArk Innovation Etf Arkk Holdingshkm_gmat4849No ratings yet

- Fintech PresentationDocument6 pagesFintech PresentationStudent Placement CoordinatorNo ratings yet

- Intro Mining First AssignmnetDocument10 pagesIntro Mining First AssignmnetTemesgen SilabatNo ratings yet

- Transport Policies and Development: Policy Research Working Paper 7366Document45 pagesTransport Policies and Development: Policy Research Working Paper 7366Sudhir GotaNo ratings yet

- Organizational InnovationDocument44 pagesOrganizational InnovationmarkNo ratings yet

- IEHE Bhopal Online PaymentDocument1 pageIEHE Bhopal Online Paymentraja20005tiwariNo ratings yet

- 1.630 ATP 2023-24 GR 9 EMS FinalDocument4 pages1.630 ATP 2023-24 GR 9 EMS FinalNeliNo ratings yet

- KCA Deutag Announces Third Quarter 2022 ResultsDocument18 pagesKCA Deutag Announces Third Quarter 2022 ResultsPatrick LegaspiNo ratings yet

- Quote To Afina Sistemas Informaticos Ltda 3017385Document1 pageQuote To Afina Sistemas Informaticos Ltda 3017385Rubén CastañoNo ratings yet

- Economic Integration: Trade Creation and Diversion EffectsDocument40 pagesEconomic Integration: Trade Creation and Diversion EffectsAdam GamblinNo ratings yet

- Daily Performance Sheet 7th November 2019 (With SIP Returns)Document489 pagesDaily Performance Sheet 7th November 2019 (With SIP Returns)Prasanta Kumar GoswamiNo ratings yet

- Fy 2018 FinancialsDocument68 pagesFy 2018 FinancialsAnonymous UH3nIimNo ratings yet

- Carillion Collapse Case StudyDocument20 pagesCarillion Collapse Case StudyChloe NgNo ratings yet

- Principles of Macroeconomics 6th Edition Frank Test Bank 1Document36 pagesPrinciples of Macroeconomics 6th Edition Frank Test Bank 1cynthiasheltondegsypokmj100% (24)

- Loan proceeds checklist requirementsDocument3 pagesLoan proceeds checklist requirementsivyNo ratings yet

- Assignment (1) 8505Document23 pagesAssignment (1) 8505Muhammad RamizNo ratings yet

- NMIMS Banking Industry Analysis ReportDocument35 pagesNMIMS Banking Industry Analysis ReportGovind Chandvani100% (1)

- Bluaccount 007284521827 Desember2022Document11 pagesBluaccount 007284521827 Desember2022H.m.a. RoufNo ratings yet

- IC SWOT and PEST Analysis 11598 - WORDDocument2 pagesIC SWOT and PEST Analysis 11598 - WORDGianna Glov100% (1)

- I-Bytes Travel & Transportation February Edition 2021Document70 pagesI-Bytes Travel & Transportation February Edition 2021IT ShadesNo ratings yet

- KTT TELEX CODE PAYMENT (Signed)Document4 pagesKTT TELEX CODE PAYMENT (Signed)ChristianMNo ratings yet

- Kotler Mm16e Inppt 01Document40 pagesKotler Mm16e Inppt 01salbeha salbehaNo ratings yet