Professional Documents

Culture Documents

Managing Financial Resources and Decisions

Uploaded by

angelomercedeblogCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing Financial Resources and Decisions

Uploaded by

angelomercedeblogCopyright:

Available Formats

Managing Financial Resources and Decisions

Task 1

With the economic appreciation within Dubai region, Mr. Mohammad intends to start a computer

trading business. Recent demands for globalization of businesses and institutions in the region have

greatly increased the demand for computer units and tools, either for administration or operation. Mr.

Mohammad sees this rich and not-yet-so-tapped market, which will eventually yield good investment

returns for him.

Mr. Mohammad, however, does not have the necessary investment capital or fund source to start up the

business. is lack of resources may lead to the defeat of the plan. !o, Mr. Mohammad looks on the

possible sources of finance that can be harvested for the realization of his computer trading business.

P1. Identify the sources of finance available to Mr. Mohammads business for the proposed costs.

Mr. Mohammad already identifies the start-up costs "license fee, economic department fee, labor

department fee, civil defense fee, etc.#, resources cost "office e$uipment, delivery van, furniture and

fi%ture#, and operating costs "salaries, insurance, advertisement fees, etc.# that must be addressed in his

endeavor. &hese costs are part of the short-term, medium-term, and long-term demands of the business.

&o pursue the business plan, Mr. Mohammad can possibly e%ploit the following resources that will be

discussed below'

Capital Investment. (t this point, Mr. Mohammad has not yet decided whether to maintain sole

ownership of the trading business or to share it with other individuals. !hould Mr. Mohammad intends

to maintain sole ownership of the business, he has the option to invest his personal assets and resources

on the business "Mc)achern, *+,*#. owever, if Mr. Mohammad does not have enough personal assets

to use, going for sole proprietorship is not recommended.

-ar better, asking for a partner to .oin the business venture is a good advantage to Mr. Mohammad. &he

partner can invest additional resources and capital to the venture, plus, it will reduce the liability of Mr.

Mohammad "Daily, *+,*#. /astly, forming a corporation is another option to consider. 0t will invite

investors to look at the profitability and feasibility of the plan, and it will make financing easier "ibid,

p. 1,#. 0n a corporation, more people can help finance the business venture and it will be an advantage

to avoid unlimited liability on the part of Mr. Mohammad and the rest of the stockholders.

usiness !peculators or "hird#Party Investments. Mr. Mohammad can handle setting or starting up

the business, however, his problem is how to ac$uire necessary resources for the business and the

operating cost. 2etting a loan from a bank is not likely to happen due to the high risk involved in

starting a business. 3ut Mr. Mohammad can seek the help of business speculators, venture capitalists or

third-party investors "4hatfield, *++1#. )ven before the computer trading business kicks off, Mr.

Mohammad can already receive funding from these investors, which can be used to set-up the office,

but necessary fi%tures, and so on.

&hird-party investment is better than loan because the business does not need to run after the repayment

of the debt. -unding from venture capitalist seeks interests only when the business is already stable and

the operation is going well.

"rade Credit. &he nature of the computer trading business allows Mr. Mohammad to stamp a deal with

manufacturers and distributors for a trade credit. -or some, consignment system is also considered to

be same category. 3asically, trade credit and consignment allow the business to sell products and goods

without even actually paying them yet. 5ayment is made only in the future, either when products are

sold or on a considerable period of time. 0n essence, trade credit allows low-capital businesses to

operate without raising capitalization.

$easing. &o reduce high cost of ac$uiring new vehicles and buying offices or store area, leasing is an

option to consider. &he computer trading business does not need to purchase needed resources for the

business operation, instead, the venture can lease these resources over a period of time.

&hese are the basic options that can be e%plored by Mr. Mohammad to finance the business start-up,

resources and operations. &here are other possible options that be e%plored as time and opportunities

permit, these include' bank overdraft "for operation, especially for salaries#, rent-to-own purchase

"resources#, and loans "for e%pansion#.

P%. &ssess the implications of the different sources of finance available to Mr. Mohammads

business.

0n the first $uestion, we have recommended four ma.or finance sources available for Mr. Mohammad.

&hese are capital investment, venture capitalists or third-party investments, trade credit, and leasing,

with the possible consideration of bank overdraft, rent-to-own purchase, and loans. 6f course, these

different sources of finance are sub.ected to opportunities and convenience, and as time tells.

-or purposes of understanding the merits of each, below is an analysis of the possible implications of

these different sources of finance.

Legal

3asically, it is easier for Mr. Mohammad to start a business if he will go for sole proprietorship. &he

simplicity of this type of ownership also offers rela%ed government procedures. 7ou don8t have to file

necessary documents as compared with a corporation or a partnership "5akroo, *+,+#. &hat means

you8ve got to comply only with the local re$uirements of the local government unit in the region. 6n

the other hand, although, partnership is more comple% than sole proprietorship, you can still take

advantage of its rela%ed procedures. 0n terms of ta%ation and other government regulations, partnership

is easier to file and you don8t have to suffer the large ta% re$uirements. 3ut with today8s business arena,

there are sub-types of partnership that will allow customized control over the company and limitation

on liability.

6f course, most companies or organizations today are in form of 9corporation: because of its fle%ible

arm to raise capitalization or funding. Mr. Mohammad looks forward to founding a corporation for his

computer trading business with the involvement of other investors. owever, a corporation is ta%ed

higher compared to other forms of business, and there are several documents to be filed with the !)4

"5akroo, *++1; )manuel < )manuel, *++=#. &he business must be approved by the commission prior to

its establishment both as de facto and de jure.

(s per recommendation, Mr. Mohammad is encouraged to build a partnership, wherein he can have

unlimited number of partners to raise funding. (nd as the company goes, he and the partners can

reorganize to form a corporation.

With regards to third-party investments, the contract may be also sub.ect to scrutiny as to level of

involvement. 0t is necessary for Mr. Mohammad to ask the level of legal control of the venture

capitalist. 6f course, Mr. Mohammad looks for control and management of the company, but if legal

terms demand him to relin$uish control to third-party investors, he will become a sideline owner. &his

and the many aspects of the third-party investment contract is an important piece of legal document that

should be studied by Mr. Mohammad.

Financial and Dilution

(s mentioned above, the introduction of venture capitalist, partners, or stockholders may result to a

convenient dilution of control. !hould Mr. Mohammad raise financing capital of the business through

partnership, corporation, or third-party investments, it would result to reduced control of the business

"4handra, *++1, p. >*?#. &he intrusion of other entities reduces Mr. Mohammad8s power over control,

while it may raise other person8s power over control.

Due to the fact that Mr. Mohammad does not have the necessary resources to support the business

venture, he may resort to capitalization that will make him of less importance in a company he had

conceived. (nd as the company goes on, such power over control and management may eventually

reduced as new partners are admitted or new e$uities are issues to raise capitalization for the business.

0n essence, the desire to raise available finance for the business may lead to the dilution of power over

control on the part of Mr. Mohammad, even if he does some mitigation against it. 0n fact, the only thing

he can possibly do is to actively .oin in any issuance of e$uities or increased partner8s investments to

retain the biggest share of control.

(s much as Mr. Mohammad8s control dilutes, his financial interest may also dilute in the process. 6f

course, partnership and corporation follow a more specific method of dividing profits or retained

earnings, and commonly it is done in pro-rata to investment. ( diluted control is the same as a diluted

financial value. Much more, any business activity, such as merger, issuance of new e$uities, may also

result to financial dilution "@han, *++A#.

0n any stage of financing, dilution happens, and it is the very concern that should be put into thought by

Mr. Mohammad if he wants to retain management and financial clout on the computer trading business

he started "@han < Bain, *++1#.

Bankruptcy and Dilution

During bankruptcy, Mr. Mohammad8s and other partners8 or stockholders8 interests on the computer

trading business are not central to the business. &he fact that the business made use of the trade credit

system of financing and leasing raises the business liability. (nd under the business bankruptcy rules,

debtors8 interest on the assets of the business is priority. Cntil these interests are met, stockholders do

not have the right to ask for repayment and shares of the assets.

When the above-mentioned interests are met and the computer trading business assets are still

available, stockholders can now start claims. owever, it will come again to what form and what

substance. 0n partnership or a corporation, if Mr. Mohammad is part of the ruling group, say preferred,

he will get payment of his investment first. 3ut if he did not take part of the ruling group, he have to

wait until all other interests are met.

2enerally, in the bankruptcy situation, if the asset of the business has already been dissolved to meet

interest, owners are less likely to receive repayment of their capital. (nd under the sole proprietorship,

debtors can go after personal assets of Mr. Mohammad to meet their interest. 0t is to this fact that Mr.

Mohammad is encouraged to consider limited partnership and corporation to avoid this scenario.

P'. (valuate the appropriate sources of finance for Mr. Mohammads business considering the

follo)ing aspects.

With the following available sources of finance cited in the first part of this task, Mr. Mohammad8s

options are wide and tremendous. owever, not all options will work .ust as fine. 0t is essential to

evaluate at least three appropriate sources of finance based on suitability of purpose, advantages, and

disadvantages.

&. Partnership.

&aken everything into account and consideration, Mr. Mohammad will fair well if he goes for a

partnership than sole proprietorship or a corporation. ( limited partnership brings the most investment

possible for the business. 0nstead of being tied up with the demands and re$uirements of a corporation,

a partnership offers an ine%pensive and convenient way to start up a computer trading business

"3evans, *++D, p.?*#.

With an unlimited number of partners admitted, Mr. Mohammad can easily raise the needed

capitalization for the venture. &he income of the business will be divided in a pro-rata basis, which will

be based on the amount of investment "3righam < ouston, *++=, p.?#. &his also provides an e%it out

of the high corporate income ta%es, as partners8 income will be ta%ed individually and according to their

earnings. (nd partners can invest to the e%tent of their capability, which will be of great advantage to

attract more investors.

owever, investors may get wary or may have some doubts over the liability e%tent of a partnership.

(n action of a partner may affect the capability and future of other partners. &o avoid this situation and

eliminate investors8 fear, it is necessary to form limited partnership that will safeguard the personal

assets of investors "Madura, *++?#. (nother disadvantage is when partners leave the business, it may

place disruption to the smooth organization procedures. &he dismissal or death of a partner re$uires the

partnership to reorganize E and this may prove too inconvenient and difficult for the partnership.

Moreover, Mr. Mohammad can always retain management control being both an investment and

managing partner. Without this leverage, Mr. Mohammad can maintain the way the business will move.

0t is a great advantage for any person who is looking forward to managing and planning for a business,

but lacks the necessary resources to kick the business.

Fonetheless, the partnership can easily reorganize to form a corporation when deemed necessary. &he

forming of the corporation will be an advantage as the business grows and e%pansion is imminent.

. "rade Credit.

(s much as forming a partnership will raise finances to start the business, making much of trade credit

is a big thing. &rade credit allows computer goods or products to be 9purchased or delivered but

payments are postponed to an agreed future date "ussain, ,=1=#.: &his arrangement will allow the

business to operate with less cost. &hus, it will allow Mr. Mohammad to work things out without the

worry of loss of operating finances.

0n the same respect, trade credit allows the business to engage in a credit "in form# without the interest.

0t is as if goods or products are purchased in cash. &his advantage eliminates the high credit interest

that are usually charged on loans. owever, according to 3habatosh, the supplier may add or hide the

interest on the price of goods. (s a result, the selling price of the computer trading business may be

higher than the rest of the competitors.

&he underlying premise behind the trade credit is for the business to sell the units before the agreed

date of payment. 0n this scenario, the business can gain profit from the trade credit without e%posing its

available funds to finance the said operation. &he opposite, however, re$uires the business to shell out

some of its assets or available funds to finance the operation, which is not beneficial to the business,

especially when goods are not sold in a short period of time. 0n such situation, available funds may be

e%hausted and operation may be halted.

C. *ire Purchase.

(s much as the business needs necessary e$uipment and tools, such as vehicles, to operate, Mr.

Mohammad needs to find a perfect source of finance, and the rescue is through hire purchase.

(lthough, in the first assignment, leasing is recommended, but such would not be beneficial. /easing

will only the business to rent the resource for a time and lose ownership thereof. Fot with hire

purchase, this would allow the business to lease the resource and eventually own it on a proper time.

Mr. Mohammad can sign a hire-purchase agreement that will e%pire in a period of time. (t the last

installment, the computer trading business receives ownership of the property. (lthough the property

by then is already used and may have depreciated in value, the computer trading business adds up a

new asset to the balance sheet "ussain, ,=1=#. (nd as time permits, the business can re-sell the

property to gain out of it. Whichever is the best way, hire-purchase would allow the business to operate

without e%posing its cash.

&he essence of leasing is buying time for the business until it has the capacity to buy its own

e$uipment. &his still works with hire-purchase, the only difference is the ownership title to the property

when terms of the agreements are met.

Mr. Mohammad8s dilemma on finding appropriate sources of finance is now solved. 0t must be noted,

however, that as the business grows and e%pands, new forms and sources of finances can be tapped to

supply the needs and demands of the business. (s always, business is about creativity and timing.

P+. Cost of the Different !ources of Finance

&he recommended sources of finance that Mr. Mohammad should e%plore do not count much of a cost.

3asically, the formation of a partnership is of convenience and simplicity. Without the demand and

re$uirement of a corporation, partners can easily write the agreement between them to form the

business partnership. &his would reduce the cost of government and business compliance in almost a

half E and this would gain enough assets to use for the business than to secure a corporation status.

&he convenience of a trade credit is of great advantage, though only for a time. 0f the computer trading

business can stamp a deal that will secure a credit for =+ days, the business needs to sell goods prior to

that date. 6therwise, it would cost available funds to settle the credit after =+ days. 3ut with the

growing economic appreciation in Dubai region, it is easy for the business to gain clients or customers,

and trade credit would not be a problem. 6n the other hand, the hire purchase will re$uire the business

to pay monthly or period installments. &his would take available funds from the account of the

business. 3ut this can be met when the business operates well in the ne%t coming months.

Task 2

-or over the past years, )mirates /aw (ssociates ")/(# has provided legal services to individuals,

corporates, and other clienteles in the Dubai region, and the vastness of Cnited (rab )mirates. 0n

accordance with government regulations, the chairman of )/(, Mr. (li hires the auditing services of

&alal (bu 2azalah to keep the record straight and prepare the books of the law office. &his audit report

will also be used by Mr. (li to improve the financial performance of the law office to the year *+,G,

and to formulate new approach to their financial sheets that will better their financial status at the

moment.

P1. Importance of Financial Planning for Financial Performance and Position Improvement >++

-inancial planning is defined as the future-oriented engagement of the financial status of the business

to form a concrete prognosis of the future that will be the basis for the actions and activities of the

business or organization "4ortes, *++=#. 0t serves as the guidance of the business on how it will handle

its finances to effectively adapt a cost-effective and profit-oriented plan. 0n layman8s term, financial

planning is the effective overview on the cash inflow and outflow of the business that will translate

better understanding on how profit can be obtained. -inancial planning supports the general principle

that a business works on to ac$uire and generate profit.

(ccording to !heeba, financial planning 9determines the direction for future growth of the

business...which helps to establish future business plans for the firm like e%pansion, diversification or

restructuring.: 4entral to financial planning is looking at past performances of the organization to make

sound .udgment on pro.ecting e%penses, monitoring revenues, and taking the right intervention action

for the improvement of the performance.

&o understand how financial planning improves financial performance, it is essential to review the

steps that must be taken. -orecast plans are created to evaluate financial statements 9under alternative

versions of the operating plan in order to analyze the effects of different operating procedures on

pro.ected profits and financial ratios "3righam < )hrhardt, *+,,#.: 3y looking at the different angles

of the financial statement forecasts, Mr. (li can test the right strategy that will translate better financial

results.

&he core of the financial plan is the cash flow of the organization "onadle < owitt, ,=1D, p.,+?#.

With )mirates /aw (ssociates business pro.ects and activities, it is necessary for Mr. (li to review the

capital that will be needed. Will the pro.ect use readily available resourcesH 6r will investment on new

resources be beneficial and financially feasibleH With the evaluation of the investment and the

pro.ected return, )mirates /aw (ssociates can raise its revenues while cutting unnecessary e%penses.

Moreover, with the pro.ection, if the resources and funds of the law office cannot meet demands of the

business activity, the $uestion boils down to the capability of the law office to raise investments and

finances, with the consideration as to how the law office can meet repayment in the future.

0n this consideration, to position the company properly based on the financial term, it is very important

to check how it fairs with the market. )mirates /aw (ssociates must review its commitment to its

clients by looking at internal factors. &he performance of the law office depends on the perception of

clients which is focused on e%ception customer service. 0nternally, the law office must use the human

resource to meet this goal of market positioning. 0n this instance, it is necessary to review the human

resource planning of the law office, as the provision of services will be improved by a reward and

compensation system.

/astly, financial planning works on an effective monitoring and evaluation system that will keep the

performance and financial position of the law office on check. 0ntervention or interference is a very

important of the financial plan E and businesses should clearly outline how alternate routes of financial

plans will work to avoid loses or any financial dilution.

P%. Financial Information ,ecessary for (ffective Decisions.

(s understood, financial planning is an essential part of a business strategic plan. 0t provides a $uick

overview of the entire business processes and how the organization should be directed to accomplish its

financial goals and ob.ectives. (n effective financial plan involves careful analysis of financial

information that are relevant to the day to day activity of the business. 3asically, the information can be

obtained by understanding the rudiments or elements of financial statements. owever, there are

important financial information that can be obtained from the basic components of the following

documents that will be discussed.

Sales Forecast

(lthough )mirates /aw (ssociates is a service-oriented business, sales forecast can still be made

which will be focused on the number of clients they received in a period and the revenue they

accumulate from these said clients. (ccording to Bohn D. /uth, as cited by Iieceli < Ialos, 9a good

sales forecast is undoubtedly the most important single planning tool.: -rom the overview of the sales

forecast of )mirates /aw (ssociates, Mr. (li can easily assess promotion, management decisions,

future needs, and the achievement of business goals.

Balance Sheet

4onsidered as the complete picture of the company, the balance sheet provides information as to what

the business owns, what it owes, and the balance for owners or stockholders. Without clear

understanding of how much the company owes may result to an e%cessive loan which may hurt the

company in the process. Mr. (li should consult the balance sheet to see the available assets for the

business and its current obligations.

Cash Flow ,>+

Mr. (li, as the e%ecutive of )mirates /aw (ssociates, should know what and where the asset is spent,

and in the same way, what and where the money is received. With the aid of the cash flow, managers

get an overview over purchases of assets, payment to employees, and revenues received from rendering

services. 2etting a clear knowledge of the e%penses and revenue of the business provides information

as to how the business must be directed to ensure profitability.

2enerally, there are other financial information or documents that can help Mr. (li to make a financial

plan for the business. &hese information should be regarded and evaluated from time to time to reflect a

real-time and reliable knowledge for management decisions.

P'. "he Impact of finance on the financial statement of (mirates $a) &ssociates.

When the management gets a clear understanding of the business direction, it is easy for them to make

decisions that are effective, positive, and timely. 6f course, the implemented financial plan can only be

fully evaluated based on its results, though performance monitor can be made during the process. 0n

this regard, financial planning can be a two-way result. 0t can either provide growth and financial

performance improvement or it can undo the progress of the business.

0mperatively, however, a financial plan that takes into account every single financial information

available can always provide relevant and reliable strategies. 0n the end, the impact of financial on the

financial statement of )mirates /aw (ssociates is provide management an overview on how to increase

revenue through massive e%pansion on market, reduction of unnecessary e%penses, and positioning the

law office in the market.

(s an accountant for &alal (bu 2azalah, 0 don8t have the position to dictate Mr. (li on how to manage

the law office. 3ut 0 can provide him the necessary overview of the business that will help him decide

issues. !imply, a financial plan or the business plan still resides on the business manager and not on

accountants.

Task 3

(mirates $a) -ffice Potential Problems

Concern Financial &ccount 5roblem !olution

Revenue &oo /ow 0ncreased 4lient )ngagement

!alaries )%cessive )%penses 5ro-Rata to ours Rendered

Method

(dvertisement /ow Returns )limination or Re-5ositioning

0nsurance &oo /ow 2roup 0nsurance for -uture Risk

(ccounts Receivable /ow 4ollection !trict &erms and 4onditions to

0mprove 4ollection

3ank /oan &oo igh "compared to (4# 5ay off Debt by 6ffsetting with

(4

4ash &oo /ow 4onverting of (ssets into

-loating and Readily (vailable

4ash

Dividends /ow Cnappropriated Retained

)arnings

0mproved -inancial !tability to

0ncrease !tockholders8

4onfidence

Table 1: Potential Financial Problems of Emirates Law Office

P1. Potential financial problems (mirates $a) &ssociates might e.perience in the business.

3ased on the review of the financial information of )mirates /aw (ssociates, there are possible

problems that are already hindering the financial performance of the business. 0f not resolved, these

problems may result to tremendous downgrade or dilution of the law office.

Expenses. )mirates /aw (ssociates is a service-oriented business that provides legal services to

clients. With this business nature, it is a big wonder why the law office is spending too much E and it is

a wonder why the return of their e%penditure is not remarkable.

!tand supreme of these e%penses is the salary and wages. 6f course, lawyers should be paid high as the

.ob demands that. owever, if you pro-rate the salaries against the revenue, you will find that not all

lawyers are accumulating income for the business. ( legal business as the )/(, it is very important that

lawyers be paid according to the amount they bring to the business.

Moreover, other e%penses seem to top the bill. &ake into account the advertisement and supplies of the

business. 6f course, the business should see to it that they get enough promotion, but these

advertisements are not returning well based on revenue numbers.

Insurance. (s much as )/( spends big on salaries of lawyers and staffs, it spends less on insurance of

employees, the office, or the firm. -or a firm in a legal service industry which has tremendous risk, a

,+, +++ ()D is too low from the normal insurance allowance. !hould something happen to one of its

lawyers during a stint of legal services, the insurance may be able to cover the liability and )/( should

take from its own savings.

Accounts Receivale! /ooking at the balance sheet of )/(, we can find that the accounts receivable is

too high at ,, 1++, +++ ()D. Roughly, )/( has a poor collection system. With such high ceiling for

(J84, )/( maintains high risk of floating and unused assets, and the transfer of these (4s into

(llowance for 3ad Debts. &his is also a big problem if the business needs enough cash in hand for any

une%pected e%penses.

Loan. Fonetheless, it must be noted that the business has a very big loan of ,, +++, +++ ()D. &his

perhaps stops the business from moving forward. 0n fact, the unappropriated retained earnings is too

low due to the fact that there are lot of obligations and allocations that should be considered.

0n summary, )mirates /aw (ssociates has a very weak financial performance that it will not stand if

something happens in the market. With a ?++, +++ ()D in hand after the year ended, une%pected turns

of the economic behavior of the region may hurt the law office that much. (lthough this scenario is not

likely to happen due to the economic appreciation in the region, )mirates /aw (ssociates can still

improve its financial status to ascertain stability.

P%. !uggest actions (mirates $a) &ssociates might tale )hen e.periencing financial problems in

the business.

With the following problems cited in the first part of this task, solutions can be implemented to resolve

these issues and speed up the business and financial performance of )/(. &hese recommendations

address each specific issues at hand.

Cost"Cutting. During the collapse of the C! economy, businesses went to a radical cost-cutting

approach. 0t was a drastic change due to the fact that they were not ready for such. (ssuming that no

economic downgrade will happen in the region, it is still necessary to reduce e%penses to improve

financial status.

Mainly, it is very important for Mr. (li to check the salaries received by the law office8s lawyers. (re

they paid according to what they bring inH &he fact the clients pay in hours billed by the lawyer makes

it easier for the law office to check how much the lawyer brings in. 0t won8t be difficult for the law

office to assess the performance of each lawyer and how they work for )/(.

6n the other hand, it is also essential to check how these advertisements are working for the company.

&he return and impact of these advertisements are too minimal while the business spends more for it.

7ou cannot .ust spend on something with getting out of it. 0f the business is not receiving something

from these advertisements, it is better to drop them, and work on the word-of-mouth marketing.

Future Risk"Reduction. )mirates /aw 6ffice works with people and by people. (nd humans are more

risky than e$uipment. 4losing the gap of future financial obligation can be done by raising insurance. 0t

is something that )/( should work. &here are group insurance plans, office insurance plans, and other

financial insurance options available that can be e%plored by the law office to insurance everyone and

everything to avoid financial obligations that may cripple the business.

Better Business #rocedures. &he (4 problem can be traced back to the )/( terms and agreements. 0f

Mr. (li wants to raise its financial capacity and performance, the terms and agreements must be

reviewed to effectively control collection from clients. &he business cannot possibly survive with so

much receivable.

#ay$ent o% Loans. 0n fact, if )/( will work on its (4 problem, it is easier for them to offset the loan.

&his would provide financial freedom for the business, which will increase stability and can provide

chances on e%pansion.

owever, these recommendations are not standards. &hese can be changed as the time permits. &imely

ad.ustments must be made by )/(. Monthly review of the performance is recommended to detail a

real-time response on financial issues.

Reference:

3evans, F. "*++D#. Business Organizations And Cororate Law. 4engage /earning.

3habatosh, 3. Fundamentals Of Financial !anagement. 50 /earning 5vt. /td..

3righam, ). < )hrhardt, M. "*+,,#. Financial !anagement: T"eor# and Practice. 4engage /earning.

3righam, ). < ouston, B. "*++=#. Fundamentals of Financial !anagement. 4engage /earning.

4handra, 5. "*++1#. Financial !anagement$ &ata Mc2raw-ill )ducation.

4hatfield, 3. "*++1#. T"e %mact of Entrereneurs& 'ecision !a(ing on )tartu )uccess: %n*estigation+

Anal#sis+ and ,ecommendations. 5roKuest.

4ortes, -. "*++=#. T"e use and imortance of financial lanning in t"e -erman ri*ate ban(ing

industr#. 2R0F Ierlag.

Daily, -. "*+,*#. &a. )a**# for )mall Business. Folo.

)manuel, !. < )manuel, /. "*++=#. Cororations. (spen 5ublishers 6nline.

onadle, 3. < owitt, (. ",=1D#. Persecti*es on !anagement Caacit# Building. !CF7 5ress.

ussain, (. ",=1=#. A Te.tboo( of Business Finance. )ast (frican 5ublishers.

@han, M.7. "*++A#. Financial !anagement: Te.t+ Problems and Cases. A

th

edition. &ata Mc2raw-ill

)ducation.

Madura, -. "*++?#. %ntroduction to Business. 4engage /earning.

Mc)achern,W. "*+,*#. Contemorar# Economics$ 4engage /earning.

5akroo, 5. "*+,+#. T"e )mall Business )tart/0 1it for California. Folo.

!heeba, @. Financial !anagement. 5earson )ducation 0ndia.

Iieceli, B < Ialos, M. !ar(eting !anagement. (tlantic 5ublishers < Distributors.

You might also like

- Lecture - 8 - CompLaw - Shares N DebenturesDocument16 pagesLecture - 8 - CompLaw - Shares N DebenturestaxicoNo ratings yet

- Judicial Review of Government ProcurementDocument22 pagesJudicial Review of Government ProcurementMargaret RoseNo ratings yet

- Wealth Maximization ObjectiveDocument8 pagesWealth Maximization ObjectiveNeha SharmaNo ratings yet

- Nagoya Protocol and Its Implications On Pharmaceutical IndustryDocument10 pagesNagoya Protocol and Its Implications On Pharmaceutical IndustryBeroe Inc.No ratings yet

- Rights in Employee Inventions and Ideas. An Overview of United States LawDocument14 pagesRights in Employee Inventions and Ideas. An Overview of United States LawErica AsemNo ratings yet

- Fixed and Floating ChargesDocument6 pagesFixed and Floating ChargesChikwason Sarcozy MwanzaNo ratings yet

- LAW3840 Worksheet1ADROverviewDocument11 pagesLAW3840 Worksheet1ADROverviewRondelleKellerNo ratings yet

- The Treaty of Basseterre & OECS Economic UnionDocument15 pagesThe Treaty of Basseterre & OECS Economic UnionOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Financial ManagementDocument145 pagesFinancial Managementmanuj_uniyal89No ratings yet

- Strategic Business Analysis Co9 Case Study Final: Norway'S Pension GlobalDocument2 pagesStrategic Business Analysis Co9 Case Study Final: Norway'S Pension GlobalShirley Ann ValenciaNo ratings yet

- Final Report Impact of Free Movement Labour in OECSDocument272 pagesFinal Report Impact of Free Movement Labour in OECSOffice of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Influence of Bilateral Investment Treaties On Customary International LawDocument4 pagesInfluence of Bilateral Investment Treaties On Customary International LawBhavana ChowdaryNo ratings yet

- Short Essay 1: UnrestrictedDocument8 pagesShort Essay 1: UnrestrictedSatesh KalimuthuNo ratings yet

- Dividend Policy Guide - Factors Impacting Firm ValueDocument9 pagesDividend Policy Guide - Factors Impacting Firm ValueAnonymous H2L7lwBs3No ratings yet

- Assessing Performance of Property TaxationDocument80 pagesAssessing Performance of Property TaxationMsangiNo ratings yet

- A Theory of Entrepreneurial Opportunity Identification and DevelopmentDocument19 pagesA Theory of Entrepreneurial Opportunity Identification and DevelopmentWhorms Martins Olushola WhenuNo ratings yet

- Pacific Region Environmental Strategy 2005-2009 - Volume 1: Strategy DocumentDocument156 pagesPacific Region Environmental Strategy 2005-2009 - Volume 1: Strategy DocumentAsian Development BankNo ratings yet

- Paper Chapter 12 Group 1Document17 pagesPaper Chapter 12 Group 1Nadiani Nana100% (1)

- Beyonds Basel For Banking RegulationDocument2 pagesBeyonds Basel For Banking RegulationSayak MondalNo ratings yet

- Diversity in Corporate GovernanceDocument26 pagesDiversity in Corporate GovernanceShameza DavidNo ratings yet

- Assignment 1 S1-2016-17-2Document7 pagesAssignment 1 S1-2016-17-2Shawn25% (4)

- Note 08Document6 pagesNote 08Tharaka IndunilNo ratings yet

- Assignment 3Document5 pagesAssignment 3Chaudhary AliNo ratings yet

- Social Media Marketing and Relationship QualityDocument8 pagesSocial Media Marketing and Relationship QualityAlexander DeckerNo ratings yet

- Innovations in Digital Finance 2014Document24 pagesInnovations in Digital Finance 2014sangya01No ratings yet

- Chapter 8 An Economic Alaysis of Financiaal StructureDocument14 pagesChapter 8 An Economic Alaysis of Financiaal StructureSamanthaHandNo ratings yet

- Various Forces of Change in Business EnviromentDocument5 pagesVarious Forces of Change in Business Enviromentabhijitbiswas25No ratings yet

- Department Intiatives How Questions?: Marketing&s Ales Marketing&s Ales Marketing&s AlesDocument3 pagesDepartment Intiatives How Questions?: Marketing&s Ales Marketing&s Ales Marketing&s AlesMostafa RadeNo ratings yet

- A Transparency Disclosure Index Measuring Disclosures (Eng)Document31 pagesA Transparency Disclosure Index Measuring Disclosures (Eng)AndriNo ratings yet

- The Role of Finacial ManagementDocument25 pagesThe Role of Finacial Managementnitinvohra_capricorn100% (1)

- Valuation of Long Term Securities and Sources of FinanceDocument110 pagesValuation of Long Term Securities and Sources of FinanceLuckmore ChivandireNo ratings yet

- Business Law Self-Learning ManualDocument218 pagesBusiness Law Self-Learning ManualSheikh AaishanNo ratings yet

- Analyzing Developing Country Debt Using the Basic Transfer MechanismDocument5 pagesAnalyzing Developing Country Debt Using the Basic Transfer MechanismJade Marie FerrolinoNo ratings yet

- Sources of FinanceDocument26 pagesSources of Financevyasgautam28No ratings yet

- Global FinanceDocument49 pagesGlobal FinanceAnisha JhawarNo ratings yet

- Customer Is The KingDocument4 pagesCustomer Is The KingHiratek InternationalNo ratings yet

- Financial ManagementDocument103 pagesFinancial ManagementMehwishNo ratings yet

- MASB 1 - Presentation of Fi1Document2 pagesMASB 1 - Presentation of Fi1hyraldNo ratings yet

- An Introductory Guide To The Bribery Act: A Growing FirmDocument12 pagesAn Introductory Guide To The Bribery Act: A Growing Firmapi-86979083No ratings yet

- Euro Bond Market & TypesDocument2 pagesEuro Bond Market & TypesVikram Kaintura100% (1)

- Chapter 1Document21 pagesChapter 1Youssef Youssef Ahmed Abdelmeguid Abdel LatifNo ratings yet

- What is social cost-benefit analysisDocument28 pagesWhat is social cost-benefit analysisADITYA SATAPATHYNo ratings yet

- Finman Chapter 7 SummaryDocument2 pagesFinman Chapter 7 SummaryJoyce Anne Gevero CarreraNo ratings yet

- Sources of Long-Term FinanceDocument17 pagesSources of Long-Term FinanceGaurav AgarwalNo ratings yet

- T1-Legal Entity of A CompanyDocument14 pagesT1-Legal Entity of A CompanykityanNo ratings yet

- Negotiating a Co-Promotion Agreement Between German and UK CompaniesDocument2 pagesNegotiating a Co-Promotion Agreement Between German and UK CompaniesPinnPiyapat100% (1)

- The Impact of Monetary Policies On The Performance of Deposit Money Bank in NigeriaDocument14 pagesThe Impact of Monetary Policies On The Performance of Deposit Money Bank in NigeriaMUHAMMADU SANI SHEHUNo ratings yet

- Assignment International Economic LawDocument16 pagesAssignment International Economic LawreazNo ratings yet

- Company AnalysisDocument20 pagesCompany AnalysisRamazan BarbariNo ratings yet

- Determinants of Financial StructureDocument15 pagesDeterminants of Financial StructureAlexander DeckerNo ratings yet

- Accounting StandardsDocument13 pagesAccounting StandardsjajapagleNo ratings yet

- GROUP 3 - Pablo Gil - Case Study 1Document12 pagesGROUP 3 - Pablo Gil - Case Study 1Pablo GilNo ratings yet

- Introduction To PBFDocument35 pagesIntroduction To PBFruksharkhan7100% (1)

- CCJ Ruling Upholds Right to Free Movement in CARICOMDocument60 pagesCCJ Ruling Upholds Right to Free Movement in CARICOMKirk-patrick TaylorNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- Compelling Returns: A Practical Guide to Socially Responsible InvestingFrom EverandCompelling Returns: A Practical Guide to Socially Responsible InvestingNo ratings yet

- Growth Strategy Process Flow A Complete Guide - 2020 EditionFrom EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionNo ratings yet

- From Dependency to Sustainability: A Case Study on the Economic Capacity Development of the Ok Tedi Mine-area CommunityFrom EverandFrom Dependency to Sustainability: A Case Study on the Economic Capacity Development of the Ok Tedi Mine-area CommunityNo ratings yet

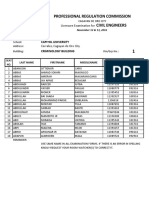

- CEB Chem-Eng1116 PDFDocument11 pagesCEB Chem-Eng1116 PDFPhilBoardResultsNo ratings yet

- Nursing Review of Anatomy and PhysiologyDocument107 pagesNursing Review of Anatomy and Physiologyjosephabram051590100% (1)

- NURS1116ra Lucena e PDFDocument23 pagesNURS1116ra Lucena e PDFPhilBoardResultsNo ratings yet

- manilaCE1116 PDFDocument287 pagesmanilaCE1116 PDFPhilBoardResults100% (1)

- Ce 112016 PDFDocument6 pagesCe 112016 PDFPhilBoardResultsNo ratings yet

- Ceb Customs1116 PDFDocument9 pagesCeb Customs1116 PDFangelomercedeblogNo ratings yet

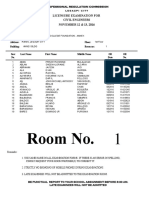

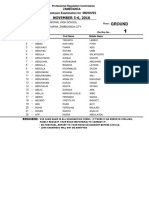

- Room No. 1: Professional Regulation CommissionDocument7 pagesRoom No. 1: Professional Regulation CommissionPhilBoardResultsNo ratings yet

- CIVIL1116ra CDO e PDFDocument22 pagesCIVIL1116ra CDO e PDFPhilBoardResultsNo ratings yet

- Ce IloiloDocument5 pagesCe IloiloangelomercedeblogNo ratings yet

- CIVIL1116ra Davao e PDFDocument40 pagesCIVIL1116ra Davao e PDFPhilBoardResultsNo ratings yet

- CIVIL1116ra Cebu e PDFDocument100 pagesCIVIL1116ra Cebu e PDFPhilBoardResultsNo ratings yet

- CIVIL1116ra Zambo eDocument4 pagesCIVIL1116ra Zambo eangelomercedeblogNo ratings yet

- P Zamboangamidwives112016 PDFDocument17 pagesP Zamboangamidwives112016 PDFPhilBoardResultsNo ratings yet

- Room Assignments: November 2016 Licensure Examination Aeronautical EngineersDocument15 pagesRoom Assignments: November 2016 Licensure Examination Aeronautical EngineersJohn Cris RanalanNo ratings yet

- GEOL16ra Mla eDocument19 pagesGEOL16ra Mla eangelomercedeblogNo ratings yet

- CRIM1016ra Lucena2 eDocument69 pagesCRIM1016ra Lucena2 eangelomercedeblogNo ratings yet

- CE1116ra TaclobanDocument4 pagesCE1116ra TaclobanangelomercedeblogNo ratings yet

- Ceb Customs1116 PDFDocument9 pagesCeb Customs1116 PDFangelomercedeblogNo ratings yet

- Palawan Edited PDFDocument21 pagesPalawan Edited PDFPhilBoardResultsNo ratings yet

- Room No. 1: Professional Regulation CommissionDocument10 pagesRoom No. 1: Professional Regulation CommissionPhilBoardResultsNo ratings yet

- mINT1016ra MLA PDFDocument26 pagesmINT1016ra MLA PDFPhilBoardResultsNo ratings yet

- P 1116MIDWIVESFORPOSTING PDFDocument9 pagesP 1116MIDWIVESFORPOSTING PDFPhilBoardResultsNo ratings yet

- Sorrowful WomanDocument5 pagesSorrowful Womanangelomercedeblog100% (1)

- CRIM1016ra Zambo e PDFDocument56 pagesCRIM1016ra Zambo e PDFPhilBoardResultsNo ratings yet

- CRIM1016ra Tugue e PDFDocument108 pagesCRIM1016ra Tugue e PDFPhilBoardResultsNo ratings yet

- Agriculturists 10-2016 Room AssignmentDocument67 pagesAgriculturists 10-2016 Room AssignmentPRC Baguio100% (1)

- Occ. Mindoro PDFDocument14 pagesOcc. Mindoro PDFPhilBoardResultsNo ratings yet

- AGRI1016ra Pagadian e PDFDocument12 pagesAGRI1016ra Pagadian e PDFPhilBoardResults100% (1)

- AGRI1016ra Tugue e PDFDocument27 pagesAGRI1016ra Tugue e PDFPhilBoardResultsNo ratings yet

- AGRI1016ra Iloilo e PDFDocument34 pagesAGRI1016ra Iloilo e PDFPhilBoardResultsNo ratings yet

- CH 03Document50 pagesCH 03lexfred55No ratings yet

- Personal Finance 8th Edition Keown Test BankDocument19 pagesPersonal Finance 8th Edition Keown Test BankDrAnnaHubbardDVMitaj100% (42)

- Projected Cash Flow Statement in ExcelDocument19 pagesProjected Cash Flow Statement in ExcelfarshidianNo ratings yet

- Barun Shaw Resume - 2020Document4 pagesBarun Shaw Resume - 2020naresh shahNo ratings yet

- How To Write A Business Plan in 2021 - Comprehensive GuideDocument5 pagesHow To Write A Business Plan in 2021 - Comprehensive GuidesaketNo ratings yet

- Dwnload Full Personal Financial Planning 13th Edition Gitman Solutions Manual PDFDocument35 pagesDwnload Full Personal Financial Planning 13th Edition Gitman Solutions Manual PDFjulianchghhc100% (11)

- Pfin 4 4th Edition Gitman Solutions ManualDocument25 pagesPfin 4 4th Edition Gitman Solutions ManualCarolineAvilakgjq100% (44)

- Business PlanDocument7 pagesBusiness Planfroilan arudNo ratings yet

- Operations & Financial PlanDocument41 pagesOperations & Financial Plansweetlunacy00100% (1)

- Managing Business Finances: Section 17.1Document18 pagesManaging Business Finances: Section 17.1Thiên TíuNo ratings yet

- Comprehensive Financial PlanDocument15 pagesComprehensive Financial PlanSatish NagdaNo ratings yet

- Financial Planning and Forecasting ObjectivesDocument13 pagesFinancial Planning and Forecasting Objectiveslethiphuongdan50% (2)

- Chapter 6Document26 pagesChapter 6Annalyn MolinaNo ratings yet

- Financial ManagementDocument79 pagesFinancial ManagementssskcollegeNo ratings yet

- Chapter 8 The Business PlanDocument25 pagesChapter 8 The Business PlanKATE ANDRE MENDOZANo ratings yet

- A Study of Financial Planning and Invest2Document6 pagesA Study of Financial Planning and Invest2Saurav RanaNo ratings yet

- The Six Step Process To Financial Planning PDFDocument2 pagesThe Six Step Process To Financial Planning PDFstarvindsouza91100% (1)

- Module 1 - Business Plans (CESocSci 4)Document32 pagesModule 1 - Business Plans (CESocSci 4)Trixy Fauna Luminario100% (1)

- Chap018 Management FinanciarDocument49 pagesChap018 Management FinanciaralkazumNo ratings yet

- Financial Forecasting and PlanningDocument40 pagesFinancial Forecasting and PlanningJilian Kate Alpapara BustamanteNo ratings yet

- Write financial plan under 40 charsDocument6 pagesWrite financial plan under 40 charsGokul SoodNo ratings yet

- Financial PlanDocument13 pagesFinancial PlanAyu Amalia MujahidaNo ratings yet

- Dudh Sagar Dairy of Financial ReportDocument83 pagesDudh Sagar Dairy of Financial ReportPatel Kashyap100% (2)

- Financial Plan SAMPLE INTERNET CAFE - Docx - Financial Plan..Document7 pagesFinancial Plan SAMPLE INTERNET CAFE - Docx - Financial Plan..Seina KNo ratings yet

- Webpay 170410200339Document125 pagesWebpay 170410200339jeyanthan88100% (2)

- Components of a Business PlanDocument17 pagesComponents of a Business PlanFrancez Anne Guanzon100% (1)

- Course FUNDAMENTALS OF ENTREPRENEURSHIP (4) 2018Document8 pagesCourse FUNDAMENTALS OF ENTREPRENEURSHIP (4) 2018naurahiman0% (1)

- Driver Based PlanningDocument8 pagesDriver Based Planningsarv2kNo ratings yet

- PDFDocument2 pagesPDFEm JayNo ratings yet

- Blueprint - How To Start A Recruiting Agency in 2021, Part Two - CrelateDocument8 pagesBlueprint - How To Start A Recruiting Agency in 2021, Part Two - CrelateRajaNo ratings yet