Professional Documents

Culture Documents

6.1 CuDeco Registry Anomalies 1

Uploaded by

asxresearch0 ratings0% found this document useful (0 votes)

24 views41 pagesBroker Trading versus Registry Activity over a 2 Year Period

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBroker Trading versus Registry Activity over a 2 Year Period

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

24 views41 pages6.1 CuDeco Registry Anomalies 1

Uploaded by

asxresearchBroker Trading versus Registry Activity over a 2 Year Period

Copyright:

© All Rights Reserved

You are on page 1of 41

1

CUDECO SHAREHOLDER RESEARCH

CHAPTER 6: REGISTRY ANOMALIES

6.1 A Review of Monthly Registry Anomalies

Spanning 2 Years of Trading

2

OVERVIEW OF THE SITUATION CONCERNING CUDECO

<Recommended background reading for first time visitors to the Shareholder Blog>

Trading behaviours associated with an Aug 18, 2010 price collapse in the share price of CuDeco Limited

have been generally dismissed by regulatory authorities as being acceptable given the company had not

delivered a resource that matched previous expectations. They said as much in response to a concerned

shareholder who in turn shared ASICs response on a public forum in May 2011, as per the following:

ASIC May 23: After careful consideration we have formed the view that it is likely that the CuDeco share

price fall on that date was related to a 2006 announcement which indicated that the resource had deposits

of 59 million tonnes with at least 2% copper

The judgement suggests that all aspects of trading have been ignored on the basis that the share price

slump was essentially the companys fault because it allegedly misled the market 4 years earlier.

Subsequent events have demonstrated that the company has been able to deliver, has continued to

deliver and has been more or less right all along with the advice it has provided to the market.

Furthermore, research is demonstrating that even ignoring the events of August 2010, the trading taking

place both before and after the resource upgrade has been seriously compromised. The current paper

and subsequent papers in the Chapter 6 series draw attention to serious anomalies between trading data

and shareholder registry data over 24 months of trading to further highlight the spread of trading activity

that might be regarded as dubious or suspicious. Certainly issues concerning CuDeco are not just related to

what occurred on Aug 18, 2010 where the regulatory response was based on conjecture, not trading data.

BACKGROUND

In 2006, the company tabled an initial inferred resource for its Rocklands Discovery of 59 mt @ 2%

Cu equivalent representing 1.2 million tons of in-ground copper equivalent metal;

The ASX deemed the 2006 statement to be non JORC compliant and forced a down grade to an

Inferred 25 mt @ 2% Cu equiv representing only 0.5 million tonnes of in-ground Cu equiv metal.

On Aug 18, 2010, the company announced a measured and indicated resource of 30 mt @ 1.24%

Cu equiv (for 0.37 million tonnes of in ground copper equivalent metal) and total resources of 245

mt @ .42% Cu equiv for 1.02 mill tonne of equiv metal following which the share price collapsed;

High levels of confusion surrounded the Aug 18 resource statement in regard to whether high grade

copper, a distinguishing feature of Rocklands style mineralization had been satisfactorily accounted

for by standard resource modelling techniques and JORC reporting requirements;

(Curiously, the regulator ignored the adjusted statement, enforced and certified by the ASX back in

2006 and referred to the original estimate in attempting to explain the Aug 18 share price slump.

Any disappointment should have manifested back in 2006, (which it did as shown by a collapse in

price when trading resumed in July 2006), and not a delayed response 4 years later. The 2010

resource should perhaps have been compared to the 2006 JORC compliant 25mt @ 2% Inferred

statement)

Rocklands was subsequently upgraded in May 2011 to a JORC compliant measured and indicated

resource of 30 mt @ 1.7% Cu equiv with total resources standing at 1.7 million tonnes of Cu

equivalent metal and with a substantial amount of high grade native copper still likely to be

discounted out of resource estimates;

Bulk mining trials over the main section of the ore body, the focus of the first 3 to 5 years of mining,

have consistently returned grades in excess of 4% Cu equivalent;

3

The 30 mt resource was tabled to support an EIS submission for a mining licence for an initial 10

years of mining, yet the licence has been granted for 30 years in recognition of the size of the

project;

Mineralization at depth and several high grade discoveries through 2011 and 2012, have not been

considered in resource estimates;

The company has consistently achieved funding at a strong premium to the share price and is

currently undergoing the transition from explorer to miner, debt free;

The share price has failed to recognize the likely mine economics of an initial 10 year mine at

Rocklands where even the Aug 18 resource statement is capable of supporting valuations in excess

of $4 per share;

Establishment media are generally dismissive of developments at Rocklands with a tendency to

highlight negatives or perceived negatives while virtually ignoring all major developments;

CuDeco is not being covered in research by mainstream brokers.

Compelling attributes of a future mine at Rocklands include:

o The granting of a 30 year mining licence;

o An open cut operation for the first 10 years with mineralization commencing at surface;

o Low stripping ratios (3.16) over the life of the project but beginning with ratios even lower

with initial mining focussing on high grade native copper and enriched supergene copper in

the central part of the Las Minerale ore body;

o An initial mining operation of 3 mt pa for the first 3 to 5 years of mining ramping up to

higher throughput as grades deplete, thereby maintaining copper production levels.

o Approximately 20+ years of open cut mining before underground mining commences;

o Excellent metallurgical recoveries after extensive testing of all ore types;

o Ready access to power, water;

o Easy accessibility by road, rail and air;

o Important infrastructure advantages being adjacent to a major town;

o Rail and port facilities secured for the transport of product;

o Company ownership of its own mining fleet where mining operations will be by contract

labour;

o 20 year Off Take agreements in place;

o Mining at Rocklands is likely to be fully funded, with zero debt and only around 200 million

shares on issue;

o A conservative Pre Tax NPV (Using 10% discount rate) of $1.25 Billion based on the current

JORC compliant resource for the first 10 year of mining;

o NPV valuations dont take into account underestimations in the theoretical JORC resource

because of the difficulties in quantifying native copper. Mining is expected to return cash

flows well in excess of estimates as suggested by the bulk mining trials returning in excess of

4% Cu equivalent;

o Additional resources have already been discovered in adjacent satellite deposits at

Rocklands, and future exploration potential both regionally and at depth still remains highly

prospective;

o Discoveries at Wilgar could lead to a separate open cut mine extracting rare earths, precious

metals and possibly uranium.

RESOURCE ISSUES:

The Aug 18 resource statement clearly misled the market with the company forced into providing a

theoretical resource assessment that undervalued Rocklands. Also, the company was not permitted to

qualify why its own in-house projections were vastly different from the JORC based estimates. Presumably

that would have been taken as criticizing the ASXs JORC code which is deemed to be sacrosanct and

4

beyond reproach. Significantly, the company has ignored JORC estimates for mine planning purposes as

detailed in the companys EIS application released prior to Aug 18.

The underestimation of Rocklands on Aug 18 is likely to have resulted from:

Limitations in the ASXs compulsory JORC code formulated without a unique resource such as

Rocklands in mind, with very significant amounts of nugget effect mineralization infiltrating a lower

grade ore body;

The harsh discounting of high grade resources by programming algorithms written into resource

modelling mining software, also designed without a unique resource like Rocklands in mind;

Resource modelling assumptions made by independent consultants in assessing Rocklands style

mineralization. Their conservatism led to substantial quantities of high grade native copper and

supergene copper being smoothed out of their resource estimate and other zones carrying

mineralization was considered as mining voids. Yet it is the high grade component of the ore body

that makes Rocklands such a unique and valuable resource and the so called voids may yet

represent a significant part of mining operations as per the companys Feb 9, 2012 announcement

reporting on surprising levels of mineralization in areas not previously considered as evidenced by a

deep costean across the ore body.

TRADING ISSUES:

Persistently anomalous trading data suggests that the market has been severely compromised over a

period of at least 2 years with the likely price capping and control over the share price by institutions the

overwhelmingly dominant feature of trading. Control over the share price has been facilitated by the

following aspects of trading as detailed in previous research:

Massive levels of trading churn that looks to have effectively swamped the market and prevented

it from performing its principal role of fair price discovery;

The use of short selling as a manipulative tool for control over the share price rather than for

legitimate price discovery purposes. Quite tellingly, short selling on market leading to lower prices

is often managed OFF market with the substitution of securities to cover shorting exposures and to

avoid price discovery on the upside;

Continuous control by a small group of brokers over the pricing outcomes associated with auctions

to commence and end trading each day;

Almost total control over pricing levels with trading algorithms ensuring that the majority of

changes in price (both Down Ticks and Up Ticks) occur between brokers who are likely to be

colluding with their trading, and representing institutional interests while doing so.

The constant selling down of significant announcements, primarily by institutional interests, which

has served to cap the share price at critical times but has also made sure that the market has

provided counter intuitive responses to what would normally be expected from good news. In this

way the compromised market has misled retail investors leading to further destabilization of the

market as they have then sold in disgust and frustration;

The constant flow of non-genuine wash trades back and forth between institutional interests has

delivered control over the share price while maintaining ownership over the shares used in such

exchanges. Trading profits appear to be only a secondary consideration as many of the trades

appear to be loss making;

The trading and settlement system also facilitates loss making trades by some brokers being

compensated by profitable trades by others where brokers are effectively acting for the same

interests. Pooling the trades and forwarding them to settlement agents for collation and clearance

can then result in marginal changes to holdings as there is the potential for trades to effectively

cancel each other out;

5

The possible use of dark pools to:

o provide a mechanism for redistributing shares back into the hands of the original owners

after being sold in the ASX market to friendlies perhaps to deliberately dampen market

expectations; and/or

o to relieve settlement pressure on sales by continuously transferring the shares before T plus

3 occurs and/or

o to relieve obligations associated with short sales with shares sold short to friendlies to cap

prices in the ASX market conveniently reversed between the same entities via dark pools.

E.g. Entity A sells to Entity B 100 shares that it doesnt own, then off market through dark

pool trading Entity B sells its recently purchased shares back to Entity A with the details

sorted out under the cover of opaque settlement arrangements.

SUMMATION:

All of the above trading behaviours appear to be facilitated by a trading and a settlement system that has

the inbuilt flexibility to process high volumes of seemingly unorthodox and manipulative trading strategies

without a hiccup and with most transactions concealed from view despite claims to the contrary about

supposedly transparent markets.

Surveillance of trading screens by ASX Officers is seen to be completely ineffectual to combat the control

over trading which manifests off screen through the dubious settlements of trades. Only audits are capable

of establishing trading links behind likely manipulative trading actions. Certainly regulators dont concede

that there is a problem and no-one seems any the wiser including brokers, journalists, investors and

shareholders. However the unusual data trends suggest that the market in CuDeco securities is far

removed from any expectation that its role should be to provide fair price discovery between genuine

buyers and genuine sellers.

What the data does demonstrate is that any regulatory assessment of trading without addressing the data

anomalies and without following through with audits cannot possibly be regarded as accurate, adequate or

even credible.

For regulators to ignore and/or dismiss disturbing data trends associated with the trading in CuDeco over a

period of 24 months by apportioning all blame to extraneous factors such as the company allegedly not

delivering on expectations back in Aug of 2010, and not moving on from there, is disappointing.

It is especially disappointing when developments achieved by the company show that despite JORC

imposed constraints and despite confusion surrounding Aug 18 events, it has clearly delivered and is

continuing to deliver on all expectations. At the same time disclosure of data anomalies indicate a

widespread targeting of the company through suspicious trading activities corresponding with a share

price that has remained undervalued and unresponsive to significant news. The disappointing market

action happens to be accompanied by corporate brokers being involved extensively in the stock to the

extent that their institutional clients have dominated trading over a period of at least 2 years. Yet there is

no interest in the company as far as the establishment financial press is concerned, nor is there support

from establishment brokers with virtually zero coverage of a major new Australian mine that has recently

been given the go ahead to proceed with a 30 year mining operation.

The situation casts doubt not only about the effectiveness of regulation but also grave doubts about the

integrity of the ASX and Australian financial system itself. It also makes it an imperative for shareholders to

do thorough due diligence and to make up their own minds about the issues.

The transparency provided by the shareholder blog at least brings the trading issues into the open where

data trends provide empirical evidence that something is seriously amiss with the trading taking place in

relation to CuDeco shares.

6

<This page has been intentionally left blank>

7

EXECUTIVE SUMMARY Research Paper 6.1

BACKGROUND

Research Paper 6.1 is the first of a series of investigations that looks at anomalous registry data. Chapter

6.1 contrasts broker buying and selling in the market with the impact that the trading has had on the

register in terms of changes to share holdings.

Analysis looks at monthly data comparisons over a period of 2 years (i.e. Years 2010 and 2011)

To assist with comparisons, the following ratio is used.

The ratio effectively represents [Registry Share Flows] [Broker Activity]

With normal trading the ratio returns values of 100% (i.e. A sell or a buy in the market corresponds directly

to a movement OFF or ON the register associated with shareholders holdings).

For example a sale of 100 shares is necessarily accompanied by a purchase of 100 shares, with the sellers

holding at registry level showing movement OFF of 100 shares, and the buyers holding showing 100 shares

moved ON. The above ratio would simply be [100+100] [100 + 100] x 100 equating to 100%.

Trading isnt always a normal or straightforward situation such as outlined above, and may involve short

selling which leads to elevated registry movements with ratios greater than 100%. With short selling, the

register needs to deal with share flows related to the stock lender and the stock borrower as well as share

flows associated with sellers and buyers, all leading to an increase in registry movements.

Alternatively, intraday transactions that are closed out by the close of trade dont necessarily flow through

to the register and would therefore result in ratio values less than 100%. Also, the netting of trades by

trading partners or members of clearance firms generally lead to fewer registry transactions than buying &

selling in the market again leading to ratio values below 100%.

All registry data assessed in the research relates to shareholder changes as reported by Market Movement

reports issued by the share registry, which are therefore comparable to broker buying and selling volumes.

The data doesnt include transfers of shares associated with the settlement of trades by brokers which

represent an entirely different issue. Settlement trends over 2 years of trading are examined in Research

Paper 6.4.

SUMMARY POINTS

1. The outstanding feature of broker and registry comparisons across 24 months of trading is not that

ratios vary from the expected 100% on a regular basis (that is only to be expected given the nature

of trading) but the size of the variations are of such magnitude that they raise serious concerns

about the nature of trading, its effect on the integrity of the market and the appropriateness of the

price discovery taking place; an essential and integral function of market dynamics;

2. The 2 months immediately preceding the Aug 18, 2010 resource announcement saw a rapid

escalation in registry activity compared to trading volumes with ratios of 165% and 218% which are

substantially different than what would be expected from normal trading activity where ratios

would be around 100%;

3. The 2 months in which significant market upheavals occurred (i.e. Aug 2010 where there was a

share price slump following a resource announcement, and Nov 2010 where there was a share

price surge accompanying buying by M&G) were both accompanied by a dramatic escalation in

wash trades and a reduction in registry activity, as shown by ratios of only 38% and 69%

respectively;

(BROKER SELLS + BROKER BUYS)

)

(REGISTRY OFF + REGISTRY ON)

X 100 %

8

4. Months where price capping occurred following significant developments by the company or when

the company was approaching critical financing discussions, were associated with a strong

escalation in registry activity with ratios such as 185%, 132%, 244%, 379%,169%, 232%, 270% and

172% observed, well in excess of expected ratios for normal trading;

5. While audits are necessary to establish the exact nature of trading and what is responsible for

widespread registry anomalism, possible explanations for elevated registry volumes might include:

a. Extensive shorting activity, perhaps not accurately captured by existing daily reports issued

by the ASX and ASIC;

b. Possible illegal shorting activity including either naked short selling or shorting where

brokers with access to pooled accounts are using client shares on a temporary basis to settle

short sales but without their knowledge and without proper lending agreements in place;

c. Shorting exposures established in the ASX market being cancelled out before T plus 3

expires by using dark pool trading to reverse the transactions without impacting the market

and with prices chosen to suit the parties involved.

d. Short positions being established in the ASX market but continuously rotated using dark

pools to avoid settlement until a more opportune time presents to enable exposed positions

to be covered;

e. Non genuine, manipulative selling back and forth through the ASX market perhaps to limit

prices, occurring between entities who are colluding with their trading with the trades

reversed via dark pools to restore portfolio balances;

6. The other feature of trading where occasionally registry volumes are significantly fewer than broker

trading volumes is most likely due to non-genuine intraday wash trades that are closed out by the

end of the day not making it to the register.

a. The sort of activity that raises concerns is the trading back and forth between related

parties, or even the same entities, where the buying and selling is split up amongst a

number of brokers with completed transactions being pooled and sorted out by settlement

specialists. Such activity makes it easy for downward pressure to be applied to the share

price while retaining ownership of the shares sold back and forth;

b. The dynamics of such trades which are closed out by the end of the day wouldnt be causing

concerns for ASX surveillance teams because of the spread of trades across a number of

brokers and the co-mingling of orders with normal transactions making it difficult to observe

any wrong doing. Of great concern also is that the volumes associated with wash trades

(legal or otherwise) can actually dwarf the volumes related to normal or genuine trading;

c. Unless there is a preparedness to conduct audits, there appears to be no way of

differentiating such transactions from the rest of the trading taking place.

7. A trading and settlement system that allows entities acting through a large number of brokers to

effectively sabotage the markets function but without changes to the holdings of the interests they

are representing as per the trading behaviours suggested in dot points 5 and 6 raises acute concern

8. Also of concern is the control over the market by trading algorithms. Entities engaging the services

of brokers running similar programs tuned to each other can dictate terms to the market with a

daily flood of non-genuine, small order exchanges, distributed back and forth between trading

partners, and in so doing can prevent genuine price discovery from taking place. Such trading

sabotages the markets natural function with volumes capable of being ramped up to whatever

parameters are chosen and with settlements conveniently distributed at the end of the day across

nominee entities to the satisfaction of all concerned. Also, Dark Pools possibly provide the

mechanism to restore any unintended imbalances in holdings that may have occurred through

brokers outside the group getting in the way. As such, the algorithms are more likely to be the

9

vehicles for trading rorts, and supporting manipulative trading agendas than servicing genuine

buying and selling activity.

9. CHART SHOWING FLUCTUATIONS BETWEEN REGISTRY CHANGES AND BROKER VOLUMES

It needs to be borne in mind that with standard settlement procedures and with genuine exchanges

between buyers and sellers, a ratio that compares registry volumes to broker volumes would show

minimal variations from one month to the next. i.e. The chart below would tend to flat line rather

than show the volatility that it does.

The vertical axis shows the variation of broker and registry data from the norm. A month where only

straight forward, genuine sales and genuine buys occurred would have an Index Change of zero indicating

that broker volumes and registry volumes would be one and the same. The persistent variances in monthly

data are an indication of how much trading is taking place that doesnt conform to normal, straight

forward, genuine buying & selling activity. The concerns therefore include:

High volumes of wash trades that dont make it to the register could easily be masking share price

manipulation, and in the current regulatory regime, without detection;

Months where excessive volumes of shares change hands on the register compared to broker

buying and selling may also be masking manipulative activity e.g. excessive levels of short selling?

Extreme variances above and below zero may therefore be providing a measure of how much stock

manipulation is taking place in which cause manipulation looks to be a dominant feature of trading.

The overriding issues associated with registry anomalism are therefore:

The troublesome extent to which it occurs and the extended period of time that it has been

tolerated for;

A trading, settlement, and regulatory system that can accommodates and camouflage enormous

volumes of suspicious trading activity without raising concerns;

Uncertainty about the type of trading activities causing it and the trading ethics involved;

The effect it is having on the function and the integrity of the market, and;

Whether trading protocols are being breached and/or whether steps need to be taken to

strengthen regulations to make existing trading and settlement systems above reproach and free

from any abuses.

Excessive

Registry

Movements

Month

10

CONTENTS

Introduction........Pg 11

THE EXTENT OF CDU REGISTRY IMBALANCES OVER A 24 MONTH PERIOD

Section 1 ........ Pg 14

SHAREHOLDER CHANGES COMPARED TO BROKER BUYING & SELLING ACTIVITY

Section 2 .... Pg 16

ANALYSIS OF TRADING TRENDS 2010

2.1 January to May 2010

2.2 June & July 2010

2.3.1 August 2010

2.3.2 Summary of Aug 18, 2010 Trading

2.4.1 September 2010

2.4.2 Broker Nominees

2.4.3 Dark Pools

2.5 October 2010

2.6 November 2010

2.7 December 2010

Section 3 .......... Pg 34

ANALYSIS OF TRADING TRENDS 2011

3.1 Intro - January & February 2011

3.2 March & April 2011

3.3 May, June & July 2011

3.4 August 2011

3.5 September & October 2011

3.6 November & December 2011

Section 4 .......Pg 38

SUMMARY POINTS

Appendix 1 ...Pg 40

Trade parasites feeding at the heart of the ASX Alan Kohler

11

INTRODUCTION

THE EXTENT OF CDU REGISTRY IMBALANCES OVER A 24 MONTH PERIOD

The buying and selling of shares is essentially a simple process resulting in corresponding changes in the

holdings of shareholders. A comparison of shareholder movements at registry level would therefore be

expected to correspond to the buying and selling volumes in the market.

However there are reasons why variations may occur such as with the netting

1

of trades to simplify and

streamline settlements and in regard to intra-day trades where transactions closed out by the end of the

day may not impact the register. Also, the practice of short selling introduces additional transactions from

a registry perspective as share flows between lenders and short selling agents also need to be considered.

Assuming most trading consists of normal transactions between genuine buyers and genuine sellers a

comparison between registry volumes and trading volumes might be considered reasonable if variations

resulted in comparisons falling within say 10% or even 20%.

An examination of monthly trading data and monthly registry data over 2 years should therefore provide

an overview of the type of trading taking place. The results for CuDeco are quite revealing as shown

below. The data trends show high volumes of wash trades at times (i.e. fewer registry changes) and an

escalation in the number of registry movements on other occasions with the causes not immediately

obvious nor readily explainable without audits of accounts.

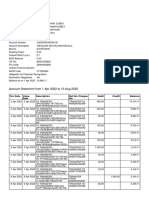

MONTH

Registry Share Volumes Versus

Broker Trading Volumes

RATIO CHANGE

2

0

1

0

Jan 88% -12%

Feb 81% -19%

Mar 91% -9%

Apr 95% -5%

May 82% -18%

Jun 165% +65%

Jul 218% +118%

Aug 38% -62%

Sept 185% +85%

Oct 88% -12%

Nov 69% -31%

Dec 132% +32%

2

0

1

1

Jan 117% +17%

Feb 244% +144%

Mar 379% +279%

Apr 114% +14%

May 169% +69%

Jun 146% +46%

Jul 232% +132%

Aug 270% +170%

Sept na na

Oct na na

Nov 126% +26%

Dec 172% +72%

1

Netting

:

of trades refers to a consolidation and offsetting of individual trades into net amounts of securities and

money due between trading partners or among members of a clearing system. Netting results in fewer settlement

transactions (Refer http://www.sfe.com.au/content/bulletins/sfeclearing/2002/sfecl2002_079.pdf)

Months where wash

trades were a prominent

feature of trading

Months where register

volumes far exceed

broker activity

Months where wash

trades were a dominant

feature of trading

Months where register

volumes far exceed

broker activity

If netting occurs on a wide scale then it makes anomalies related to excessive settlements even more of a concern.

2 YEAR TRADING SUMMARY

Rather than variances of 20%,

registry volumes range from only a

1/3 up to 3 times broker volumes

12

I

N

D

E

X

C

H

A

N

G

E

S

Registry Volumes Verses Broker Activity 2011

I

N

D

E

X

C

H

A

N

G

E

S

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Months with markedly elevated

registry volumes

INCREASING

MANIPULATION

13

The size of the anomalies and their spread across most months over the 2 year period raise questions

about the integrity of the market and its ability to perform its traditional function of price discovery.

In August 2010, registry volumes were only just over a third of trading volumes during a month when

record numbers of shares were traded. Yet in March 2011 the reverse occurred with registry volumes

almost 3 times the amount of trading activity. There were a number of months when fluctuations werent

as pronounced as those two months but were nevertheless still at levels which raise concerns.

The ambiguities associated with dark pools may also help to explain elevated registry numbers and also

raises questions about what exactly is being achieved by such transfers and why?

Mixed signals about the trading taking place are matched by the mixed signals in relation to the

performance of the share price. The two look to be related with the share price rarely responding to

favourable developments in a sustained manner, and generally failing to reflect appropriate value for the

company based on either fundamental considerations or comparisons to peers. The share price has

become all but redundant as an indicator of realistic value as demonstrated by several placements at a

strong premium to the share price and by the success of the company Buy Back (i.e. purchasing shares

from the market, cancelling them and then re-issuing shares at higher prices).

After two years of anomalous data trends and suspicious trading activity led by institutions, and with

certainty emerging about Rocklands with the construction of a major new mine at Cloncurry underway,

perhaps it is time that regulators took data irregularities seriously.

To date, as mentioned in the Introductory Overview on Pg. 2, the disinterest of regulators and their refusal

to conduct audits has been based on the company being viewed as being at fault, and with confusion

about the resource being responsible for the share price issues.

Unfortunately, the explanation completely ignores trading issues and also contains the contradiction that

while blame has been apportioned to the company for the Aug 18 JORC disaster the very same JORC

information enticed the M&G Group to become a major shareholder through a placement in September

2010 and through their strong buying on market in Nov & Dec 2010.

Logically the two events cannot be associated with the same circumstance unless the Aug 18

announcement seriously undervalued the resource and the M&G group had the expertise to identify and

understand why. It is now apparent that JORC methodology and standard industry modelling techniques

couldnt assess Rocklands accurately given the unusual but dominant nugget effect permeating the

resource. It is also becoming known that bulk trials provide the best indication of likely grades until such

time as mining commences in earnest. All thanks to the lone voice of the company in attempting to explain

the situation. There have been no official clarifications about JORC modelling issues from the ASX.

In any case, while uncertainty in relation to Rocklands has rapidly become a thing of the past since

confirmation of a 30 year mining licence in Nov 2011, data irregularities continue and are in no way

explained by any reference to the 2006 announcement by the company. As mine commissioning draws

closer it is imperative that action is taken to put an end to any manipulative activity occurring behind the

scenes that continues to manifest as anomalous data trends and an unresponsive share price.

The chronic data anomalies suggest that a thorough review of trading and settlement system procedures is

urgently required, together with an audit of the trading records of those entities chiefly responsible for the

dramatic fluctuations in the data.

The trends result from underlying trading activity which at face value appears to be highly questionable

for the following reasons.

Trades that dont make it to the register may be masking manipulative intent;

Trades that lead to a large blow out in registry volumes may be related to excessive short selling

activity and therefore price suppression.

14

Chapter 6.1. SECTION 1: SHAREHOLDER CHANGES COMPARED TO BROKER BUYING & SELLING ACTIVITY

As mentioned in the introduction, the buying and selling of shares is essentially a simple matter. A sale of

shares by an entity results in a reduction in ownership and a purchase leads to an increase in ownership.

All changes are recorded on the companys share register. As such it would be expected that broker

trading numbers and the volumes of registry changes would more or less coincide, yet that hasnt been the

case with the trading that has occurred with CuDeco as summarized below over a 24 month period.

The tables below enables Sells to be compared to Movements Off and Buys to be compared to

Movements On over a period of 2 years. Share placements have been excluded from registry flows.

2010

ASX BROKER BUYING &

SELLING

REGISTER

(SHAREHOLDER

MOVEMENTS)

2011

ASX BROKER BUYING &

SELLING

REGISTER

(SHAREHOLDER

MOVEMENTS)

Month SELLS BUYS OFF ON

Month SELLS BUYS OFF ON

Jan 9,565,555 9,565,555 8,375,943 8,374,948

Jan 7,494,594 7,494,594 8,754,218 8,771,819

Feb 12,115,534 12,115,534 9,851,251 9,731,157

Feb 6,961,872 6,961,872 16,860,995 17,120,090

Mar 15,611,534 15,611,534 14,556,105 13,887,077

Mar 4,281,778 4,281,778 16,562,824 15,860,722

Apr 10,409,873 10,409,873 9,687,287 10,065,262

Apr 3,933,436 3,933,436 4,416,263 4,576,597

May 14,557,103 14,557,103 11,914,444 11,937,729

May 10,413,415 10,413,415 17,501,763 17,679,456

Jun 13,350,211 13,350,211 22,002,998 22,143,737

Jun 9,002,175 9,002,175 13,254,025 13,023,909

Jul 11,541,679 11,541,679 25,159,419 25,087,370

Jul 8,618,502 8,618,502 19,798,850 20,264,037

Aug 93,327,086 93,327,086 36,285,447 34,349,734

Aug 8,554,067 8,554,067 23,002,052 23,186,120

Sept 24,023,623 24,023,623 43,644,290 45,340,980

Sept 0 0 3,375,211 3,312,203

Oct 32,051,119 32,051,119 28,123,407 28,319,927

Oct 0 0 2,262,073 2,484,832

Nov 42,508,669 42,508,669 29,407,542 29,631,683

Nov 12,294,931 12,294,931 15,852,072 15,112,710

Dec 15,578,750 15,578,750 20,528,663 20,620,404

Dec 9,543,253 9,543,253 16,187,454 16,597,278

For comparative purposes it is helpful to compare monthly Totals for Broker Activity (i.e. Buying plus

Selling) to Totals for Registry Volumes (i.e. ON Movements plus OFF Movements) using an index as shown:

2010

2011

Broker Activity

BUYS + SELLS

Registry Activity

ON + OFF

Register Versus

Broker Activity

Broker Activity

BUYS + SELLS

Registry Activity

ON + OFF

Register Versus

Broker Activity

Jan 19,131,110 16,750,891 87.6%

Jan 14,989,188 17,526,037 116.9%

Feb 24,231,068 19,582,408 80.8%

Feb 13,923,744 33,981,085 244.1%

Mar 31,223,068 28,443,182 91.1%

Mar 8,563,556 32,423,546 378.6%

Apr 20,819,746 19,752,549 94.9%

Apr 7,866,872 8,992,860 114.3%

May 29,114,206 23,852,173 81.9%

May 20,826,830 35,181,219 168.9%

Jun 26,700,422 44,146,735 165.3%

Jun 18,004,350 26,277,934 146.0%

Jul 23,083,358 50,246,789 217.7%

Jul 17,237,004 40,062,887 232.4%

Aug 186,654,172 70,635,181 37.8%

Aug 17,108,134 46,188,172 270.0%

Sept 48,047,246 88,985,270 185.2%

Sept 0 6,687,414 na

Oct 64,102,238 56,443,334 88.1%

Oct 0 4,746,905 na

Nov 85,017,338 59,039,225 69.4%

Nov 24,589,862 30,964,782 125.9%

Dec 31,157,500 41,149,067 132.1%

Dec 19,086,506 32,784,732 171.8%

Persistent imbalances between Selling and Movements

OFF the register over the 2 year period

2010 - Mainly

registry short

falls?

2011 - Mainly

registry

surpluses!

Persistent imbalances between Buying and Movements

ON to the register over the 2 year period

Erratic

15

The data focusses on shareholder changes on the register resulting from buying and selling. It doesnt

include the registry share flows associated with the settlement of trades. It would appear that although

buying and selling is essentially a straight forward matter, by the time that the buying and selling impacts

the register the result is anything but straight forward. The monthly trends in the data may be summarized

as periods where:

Broker Activity and Registry Activity are more or less in balance such as in Jan, Mar, Apr and Oct of

2010, and Jan & Apr of 2011

Broker Activity exceeds Registry Activity (i.e. Feb and May 2010); and

Broker Activity far exceeds Registry Activity (i.e. Aug and Nov 2010); and

Registry activity far exceeds the buying and selling in the market (i.e. Jun, Jul, Sept & Dec 2010, and

Feb, Mar, May, Jun, Jul, Aug and Dec 2011).

Reasons why broker buying and selling volumes might differ from the registry share flows include:

1. Netting by brokers where buying and selling orders of clients are combined to give a net result for

settlement purposes. Netted transactions and fewer registry entries might occur where broker

clients have traded intra-day or within the T plus 3 settlement timeframe. Netting of trades may

have been responsible for the registry shortfalls from Jan to May 2010 and in Aug and Nov of 2010.

Extensive netting of trades may also be associated with a flood of dubious wash trades

1

.

2. Private Off Market transactions that arent included in daily trading volumes where individual

holders may switch shares from one account to another or effectively buy and sell shares between

themselves using paper transfers. However the volumes involved in such Off Market transfers are

incidental and not a major contributor to anomalous share volumes.

3. Broker exchanges (or crossings?) that are not included in daily ASX trading volumes as for example

occurred when the stock wasnt trading during March & April of 2011. Such transactions have been

a major contributor to anomalous share flows and may have been accomplished via Dark Pool

trading about which comparatively little is known. Similar exchanges may also have occurred even

when the stock was trading but again separate to ASX trading thus helping to boost registry

volumes (Refer Sect 2.4.3 Pg 21 for information on Dark Pools);

4. Share placements where shares are issued by the company separate to daily trading. These are

both readily identified on the register and easily understood;

1

The issue of wash trades and possible market manipulation has been addressed

in Research Paper 3.3,

Section 3.3.1. An excerpt follows:

Market manipulation is acknowledged as a practice inherent in all global markets requiring close

regulatory attention at all times. It has been defined as Transactions which create an artificial price or

maintain an artificial price for a tradable security and involves a range of trading techniques including

stock churn, wash trades, excessive short selling, and actions to deliberately drive a share price down.

Wash trading has been described as:

an illegal form of stock manipulation in which an investor simultaneously sells and buys shares

in order to artificially increase trading volume, and,

"a securities transaction which involves no change in the beneficial ownership of the security."

The wide fluctuations between monthly broker data and monthly registry data are certainly difficult to

reconcile with normal trading, particularly with registry procedures assumed to be routine and

consistent. The extreme variations are in fact likely to be signalling serious market integrity issues.

16

Chapter 6.1 SECTION 2.1 ANALYSIS OF TRADING TRENDS - 2010

JANUARY 2010 TO MAY 2010:

The first 5 months of 2010 (Jan through to May) had registry activity falling short of broker activity. Intra-

day trading and the netting of trades by brokers has possibly led to fewer registry transactions than buying

and selling activity in the market.

2010

ASX BROKER BUYING &

SELLING

REGISTER SHAREHOLDER

MOVEMENTS

Register Activity

as a % of Broker

Activity

Month SELLS BUYS OFF ON

Jan 9,565,555 9,565,555 8,375,943 8,374,948

88%

Feb 12,115,534 12,115,534 9,851,251 9,731,157 81%

Mar 15,611,534 15,611,534 14,556,105 13,887,077 91%

Apr 10,409,873 10,409,873 9,687,287 10,065,262 95%

May 14,557,103 14,557,103 11,914,444 11,937,729 82%

As detailed in Research Paper 3.2, trading was characterized by falls through January 2010 amid general

market weakness. However CuDeco fell more sharply than its peers and other mining companies generally.

The period also coincided with the company making several solid announcements (particularly in relation

to new discoveries at Wilgar) which were all met by heavy selling (as referenced in Research Paper 3.5).

In general it was the institutions that were doing the net selling during the period January to May 2010,

with retail investors doing the buying.

Chapter 6.1 SECTION 2.2 JUNE & JULY TRADING

A change in trend occurred in June and was continued in July whereby registry transactions substantially

increased compared to the levels of buying and selling occurring in the market. While it is difficult to

account for the abrupt changes in trend responsible for the large numbers of excess registry movements,

the index at least quantifies the extent of variances.

2010

ASX BROKER BUYING &

SELLING

REGISTRY SHAREHOLDER

MOVEMENTS

Register Activity

as a % of Broker

Activity

Month SELLS BUYS OFF ON

Jun 13,350,211 13,350,211 22,002,998 22,143,737

165%

Jul 11,541,679 11,541,679 25,159,419 25,087,370 218%

The data for June and July is extremely anomalous and presents as a red flag that something extremely

unusual was taking place. Two possibilities come to mind in an attempt to try and explain the imbalances.

Client shares in pooled accounts were being used to temporarily cover a short position but without the

clients knowledge or permission (i.e. without formal lending agreements in place);

Trading via dark pools was rotating an exposed short position that was proving difficult to settle.

The extended settlements possibly had implications for the trading that took place during these two

months as well. i.e. If there was an exposed short position then trading may have been compromised by

attempts to protect the position and to prevent it from becoming further exposed.

The matter is more fully investigated in the soon to be published Research Paper 7 titled The Impact of

Institutions on the CuDeco Register. The implications regarding Dark Pools are outlined further in Sect

2.4.3 Pg. 30 of the current paper.

NORMAL

Trading?

Abnormally High?

17

Chapter 6.1 SECTION 2.3.1 AUGUST TRADING:

Trading during early August also featured some strong data anomalies (Refer Research Paper 7.1) similar to

what occurred through June and July. The anomalous registry activity set the scene for a share price

collapse following the release of the Aug 18 resource upgrade. The resource statement was perceived to

be disappointing because of grades less than expected given the high grade intersections reported by the

company over several years. The reality appears to be that the JORC compliant statement misstated

resources because of the harsh discounting applied to high grade native copper and high grade supergene

mineralization. The matter still hasnt been adequately qualified by either the ASX through its JORC

committee, by the financial media or by the broking community who have access to resource analysts

capable of understanding what has played out. Resource analysts taking the time to do thorough Due

Diligence would also appreciate why M&G analysts saw the stock as a strong buy yet no qualifying advice

has ever been made available publicly. The company has at least attempted to address the situation

through its EIS documentation, its subsequent resource upgrade in May 20, 2011, impressive results from

extensive metallurgical and bulk mining trials and more recently, by a deep costean across the main zone

of the ore body. The clarifying information released by the company has generally been met with price

capping activity in the market and ignored by the media and the broking fraternity as previously detailed in

Research Paper 3.6.

Private Investors who have also done extensive Due Diligence have opted to fund a mine at Rocklands at a

strong premium to the share price. Their actions support the companys stance in regard to what it will

actually be mining at Rocklands, and further suggest that there are problems with theoretical JORC

estimates.

August Data

2010

ASX BROKER BUYING &

SELLING

SHAREHOLDER REGISTRY

MOVEMENTS

Register Activity as a

% of Broker Activity

SELLS BUYS OFF ON

Aug 93,327,086 93,327,086 36,285,447 34,349,734 38%

The share price collapse associated with Aug 18 resulted in more shares traded for the month than had

traded over the previous 7 months. However, just over a third of the record number of shares that traded

during August actually impacted the register. Non genuine wash trades were the dominant feature of

trading with institutions appearing to push prices lower while trading large volumes of shares back and

forth amongst themselves. Importantly however, sophisticated investors retained their holdings thereby

indicating that they didnt have a problem with the resource. The trading data suggests that the company

was destabilized during the confusion about the resource.

High levels of churn associated with institutional brokers provide the paradox that entities destabilized the

company through their trading yet they remained fully invested. At the same time they were likely to have

incurred tax losses (Refer Profitability Considerations Pg. 19). The motivations behind such trading are

difficult to comprehend from a legitimate trading perspective.

On the other hand, many retail investors were either forced to sell their holdings because of margin

pressures or they were panicked out of their holdings by the extreme market volatility that was created.

Extensive wash trades created an impression of massive selling which also contributed to investors being

misled. The selling however was orchestrated and matched by just as much buying which resulted in

minimal changes to holdings by the time transactions were collated and prepared for settlements.

An abnormally

low ratio

indicating large

volumes of

wash trades

18

For the trading events of August 2010 to be properly assessed free from the noise and conjecture

surrounding what the JORC delivered or didnt deliver, or what the company did or didnt do, it is

necessary to understand the dubious trading behaviours that are embedded into anomalous trading data

spanning a period of two years, not just one month. There have been several trading behaviours identified

(Refer Paper 5.4 Pg. 3 Issues 1 to 12) that suggest the company has been unfairly targeted over a very long

time with some of the strategies used to create havoc through August of 2010 as well.

Chapter 6.1 SECTION 2.3.2 SUMMARY of AUG 18 TRADING

To recap from Research paper 4.1, the trading volumes and the patterns of trading on Aug 18 suggest that

collusive strategies were in play with a game plan that was implemented immediately the undervalued

resource estimate was released to the market. The following features of trading stand out.

5 million shares were traded in the 1

st

hour of trading for a fall of 14.7% from the previous close;

16.466 million Shares traded for the day for a fall of 49% from the previous close. (By comparison,

the average daily volumes for the previous 7.5 months of trading was around 500 thousand shares);

Strangely, brokers SOSL, HUB24 (formerly ANZIEX) and BBY were uncharacteristically active in

trading at levels well above market shares they had established over the preceding 7.5 months.

Their market shares were up 413%, 700% and 113% respectively on Aug 18;

Brokers dominant in all trading over the previous 7.5 months tended to stand back and allow

brokers with minimal previous involvement to set the trading agendas. The actions suggest that

trading was highly orchestrated;

DMG was both a major churner of stock (1.52 mill sales & 0.81 mill buys) and the second largest net

seller on the day (0.71 mill net sales), presumably for institutions;

Accompanying DMG with their heavy selling was broker BELL who heavily sold throughout the day

and mostly for one major client;

COMM was by far the most dominant broker in trading with a market share of 25% (an increase of

58% to its level of involvement over the previous 7.5 month) yet the majority of trading was

conducted anonymously by entities not identified on the register (i.e. around 68% of all their

trading was by anonymous entities, not retail clients). COMM bought 4.664 million shares, sold

The overwhelming theme highlighted by the research undertaken is that a wide range of trading

behaviours has led to long term distortions in trading and registry data that signal that something is

seriously amiss with the integrity of the market for CuDeco Ltd securities. The root causes of consistently

anomalous trading data need to be identified and understood before the situation can be properly

addressed. Certainly, the data trends accompanying trading suggest that a corporate targeting of the

company has been responsible for the stripping of large numbers of shares from retail investors and at

the same time destroying substantial wealth for the company and its shareholders.

While the issues have obvious implications for investors and undermine confidence in the ASX itself, it

also needs to be borne in mind that dubious trading strategies have made it extremely difficult to

establish a major new mine in Australia that will lead to the creation of jobs, regional development for

QLD, royalties for the QLD State Government, tax revenues for the Australian Government and the

strengthening of Australias balance of trade. The corporate targeting of companies such as CuDeco

comes at no small cost, particularly if a cheap takeover was successful in achieving overseas ownership of

another important and emerging Australian asset.

19

3.545 million shares and crossed 887,945 shares. COMM was in fact responsible for 68.5% of all

cross trades (i.e. XTs) on Aug 18. Yet despite all of their trading activity, the register reveals only

954,072 of retail sales and 1,636,287 of retail purchases following Aug 18 trading. An investigation

into the COMM clients associated with cross trades and the large volume of anonymous wash

trades transacted by COMM that didnt impact the register, would most likely provide very useful

insights into the nature of trading that occurred;

Despite the large volumes traded on Aug 18, only 14% of the selling and 23% of the buying of all

brokers showed up on the register as being related to retail interests. Also, the register reflects

little activity in relation to the remaining 14.2 mill sales and 12.7 mill buys that occurred on Aug 18.

The overall trend was that trading was dominated by non-genuine wash trades that didnt make it

to the register with much of it camouflaged amongst the retail client orders of brokers such as

COMM, ETRD, and AIEX. An investigation of the corporate activity taking place within retail brokers

would therefore also reveal a lot about what actually took place on Aug 18;

Foster Stockbroking was one of the most active brokers in the opening auction knowing that its

hastily written, poorly researched, unsigned broker report was about to be released to the market.

Foster had previously set a price target of $9.60 on the stock but was suddenly calling for $1.20. To

date no action appears to have been taken in regard to Foster Stockbroking so it is assumed that

their actions have fallen within trading guidelines and codes of ethics governing broker conduct.

However, the ready acceptance of such behaviours and a disregard and/or disinterest in

investigating dubious trading agendas serves to destroy confidence in the financial system;

Deutsche Securities who had been an overriding force in auctions in the 7.5 months leading up to

Aug 18 and who had attended 94% of all auctions, didnt participate in what was arguably the most

important pre-open auction for the entire year. The unusual absence of DMG also suggests that

trading on Aug 18 may have been orchestrated and followed a tight script;

Profitability Considerations: Assuming that most trading was back and forth churn conducted on

behalf of institutional entities, a tax perspective on trading would require the previous average

costs of shares held as at June 30, 2010 and the average cost of shares purchased up until Aug 18,

to be averaged against stock bought on Aug 18 to obtain an overall cost basis from which sales

could be measured against. Up until the trading halt of Aug 13, 2010, the holding costs of shares

owned would be expected to be well in excess of say $4.00. It means that holding costs (i.e. $4.00

or above) plus the average buying costs on Aug 18 (say $2.85) would result in a cost basis of shares

traded in excess of the selling prices achieved on Aug 18. As such, it is likely that all high volume

back and forth trading by institutions would have been loss making;

The profitability of trading can be estimated using actual trading data such as that by broker State One

Securities (SOSL) who were unusually active on Aug 18 compared to their previous involvement with

the stock.

SOSL Sales: 1.33 million shares sold at an average selling price of $2.863

SOSL Purchases: 1.38 million shares purchased at an average buying price of $2.855

SOSL Churn: 1.33 million shares were bought and sold for a profit margin of $0.008 per share

Accumulation: 51,349 shares were retained at the close of trade

Holding Costs: Assume $4.44 for shares held at June 30 and shares bought July & early Aug 2010

Cost of Shares churned: Say ($2.85+$4.44)/2 or $3.65

Selling Price Achieved: $2.86

Assuming that SOSL was acting for institutions, they can therefore be considered as selling shares for

an average of $2.86 which would have effectively cost around $3.65. But why?

20

Selling the accumulated shares at the close of trade would have crystalized further losses. i.e. 51,349

shares effectively costing on average around $3.65 and being sold at say the close of trade price of

$2.45 is a further loss making exercise. Even larger losses would have resulted if the accumulated

shares were sold a few days later when the share price declined to around $1.60. Based on the above,

the efforts put into trading appear somewhat pointless at least from a profit perspective.

Even if SOSL were representing clients with no previous history in the stock the profit motive

surrounding their trading is still questionable. Churning 1.33 mill shares for an average buy price of

$2.855 and an average sell price of $2.863 (i.e. a margin of $0.008), is still seen to be loss making

overall when the accumulated shares are valued at closing prices of $2.450 and compared to buying

prices of $2.855. And even more so if they were sold a few days later;

Unusual Down Tick Trends: In a market characterized by panic and confusion, the share price

collapsed rapidly, falling from $3.59 at the open to $3.06 after an hours trading, before sliding to

$2.45 at the close. In such a scenario Down Ticks in price would be expected to occur from

desperate sellers accepting what was being offered by buyers (i.e. the BID price). As it happened,

the complete opposite occurred with down ticks favouring ASKs 93% of the time. The extreme

statistical bias against what would be logically expected suggests that trading was controlled by

algorithms belonging to brokers who were colluding with their trading. The dominant sellers

associated with Down Ticks were brokers COMM, DMG, SOSL, and BBY, and the dominant buyers of

Down Ticks were much the same group in COMM, SOSL, CITI and BBY. Data such as the above cuts

through to the essence of what actually took place and unfortunately, what is revealed is difficult to

reconcile with what would be expected from normal and/or fair trading. It also demonstrates that

the auditing of accounts of brokers and their major trading clients is an imperative if a proper

assessment is to be made of the events surrounding Aug 18;

An absence of net selling by sophisticated investors despite the heavy churning of stock they

appear to be responsible for, underscores the realization that Rocklands remained a valuable

minerals discovery from their perspective despite the frenzied trading undertaken;

Shorting Considerations: Official open short positions on Aug 18 showed an increase of only

461,029 shares compared to trading volumes of 16.47 million shares. At first glance it might appear

that the downward pressure on the share price was to do with investors or traders genuinely

selling, rather than the shorting of the stock. The increase in open short positions is certainly small

by comparison to trading volumes.

However, it is not known what percentage of wash trades were related to intra-day shorting (i.e.

selling first and then re-purchasing later with transactions closed out by the end of trading). From a

logical perspective, to make money trading in a rapidly falling market, sales need to be made first

followed by the re-purchase of stock afterwards so the likelihood of high levels of shorting activity

associated with wash trades is more than a distinct possibility. Such trading could easily be

associated with manipulation and could even be illegal if proper lending agreements werent in

place. Given the extremely large volumes involved it is an issue that requires serious investigation.

There is the added complication that some entities may have used some brokers to short sell, with

their short covering done by purchase orders put through other brokers and with the transactions

sorted out when pooled and forwarded to ASTC settlement agents. The system of settlements may

therefore be viewed as a convenient cleansing facility where dubious or even illegal trading

activity can be effectively normalized and assimilated into the register as required;

21

Collusive Trading: Additional to shorting concerns, are bona fide shareholders who have the shares

to cover their sales also participating in the same practice of using the services of a number of

brokers to do their buying and selling then have all the transactions forwarded to a settlement

agent to be collated and prepared for settlement. A group of entities acting similarly and even

facilitating each others buying and selling, all while spreading their influence across a wide range of

brokers can be seen to effectively dominate trading and to override the markets function of fair

price discovery between genuine buyers and sellers. Again, such activity in the context of a trading

and settlement system that tolerates and facilitates such behaviours provides the perfect foil for

manipulative interests to achieve their trading objectives at the expense of all other investors;

Trading data suggests that the share slump was probably more attributable to high volumes of

churn by a number of brokers acting in unison to create mayhem and uncertainty, with their

trading algorithms tuned to accommodate each others continuous buying and selling. In that

scenario it would only take a couple of brokers who were dominant sellers to tilt momentum

downwards and that occurred with the heavy net selling of DMG and BELL. The 1

st

and 2

nd

hours of

trading is summarized below;

1

st

HOUR Total Volume 5.34 million shares

BROKER SELLS BUYS NET BUYS MARGIN

BROKER SELLS BUYS NET SELLS MARGIN

SBAR 14,000 291,360 277,360 $0.45

BELL 596,792 95,331 -501,461 $0.02

COMM 932,419 1,163,258 230,839 -$0.02

DMG 767,315 316,500 -450,815 $0.03

ETRD 249,349 459,163 209,814 $0.04

ORDS 126,226 11,000 -115,226 -$0.52

ANZIEX 157,000 290,000 133,000 $0.03

FOST 117,227 5,000 -112,227 $0.33

AIEX 101,118 231,446 130,328 -$0.09

MACQ 55,356 20,045 -35,311 -$0.22

PSL 4,040 110,000 105,960 -$0.17

GSP 118,184 45,783 -72,401 $0.22

MACP 86,179 168,240 82,061 $0.03

HART 74,804 7,804 -67,000 -$0.07

BBY 341,070 412,198 71,128 -$0.03

MERL 151995 141140 -10,855 $0.07

NORS 20,000 85,734 65,734 $0.04

Other 224223 30231 -193,992 na

MSDW 3,487 67,188 63,701 $0.06

CITI 227,121 266,307 39,186 -$0.01

BRLL 59,072 59,072

0

-$0.01

TPPM 157,960 184,652 26,692 -$0.07

INTS 23,000 23,000

0

$0.01

UBSW 37,189 63,499 26,310 -$0.02

STBG 50,000 50,000

0

$0.09

SOSL 517,774 537,274 19,500 $0.01

OTHER 127,807 205,482 77,675 na

Net Buying

1,559,288

Net Selling

-1,559,288

The trading activity is seen to be dominated by brokers acting predominantly for institutions and

sophisticated investors (shown shaded in mauve) with their buying and selling orders generated

automatically by pre-set trading algorithms. In the scenario where entities are colluding with their trading,

it matters not whose algorithms are set to generate profitable trading margins and which trading programs

are set to generate losses as all trades are eventually pooled and profits and losses effectively cancel each

other out for all orders generated by the same entities.

The dominance of institutions is accentuated when retail activity is taken into account. Retail settlement

volumes after T plus 3 following Aug 18 showed that only a small portion of the overall buying and selling

of retail brokers serviced retail interests on the register. The majority of buying and selling associated with

retail brokers was therefore likely to be associated with anonymous institutional interests and/or

sophisticated investors with those transactions passed on to ASTC & ACH agents for settlement.

A summary of the type of buying brokers were associated with on Aug 18 can be extracted from the table

on Pg. 51 of Research Paper 4.1 Sect 4.8.1 which contrasts retail settlements against the total buying &

selling of the brokers concerned.

22

The results are as follows with the predominantly corporate brokers separated from the more retail

focussed brokers and also showing retail activity separate to corporate & institutional activity for each

group:

BROKER OTHER RETAIL

BROKER OTHER RETAIL

BROKER RETAIL OTHER

CITI

100% 0%

TAYL 97% 3%

COMM

31% 69%

DMG

100% 0%

BRLL 97% 3%

ETRD

35% 66%

MERL

100% 0%

HART 95% 5%

BELL

37% 63%

CSUI

100% 0%

TPPM 94% 6%

AIEX

49% 51%

GS

100% 0%

ORDS 93% 7%

SBAR

52% 48%

MERL

100% 0%

PSL 92% 8%

MACQ

89% 11%

UBSW 99% 1%

JDV 89% 11%

CMCS

65% 35%

MACP 99% 1%

WILS 88% 12%

SOSL

99% 1%

SHAW 76% 24%

ANZIEX 98% 2%

RBSM 71% 29%

BELL Securities was a pivotal seller on Aug 18 and mainly on behalf of a single large client. The selling is

unusual as large client orders are generally crossed, not sacrificed into the market on highly volatile trading

days especially when there are willing institutional buyers as shown by the trading volumes. There is also

the precedent of large share transfers occurring OFF Market such as appeared to have occurred on Aug 16

and Aug 17 (Refer Table Pg 25) where large orders can certainly be absorbed if required, without impacting

the market.

The heavy selling by DMG may have been on behalf of an institution or a sophisticated investor or

alternatively it may have been associated with the short sales associated with the increase in open short

positions. In any case the heavy selling by BELL and DMG superimposed over high levels of trading churn by

a large number of brokers acting for sophisticated investors looks to be crucial in forcing prices

dramatically lower. There is also the possibility that the heavy selling by DMG was absorbed by the buying

through a range of brokers led by SBAR and COMM but acting for much the same interests as the DMG

sellers. i.e. the wash trade effect!

Despite all of the activity in response to the resource announcement, institutional holdings retained their

shares emphasizing that they still saw value in Rocklands despite their prolific trading activity.

Brokers who

predominantly

serviced institutional

and corporate

interests on Aug 18

Brokers who serviced

retail interests but

also the interests of

sophisticated clients

CORPORATE & INSTITUTIONAL BROKERS RETAIL BROKERS

The substantial trading activity of retail brokers is seen to be in support of interests other than their retail

clients. The retail brokers listed represent 40% (6.70 mill) of all sales on Aug 18 and 48% (7.81 mill) of all

purchases however their retail client activity averaged around only 36% of all their buying and selling

OTHER = CORPORATE & INSTITUTIONAL ACTIVITY

NOTE:

23

2nd HOUR Total Volume 2.36 million shares

BROKER SELLS BUYS NET BUYS MARGIN

BROKER SELLS BUYS NET SELLS MARGIN

COMM 755,894 1,067,687 311,793 $0.00

HART 191,213 0 -191,213 na

SBAR

120,000 120,000 na

BELL 171,713 25,000 -146,713 $0.02

BBY 41,459 134,225 92,766 $0.14

MERL 230,956 88,155 -142,801 -$0.06

MSDW 801 47,892 47,091 $0.02

ANZIEX 124,072 62,000 -62,072 -$0.04

ETRD 94,356 132,941 38,585 -$0.02

SHAW 38,000 5,000 -33,000 $0.11

NORS 30,000 67,500 37,500 -$0.02

MACP 75,100 42,615 -32,485 $0.00

UBSW 8,331 24,951 16,620 -$0.05

CSUI 32,427 0 -32,427 #DIV/0!

SOSL 146,891 160,027 13,136 $0.01

MACQ 32,452 1,469 -30,983 $0.10

RBSM 0 9,500 9,500 na

DMG 148,617 128,417 -20,200 $0.01

OTHER 30,376 57,546 27,170 na

AIEX 144,692 138,263 -6,429 -$0.03

OTHER 63,642 47,804 -15,838 na

Total Net Buys 714,161

Total Net Sells 714,161

Brokers mostly acting for institutions and sophisticated investors again set the trading agendas during the

2

nd

hour with volumes lower than the 1

st

hour but nevertheless still high compared to more normal levels

of trading. DMGs net selling was replaced by selling by broker HART (again for institutions?) with BELL still

prominent as well. If indeed Harleys were acting for the same institutional entities it would likely

demonstrate a tag team approach to trading,

The trading churn and targeted selling set up the conditions where stop losses were triggered leading to

acceleration in the downward trend. Sophisticated investors with their superior information systems and

contacts in the industry would have known what those levels were and may have targeted them

specifically. The first hour saw prices retreat from $3.59 down to $3.06 which was then followed by a drop

to $2.83 in the second hour. The heavily engineered falls in the share price by brokers acting

predominantly for institutions set the scene for a capitulation by retail investors in the trading that

followed and over the ensuing days. The dominant feature of initial trading was the levels of churn

generated by trading algorithms set to high levels of buying and selling. Confusion associated with the

JORC reporting of resources created the perfect opportunity for the market to be managed sharply lower

which then took on a momentum all of its own as investor panic set in.

While it was true that retail investors were extremely confused about what happened to the high grade

copper that didnt seem to make it into the resource statement, they actually net bought shares on Aug 18.

However the relentless push lower by the trading churn of sophisticated investors eventually forced

irrational panic and a share price route with prices falling to around $1.60 and helping to convey an

impression that the Rocklands resource was second rate and/or sub-standard. None of which was true.

Trading Algorithms: The trading by prominent brokers on Aug 18 featured high usage of algobot trading

programs as shown in the table which summarizes total trades by prominent brokers for both the first

hour of trading as well as for the complete days trading. The market share (%) of trades is quite telling

1

st

Hour All Day

BROKER Total Trades % Share of all Trades Total Trades % Share of all Trades

COMM 778 17.5% 2,975 21.2%

DMG 466 10.5% 1,525 10.9%

SOSL 463 10.4% 1,454 10.4%

BBY 363 8.2% 936 6.7%

ETRD 285 6.4% 874 6.2%

UBSW 214 4.8% 723 5.2%

CITI 206 4.6% 718 5.1%

AIEX 139 3.1% 562 4.0%

MERL 121 2.7% 458 3.3%

ANZIEX 118 2.7% 442 3.2%

BELL 183 4.1% 433 3.1%

MACQ 139 3.1% 291 2.1%

MACP 79 1.8% 266 1.9%

24

Automatic trading algorithms facilitated buying and selling at rates on Aug 18 that appear to be consistent

across the entire days trading, and as such look to be governed by trading agendas rather than genuine

buying and selling. If the buying and selling is mostly on behalf of institutions there would be plenty of

shares to back up selling orders and plenty of purchasing power to support buy orders. However, the

reality was that much of the buying and selling simply cancelled each other out at registry level leading to

minimal impact on the register compared to the volumes of shares traded.

Algorithms looked to be set at rates to generate high volumes of buying and selling by some brokers with

others having their trading algorithms tuned similarly. Trading volumes could therefore increase

exponentially in that scenario and on Aug 18 and the days that followed they did exactly that. If the

brokers algorithms were representing much the same interests then it would suggest that the market was

heavily manipulated with prices stepped down to pre-set agendas. Audits would clarify the situation.

The consistency in the trading data numbers across the entire day is quite remarkable giving the

impression that number of shares bought and sold was incidental and that trading agendas were the key.

Trading agendas tend to be more closely affiliated with share price manipulation than genuine buying and

selling. Certainly the trading behaviours appear to be the exact opposite to what would be expected with

genuine buying and selling where orders get filled and so transactions cease.

TRADING ALGORITHMS AND HIGH FREQUENCY TRADING (hft): Also refer Appendix 1

The reasons responsible for anomalous Down Tick behaviour (and anomalous Up Tick behaviour) (Pg. 20)

look to be intricately associated with the high frequency trading algorithms referred to in the Alan Kohler

article provided as Appendix 1.

The fact that Down Ticks in price occur at an astonishing 94% (approx.) of the time at the sellers ASK price

across all trading in panic stricken markets (such as on Aug 18), as well as with buyer driven markets (such

as when M&G were accumulating shares, Refer Research Paper 6.3) and with practically every other

trading day as well, is statistically incongruous. It is certainly far removed from what would be logically

expected. The extreme bias is very likely to be related to the ability of trading algorithms to sense orders as

belonging to a trading partner or not with action taken in millionths of a second to either step back from

making a transaction or to intervene with an order (e.g. to force a Down Tick). Alan Kohler has actually

drawn attention to this issue by noting:

Equally they could also dart behind them if it meant withdrawing a selling order for example that was

representing a parcel of shares that wasnt really for sale.

The situation provides clear insights into a murky situation that may sit at the heart of share price

manipulation that is sanctioned and even facilitated by the current regulatory regime as per the bank of

computers sitting at ASX headquarters as mentioned in the article.

In the Australian Securities Exchange's Sydney data room, which is about the size of a big lounge room, there are six

"cuckoos". These are the banks of servers installed by high-frequency traders. They sit against the wall opposite the

ASX servers and each is connected directly into the host by a fat fibre optic pipe. Each cable is precisely the same

length by agreement with the ASX so that none gets an advantage; if one server is closer to the input, its cable is

looped around to lengthen it. Think about that: one less metre of optic fibre carrying data at 299.8 million metres per

second - that is, the speed of light - would give one share trader an unfair advantage over the rest. It suggests that

something pretty quick is going on.