Professional Documents

Culture Documents

Basic Underwriting (ATG)

Uploaded by

dwrighte1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Underwriting (ATG)

Uploaded by

dwrighte1Copyright:

Available Formats

BASIC

UNDERWRITING

ILLINOIS

ATG

UNDERWRITING DEPARTMENT

800.252.0402

Fax: 217.359.2014

E-mail: legal@atgf.com

T

a

b

l

e

o

f

C

o

n

t

e

n

t

s

Table of contents

CHAPTER 1 ABSTRACT REVIEW AND TITLE SEARCH

CHAPTER 2 BANKRUPTCY

CHAPTER 3 CO-OWNERSHIP:

A. J OINT TENANCY

B. TENANCY BY THE ENTIRETY

C. TENANCY IN COMMON

CHAPTER 4 DISSOLUTION OF MARRIAGE & CHILD SUPPORT

CHAPTER 5 EASEMENTS & ACCESS

CHAPTER 6 ENCROACHMENTS & EXTENDED COVERAGE

CHAPTER 7 ENTITIES:

A. ASSOCIATIONS

B. CORPORATIONS

C. LAND TRUSTS

D. LIMITED LIABILITY COMPANIES

E. MUNICIPAL CORPORATIONS

F. PARTNERSHIPS

G. TRUSTS

CHAPTER 8 ESTATES:

A. DISABLED PERSONS

B. MINORS

C. DECEDENTS

CHAPTER 9 FINANCING & SECURED INTERESTS:

A. FUTURE ADVANCES

B. INSTALLMENT CONTRACTS

C. MORTGAGES

D. REVOLVING CREDIT MORTGAGES

E. VARIABLE RATE MORTGAGES

CHAPTER 10 LIENS:

A. ENVIRONMENTAL & IRPTA

B. ILLINOIS TAX & MISCELLANEOUS

C. J UDGMENTS

D. MECHANICS

E. MUNICIPAL

F. SPECIAL DISTRICTS

CHAPTER 11 MISCELLANEOUS:

A. ALIENS

B. HOMESTEAD

CHAPTER 12 MORTGAGE FORECLOSURE

CHAPTER 13 POWERS OF ATTORNEY

CHAPTER 14 RAILROADS

CHAPTER 15 SPECIAL POLICIES:

A. CONSTRUCTION

B. LEASEHOLDS

C. U.S. GOVERNMENT

CHAPTER 16 SUBDIVISION OF LAND:

A. CONDOMINIUMS

B. PLANNED UNIT DEVELOPMENTS

C. SUBDIVISIONS

D. TOWNHOUSES

E. VACATED STREETS & ALLEYS

F. ZONING

CHAPTER 17 WATERWAYS

CHAPTER 18 (RESERVED)

CHAPTER 19 (RESERVED)

CHAPTER 20 (RESERVED)

CHAPTER 21 (RESERVED)

CHAPTER 22 (RESERVED)

CHAPTER 23 (RESERVED)

CHAPTER 24 SPECIAL EXCEPTIONS

CHAPTER 25 UNDERWRITING BULLETINS AND NOTES

FORWARD

This Underwriting Manual is for the use of Illinois ATG members in examining title to real estate in

Illinois and raising appropriate exceptions for matters disclosed by the examination. The Manual is not

intended to be an exhaustive treatment of all possible problems that might affect title to real estate. Nor

is it intended to be all-inclusive of the potential title defects within the subject matter of a chapter.

Rather, the Manual is addressed to the most common title problems encountered by ATG members and

ATG requirements in dealing with these problems. Finally, this Manual is not intended to be a substitute

for attorney examination and judgment in insuring title. While we encourage ATG members' paralegal

and secretarial staffs to read the following chapters in order to better understand the process of title

examination, we emphasize that the determination of the status of title to real estate is part of the

practice of law and therefore must be conducted with the direct participation of a licensed attorney.

ATG members should note that the Underwriting Manual sets forth the most conservative position on

handling title defects. In certain cases, it may be possible to treat defects more liberally, depending upon

all of the facts and circumstances surrounding the transaction. Thus, while the Manual may be used to

discover when and how to raise specific exceptions, and will indicate the most conservative way to

handle them from ATG's standpoint, we encourage ATG members to contact the Underwriting

Department for possible alternatives where the procedures outlined herein are overly burdensome, if not

impossible, under the circumstances.

The subject matter of the following chapters and the scope of coverage therein was based upon our

perception of the areas most commonly encountered by ATG members. This perception was based upon

the numbers and types of questions we received at ATG on a day-to-day basis. We encourage the users

of this Manual to call us with any comments, questions, and suggestions to improve the subjects covered

and the scope of the coverage of those subjects.

February 1999

1

A

b

s

t

r

a

c

t

R

e

v

i

e

w

a

n

d

T

i

t

l

e

S

e

a

r

c

h

ATG Basic Underwriting - Illinois Page 1-1

ATG

CHAPTER 1 ABSTRACT REVIEW AND TITLE SEARCH

I. ABSTRACT REVIEW

Every attorney who has been faced with the review of an abstract of title or complicated title

search report faces a preliminary problem of how to organize such a review. The problem is

compounded by the necessity of establishing a written memorial of the review that is capable of

being understood both at the time of the review and in the event it needs to be analyzed in the

future. There are no set rules for the mechanics of an abstract review and most attorneys develop

their own system. The following is a suggested approach that an attorney may find helpful. The

example set forth below is an over-simplification of what would be necessary in most abstract

reviews. However, the concept can be used for more difficult title reviews.

The basic idea is to provide a chronological listing of both the chain of title and any defects,

encumbrances or other matters discovered during the search which may affect the quality of title.

Therefore, the format is divided into two columns. The column on the right will be the chain of

title. The left-hand column will be a listing of defects, encumbrances, or special problems that

have been noted in the search. To identify the review, a brief legal description is written in the

upper left-hand corner. The client name or file number could be written in the upper right-hand

corner along with the date.

The first information on the left-hand column would be the date of certification of the first

section of the abstract. Most abstracts will have been updated on several occasions and there may

be numerous certifications each of which should be identified. This will also serve to confirm

that the abstract is a complete record of the title. For identification purposes, each certification

should be noted in the chronological order as it appears in the abstract. The reviewer will then

commence the chain of title column on the right-hand side of the page with the first deed being

the patent deed from the United States government or such subsequent deed as is the first deed in

the abstract to be reviewed. Thereafter, each transfer of title will be noted chronologically by

inserting the name or initials of the grantee and the number of the item at which the transferring

document appears. In our example, the patent deed from the United States government to A. B.

J ones is item 1 in the first portion of the abstract, which is certified to May 1, 1922. The chain of

title then proceeds from J ones to C. D. Smith by warranty deed and then to E. F. Smith through

probate proceedings which first appear at item 6 of the abstract.

The only matters that were listed in the example for the first section were the mortgage at item 4

from C. D. Smith to First National Bank and the release of that mortgage. The release, which

was item 5, is noted directly after the mortgage. It is not necessary to list every item that appears

in the abstract, but only those that the examiner believes may have some impact upon the quality

of title that would form the basis of a title objection. If there is a question in the reviewer's mind

on a matter, it should be noted for later analysis.

Section B of the left-hand column notes the second portion of the abstract, which is certified

through J une 15, 1984. In that section is a quitclaim deed from G. H. Black to I. J . White, which

is item 1. Also in that section is a mortgage that has been executed by White to First Federal

Savings & Loan. There was no release of this mortgage and, therefore, the item remains as a

defect which must be set forth on a title commitment or policy as a Schedule B exception.

Furthermore, there was a judgment at item 3 by K. L. Gray against I. J . White, the titleholder,

and, again, this item remains unreleased and must be disclosed as an exception on the title

commitment and policy.

Page 1-2 ATG Basic Underwriting - Illinois

ATG

Upon completing the abstract review notes, the reviewer will then go back to determine which

matters still affect the property and must be set forth as exceptions in either a title commitment

or policy. Once it has been determined that a matter no longer affects the property, a line can be

drawn through that note so that it will be ignored when dictating or writing the commitment,

policy, or opinion. After omitting all matters that no longer affect the property, the reviewer can

then quickly determine from the right-hand column who is in title and from the left-hand column

which exceptions must be set forth.

Again, this is not an exhaustive analysis of abstract review procedures. It is intended to give a

reviewer a procedure for organizing such a review. It is suggested that these notes be retained in

the client file for future reference.

If the attorney or firm does a great deal of abstract review, it may be wise to set up an index for

subdivisions and sections so that if another abstract or search is to be reviewed at a later time

which involves the same subdivision or section, a quick reference can be made to the prior notes

which involve the larger tract from which that lot was carved. This can be easily accomplished

for example by having an index for various subdivisions and sections in the locality, referencing

within those subdivision and section headings which lots and parcels have been reviewed. For

example, if Tall Oaks subdivision was subdivided in 1955 and a review has already been made

of Lot 1 (per our example), the index would list all of the subdivisions in alphabetical order,

including Tall Oaks subdivision. Under Tall Oaks subdivision an entry would be made for Lot 1

with a reference to the specific client file in which the abstract review notes could be found.

Thereafter, if the attorney is presented with an abstract for Lot 2 in Tall Oaks subdivision, he

would need only to start his search for Lot 2 from the date of the platting of the subdivision

(1955), since prior review of the real estate which formed that subdivision has already been

made. Of course, the notes for Lot 1 must be examined to determine exceptions that may affect

Lot 2 as well.

ATG Basic Underwriting - Illinois Page 1-3

ATG

EXAMPLE

Page 1-4 ATG Basic Underwriting - Illinois

ATG

II. TITLE SEARCH STANDARDS AND PRACTICES

A. Purpose

It is a requirement of Attorneys Title that a title search be conducted in connection with

issuing title commitments and policies. There are several methods by which this can be

accomplished. Qualified searchers from the members office may conduct this search.

Many counties offer on-line search capability. Call your recorders office for information

and pricing. You can also contract the search out to a qualified search service. Before

contracting with a search provider that is not on the ATG-approved list, be certain that

the search service has a current Errors & Omissions (E&O) policy. Keep proof of the

search results with the other title documents in your file. Using the form of checklist

suggested by ATG

will assure that proper procedures for conducting a search are

followed, and will provide evidence that a search was conducted, should that evidence be

required in a claim.

B. Search Period

1. Prior Evidence of Title Exists (All States)

a. You are authorized to conduct a search from the date of an existing

owners or mortgagee/loan policy written by an ATG

member or a

commercial title insurance company authorized to conduct business in the

state in which the property is located. Mid-America Title Insurance

Company policies are not acceptable as prior title policies.

b. A prior title commitment may be used as prior evidence of title provided

the member has evidence that the final policy has been or will be issued.

c. You are also authorized to conduct a search from the date of the last

continuation of an abstract that you have in hand for examination as long

as an ATG member has issued an abstract opinion letter through the last

continuation date. This requirement exists because the member, and

consequently ATG

, will have no privity with the author of a title opinion

letter written by another attorney should a claim arise. If another ATG

member wrote the opinion letter, contact an ATG underwriter for

approval.

2. No Prior Evidence of Title Exists

The following guidelines set forth the search requirements in situations in which

there is no prior title evidence.

a. Subdivided residential land

The searcher should review the plat and any covenants, building line, and

restrictions attached to the plat. The purpose of reviewing the plat is to

determine easements, building lines, and restrictions that should be shown

as exceptions to title and to establish the titleholder to the property. The

first deed conveying the lot being searched should then be reviewed to

uncover any restrictions created by that deed. To find this deed, the

searcher should search the name of the subdivision developer in the

ATG Basic Underwriting - Illinois Page 1-5

ATG

Grantor Index or find the first deed in the Tract index if available.

Thereafter, a chain of title search should be conducted, beginning with the

first warranty deed recorded more than the applicable search period prior

to the current date, through the current date.

If the subdivision or condominium was created within the past 20 years,

and there are 10 or more lots or units, the search may be conducted

beginning with the recorded plat or declaration. If there are less than 10

lots or units, then a 20-year search must be conducted.

i. Illinois and Indiana

The applicable search period for platted land is 20 years;

ii. Wisconsin

The applicable search period platted land is 30 years for deeds,

mortgages, all other conveyances, judgments, liens and

encumbrances. The applicable search period for easements and

restrictions is 60 years.

If the land being searched is part of an area that has a history of

land patents to Native Americans, reservations of mineral rights or

other land grants or reservations, it may be necessary to search for

the federal land patent.

b. Unsubdivided land or commercial property

The searcher should conduct a search for the applicable search period,

regardless of whether or not there is a more recent plat. If the plat and first

deed are dated before the applicable search period, obtain the plat and first

deed, and then continue the search for the applicable search period. In

addition to discerning that title has transferred properly throughout the

years, this procedure will discover any restrictions, easements, or other

exceptions to title created by recorded instruments.

i. Illinois and Indiana

The applicable search period for unplatted land and unplatted

commercial property is 100 years. The applicable search period

for platted commercial property is 40 years.

ii. Wisconsin

The applicable search period for unplatted land and commercial

property is 30 years for deeds, mortgages, all other conveyances,

judgments, liens, and encumbrances. The applicable search

period for easements and restrictions is 60 years.

If the land being searched is part of an area that has a history of

land patents to Native Americans, reservations of mineral rights or

Page 1-6 ATG Basic Underwriting - Illinois

ATG

other land grants or reservations, it may be necessary to search for

the federal land patent.

C. Documenting the Search (All States)

1. Prior Policy

Keep a copy of the prior policy with the search checklist in the event a claim is

created by title exceptions not being raised or other inaccuracies in that policy.

2. Effective Date

Determine the effective date and time of the initial search for the preparation of a

commitment, as of the end of the day through which documents have been posted,

according to the Recorder's Office. The effective date and time of your final

search (in preparation of the owner's and mortgagee policies) will be the date and

time of recording of the documents being insured. The effective date and time of

your search is determined by the date and time of recording of the last document

searched, and not the date and time you leave the Recorder's office. Since some

Recorder's offices are several days behind in recording documents, it is always

wise to ask the Recorder through what date/time the records have been posted.

3. Copies of documents

Provide copies or abstracts of documents in accordance with the requirements set

forth, below.

4. J udgment and lien search

Provide a judgment and lien search for all parties who are or were in title to the

property at any time during the appropriate search period. Provide a judgment and

lien search for the buyers for the appropriate search period.

5. Real estate tax search

Provide a real estate tax search for the past five years. Include in the search the

amount and status (paid; unpaid and due; unpaid and forfeited; unpaid and sold;

not yet due and payable) of the most recent years taxes, and provide a copy of the

tax bill, if available.

6. Special assessments

Provide a special assessment search, indicating the date the special assessment

was confirmed, the amount due, the total number of installments, if any, and the

status of payment.

7. Special service areas

Examine the tax bill for information regarding special service areas and separately

report the information, including the name or number of the special service area.

ATG Basic Underwriting - Illinois Page 1-7

ATG

8. Computerized records

Provide a computerized printout of the judgment and lien search and the land

records for those counties that have computerized records, along with a legend

explaining any abbreviations, column headings, etc. In Cook County, the

computerized printout from either Landata or Chicago Title must be provided.

D. Document Copies (All States)

1. General Rule

a. All Documents indicated in the search report, including, but not limited to,

deeds, mortgages, liens, releases, plats, easements, restrictions, and

declarations, must be provided to the member with the search.

b. When the property searched is part of a condominium, the plat attached to

the declaration must be provided. The first page of the plat and the page of

the plat containing the unit and any page containing common elements or

limited common elements that are part of the unit must be provided.

c. All plats copied must include the full plat showing easements, restrictions,

county and municipal certifications, legal descriptions, signatures, and

recording information.

2. Abstracts of documents

a. In all counties except Cook and DuPage, if documents are not available or

if copying documents would be unreasonably expensive or time

consuming, the searcher may have an ATG-approved abstractor abstract

the document.

b. Abstracting of a document must include at a minimum the following

information if available:

i. date of the document;

ii. date of acknowledgement of the document;

iii. date of recording of the document;

iv. the document number and book and page (if applicable);

v. marital status of the grantors;

vi. estate or tenancy of the grantees in deeds;

vii. restrictions, covenants, or agreements;

viii. clauses stricken from a preprinted form;

ix. variations in the legal description in the document with the legal

description searched;

Page 1-8 ATG Basic Underwriting - Illinois

ATG

x. the absence of, or inconsistencies or irregularities in, the signatures

and acknowledgement of the document.

3. Abstracting is permitted only for form deeds, mortgages, releases, assignments of

mortgages and assignments of rent. Any non-form document must be provided

with the search.

E. Later Date Searches (All States)

A later date search from the effective date of the most recently conducted search, through

the current date or through the date of recording of documents, must be provided. The

search shall comply with all of the rules and procedures as set forth, above.

F. The Title Search Checklist

The top portion of every title search checklist prepared by ATGis the same. It prompts

the searcher to examine the prior evidence of title before commencing the search and

provides the searcher with ready access to title information needed to conduct that search.

A permanent record of the search must be created, and a part of that record is the exact

names of the parties searched, the date the search is commenced, and the legal description

of the property searched. The checklist also prompts the searcher to look only at

mortgage releases that affect the subject property by providing space to note the

particulars of an existing mortgage.

Complete the top portion of the search checklist before going to the Recorders office in

order to become familiar with the particulars of the search and to assure the completion

of an accurate search. This will require an examination of the abstract or prior title policy

before starting the search process to determine the titleholder, any liens or encumbrances

affecting the property, any special taxing districts to which the property is subject, or any

other title matters that may be affected by recordings found in the search.

Once again we issue a warning: a title searcher should not become too familiar with

the transaction as to presume the outcome of the search and fail to pay proper

attention to searching the indices.

1. Releases of Existing Liens

List on the back of the checklist any liens that show as exceptions in the prior

evidence of title, such as state and federal tax liens, mechanics liens, etc. This is

done as a reminder to the searcher to check the original indexing of the lien for a

release of that lien. Remember that the originals of certain liens are returned to

their rightful owners after recording and others are kept in the Recorder's Office.

In most cases, those liens that are kept in the Recorders office are filed by a file

number rather than by book and page number or document number. Thus, the

searcher will not find them in microfilm or photocopies but in filing cabinets

located in the Recorders Office. The releases of these liens are indexed on the

same line as the original indexing of the lien. Thus, to find if a lien has been

released, the searcher must note the existence of that lien on the search checklist

prior to commencing the search. Maintain a record of documents found in the

search by keeping a list of all documents found under each name in the search.

Indicate NOP (not our property) beside a document that does not affect the

ATG Basic Underwriting - Illinois Page 1-9

ATG

subject property. A copy of each applicable document is to be made as required

under Section D, above. This system will give you an opportunity to make a legal

determination as to each documents sufficiency. The third and fourth pages of

the checklist provide a place to record pertinent information concerning each

document found in the initial search and final search.

Oftentimes the buyer of property may assume a mortgage entered into by a prior

owner (mortgagor) of the property. If this is so and the county indexes releases in

a Mortgage Release Index, search for a release under the name of the mortgagor

in the mortgage. In this case, the Mortgage Release Index will be the only index

searched in the name of the mortgagor.

2. Similar names

Let us assume for sake of reference that we are searching the names J ohn Public

and Patricia C. Public. If a searcher finds a judgment or lien against J ohn M.

Public or Patricia (no middle initial) Public, that document should be considered

as applying to the search and the following exception added to Schedule B of the

commitment:

We find judgments, liens, or other matters of record involving a

person or persons whose names are similar to J. Public. Relative

thereto, a Personal Information Affidavit establishing the identity

of the above-described person must be supplied in order to

facilitate the exclusion, if possible, of these items.

Do not rely solely on the denial of the affiant in the Personal Information

Affidavit that no judgments or liens exist against him or her. Consider a situation

wherein a previous address of affiant is the same as the address of the judgment or

lien debtor found in the search. Remember, also, to check a name under the first

initial of the first name when conducting a name search. For instance, when the

name is Patricia Public, check all entries for Public, with a first name beginning

with P to discover a document executed by P.C. Public rather than searching

just Patricia Public. Also search for nicknames, such as Bill for William and

Bob for Robert. This is particularly important when performing a computer

search.

G. Guidelines to Indices

1. Tract index

Some counties maintain a tract index in addition to the other indices required by

statute. While this is a valuable tool to the title searcher, it is an unofficial index

and may not be relied on solely to conduct the search. The searcher is required to

conduct a search in the Grantor/Grantee index and any other applicable indices.

This requirement is waived for counties in which the tract index has been proven

to be reliable and, in some cases, superior to the Grantor/Grantee index. All

documents that contain a legal description will be indexed in a Tract index. Be

aware that in searching a tract index, the search is not by name but by legal

description of the subject property. In other words, if a document is discovered

that contains the legal description of the subject property, but that is filed against

Page 1-10 ATG Basic Underwriting - Illinois

ATG

a name unknown to the chain of title, examine the document, and raise an

exception in Schedule B of the commitment in the following form:

Right, title, or interest of * as disclosed by * recorded *, as

Document No. *

2. Grantor Index

When preparing a title search checklist in an unfamiliar county, first determine

what documents are indexed in the Grantor Index. Some counties index all

documents therein, some index only deeds, mortgages, and other documents that

contain a legal description and effect a conveyance of all or part of a property. For

example, Champaign County maintains a Miscellaneous Index into which powers

of attorney and other documents that do not contain a legal description are

indexed. Other counties do not maintain a Miscellaneous Index and index those

documents in the Grantor Index.

The Grantor Index contains documents indexed by name of the grantor and should

be searched in the name of the seller and/or any other party in interest to the

property. (Hereafter, seller will include any other party-in-interest to the

property.) If a tract index is not maintained, the Grantor index is the first index

that must be searched to determine whether title has transferred since the date of

the prior evidence of title. If a document has been recorded that creates a new

interests in the property, (e.g., a deed in trust or memorandum of contract), the

additional names must be searched in the same manner as the seller from the date

the interests in the property were created. These names must also be searched for

the appropriate length of time in the applicable judgment and lien and other

indices to determine if there are outstanding liens against them that attached to the

property at the time their interest in the property was created.

Because there is nothing in a Grantor Index that could be executed by a buyer of

property that would affect the property being searched, you are not required to

search this index in the name of the buyer. Therefore, the checklist must be

structured to illustrate that fact.

3. Grantee Index

The same documents that are indexed in the Grantor Index will be indexed in the

Grantee Index by name of the grantee in a document. The only instance in which

you will be required to search this index is if the Recorders Office does not

maintain a separate Release Index, but indexes releases in the Grantee Index. If

this is so, search in the name of any party who is a mortgagor in an existing

mortgage against the property.

Bear in mind that some counties index liens in the Grantor/Grantee Index. If so,

searching individual lien indices may be avoided. Again, if this is the case,

determine which liens are indexed therein to determine which names should be

searched in the Grantee Index.

ATG Basic Underwriting - Illinois Page 1-11

ATG

4. Mortgagor Index

Mortgages are indexed in this index in the name of the mortgagor. A search in the

name of the seller is required in the Mortgagor Index from the date of the prior

evidence of title. Some counties do not maintain a mortgage index, but index

mortgages in the Grantor/Grantee Index. Remember that some counties do not

maintain a Release Index, but index releases on the same line as the original

indexing of the mortgage. Also, some counties do not even index releases, but

simply note the recording information of the release on the copy of the mortgage.

Absent a Mortgage Release Index, you should question the Recorder as to how

releases of mortgages are indexed.

With the introduction of the secondary mortgage market and mortgage

assignments becoming commonplace, it is necessary to search for an assignment

of any existing mortgage on the property. To do this, the searcher must first

determine where these assignments are indexed. Some counties may index them

in the Grantor Index, while others may index them in the Mortgagor Index.

Simply check with the Recorder to find out where they are indexed. Thereafter,

when conducting a search, search the name of the mortgagee in the appropriate

index from the date of the prior evidence of title. There is one exception to the

rule that all documents containing any name in the search must be checked.

Because of the volume of documents found in the name of a mortgagee and the

fact that mortgage assignments are made individually, you may rely on the legal

description in the index to determine whether an assignment relates to the subject

property. In some counties, the reference may be to the book and page or

document number of the mortgage recording rather than to the legal description

and you may rely on this information also to determine whether an assignment

relates to the subject property.

5. Mortgagee Index

Mortgages are indexed in this index in the name of the mortgagee. While this

index is maintained in Recorders Offices that maintain a Mortgagor Index, you

are not required to search this index under any name.

6. Oil and Gas Leases

Conveyances of mineral rights to the property will be indexed herein. This index

must be searched in the name of the seller from the date of the prior evidence of

title.

7. Lessor Index

Effingham County, and possibly others in the State, has a development of

personal residences around Lake Sara. These properties are not sold but are

leased. Effingham County maintains a Lessor/Lessee Index into which transfers

of these properties are indexed. Thus, if a partys interest in property is a

leasehold, this index will be searched in the same fashion as a Grantor Index.

Additionally, a Lessor will be searched in the same manner as the seller in the lien

and other indices maintained by the Recorders Office.

Page 1-12 ATG Basic Underwriting - Illinois

ATG

8. Lessee Index

Like the Grantee Index, members are not required to search this index in the

course of their search.

9. Plats and Amendments

It is necessary to search for the recording of plats or amendments to existing plats

from the date of the prior evidence of title. This is done in various ways,

depending upon the indices available and the type of property.

If the county in which the property is located maintains a Tract index, plats or

amendments to plats will be indexed therein and no other index need be searched.

In this case, there is no need for a separate line for Plats and Amendments on

the title search checklist.

If the county maintains a Grantor/Grantee system and the property lies within a

platted subdivision, search the Plat Index in the name of the subdivision from the

date of the prior evidence of title. If the county maintains a Grantor/Grantee

system and the property lies within unplatted ground, search the Plat Index in the

name of the seller from the date of the prior evidence of title. Notice on the

sample checklist that there is a line to indicate whether Plats and Amendments

have been checked.

10. Miscellaneous Index

Few counties maintain a Miscellaneous Index, but if they do, it contains

documents that do not have a legal description. Some examples are powers of

attorney, articles of incorporation, reports of stock transfers, and other documents

for which there is not a separate index. It is necessary to conduct a search in the

name of the seller in this index and thereafter, to determine whether any document

found will affect the subject property. It is unnecessary to search this index in the

name of the buyer.

11. Release Index

Few counties maintain a Release Index. But if they do, mortgage releases are

indexed therein. In other counties, mortgage releases are indexed in the Grantee

Index noted on the same line as the original indexing of the mortgage, or noted on

the copy of the mortgage maintained in the Recorders office, either on microfilm

cards or photocopies. The absence of a Release Index will point out that some

other method is used. Whatever the method, search in the name of the mortgagor

for each existing mortgage from the date of the prior evidence of title or from the

date of the mortgage if entered into during, the period of the search. Search the

applicable names in the Grantee section of this index, as the mortgagor will be the

grantee in a release.

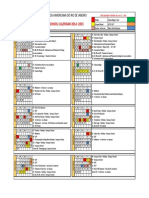

The following table contains a breakdown of various liens that may be

encountered during the search process and the statutes of limitations relating to

those liens:

ATG Basic Underwriting - Illinois Page 1-13

ATG

Type of Lien

Lien Affects

Property or

Person

Search Buyer

or Seller

Statute of

Limitations

Mobile Home Person Both 10 Years

Federal Tax Person Both 10 Years

Retailer's Occupation Tax Person Both SEE BELOW

Unemployment Compensation Contribution Person Both 3 Years

Memorandum of J udgment Person Both 8 Years

Old Age Assistance Property SEE BELOW 5 Years

Lis Pendens Notice Property SEE BELOW

Mechanics Lien Property Seller 2 Years

Sanitary District Property Seller 30 Years

Demolition Liens Property Seller 10 Years

Bail Bonds Property Seller NONE

Oil & Gas Property Seller SEE BELOW

12. State Tax Lien and Retailer's Occupation Tax Liens

These liens affect any property now owned or hereafter acquired by a debtor. On

September 13, 1984, the Legislature amended the statute of limitations for each of

these liens changing the enforceability from five years to 20 years. This

amendment also provided that any such liens that were not unenforceable by lapse

of time became effective for 20 years. Therefore, it is not yet required to search

these indices for 20 years, but simply begin the search in 1979. In late1999, after

20 years has passed since the change in the statute, and those initial liens filed

under the new statute begin to expire, you will begin searching for a 20-year

period.

13. Old Age Assistance Liens

These liens affect only the property against which they are filed. Therefore, in

examining the lien, the searcher should see that it contains a legal description. In a

Recorders office that maintains a Tract index, these liens will be indexed therein.

In an office that maintains a Grantor/Grantee system, search this index in the

name of the seller but not in the name of the buyer. Old Age Assistance Liens are

effective for five years.

14. Lis Pendens

In this instance, the designers of books of index erred as Memoranda of J udgment

and Lis Pendens are normally indexed in the same book, the J udgment, Notice &

Decree Index. Lis Pendens (or Notice of Pending Suit) contains a legal

description (it will be indexed in a Tract index) and affects only the property

against which it is filed. Furthermore, it is effective against the property for the

pendency of the search. Thus, while the purpose of a search checklist is to keep

Page 1-14 ATG Basic Underwriting - Illinois

ATG

tract of all names to be searched in each index and for what length of time to

search each name, special attention must be paid to the document that is found to

determine whether it affects the search. Pay particular attention if the Recorder's

Office maintains a Tract index. While Lis Pendens notices will be indexed in the

Tract index, the J udgment, Notice, and Decree Index must still be searched for

memoranda of judgment.

15. Mechanics Liens

These liens affect only the property against which they are filed; therefore, search

this index only in the name of the seller. This lien will contain a legal description

and, thus, will be indexed in a Tract index. Mechanics liens are enforceable for

two years from the date the work was completed.

16. Sanitary District Liens

These liens affect only the property against which they are filed; therefore, search

this index only in the name of the seller. These liens contain a legal description

and will be indexed in a Tract Index. Sanitary district liens are enforceable for 30

years. They are normally indexed in a Lien Index (along with Mechanics Liens

and, sometimes, other liens) and, therefore, the search checklist must indicate the

longest number of years to search determined by which liens are indexed therein.

17. Demolition Liens

These liens affect only the property against which they are filed; therefore, search

this index only in the name of the seller. This lien will contain a legal description

and, thus, will be indexed in a Tract index. Normally these liens are indexed in the

Lien Index. Demolition Liens are enforceable for 10 years.

18. Oil and Gas Liens

While this is a rare instrument, this index is found in at least one county in

Illinois. Its purpose is to index agreements subordinating previously existing liens

created by mortgages or deeds of trust to the oil and gas lease. This agreement

obtains the lien holders consent to development of the property for oil and gas,

and may address directing payment of proceeds directly to the lien holder for

application on the secured debt. This index should be searched in the name of the

seller from the date of the prior evidence of title. This lien will contain a legal

description and will be indexed in a Tract index.

19. Bail Bond Liens

These liens affect only the property against which they are filed; therefore, search

this index only in the name of the seller. This lien will contain a legal description

and, thus, will be indexed in a Tract index. A Bail Bond Lien remains in effect

until the conditions of the bail bond have been performed and the bail bond

discharged, meaning that this index should be searched for the pendency of the

search.

ATG Basic Underwriting - Illinois Page 1-15

ATG

This list may not be all inclusive of the liens you will find indexed in the

Recorder's Office. If you find other liens filed against the parties, contact an ATG

underwriter for information concerning the effect and duration of those liens.

H. Guidelines for General Real Estate Taxes

1. General Real Estate Taxes

a. Indicate the permanent index number assigned to the property, and note

the name of the party paying the real estate taxes (or the party to whom the

taxes are billed). If the tax records indicate payment was made by or billed

to someone other than the seller of the property, this fact may indicate the

existence of a contract sale or lease of the property that does not appear of

record, and requires inclusion of the following exception on Schedule B of

the title commitment:

The tax records indicate that *, a stranger to title, made

payments of general real estate taxes. The original receipt

showing such payment should be produced at this office

and this commitment is subject to: (1) rights or claims of

said party and all parties claiming thereunder, including

judgment and lien creditors, if any; and (2) the aforesaid

taxes, if not paid by a parry interested in the land.

This paragraph applies also to special assessments paid by someone other

than the titleholder. It does not apply to taxes paid by the mortgagee in a

mortgage existing against the property.

b. First determine the amount and status of the last known tax bill. This

information will be used to create a Schedule B exception for taxes in the

following form:

Permanent Index No. *; General real estate taxes for the

year, in the amount of $* are shown paid; * taxes are not

yet due and payable.

c. The next step is to check the real estate taxes for the last five years to

determine that those taxes have not been sold or forfeited. The five-year

period begins with the last taxes that could have been sold at tax sale. For

instance, assume that the commitment was effective December 21, 1997.

Real estate taxes for the year 1996, if not paid, would have been offered at

tax sale. Therefore, the five-year period would begin with 1996, meaning

that the searcher would check for payment of the 1996, 1995, 1994, 1993,

and 1992 taxes.

d. All permanent index numbers that affect the property must be verified by

the searcher. If a permanent index number affects property in addition to

that being searched, that fact must be indicated in the search report. If

more than one permanent index number affects the property being

searched, those additional permanent index numbers must be searched and

reported.

Page 1-16 ATG Basic Underwriting - Illinois

ATG

2. Special Assessments

The procedures necessary to levy a special assessment of any kind are basically

the same. A petition for court approval with an assessment roll is filed, notice to

interested parties is served, a court hearing is held, and the courts decision with

the assessment roll is certified to the appropriate collecting officials.

When any assessment roll has been approved and confirmed by the Circuit Court

having jurisdiction of the district, a certified copy of the judgment is delivered to

the County Collector. In counties with township organization, the offices of the

County Collector and County Treasurer are combined.

Before any assessment becomes due and payable, the collector mails to the owner

of the property, or to the persons in whose name the property was last assessed, a

statement containing a property description, the amount of the assessment, the

date the assessment is due, and the manner in which it should be paid. The annual

maintenance assessments are due and payable and become a lien on the land on

the first day of J anuary next succeeding the confirmation of the levy. Original and

additional assessments are due as specified in the court order approving the

assessments. One-half of the annual maintenance assessment becomes delinquent

on the first day of the following J une and the remaining half becomes delinquent

on the first day of the following September.

Effective J anuary 1, 1988, Public Act 85-521 requires that, after entry of the

judgment for a special assessment for a drainage district, the Clerk shall record

the entire assessment roll or verdict as confirmed in the record, and make out and

certify copies of the assessment roll or verdict as it pertains to property in the

district located in the county. The amendment further requires the Commissioner

to file the certified copies in the Recorder's Office of every county containing

lands or other property of the district. Public Act 85-479, effective September 17,

1987, requires that all municipal assessments must be recorded in the County

Recorder's office. No lien for payment can exist until this recording takes place.

Quite obviously, the concern is finding the proper keeper of records of city or

township assessments or assessments by the various other authorities empowered

to levy these assessments prior to September 17, 1987 or J anuary 1, 1988. Bear in

mind that assessments may be levied by drainage districts (which records are

normally kept with the County Treasurer) or hospital, fire protection, forest

preserve, or other types of special districts. These records may be kept by city or

village clerks, treasurers, township officials, or commissioners. In the smaller

towns, it is often more difficult to find the keeper of the records, but easier to keep

abreast of special assessments because of newspaper coverage or ones

involvement in city government. Personal knowledge of road improvements or

street lighting additions (or the like) should alert the searcher that assessments

might exist against the property.

I. Break in the Chain of Title/Wild Deed or Mortgage (All States)

1. If a deed from an interloper (stranger) is found in the search, show the chain of

title up to the last grantee before the interloper, report the deed from the interloper

ATG Basic Underwriting - Illinois Page 1-17

ATG

with a note that the deed is outside the chain of title, and continue the search

through both the interloper and the proper grantee in the chain, if possible.

2. If the search reveals a wild deed or mortgage (a deed or mortgage in which

neither the grantors or mortgagors nor the grantees or mortgagees appear

anywhere in the chain of title), report the wild deed or mortgage with a note that

the grantors/mortgagors and the grantees/mortgagees do not appear in the chain of

title, and continue the search through the proper grantees.

J. Miscellaneous

1. Torrens Property (Cook County)

a. Property registered in Torrens will have a Certificate that shows the owner

of the property, the legal description, and, on the reverse side, the

exceptions that pertain to the property. The Torrens system has been

eliminated, but many of the properties have not yet been deregistered.

b. In searching Torrens property, the member or searcher must check the last

Torrens certificate at the Registrars Office. Copies should be provided, if

available.

c. All documents from the last Torrens certificate must be reported and

included with the search report, even if there is a prior policy.

d. Property that has been deregistered will have a new chain of title

beginning with the recorded Certification of Title, a document prepared by

the Torrens Office showing the names of the owners of the property, the

legal description, and the matters that affect the title to the property. If

there is no prior policy, the search may commence with the recorded

Certification of Title.

e. The requirements stated above must be followed for all Torrens searches.

2. Recording services

When recording services are provided by you or your search provider, all

documents to be recorded must be recorded in a timely manner, in no case more

than five days after receipt of the documents by you or your search provider.

3. Gap Searches

In Cook County, the search provider must provide a gap search from the effective

date of the initial search in accordance with ATGs gap search program.

Page 1-18 ATG Basic Underwriting - Illinois

ATG

[THIS PAGE INTENTIONALLY LEFT BLANK]

ATG Basic Underwriting - Illinois Page 1-19

ATG

EXHIBIT 1-1: PERSONAL INFORMATION AFFIDAVIT (page 1 of 2)

Page 1-20 ATG Basic Underwriting - Illinois

ATG

EXHIBIT 1-1: PERSONAL INFORMATION AFFIDAVIT (page 2 of 2)

ATG Basic Underwriting - Illinois Page 1-21

ATG

[NOTES]

2

B

a

n

k

r

u

p

t

c

y

ATG Basic Underwriting - Illinois Page 2-1

ATG

CHAPTER 2 BANKRUPTCY

In certain situations, you may be requested to issue title insurance upon the sale of real estate owned by

a party or parties who have filed a bankruptcy petition. Prior to October 8, 1984, the Bankruptcy Act

provided that upon filing of a petition in bankruptcy, title to all property of the bankrupt vested in the

trustee. This is no longer true for petitions filed on or after October 8, 1984. While it may be true that

title no longer passes upon the filing of a petition in bankruptcy, the trustee and the bankruptcy court

clearly have rights and duties in connection with the control of all property of the debtor, including the

real estate. Extreme care must be taken in dealing with any bankruptcy situation whether it be Chapter 7

(Liquidation), Chapter 11 (Reorganization), Chapter 12 (Farm), or Chapter 13 (Adjustment of Debts of

an Individual with Regular Income).

I. EFFECT OF FILING A PETITION IN BANKRUPTCY

At the time of the filing of the petition, all of the property of the debtor is brought within the

control of the trustee and the court.

1

This also includes property acquired by bequest, devise,

inheritance, or divorce within 180 days after the filing of the petition. All other property acquired

by the estate after the commencement of the case will also be the property of the estate.

Naturally, the bankrupt is not authorized to transfer any of the property which would diminish

the available assets that are to be held by the trustee for satisfaction of the creditors claims.

Under the Act in effect prior to October 8, 1984, the trustee under 549 could avoid any transfer

of the property after commencement of the proceedings unless the buyer had acquired an asset

for value without knowledge of the bankruptcy proceedings and the property was not located in

the county where the bankruptcy court sat. For cases commenced on or after October 8, 1984, the

trustee must file a copy of the petition in the recorders office for every county in which real

estate is located in order to impart constructive notice to third parties of the bankruptcy

proceedings.

2

That provision states:

The trustee may not avoid a transfer of real property to a good faith purchaser

without knowledge of the commencement of the case and for present fair

equivalent value unless a copy or notice of the petition was filed, where a transfer

of such real property may be recorded to perfect such transfer, before such

transfer is so perfected that a bona fide purchaser of such property, against whom

applicable law permits such transfer to be perfected, could not acquire an interest

that is superior to the interest of such good faith purchaser. A good faith

purchaser without knowledge of the commencement of the case and for less than

present fair equivalent value has a lien on the property transferred to the extent of

any present value given, unless a copy or notice of the petition was so filed before

such transfer was so perfected.

Therefore, a duty is imposed on the trustee to record notice of the bankruptcy proceedings in

order to prevent an effective transfer of the property to a good faith purchaser.

It is necessary, therefore, in all cases to make a search of the recorders office to determine

whether a bankruptcy proceeding has been filed by either the seller or buyer of the property. If a

recorded notice is found in the search, or if you have personal knowledge of the bankruptcy

Page 2-2 ATG Basic Underwriting - Illinois

ATG

proceedings, or otherwise become aware of the proceedings, the following exception should be

inserted in the commitment:

Statutory rights, powers and duties of the trustee in bankruptcy and the court in

the bankruptcy proceedings filed by *, on *, in the Federal District Court for the

* District of Illinois in Case No. *, [notice of which was recorded on * as

Document No. * (in Book *, Page No. *).]

II. TRANSFERS OF PROPERTY OF A BANKRUPT

There are several ways that the property of a bankrupt can be effectively transferred. The first

instance, of course, would be where the bankruptcy proceeding has terminated and the debtor is

once again free to deal with the property as his own. It is important to remember that the entry of

a discharge alone is not sufficient to give the debtor the authority to transfer the property. There

must also be a dismissal of the bankruptcy proceedings following the discharge.

It is also possible for the property to be freed from the control of the trustee and the court by

abandonment of the property. Section 544 of the Act provides that after notice at a hearing the

trustee may abandon any property of the estate that is burdensome to the estate or that is of

inconsequential value and benefit to the estate. This often occurs when the mortgage or other

liens and homestead exemption exceed the value of the property making it valueless to the

creditors. Therefore, check the proceedings to make sure that notice of the intention to abandon

the property has been given to the creditors, no objection has been raised, and that an order of

abandonment of this specific property has been entered by the court. Once abandoned, the

property is free of the bankruptcy proceedings and may be transferred or otherwise dealt with by

the debtor. When an order of abandonment has been properly entered, the deed conveying the

property need be executed only by the debtor and any other titleholder, but not the trustee.

The trustee may also sell the property when such sale will benefit the estate.

3

Section 363(b)

authorizes the trustee, after notice and a hearing, to sell or lease, other than in the ordinary course

of business, the property of the estate. If the trustee is proposing to execute the deed to transfer

the property, check the bankruptcy proceedings to make sure that notice has been sent to all

creditors, and a hearing has been conducted wherein the court has ordered the sale of the specific

property by the trustee. Section 363(c) provides that where there is authority to continue the

business of the debtor, in the absence of a court order to the contrary, any use, sale, or lease of

the estate property in the ordinary course of that business may be made without prior notice,

hearing, or order of the court. For purposes of issuing title insurance, the following may be relied

upon as authority for the trustee to continue the debtors business:

1. Chapter 7 cases:

4

Find in the bankruptcy proceedings that a specific order of the

court authorizing conduct of the debtors business has been entered.

2. Chapter 11 cases:

5

The trustee or the debtor in possession may be assumed to

have authority to conduct the debtors business if no court order has been entered

denying that authority and the plan does not prohibit a sale in the ordinary course.

3. Chapter 13 cases:

6

The trustee or the debtor in possession may be assumed to

have authority to conduct the debtors business if no court order has been entered

denying that authority and the plan does not prohibit a sale in the ordinary course.

Finally, the trustee is given special authority to sell property free and clear of liens under limited

circumstances as set forth in 363(f). That section provides that the trustee may sell property free

ATG Basic Underwriting - Illinois Page 2-3

ATG

and clear of any interest in such property of any entity other than the estate, only if one of the

following is true:

1. Applicable non-bankruptcy law permits sale of such property free and clear of

such interest;

2. Such entity consents;

3. Such interest is a lien and the price at which such property is to be sold is greater

than the aggregate value of all liens on such property;

4. Such interest is in bona fide dispute; or,

5. Such entity could be compelled, in a legal or equitable proceeding, to accept a

money satisfaction of such interest.

Naturally, this section requires that there be notice to all creditors and a hearing on the petition

for sale. Examine the proceedings under 363(f) to confirm that there has been compliance with

the statutory requirements and the court order must justify the sale for one of the reasons set

forth in 363(f). Assuming that a proper 363(f) sale has been conducted, issue the policy to the

grantee of the deed from the trustee free and clear of the liens and encumbrances of all parties

who were given notice in the petition for sale. Since this is somewhat of an extraordinary

remedy, strict compliance with the statutory requirements and notice provisions must occur.

III. LIENS AGAINST BANKRUPTS PROPERTY

A. Judgment Liens and Discharge

There is a common misconception that property held by a bankrupt will be freed from the

imposition of judgment liens if the debt is discharged in bankruptcy. This is not true for

property that was held by the bankrupt at the time of the discharge. In this situation, once

the judgment lien has been properly perfected by recording of a memorandum or certified

copy of the lien in the recorders office, the lien becomes much like a perfected security

interest. The discharge in bankruptcy, while removing the personal obligation to pay the

debt, does not remove the lien against the property. The judgment creditor could still

foreclose on the judgment lien and use the sale proceeds to satisfy the debt. There could

not be any deficiency award in the foreclosure proceedings, but the judgment creditor can

fully realize on the property even after discharge.

7

Therefore, if a judgment lien is

discovered in the search, an exception must be raised on the commitment and policies

even if there has been a discharge of the debt.

On the other hand, if the discharge and dismissal in bankruptcy occur prior to the

bankrupt acquiring title to the property, no lien attaches. Since the debt has been

eliminated by the discharge, the subsequent acquisition of real estate does not cause a lien

right to be created. In this situation, you do not need to raise an exception for a judgment

lien on the commitment or policies.

B. Avoidance of Liens in Bankruptcy Proceedings

Pursuant to 545, the trustee is entitled to avoid statutory liens on the property of the

debtor. Statutory liens are those liens that are created only by reason of a statute and not

based upon any form of agreement. Examples of statutory liens would be mechanics

Page 2-4 ATG Basic Underwriting - Illinois

ATG

liens, tax liens, judgment liens, etc. The mortgage lien would be a lien arising by

agreement and, therefore, not subject to avoidance under this section.

The trustee is entitled to avoid such statutory liens on the property of the debtor to the

extent that such liens first became effective against the debtor:

1. when a bankruptcy case against the debtor has been commenced;

2. when an insolvency proceeding, other than bankruptcy was commenced;

3. when a custodian was appointed or took possession;

4. when the debtor became insolvent;

5. when the debtors condition fails to meet a specified standard; or,

6. at the time of an execution against the property of the debtor levied at the instance

of an entity other than the holder of such statutory lien.

Statutory liens may also be avoided under Section 545 when they are not perfected or

enforceable at the time of the commencement of the case against a bona fide purchaser

that purchased such property at the time of the commencement of the case, whether or not

such purchaser exists. This would apply, for example, to a mechanics lien claim that

relates back to the date of the contract with the owner. Since such then would be effective

against a bona fide purchaser (even if no such purchaser actually exists at the

commencement of the bankruptcy case), the trustee may not avoid the lien.

Only when the trustee has petitioned for removal of such a lien pursuant to this section

and the court, after notice and hearing, has approved the trustees petition may you waive

the listed statutory liens from a commitment or policy.

IV. BANKRUPTCY AND JOINT TENANCY

The case of In re Tyson, 48 B.R. 412, (Illinois 1985) has surprisingly held that the filing of a

petition in bankruptcy by a joint tenant severs the joint tenancy. The court concluded that the

filing of the bankruptcy gave some interest in the property to the trustee and, therefore, destroyed

one or more of the four unities.

The holding in this case seems somewhat questionable, especially since the new Bankruptcy

Code eliminates any reference to a transfer of title to the trustee. Certainly, there may be no

intention on the part of the joint tenants to sever the joint tenancy by simply filing bankruptcy. In

any event, if clients of ATG members have filed for bankruptcy and their joint tenancy property

has been abandoned by the trustee or otherwise returned to the joint tenants, it would be

advisable to re-convey the property to the joint tenants by quitclaim deed clearly setting forth the

joint tenancy of the grantees on the deed. This will eliminate any contention that the joint

tenancy no longer exists.

V. BANKRUPTCY AND MORTGAGE FORECLOSURE

See the section on Mortgage Foreclosure contained in this manual.

ATG Basic Underwriting - Illinois Page 2-5

ATG

1 11 U.S.C 541

2 11 U.S.C. 549(c).

3 11 U.S.C. 363.

4 11 U.S.C. 721

5 11 U.S.C. 1108

6 11 U.S.C. 1304

7 Miller v. Barto, 247 Ill. 104, 93 N.E. 140 (1910).

3

A

C

o

-

O

w

n

e

r

s

h

i

p

:

J

o

i

n

t

T

e

n

a

n

c

y

ATG Basic Underwriting - Illinois Page 3A-1

ATG

CHAPTER 3A CO-OWNERSHIP:

JOINT TENANCY

I. CREATION OF A JOINT TENANCY

J oint tenancy has long been used as a form of co-ownership of interests in real estate. At

common law, it was presumed that a conveyance or devise to two or more persons created a joint

tenancy unless the grantor or testator indicated otherwise. Illinois statutory law has reversed this

presumption. Therefore, closely examine the language of a document purporting to create a joint

tenancy to determine the intention of the grantor or testator.

In order to create a valid joint tenancy, there must be a conveyance to the co-owner grantees

using the statutory language: not in tenancy in common but in joint tenancy.

1

Although the

statute states that the conveyance shall expressly declare the joint tenancy, the Illinois courts

have frequently held that as long as the language used clearly intended to create a joint tenancy,

the statutory language need not be used.

2

In addition to a clear intent expressed in the conveyance, the four unities of time, title, interest,

and possession must be present in order to create a valid joint tenancy.

3

This means that each

joint tenant must have an equal undivided interest in the property, have an equal right to

possession, have the same quantity of estate, and that the interests were all created at the same

time. If any of these unities is missing, a tenancy in common will instead be created.

You can rely on the Illinois statute permitting a grantor to convey to himself and another so as to

create a valid joint tenancy. On the other hand, it remains true that one cannot create a joint

tenancy where the grantees own unequal shares in the property.

A related problem in determining the grantors intent arises when a joint tenancy form deed is

used and only one grantee is named. In this situation, the following exception must be raised:

The deed from * to * recorded * as Document No. * [in Book *, Page *] is a joint

tenancy deed in form. The deed should be produced for examination; and an

affidavit executed by all parties named in said deed disclosing the names of the

intended grantees should be supplied. This Commitment is subject to such further

exceptions, if any, as may then be deemed necessary.

This exception may be waived if you determine from the instrument and the affidavit that no

intended grantees name was erased, or omitted through inadvertence, from the deed.

II. SEVERANCE OF A JOINT TENANCY

Even though property may be held in joint tenancy, either joint tenant may freely alienate his

undivided interest in the property. Some types of acts or events may sever the joint tenancy, and

others may not. Samples of some of the more common acts or events and the probable effect on a

joint tenancy are as follows:

1. A conveyance by a joint tenant to a third party or parties will sever the joint

tenancy.

Page 3A-2 ATG Basic Underwriting - Illinois

ATG

2. A conveyance by a joint tenant to himself or herself will sever the joint tenancy if

such was the intention of the grantor-grantee.

3. An involuntary conveyance of the joint tenants interest will sever the joint

tenancy, e.g., sheriffs execution sale and deed or bankruptcy sale deed.

4. A judgment for dissolution of marriage will not sever a joint tenancy between

husband and wife unless the judgment orders that the property be sold and

proceeds be divided.

5. A partition complaint will not sever the joint tenancy but a judgment of partition

will.

6. A mortgage or trust deed will not sever a joint tenancy.

7. The last will and testament of a joint tenant who attempts to devise joint tenancy

property will not sever the joint tenancy (but see discussion on the doctrine of

election, infra.)

Any action or event that would cause any one of the four unities of time, title, interest, or

possession to be destroyed will sever the joint tenancy, and create a tenancy in common.

If the examination of title discloses these or any other acts or events by a joint tenant, and you

are unsure as to the result, contact the ATG underwriting department with the pertinent

information for instructions.

III. DEATH OF JOINT TENANT

As a general rule, on the death of a joint tenant, title to the real estate passes to the surviving joint

tenant or tenants. Accordingly, when examining title in such a situation first determine that the

joint tenancy was validly created and, if so, that it has not been severed prior to the death. See the

preceding sections in this chapter for a brief analysis of creation and severance problems.

If the title search, application for title insurance or other evidence discloses the death of a joint

tenant in the chain of title, show title in the surviving joint tenant or tenants and raise the

following exception on Schedule B of the OMC:

We should be supplied with satisfactory evidence establishing the death, the

testacy or intestacy, and the value of the estate of *, deceased; and this

commitment is subject to such further exceptions, if any, as may then be deemed

necessary.

This exception may be modified or eliminated when such evidence has been supplied in whole or

in part, prior to the issuance of the OMC.

A J oint Tenancy Affidavit (ATG Form 307) is available to members and, when properly

executed, will supply all information required in the above exception. The affidavit supplied

must then be examined to ascertain whether any further exceptions must be raised. The following

analysis points out potential problem areas to consider. If such problems arise, please contact the

ATG underwriting department for the appropriate exceptions or clearance procedures.

ATG Basic Underwriting - Illinois Page 3A-3

ATG

A. Proof of Death

You must be supplied with a certified copy of the death certificate of the decedent. The

reason for this requirement is two-fold: First, title will not pass until death occurs, and

second, the cause of death may bar the survivor from acquiring the decedents interest. A

person who intentionally and unjustifiably causes the death of another shall not receive

any property by reason of the death, including what a surviving joint tenant would have

received.

4

Accordingly, if the death certificate discloses that the decedent died from other

than natural causes, you must require further evidence as to who may have caused the

death.

B. Testacy or Intestacy

Even though the title to the real estate passes by operation of law to the surviving joint

tenant, the decedents last will and testament must be examined to determine whether the

case law dealing with joint and mutual wills or the doctrine of election is applicable.

The doctrine of election may be applicable where the decedent attempts to devise the

specifically described joint tenancy property to someone other than the surviving joint

tenant, and devises or bequeaths other property, not necessarily real estate, to the

surviving joint tenant. In such a situation if the decedent clearly indicates in his or her

will that the surviving joint tenant must elect the estate property or the joint tenancy

property, the surviving joint tenant must elect between the joint tenancy property and the

property bequeathed in the will.

5

If the decedent and the surviving joint tenant have executed a joint and mutual will, the

will may have created a contract to devise the joint tenancy property to the ultimate

devisees in the will. Thus, while title is vested in the survivor, it is subject to the contract

so created that may be enforced against the survivor or his or her successors in interest.

C. Value of the Decedents Estate

You must be supplied with information relative to the value of the decedents taxable

estate so that you can determine whether to raise exceptions relative to Illinois or federal

estate taxes. The federal estate tax is imposed upon the net value of decedents estate.

Each decedent is entitled to a lifetime credit from the unified estate and gift tax. For

decedents dying in 1998 and thereafter, the value of the gross estate equivalent to the

maximum allowable lifetime credit is $625,000. The amount of the credit equivalent is

currently scheduled to increase every year through the year 2000, so the Internal Revenue

code must be consulted for the current amount. If you ascertain that the estate of the

decedent was of such size that it is unlikely that an estate tax would be due, he or she

need not raise an exception for the tax. Further, a surviving joint tenant can convey title

to a bona fide purchaser or mortgagee free and clear of the lien of federal estate taxes.

6

Effective J anuary 1, 1983, the Illinois Inheritance Tax was eliminated and was replaced

by the Illinois Estate Tax. There is no Illinois estate tax due except to the extent that the

decedents estate would be eligible for the credit for state death taxes under Federal estate

tax law. Therefore, for decedents dying after December 31, 1982, if you have eliminated

the possibility of federal estate taxes, you need not raise Illinois estate taxes as an

exception upon a conveyance to a bona fide purchaser or mortgagee. For decedents dying

Page 3A-4 ATG Basic Underwriting - Illinois

ATG

prior to J anuary 1, 1983, contact the ATG underwriting department if you have any

questions regarding Illinois inheritance tax liens.

1

765 ILCS 1005/1

2

See, e.g., Slater v. Gruger, 165 Ill. 329, 46 N.E. 235 (1897)

3

Klouda v. Pechousek, 414 Ill.75, 110 N.E.2d 258 (1953)

4

755 ILCS 5/2-6

5

Williamson v. Williamson, 275 Ill.App.3d 999, 657 N.E. 2d 651, 212 Ill. Dec 450 (1995)

6

6324(a)(2) of the Internal Revenue Code

ATG Basic Underwriting - Illinois Page 3A-5

ATG

EXHIBIT 3A-1: JOINT TENANCY AFFIDAVIT (page 1 of 2)

Page 3A-6 ATG Basic Underwriting - Illinois

ATG

EXHIBIT 3A-1: JOINT TENANCY AFFIDAVIT (page 2 of 2)

ATG Basic Underwriting - Illinois Page 3A-7

ATG

[NOTES]

3

B

C

o

-

O

w

n

e

r

s

h

i

p

:

T

e

n

a

n

c

y

b

y

t

h

e

E

n

t

i

r

e

t

y

ATG Basic Underwriting - Illinois Page 3B-1

ATG

CHAPTER 3B CO-OWNERSHIP:

TENANCY BY THE ENTIRETY

I. CREATION OF A TENANCY BY THE ENTIRETY

This form of survivorship ownership became effective starting on October 1, 1990.

1

A husband

and wife may take title by tenancy by the entirety if all of the following conditions are satisfied:

A. The property is maintained or intended to be maintained as a homestead by both husband

and wife together during coverture;

B. The deed or instrument of conveyance to the husband and wife expressly declares that the

devise is to the grantees, as husband and wife, not as joint tenants or tenants in common

but as tenants by the entirety.

C. The grantees are in fact husband and wife (tenancy by the entirety is not available for

non-married grantees).

If the grantees are not in fact husband and wife at the creation of the tenancy, then a joint tenancy

is created.

2

If the Owner Policy to be issued will insure the proposed Insureds as tenants by the entirety, the

following exception must be raised on the commitment:

If the policy or policies committed for under this commitment will insure the

titleholders as tenants by the entirety, any deed or instrument of conveyance must

convey the land to the proposed Insureds and must identify them as husband and

wife, and must contain the language required under Illinois law. In addition, ATG

must be supplied an affidavit (ATG Form 329) signed by the proposed Insureds

and setting forth that at the time of execution and delivery of the deed or