Professional Documents

Culture Documents

Kebijakan Dividen

Uploaded by

Chuda KudaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kebijakan Dividen

Uploaded by

Chuda KudaCopyright:

Available Formats

Payout Policy

To make appropriate dividend decisions for the To make appropriate dividend decisions for the

firm, management need to understand types of

dividends, arguments about relevance of

dividends, the factors that affect dividend policy,

and types of dividend policies.

Dividen merupakan bagian dari laba

yang dibagikan kepada pemilik saham

Laba sebelum bunga dan pajak

Bunga

Laba sebelum pajak Laba sebelum pajak

Pajak

Laba setelah pajak

Dividen saham preferen

Laba yang tersedia untuk pemilik saham biasa

The term payout policy refers to the decisions

that firm make about whether to distribute

cash to shareholders, how much cash to

distribute, and by what means cash should be distribute, and by what means cash should be

distributed.

Dividend Fundamentals

A dividend is a redistribution from earnings.

Retained earnings is earnings not distributed to owners as

dividends, are a form of internal financing, the dividend

decision can significantly affect the firms external

financing requirements. financing requirements.

If the firm needs financing, the larger cash dividend paid,

the greater the amount of financing it must raise

externally through borrowing or through the sale of

common or preferred stock.

Cash Dividend Payment

Procedures:

At quarterly or semiannual meetings, a firms

board of directors decides whether and in what

amount to pay cash dividends.

If a firms directors declare a dividend, they issue

a statement indicating the dividend amount and

setting three important dates, the record date,

a statement indicating the dividend amount and

setting three important dates, the record date,

ex-dividend date and payment date.

Dividend policy is one of the factors that drives an

investors decision to purchase a stock, most

companies announce their dividend policy.

Date of Record Date of Record Date of Record Date of Record: The date on which investors

must own shares in order to receive the dividend

payment.

Ex Dividend Date Ex Dividend Date Ex Dividend Date Ex Dividend Date: Four days prior to the date of

record. The day on which a stock trades ex record. The day on which a stock trades ex

dividend (exclusive of dividends).

Distribution Date Distribution Date Distribution Date Distribution Date: The day on which a dividend is

paid (payment date) to stockholders.

Cash Dividend Payment Procedures:

Example 14.1 Example 14.1

On June 24, 2010, the board of directors announced

that the firms next quarterly cash dividend would

be $0.15 per share, payable on October 26,2010 to

shareholders of record on Tuesday, October 5, 2010.

Firm shares would begin trading ex dividend on the

previous Friday, October 1.

The firm had 420,061,666 shares of common stock

outstanding, so the total dividend payment would be

$ 63,009,250.

Before the dividend was declared, the key

accounts of the firm were as follows:

Cash $ 1,826,000,000 Dividends Payable $ 0

Retained Earnings 5,797,000,000 Retained Earnings 5,797,000,000

When the dividend was announced by the directors,

$63,009,250 of the retained earnings ($0.15/share x

420,061,666 shares) was transferred to the dividends payable

account. As a result, the key accounts changed as follows: account. As a result, the key accounts changed as follows:

Cash $ 1,826,000,000 Dividends Payable $ 63,009,250

Retained Earnings 5,733,990,750

When firm actually paid the dividend on

October 26, this produced the following

balances in the key accounts of the firm:

Cash $1,763,000,750 Dividends Payable $ 0 Cash $1,763,000,750 Dividends Payable $ 0

Retained Earnings 5,733,990,750

The net effect of declaring and paying the

dividend was no reduce the firms total assets

(and stockholders equity) by $ 63,009,250.

Successful companies earn income. That income can

then be reinvested in operating assets, used to

retire debt, or distributed to stockholders.

If decision is made to distribute income to

stockholders, 3 key issues arise: stockholders, 3 key issues arise:

(1) how much should be distributed?

(2) should the distribution be in form of dividends or

should the cash be passed on to stockholders by

buying back stock?

(3) how stable should the distribution be;

that is, should the funds paid out from year

to year be stable and dependable, which

stockholders like, or be allowed to vary stockholders like, or be allowed to vary

with the firms cash flows and investment

requirements, which might be better from

the firms; standpoint?

What do investors prefer?

When deciding how much cash to distribute, financial

managers must keep in mind that the firms objective is

to maximize shareholders value.

Consequently, the target payout ratio should be based in

large part on investors preferences for dividends versus large part on investors preferences for dividends versus

capital gains: Do investors prefer to receive dividends or

to have the firm plow the cash back into business, which

presumably will produce capital gains?

Constant growth stock valuation model:

P0 = D1

rs - g rs - g

Target payout ratio defined as the percentage of net income

to be paid out as cash dividends.

Jika perusahaan menaikkan rasio pembagian

dividen, D1 akan naik, maka akan menaikkan

harga saham.

Jika dividen tunai terus dibagikan, maka makin Jika dividen tunai terus dibagikan, maka makin

sedikit dana yang tersedia untuk investasi,

sehingga growth rendah, dan dapat

menurunkan harga saham.

Optimal Dividend Policy

The dividend policy that strikes a balance

between current dividend and future growth

and maximizes that firms stock price.

Kebijakan dividen yang menciptakan Kebijakan dividen yang menciptakan

keseimbangan antara pembagian dividen saat

ini dan pertumbuhan di waktu yang akan

datang yang akan memaksimumkan harga

saham.

Dividend Reinvestment Plans

Dividend Reinvestment Plans (DRIPs) enable stockholders to use

dividends received on the firms stock to acquire additional

shareseven fractional sharesat little or no transaction cost.

With DRIPs, plan participants typically can acquire shares at about

5 percent below the prevailing market prices.

From its point of view, the firm can issue new shares to From its point of view, the firm can issue new shares to

participants more economically, avoiding the under pricing and

flotation costs that would accompany the public sale of new

shares.

The Relevance of Dividend Policy

The most important question about payout

policy:

Does payout/dividend policy have a significant

effect on the value of a firm? effect on the value of a firm?

Residual Theory of Dividends

The residual theory of dividends suggests that

dividend payments should be viewed as

residualthe amount left over after all

acceptable investment opportunities have acceptable investment opportunities have

been undertaken.

The firm would treat the dividend decision in

three steps :

Step 1: Determine the optimal level of capital

expenditures which is given by the point of

intersection of the investment opportunities intersection of the investment opportunities

schedule (IOS) and weighted marginal cost of

capital schedule (WMCC).

Step 2: Using the optimal capital structure

proportions, estimate the total amount of

equity financing needed to support the equity financing needed to support the

expenditures estimated in Step 1.

Step 3: Because the cost of retained earnings is less

than new equity, use retained earnings to meet the

equity requirement in Step 2. If inadequate, sell new

stock. If there is an excess of retained earnings,

distribute the surplus amountthe residualas

dividends.

According to this approach, as long as the firms equity

need exceeds the amount of retained earnings, no cash

dividend is paid.

The argument for this approach is that it is sound

management to be certain that the company has the management to be certain that the company has the

money it needs to compete effectively.

This view of dividends suggest thar the required return

of investors, is not influenced by the firms dividend

policya premise that in turn implies that dividend

policy is irrelevant in the sense that it does not affect

firm value.

EXAMPLE:

Overbrook Industries has available from the current periods operations

$1.8 million that can be retained or paid out in dividends.

The firms optimal capital structure is 30% debt and 70% equity.

Figure depicts the firms Weighted Marginal Cost of Capital (WMCC) Figure depicts the firms Weighted Marginal Cost of Capital (WMCC)

schedule along with three investment opportunity schedules (IOSs).

WMCC and IOSs

For each IOS, the level of total new financing or

investment determined by the point of

intersection of the IOS and the WMCC has intersection of the IOS and the WMCC has

been noted.

For IOS 1 , it is $ 1.5 million, for IOS 2 $ 2.4

million, and for IOS 3 $ 3.2 million.

Applying the Residual Theory of Dividends for

Each of Three IOSs

Table shows that if IOS1 exists, the firm will pay

out $750,000 in dividends because only

$1,050,000 of the $1,800,000 of available $1,050,000 of the $1,800,000 of available

earnings is needed. 41,7% payout ratio.

The table also shows the dividend payouts

associated with IOS2 and IOS3. Depending on

which IOS exists, the firms dividend would in which IOS exists, the firms dividend would in

effect be the residual, if any, remaining after

all acceptable investments have been

financed.

The Dividend Irrelevance Theory

Merton Miller and Franco Modigliani (MM) developed a

theory that shows that in perfect financial markets

(certainty, no taxes, no transactions costs or other

market imperfections), the value of a firm is unaffected

by the distribution of dividends.

They argue that value is driven only by the future

earnings and risk of its investments.

Retaining earnings or paying them in dividends does not

affect this value.

Some studies suggested that large dividend

changes affect stock price behavior.

MM argued, however, that these effects are the

result of the information conveyed by these result of the information conveyed by these

dividend changes, not to the dividend itself.

Furthermore, MM argue for the existence of a

clientele effect.

Investors preferring dividends will purchase

high dividend stocks, while those preferring high dividend stocks, while those preferring

capital gains will purchase low dividend paying

stocks.

clientele effect

The argument that different payout policies

attract different types of investors but still do

not change the value of the firm. not change the value of the firm.

In summary, MM and other dividend irrelevance proponents argue

thatall else being equalan investors required return, and

therefore the value of the firm, is unaffected by dividend policy

because:

1. The firms value is determined solely by the earning power and

risk of its asset investments. risk of its asset investments.

2. If dividends do affect value, they do so because of the

information content, which signals managements future

expectations.

3. A clientele effect exists that causes shareholders to receive the

level of dividends they expect.

Arguments for Dividend Relevance

Dividend relevance theory, advanced by Gordon and

Lintner, that there is a direct relationship between a

firms dividend policy and its and market value.

bird-in-the-hand argument. The belief, in support of

dividend relevance theory, that investors see current dividend relevance theory, that investors see current

dividends as less risky than future dividends or

capital gains.

information content. The information privided by the

dividends of a firm with respect to future earnings,

which causes owners to bid up or down the price of

the firms stock.

Kesimpulan:

1. Jika kesempatan investasi meningkat, maka rasio

pembayaran dividen turun.

2. Investor memperkirakan, bahwa pembagian dividen

saat ini sebagai petunjuk estimasi pendapatan

perusahaan di waktu yang akan datang perusahaan di waktu yang akan datang

3. Jika pembagian dividen akan mempengaruhi harga

saham, maka hal tersebut sebagai

keinginan pemegang saham untuk

meminimalkan/menunda pembayaran pajak,

dan peranan dividen sebagai alat untuk

meminimalkan biaya keagenan meminimalkan biaya keagenan

4. Jika teori harapan benar, maka manajemen

merencanakan mengenai pembagian dividen

dan rencana investasi dengan baik .

5. Karena investor juga membayar pajak

penghasilan, maka investor yang sudah berada

dalam tax bracket yang tinggi ( di Indonesia

35%), mungkin akan menyukai untuk tidak 35%), mungkin akan menyukai untuk tidak

menerima dividen dan memilih capital gains.

Factors Affecting Dividend Policy:

1. Legal Constraints

2. Contractual Constraints

3. Internal Constraints

4. Growth Prospects 4. Growth Prospects

5. Owner Considerations

6. Market Considerations

Types of Dividend Policies:

1. Constant-Payout-Ratio Policy

2. Regular Dividend Policy

3. Low-Regular-and-Extra Dividend Policy

Constant-Payout-Ratio Policy

With a constant-payout-ratio dividend policy, the firm

establishes that a specific percentage of earnings is paid

to shareholders each period.

A major shortcoming of this approach is that if the firms

earnings drop or are volatile, so too will be the dividend earnings drop or are volatile, so too will be the dividend

payments.

As mentioned earlier, investors view volatile dividends as

negative and riskywhich can lead to lower share prices.

Example:

Peachtree Industries has a policy of paying out

40% of earnings in cash dividends. In the

periods when a loss occurs, the firms policy is

to pay no cash dividends. to pay no cash dividends.

Data Peachtrees earnings, dividends, and

average stock prices for the past 6 years

follow:

Regular Dividend Policy

The regular dividend policy is based on the payment of a

fixed-dollar dividend each period.

It provides stockholders with positive information

indicating that the firm is doing well and it minimizes

uncertainty. uncertainty.

Generally, firms using this policy will increase the regular

dividend once earnings are proven to be reliable.

Example:

The dividend policy of Woodward Laboratories is to pay annual dividends

of $1.00 per share until per-share earnings exceeded $4.00 for three

consecutive years.

At that point, the annual dividend is raised to $1.50 per share, and a new

earnings plateau is established. earnings plateau is established.

The firm does not anticipate decreasing its dividend unless its liquidity is

in jeopardy.

Data for Woodwards earnings, dividends, and average stock prices for the

past 12 years follow.

Low-Regular-and-Extra Dividend Policy

Using this policy, firms pay a low regular dividend,

supplemented by additional dividends when earnings can

support it.

When earnings are higher than normal, the firm will pay

this additional dividend, often called an extra dividend,

without the obligation to maintain it during subsequent without the obligation to maintain it during subsequent

periods.

This type of policy is often used by firms whose sales and

earnings are susceptible to swings in the business cycle.

Other Forms of Dividends:

1. Stock Dividends

2. Stock Splits

3. Stock Repurchases

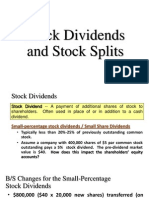

Stock Dividends

A stock dividend is paid in stock rather than in cash.

Many investors believe that stock dividends increase the

value of their holdings.

In fact, from a market value standpoint, stock dividends

function much like stock splits. The investor ends up function much like stock splits. The investor ends up

owning more shares, but the value of their shares is less.

From a book value standpoint, funds are transferred from

retained earnings to common stock and additional paid-

in-capital.

Accounting Aspects

The current stockholders equity on the

balance sheet of Garrison Corporation is as

shown in the following accounts.

If Garrison declares a 10% stock dividend and the current market

price of the stock is $15 per share, $150,000 of retained earnings

(10% x 100,000 shares x $15 per share) will be capitalized.

The $150,000 will be distributed between the common stock (par) The $150,000 will be distributed between the common stock (par)

account ($ 40,000) and paid-in-capital in excess of par account

based on the par value of the common stock ($ 110,000).

The resulting balances are as follows:

Because 10,000 new shares (10% x 100,000)

have been issued at the current price of $15

per share, $150,000 ($15 per share x 10,000

shares) is shifted from retained earnings to shares) is shifted from retained earnings to

the common stock and paid-in-capital

accounts.

The Shareholders Viewpoint

From a shareholders perspective, stock dividends

result in a dilution of shares owned.

For example, assume a stockholder owned 100

shares at $20/share ($2,000 total) before a stock shares at $20/share ($2,000 total) before a stock

dividend.

If the firm declares a 10% stock dividend, the

shareholder will have 110 shares of stock.

However, the total value of her shares will still be

$2,000.

Therefore, the value of her share must have fallen

to $18.18/share ($2,000/110).

The Companys Viewpoint

Disadvantages of stock dividends include:

The cost of issuing the new shares

Taxes and listing fees on the new shares

Other recording costs

Advantages of stock dividends include:

The company conserves needed cash

Signaling effect to the shareholders that the firm is

retaining cash because of lucrative investment

opportunities opportunities

Stock Splits

A stock split is a recapitalization that affects

the number of shares outstanding, par value,

earnings per share, and market price.

The rationale for a stock split is that it lowers The rationale for a stock split is that it lowers

the price of the stock and makes it more

attractive to individual investors

Example:

Delphi Company had 200,000 shares of $2-par

value common stock outstanding and declares

a 2-for-1 split. The total before and after split

impact on stockholders equity is: impact on stockholders equity is:

A reverse stock split reduces the number of

shares outstanding and raises stock pricethe

opposite of a stock split.

The rationale for a reverse stock split is to add The rationale for a reverse stock split is to add

respectability to the stock and convey the

meaning that it isnt a junk stock.

Research on both stock splits and stock

dividends generally supports the theory that

they do not affect the value of shares. They

are often used, however, to send a signal to are often used, however, to send a signal to

investors that good things are going to

happen.

Stock Repurchases

A stock repurchase is the purchasing and

retiring of stock by the issuing corporation.

A repurchase is a partial liquidation since it

decreases the number of shares outstanding. decreases the number of shares outstanding.

It may also be thought of as an alternative to

cash dividends.

Alternative reasons for stock repurchases:

To use the shares for another purpose

To alter the firms capital structure

To increase EPS and ROE resulting in a higher

market price

To reduce the chance of a hostile takeover

Stock Repurchases Viewed as a Cash Dividend

The repurchase of stock results in a type of reverse

dilution.

The net effect of the repurchase is similar to the payment

of a cash dividend.

However, if the firm pays the dividend, the owner would However, if the firm pays the dividend, the owner would

have to pay tax on the income.

The gain on the increase in share price as a result of the

repurchase, however, would not be taxed until sold.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tutorial 8Document2 pagesTutorial 8phil0% (1)

- Chapter 10 Solutions StudentsDocument33 pagesChapter 10 Solutions StudentsKelvin AidooNo ratings yet

- Ross. Westerfield Jaffe. Jordan Chapter 18 TestDocument23 pagesRoss. Westerfield Jaffe. Jordan Chapter 18 TestShayan Shahabi100% (4)

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Dividends - Stock Split - Reverse Split & Bonus ShareDocument2 pagesDividends - Stock Split - Reverse Split & Bonus Sharesaviolopes29No ratings yet

- Financial Statement Analysis and Valuation 4Th Edition Easton Test Bank Full Chapter PDFDocument65 pagesFinancial Statement Analysis and Valuation 4Th Edition Easton Test Bank Full Chapter PDFvanbernie75nn6100% (9)

- Dividend PolicyDocument52 pagesDividend PolicyKlaus Mikaelson100% (1)

- Chapter 14Document46 pagesChapter 14Nguyen Hai Anh100% (1)

- Gitman c14 SG 13geDocument13 pagesGitman c14 SG 13gekarim100% (3)

- BASF NewsAlert 30june2008 1Document1 pageBASF NewsAlert 30june2008 1ResearchOracleNo ratings yet

- CH 05Document16 pagesCH 05Noman KhalidNo ratings yet

- Investing With Nse 500 Top GainersDocument6 pagesInvesting With Nse 500 Top GainersAnuranjan VermaNo ratings yet

- CF Chap 4 MultipleDocument22 pagesCF Chap 4 MultipleĐào Thị Thùy TrangNo ratings yet

- Mechanics of Options Markets: Options, Futures, and Other Derivatives, 8th Edition, 1Document20 pagesMechanics of Options Markets: Options, Futures, and Other Derivatives, 8th Edition, 1Dinesh ChandNo ratings yet

- Target 3 Stock and DividendDocument5 pagesTarget 3 Stock and DividendAjeet YadavNo ratings yet

- Dividend Policy Dividend PolicyDocument43 pagesDividend Policy Dividend PolicyWiraa JunaNo ratings yet

- Chapter 8 Dividend PolicyDocument24 pagesChapter 8 Dividend Policycarlo serrano100% (1)

- Corporate ActionDocument4 pagesCorporate ActionDhiraj RamtekeNo ratings yet

- Payout Policy: © 2019 Pearson Education LTDDocument7 pagesPayout Policy: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Differences Between Cash Dividends and Stock DividendsDocument4 pagesDifferences Between Cash Dividends and Stock DividendsUme Aiman Binte NasarNo ratings yet

- Chapter 13: Dividend PolicyDocument18 pagesChapter 13: Dividend PolicyRezhel Vyrneth TurgoNo ratings yet

- Dividend PolicyDocument45 pagesDividend PolicyBusHra Alam0% (1)

- Chapters 4 and 5 Capital Structure Decision and Dividends & DividendDocument118 pagesChapters 4 and 5 Capital Structure Decision and Dividends & DividendKalkidan ZerihunNo ratings yet

- Distribution To ShareholdersDocument47 pagesDistribution To ShareholdersVanny NaragasNo ratings yet

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Dell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Document71 pagesDell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Henry WijayaNo ratings yet

- Horngren's Accounting: Volume Two, Eleventh Canadian EditionDocument72 pagesHorngren's Accounting: Volume Two, Eleventh Canadian Editionkaylee deadmanNo ratings yet

- CH 18: Dividend PolicyDocument55 pagesCH 18: Dividend PolicySaba MalikNo ratings yet

- Southeastern Steel CompanyDocument33 pagesSoutheastern Steel CompanyKanav Dosajh100% (2)

- Dividend Policy and Retained EarningDocument28 pagesDividend Policy and Retained EarningMd Abusaied AsikNo ratings yet