Professional Documents

Culture Documents

Financial Statement Analysis and Security Valuation Solutions Chapter 6

Uploaded by

Mia GreeneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis and Security Valuation Solutions Chapter 6

Uploaded by

Mia GreeneCopyright:

Available Formats

E6.

1 Forecasting Earnings Growth and Abnormal Earnings Growth

The calculations are as follows:

2009 2010 2011

Dps 0.25 0.25 0.30

Eps 3.00 3.60 4.10 (1)

Dps reinvested at 10% 0.025 0.025

Cum-div earnings 3.625 4.125 (2)

Normal earnings 3.300 3.960

AEG 0.325 0.165

(a)

Ex-div growth rate (from line 1) 20.0% 13.89%

Cum-div growth rate (from line 2) 20.83% 14.58%

- 3.625/3.00 for 2010

- 4.125/3.60 for 2011

(b) AEG is in pro forma above

(c) Normal forward P/E = 1/0.10 = 10.

(d) As AEG is forecasted to be greater than zero, then one would expect the forward P/E to

be greater than 10. Equivalently, as the cum-dividend earnings growth rate is expected to

be greater than the required return of 10%, the P/E should be greater than the normal P/E

E6.3. Valuation From Forecasting Abnormal Earnings Growth

This exercise complements Exercise 5.3 in Chapter 5, using the same forecasts. The question

asks you to convert a pro forma to a valuation using abnormal earnings growth methods. First

complete the pro forma by forecasting cum-dividend earnings and normal earnings. Then

calculate abnormal earnings growth and value the firm.

2010E 2011E 2012E 2013 2014

Earnings 388.0 570.0 599.0 629.0 660.45

Dividends 115.0 160.0 349.0 367.0 385.40

Reinvested dividends 11.5 16.0 34.9 36.70

Cum-div earnings 581.5 615.0 663.9 697.15

Normal earnings 426.8 627.0 658.9 691.90

Abnormal earn growth 154.7 -12.0 5.0 5.25

Growth rates:

Earnings growth 46.91% 5.09% 5.00% 5.00%

Cum-div earn growth (AEG) 49.87% 7.89% 10.83% 10.83%

Growth in AEG 5.0%

Discount rate 1.100 1.210

PV of AEG 140.64 -9.92

Note that the AEG for 2011 and 2012 are discounted back to the end of 2010.

a. Forecasted abnormal earnings growth (AEG) is given in the pro forma above.

AEG is the difference between cum-dividend earnings and normal earnings. So, for 2011,

AEG = 581.5 426.8 = 154.7.

Cum-dividend earnings is earnings plus prior years dividend reinvested at the required rate of return. So, for

2011,

Cum-dividend earnings = 570.0 + (115 10%) = 581.5

Normal earnings is prior years earnings growing at the required rate. So, for 2011,

Normal earnings = 388 1.10 = 426.8

Abnormal earnings growth can also be calculated as

AEG = (cum-div growth rate required rate) prior years earnings

So, for 2011,

AEG = (0.4987 0.10) 388 = 154.7

b. The growth rates are given in the pro forma.

c. The growth rate of AEG after 2012 is 5%. Assuming this rate will continue into the

future, the valuation runs as follows:

Forward earnings, 2010 388.00

Total present value of AEG for 2011-2012 130.72

(140.64 9.92 = 130.72)

Continuing value (CV), 2006

05 . 1 10 . 1

5

= = 100.00

Present value of CV =

210 . 1

0 . 100

82.64

601.36

Capitalization rate 0.10

Value of the equity

10 . 0

36 . 601

= 6,013.6

Value per share on 1,380 million shares 4.36

This is a Case 2 valuation. If you worked exercise E5.3 using residual earnings methods,

compare you value calculation with the one here.

d. The forward P/E = 6,013.6/388 =15.5. The normal P/E is 1/0.10 = 10.

E6.13. Using Earnings Growth Forecasts to Challenge a Stock Price: Toro Company

a. With a required return of 10%, the value from capitalizing forward earnings is

Value

2002

= $5.30/0.10 = $53

With a view to part d of the question, forward earnings explain most of the current market price

of $55. If one can forecast growth after the forward year, one would be willing to pay more that

$53.

b. First forecast the ex-dividend earnings based of analysts growth rate of 12%. Then add the

earnings from reinvesting dividends at 10%.

2003 2004 2005 2006 2007 2008

Eps growing at 12% 5.30 5.936 6.648 7.446 8.340 9.340

Dividends 0.53 0.594 0.665 0.745 0.834 0.934

Dividends reinvested at 10% 0.053 0.059 0.067 0.075 0.083

Cum-dividend earnings 5.989 6.707 7.513 8.415 9.423

c. Abnormal earnings growth (AEG) is cum-dividend earnings minus normal growth earnings.

Normal earnings is earnings growing at the required return of 10%:

Cum-dividend earnings 5.989 6.707 7.513 8.415 9.423

Normal earnings 5.830 6.530 7.313 8.191 9.174

Abnormal earnings growth (AEG) 0.159 0.177 0.200 0.224 0.249

d. With abnormal earnings growth forecasted after the forward year, the stock should be worth

more than capitalized forward earnings of $53, the approximate market price. (One would have

to examine the integrity of the analysts forecasts, however.)

The growth rate forecast for AEG for 2005-2008 is 12% (allow for rounding error in

calculating this growth rate from the AEG numbers above). This cannot be sustained if the

required return is 10%, but there is plenty of short-term growth to justify a price above $55. (Of

course, one can call the analysts forecasts into question.)

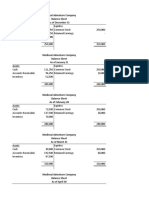

E6.15. Is a Normal Forward P/E Ratio Appropriate? Maytag Corporation

a. Normal forward P/E for a 10% cost of capital = 1/0.10 = 10.0.

Actual traded forward P/E = $28.80/$2.94 = 9.80.

The firm was trading below a normal P/E, so the market was forecasting negative

abnormal earnings growth after 2003.

b. A five-year pro forma with a 3.1% eps growth rate after 2004 and forecasted dps that

maintains the payout ratio in 2003:

2003 2004 2005 2006 2007

Eps 2.94 3.03 3.12 3.22 3.32

Dps 0.72 0.74 0.76 0.79 0.81

Dps reinvested at 10% 0.072 0.074 0.076 0.079

Cum-dividend earnings 3.102 3.194 3.296 3.399

Normal earnings at 10% 3.234 3.333 3.432 3.542

Abnormal earnings growth -0.132 -0.139 -0.136 -0.143

An AEG valuation based on just these five years of forecasts is:

(

+ =

4641 . 1

143 . 0

331 . 1

136 . 0

21 . 1

139 . 0

10 . 1

132 . 0

94 . 2

10 . 0

1

2002

E

V

= $25.07

So, even if abnormal earnings growth were expected to recover to zero after 2007, the

current price of $28.80 is too high.

You might also like

- Ch 6-17 Solutions Financial Statement AnalysisDocument212 pagesCh 6-17 Solutions Financial Statement Analysislnasman85No ratings yet

- SEx 5Document44 pagesSEx 5Amir Madani100% (3)

- Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocument56 pagesFull-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- Solution To E4-8&10Document4 pagesSolution To E4-8&10Adam100% (1)

- Chap 9 - 12 SolutionsDocument51 pagesChap 9 - 12 SolutionsSasank Tippavarjula81% (16)

- SEx 1Document12 pagesSEx 1Amir Madani50% (2)

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 10Document24 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 10sakibba80% (5)

- Solution For "Financial Statement Analysis" Penman 5th EditionDocument16 pagesSolution For "Financial Statement Analysis" Penman 5th EditionKhai Dinh Tran64% (28)

- Financial Statement Analysis and Security Valuation Penman 5th Edition Solutions ManualDocument3 pagesFinancial Statement Analysis and Security Valuation Penman 5th Edition Solutions ManualMuhammad Jahanzaib Nasir22% (9)

- SEx 13Document36 pagesSEx 13Amir MadaniNo ratings yet

- Accounting Chapter 10 Solutions GuideDocument56 pagesAccounting Chapter 10 Solutions GuidemeaningbehindclosedNo ratings yet

- SEx 4Document24 pagesSEx 4Amir Madani100% (3)

- Penman 5ed Chap007Document22 pagesPenman 5ed Chap007Hirastikanah HKNo ratings yet

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- SEx 14Document41 pagesSEx 14Amir MadaniNo ratings yet

- SEx 10Document24 pagesSEx 10Amir Madani100% (3)

- SEx 11Document32 pagesSEx 11Amir Madani60% (5)

- SEx 7Document16 pagesSEx 7Amir Madani100% (1)

- SEx 8Document30 pagesSEx 8Amir Madani100% (2)

- Test Bank For Financial Statement Analysis and Security Valuation 5th Edition PenmanDocument14 pagesTest Bank For Financial Statement Analysis and Security Valuation 5th Edition PenmanDhoni Khan100% (3)

- SEx 3Document33 pagesSEx 3Amir Madani100% (4)

- Corporate Finance - Chapter 16 and 17Document20 pagesCorporate Finance - Chapter 16 and 17Shamaas Hussain100% (5)

- Penman - Financial Statement Analysis and SecurDocument371 pagesPenman - Financial Statement Analysis and SecurAndreyZinchenko100% (3)

- IFM11 Solution To Ch05 P20 Build A ModelDocument6 pagesIFM11 Solution To Ch05 P20 Build A ModelDiana SorianoNo ratings yet

- Soal GSLC-6 Advanced AccountingDocument2 pagesSoal GSLC-6 Advanced AccountingEunice ShevlinNo ratings yet

- FA Chapter 11 Group Accounts Consolidated Balance SheetDocument50 pagesFA Chapter 11 Group Accounts Consolidated Balance Sheetabhinand67% (3)

- 08 Corporate BondsDocument4 pages08 Corporate Bondspriandhita asmoro75% (4)

- ch02 PenmanDocument31 pagesch02 PenmansaminbdNo ratings yet

- 3 Group Accounts and Business Combinations Lecture NotesDocument47 pages3 Group Accounts and Business Combinations Lecture NotesAKINYEMI ADISA KAMORU100% (4)

- Solution Ch8inclassexerciseDocument5 pagesSolution Ch8inclassexerciseAdam100% (1)

- LopDocument3 pagesLopWidia Irma Yunita0% (2)

- Solution To E5-9&11Document2 pagesSolution To E5-9&11Adam0% (1)

- Financial Statement Analysis HomeworkDocument2 pagesFinancial Statement Analysis HomeworkpratheekNo ratings yet

- Exercise Advanced Accounting SolutionsDocument14 pagesExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- R33 Residual Income ValuationDocument34 pagesR33 Residual Income ValuationAftab SaadNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Assignment 5-2020Document2 pagesAssignment 5-2020Muhammad Hamza0% (4)

- Chap 006Document62 pagesChap 006MubasherAkram33% (3)

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995No ratings yet

- Case 5Document3 pagesCase 5rizkirachNo ratings yet

- Capital Structure Test QuestionsDocument28 pagesCapital Structure Test QuestionsSardonna FongNo ratings yet

- Multiple Choice Questions: Financial Statements and AnalysisDocument29 pagesMultiple Choice Questions: Financial Statements and AnalysisHarvey PeraltaNo ratings yet

- Tutorial 6 Capital Budgeting QuestionDocument4 pagesTutorial 6 Capital Budgeting Questiontichien100% (2)

- Financial Statements Chapter 2Document20 pagesFinancial Statements Chapter 2stefy934100% (2)

- Chapter 22 Problem #1Document6 pagesChapter 22 Problem #1Lê Đặng Minh Thảo100% (1)

- Chapter 5 - Cost EstimationDocument36 pagesChapter 5 - Cost Estimationalleyezonmii0% (2)

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains Solution01dynamic33% (3)

- Intermediate Accounting Vol.2 Chapter 22Document59 pagesIntermediate Accounting Vol.2 Chapter 22Ahmad Obaidat100% (2)

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFDocument79 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFYopie ChandraNo ratings yet

- Accrual Accounting and ValuationDocument49 pagesAccrual Accounting and ValuationSonyaTanSiYing100% (1)

- Solution To Self-Study Exercise 4Document6 pagesSolution To Self-Study Exercise 4chanNo ratings yet

- Solsch6 175ed2016pdf PDF Free 2Document212 pagesSolsch6 175ed2016pdf PDF Free 2Ar VadillaNo ratings yet

- Sol 3 CH 6Document46 pagesSol 3 CH 6Aditya KrishnaNo ratings yet

- Concept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book ValuesDocument41 pagesConcept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book Valuesamina_alsayegh50% (2)

- Quiz 1 Practice ProblemsDocument8 pagesQuiz 1 Practice ProblemsUmaid FaisalNo ratings yet

- Question 1Document8 pagesQuestion 1elvitaNo ratings yet

- Concept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book ValuesDocument41 pagesConcept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book Valuesaqiilah subrotoNo ratings yet

- Solution To Practice Exercise Set 1: B8110, Fall 2009Document10 pagesSolution To Practice Exercise Set 1: B8110, Fall 2009Aasrith KandulaNo ratings yet

- Concept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book ValuesDocument40 pagesConcept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book ValuesMd MirazNo ratings yet

- Solutions To Exam Financial Statement Analysis June 23, 2011Document8 pagesSolutions To Exam Financial Statement Analysis June 23, 2011BuketNo ratings yet

- B&I DBBL PRSNDocument42 pagesB&I DBBL PRSNMahirNo ratings yet

- Accounting Ratios - Class NotesDocument8 pagesAccounting Ratios - Class NotesAbdullahSaqibNo ratings yet

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmNo ratings yet

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Peran Audit Atas Kas Dan Setara Kas Pada PT. Murni Gas Raya SamarindaDocument5 pagesPeran Audit Atas Kas Dan Setara Kas Pada PT. Murni Gas Raya SamarindaAn WismoNo ratings yet

- Forecasting RevenueDocument55 pagesForecasting RevenueHyacinth Alban100% (2)

- 2019 Friendly Hills BankDocument36 pages2019 Friendly Hills BankNate TobikNo ratings yet

- Investment in Associates (PAS 28) : Conceptual Framework and Accounting StandardsDocument6 pagesInvestment in Associates (PAS 28) : Conceptual Framework and Accounting StandardsMeg sharkNo ratings yet

- ACC501 Solved MCQsDocument6 pagesACC501 Solved MCQsMuhammad aqeeb qureshiNo ratings yet

- Companies Act - SI 62 - 1996Document35 pagesCompanies Act - SI 62 - 1996CourageNo ratings yet

- C 03Document52 pagesC 03Lạc LốiNo ratings yet

- Partnership Dissolution ProblemsDocument2 pagesPartnership Dissolution ProblemsAilene MendozaNo ratings yet

- Reduce Non-Value Time Internal ProcessesDocument3 pagesReduce Non-Value Time Internal ProcessesJack SonNo ratings yet

- Chapter 11 Audit Reports On Financial StatementsDocument54 pagesChapter 11 Audit Reports On Financial StatementsKayla Sophia PatioNo ratings yet

- BHELDocument43 pagesBHELsayan GuhaNo ratings yet

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- 004 - Final SCH III - Indicative Template FinalDocument54 pages004 - Final SCH III - Indicative Template FinalAbhishek YadavNo ratings yet

- CA - Zam Dec-2017Document102 pagesCA - Zam Dec-2017Dixie CheeloNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Partnership Liquidation ProblemsDocument3 pagesPartnership Liquidation ProblemsErma Caseñas50% (2)

- Capital Budgeting MethodsDocument40 pagesCapital Budgeting MethodsSai VishalNo ratings yet

- 07 - Capital - Structure ProblemsDocument5 pages07 - Capital - Structure ProblemsRohit KumarNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2005 1 HourDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2005 1 HourzeelNo ratings yet

- Simple Balance Sheet For Sole Proprietorship or PartnershipDocument2 pagesSimple Balance Sheet For Sole Proprietorship or PartnershipMary86% (7)

- Introduction to Single Entity AccountsDocument38 pagesIntroduction to Single Entity Accountsshrish gupta100% (1)

- Accounting EquationDocument5 pagesAccounting EquationLucky Mark Abitong75% (12)

- Final FSQ12022 - PT Blue Bird - TBK - 31 Mar 2022Document105 pagesFinal FSQ12022 - PT Blue Bird - TBK - 31 Mar 202239. ALIF FAJAR ADHAR MAPAREPPANo ratings yet

- Accounting Test Bank 6Document32 pagesAccounting Test Bank 6likesNo ratings yet

- Equity PricingDocument4 pagesEquity PricingMichelle ManuelNo ratings yet

- PA II HandoutDocument39 pagesPA II Handoutzizu ferejeNo ratings yet