Professional Documents

Culture Documents

Chap 011

Uploaded by

Neetu RajaramanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 011

Uploaded by

Neetu RajaramanCopyright:

Available Formats

Chapter 11 The Statement of Cash Flows

CHAPTER 11

THE STATEMENT OF CASH FLOWS

Changes from Twelfth Edition

Updated from the Twelfth Edition. Great Valu Variety Stores has been dropped.

Approach

This is a topic that has always been difficult for students. The indirect method of developing the amount

of cash flow from operating activities is particularly difficult. The hearings prior to FASB 95 indicated

that the investment analyst community would press companies to continue using the indirect

(reconciliation) method; the primary supporters of the direct method were bankers. Thus, it appears that

students will not be well served in this subject area unless they gain an understanding of the indirect

method.

Since students were introduced to the difference between cash flows and accrual accountings revenues

and expenses way back in Chapter 3, this should be reinforcement at this point, but it usually seems to be

a new revelation to at least a subset of the class. For those who never succeed in fully understanding the

rationale for the adjustments, Illustration 11-4 now gives them a rote approach to which they can revert.

Cases

Medieval Adventures Company is an armchair case intended to dramatize the difference between

operating cash flow and income.

Amerbran Company (A) illustrates preparation of the cash flow statement from the other two statements

and supplemental information.

Problems

Problem 11-1

2010 sales...........................................................................................................................................................................

$8,337,000

Less: Change in accounts receivable..................................................................................................................................

(130,000)

Cash generated from sales during 2003..............................................................................................................................

$8,207,000

Problem 11-2

a. Use of $2 million cash to purchase equipment is an investment use of cash.

b. Cash proceeds from the issuance of common stock is a financing source of cash. The use of cash to

retire mortgage bonds is a financing use of cash.

c. No cash effect.

d. No cash effect.

e. Cash proceeds from the sale of machinery is an investment source of cash.

The above responses assume the direct method is used to present its cash flow of statement.

11-1

Chapter 11 The Statement of Cash Flows

Problem 11-3

Kidsn Caboodle

Statement of Cash Flows

Cash received from customers..........................................................................................................................

$155,000

Cash used in operations....................................................................................................................................

(146,900)

Cash from operations....................................................................................................................................

$8,100

Equipment........................................................................................................................................................

(10,500)

Cash used for investments.............................................................................................................................

(10,500)

Loan.................................................................................................................................................................

21,000

Cash from financing......................................................................................................................................

21,000

Increase in cash.............................................................................................................................................

$ 18,600

Problem 11-4

Net loss...............................................................................................................................................................

$(11,000)

Depreciation.......................................................................................................................................................

26,400

15,400

Accounts receivable (reduced)............................................................................................................................

17,600

Accounts payable (increased).............................................................................................................................

8,800

Accrued salaries (increased)...............................................................................................................................

3,300

Other accruals (increased)..................................................................................................................................

2,200

Cash flow from operations..................................................................................................................................

47,300

Investments.........................................................................................................................................................

0

Long-term debt (reduced)...................................................................................................................................

(29,700)

Change in cash................................................................................................................................................

17,600

Beginning cash................................................................................................................................................

4,400

Ending cash.....................................................................................................................................................

$22,000

Problem 11-5

Operating Activities

Cash received from customers.........................................................................................................................

$62,100

Interest received..............................................................................................................................................

345

Operating cash payments.................................................................................................................................

(54,165)

Interest payment..............................................................................................................................................

(1,035)

Net cash provided by operations.....................................................................................................................

7,245

Investing Activities

Sale of old machine.........................................................................................................................................

3,105

Down payment on new truck...........................................................................................................................

(3,450)

Net cash used in investing activities................................................................................................................

(345)

Financing Activities

11-2

Chapter 11 The Statement of Cash Flows

Payment of debt..................................................................................................................................

(3,450)

Net cash used in financing activities...................................................................................................

(3,450)

Increase in cash..................................................................................................................................

3,450

Beginning cash...................................................................................................................................

3,450

Ending cash........................................................................................................................................

$ 6,900

Cases

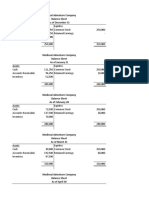

Case 11-1 Medieval Adventures Company*

Note: This case is unchanged from the Twelfth Edition.

Approach

This (obviously) is an armchair case, intended to show dramatically the difference between profit and

cash flow from operations. The case has mechanistic patterns built into it to help students see what is

going on: relatively rapid growth is causing cash to be tied up in receivables and inventories faster than it

is regenerated from collections. Although the case may seem trivial (at least after the calculations have

been made) because of these mechanistic patterns, in fact many businesses have had severe (sometimes

fatal) financial crises because management did not anticipate the basic phenomenon that this case

develops. The graph included herein can be used in class to help illustrate this phenomenon.

Medieval Adventures Company

600,000

500,000

Sales

400,000

Net Income

Net Operating Cash Flow

300,000

Cash Balance w /o Loan

Accounts Receivable

200,000

100,000

0

-100,000

Jan

Feb

March

April

May

June

July

Aug

Sep

Oct

This teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

11-3

Chapter 11 The Statement of Cash Flows

Question 1

The required monthly statements are shown on the following pages. The peak need comes by the end of

July, when a $40,000 loan would be needed to maintain a zero cash balance. In August, cash generated by

operations finally turns positive, enabling partial repayments of the loan. Octobers $27,500 cash

generated by operations enables making the final $15,000 loan repayment and ending the month with a

$12,500 cash balance.

Question 2

This question is the key one in terms of student insight from this case. The company has been paying its

costs currently, but allowing customers two months to pay. This, coupled with constant growth, causes

large net operating outflows for several months, which collectively eat up the firms initial capital. It is

important for students to understand why it is that this situation eventually turns around: the unit margin

is $20 and the monthly nonproduction costs are fixed at $10,000; thus, the continued unit sales growth

eventually (in August) causes the current inflows (from sales two months ago) to exceed the current

outflows (production costs for next months sales plus $10,000). In other words, as the income statement

shows, the firm is profitable, and eventually those profits get realized in cash.

This need could have been avoided by projecting the cash flow figures that the students have developed

after the fact. Then the company could have arranged the necessary line of credit. Banks are happy to

provide such funds for companies that anticipate the need because that anticipation reflects good financial

management. On the other hand, banks are hesitant to lend to a firm that has been taken by surprise by a

cash shortage. Of course, a no-cost method to avoid the problem was also probably feasible. The

company could have arranged credit with vendors to help finance the inventory, and could have been

more aggressive in collecting from its customers in accord with the stated 30-day terms. If the company

delayed its payments by 30 days and accelerated receivable collections from 60 to 30 days (thus

shortening its cash cycle by 60 days), the operating cash flow would have turned positive in March and

no cash crisis would have occurred.

Question 3

The purpose of this question is to give students practice in deriving a cash flow statement from the

income statement and balance sheets. Because of the work done in question 1, where cash flows were

dealt with directly, students can gain some confidence in these derivation procedures before they apply

the procedures in more complex and realistic cases. The statements are as follows (in somewhat

simplified format, befitting this introductory problem):

11-4

Chapter 11 The Statement of Cash Flows

March

May

July

Net income...................................................................................................................................................................................................................

$30,000

$50,000

$70,000

Increase in accounts receivable....................................................................................................................................................................................

(55,000)

(55,000)

(55,000)

Increase in inventory....................................................................................................................................................................................................

(17,500)

(17,500)

(17,500)

Cash from operations...................................................................................................................................................................................................

(42,500)

(22,500)

(2,500)

Proceeds of debt...........................................................................................................................................................................................................

-022,500

2,500

Cash increase (decrease)..............................................................................................................................................................................................

(42,500)

0

0

Beginning of month cash balance................................................................................................................................................................................

72,500

0

0

End of month cash balance...........................................................................................................................................................................................

$30,000

$0

$0

OPERATING BUDGET

Jan.

Feb.

Mar.

Apr.

May

June

July

Aug.

Sept.

Sales.............................................................................................................................................................................................................................

$55,000

$82,500

$110,000

$137,500

$165,000

$192,500

$220,000

$247,500

$275,000

Cost of Sales.................................................................................................................................................................................................................

35,000

52,500

70,000

87,500

105,000

122,500

140,000

157,500

175,000

Gross Margin................................................................................................................................................................................................................

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

Other Expenses.............................................................................................................................................................................................................

10,000

10,000

10,000

10,000

10,000

10,000

10,000

10,000

10,000

Net Income...................................................................................................................................................................................................................

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

CASH BUDGET

Cash lnflows:

Cash forwarded............................................................................................................................................................................................................

$146,250

$111,250

$ 72,500

$ 30,000

$-0$-0$-0$-0$-0Collections....................................................................................................................................................................................................................

27,500

41,250

55,000

82,500

110,000

137,500

165,000

192,500

220,000

Loan from bank.........................................................................................................................................................................................................

------2,500

22,500

12,500

2,500

----Total......................................................................................................................................................................................................................

$173,750

$152,500

$127,500

$115,000

$132,500

$150,000

$167,500

$192,500

$220,000

Cash Outflows:

Costs & expenses.........................................................................................................................................................................................................

$ 62,500

$ 80,000

$ 97,500

$115,000

$132,500

$150,000

$167,500

$185,000

$202,500

Loan payback............................................................................................................................................................................................................

--------------7,500

17,500

Cash balance.........................................................................................................................................................................................................

$111,250

$ 72,500

$ 30,000

$0

$0

$0

$0

$0

$0

Memo:

Net operating cash flow................................................................................................................................................................................................

$(35,000)

$(38,750)

$(42,500)

$(32,500)

$(22,500)

$(12,500)

$(2,500)

$ 7,500

$ 17,500

Cash balance w/o loan..................................................................................................................................................................................................

$111,250

$ 72,500

$ 30,000

$ (2,500)

$(25,000)

$(37,500)

$(40,000)

$(32,500)

$(15,000)

11-5

Oct.

$302,500

192,500

110,000

10,000

100,000

$-0247,500

--$247,500

$220,000

15,000

$ 12,500

$ 27,500

$ 12,500

Chapter 11 The Statement of Cash Flows

Dec.

31st

Jan.

31st

Feb.

28th

BALANCE SHEET

Mar

Apr.

31st

30th

Sept.

30th

0ct.

31st

Assets:

Cash...........................................................................................................................................................................................................................

$146,250

$111,250

$ 72,500

$ 30,000

$0

$0

$0

$0

$0

Accounts Receivable.................................................................................................................................................................................................

68,750

96,250

137,500

192,500

247,500

302,500

357,500

412,500

467,500

Inventory...................................................................................................................................................................................................................

35,000

52,500

70,000

87,500

105,000

122,500

140,000

157,500

175,000

Total.......................................................................................................................................................................................................................

$250,000

$260,000

$280,000

$310,000

$352,500

$425,000

$497,500

$570,000

$642,500

$0

522,500

192,500

$715,000

$ 12,500

577,500

210,000

$800,000

Liabilities and Equity:

Note Payable.............................................................................................................................................................................................................

$ --$ --$ --$ --$ 2,500

$ 25,000

$ 37,500

$ 40,000

$ 32,500

Common Stock..........................................................................................................................................................................................................

250,000

250,000

250,000

250,000

250,000

250,000

250,000

250,000

250,000

Retained Earnings.....................................................................................................................................................................................................

_______

10,000

30,000

60,000

100,000

150,000

210,000

280,000

360,000

Total..........................................................................................................................................................................................................................

$250,000

$260,000

$280,000

$310,000

$352,500

$425,000

$497,500

$570,000

$642,500

$ 15,000

250,000

450,000

$715,000

$ --250,000

550,000

$800,000

11-6

May

31st

June

30th

July

31st

Aug.

31st

Chapter 11 The Statement of Cash Flows

Case 11-2 Amerbran Company (A)*

Note: This case is unchanged from the Twelfth Edition.

Approach

This case is based on actual financial statements of American Brands, Inc. Although the numbers have

been changed from those reported, the magnitudes and relationships have been preserved. This case

provides additional practice in preparing a statement of cash flows. Since specific information is not

given on cash collections and operating disbursements, it is expected that students will use the indirect

approach in developing the cash generated by operations amount. The statements in Exhibit I also provide

the raw data for the (B) case, which is a ratio analysis case that appears in Chapter 13.

Answer to Question

The required cash flow statement appears below. The explanatory notes to the statement are as follows:

Note 1 This is the net of the following components:

Increase in accounts receivable .......................................................................................................................

$(68,827)

Increase in inventories .....................................................................................................................................

(19,510)

Decrease in prepaid expenses ..........................................................................................................................

1,027

Increase in accounts payable ...........................................................................................................................

33,075

Increase in accrued expenses payable .............................................................................................................

194,728

$ 140,493

Note 2. The two components of this acquisition, as given in the case, could be shown separately.

Note 3. The decrease in long-term debt is less than the decrease in long-term liabilities because the latter

also includes deferred taxes.

Note 4. Lacking specific information to the contrary, it is assumed that reissuance of treasury stock for

bonuses generated no cash. The stock dividend was, in effect, a 2-for-1 stock split. The only

difference is that if it were a stock split, the total shown for common stock at par would have

remained $161,417 rather than doubling to $322,834.

Note 5. The three major categories of cash flows generated a net of $11,785 of cash. Since the increase to

be explained is only $4,960, miscellaneous activities must have used $6,825 of cash. Some

students may include this line in operating activities, rather than as a fourth category; if they do,

the net cash flow from operations becomes $567,303.

AMERBRAN COMPANY

Statement of Cash Flows

For the year ended December 31, 20x1

(in thousands)

Net cash flow from operating activities:

Net income......................................................................................................................................................................

$328,773

Noncash items included in income:

Depreciation and amortization.....................................................................................................................................

115,974

Deferred taxes..............................................................................................................................................................

(17,548)

*

This teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

11-7

Chapter 11 The Statement of Cash Flows

Net change in receivables, inventories, and payables (Note 1)................................................................................................

140,493

Write-off of obsolete equipment...............................................................................................................................................

66,046

Income from subsidiary............................................................................................................................................................

(59,610)

Net cash flow from operating activities.......................................................................................................................................

(574,128)

Cash flows from investing activities:

Acquisitions of property, plant, and equipment...........................................................................................................................

(260,075)

Proceeds from disposals...............................................................................................................................................................

33,162

Acquisition of Company X (Note 2)............................................................................................................................................

(133,721)

Net cash used by investing activities........................................................................................................................................

(360,634)

Cash flows from financing activities:

Increase in short-term debt...........................................................................................................................................................

79,664

Decrease in long-term debt (Note 3)............................................................................................................................................

(34,606)

Dividends paid.............................................................................................................................................................................

(216,158)

Purchase of treasury stock (Note 4).............................................................................................................................................

(30,609)

Net cash used by financing activities........................................................................................................................................

(201,709)

Cash flows from miscellaneous activities (Note 5).........................................................................................................................

(6,825)

Net increase in cash.........................................................................................................................................................................

4,960

Cash at beginning of year................................................................................................................................................................

23,952

Cash at end of year..........................................................................................................................................................................

$ 28,912

11-8

You might also like

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- How To Pass The Cfa Exam EbookDocument15 pagesHow To Pass The Cfa Exam EbookCharles Heng100% (12)

- Queuing Ex SolutionsDocument3 pagesQueuing Ex SolutionsIvan Valdivia100% (1)

- Accounting Case Study: PC DepotDocument7 pagesAccounting Case Study: PC DepotPutri Saffira YusufNo ratings yet

- Chapter 13Document61 pagesChapter 13frq qqr70% (20)

- Butler Lumber Case Study Solution: Assess Financial Situation & Loan RequestDocument8 pagesButler Lumber Case Study Solution: Assess Financial Situation & Loan RequestBagus Be WeNo ratings yet

- Chap 006Document62 pagesChap 006MubasherAkram33% (3)

- Pressures Leading to Fraudulent Reporting and Detecting Accounting ScandalsDocument4 pagesPressures Leading to Fraudulent Reporting and Detecting Accounting Scandalsarnabdas1122100% (1)

- Chap 026Document17 pagesChap 026Neetu Rajaraman100% (2)

- Medieval company monthly cash flowDocument6 pagesMedieval company monthly cash flowlouiegoods24100% (2)

- Chemalite Income StatementDocument10 pagesChemalite Income StatementManoj Singh0% (1)

- Analyze Cash FlowsDocument20 pagesAnalyze Cash FlowsA cNo ratings yet

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- Financial Statement Analysis: Amerbran Company (BDocument37 pagesFinancial Statement Analysis: Amerbran Company (BZati Ga'in100% (1)

- Chap 015Document4 pagesChap 015Neetu RajaramanNo ratings yet

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Solving The Puzzle of The Cash Flow StatementDocument8 pagesSolving The Puzzle of The Cash Flow StatementPraneta ShuklaNo ratings yet

- Case de DesinoDocument4 pagesCase de DesinoStefPer100% (1)

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- 1 - Case 12 Guna FibresDocument11 pages1 - Case 12 Guna FibresBalaji Palatine100% (1)

- Chap 008Document17 pagesChap 008Neetu RajaramanNo ratings yet

- PWC Income Tax 2013 PDFDocument668 pagesPWC Income Tax 2013 PDFKoffee Farmer100% (1)

- Chap 005Document12 pagesChap 005SurajAluruNo ratings yet

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- Chap 012Document11 pagesChap 012Neetu RajaramanNo ratings yet

- 11-1 Medieval Company - AssignmentDocument3 pages11-1 Medieval Company - AssignmentOkta Paulia100% (2)

- Chap 013Document12 pagesChap 013Neetu RajaramanNo ratings yet

- ch09 SM Leo 10eDocument63 pagesch09 SM Leo 10ePyae Phyo67% (3)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Kota FibresDocument10 pagesKota FibresShishirNo ratings yet

- Chap 006Document15 pagesChap 006Neetu RajaramanNo ratings yet

- Chapter 7-1 SternDocument7 pagesChapter 7-1 SternPatrick HariramaniNo ratings yet

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Case 11-1 2004Document2 pagesCase 11-1 2004Bitan BanerjeeNo ratings yet

- Analyzing Cost Savings of Upgrading US Distribution Network to Include LA Distribution CenterDocument3 pagesAnalyzing Cost Savings of Upgrading US Distribution Network to Include LA Distribution CenterRIJu KuNNo ratings yet

- Analysis of Home Depot's Financial Performance:: Current RatioDocument4 pagesAnalysis of Home Depot's Financial Performance:: Current RatioDikshaNo ratings yet

- Guide To Accounting For Income Taxes NewDocument620 pagesGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Lieberose Solar ParkDocument23 pagesLieberose Solar ParkNeetu RajaramanNo ratings yet

- Chap 009Document19 pagesChap 009Neetu RajaramanNo ratings yet

- Chapter 13 Solutions ManualDocument120 pagesChapter 13 Solutions Manualbearfood80% (20)

- Kota Fibres, LTD.: BY Ashish Dhanani Mudit Garg Nitin PhogatDocument21 pagesKota Fibres, LTD.: BY Ashish Dhanani Mudit Garg Nitin PhogatAshish Dhanani100% (1)

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- Kota Fibres LTD: ASE NalysisDocument7 pagesKota Fibres LTD: ASE NalysisSuman MandalNo ratings yet

- Chap 020Document10 pagesChap 020Neetu RajaramanNo ratings yet

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- CASE 8 - Norman Corporation (A) (Final)Document3 pagesCASE 8 - Norman Corporation (A) (Final)Katrizia FauniNo ratings yet

- 2 Manas BuildingDocument6 pages2 Manas BuildingSandhali JoshiNo ratings yet

- CH 11+16th+globalDocument37 pagesCH 11+16th+globalAmina SultangaliyevaNo ratings yet

- MacroeconomicsDocument2 pagesMacroeconomicsmonikam meshramNo ratings yet

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDocument14 pagesAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniNo ratings yet

- EXAM REVIEWDocument5 pagesEXAM REVIEWFredie LeeNo ratings yet

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- Case StudiesDocument6 pagesCase StudiesFrancesnova B. Dela PeñaNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- Operations Management: William J. StevensonDocument46 pagesOperations Management: William J. StevensonmanarNo ratings yet

- Sem 3Document9 pagesSem 3shioamn100% (1)

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessDocument10 pagesChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- Chapter 5Document3 pagesChapter 5zixuan weiNo ratings yet

- Dokumen - Tips - Cases in Financial Management 2nd Edition by Joseph M in Financial Management PDFDocument4 pagesDokumen - Tips - Cases in Financial Management 2nd Edition by Joseph M in Financial Management PDFNauman AminNo ratings yet

- Kim FullerDocument3 pagesKim FullerVinay GoyalNo ratings yet

- Assign1-Leo's Four PlexDocument2 pagesAssign1-Leo's Four Plexकमल लम्साल100% (1)

- 310 Balance Cash HoldingsDocument21 pages310 Balance Cash Holdingsdawit TerefeNo ratings yet

- Fabm 2 q3 Week 5 Module 4 Statement of Cash Flows For ReproductionDocument23 pagesFabm 2 q3 Week 5 Module 4 Statement of Cash Flows For ReproductionFranzen GabianaNo ratings yet

- 13-Cash Flow StatementDocument66 pages13-Cash Flow Statementtibip12345100% (6)

- T10 Managing Finance Notes by SeahDocument43 pagesT10 Managing Finance Notes by SeahSeah Chooi KhengNo ratings yet

- Topic 3 7 Cash FlowDocument16 pagesTopic 3 7 Cash FlowEren BarlasNo ratings yet

- Cases Chap013Document12 pagesCases Chap013Henry PanNo ratings yet

- The Role of Working CapitalDocument9 pagesThe Role of Working CapitalAbuBakarSiddiqueNo ratings yet

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet

- Chap 3 Accounting For ManagersDocument19 pagesChap 3 Accounting For ManagersBitan BanerjeeNo ratings yet

- Fundamental Financial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument23 pagesFundamental Financial Accounting Concepts 9th Edition Edmonds Solutions Manualaustinolivergiacywnzqp100% (26)

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDocument19 pagesBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Beter Balance Cash HoldingsDocument28 pagesBeter Balance Cash HoldingsJemal SeidNo ratings yet

- Chap 024Document22 pagesChap 024Neetu RajaramanNo ratings yet

- Lieberose Solar Park - Presentation-WorkedDocument43 pagesLieberose Solar Park - Presentation-WorkedNeetu RajaramanNo ratings yet

- Solution Manual For AccountingDocument21 pagesSolution Manual For AccountingNeetu RajaramanNo ratings yet

- Management Accounting System Design Case StudyDocument12 pagesManagement Accounting System Design Case StudyRand Al-akam100% (1)

- Chap 021Document19 pagesChap 021Neetu Rajaraman100% (1)

- Chap 025Document17 pagesChap 025Neetu Rajaraman100% (7)

- Chap 023Document23 pagesChap 023Neetu RajaramanNo ratings yet

- Chap 014Document7 pagesChap 014Neetu RajaramanNo ratings yet

- Chap 019Document20 pagesChap 019Neetu RajaramanNo ratings yet

- Chap 018Document25 pagesChap 018Neetu RajaramanNo ratings yet

- Chap 016Document8 pagesChap 016Neetu Rajaraman100% (2)

- Chap 017Document12 pagesChap 017Neetu Rajaraman100% (1)

- Chap 010Document22 pagesChap 010Neetu RajaramanNo ratings yet

- Chap 3 Accounting For ManagersDocument19 pagesChap 3 Accounting For ManagersBitan BanerjeeNo ratings yet

- Chap 007Document13 pagesChap 007Neetu RajaramanNo ratings yet

- Chap 001Document17 pagesChap 001Neetu RajaramanNo ratings yet

- Chap 004Document28 pagesChap 004mzblossom100% (1)

- Blue Star Limited: Accounting Policies Followed by The CompanyDocument8 pagesBlue Star Limited: Accounting Policies Followed by The CompanyRitika SorengNo ratings yet

- Accounting for Income Tax DifferencesDocument42 pagesAccounting for Income Tax DifferencesAngela Miles DizonNo ratings yet

- AME - 2022 - Tutorial 3 - SolutionsDocument23 pagesAME - 2022 - Tutorial 3 - SolutionsjjpasemperNo ratings yet

- Accounting For Income Tax-Report ScriptDocument6 pagesAccounting For Income Tax-Report ScriptJeane Mae BooNo ratings yet

- SAMPLE MANUFACTURING COMPANY LIMITED FINANCIAL STATEMENTS FOR YEAR ENDED DEC 31, 2011Document36 pagesSAMPLE MANUFACTURING COMPANY LIMITED FINANCIAL STATEMENTS FOR YEAR ENDED DEC 31, 2011talhaadnanNo ratings yet

- Question 62: Advanced ConsolidationDocument7 pagesQuestion 62: Advanced ConsolidationSaifurrehman MalikNo ratings yet

- CA Final FR A MTP 2 Nov23 Castudynotes ComDocument15 pagesCA Final FR A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- NBK Annual Report 2011Document43 pagesNBK Annual Report 2011Mohamad RizwanNo ratings yet

- Inter Milan 2018Document34 pagesInter Milan 2018mujana mujanaNo ratings yet

- Income Taxes By: Damtew Mengesha (Acca, Dipifrs)Document32 pagesIncome Taxes By: Damtew Mengesha (Acca, Dipifrs)Eshetie Mekonene Amare100% (1)

- Ia2 ReviewerDocument7 pagesIa2 ReviewerAiden MagnoNo ratings yet

- C12 - PAS 10 Events After The Reporting PeriodDocument3 pagesC12 - PAS 10 Events After The Reporting PeriodAllaine Elfa100% (1)

- Ifrs Standards BrochureDocument64 pagesIfrs Standards Brochuresantosh kumarNo ratings yet

- Hanad General Trading Financial Statements 2023Document8 pagesHanad General Trading Financial Statements 2023Nyakwar Leoh NyabayaNo ratings yet

- TBZ VivzDocument67 pagesTBZ VivzKunal SinghNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument26 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- Tech Mahindra Financial Statement: Balance SheetDocument45 pagesTech Mahindra Financial Statement: Balance SheetHRIDESH DWIVEDINo ratings yet

- Akash Clay LTDDocument64 pagesAkash Clay LTDSathavara KetulNo ratings yet

- Mastering Corporate Accounting ConsolidationsDocument7 pagesMastering Corporate Accounting ConsolidationsArmaghan Ali MalikNo ratings yet

- Academy of Finance - PTP, Otc, RTR - Londonsam Polska 2019 PDFDocument9 pagesAcademy of Finance - PTP, Otc, RTR - Londonsam Polska 2019 PDFJinore GomaceNo ratings yet

- Tutor's Support Pack: HND Accounting Graded Unit 3 DE66 35Document172 pagesTutor's Support Pack: HND Accounting Graded Unit 3 DE66 35npallaresfNo ratings yet

- Accounting Standard (As) 22Document12 pagesAccounting Standard (As) 22Sahil GangwaniNo ratings yet

- Key Tax Issues at Year End For Re Investors 2019 20 PDFDocument202 pagesKey Tax Issues at Year End For Re Investors 2019 20 PDFAJ QuimNo ratings yet

- Chart of AccountDocument13 pagesChart of AccountHarso SurosoNo ratings yet