Professional Documents

Culture Documents

Thesis On IFIC BANK Bangladesh

Uploaded by

jilanistuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesis On IFIC BANK Bangladesh

Uploaded by

jilanistuCopyright:

Available Formats

IX

INTRODUCTION

1

Introduction

1.1 Background of the Study

I am the student of Masters of Business Administration (M.B.A) study the subject's related

to business including Accounting, Management, Finance, Mareting, Mathematics, and

!ocial and cultural status and little about science and technology. "he schools of business at

home and abroad try to familiari#e each student as they mo$e comfortably in the business

en$ironment. But only the theoretical study in the class rooms is not enough rather a

%ractical e&%erience and the only means of %ractical e&%erience is internshi% %rogram.

1.2 Rational of the Study

In the business en$ironment at home ' abroad there are lots of financial institution, business

firms, and industries (hich %ro$ide this facility to(ards us. If (e could not get this facility

of internshi% then a (ide ga%s (ill tae %lace bet(een our study and e&%erience. I thin this

is an e&tremely $aluable asset for us.

)e the students of business do this usually for three months. In our country there are many

bans %articularly the esteemed %ri$ate sector bans, and elite business firms %ro$ide this. In

this res%ect I ha$e done my internshi% at IFI* ban ltd. the one of the most reno(ned

%ri$ate ban in Bangladesh. I am thanful to IFI* Ban for this.

1. O!"ecti#e of the Re$ort

"he objecti$es of the re%orts is to %ro$ide

A general descri%tion of the baning

An e&%osure of %ractices of different baning acti$ities in IFI* Ban +td...

,ele$ant rules, regulations, theories and %ractices for baning.

Significance

IFI* BA-. +"/. is one of leading %ri$ate commercial bans of the country. "hrough it has

01 branches all o$er the country2 it is %erforming baning acti$ities $ery successfully. "o

mobili#e funds from sur%lus units and de%loy funds to deficit units, the ban is %laying a

great role in the economic de$elo%ment of the country. IFI* BA-. +"/. is one of the ey

%layers of country3s economic de$elo%ment.

1

1.% Sco$e of the Re$ort

"he re%ort co$ers different de%artments of IFI* BA-. +"/, lie 4eneral Baning, +oans

and Ad$ance ' Foreign 5&change etc. It also %resents a brief scenario of IFI* BA-. +"/

in total.

1.& "he limitations of the !tudy

"his is my first re%ort. I am not a(are of the format and (riting style of the re%ort. I thin6

this is the main reason (hy some limitations ha$e been recogni#ed here. But the re%orts

submitted to IFI* Ban academic section's library by the internees student of $arious

uni$ersities3s (ored as guideline to %re%are this re%ort. I ha$e also used reliable sources of

information by using some te&t boo, the manual etc. I ha$e tried to do the %erformance

measurement by using the data %ublished in annual re%orts.

!o I thin the main limitations of this re%ort are

7 +ac of e&%erience to %re%are a re%ort.

7+ac of clear no(ledge of different ratios.

7+ac of information

1.' (ethodology)

I inter$ie(ed the branch incumbent, de%artment in charges, officers and clients. I ha$e

obser$ed the acti$ities of the %eo%le of different dess, I did also obser$e the %ractice of the

branch3s Management. I ha$e re$ie(ed the Annual ,e%orts 8of IFI* BA-. +"/., Ban

*om%anies Act71991, -egotiable Instrument Act71::1. I ha$e also re$ie(ed /ifferent

;ublications regarding baning functions, foreign e&change o%eration, credit %olicies, and

<;ractical =rientation /airy3 Maintained by me.

7"his re%ort is formatted into fi$e segments

(a) "he Introduction

(b) "he =rgani#ational ;rofile

(c) =$erall Baning =%eration

(d) >uman ,esource Function In IFI* Ban.

(e) ;erformance Measurement

(f) Analytical !tudy and ,ecommendation

7In this re%ort the baning o%eration has been looed into as far as %ossible and a

%erformance measurement has been done by using different ratios and diagrams.

?

.

@

I F I * BA-. A" A ! .5 " *>

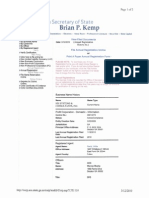

2.1 O*+R*I+, O- I-IC B.N/ 0TD.

International Finance In$estment and *ommerce Ban +imited 6IFI* Ban6

came in to e&istence In 19A0 as a joint $enture bet(een the 4o$ernment of

Bangladesh and s%onsors In the %ri$ate sector (ith the objecti$e of (oring

as a finance com%any (ithin the country and setting u% joint $enture

bansBfinancial Institutions abroad. IFI* (as Incor%orated as a %ublic

limited com%any (ith an authori#ed ca%ital of ". 1C core and %aid u%

ca%ital of ".1C core. IFI* commenced Its o%eration on February 1:,19AA

(ith a !ubscribed ca%ital of ".D core, contributed by leading %ri$ate sector

entre%reneurs In the country. the 4o$ernment held @9 %ercent shares and the

rest D1 %ercent (ere held by the s%onsors and general %ublic.

But, In 19:? (hen the 4o$ernment allo(ed bans In the %ri$ate sector IFI*

(as con$erted Into a full7fledged commercial ban. the In$estment com%any

has transformed Into baning com%any In Eune 1?,19:? and started acti$ities

from Eune 1@,19:? through Its Motijheel Branch.

At the $ery beginning the 0C %ercent share are o(ned by %ri$ate

entre%reneur and @C %ercent are o(ned by 4o$t. at the end of 19:@ the

authori#ed ca%ital (as 1C core and the %aid u% ca%ital (as Acrore 1D lacs

"aa only.

Annual re%ort as on 19:?. the o(nershi% of non 4o$t. sector is included7

1. Mr. Eahurul Islam, *hairman.

1. !alman F. ,ahman, Fice7*hairman.

?. A.M. Aga Gsuf.

@. !yed. Mohsen Ali.

D. Mr. Ahmadul .abir. =(ner of 6/ainic !hangbad6.

D

2. (i11ion2 *i1ion2 Strategy State3ent

"o establish and conduct all ty%es of baning financial in$estment

and trust business in Bangladesh and abroad.

"o carry on any business relating to (age earners scheme as may be

allo(ed by Bangladesh Ban from time to time including maintaining

of foreign currency accounts and any other matter related there to.

"o contract or negotiate all inds of loan.

"o form, %romote, organi#e, assist, %artici%ate or aid in forming,

%romoting or organi#ing any com%any or others.

"o encourage, s%onsor and facilitate %artici%ation of %ri$ate ca%ital in

financial, industrial or commercial in$estment.

"o %urchase or other(ise acHuire, undertae the (hole or any %art in

the business.

"o tae %art in the formation, management, su%er$ision or control of

the business or o%erations of any com%any.

2. O,N+RS4I5 STRUCTUR+

"he go$ernment of the %eo%les' ,e%ublic of Bangladesh no( holds ?D %ercent of

share ca%ital of the ban. +eading Industrialists of the country ha$ing $ast

e&%erience In the field of trade and commerce o(n ?@ %ercent of the share

ca%ital and the rest Is held by the general %ublic.

2.% CO(5OSITION O- T4+ BO.RD

Gnlie others ban in the %ri$ate sector, Board of directors of this ban is an

uniHue combination of both %ri$ate and 4o$t. sector e&%erience. *urrently it

consist nine (9) directors, of them four re%resent the s%onsors and general

%ublic and four senior officials in the ran and status of Eoin secretaryB

Additional secretary re%resent the go$ernment. "he Managing /irector is the

e&7officio director of the board. Board of /irectors, the a%e& body of the

Ban, formulates %olicy guidelines, %ro$ides strategic %lanning and

su%er$ises business and %erformance of management (hile the Board

0

remains accountable to the com%any and its shareholders. "he Board is

assisted by the 5&ecuti$e *ommittee and Audit *ommittee.

2.& C.5IT.0 .ND R+S+R*+

IFI* Ban has been consistently maintaining the <*a%ital AdeHuacy ,atio3,

as %rescribed by Bangladesh Ban. "his has been %ossible by a %olicy of

building u% both ca%ital and reser$es. It started (ith an Authori#ed and ;aid7

u% *a%ital of ". 1CC million and ". 0?.1C million res%ecti$ely in 19:?

(hich stand at ". DCC million and ". @C0.?9 million res%ecti$ely in 1CC?

2.' (ile1tone1 in De#elo$3ent of The Organi6ation

A

2.7 (anage3ent Structure)

(.N.8IN8 DIR+CTOR 9(D:

D+5UT; (.N.8IN8 DIR+CTOR 9D(D:

+X+CUTI*+ *IC+ 5R+SID+NT 9+*5:

S+NIOR *IC+ 5R+SID+NT 9S*5:

*IC+ 5R+SID+NT 9*5:

S+NIOR .SSIST.NT *IC+ 5R+SID+NT 9S.*5:

.SSIST.NT *IC+ 5R+SID+NT 9.*5:

S+NIOR 5RINCI50+ O--IC+R 9S5O:

5RINCI0+ O--IC+R 95O:

S+NIOR O--IC+R 9SO:

O--IC+R

2.< Ri1k (anage3ent

Credit Risk:

*redit ris is the %otential that the borro(er may not re%ay or fails to re%ay hisBher

debt obligation. "hey are e&%osed to credit ris through traditional lending

acti$ities and transactions in$ol$ing settlements bet(een their counter%arts.

O!"ecti#e1

:

II

Maintain a (ell7di$ersified asset %ortfolio (ithin a%%ro$ed ris tolerance le$els and

earn a return a%%ro%riate to the ris %rofile of the %ortfolio.

.$$roach

!ill a%%raisal officers first e$aluate credit transactions for commercial and

cor%orate loans. *redit Management *ommittee %ro$ides and inde%endent

assessment of all significant transactions, and a concurrence form this function is

usually reHuired to mae a lending commitment to a customer. "heir Audit and

Ins%ection /i$ision also re$ie(s management %rocesses in order to ensure that

establish credit %olicies are follo(ed. In addition, *redit Management *ommittee

%erforms %eriodic re$ie(s of significant and higher ris transactions.

Market Risk:

J

Maret ris is the %otential for loss from changes in the $alue of financial

instruments. "he $alue of a financial instrument can be affected by changes in

interest rates, foreign e&change rates and eHuity and commodity %rices. "hey are

e&%osed to maret ris (hen they enter into the follo(ing transactionsJ

+oans and Ad$ances (+/=s)

/e%osit (ith other Bans

7 In$estment

7 "reasury Bills

7 Bond

7 !hares

Foreign 5&change ;ositioning

O!"ecti#e

Identify, measure, monitor and re%ort all maret ris7taing acti$ities, ensuring that

e&%osures remain (ithin a%%ro$ed ris tolerance le$els and that the return from

maret ris acti$ities is acce%table.

.$$roach

"hey ha$e established Asset +iability *ommittee (A+*=) to monitor their maret

9

ris acti$ities. "he %rimary ris measurement methodology is ,e%ricing 4a% and its

sensiti$ity to interest rate changes. ,e%rising 4a% o$er 117month %eriod stood at

%ositi$e B/" @1D1.A0 million as at /ec ?1, 1CC:. ,e%rising 4a% as %ercentage of

total assets stood at 1@.A1K, (hich is (ithin the international standard of 1CK. In

the %osition, the -et Interest Income (-II) of the Ban may increase by B/" @1.D1

million in case of 1CC basis %oint increase in interest rate. >o(e$er, in case of 1CC

basis %oint decease in interest rate, the -II of the Ban (ill go do(n by B/" @1.D1

million.

9BDT in 3illion:

5articular1 *olu3e

,ate !ensiti$e Assets (,!A) 1A0D0.D0

,ate !ensiti$e +iabilities (,!+) 1?@C@.:C

,e%ricing 4a% (,!A7,!+) @1D1.A0

,e%ricing 4a% as K of "otal Assets 1@.A1K

For 1CC basis %oint increase in interest rate @1.D1

For 1CC basis %oint decrease in interest rate (@1.D1)

Liquidity Risk:

+iHuidity ris is the ris that the Ban may fail to meet is obligation due to short of

cash andBor cash eHui$alent assets. "his situation may arise in the case of

(ithdra(al of de%osits, debt maturities and commitment to %ro$ide credit.

O!"ecti#e

Main sufficient liHuid assetsL and finding ca%acity to meet their financial

commitments, under all circumstances, (ithout ha$ing to raise funds at

unreasonable %rices or sell assets on forced basis.

.$$roach

"heir a%%roach to liHuidity management is to %roject liHuidity reHuirements based

on e&%ected and stressed economic, maret, %olitical and enter%rise7s%ecific e$ent.

"his enables them to ensure that they ha$e sufficient funds a$ailable to meet their

financial commitments e$en in times of crisis. Funds encom%ass both liHuid assets

on hand and ca%ability to raise additional funds. "heir large based of scheme

de%osits form indi$iduals and strong ca%ital %ositions %ro$ide a long7term stable

source of funding. "he %rimary ris measurement methodology is to monitor liHuid

1C

asset ratios, de%osits mi&, core de%osits as %ercentage of total de%osits and net

liHuidity ga%.

0 20 40 60 80 100

Others

Sanings

Deposits Under

Scheme

%

+iHuid Assets M*ash N Balance (ith Bangladesh Ban N /e%osit

(ith other BansN Money at *all and !hort -otice N

In$estments.

Operational Risk:

=%erational ris is the ris of loss resulting form inadeHuate or failed internal

%rocesses, %eo%le and systems or from e&ternal e$ents.

O!"ecti#e

=%erational ris is inherent in all business acti$ities, and the management of these

riss is im%ortant to the achie$ement of organi#ational goals. )hile o%erational

riss can ne$er be eliminated, these can be managed, mitigated and in some cases

insured against to %reser$e and create $alue.

.$$roach

=%erational ris is managed through the establishment of effecti$e infrastructure

and controls. "o this end, (e ha$e established a (ell7formulated frame(or that

uses the strengths and s%eciali#ed no(ledge of our lines of business. =ur strategy

is to ma&imi#e our ability to manage and measure o%erational ris through

im%lementation of a frame(or that taes ad$antages of the best %ractices in the

industry

2.= >OINT *+NTUR+ .BRO.D

11

Bank of (aldi#e1 li3ited 9B(0:

IFI* Ban limited has established a joint $enture in the name of Ban of

Maldi$es limited at Male in the re%ublic of Maldi$es right in 19:? i.e. 1C

years ago. "his is the first -ational Ban of Maldi$es. "he o(nershi%

com%osition is 0CJ@C %ercent. "he 4o$ernment of Maldi$es o(n 0CK sharer

and the @CK sharer are o(ned by IFI* Ban limited.

O3an?Banglade1h e@change co3$any 900C:

"o hel% remittance of more the ?C,CCC Bangladesh (age 5arners li$ing in

=men. "he ban has established an e&change house7=MA-

BA-4+A/5!> 5O*>A-45 *=M;A-P (++*) in the !ultanate of =man

in collaboration (ith =mani nationals =B5* has se$en branches.

Ne$al Banglade1h !ank 0td.

Q,

"his is the first joint $enture ban bet(een t(o countries. In /ecember 199?

the ban establish a joint $enture (ith DCK eHuity in -e%al. "he ban comes

into o%eration in Eune 199@.

O*+RS+.S BR.NC4

"he ban has a branch in .arachi in ;aistan (hich has started o%erations in

early 19:A. )ithin the short s%an of its o%erations the branch %rocured

si#eable business subseHuently. "he ban o%ened its second branch at +ahore

in 199?. Bath the branches enjoy re%utation and good (ill in ;aistan and

ha$e been o%erating %rofitably.

BR.NC4 N+T,OR/ 9DO(+STIC:

"he branches of the Ban co$er all the im%ortant trading and commercial

centers in Bangladesh. As of date, it has 01 branches (ithin Bangladesh. All

the branches are eHui%%ed (ith com%uters in addition to modern facilities,

logistics and %rofessionally com%etent man%o(er.

2.1A /ey -igure1

IFI* Ban follo(s the credit %olicy (ithin the frame(or of three main

objecti$es namely, maintenance and im%ro$ement of Huality assets, reco$ery

on time and building u% an efficient customer oriented credit deli$ery

system..

"he %ortfolio includes (oring ca%ital financing, %roject financing, and

im%ort7e&%ort financing and domestic trade financing etc. the continued to

e&tend (oring ca%ital facilities to customers to ensure smooth and

11

uninterru%ted o%eration of their business. At the same time, it e&%anded

%roject financing %ortfolio to meet the gro(th demands of the economy for

long term finance in a de%ressed ca%ital maret.

!o far the Ban has financed 19D %rojects. Among them @: %rojects (ere

financed during 1C1? amounting to ". 11CD.0C million. "he Ban also

%artici%ates in !yndicate Financing and so far has disbursed ". 1CCC million

in 1C %rojects. "he ban successfully handled t(o credit lines $i#7I/A credit

-o.1?@C and A/B loan -o.1CAC BA- (!F) (ith reco$ery rate of 1CCK and

:AK res%ecti$ely. Gnder these %rograms the Ban sanctioned loans of

".@1:.CC million to as D? units.

2.11 Ter3inology

IFI* Ban has been successfully %ro$iding in the recent years a good number of

ne( %roducts besides so called traditional ser$ices to meet the increasing demands

of the clients and the members of the %ublic. !ome of them areJ Fisa *redit cards,

A"Ms, ;hone Baning, ;ension !a$ing !cheme, /eath ,is Benefit !cheme,

*onsumer *redit !cheme, and 5ducation ;lan.

1.11 4u3an Re1ource De$art3ent) 94RD:

>uman resource de%artment in$ol$es all management decisions and %ractices that directly

affect or influence the %eo%le, or human resources, (ho (or for the organi#ation. In recent

years, increased attention has been de$oted to ho( organi#ations manage >uman ,esources.

"his increased attention comes from the reali#ation that an organi#ation3s em%loyees enable

an organi#ation to achie$e its goals and the management of these human resources is critical

to an organi#ation3s success.

-unction1 of 4RD)

1?

1. ;lanning for =rgani#ation, Eobs and ;eo%le

!trategic >uman ,esources

>uman ,esources ;lanning

Eob Analysis

1. AcHuiring >uman ,esources

55= (5Hual 5m%loyment =%%ortunity)

,ecruiting

!election

?. Building %erformance

>uman ,esources /e$elo%ment

>uman ,esources A%%roaches to im%ro$ing *om%etiti$eness

@. ,e(arding em%loyees

;erformance A%%raisal

*om%ensation and Benefits

D. Maintaining >uman ,esources

!afety and >ealth

+abor ,elation

5m%loyment "ransitions

0. Managing Multinational >,/

I3$ortance of 4RD)

"oday, %rofessionals in the human resources area are im%ortant elements in the success of

any organi#ation. "here jobs reHuire a ne( le$el of so%histication that is un%recedented in

human resources management. -ot sur%risingly, their status in the organi#ation has also

been ele$ated. 5$en the name has changed. Although the terms personal and human

resources management are freHuently used interchangeably, it is im%ortant to note that the

t(o connote Huite different as%ects. =nce a single indi$idual heading the %ersonal function,

today the human resource de%artment head may be a $ice %resident sitting on e&ecuti$e

boards, and %artici%ating in the de$elo%ment of the o$erall organi#ational strategy.

5hilo1o$hy)

1@

>uman ,esource (ors (ith the em%loyees in the organi#ation. Its main $ie(s are to %ut

the right %eo%le in the right %laces and also mae them an asset for an organi#ation.

O!"ecti#e)

>uman ,esource Management refers to the %ractices and %olicies one need to carry out the

%eo%le or %ersonnel as%ects of one3s management job. "hese includeJ

*onducting job analysis (determining the nature of each em%loyee3s job)

;lanning labor needs and recruiting job candidate.

!electing job candidates

=rienting and training ne( em%loyees

Managing (ages and salaries (determining ho( to com%ensate em%loyees)

;ro$iding incenti$es and benefits

A%%raising %erformance

*ommunicating (inter$ie(ing, counseling, disci%lining)

"raining and de$elo%ment

Building em%loyee commitment.

2.1 Di1trict ,i1e Branch Di1tri!ution)

1D

10

1A

1:

19

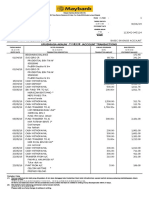

2.1% Balance Sheet)

1C

11

2.1& 5rofit and 0o11 .ccount)

11

2.1' Ca1h -loB State3ent)

1?

.

1@

.1 8eneral Banking)

/uring my %ractical orientation I (as %laced in IFI* Ban +imited. First I (as %laced in

Branch. I ha$e com%leted 4eneral Baning and some e&%osure in Ad$ance in this branch.

4eneral Baning is the starting %oint and main function of all the baning o%erations it is the

de%artment (hich %ro$ides day7to7day ser$ice to the customers. 5$eryday it collects de%osit

from the customers by allo(ing broing interest rate, meets their demand for cash by

honoring *heHues and lend it to the customers against ending interest rate. +ending interest

rate in higher than borro(ing interest rate, this is the %rofit for the ban.

-unction1 of thi1 de$art3ent

RAccounts o%ening section.

R*ash section ,emittance section.

R*learing section.

RAccounts section.

R5stablishment.

.1.1 .ccount1 O$ening Section

"his section o%ens different ty%es of account for their $alued customers. !election of

customer is $ery im%ortant for the ban because ban3s success and failure largely de%ends

on their customers. If customers are bad they creates fraud and forgery by their account (ith

ban and, this destroys the good (ill of the bans. !o, this section taes e&treme caution in

selecting its $alued customer.

Ty$e1 of .ccount1 Accounts can be classified into t(o ty%esJ

O$erati#e .ccount Non?O$erati#e .ccount1

;!! AlC

*urrent /e%osit Account

MI! AB*

!a$ings /e%osit Account

F/, AlC

!=/ Al*

!"/ Al*

1D

.1.2 Docu3ent1 for O$ening S$ecial .ccount)

5.RTICU0.RS

N+C+SS.R; DOCU(+NTS

.1. 0I(IT+D CO(5.N;

*ertificate of incor%oration

*ertificate of *ommencement of Business (in

case of ;ublic +imited *om%any only)

Form OII, (+ist of all /irectors, /esignation,

Address, !%ecimen signature)

Memorandum of Association

Articles of Association

;o(er of attorney

,esolution of the Board of /irectors authori#ing

o%ening of an account.

.1.% SOCI+TI+SCC0UBSC.SSOCI.TIONS

=ther than abo$e7mentioned common

documents, resolution of (ho (ill o%erate the

account must be noted.

.1.& 5RO5RI+TORS4I5 -IR(C

5.RTN+RS4I5 -IR(

-ame of authori#ed %ersons, designation,

s%ecimen signature,

"rade license,

;ass%ort (if there is no introducer)

Account must be o%ened in the name of the firm,

"hree form should describe the names and

addresses of all %artners,

;artnershi% deed is reHuired,

"rade license from *ity *or%oration is needed,

+etter of authority is achie$ed

10

.ccount O$ening 5rocedure in a floB chart)

I11uing CheDue !ook1 to the cu1to3er1

"he ban issues 1C lea$es cheHue boo for sa$ings account and 1C, DC and 1CC lea$es

cheHue boos for current account. "o com%lete the issuing of cheHue boos a customer has

to fill u% the reHuisition form for cheHue boos. "hen a ne( cheHue boo (ill be filled u% by

the account number of the customer. "he reHuisition sli%s are maintained and recorded in a

register as $oucher.

1A

A%%licant fills u% the

rele$ant a%%lication form

in the %rescribed

manner.

>eBshe is reHuired to fill

u% the s%ecimen

signature card

For indi$idual

introduction is needed

by an account holder

"he authori#ed officer

scrutini#es the

introduction and e&amine

the documents submit

Issuance of de%osit sli%

and the de%osit must be

made in cash. -o cheHue

or draft is acce%table to

the Ban

Account is o%ened

After de%ositing the cash

one cheHue boo is issued

Dor3ant account

If any account is ino%erati$e for more then one year is called dormant account. "o o%erate

this accounts manager's %ermission is necessary.

Tran1fer of .ccount

Account holder may transfer his account from one branch to another branch. For this he

must a%%ly to the manager of the branch (here he is maintaining his account. "hen the

manager sends a reHuest to the manager of the branch (here the account holder (ants to

transfer his account for o%ening the account.

/ind1 of .ccount 4older1

Branch may o%en accounts of the follo(ing categories of de%ositorsJ

1) Indi$iduals 7 Indi$iduals are adult %ersons of 1: years age or more (ho are com%etent

to

enter into contracts.

1) Eoint accounts 7 More than one adults jointly or adult (ith minor(s) may constitute joint

accounts.

?) !ole ;ro%rietorshi% concern 7 A business trading concern o(ned by a single adult %erson

is sole %ro%rietorshi% concern.

@) ;artnershi% firms 7 A business concern o(ned and managed by more than one %ersons

(hich may be registered or not registered is a %artnershi% firm.

D) ;ri$ate limited 7 A body cor%orate formed and registered under com%anies Act 199@,

(ith limited members.

0) ;ublic limited 7 A body cor%orate formed ' registered under com%anies Act 199@ (ith

limited liability of the shareholders and (ith no u%%er ceiling of shareholding both

certificate of incor%oration and certificate of commencement has gi$en by registrar.

A) "rusts 7 "rusts are created by trust deed in accordance (ith the la(.

:) +ISGI/A"=,! 7 +iHuidators are a%%ointed by court of la( for com%anies going into

liHuidation.

9) 5O5*G"=,! 7 5&ecutors are a%%ointed by a deceased himself before his death by

6(ith6 to settle the accounts of the %erson after his death.

1C) *lubBAssociationsB!ocieties 7 "here are organi#ations created ' registered or not

registered under societies registration act.

11) *o7o%erati$es 7 "here are cor%orate bodies registered under societies registration Act or

1:

com%anies Act or the co7o%erati$e societies Act.

11) -on74o$t. =rgani#ation 7 -4=s are $oluntary organi#ations created ' registered and

society's registration Act or co7o%erati$e societies Act.

1?) -on7"rading concern 7 "hese are organi#ation registered under societies registration Act

or com%anies Act or co7o%erati$e societies Act.

.1.' Other 5roduct1 and Ser#ice

R *urrent /e%osit Accounts (*/ account)

7 A current account may be o%ened by any indi$idual, firm, com%any, club, associates, etc.

BanJ may, ho(e$er, refuse (ithout assigning any reasons to o%en current account to any

body.

7 Minimum balance of ". DCCC (hile o%en.

7 -o current account (ill be o%ened (ith *heHues.

7 Fund in the current de%osit account shall be %ayable on demand.

7 Minimum balance to be maintained of ". 1CCC.

7 If minimum balance falls then incidental charges of ". DC (ill be reali#ed half is early.

7 -o interest is %ayable on the balance of */.

7 In case of closing of current account ". 1CC is to be reali#ed against incidental charges.

R !a$ing /e%osit Accounts (!B account)

7 0.DK interest is %ro$ided to de%ositors.

7 "he minimum amount of balance to be maintained (ith this ty%e of account is ". 1CCC

7 A de%ositor can (ithdra( t(o times in a (ee for more (ithdra(al de%ositors are not

entitled for any interest.

7 "o (ithdra( abo$e ". 1C,CCC the de%ositors has to notice.

7 -o sa$ings account (ill be allo(ed to be o$erdra(n.

R !hort term de%osit (!I/ AB*)

. . ? 4enerally o%ened by big business firm.

7 Interest de%ends on the amount de%osited.

7 Minimum amount of balance has to be maintained (ith !"/ account is " 1 lacs, (hile

19

o%en

7 Interest is gi$en at a rate of @K

7 Minimum amount is " DCCC must be maintained.

R ;ension !a$ings !cheme (;!!)

7 "his is a scheme to mae the customer introduced to the baning system under this

schemes the customers are to %ay a certain of money at monthly inter$al u% to a %eriod of D

to 1C years and after the %eriod they (ill get the returns along (ith the full interest earned

during the %eriod and the %rinci%al amount. Most of the clients under this scheme are middle

crass and lo(er middle class %eo%le

7 4enerally o%ened by small se$er.

7 Minimum Amount " DCC and minimum " 1CCC

7 Interest rate 9.CCK

7 Maturity D to 1C years.

PSS 5 years

Monthly installment ;rinci%al amount Bonus )ith Bonus

DCC ?0,10D 1DCC ?A,A0D

1CCC A1,D?C ?CCC AD,D?C

1CCC 1,@D,C0C 0CCC ' 1,D1,C0C

Liquidation of PSS

7 In case of premature encashment if the period is below 1 year then no interest will be

provide.

7 ff above 1 year interest will be given T Savings.

R (onthly Inco3e Sche3e 9(IS:

7 "his is another attracti$e scheme offered by this ban under this scheme the de%ositors anJ

to de%osit a fi&ed amount to the ban' and for their fi&ed amount they are entitled to earn J2

monthly %ayment from the ban. "his is an attracti$e scheme for the retired %erson. "his iQ

also a ind of F/,, but here the interest is gi$en monthly to the customers the de%osit (ill

bQ DC,CCC, 1C,CC,CCC, 1,DC,CCC res%ecti$ely.

7 "he rate of interest is 1C.:CK

?C

7 Maturity is CD years.

Liquidation of MIS

7 200 bank charge for premature encashment as out access duty.

7 Closing before 0 months no benefit will be providing.

7 reen casement between 0 months to 1 year interest are provide according to savings rate. 7 re

encashment between 1 to ? years savings interest are provide 0.!0 N saving rate

7 re encashment between ? to D years. Interests are providing 1.00"saving rate.

R -i@ed De$o1it Re1er#e 9-DR:

7 F/, is neither transferable nor negotiable.

7 It can be o%ened by all.

7 ;ro$ided A.DCK 7 :.1DK interest.

7 Interest rate $ery on %rinci%al amount.

7 "he de%osited %rinci%al amounts ha$e not fi&ed by the Ban.

7 =ne can de%osit any sum of amount under fi&ed de%osit reser$e.

7 In case of (ith dra(l before maturity the %re$ious maturity %eriod is considered to %aJ

interest according to sa$ings interest rate 0.DK it is no(n as %re matured en7casement.

Interest rate ha$e been rated by the Management of IFI* Ban on F/, ha$e gi$en belo(

(aturity $eriod Rate of intere1t

? months A.DK

0 months :.CCK

1 year :.1DK

1 year :.1DK

? year :.1DK

Liquidation of FDR

7 #nly the account holder himself and the authori$ed person can li%uid the &'( after maturity.

7 In case of )oint name authentication from both is necessary.

7 If demand before maturity the last e*pired duration is considered to pay interest.

.ccount o$ening $roce11

!te% l7 ,ecei$ing filled u% a%%lication in ban's %rescribed form mentioning (hat ty%e of

account is desired to be o%ened.

!to% 1? "he form is failed u% by the a%%licant.

!te% ??"(o co%ies of %ass%ort si#ed %hotogra%hs for indi$idual and in case of firm's

?1

%hotogra%hs of all %artners are necessary.

!te% @7A%%licant must submit reHuired document.

!te% D7A%%licant must sign s%ecimen signature sheet and gi$e mandate.

!te% 07Introducer's signature and accounts number $erified.

!te% A7 Authori#ed officer acce%ts the a%%lication

!te% :7 Minimum balance is de%osited only cash is acce%table.

!te% 97 Account is o%ened and de%osit sli% and a cheHue boo has gi$en.

?1

.2 Re3ittance in Banglade1h

*ash handling from one %lace to another is risy. !o, ban remits funds on behalf of the

customers to sa$e them from any misha%s through the net(or of their branches. IFI* has a

(ide net(or of branches all o$er the country and offers $arious ty%es of remittance

facilities to the %ublic. "hey ser$e as best media for remittance of funds from one %lace to

another. "his ser$ice is a$ailable to both customers as (ell as non7customers of the ban.

"he follo(ings are some of the im%ortant modes of transferring funds from one %lace to

another through bans. "hese are 8

i) ;ayment =rder (;=)

ii) /emand /raft (//)

iii) "elegra%hic transfer ("")

. 0ocal Re3ittance

!ending money from one %lace to another %lace for the customer is another im%ortant

ser$ice of the ban. "his ser$ice is an im%ortant %art of transaction system. In this ser$ice

system, %eo%le, es%ecially businessman can transfer funds from one %lace to another %lace

easily. "here are three inds of techniHue for remitting money from one %lace to another

these are

7/emand draft (//)

7;ay order (;=)

7"elegra%hic "ransfer ("")

??

,emitt

ance

..1 5ay Order 95.O: I11ue

;ay order gi$es the right to claim from the issuing ban1e A %ayment is an instrument from

one branch another branch of the ban to %ay a s%ecific sum of money. Gnlie cheHue there

is no %ossibility of dishonoring because before issuing %ay order the ban taes money in

ad$ance. "here are three reasons behind use of ;.=J

,emitting ;ur%ose

Ad$ice to ;ay

;ayment against bill submitted to the ban.

Pay Order consists of three parties:

+ Beneficiary

7 A%%licant

7 *ounter ;art.

Commission and chares of P!O:

Amount of ;.= *ommission on ,emittance 1DK FA" on *ommission

G% to ".. 1CC,CCC

1D @

1CC,CC1 to DCC,CCC DC :

Abo$e DCC,CCC

1CC 1D

Payment Process of Payin "ank:

;ayment is made through clearing.

Payment of Pay Order :

An the ;= issued by the ban is crossed one it is not %aid o$er the counter. =n the contrary

the amount is transferred to the %ayees3 account. "o transfer the amount the %ayee must duly

stam% the ;=.

?@

"he %ayee de%osits it to

his *ollecting Baner

;ayment is gi$en and is

registered in incoming

%ayment of ;.= Boo.

*ollecting Ban sends the

;.=. to the issuing Ban

through clearing house

arrangement

"he ;ay =rder is %assed

and cancelled in the

de%osit section.

Cancellation of P! #:

Step+I, Application writes to the manager of the account maintaining branch.

Step+2, -erification of specimen signature.

.ncasement of .#, /o encashment of that .#. the payee of the instrument deposits the

.#. to his bank. /he bank sends the pay order to the issuing bank through clearing. /hen

the . =. is passed through the deposit section and the . =. is send back to the clearing

house again and later the amount of .#. credited to payee0s account.

-loB Chart of 5.O.?4oB It ,ork1 )

If any AB* (ith

IFI* BA-.(the collecting

Baner)

?D

>e %urchased the ;.=. in

fa$or of a %erson or

com%any

5urcha1er ha1 an account

(ith IFI* and fill u% the

rele$ant from (ith a credit

$oucher

"he beneficiary de%osits the

;= in his account (ith IFI*

or another Ban

*ollecting Baner sends

an IB/A

"he collecting Baner

%resents the ;= to %aying

Baner through clearing

house

;ayee3s account is

credited (ith collecting

Baner

;ayee3s account credited

(ith collecting Baner

..2 De3and Draft 9DD: I11ue

// is an order of issuing branch on another branch of the same ban to %ay s%ecified sum of

money to %ayee on demand. It is generally issued (hen customer (ants to remit money in

any %lace i.e. outside or the clearing house area of issuing branch. ;ayee can be the

%urchaser himself or another mentioned in the //. It is safe techniHue of transferring money

from one %lace to another.

Payment process of the payin $ank:

+/est confirmation if the '' value is more then /k. 2!1000.00

+Confirm that the '' is not forged one.

+Confirm with sent advice.

+2ake paymen

Commission and chares of DD:

ostal charge /k. 1!.00 " commission 0.103 " 1!3 -at on commission.

4oB DD ,ork1)

?0

If // comes to the Ban

on (hich it is dra(n, the

Ban honors it.

An IB*A along (ith

%hotoco%y of // is sent

to the %aying Ban (An

ad$ice to %aying Baner)

// is handed to the

customer (here %aying

Ban is mentioned and

%ayment (ill be made

from another Ban

A%%licant fills u% the

rele$ant form (ith a

credit $oucher (income

AB*) for the Ban

"he a%%licant should

ha$e AB* (ith IFI*

Cancellation of '',

Step 7 I , Application is writing to the manager of the account maintaining branch.

Step 7 2 , -erification of specimen signature.

Step + 4 , 5ournal posting for incoming,

+6ills payable '' payable 'r.

+ I&IC 7eneral AIC Cr

5ournal posting for outgoing,

+I&IC general A8C 'r.

+arty A8C Cr.

Step + 9 , Send a letter to paying bank

.. Telegra$hic Tran1fer 9TT:

Issuing branch reHuests to another branch to %ay s%ecified sum of money to a s%ecific %erson

on demand by telegra%h or tele& or tele%hone. "ransfer of fund by "" is the ra%id and

*on$enient but e&%ensi$e method.

TT 9I11ue:)

*ustomer fills u% the "" form and %ays the amount along (ith commission in cash

or by cheHue.

"he res%ected officer issues a cost memo after recei$ing the "" form (ith %ayment

seal, then sign it and at last gi$e it to the customer.

-e&t a "" confirmation sli% is issued and its entry is gi$en in the "" issue register.

A test number is also %ut on the face of the sli%. "(o authori#ed officer signs this

sli%.

"he res%ecti$e officer transfers the message to the dra(ee branch mentioning the

amount, name of the %ayee, name of the issuing branch, date, test number and his her %o(er

of attorney (;.A.) number.

"he confirmation sli% is send by %ost.

?A

4oB TT ,ork1 9OutBard: )

?:

A%%licant fills u% the rele$ant form (ith a

credit $oucher (Income AB*) for the Ban

A%%licant has an account

(ith IFI* Ban

"e&t of tele& is (ritten or the rele$ant information along (ith

"est code is sent to the %ayee Ban through fa& or tele%hone

Another 1 co%ies of the te&t are sent through courier to the ;ayee3s

Ban.

"he reconciliation de%artments

reconcile t(o co%ies and

detect the fraud or forgery if

any

"hen one co%y from dra(er3s Ban and

another from ;ayee3s Ban are sent to the

reconciliation de%artment of local office.

Before that the ;ayee3s

Ban decode the test and if test

is agreed

;ayee3s account credited

Payment Process of %%:

!te%7IJ "est confirmation

!te%71J *onfirm issuing branch

!te%7?J *onfirm %ayee's account.

!te%7@J *onfirm amount

!te%7DJ Mae %ayment

!te%70J Ad$ice sends to the >ead =ffice for reconciliation.

Commission and Chares of %%:

7"ele%hone or "ele& charge "..?C.

7*ommission of ;rinci%al amount.

71DK FA" on commission.

+ntry for TT

a: On I11uing of TT )

1. *ash B ,es%ecti$e AB* (issuer) 77777777777777 /r.

IFI* BA-.4eneral AB* 7777777777777777777777777777 *r.

(;rinci%al amount)

Income AB*7%ostage 77777777777777777777777777 7777777*r.

Income AB*7*ommission on "" 7777777777777777 77*r.

1. IFI* BA-.4eneral AB* 77777777777777777777777777 /r.

Bills ;ayable AB*7"" ;ayable 7777777777777777777 *r.

!: On 5ay3ent of TT

Bills ;ayable AB* 8 "" ;ayable 7777777777777777777777 /r.

;arty AB* 777777777777777777777777777777777777777 *r.

Te1t .rrange3ent of TT E DD

"est is the security code by decoding (hich any branch can be sure that the "" or // is not

forged one. =nly the authori#ed officers no( the test code. 5ach ban maintains secret

code for this. "hat is the test arrangement is the combination of different secret codes.

?9

.% Clearing Section

"his section recei$es all inds of cheHue in fa$or of the $alued client for clearing on the %art

of their baning ser$ices. After recei$ing cheHue it is necessary to endorse it and cross it

s%ecially. *learing of cheHue is done through the clearing house in Bangladesh Ban.

7 1 st clearing

7 1nd clearing

Ty$e1 of cheDue for clearing

"here are four ty%es of cheHue for clearingJ

1) In(ard clearing cheHue.

1) =ut(ard clearing cheHue.

?) In(ard bills for collection.

@) =ut(ard bills for collection.

R Inward clearing che%ue

It refers the instruments dra(n on IFI* ban recei$ed by other bans in the clearing house

from the re%resentati$e of other ban.

R #utward bills for collection

)hen our branch sends *heHues to other branch ofIFI* ban is called =B*. Accounting

treatment of this %rocessJ

IFI* general (!ender's Branch) /r.

/e%ositor's AB* *r.

R Inward bills for collection :l.C;

"here are t(o ty%es of clearing, firstly cheHue collects from the other branch of IFI* banle

"hese *heHues are settled by sending m*A i.e. debiting de%ositors account and crediting

sender's branch account. .

!econdly cheHue collects from another ban outside the clearing house. "hese cheHue are

settled debiting de%ositors account and sending // or "" in fa$or of senders ban.

R #utward Clearing Che%ue

*heHue dra(n of another branch of IFI* ban are called =ut(ard *learing *heHue. "hese

ty%es of cheHue are directly sent to the res%ecti$e branch and reHuest them to send IB*A.

@C

.& Ca1h Section

*ash de%artment is the most $ital and sensiti$e organ of a branch as it deals (ith all inds of

cash transactions. "his de%artment starts the day (ith cash in $ault. 5ach day some cash i.e.

o%ening cash balance are transferred to the cash officers from the cash $ault. -et figure of

this cash recei%ts and %ayments are added to the o%ening cash balance. "he figure is called

closing balance. "his closing balance is then added to the $ault. And this is the final cash

balance figure for the ban at the end of any %articular day.

-unction1 of ca1h de$art3ent

7*ash %ayment

7*heHue cancellation %rocess

7*ash recei%t

R *ash %ayment

*ash %ayment is made only against cheHue.

"his is the uniHue functions of the bacing system (hich is no(n as 6%ayment on

demand6 .It maes %ayment only against its %rinted $alid cheHue.

R *heHue cancellation %rocess

,ecei$ing cheHue by the em%loyee in the cash counter and $erification of the follo(ing by

the cash officer in the com%uter sectionJ

i) /ate ofthe cheHue. (it is %resented (ithin 0 month from issue date)

ii) Issued from this branch.

iii) An amount in figure and in (ord does not differ.

i$) *heHue is not torn or mutilated. "hen gi$es %ay cash seal and sends to the %ayment

counter and %ayment office maes %ayment.

R *ash recei%t .

Another im%ortant function of this de%artment is recei%t of cash. /e%ositors de%osit money

in the account through this section by de%osit sli%.

i) It recei$es de%osit from de%ositors in from of cash.

ii) !o it is the 6mobili#ation unit6 of the baning system.

iii) It collects money only its recei%ts from.

i$) It recei$es cash for issuing %ay order "", //.

@1

Book1 3aintained !y thi1 1ection)

i) Fault registerJ It ee%s accounts of cash balance in $ault at the ban.

ii) *ash recei%t registerJ *ash recei%t in (hole of the day is recorded here.

iii) *ash %ayment registerJ *ash %ayments are made in a day are entries here.

i$) ,ough $ault registerJ *ash collection for final entry in $ault registers done here, as

any error and correction is not acce%table.

$) *ash balance booJ Balance here is com%ared (ith $ault register. If no deference is

found, indicate no error and omission.

.< Clo1ing of .ccount

"o close an account %arties may be reHuest to send an a%%lication along (ith the unused

lea$es of the cheHue boo. =n recei%t of the a%%lication the follo(ing ste%s are taen.

i) "he signature of the account holder is $erified.

ii) "he number of the unused cheHue lea$es shall be noted therefore.

iii) /ebiting the incidental charges to the account.

i$) "he account holder is ad$ised to dra( the remaining balance.

.= .ccount1 1ection

"his is ob$iously an inde%endent and uniHue de%artment, (hich (ors as the com%osition of

all the de%artments of the branch. "his section is fully com%uteri#ed. !o the con$entional

large ledger and journal boos are not e%t lie the some nationali#ed ban. It recei$es the

$ouchers from all de%artments and %re%ares the subsidiaries and maintains accounts.

+1ta!li1h3ent 1ection

"his section deals (ith em%loyees salary, many ty%es of internal e&%enses such as %urchases

of stationary, eHui%ment, machinery, %ayment of labor cost and con$ence. In case of lea$e

of absence em%loyee collects %rescribed form from this section.

0ocker facilitie1

+ocer facility is a$ailable in this branch. 4enerally %eo%le ee% their $aluable ornaments in

the locer. +ocers are three si#es one are small and other are middle and big. If any body

(ant to o%en a locer sBhe has to %ay rent ". 1:CC for big si#e, ". 1DCC for large and ".

11CC for small si#e annually. Any indi$idual can o%en a locer.

@1

.1A Credit and Ri1k (anage3ent

"he (ord credit comes from the +atin UcredoV means UI belie$eV. It is a lender3s

trust in a %erson3sBfirm3sBcom%any3s ability or %otential ability to command goods

or ser$ices of another in return for %romise to %ay such goods or ser$ices of

another in return for %romise to %ay such goods or ser$ices at some s%ecified time

in the future. "he maing of loans and ad$ances has al(ays been %rominent

%rofitable function of the bans. !anctioning credit to customers out of the funds at

its dis%osal is one of the %rinci%al ser$ices of a modern Ban.

As a financial intermediary the %rimary objecti$e of a ban is to collect de%osits

from the sur%lus units ((ho ha$e sur%lus fund) and utili#e the same by lending the

deficit units ((hose reHuires funds). Ban is the %ro%er medium of those %arties to

utili#e the ca%ital %ro%erly. Ban guild the sur%lus %arties (here to in$est. Ban

collect de%osits from sur%lus %arties in return ban gi$e them some %ercent of

benefits that are gained out of the different loan or credit e&tended to the

borro(ers. Ban taes residual %ortion of benefit from the credits.

As Ban deals (ith the money collected from the de%ositors re%ayable on demand.

!o, it can not afford to loc u% it fund for long or uncertain %eriods. *onseHuently,

Ban must safeguards its de%osits through effecti$e management of all %ossible

riss associated (ith its credits.

=ne of the most significant riss of a ban is e&%osed to is, (hat is generally

termed as &Credit Risk', (hich is the %rimary ris in the baning system. !ince the

largest slice of income generated by a ban and a major %ercentage of assets is

subject to this ris, it is ob$ious that %rudent management of this ris is

fundamental to the sustainability of a ban. Management of *redit ,iss needs to

be a robust %rocess that enables the Bans to %roacti$ely manage the credit

%ortfolio in order to minimi#e losses and earns an acce%table le$el of return for the

!hareholders.

,is is inherent in all as%ects of commercial o%eration. >o(e$er for Bans *redit

ris is the fundamental to the sustainability of a ban. "hus *redit ,is is an

essential factor that needs to be managed.

Credit Risk

*redit ris is the %ossibility that a borro(er (ill fail to meet its obligation in

accordance (ith agreed terms. *redit ris, therefore, arises from the Ban3s

dealings (ith or lending to cor%orate, indi$idual and other Bans or financial

institutions.

"o %re$ent e&cessi$e flo( of credit and %ro%er use of it, bans reHuire taing on

the a%%ro%riate credit a%%raisal %rocedure to im%ose financial disci%line on

borro(ers. "he %rocedure that organi#e, control and moti$ate the borro(ers (ill

called credit management.

@?

So3e Definition1 related Bith Credit Ri1k are Duoted !eloB )

U"he conce%t of high Huality loan cannot e&ist in the absence of objecti$e

credit standards.V

+ (. /aggart 2urphy.

UAsset Huality is the most im%ortant fundamental dimension of ban analysis.

Asset Huality ultimately dri$es e$erything, including margins, ca%ital adeHuacy,

underlying %rofitability, in$estment sentiment and $aluations.V 8 (oy (amos1

<ead of 6anking Analysis1 7oldman Sachs1 <ong =ong.

(ecessity of Credit Risk Manaement)

Baning in the ne( century is e$en more %ros%erous than the %ast o(ing to

re$olutionary ad$ancement in technology, as (ell as, de$elo%ment of ne( ideas

and systems. *onseHuently, e$ery Ban has to be (ell8eHui%%ed to cou% (ith the

modern baning system and to ado%t effecti$e means and (ays to negotiate its all

%ossible riss es%ecially the *redit ,is.

*redit constitutes the major %art of the Ban3s asset %ortfolio and managing credit

ris is by far the most im%ortant concern of the Ban. "he failure of a commercial

Ban is usually associated (ith the %roblems in *redit %ortfolio and is less often

the result of shrinage in the $alue of other assets. As such, *redit %ortfolio not

only features dominates in the assets structure of the Ban, it is critically im%ortant

to the success of the Ban as (ell.

)hile Bans ha$e faced difficulties o$er the years for a multitude of reasons, the

major cause of serious baning %roblems continues to be directly related to la&

credit standards for borro(ers and counter%arties, %oor %ortfolio ris management,

or a lac of attention to changes in economic or other circumstances that can lead

to a deterioration in the credit standing of a ban3s counter%arties. "his e&%erience

is common in both 481C and non 481C countries.

For most bans, loans and ad$ances are the largest and most ob$ious source of

credit ris2 ho(e$er, other sources of credit ris e&ist throughout the acti$ities of a

ban, including in the baning boo and in the trading boo, and both on and off

the balance sheet. Bans are increasingly facing credit ris (or counter%arty ris) in

$arious financial instruments other than loans and ad$ances, including acce%tances,

inter ban transactions, trade financing, foreign e&change transactions, financial

futures, s(a%s, bonds, eHuities, o%tions, and in the e&tension of commitments and

guarantees, and the settlement of transactions.

Management of *redit ,iss needs to be a robust %rocess that enables Bans to

%roacti$ely manage credit %ortfolio in order to minimi#e losses and earns an

acce%table le$el of return. 4i$en the fast changing dynamic global economy and

the increasing %ressure of globali#ation, liberali#ation, consolidation and

disintermediation, it is essential that Bans ha$e robust *redit ris management

%olices and %rocedures that are sensiti$e and res%onsi$e to these changes.

@@

!ince e&%osure to credit ris continues to be the leading source of %roblems in

bans (orld8(ide, bans should be able to dra( useful lessons from %ast

e&%eriences. Bans should no( ha$e a een a(areness of the need to identify

measure, monitor and control credit ris.

"o %ro$ide a board guideline for the Management of *redit ,is to(ards achie$ing

the objecti$es of the Ban, for efficient and %rofitable de%loyment of its mobili#ed

resources and to administer the *redit %ortfolio in the most efficient (ay, a clearly

defined, (ell %lanned, com%rehensi$e and a%%ro%riate *redit %olicy and *ontrol

4uidelines of the Ban is a %re8reHuisite

=n the other hand, IFI* is a ne( generation Ban. It is committed to %ro$ide high

Huality financial ser$icesB%roducts to contribute to the gro(th of 4./.;. of the

country through stimulating trade ' commerce, accelerating the %ace of

industriali#ation, boosting u% e&%ort, creating em%loyment o%%ortunity for the

educated youth, %o$erty alle$iation, raising standard of li$ing of limited income

grou% and o$er all sustainable socio7economic de$elo%ment of the country.

In achie$ing the aforesaid objecti$es of the Ban, *redit =%eration of the Ban is

of %aramount im%ortance. >ence,IFI* has changed a lot as credit culture has been

shifting to(ards a more %rofessional and standardi#ed *redit ,is Management

a%%roach.

In $ie( of the abo$e, the re%ort is %re%ared on Management of *redit ,iss

through the case study of IFI* Ban +td., (hich an effort to carry out a

com%rehensi$e study on ho( to manage the *redit riss and ho( to ee% it in

acce%table and a%%etite le$el.

Core Risks of "ankin)

"he riss of baning are com%le& and multi8dimensional. Bans are e&%osed to a

number of riss of different ty%es. ,esultantly, managing ris is an art of

identifying, measuring and mitigating the riss.

In $ie( of the abo$e, Bangladesh Ban has identified CD(fi$e) core ris area

relating to baning business (hich are as follo(sJ

*ore ,iss of Baning

@D

The (anage3ent of a!o#e Core Ri1k1 of Banking are de1cri!ed !eloB )

Credit Risk Manaement 8 It has already been stated in this re%ort that

Management of *redit ,is is the most significant and ey tas of the ban.

*redit ,is refers the %robability of loss arising from the failure of a

counter%artyB customer to %erform as %er agreement (ith the Ban. "he failure

may result from un(illingness of the borro(er or decline in either hisB her

financial condition or in the maret scenario. 5$entually, credit ris comes as

the most sensiti$e %art of ris management of the Ban.

*redit ,is has been discussed further in detail hereinafter.

)sset Lia$ility* "alance Sheet Risk Manaement 8 A Ban assets are mainly

de$elo%ed (ith and baced by its liabilities. "hus successful baning reHuires

efficient and effecti$e management of its assets and liabilities. Bans should

ha$e (ell8organi#ed Asset +iability Management des to monitor Balance

!heet ,is and +iHuidity ,is.

"he term Balance !heet ris refers to %otential change in earnings due to

change in the rate of ;rofit, Suality of assets, etc.

=n the other hand, +iHuidity ris can be defined as the ris or chance of failure

to meet u% any (ithdra(alB disbursement reHuest by a counter%artyB customer.

Forein +,chane Risk Manaement 8 !ince Foreign 5&change in$ol$es

%urchase and sale of foreign currencies against local currency, thus Foreign

5&change ris is the ris or chance of loss due to une&%ected mo$ement of

maret %rice of the currencies of different countries or the %rice of the assets

denominated by foreign currencies.

In our country all the foreign e&change transactions are carried out on behalf of

the customers against underlying e&change transaction rules and regulations

laid do(n by Bangladesh Ban, G*;/* :>niform Customs ? ractices for

'ocumentary Credit;and other 4o$ernment bodies.

For effecti$e and efficient management of Foreign 5&change ,is, Bans

should ha$e (ell8de$elo%ed and (ell8structured Foreign 5&change ,is

Manual and International !tandard /ealing ,oom Manual.

Internal Control - Compliance 8 Internal *ontrol ' *om%liance is the ey

of good management and a strong core of an organi#ation. It ensures safe and

smooth o%erations (ithin the organi#ation. All the rules and regulation

%racticed in the baning industry are meant to safety and efficiency in baning

o%erations of all ind.

Internal *ontrol ' *om%liance ensures that all the (oring units of a Ban

abide by those rules and regulations (ithout any fail. !ometimes o%erational

@0

loss arises out of errors and fraud due to lac of Internal *ontrol '

*om%liance.

Pre.ention of Money Launderin Risk 8 Money laundering refers to the act

of con$erting blacB illegal money into (hiteB legal money or %ro%erty. "he

%rocess of money laundering reHuires in$ol$ement of a ban, (hich is $ery

alarming for the baning industry.

Money laundering ris can be defined as the loss of re%utation and e&%enses

incurred as %enalty for being negligent in %re$ention of money laundering. For

successful %re$ention and efficient management of the ris Bans should

designate *om%liance officers at >ead =ffice and at the Branches, (ho

inde%endently re$ie( the transactions of the accounts to $erify sus%icious

transactions.

,is assessment is the %rocess of analy#ing %otential losses from a gi$en

ha#ard using a combination of no(n information about the situation,

no(ledge about the underlying %rocess, and judgment about the information

that is not no(n or (ell understood.

,is is defined as the %roduct of a ha#ard (such as damage costs) and the

%robability that this ha#ard occurs. In other (ords, (%robability) & (ha#ard) M

ris. "he first t(o $alues must be no(n or at least estimated in order to define

ris.

"he %rocess of combining a ris assessment (ith decisions on ho( to address

that ris is called ris management. ,is management is %art of a larger

decision %rocess that considers the technical and social as%ects of the ris

situation. ,is assessments are %erformed %rimarily for the %ur%ose of

%ro$iding information and insight to those (ho mae decisions about ho( that

ris should be managed. Eudgment and $alues enter into ris assessment in the

conte&t of (hat techniHues one should use to objecti$ely describe and e$aluate

ris. Eudgment and $alues enter into ris management in the conte&t of (hat is

the most effecti$e and socially acce%table solution.

"he combined ris assessment and ris management %rocess can be described

as a si& ste% %rocess. "he first three ste%s are associated (ith ris assessment

and the last three (ith ris management.

Flo( *hart of combined ris assessment and ris management %rocessJ

Formulate %roblem in a broad conte&t

;erform the ris analysis

/efine the o%tions

,is

Assessment

@A

The $rocedure of (anaging the Core Ri1k1 in I-IC are de1cri!ed !eloB )

Being a com%liant ban IFI* %ursues the guidelines of Bangladesh Ban

meticulously, in conseHuence of (hich the ban is being able to ee% the riss at

lo( le$el.

EB+ has formulated a com%rehensi$e *redit ,is Management ;olicy /ocument in

line (ith the guidelines issued by Bangladesh Ban, (hich is discussed hereinafter.

"he ban contem%lates to ha$e its assets assessed by an inde%endent agency for the

%ur%ose of (oring out strategy to manage credit riss.

In order to manage the asset liability ris IFI* has a (ell8organi#ed Asset +iability

Management /es under direct su%er$ision of a (ell8formed and (ell groomed

Asset +iability *ommittee (A+*=) (ith a $ie( to monitor and a$ert significant

$olatility in -et ;rofit Income (-;I), in$estment $alue of e&change earnings. "he

A+*= of the Ban monitors Balance !heet ris and re$ie(s liHuidity contingency

%lan. In order to manage the contingent %oints of time and o%eration, the A+*= of

the Ban calls for s%ecial meetings, analy#es the situation and decides (hat should

be done to ser$e the Ban3s interest most.

"he >ead =ffice International /i$ision of IFI* %lays the $ital role to manage

Foreign 5&change ,iss in the %rocess by checing the Foreign 5&change

%rocedure %erformed by the Ban and by re%orting it directly to the Managing

/irector of the Ban.

)ith a $ie( to mitigate o%erational ris the ban has an effecti$e Internal *ontrol

' *om%liance /i$ision that endea$ors to mae the internal control system

effecti$ely by intensifying the internal audit, both com%rehensi$e and s%ecial, of

the Branches and >ead =ffice. "he Audit *ommittee of the Board of /irectors

re$ie(s the audit re%orts and %uts forth suggestions (hich are being follo(ed (ith

due care. "he ban has the %lan to ha$e U!tandard =%eration ;rocedureV (!=;)

formulated by a re%uted consultant, (hich (ould strengthen the internal control

system and mitigate the o%eration riss.

Mae sound decisions

Im%lement decisions

5$aluate actions taen

,is

Management

@:

"here is an anti money laundering %olicy in %lace a%%ro$ed by the Board of

/irector, (hich is in line (ith 4uidance -otes on the subject issued by Bangladesh

Ban. "his contains all the control %oints to detect money laundering and to resist

terrorist financing. "he Board and the Management are fully committed to

%re$ention of money laundering.

@9

"erm +oan +oan 4eneral

*ontinuous +oan

A/FA-*5

.1A.1 0oan1 and .d#ance

Introduction

"his is the sur$i$al unit of a ban because until and unless the success of this section is a

Huestion to e$ery ban. If this section is not %ro%erly (oring, the ban it self may become

banru%t. "his is im%ortant because this is the earning unit of the ban. Bans are acce%ting

de%osits from the de%ositors in condition of %ro$iding interest to them as (ell as safe

ee%ing their de%osits. -o( the Huestion may gradually arise ho( the ban (ill %ro$ide

interest to the clients and the sim%le ans(er is ad$ance.

)e often use loans and ad$ances as an alternati$e to one another. But academically this

conce%t is incorrect. Ad$ance is the combination of such items (here loan is a %art only for

this credit section of the ban.

Ty$e1 of .d#ance

All loan and ad$ance that are %ro$ided by this ban can be categori#ed into there heads

according to the nature and characteristics of each %roductJ

Fiure sho/s the different types of ad.ances

DC

Nature of Different Ty$e1 of .d#ance

Ca1h Credit 4;5OT4+C.TION 9CC 4;5O:

*ash credit is gi$en through the cash credit account. *ash credit is an acti$e and running

account (here de%osit and (ithdra(als may be made freHuently. "he debit balance of the

account on any day can not e&ceed the agreed limit.

Instrument >P;=">5*A"I=- /55/.

DCK margin reHuires to o%en a ** account. ($aries)

=%eration of cash credit is same as that of o$erdraft the %ur%ose of cash credit is to meet

(oring ca%ital needs of traders, farmers, and industrialist.

It is granted only the first class %arties.

It is charged against a %ro%erty (here neither the o(nershi% nor the %ossession is %assed

to the ban.

Ca1h Credit 50+D8+

"he nature, o%erational (or, and characteristics of **7 ;+5/45 in as same as **7

>P;=.

**.;+5/45 in different from **7>P;= only from the securities or business goods

against the loan amount.

It is charged against %ro%erties (here the o(nershi% may remain to the borro(er but the

%ossession is %assed to the ban.

Instrument 7 ;ledge /eed.

Secured O#erdraft 9SOD:

=$erdrafts are those dra(ings, (hich are allo(ed by the bans in e&cess of the balance

in the current account u% to a s%ecified amount for definite %eriod as arranged for.

4enerally it is gi$en to the businessmen to increase their business acti$ities.

Gsually %ro$ide against F/,, ;!!, i.e. financial obligation or any %rimary securities.

"he interest charges from the date of first (ithdra(.

Interest is calculated and charged only on the actual debit balance on daily %roduct basis.

Balance of =/ account are fluctuates

"he interest rate of !=/ is ?K abo$e of F/, interest rate if the F/, is in our Ban.

If the F/, is in other ban then the interest r1te is 14.50%

D1

Industries +oan

It is a term loan.

It is gi$en for three (?) years at eHual installment.

4rass %eriod is allo(ed of this ty%es of loan.

4rass %eriod is the %eriod that reHuire to earn $isible returns.

=thers loan

+oan %ro$ided for other %ur%ose (hich is %roducti$e and less ris rather industrial sector are

treated as others loan.

"he terms and conditions of these ty%es of loan are same as industry loan.

>ouse Building +oan

"his loan is gi$e for the construction of building house. It is gi$es for three (?) years at eHual

monthly installment. "his loan is not %ro$ides freHuently.

!taff >ouse Building +oan (!>B+)

11C times of BA!I* salary is %ro$ided as !>B+. Ban rate N 1 K interest is charged to the

loan amount. ,e%aymeilt adjusted from their monthly salary. ,e%ayment is made at eHual

monthly installment.

*onsumes *redit !cheme

Gnder this scheme credit is gi$en to the customer to %urchase necessary and lu&ury

commodities lie com%uter, motor $ehicle, tele$ision, refrigerator, music system se(ing

machine, furniture etc.

=ther then the em%loyee it is gi$en to the $aluable client.

It is a 1@,?0,@: installment system T 1D.DCK interest.

!tuff loan against ;ro$ident Fund (!+;F)

1CK of basic in contributed by em%loyee ,e%ayment is adjusted from their on they salary.

Ma&imum sanction from ;F.

D1

+oan against ;!!

"his loan is %ro$ides against ;!! fund. :CK are gi$en of the ;!! fund.

"his is 1CCK secured for the ban.

;ayment against /ocument (;A/)

"he im%orters are to o%en letter of credit through any ban for im%orting goods. Most of the

time they are to e&tend credit to the im%orters if not %rohibited by Bangladesh ban. "his

loan creates, on recei%t of shi%%ing documents from the negotiating ban, is transferred and

lodged to ;A/.

;A/ is associated (ith im%ort and im%ort financing. "he ban o%ening letter of credit is

bound to honor its commitment to %ass for im%ort bills (hen these are %resented for

%ayment %ro$ided that it is dra(n strictly in terms of the letter of credit, in fact the amount

their sends ad$anced on behalf of the im%orter.

+oan against im%orted Merchandise (+IM)

In many cases, a ban has to clear the goods im%orted under letter of credit at the reHuest of

the borro(er. )hen the im%orter does not come for(ard to retire the documents ins%ire of

re%eated reminders ban has on forced circumstances to clear the im%orted consignment on

arri$al of the same to a$oid demurrage at the %ort (hich adds to the burden of commitment.

)hen the im%orter fails to retire the documents or reHuest for clearance of goods, the

outstanding under ;A/ is transferred to +IM account.

After clearance, consignments are taen deli$ery by the im%orter on full %ayment of ban's

liability. -ormally %art deli$ery is not allo(ed (hile on +IM A8C. (hen the deli$ery in %art

is desired by the im%orter, the +IM is con$erted into cash credit account retaining

%ro%er margin and e&ecuting charge documents, the deli$ery is effected themsel$es on

obtaining %ro rate %ayment.

"rust ,ecei%ts (",)

"his is an arrangement under (hich credit is allo(ed against trust recei%ts and im%orted or

e&%ortable goods remain in the custody of the im%orter or e&%orter but he is to e&ecute a

stam%ed trust recei%t in fa$or of the ban (here a declaration is made that goods im%orted

D?

or bought (ith the ban's financial assistance are held by him in trust for the ban. .

5&%ort *ash *redit (5**)

5** are e&tended to an e&%ort to facilitate the e&%ort of goods ' commodities for (hich

there is e&%ort letter of credit or contract on hand. It is a %re7shi%ment ' short term credit to

be liHuidated out of the %roceeds of e&%ort documents (hich include negotiation or %urchase

of e&%ort documents.

Securitie1 again1t .d#ance1

"he follo(ing securities are to be obtained by the branches de%ending on the nature of

ad$ances (hile allo(ing secured ad$ances to the %arties.

7 ;ratirashya !anchay ;atra, Bangladesh !anchay ;atra, I*B unit certificates,

)age 5arner /e$elo%ment Bond

7 Fi&ed /e%osit ,ecei%t issued by any branch of IFI* Ban +imited.

7 !hares Huoted in the /haa !toc 5&change +imited

7 ;ledge of goods and %roduce

7 >y%othecation of goods, %roduce and machinery

7 Immo$able %ro%erty

7 Fi&ed assets of a manufacturing unit

*heHues, /rafts, ;ay =rder, ,ail(ay ,ecei%ts, !teamer ,ecei%ts, Burge ,ecei%ts of the

4o$t. or *or%orations

!hi%%ing document

,hich .d#ance1 .gain1t ,hich Securitie1

All securities are not suitable for all ty%es of ad$ances. 5ach security has its o(n suitability.

!%ecific securities to be obtained by the branches (hile allo(ing ad$ance are sho(n belo(

against the ty%es of ad$ancesJ

D@

Ty$e1 of ad#ance1 Securitie1

+oans +ien of $arious inds of !anchay ;atras, 4o$t. !ecurities,

and !hares Huoted in the !toc 5&change, /ebentures, Fi&ed /e%osit ,ecei%ts, ;ledge of

goldB4old ornaments, hy%othecation of $ehicles. *ollateral of immo$able %ro%erties.

=$erdraft !anchay ;atra, -on7resident for de%osit (-F*/), shares,

debt. ;romissory notes, fi&ed de%osit, insurance %olicies, gold etc.

*ash *redits ;ledge or hy%othecation of stoc, %roduced merchandise.

Inland bills %urchase (IB;) "he bill itself.

;A/ !hi%%ing document for im%orts.

IM ;ledge of im%orted merchandise.

", "rust recei%t obtained in lieu of trustees.

5** ;ledge or hy%othecation of goods recei%ts.

Foreign Bills ;urchase !hi%%ing document for e&%orts.

5roce11 of 0oan Section

Ste$?1 ) Sanctioning !y the co3$etent authority

A secured ad$ance may be grant to a %arty only after getting a limit sectioned

from the com%etent authority.

Ste$?2 ) 0oanC.d#ance 5ro$o1al

For obtaining a loanBad$ance the %arty must mae an a%%lication in standard form in (riting

to the branch (here he maintains his o%erati$e account. After recei$ing the a%%lication from

the %arty, the branch manager (ill tae immediate ste%s to com%ile re%ort regarding the

%arty based on the follo(ing sources of informationJ

;ersonal in$estigation

*onfidential su%%orts from

=ther bans,

DD

*hamber of commerce

*IB from Bangladesh ban as the earnable.

"reading account ;B*, BB!. MBA if' any and other documents submitted by the

%arty.

"he a$erage balance and the %resent maintained in the account.

"he nature of o%erations during the last si& months and the date of o%ening

account.

Ste$? ) 5re$aration of li3it $ro$o1al1

"he branch, may %re%are a limit %ro%osal after being fully satisfied (ith the follo(ing

%ointsJ

"he financial %osition of the %arty.

;ur%ose for (hich ad$ance is reHuired.

-ature of securities offered.

"he %ayment arrangement.

Ste$?% ) ReneBal 5ro$o1al.

Ste$?& ) .$$ro#al !y 4ead Office and Branch re1$on1i!le.

+imit %ro%osal sent to >=.

!anctionBreject

,ecei$e the limit section ad$ice.

Ste$?' ) Di1!ur1e3ent of loan.

Ste$?7 ) 0oan 3onitoring and ad3ini1tration.

D0

Cla11ification of 0oan 9C0:

Ad$ance may classified or unclassified are determine on the basis of regularity of loan

reco$ery.

Figure ShoB1 the Cla11ification or 1oan

Uncla11ified 0oan) the re%ayment of ad$ance (hich ha$e regularity are called unc1assifiec

ad$ance. "his is a clean loan that is these is no o$erdue installment or not the e&%ire due

date.

Cla11ified) "he re%ayments of ad$ance (hich ha$e no regularity are classified. "hat means

(hich are irregular in nature, o$erdue installment of %ayment, and e&%ire the due date. "here

are three standards of classificationJ

7 !ub !tandard

7 /oubtful

- Bad +oan

A!!5!!M5-" =F +=A- ' A/FA-*5

*+A!IFI5/ (I,,54G+A,)

*+A!!IFI5/

(IRREGULAR)

/=GB"FG+

!GB!"A-/A,/

BA/ +=A-

G-*+A!!IFI5/

(,54G+A,)

DA

5ligible security

7 For land and building DCK.

7 Financial obligation 1CCK.

Interest sus%ense

7 "otal balance of interest against classified loan.

Base for %ro$ision

7 FormulaJ =utstanding 7 Interest sur%asses 7 5ligible security

7 In case of unclassified ad$ance the base for %ro$ision should e%t 1 K of the total

outstanding amount.

7 In case of bad loan the base for %ro$ision should e%t 1CCK of the total outstanding

amount

7 In case of doubtful loan the base for %ro$ision should e%t DCK of the total

=utstanding amount.

7 In case of sub standards loan the base for %ro$ision should e%t 1CK the total

=utstanding amount.

Basically this standards of classification are de%ends on the e&%ansion of time. "here are se%arate

systems of classification for each ty%e of loan. 5ach baning institution ha$e de$elo% there o(n

system of loan classification.

D:

0ending Ri1k .naly1i1 90R.:

+,A is the combination of analysis of $arious ty%es of riss that may occur (hile a loan

ha$e sanctioned. "his is an analysis of the measurement of %erformance of a com%any or

indi$iduals. )hen a loan has been %ro$ided by the ban then all ty%es of riss ha$e to

calculate. "his is not easy to e&%ress all the %ros and corns of +,A are not %ossible in this

re%ort. Before sanctioning a loan it is necessary to analy#e the +,A. IFI* Ban has

formatted this analysis (hich contains se$eral sheets of analysis to identify the strength and

(eaness and the re%ayment %robability of the lending.

>ere sho(s the sim%le flo( chart of +,A (here considering the business ris, com%any

ris, industry and management ris in the follo(ingJ

-igure) ShoB1 the Co3$onent1 that analy6ed in the 0R.

+5-/I-4 ,I!.

A-A+P!I!

Business ,is

Industry ,is

Industry ,is

*om%any ,is

*om%any

Management ,is

!ecurity ,is

!u%%ly ,is

!ales ,is

;erformance ,is

,eliance ,is

Mgt. *om%etence ,is

Mgt. Integrity Mgt.

*om%etence ,is

!ecurity *ontrol ,is

!ecurity *o$er ,is

D9

.1A.2 -oreign +@change

Introduction

A %erson li$ing in /haa city can mae %ayment to another in *hittagong (ith money or by

*heHues on any ban of the country. !uch %ayments do not %resent any %roblems. But

things are different (hen the debtor and the creditor li$e in different country. )hen a trader

from /haa city im%orts goods from -e( Por, the %ayment in$ol$es certain com%lication.

"he /haa man can %ay in taa but taa is of no use to -e( Por e&%orter. "here must be

some means of changing taa into dollar. =b$iously the inter$ention of a third %arty is

reHuired. !o there is a need for a foreign e&change mechanism.

&oreign e*change refers to the process or mechanism by which the currency of one country

is converted into the currency of another country. &oreign e*change is the means and

methods by which rights to wealth in a country@s currency are converted into rights to

wealth in another country@s currency.

+A.(. C<#B'<>(C

In terms of foreign e*change regulation Act 1D9E, as ada%ted in Bangladesh,

foreign e*change means foreign currency and includes all deposits. credits and balances

payable in foreign currency as well as all foreign currency instruments such as1 drafts1

travelers Che%ues1 and bills of e*change in any foreign country.

.1A. -oreign +@change 3arket and Banglade1h

"he statute for administration of foreign currency in Bangladesh is the foreign e&change

regulation Act, 19@A as ada%ted in Bangladesh. Gnder this Act, the res%onsibility and

authority of administration of foreign e&change is $ested by the go$ernment (ith the

Bangladesh ban.

)hile the Bangladesh ban has full authority to administer foreign e&change in Bangladesh,

it cannot do so by itself. "his is not %ossible for Bangladesh ban to deal (ith a large

number of e&%orters and im%orters indi$idually. "herefore, %ro$ision has been made in the

act, enabling the Bangladesh ban to delegate its %o(ers of functions to authori#ed dealers.

0C

.uthori6ed Dealer1 9.D:

In administering e&change control and foreign trade, *entral Ban of the country

(Bangladesh Ban) authori#es fe( branches of commercial bans to deal in foreign

e&change. "hese branches are no(n as UAuthori#ed /ealersV. "hey act as an agent of the

*entral Ban and (or under the UForeign 5&change ,egulations Act719@AV and

U4uidelines for Foreign 5&change "ransactions7Folume 1 ' 1V %rescribed by Bangladesh

Ban.

.1A.1A -oreign +@change De$art3ent)

"he IFI* Ban deals (ith foreign e&change (ith good(ill for a long time. It is handling of

foreign e&change closer to t(enty (1C) years. -o(adays 10 branches of this ban are

authori#ed to deal foreign e&change by Bangladesh Ban.

IFI* BA-. offers t(o ty%es of credit facilities to its customers. !uch as7

a) Funded *redit and

b) -on Funded *redit

a: -unded Credit )