Professional Documents

Culture Documents

Text File

Uploaded by

Gan Inn SiangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Text File

Uploaded by

Gan Inn SiangCopyright:

Available Formats

Smith and Keenan's

COMPANY LAW

Also available:

Smith and Keenan's ENGLISH LAW

Smith and Keenan's ADVANCED BUSINESS LAW

Keenan and Riches' BUSINESS LAW

Smith and Keenan's

COMPANY LAW

Charles Wild

PhD, MBA, LLM, PCHE, LPC, CPE, BSc (Econ) Head of the School of Law at the Unive

rsity of Hertfordshire Head of the Centre for International Law, University of H

ertfordshire

Stuart Weinstein

JD, MBA, BA Associate Head (Professional), School of Law, University of Hertford

shire Solicitor, Supreme Court of England and Wales Attorney-at-Law, New York, C

alifornia, District of Columbia

Pearson Education Limited

Edinburgh Gate Harlow Essex CM20 2JE England

and Associated Companies throughout the world

Visit us on the World Wide Web at:

www.pearsoned.co.uk

First published under the Pitman imprint in 1966 Second edition published 1970 T

hird edition published 1976 Fourth edition published 1981 Fifth edition publishe

d 1983 Sixth edition published 1986 Seventh edition published 1987 Eighth editio

n published 1990 Ninth edition published 1993 Tenth edition published 1996 Eleve

nth edition published 1999 Twelfth edition published 2002 Thirteenth edition pub

lished 2005

Fourteenth edition published 2009

Kenneth Smith and Denis Keenan 1966 Denis Keenan and Mrs K Smith 1970, 1983 Deni

s Keenan 1987, 2005 Mary Keenan, Charles Wild and Stuart Weinstein 2009

The rights of Charles Wild and Stuart Weinstein to be identified as authors of t

his work have been asserted by them in accordance with the Copyright, Designs an

d Patents Act 1988.

All rights reserved. No part of this publication may be reproduced, stored in a

retrieval system, or transmitted in any form or by any means, electronic, mechan

ical, photocopying, recording, or otherwise, without either the prior written pe

rmission of the publisher or a licence permitting restricted copying in the Unit

ed Kingdom issued by the Copyright Licensing Agency Ltd, Saffron House, 610 Kirby

Street, London EC1N 8TS.

All trademarks used herein are the property of their respective owners. The use

of any trademark in this text does not vest in the author or publisher any trade

mark ownership rights in such trademarks, nor does the use of such trademarks im

ply any affiliation with or endorsement of this book by such owners.

Crown Copyright material is reproduced with the permission of the Controller of

HMSO and the Queen's Printer for Scotland.

Law Commission Reports are reproduced under the terms of the Click-Use Licence.

ISBN: 978-1-4058-4613-4

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library.

Library of Congress Cataloging-in-Publication Data

Wild, Charles. Smith and Keenan's company law / Charles Wild, Stuart Weinstein. 14

th ed.

p. cm.

Rev. ed. of: Smith & Keenan's company law / Denis Keenan. 13th ed. 2005.

ISBN 978-1-4058-4613-4 (pbk.)

1. Corporation lawEngland. 2. Corporation lawWales. I. Weinstein, Stuart. II.

Keenan, Denis J. Smith & Keenan's company law. III. Title. IV. Title: Company law.

KD2079.S55 2009 346.42066dc22

2009005370

10987654321 13 12 11 10 09

Typeset in 10/12.5pt Minion by 35 Printed by Ashford Colour Press Ltd, Gosport

The publisher's policy is to use paper manufactured from sustainable forests.

Brief contents

Guided tour xiv Preface to the fourteenth edition xvii Law report abbreviations

xviii Table of cases xix Table of statutes xxxi

1 The nature of a company 1 2 Promotion and incorporation 44 3 The constitution

of the company the memorandum of association 66 4 The constitution of the compa

ny the articles of association 80 5 The constitution of the company altering the

articles 94 6 The company and its contracts 104 7 The capital of a company 118

8 Capital maintenance generally 133 9 Capital maintenance company distributions

159 10 Company flotations 175 11 Shares generally 188 12 Shares transfer and tra

nsmission 205 13 Shares payment for and insider dealing 220 14 Membership capaci

ty, registration, director and substantial holdings, annual return 237 15 The st

atutory derivative action 250 16 The protection of minorities 268 17 Directors a

nd management generally 286 18 Financial arrangements with, and fair dealing by,

directors 312 19 The duties of directors 330 20 Vacation of office, disqualific

ation and personal liability 353 21 Meetings and resolutions 380 22 Debentures a

nd charges 415 23 Accounts and audit 441 24 Amalgamations, reconstructions and t

akeovers 468

25 Corporate insolvency company rescue 489

26 Corporate insolvency procedures other than rescue 513

27 Corporate insolvency winding-up in context 524

Answers to test your knowledge questions 548 <BR><BR>Index 550 <BR><BR>

Contents

Guided tour xiv Preface to the fourteenth edition xvii Law report abbreviations

xviii Table of cases xix Table of statutes xxxi

1 The nature of a company 1

General features 2 Classification of corporations the company as a corporation

3 Classification of registered companies 7 Lifting the corporate veil 22 Compani

es and partnerships compared 31 The ordinary and limited partnership 31 Limited

liability partnerships the Act 33 Limited liability partnerships the regulations

34 LLP or private limited company? a checklist 37 Reform an ordinary partnershi

p with legal personality 38 Advantages and disadvantages of incorporation 39 Com

panies and human rights 40 Essay questions 41 Test your knowledge 42 2 Promotion

and incorporation 44 The promoter 45 Incorporation 54 Electronic incorporation

57 Effect of incorporation 57 Ready-made companies 58 Publicity in connection wi

th incorporation 58 Post-incorporation procedures for re-registration 59 Essay q

uestions 63 Test your knowledge 64 3 The constitution of the company the memoran

dum of association 66

Company names 67 The objects clause 71 Capital 75 The registered office 76 Essay

questions 77 Test your knowledge 79

4 The constitution of the company the articles of association 80 The legal effec

t of the articles 82 The articles and insider/outsider rights 85 The effect of t

he Contracts (Rights of Third Parties) Act 1999 89 Shareholders' agreements 90 Ess

ay questions 92 Test your knowledge 93

5 The constitution of the company altering the articles 94

Breaches of contract arising out of alteration of the articles 100 Alteration of

the articles by the court 102 Essay questions 103

6 The company and its contracts 104

Public companies and the s 761 certificate 105 Directors and others as agents 10

6 Essay questions 115 Test your knowledge 116

7 The capital of a company 118

Ordinary shares 121 Preference shares 121 Variation and abrogation of class righ

ts 125 Alteration of share capital 127 Redeemable shares 128 Essay questions 131

Test your knowledge 131

8 Capital maintenance generally 133

Reduction of capital 134 Acquisition of own shares generally 139 Purchase of own

shares 141 Financial assistance for the purchase of shares 149 Essay questions

156 Test your knowledge 157

9 Capital maintenance company distributions 159

Profits available for distribution generally 160 What is a distribution? 160 Pro

fits available public and private companies 161 Realised profits and accounting

standards 162 Related statutory rules 163 Special cases 165 Relevant accounts 16

5 Audit considerations 165 Declaration and payment of dividends 166 Consequences

of unlawful distribution 169 Capitalising profits 170 Reserves 171 Essay questi

ons 171 Aid to learning on distributions 172

10 Company flotations 175

The official system for listing securities on an investment exchange 176 Offers

of unlisted securities 181 The remedy of rescission 181 Procedures for issuing s

hares 182 Underwriting 182 Brokerage 184 Reform 184 Essay questions 185 Test you

r knowledge 186

11 Shares generally 188

Subscribers' contract 189 Allotment 190 Return of an allotment 192 Share certifica

tes 193 Share warrants (or bearer shares) 195 Calls 196 Mortgages of shares 197

Lien 199 Forfeiture of shares 200 Surrender of shares 201 Essay questions 202 Te

st your knowledge 203

12 Shares transfer and transmission 205

Transfer of unlisted shares 206 Transfer of listed shares 208 Companies whose ar

ticles restrict transfer 211 Transmission of shares 216 Trustees 217 Essay quest

ions 217 Test your knowledge 218

13 Shares payment for and insider dealing 220

The consideration generally 221 Prohibition on allotment of shares at a discount

225 Shares issued at a premium 226 Insider dealing 229 Market abuse 231 Model C

ode for Securities Transactions by directors of listed companies 233 Essay quest

ions 234 Test your knowledge 235

14 Membership capacity, registration, director and substantial holdings, annual

return 237

Capacity 238 The register of members 239 Director and substantial shareholdings

243 The annual return 245 Essay questions 247 Test your knowledge 248

15 The statutory derivative action 250

The s 33 contract revisited 252 Shareholders' agreements 252 The rule in Foss v Ha

rbottle 253 The statutory derivative action 262 Essay questions 266 Suggested fu

rther reading 267

16 The protection of minorities 268

Statutory protection against unfair prejudice 269 Minority petition for a just a

nd equitable winding-up 281 Essay questions 283 Test your knowledge 284 Suggeste

d further reading 285

17 Directors and management generally 286

Definition 287 Appointment of directors 289 Directors' share qualification 299 Div

ision of power directors and members 300 The chairman and executive directors 30

4 Directors as agents 306 Publicity in connection with directors 306 The secreta

ry 307 The company accountant 310 Essay questions 310 Test your knowledge 310

18 Financial arrangements with, and fair dealing by, directors 312

Remuneration 313 Expenses 318 Pensions 318 Compensation for loss of office 319 F

air dealing by directors 319 Essay questions 328 Test your knowledge 328

19 The duties of directors 330

The CA 2006 codifies the general duties of directors 331 Duties of directors to

the company 331 Ministerial `eight-point guidance' 332 Specific duties set forth in

the CA 2006 333 Fiduciary duties 333 Duties of skill and care 338 Duties to empl

oyees 341 Duties of directors to shareholders 343 Duties to creditors 345 Duties

of directors to other outsiders 346 Effects of a breach of duty 347 Directors a

nd political donations 348 The FSA Listing Rules a combined code 349 Essay quest

ions 349 Test your knowledge 351

20 Vacation of office, disqualification and personal liability 353

Expiration of the period of office 354 Removal under statute 355 Removal under t

he articles 356 Statutory removal restrictions 357 Resignation 358 Winding-up 35

8 Appointment of an administrator/administrative receiver 359 Disqualification g

enerally 360 Disqualification by the court and personal liability 361 Disqualifi

cation only 361 Disqualification and personal liability 366 Personal liability o

nly 372 Human rights and directors 374 Essay questions 376 Test your knowledge 3

78

21 Meetings and resolutions 380

General meetings of the company 381 Notice of meetings 385 Procedure at meetings

legal aspects 390 The chairman 392 Voting 393 Proxies 395 Adjournment of the me

eting 397 Minutes 398 Class meetings 399 Company meetings and the disabled 399 B

oard meetings 400 Resolutions generally 402 Ordinary resolutions requiring speci

al notice 405 Amendments 405 Written resolutions for private companies (s 288, C

A 2006, et seq.) 407 Elective resolutions of private companies 408 Meetings of s

ingle-member companies 409 Electronic communications CA 2006 409 Essay questions

412 Test your knowledge 413

22 Debentures and charges 415

Power to borrow 416 Debentures generally 416 Types of debentures 417 Acquisition

of debentures 420 The trust deed 421 Company charges 423 Crystallisation of flo

ating charges 425 Postponement of floating charges 426 Validity of charges 431 R

egistration of charges 431 Company's register 434 Avoidance of floating charges 43

5 Preference 437 Remedies of secured debenture holders 437 Essay questions 438 T

est your knowledge 439

23 Accounts and audit 441

Small and medium-sized companies 442 Accounting records 444 Annual accounts 445

Group accounts 448 The directors' report 449 Publication of accounts and reports 4

51 Filing of accounts and reports 452 Auditors 454 Duties of auditors 457 Rights

of auditors 457 Information and the Companies (Audit, Investigations and Commun

ity Enterprise) Act 2004 457 Duty of care of the auditor 458 Auditors' liability 4

61 Essay questions 465 Test your knowledge 466

24 Amalgamations, reconstructions and takeovers 468

Generally 469 Amalgamations and reconstructions 470 Amalgamation (or reconstruct

ion) under the Insolvency Act 1986, s 110 471 Amalgamation (or reconstruction) u

nder the CA 2006, s 895 472 Takeovers 476

Essay questions 485 Test your knowledge 487

25 Corporate insolvency company rescue <BR>489

Voluntary arrangements 490 Administration 498 Essay questions 510 Test your know

ledge 511

26 Corporate insolvency procedures other than rescue 513

Receiverships 514 Winding-up 514 Compulsory winding-up 515 Voluntary winding-up

515 Members' voluntary winding-up 516 Creditors' voluntary winding-up 518 Alternativ

es to winding-up 520

27 Corporate insolvency winding-up in context <BR>524

Winding-up by the court 525 Voluntary winding-up 531 The duties of a liquidator

533 Compulsory winding-up by a company in voluntary liquidation 543 Essay questi

ons 544 Test your knowledge 546

Answers to test your knowledge questions 548 Index 550

Visit the Company Law, fourteenth edition mylawchamber site at www.mylawchamber.

co.uk/keenancompany to access valuable learning material.

FOR STUDENTS

Companion website support

l Use the model answers to questions in the book and additional problem qu

estions to test yourself on each topic throughout the course.

l Use the updates to major changes in the law to make sure you are ahead o

f the game by knowing the latest developments.

l Use the live weblinks to help you read more widely around the subject, a

nd really impress your lecturers.

Guided tour

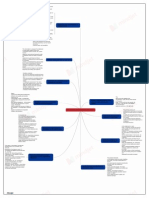

Topic Maps start of chapter topic maps are used throughout to illustrate complex

legal structures and processes explained in the chapter ahead.

Case Summaries throughout chapters essential case summaries explain key decision

s in Company Law clearly explaining the decision.

Essay Questions end of chapter essay questions allow you to hone your essay writ

ing skills whilst asking you to consider carefully what you have learnt from you

r chapter reading. Answer guidance may be found on the website.

Test your Knowledge end of chapter Test your Knowledge sections challenge you to

check that you understand each topic fully. Answers can be found at the back of

the book.

Visit the Company Law, fourteenth edition mylawchamber site at www.mylawchamber.

co.uk/keenan company to access:

l Companion website support: Use the model answers to questions in the boo

k and additional problem questions to test yourself on each topic throughout the

course. The website includes updates to major changes in the law to make sure y

ou are ahead of the game, and weblinks to help you read more widely around the s

ubject.

Preface to the fourteenth edition

The production of this edition has been an enjoyable and rewarding process, alth

ough it has also proved to be a signicant undertaking for a variety of reasons. F

irst of all, we have faced the considerable responsibility of taking over editor

ship of the text from Denis Keenan, who had been its driving force since 1966. O

ver the years Denis had built up a loyal following of students, academics and pr

ofessionals who valued his concise, accessible and informative style. A priority

for us throughout has been to continue this legacy.

Secondly, the introduction of the Companies Act 2006 has, quite understandably,

required a considerable reworking of the thirteenth edition in order to incorpor

ate the changes brought about by the new Act, not only in terms of basic section

numbering but more fundamentally in terms of its approach to corporate regulati

on at the small and medium-sized company level. We have also sought to include c

ase law that has already begun to emerge, as well as a selection of references t

o academic articles, so as to ensure that the text is as up to date as possible

for the reader.

In many respects, this links with the nal and most challenging hurdle that we hav

e faced in writing this edition. As academics we both have our own particular ar

eas of interest and, understandably, seek to explore those aspects of company la

w which we enjoy researching, supervising and lecturing. However, we are also ve

ry much aware that a text which is aimed at both a legal and non-legal audience

must enable the reader to explore as much, or as little, of a particular topic a

s s/he wishes to undertake. We hope that the reader nds this edition as enjoyable

to read as it has been for us to produce.

This edition includes an extended analysis of the statutory contract and the con

stitution of a company, both of which are central to an understanding of company

law and which have been the subject of change under the 2006 Act. We have also

taken the opportunity to explore in greater detail the area of minority protecti

on, another facet of corporate law which is at the heart of this subject area bu

t that can lead to confusion if taken in isolation and separated from broader th

emes such as majority rule, the separate legal identity of a company and the not

ion of the proper plaintiff. In addition, the chapters on company accounts, the

auditing process and insolvency law have been reworked so as to provide the read

er with greater detail and insight into the processes involved.

We would like to thank those members of staff at Pearson Education who have help

ed produce this edition, particularly Zoe Botterill, Acquisitions Editor Law, an

d Katherine Cowdrey. Our thanks are also due to those who designed, set, printed

and bound the book.

We would also like to thank our respective families who have shown considerable

patience and understanding over the past few months. The production of any text

requires a signicant support network and for that we are both truly grateful.

Any errors and omissions at the level at which the text is aimed are down to the

authors.

Charles Wild and Stuart Weinstein March 2009

Law report abbreviations

The following table sets out the abbreviations used when citing the various seri

es of certain law reports which are in common use, together with the periods ove

r which they extend.

AC Law Reports, Appeal Cases, 1891(current)

ATC Annotated Tax Cases, 192275

All ER All England Law Reports, 1936(current)

All ER (D) All England Direct (an online service)

All ER Rep All England Law Reports Reprint, 36 vols 15581935

App Cas Law Reports, Appeal Cases, 15 vols 187590

BCC British Company Law and Practice (CCH editions)(current)

BCLC Butterworths Company Law Cases, 1983(current)

B & CR Reports of Bankruptcy and Companies Winding-up Cases, 1918(current)

CL Current Law Monthly Digest, 1947(current)

CLJ Cambridge Law Journal

CLY Current Law Yearbook, 1947(current)

CMLR Common Market Law Reports, 1962(current)

Ch Law Reports Chancery Division, 1891(current)

Com Cas Commercial Cases, 18951941

Fam Law Reports Family Division, 1972(current)

ICR Industrial Court Reports, 197274; Industrial Cases Reports, 1974 (current)

IRLB Industrial Relations Law Bulletin, 1993(current)

IRLR Industrial Relations Law Reports, 1971(current)

ITR Reports of decisions of the Industrial Tribunals, 1966(current)

KB Law Reports, King's Bench Division, 190152

LGR Local Government Reports, 1902(current)

Lloyd LR or Lloyd's List Law Reports, 1919(current)

(from 1951)

Lloyd's Rep

LRRP Law Reports Restrictive Practices, 1957(current)

LSG Law Society Gazette Reports

NLJ New Law Journal

P Law Reports, Probate, Divorce and Admiralty Division, 18911971

P & CR Planning and Compensation Reports, 1949(current)

PIQR Personal Injuries and Quantum Reports

QB Law Reports Queen's Bench Division, 18911901; 1953(current)

SJ Solicitors' Journal, 1856(current)

STC Simon's Tax Cases, 1973(current)

Tax Cas (or TC) Tax Cases, 1875(current)

TLR Times Law Reports, 18841952

WLR Weekly Law Reports, 1953(current)

xviii

Table of cases

A & B C Chewing Gum Ltd, re [1975] 1 All ER 1017 291

ABC Coupler & Engineering Ltd, re [1961] 1 All ER 354 527

Abbott v Strong (1998) The Times, 9 July

462

Accidental Death Insurance Co, Allin's Case, re (1873) LR 16 Eq 449 213

Adams v Cape Industries [1990] Ch 433 1, 7, 23

Adair v Old Bushmills Distillery [1908] WN 24 122

Adelaide Electric Co v Prudential Assurance [1934] AC 122 125

Advantage Healthcare (T10) Ltd, re [1999] All ER (D) 1294 433

Aerators Ltd v Tollitt [1902] 2 Ch 319 69

Airey v Cordell [2006] EWHC 2728 (Ch)

264

Agnew v Inland Revenue [2001] All ER (D) 21 424, 425

Al-Nakib Investments (Jersey) Ltd v Longcroft [1990] 3 All ER 321 180

Al Saudi Banque v Clarke Pixley [1989] 3 All ER 361 462

Alexander v Automatic Telephone Co [1900] 2 Ch 56 297

Allen v Gold Reefs of West Africa Ltd [1900] 1 Ch 656 94, 95, 96, 99, 120

Allen v Hyatt (1914) 30 TLR 444 345

Allied Carpets Group plc v Nethercott [2001] BCC 81 170

Allin's Case see Accidental Death Insurance Co, Allin's Case, re

Aluminium Industrie Vaassen BV v Romalpa Aluminium [1976] 2 All ER 552 428, 429

American Cyanamid Co v Ethicon [1975] AC 396 429

Anglesey Colliery Co, re (1886) 1 Ch App 555 526

Anglo-American Insurance Ltd [2001] 1 BCLC 755 473

Antal International Ltd [2003] EWHC 1339 (Ch), [2003] 2 BCLC 406 509

Arab Bank plc v Mercantile Holdings Ltd [1994] 1 All ER 74 155

Arthur Rathbone Kitchens Ltd, re [1997] 2 BCLC 280 493

Ashbury Railway Carriage and Iron Co v Riche (1875) LR 7 HL 653 71, 74

Ashpurton Estates Ltd, re [1982] 3 All ER 665 434

Asprey & Garrard Ltd v WRA (Guns) Ltd (2001) High Court 18 May unreported

68

ASRS Establishement Ltd, re (1999) The Times, 17 November 423

Astec (BSR) plc, re [1999] 2 BCLC 556 275276, 277

Atlas Wright (Europe) Ltd v Wright and Wright (1999) The Times, 3 February

296

Attorney General's Reference (No 2 of 1982) [1984] 2 All ER 216 5

Attorney-General v Lindi St Claire (Personal Services) Ltd [1981] 2 Co Law 69 57

, 67

Baber v Kenwood Manufacturing Co [1978] 1 Lloyd's Rep 175 459

Baily v British Equitable Assurance Co Ltd [1904] 1 Ch 374 100

Bairstow v Queens Moat Houses plc, High Court [2000] 1 BCLC 549 170

Baker v Gibbons [1972] 2 All ER 759 336

Ball v Eden Project Ltd, Eden Project v Ball [2001] 1 BCLC 313 336

Bamford v Bamford [1969] 2 WLR 1107 303, 347

Bank of Credit and Commerce International (No 8), re [1997] 4 All ER 568 432

Barclays Bank plc v Ellis (2000) The Times, 24 October 41

Barclays Bank v Stuart London Ltd [2001] 2 BCLC 316 434

Bargate v Shortridge (1855) 5 HL Cas 297

114

Beattie v E and F Beattie Ltd [1938] Ch 708 84, 87, 252

Bell Houses Ltd v City Wall Properties Ltd [1966] 2 All ER 674 73

Bell v Lever Bros Ltd [1932] AC 161 336

Bellador Silk, re [1965] 1 All ER 667 271

Bellerby v Rowland & Marwood's SS Co Ltd [1902] 2 Ch 14 201

Belmont Finance v Williams (No 2) [1980] 1 All ER 393 150, 151

Berry and Stewart v Tottenham Hotspur FC Ltd [1935] Ch 718 213

Bersel Manufacturing Co Ltd v Berry [1968] 2 All ER 552 356

Bhullar Bros Ltd, re [2003] All ER (D) 445

335

Biba Group Ltd v Biba Boutique [1980] RPC 413 70

Biosource Technologies Inc v Axis Genetics plc (in administration) [2000] 1 BCLC

286 507

Birch v Cropper (1889) 14 App Cas 525

123

Bird Precision Bellows, re [1984] 2 WLR 869

280

Blackspur Group plc (No 3), in re (2001) The Times, 5 July 366

Blackspur Group plc, re [1997] 1 WLR 710 365, 366

Blaker v Herts & Essex Waterworks (1889) 41 Ch D 399 438

Blue Arrow plc, re [1987] BCLC 585 251, 277, 279

Boardman v Phipps [1967] 2 AC 46 335

Bolam v Friern Hospital Management Committee [1957] 2 All ER 118 163, 463

Bolitho v City and Hackney Health Authority [1997] 4 All ER 771 163, 463

Bonelli's Electric Telegraph Co, Cook's Claim (No 2), re (1874) LR 18 Eq 656

294

Borden (UK) Ltd v Scottish Timber Products Ltd [1979] 3 All ER 961 429

Bowman v Secular Society [1917] AC 406

57

Brac Rent-A-Car International Inc, in re [2003] All ER (D) 98 (Feb) 77, 530, 531

Bradford Banking Co Ltd v Henry Briggs, Son & Co Ltd, The (1886) 12 App Cas 29

199, 243 Bradman v Trinity Estates plc [1989] BCLC 757 388 Brady v Brady [1988]

2 All ER 617 150, 152

Braymist Ltd v Wise Finance Company Ltd (2001) The Times, 27 March 52 Brelec Ins

tallations Ltd, re (2000) The Times, 18 April 493 Briess v Woolley [1954] 1 All

ER 909 345 British Seamless Paper Box Co, re (1881) 17 Ch D 467 49 British Union

for the Abolition of Vivisection, re (1995) The Times, 3 March

382

Brown and Green Ltd v Hays (1920) 36 TLR 330 313

Brown v British Abrasive Wheel Co [1919] 1 Ch 290 257

Browne v La Trinidad (1887) 37 Ch D 1 251, 400

Brumark Case, see Agnew v Inland Revenue Buchan v Secretary of State for Employm

ent (1997) 565 IRLB 2 6, 289, 297, 298, 426

Bugle Press Ltd, re [1960] 3 All ER 791 483

Burland v Earle [1902] AC 83 99, 255

Burns v Siemens Bros Dynamo Works Ltd [1919] 1 Ch 225 241

Bushell v Faith [1969] 1 All ER 1002 80, 119, 301, 355, 389, 405

Byng v London Life Association Ltd (1988) The Times, 22 December 398

C E King Ltd (in administration) [2000] 2 BCLC 297 508

Cadbury Schweppes plc v Simji [2001] 1 WLR 615 492

Cancol Ltd, re [1996] 1 BCLC 100 491

Cannon v Trask (1875) LR 20 Eq 669 383

Caparo Industries v Dickman [1990] 1 All ER 361 180, 441, 462, 463 Cape Breton,

re (1887) 12 App Cas 652 47 Cawley & Co, re (1889) 42 Ch D 209 197 Centrebind, r

e [1966] 3 All ER 889 535 Chapman's Case (1866) LR 1 Eq 346 529 Charge Card Servic

es Ltd, re [1986] 3 All ER 289 432 Chida Mines Ltd v Anderson (1905) 33 TLR 27 3

08 China Jazz Worldwide plc, re [2003] All ER

(D) 66 (Jun) 374 Ciro Citterio Menswear plc v Thakrar [2002] 2 All ER 717 321 Ci

tco Banking Corporation NV v Pusser's Ltd [2007] UKPC 13 99 City Equitable Fire In

surance Co, re [1925] Ch 407 338, 339, 460 Clayton's Case (1816) 1 Mer 572 436 Cle

adon Trust Ltd, re [1939] Ch 286 308 Clemens v Clemens Bros [1976] 2 All ER 268

257, 281, 337 CMS Dolphin Ltd v Simonet Ltd [2001] 2 BCLC 704 336 Cobley v Forwa

rd Technology Industries plc [2003] All ER (D) 175 295 Colt Telecom Ltd, re (20

December 2002) unreported 500 Company (No 002567 of 1982), re a [1983] 2 All ER

854 282 Company (No 004475 of 1982), re a [1983] 2 WLR 381 279 Company (No 00477

of 1986), re a [1986] PCC 372 271, 278 Company (No 004803 of 1996), re a [1996]

The Times, 2 December 371 Company (No 005287 of 1985) re a [1986] 1 WLR 281 274

Company (No 008699 of 1985), re a [1986] PCC 296 281 Company (No 007623 of 1984

), re a [1986] BCLC 362 281 Compaq Computers Ltd v Abercorn Group Ltd (t/a Osiri

s) [1993] BCLC 603 428 Conegrade Ltd, re [2003] BPIR 358 324 Connolly v Sellers

Arenascene Ltd (2000) 633 IRLB 15 6, 298

Consumer and Industrial Press Ltd, re [1988] BCLC 177 498, 508

Conti v Ueberseebank AG [2000] 4 CL 698

522

Continental Assurance Co of London plc, re [1996] 28 LS Gaz 29 365

Contract Corporation, Gooch's Case, re (1872) LR 8 Ch App 266 239

Cook v Deeks [1916] 1 AC 554 256, 258, 260, 302, 336

Cook's Claim (No 2) see Bonelli's Electric Telegraph Co, Cook's Claim (No 2), re

Copal Varnish Co Ltd, re [1917] 2 Ch 349 214

Cotman v Brougham [1918] AC 514 57, 72, 73

Cotronic (UK) Ltd v Dezonie [1991] BCC 200 52

Coulthard v Neville Russell (A Firm) [1998] 1 BCLC 143 155, 462

County Properties Ltd v Scottish Ministers (2000) The Times, 19 September; rever

sed 2002 SC 79 40

Cousins v International Brick Co Ltd [1931] 2 Ch 90 396

Crantrave Ltd (in liquidation) v Lloyds Bank plc [2000] 3 WLR 877 430

Craven Textile Engineers Ltd v Batley Football Club Ltd, Transcript: B2 99/1127,

CA 325

Craven-Ellis v Canons Ltd [1936] 2 KB 403 314

Crichton's Oil Co, re [1902] 2 Ch 86 122

Criterion Properties plc v Stratford UK Properties LLC [2002] 2 BCLC 151 337

Cumbrian Newspapers Group Ltd v Cumberland & Westmorland Herald [1986] 3 WLR 26

80, 94, 118, 119, 278

Currencies Direct Ltd v Ellis [2003] 2 BCLC 482 323

Cyona Distributors, re [1967] 1 All ER 281

536

D'Jan of London, re [1994] 1 BLCL 561 339, 340

Dafen Tinplate Co Ltd v Llanelly Steel Co (1907) Ltd [1920] 2 Ch 124 97, 257

Daimler Co Ltd v Continental Tyre & Rubber Co (Great Britain) Ltd [1916] 2 AC 30

7 28, 76, 308

Daniels v Daniels [1978] 2 All ER 89 255, 259, 260

Daniels v Walker [2000] 1 WLR 1382 41

Danmarks/Bosbaek Case [1998] All ER (EC) 112 428

David Moseley & Sons Ltd [1939] 2 All ER 791 354

Davis v R Bolton & Co [1894] 3 Ch 678 109

De Courcy v Clements [1971] 1 All ER 681

516

Debtor (No 2021 of 1995), ex parte IRC v Debtor, re a [1996] 2 All ER 345 396

Debtor (No 50A SD/95), re a [1997] 2 All ER 789 525

Derry v Peek (1889) 14 App Cas 337 180

Destone Fabrics Ltd, re [1941] 1 All ER 545

436

Development Co of Central and West Africa, re [1902] Ch 547 138

Devlin v Slough Estates Ltd [1982] 2 All ER 273 261

DHN Food Distributors v Tower Hamlets London Borough Council [1976] 3 All ER 462

26, 28

Dimblebey & Sons Ltd v NUJ [1984] 1 All ER 751 26

Dimbula Valley (Ceylon) Tea Co Ltd v Laurie [1961] 1 All ER 769 124

DPP v Dziurzynski (2002) The Times, 8 July

2

Dorchester Finance Co Ltd v Stebbing [1989] BCLC 498 339, 347

Dunderland Iron Ore Co Ltd, re [1909] 1 Ch 446 421

Duomatic Ltd, in re [1969] 2 Ch 365, [1969] 1 All ER 161 37, 91, 296, 313, 319,

348, 407, 534

E W Savory Ltd, re [1951] All ER 1036 122 East v Bennet Bros Ltd [1911] 1 Ch 163

392

East Pant Du United Lead Mining Co Ltd v Merryweather (1864) 2 Hem & M 254

261

Eaton v Robert Eaton Ltd and Secretary of State for Employment [1988] IRLR 83

297

Ebrahimi v Westbourne Galleries [1972] 2 All ER 492 29, 258, 272, 281, 282, 291

EDC v UK [1998] BCC 370 375

Eddystone Marine Insurance Co, re [1893] 3 Ch 9 222, 223

Edwards v Halliwell [1950] 2 All ER 1064 251, 254, 255

EIC Services Ltd v Phipps [2003] 3 All ER 804 107

Elder v Elder & Watson 1952 SC 49 271

El Sombrero Ltd, re [1958] 3 All ER 1 391

Electronics Ltd v Akhter Computers Ltd [2001] 1 BCLC 433 112

Eley v Positive Government Security Life Assurance Co (1876) 1 Ex D 88 84, 87, 8

9, 120, 252

Erlanger v New Sombrero Phosphate Co (1878) 3 App Cas 1218 47

Estmanco (Kilner House) Ltd v Greater London Council [1982] 1 All ER 437 255

Esparto Trading, re (1879) 12 Ch D 191 200

Euro Brokers Holdings Ltd v Monecor (London) Ltd [2003] 1 BCLC 506 91, 407

European Society Arbitration Acts, re (1878) 8 Ch D 679 243

Everson v Secretary of State for Trade and Industry [2000] All ER (EC) 29 427, 4

28

Ewing v Buttercup Margarine Company Ltd [1917] 2 Ch 1 69

Fayed v UK (1994) The Times, 11 October

375

Firedart Ltd, Ofcial Receiver v Fairall, re [1994] 2 BCLC 340 364

Fireproof Doors, re [1916] 2 Ch 142 398

Firestone Tyre & Rubber Co Ltd v Lewellin [1957] 1 All ER 561 27

First Global Media Group Ltd v Larkin [2003] All ER (D) 293 323

Five Minute Car Wash Service Ltd, re [1966] 1 All ER 242 282

Fleming v Secretary of State for Trade and Industry (1998) 588 IRLB 10 6, 298 Fl

itcroft's Case (1882) 21 Ch D 519 169

Folkes Group plc v Alexander [2002] 2 BCLC 254 102

Fomento (Sterling Area) Ltd v Selsdon Fountain Pen Co Ltd [1958] 1 WLR 45

460

Fortune Copper Mining Co, re (1870) LR 10 Eq 390 77

Foss v Harbottle (1843) 2 Hare 461 87, 88, 251, 256, 257, 260, 261, 262, 264, 26

7, 269, 271, 274, 284, 342

Foster v Foster [1916] 1 Ch 532 313

Fowler v Broads Patent Night Light Co [1893] 1 Ch 724 529

Franbar Holdings Ltd v Patel and Others [2008] EWHC 1534 (Ch) 265

Freeman & Lockyer v Buckhurst Park Properties Ltd [1964] 1 All ER 630 104, 111

Galloway v Hall Concerts Society [1915] 2 Ch 233 303, 337

Garage Door Associates, re [1984] 1 All ER 434 279

Gardner v Iredale [1912] 1 Ch 700 223

Gartside v Silkstone and Dodworth Coal and Iron Co Ltd (1882) 21 Ch D 762 417

Gencor ACP Ltd v Dalby [2000] 2 BCLC 734 334

General Auction Estate and Monetary Co v Smith [1891] 3 Ch 432 416

George Newman & Co, re [1895] 1 CH 674

313

Gething v Kilner [1972] 1 All ER 1166, [1972] 1 WLR 337 345, 480

Gilford Motor Co v Horne [1933] Ch 935 24

Gluckstein v Barnes [1900] AC 240 46, 47

Gomba Holdings UK Ltd v Moman [1986] 3 All ER 94 359

Gooch's Case see Contract Corporation, Gooch's Case, re

Goy & Co Ltd, Farmer v Goy & Co Ltd, re [1900] 2 Ch 149 418

Grant v United Kingdom Switchback Railways Co (1888) 40 Ch D 135 301, 302

Table of cases

Gray v Lewis (1873) 8 Ch App 1035 254

Greene, re [1949] 1 All ER 167 206

Greenhalgh v Arderne Cinemas Ltd [1946] 1 All ER 512; [1951] Ch 286 95, 96, 125

Greymouth Point Elizabeth Rail & Coal Co Ltd, re [1904] 1 Ch 32 401

Guinness v Saunders [1990] 1 All ER 652 324, 325

H & K Medway Ltd, Mackay v IRC [1997] 2 All ER 321 430

H and others, re [1996] 2 All ER 391 26

H R Harmer Ltd, re [1958] 3 All ER 689 269, 273, 274

H R Paul & Son Ltd, re (1973) The Times, 17 November 392

Hackney Pavilion Ltd, re [1924] 1 Ch 276 214

Hague v Dandeson (1848) 2 Exch 741 200

Halifax plc v Halifax Repossessions Ltd [2004] 2 BCLC 455 70

Hallet, ex parte National Insurance Co, re [1894] WN 156 217

Halls v David and Another (1989) The Times, 18 February 368

Halt Garage (1964) Ltd, re [1982] 3 All ER 1016 315

Hamlet International plc: re Jeffrey Rogers (Imports) Ltd, re [1998] 95 (16) LSG

24

432

Harmony and Montague Tin and Copper Mining Co, Spargo's Case, re (1873) LR 8 Ch Ap

p 407 221

Hawk Insurance Co Ltd [2001] All ER (D) 289 473

Heald v O'Connor [1971] 1 All ER 1105

149

Hedley Byrne & Co v Heller & Partners [1963] 2 All ER 575 459

Heffer v Secretary of State for Trade and Industry (EAT 355/96) 298

Hellenic and General Trust Ltd, re [1975] 3 All ER 382 25, 473

Hely-Hutchinson v Brayhead [1968] 1 QB 549 114, 325

Henderson v Bank of Australasia (1890) 45 Ch D 330 407

Hennessy v National Agricultural and Industrial Development Association [1947] I

R 159 20

Henry Head & Co Ltd v Ropner Holdings Ltd [1952] Ch 124 227, 228

Hickman v Kent or Romney March Sheepbreeders' Association [1915] 1 Ch 881 80, 82,

83, 84, 87, 88, 252

Hilder v Dexter [1902] AC 474 229

Hillman v Crystal Bowl Amusements [1973] 1 All ER 379 397

Hirsche v Sims [1894] AC 654 195

Hogg v Cramphorn [1966] 3 All ER 420 337

Hoicrest Ltd, re [1999] 2 BCLC 346 207

Holders Investment Trust, re [1971] 2 All ER 289 130

Home & Colonial Insurance Co, re [1929] All ER Rep 231 534

Homer District Consolidated Gold Mines Ltd, ex parte Smith, re (1888) 39 Ch D 54

6 400

Hong Kong & China Gas Co Ltd v Glen [1914] 1 Ch 527 223

Hooley, ex parte United Ordnance and Engineering Co Ltd, re [1899] 2 QB 579

541

Horbury Bridge Coal, Iron & Wagon Co, re (1879) 11 Ch D 109 404

House of Fraser plc v ACGE Investments [1987] 2 WLR 1083 125

HR Paul & Son, re (1973) The Times, 17 November 392

Hutton v West Cork Railway (1883) 23 Ch D 654 315

Indo China Steam Navigation Co, re [1917] 2 Ch 100 308

Industrial Development Consultants v Cooley [1972] 2 All ER 162 257, 334

Inverdeck Ltd, re [1998] 2 BCLC 242 206

Investors Compensation Scheme Ltd v West Bromwich Building Society [1998] 1 BCLC

493 103

IRC v Adams and Partners Ltd [1999] 2 BCLC 730 490

Irvine v Union Bank of Australia (1877) 2 App Cas 366 109 Isaacs v Chapman (1916

) 32 TLR 237 395

Islington Metal and Plating Works, re [1983] 3 All ER 218 538

Ivey v Secretary of State for Employment (1997) 565 IRLB 2 298

J E Cade & Son Ltd, re [1992] BCLC 213

276

J J Harrison (Properties) Ltd v Harrison [2001] 1 All ER (D) 160 337

Jacobus Marler Estates Ltd v Marler (1913) 114 LT 640n 47

James McNaughton Paper Group v Hicks Anderson [1991] 1 All ER 134 462

James v Eve (1873) LR 6 HL 335 290

James v Kent & Co Ltd [1950] 2 All ER 1099

296

JEB Fasteners Ltd v Marks Bloom & Co [1983] 1 All ER 583 441, 464

Jesner v Jarrad (1992) The Times, 26 October 282

John v Rees [1969] 2 All ER 274 398

John Smith's Tadcaster Brewery Co Ltd, re [1953] Ch 308 125

Jones v Bellgrove Properties [1949] 2 All ER 198 310

Jones v Lipman [1962] 1 All ER 442 24

Joseph Holt plc Winpar Holdings Ltd v Joseph Holt Group plc, re [2000] 97 (44),

LSG 44 483

JRRT (Investments) v Haycraft [1993] BCLC 401 207

JSF Finance & Currency Exchange Co Ltd v Akma Solutions Inc [2001] 2 BCLC 307

525

Jubilee Cotton Mills v Lewis [1924] AC 958

58

Jupiter House Investments (Cambridge) Ltd, re [1985] 1 WLR 975 138

Kayford, re [1975] 1 All ER 604 535

Keenan Bros Ltd, re [1985] 1 RLM 641 424

Kelner v Baxter (1866) LR 2 CP 174 50

Kent Coalelds Syndicate, re [1898] 1 QB 754 240

Kenyon Swansea Ltd, re (1987) The Times, 29 April 270

Kerr v Marine Products Ltd (1928) 44 TLR 292 313

Kerr v Mottram [1940] Ch 657 398

King v Crown Energy Trading [2003] EWHC 163 531

Kingston Cotton Mill Co, re [1896] 2 Ch 279 459, 460

Knightsbridge Estates Trust Ltd v Byrne [1940] AC 613 420

Kreditbank Cassel v Schenkers Ltd [1927] 1 KB 826 113

Kripps v Touche Ross [1997] 163

Kudos Glass Ltd (in liquidation), re [2001] 1 BCLC 390 493

Kushler, re [1943] 2 All ER 22 437

Lagunas Nitrate Co v Schroeder (1901) 85 LT 22 167

Lander v Premier Pict Petroleum Ltd [1998] BCC 248 319

Lee (Catherine) v Lee's Air Farming Ltd [1960] 3 All ER 420 5, 298

Lee v Chou Wen Hsian [1984] 1 WLR 1202

356

Lee v Lee's Air Farming Ltd [1960] 3 All ER 420 298

Leeds and Hanley Theatres of Varieties Ltd, re [1902] 2 Ch 809 47, 48

Leeds Estate, Building and Investment Co v Shepherd (1887) 36 Ch D 787 459

Legal Costs Negotiators Ltd [1998] CLY 695 272, 273

Leon v York-O-Matic [1966] 3 All ER 277

534

Lewis v Inland Revenue Commissioners (2000) The Times, 15 November

537

Lewis's Case see Lundy Granite Co, Lewis's Case, re

Liquidator of West Mercia Safetywear Ltd v Dodd [1988] BCLC 250 345

Lister v Ronford Ice and Cold Storage Co [1957] 1 All ER 125 338

Lloyd Cheyham & Co v Littlejohn & Co [1987] BCLC 303 163, 463

Loch v John Blackwood Ltd [1924] AC 783

281

Table of cases

Lomax Leisure Ltd, re [1999] 1 All ER 22

507

London and County Coal Co, re (1866) LR 3 Eq 355 282

London and General Bank, re [1895] 2 Ch 166 458

London Flats Ltd, re [1969] 2 All ER 744 391, 392, 517

London School of Electronics, re [1985] 3 WLR 474 261, 280, 281

Loquitor Ltd, IRC v Richmond, re [2003] STC 1394 170

Lowry v Consolidated African Selection Trust Ltd [1940] 2 All ER 545 229

Lubin, Rosen & Associates [1975] 1 All ER 577 544

Lucania Temperance Billiard Halls (London) Ltd, re [1966] Ch 98 136

Lundy Granite Co, Lewis's Case, re (1872) 26 LT 673 313, 316

Lyle & Scott Ltd v Scott's Trustees [1959] 2 All ER 661 212

Macaura v Northern Assurance Co Ltd [1925] AC 619 5, 189

MacDougall v Gardiner (1875) 1 Ch D 13 254

Mackenzie & Co Ltd, re [1916] 2 Ch 450 387

Macpherson v European Strategic Bureau Ltd [2000] 2 BCLC 683 160, 346

Macro v Thompson [1997] BCLC 626 212

Mahoney v East Holyford Mining Co (1875) LR 7 HL 869 109

Manton v Brighton Corporation [1951] 2 All ER 101 302

Marini Ltd (liquidator of Marini Ltd) v Dickinson [2003] EWHC 334 170

Marquis of Bute's case [1892] 2 Ch 100 338

McConnell v Prill [1916] 2 Ch 57 388

McKays Case see Morvah Consols Tin mining Co, McKays Case, re

McLean v Secretary of State for Employment (1992) 455 IRLIB 14 297

Menier v Hooper's Telegraph Works Ltd (1874) 9 Ch App 350 256, 258

Mercer v Heart of Midlothian plc 2001 SLT 945 319

Metropolitan Coal Consumers' Association v Scrimgeour [1895] 2 QB 604 184 Migratio

n Services International Ltd, in re [2000] 1 BCLC 666 373 Mission Capital plc v

Sinclair and Another [2008] All ER (D) 225 (Mar) 265, 266 Mitchell v City of Gla

sgow Bank (1879) 4 App Cas 624 21 Mitchell v Hobbs (UK) Ltd v Mill [1996] 2 BCLC

102 305 Modelboard Ltd v Outer Box Ltd (in liquidation) [1993] BCLC 623 428 Mon

d v Hammond Suddards [2000] Ch 405

537 Moore v Gadd [1997] 8 LSG 27 368 Moorgate Mercantile Holdings, re [1980]

1 All ER 40 406 Morgan Crucible Co plc v Hill Samuel Bank Ltd [1991] 1 All ER 14

8 462 Morgan v Gray [1953] 1 All ER 213, [1953] Ch 83 216, 393 Morgan v Morgan I

nsurance Brokers Ltd [1993] BCC 145 384 Morphites v Bernasconi [2003] 2 BCLC 533

367

Morris v Banque Arabe et Internationale D'Investissement SA (No 2) (2000) The Time

s, 26 October 367

Morris v Kanssen [1946] 1 All ER 586 114 Morvah Consols Tin Mining Co, McKays Ca

se, re (1875) 2 CH D 1 308 Mosely v Koffyfontein Mines Ltd [1904]

2 Ch 108 225, 421 Moss v Elphick [1910] 1 KB 846 33 Mossmain Ltd, re [1986] Fina

ncial Times,

27 June 281 Moxham v Grant [1900] 1 QB 88 169 Multinational Gas and Petrochemica

l Co v

Multinational Gas and Petrochemical Services Ltd [1983] 2 All ER 563 26, 259

Musselwhite v C H Musselwhite & Sons Ltd [1962] Ch 964 387

Natal Land and Colonization Co v Pauline Colliery and Development Syndicate [190

4] AC 120 54

National Motor Mail Coach Co Ltd, Clinton's Claim, re [1908] 2 Ch 515 50

Nelson v James Nelson & Sons Ltd [1914] 2 KB 770 101

Neptune (Vehicle Washing Equipment) Ltd, re (1995) The Times, 2 March 325

New British Iron Co, ex parte Beckwith, re [1898] 1 Ch 324 85, 89

New Bullas Trading Ltd, re [1994] 1 BCLC 485 424

New Eberhardt Co ex parte Menzies, re (1889) 43 Ch D 118 189

Newhart Developments Ltd v Co-operative Commercial Bank Ltd [1978] 2 All ER 896

359, 360

NFU Development Trust Ltd [1973] 1 All ER 135 470, 473 Norman v Theodore Goddard

[1992] BCLC 1028 339 Northern Engineering Industries plc, re [1993] BCLC 1151 1

34 North-West Transportation Co Ltd v Beatty (1887) 12 App Cas 589 99, 303, 341

Nottingham General Cemetary Co, re [1955] 2 All ER 504 541 Nurcombe v Nurcombe [

1985] 1 All ER 65

261

O'Neill and Another v Phillips and Others [1999] 1 WLR 1092 85, 251, 276, 277

Oakdale (Richmond) Ltd v National Westminster Bank plc [1997] 1 BCLC 63

424

Ocean Coal Co Ltd v Powell Duffryn Steam Coal Co Ltd [1932] 1 Ch 654 212 Oliver

v Dalgleish [1963] 3 All ER 330 395, 396

Ooregum Gold Mining Co of India v Roper [1892] AC 125 221 Ord v Belhaven Pubs Lt

d [1998] 2 BCLC

447 7

Ossory Estates plc, re [1988] BCLC 213 224 Otton v Secretary of State for Employ

ment (1995) 7 February EAT 1150/94 297

P v F Ltd [2001] NLJR 284 240 Pamstock Ltd, re [1994] 1 BCLC 716 363

Panorama Developments (Guildford) Ltd v Fidelis Furnishing Fabrics Ltd [1971] 3

All ER 16 111, 308

Pantone 485 Ltd, Miller v Bain, re [2002] 1 BCLC 266 341

Park House Properties Ltd, re [1997] 2 BCLC 530 364

Parke v Daily News Ltd [1962] Ch 927 342

Parkes Garage (Swadlincote) Ltd, re [1929] 1 Ch 139 437

Patent Floor Cloth Co, re (1872) LT 467 538

Pavlides v Jensen [1956] 2 All ER 518 255, 259, 260, 262

Payne v The Cork Co Ltd [1900] 1 Ch 308 472

Peachdart Ltd, re [1983] 3 All ER 204 429

Pearce Duff Co Ltd, re [1960] 3 All ER 222

386

Pedley v Inland Waterways Association Ltd [1977] 1 All ER 209 301, 357

Peel v L & NW Railway [1907] 1 Ch 5 396

Pelling v Families Need Fathers Ltd [2003] [2002] 1 All ER 440 240

Pender v Lushington (1877) 6 Ch D 70 84, 89, 254

Penrose v Ofcial Receiver [1996] 2 All ER 96 373

Percival v Wright [1902] 2 Ch 421 230, 231, 342

Peskin v Anderson [2001] 1 BCLC 372

344

Peso Silver mines Ltd (NPL) v Cropper (1966) 58 DLR (2d) 1 336

Philip Morris Products Inc v Rothmans International Enterprises Ltd (No 2) (2000

) The Times, 10 August 481

Phillips v Manufacturers' Securities Ltd (1917) 116 LT 290 98

Phonogram Ltd v Lane [1981] 3 All ER 182 50, 53

Platt v Platt [1999] 2 BCLC 745 344

PNC Telecom plc v Thomas [2003] BCC 202 384, 396

Polly Peck International plc (in administration) v Henry [1999] 1 BCLC 407 510

Polly Peck International plc (in administration), re [1996] 2 All ER 433 26

Pool Shipping Ltd, re [1920] 1 Ch 251 215

Popely v Planvarrie Ltd [1996] 5 CL 104

214

Portbase (Clothing) Ltd, Mond v Taylor, re [1993] 3 All ER 829 423, 430

Possfund Custodian Trustee Ltd v Victor Derek Diamond [1996] 2 All ER 774 181

Powdrill v Watson [1995] 1 AC 394 509

Power v Sharp Investments Ltd [1993] BCC 609 425

Practice Direction [2002] 3 All ER 95 501

Precision Dippings Ltd, re [1985] 3 WLR 812 166

Produce Marketing Consortium Ltd, in re [1989] 3 All ER 1 367

Prudential Assurance Co Ltd v Newman Industries Ltd [1980] 2 All ER 84 125, 256,

258

Prudential Assurance v Newman (No 2) [1982] 1 All ER 354 261, 302, 345

Punt v Symons & Co Ltd [1903] 2 Ch 506 100, 101

Quin & Axtens v Salmon [1909] AC 442 80, 86, 87, 89, 252

R A Noble (Clothing) Ltd, re [1983] BCLC 273 279, 281

R v Corbin [1984] Crim LR 302 361

R v Doring (2002) 33 LS Gaz R 21 292

R v Registrar of Companies, ex p Bowen [1914] 3 KB 1161 56

R v International Stock Exchange of the United Kingdom and the Republic of Irela

nd, ex parte Else (1892) Ltd [1993] BCC 11 177

R v McCredie [2000] BCLC 438 536

R v Merchant Tailors Co (1831) 2 B & Ad 115 406

R v Panel on Takeovers [1987] 1 All ER 564

479

R v Secretary of State for the Environment, etc., ex parte Holding Barnes plc (2

001) The Times, 10 May 40

Ratin & Regent House Properties v Conway [2006] 1 All ER 571 27

Ransomes plc [1999] 1 BCLC 775 84, 212

Rayeld v Hands [1958] 2 All ER 194 507

Razzaq v Pala [1997] 1 WLR 1336

Read v Astoria Garage (Streatham) Ltd [1952] Ch 637 89

Regal (Hastings) Ltd v Gulliver [1942] 1 All ER 378 335, 349, 484, 536

Reigate v Union Manufacturing Co (Ramsbottom) [1918] 1 KB 592 516

Republic of Bolivia Exploration Syndicate Ltd [1914] 1 Ch 139 459

Rhondda Waste Disposal Ltd (in administration), re [2000] EGCS 25 507

Richmond Gate Property Co Ltd, re [1964] 3 All ER 936 314

Roberts and Cooper Ltd, re [1929] 2 Ch 383

122

Rolled Steel Products (Holdings) Ltd v British Steel Corporation [1985] 2 WLR 90

8 72, 104, 109, 304, 337

Romalpa see Aluminium Industrie Vaassen BV v Romalpa Aluminium

Rose v McGivern [1998] 2 BCLC 593 384

Ross v Telford [1998] 1 BCLC 82 382, 383

Royal Bank of Scotland plc v Bannerman Johstone Maclay (a rm) 2003 SLT 181

464

Royal Bank of Scotland plc v Sandstone Properties Ltd (1998) The Times, 12 March

211

Royal British Bank v Turquand (1856) 6 E & B 327 104, 108, 109, 113, 115, 299

Ruben v Great Fingall Consolidated [1906] AC 439 104, 113, 195

Russell v Northern Bank Development Corporation Ltd [1992] 1 WLR 588 80, 90, 95,

263

Ryder Installations, re [1966] 1 All ER 453

543

Safeguard Industrial Investments Ltd v National Westminster Bank [1982] 1 All ER

449 215

Salmon v Quin & Axtens Ltd [1909] 1 Ch 311 86

Salomon v Salomon & Co Ltd [1897] AC 223 5, 7, 22, 24, 25, 41, 85, 131, 223 Salt

dean Estate Co Ltd [1968] 1 WLR 1844

125 Sam Weller, re [1989] 3 WLR 923 279 Saul D Harrison & Sons plc, re [1995] 1

BCLC 14 271, 276, 277 Saunders v UK (1997) 23 EHRR 313 375 Savoy Hotel Ltd, re [

1981] 3 All ER 646 474 Scott v Frank F Scott (London) Ltd [1940] Ch 794 102 Scot

tish Co-operative Wholesale Society Ltd v Meyer [1958] 3 All ER 66 269, 270, 271

, 336 Scottish Insurance Corporation v Wilsons and Clyde Coal Co [1949] AC 462 1

23 Scotto v Petch (2001) The Times, 8 February

212

Seagull Manufacturing Co (No 2), re [1994] 2 All ER 767 363 Secretary of State f

or Employment v Wilson (1996) 550 IRLB 5 427 Secretary of State for Trade and In

dustry v Backhouse (2001) The Times, 23 February 6 Secretary of State for Trade

and Industry v Bottrill [1998] IRLR 120; (1999) 615 IRLB 12 6, 298 Secretary of

State for Trade and Industry v Cleland [1997] 1 BCLC 437 366 Secretary of State

for Trade and Industry v Creegan [2002] 1 BCLC 99 370 Secretary of State for Tra

de and Industry v Deverell [2000] 2 BCLC 133 288 Secretary of State for Trade an

d Industry v Ivens [1997] BCLC 334 364 Secretary of State for Trade and Industry

v Laing [1996] 2 BCLC 324 288 Secretary of State for Trade and Industry v Tjoll

e [1998] 1 BCLC 333 287 Shackleford, Ford & Co v Dangereld (1868) LR 3 CP 407 197

Sharp v Dawes (1876) 2 QBD 26 390 Shaw & Sons (Salford) Ltd v Shaw [1935] 2 KB

113 310 Shefeld Corporation v Barclay [1905] AC 392 210, 211

Sheppard and Cooper Ltd v TSB Bank plc [1996] 2 All ER 654 425

Shuttleworth v Cox Brothers & Co (Maidenhead) Ltd [1927] 2 KB 9 94, 95, 98, 99,

101, 360

Sidebottom v Kershaw, Leese & Co [1920] 1 Ch 154 98, 243, 257

Siebe Gorman & Co Ltd v Barclays Bank Ltd [1979] 2 Lloyd's Rep 142 424, 425

Simpson v Molson's Bank [1895] AC 270

242

Smith (Administrator of Coslett (Contractors) Ltd) v Bridgend County Borough Cou

ncil [2001] UKHL 58, [2002] 1 All ER 292 434

Smith v Croft (No 2) [1987] 3 All ER 909

259

Smith v Henniker-Major & Co (a rm) [2002] All ER (D) 310 (Jul) 108

Smith v Paringa Mines Ltd [1906] 2 Ch 193

383

Smith, Stone and Knight Ltd v Birmingham Corporation [1939] 4 All ER 116 28

Socit Anonyme des Anciens Etablissements Panhard et Lavassor v Panhard Levassor Mo

tor Co Ltd [1901] 2 Ch 513 68

Socit Gnrale de Paris v Walker (1885) 11 App Cas 20 242

Southern Foundries v Shirlaw [1940] AC 701 100, 305, 360

Spargo's Case see Harmony and Montague Tin and Copper Mining Co, Spargo's Case, re

Spectrum Plus Ltd (in liquidation), in re [2004] NLJR 890 425

Spiller v Mayo (Rhodesia) Development Co (1908) Ltd [1926] WN 78 397

Standard Chartered Bank v Pakistan National Shipping Co (No 2) [2003] 1 All ER 1

73 341

Staples v Eastman Photographic Materials Co [1896] 2 Ch 303 122

State of Wyoming Syndicate, re [1901] 2 Ch 431 308, 383

Stedman v UK (1997) 23 EHRR CD 168

376

Table of cases

Steinberg v Scala (Leeds) Ltd [1923] 2 Ch 452 238

Structures and Computers Ltd v Ansys Inc (1997) The Times, 3 October 500

Swabey v Port Gold Mining Co (1889) 1 Meg 385 101

Swaledale Cleaners, re [1968] 3 All ER 619 206, 214

Swedish Central Railway Co Ltd v Thompson [1925] AC 495 76

Sykes (Butchers) Ltd, re [1998] 1 BCLC 110

287

T & D Industries plc [2000] 1 All ER 333

489

T O Supplies Ltd v Jerry Creighton Ltd [1951] 1 KB 42 77

Tait Consibee (Oxford) Ltd v Tait [1997] 2 BCLC 349 322

Tate Access Floors Inc v Boswell [1991] Ch 512 4

Taupo Totara Timber Co Ltd v Rowe [1977] 3 All ER 123 319

Taurine Co, re (1883) 25 Ch D 118 392

Taylors Industrial Flooring Ltd v M & H Plant Hire (Manchester) Ltd [1990] BCLC

216 526

TCB v Gray [1987] 3 WLR 1144 106, 109

Teede and Bishop Ltd, re (1901) 70 LJ Ch

409 406 Thomas Gerrard & Son Ltd, re [1968] Ch 455 461 Thomas Saunders Partnersh

ip v Harvey [1989] 30 Con LR 103 340 Thundercrest, re (1994) The Times, 2 August

388

Towers v African Tug Co [1904] 1 Ch 558

261

Trevor v Whitworth (1887) 12 App Cas 409 139, 141, 201

Trident Fashions plc, Re (2004) The Times, 23 April 492

Trustor AB v Smallbone (2001) The Times, 30 March 6

Turquand's Case see Royal British Bank v Turquand

Twycross v Grant (1877) 2 CPD 469 45

UK Safety Group Ltd v Heane [1998] 2 BCLC 208 294

United Provident Assurance Co Ltd, re [1910] 2 Ch 477 120

Virdi v Abbey Leisure Ltd [1990] BCLC 342

282

Wall v London Northern & Assets Corporation [1898] 2 Ch 469 393

Wallersteiner v Moir [1974] 3 All ER 217 25

Wallersteiner v Moir (No 2) [1975] 1 All ER 849 261

Walter Symons Ltd, re [1934] Ch 308 122

Waring and Gillow Ltd v Gillow and Gillow Ltd (1916) 32 TLR 389 70

Warner International & Overseas Engineering Co Ltd v Kilburn, Brown & Co (1914)

84 LJ KB 365 183

Webb v Earle [1875] LR 20 Eq 556 122

Webb, Hale & Co v Alexandria Water Co (1905) 93 LT 339 196

Weeks v Propert (1873) LR 8 CP 427 346

Welton v Saffery [1897] AC 299 91

Weisgard v Pilkington [1996] CLY 3488

437

West Canadian Collieries Ltd, re [1962] Ch 370 387

West v Blanchet and Another [2000] 1 BCLC 795 274, 275

Westbourne Galleries see Ebrahimi v Westbourne Galleries

Western Intelligence Ltd v KDO Label Printing Machines Ltd [1998] BCC 472

434

Westmid Services Ltd, Secretary of State for Trade and Industry v Grifths, re [19

98] 2 All ER 124 373

Westminster Fire Ofcer v Glasgow Provident Investment Society (1888) 13 App Cas 6

99 5

Westminster Road Construction and Engineering Company Ltd (1932) unreported 460

Whaley Bridge Printing Co v Green (1880) 5 QBD 109 45

Wharfedale Brewery Co, re [1952] Ch 913 122, 123

Whitbread (Hotels) Ltd Petitioners 2002 SLT 178 523

Whitchurch Insurance Consultants Ltd, re [1993] BCLC 1359 383

White v Bristol Aeroplane Co Ltd [1953] Ch 65 94, 100, 120, 126

Will v United Lankat Plantations Co [1914] AC 11 122

William C Leitch Ltd (No 2), re [1933] Ch 261 536

Williams v Natural Life Health Foods Ltd (1998) The Times, 1 May 340

Wilson v Kelland [1910] 2 Ch 306 430

Windsor Steam Coal Ltd, re [1929] 1 Ch 151

545

Wood v Odessa Waterworks Co (1889) 42 Ch D 636 83

Wood, Skinner and Co Ltd, re [1944] Ch 323 123

Woodroffes (Musical Instruments) re [1985] 2 All ER 908 425

Woolfson v Strathclyde Regional Council (1978) 38 P & CR 521 26

Wragg Ltd, re [1897] 1 Ch 796 222

Yeovil Glove Co Ltd, re [1965] Ch 148 436

Yorkshire Enterprises Ltd v Robson Rhodes New Law Online (1998) 17 June, Transcr

ipt Case No 2980610103 463

Young v Ladies Imperial Club [1920] 2 KB 523 386

Zinotty Properties Ltd, re [1984] 3 All ER 754 358

Table of statutes

Access to Justice Act 1999 537 s 6 537 s 28 537 Sch 2 para 1(g) 537

Companies Act 1844 82 Companies Act 1862 83 s 30 200 Companies Act 1929 149 Tabl

e A Art 68 89 Companies Act 1935 s 309(1) 351 Companies Act 1948 15, 16, 17, 381

s 54 25 s 122(1)(g) 29, 269 s 190 25 s 210 29, 269, 271, 273, 279, 280 Companie

s Act 1980 160, 226 s 75 271, 280 Companies Act 1985 15, 17, 20, 32, 53, 54, 92,

93, 166, 189, 244, 267, 283, 306, 322, 323, 326, 328, 403, 405, 406, 410, 411,

412, 423, 429, 432, 439, 462, 484, 534, 540, 541 s 3A 67, 73, 78 s 10 289 s 14 8

2, 84, 189, 251, 267 s 35 74, 306 s 35A 107, 109, 306 s 40 193, 194 s 80(1) 190

(2) 190

(9) 190

(10) 190

s 88 192, 193

s 89 190

s 91 191

s 92 191 s 95 191 s 103 224 s 117 308, 525 s 121 75 s 125 119, 126 s 132 476 s 1

35 134 s 137 135 s 139 348 s 140 348 s 151 365 s 153(2)(a) 152 s 185 193 s 212 2

45 s 221 364 s 224(2) 445 s 232 317 s 241 540 s 245 540 s 247(3) 493 s 263(2)(d)

346 s 270 170 s 271 170 s 282 287 s 285 197, 299 s 286 309 s 292 289 s 303 301,

360 s 306 384 s 309 341 s 317 324, 325, 333 s 318 296 s 319 296 s 325 244 s 324

(6) 244 s 346 244 s 349 373 s 351 112, 113 s 359 207 s 360 198, 200, 299 s 366 3

81 s 366A(2) 408 s 368 301, 383, 384, 385 s 369 385 s 371 382 s 376 301 s 377 30

1 s 390 408 s 395 433, 434 s 416 430 s 425 470, 474, 490, 521

(1) 470 s 427A(1) 470 s 428 483 s 429 482, 483

(1) 470, 483

(2) 470 s 430(2) 483 s 437 363 s 447 363 s 448 363 s 450 271 s 458 362 s 459 269

, 271, 275, 276, 277, 278, 279,

282, 283, 285, 328 ss 459461 285 s 652 520, 522 ss 652A652F 521 s 652B(1) 521

(6) 522 s 653 521, 522 s 711 192 s 727 170 s 741 287 Part 10A 348 Sch 6 317, 326

para 22 326

para 24 326

Sch 7 244

Sch 7A 315, 317

Sch 8

para 19(3) 326 Sch 15A 407 Part VII 124 Companies Act 1989 403

Companies Act 2006 xv, 2, 9, 10, 13, 16, 32, 34, 37, 45, 49, 53, 54, 73, 81, 90,

92, 93, 125, 136, 150, 151, 155, 165, 166, 172, 176, 226, 227, 228, 229, 234, 2

44, 247, 249, 250, 263, 266, 269, 288, 307, 308, 320, 323, 329, 330, 331, 342, 3

43, 349, 381, 386, 401, 406, 408, 411, 420, 429, 431, 435, 442, 444, 446, 448, 4

65, 466, 467, 469, 475, 484, 487, 488, 534 Part 1 (ss 16) 82 s 4 7 s 6(2) 89 s 7

8 s 8 67, 81, 126

(2)

67

s 9 66, 67

(2)

55

(a)

67

(b)

76

(3)

55

(4)

119

s 10 5, 118, 119

(2) 75

(c) 119

(5)

75

s 12 56, 289

s 13 56

s 14 56, 82

s 15 7, 56, 57

s 16 57

s 17 54, 67, 74, 80, 81, 83, 86, 93,

252

s 18 81, 88

(3)

81

s 20 81

(2)

81

s 21 75, 86, 94, 95, 120, 125

(1)

90

s 22 75, 94, 95, 120

(1) 95

(3)

95

s 23 95

s 24 95

s 25 94

(1) 95 s 26(1) 95 s 27(1) 95

(4) 95 s 28 66, 82

(1) 67, 73, 83 s 29 80, 81, 90 (1)(a) 81

(b) 81

(c) 81 s 30 404 s 31 66, 306

(1) 73 s 33 80, 82, 83, 85, 86, 87, 89, 92, 95, 96, 99, 157, 189, 250, 251, 252,

267, 346

(1) 67 s 36 242 s 39 66, 74, 79, 255, 415, 416 s 40 74, 104, 108, 109, 110, 112,

113, 116, 117, 415, 416

(1) 74, 106

(2)(b) 106, 107

(4) 74, 107

(5) 74, 107 s 42 74 s 50(1) 193, 194 s 51 50, 51, 52, 53 s 53 67 s 54(1) 68 s 58

67 s 59 67 s 60 67 s 65 68 s 66 68

(4) 68 s 77 70 s 78 16, 70

(1) 70 s 79 70

(1) 70 s 80 70 s 81(1) 71 s 82 67, 373 s 83 373 s 84 373 s 85 373 s 89 258

(1) 182 s 91 59 s 92 59 s 93 59 s 94 59 s 95 59, 60, 258 s 96 59 s 97 61, 183 s

98 61, 140, 295 s 99 61 s 100 61 s 101 61 s 102 62 s 103 62 s 104 62 s 105 62 s

106 62 s 107 62 s 108 62 s 112 262 (1), (2) 238 s 113(1) 239 (2)(a) 239

(b) 239

(c) 239

(3) 239

(b) 239 (4)(8) 239 s 114(1)(a) 239

(2) 239

(3) 240

(5) 240 s 115 239

(1) 239

(2) 239

(4) 239 s 116 240 (1)(b) 240

(2) 240 s 117(1)(a) 240

(b) 240 (3)(a) 240

(b) 240

(5) 240

s 118(3) 240 s 119(1) 240

(2) 240 s 125 207, 241

(2) 241

(4) 241 s 126 200, 241, 243 s 127 241, 299 s 130 227, 235 s 136(1)(a), (b) 140 s

137 140 s 138 140 s 144 140 Part 10 (ss 154259) 287, 155 s 154 9, 287 s 157 292

s 158 292 s 159 292 s 160 18, 289, 242 s 161 197 s 162 287, 299, 306 s 163 306 s

165 306 s 167 58 s 168 29, 294, 295, 307, 355, 356, 357, 360, 389, 407 s 169 30

1, 355, 357 Ch 2 (ss 170181) 331 s 170 262, 330, 331

(1) 331

(5) 288 s 171 72, 262, 331, 332 s 172 262, 263, 264, 265, 331, 332, 341, 449 s 1

73 262 s 174 262, 332 s 175 262, 332

(6) 332 s 176 332 s 177 332, 333 s 178 331, 332, 541 s 179 332, 541 s 180 332 s

182 324, 333 Ch 4 (ss 188226) 333 s 188 296

(5) 408 s 190 325

s 191 325

s 192 325

s 193 325

s 194 325

s 195 325

s 196 325

s 213 321

s 217 319

s 219 319

s 223 322 Ch 5 (ss 227230) 333

s 231 333

s 273 309

s 274 309

s 289 296

s 276 262

s 231 10

s 248 398

s 249A(1A) 14 (1B) 14 (1C) 14

s 249AA 16 (2)(a) 116

s 250 287

s 251 287

Part 11 (ss 260269) 331

s 260 250, 262, 264

(1) 262

(4) 262

(5) 262 s 261 250, 262, 263 (1)(4) 263 s 262 250, 262, 263 s 263 250, 262, 265, 2

66

(2) 263, 264, 266

(3) 264

(a) 266

(b) 265, 266 (c)(f) 266

(4) 264 s 264 250, 262 Part 12 (ss 270280) 307 s 270 9, 308

(1) 287 s 271 9, 308 s 273 18, 308 s 274 9

s 281(1) 407

s 283(2) 407

s 284 20

s 288(4), (5) 407

s 291 407

s 292 407

s 296 407

s 298 407

s 303 189, 301, 354, 358, 383, 384 (5)(a) 189

s 304 384

s 305 384

s 306 382

s 307 385, 387

s 308 387

s 309 387

s 310 386

s 311 388

s 312 390

(4) 356 s 314 301, 357, 389

(4) 389 s 315 301 s 316(1) 389

(2) 389 s 317 389 s 318 390 s 319 393 s 321 393 s 322 395 s 323 397 s 324 20, 18

9, 393, 395, 397 s 325 388 s 328 9 s 329 394 s 334 392 s 335 392 s 336 381 s 337

388 s 338 357 s 339 388 s 341 322 s 334 322 s 357 9 s 358 189, 398 Part 14 (ss

362379) 348

s 371 384 Part 15 (ss 380474) 447 s 381 10, 442 s 382 10, 12, 441, 442, 493 (1)(3)

442 (5), (6) 442

(7) 443 s 383 10, 13, 441, 442, 443

(1) 443

(3) 443

(4) 443

(6) 443 s 384 10, 441, 442, 443 (1), (2) 443 s 386 17, 364, 444 (2)(4) 444 s 387

364

(1) 445

(3) 445 s 388(1) 444, 445

(2) 445

(3) 445

(b) 444

(4) 444 (a), (b) 444 s 390 441, 445

(2) 445

(3) 445 s 391 441, 445

(2) 445

(4) 445, 446

(5) 446

(6) 446 s 392 441, 445, 452 (1), (2) 446 s 393 441

(1) 447 s 394 446 s 395 168

(1) 446

(3) 446 s 396 162, 168, 446 (1), (2) 446 (3)(5) 447 s 397 168, 447 s 399(2) 448 s

400 449

s 401 449

s 404 443, 448 (1)(3) 448 (4), (5) 447

s 405 30 (1)(3) 449

s 406 448

s 407 449

s 411 447

s 412 317

s 413 317 (1), (2) 447

s 414 15, 168, 441 (1)(4) 448

s 415 441

(1) 449

(4) 449 s 416 441, 449

(3) 449 s 417 441, 449 (2), (3) 449

(5) 449

(6)(8) 450

(10) 450 s 418 441, 450 (1), (2) 450 (4), (5) 450 s 419 441

(1) 450

(2) 451 Ch 6 (ss 420422) 315 s 420 315 s 421 315 s 422 315 s 423 17, 451, 456

(1) 451 s 424(2) 451 (3), (4) 451 s 425 451 s 426 451

(4) 451 s 427 451 s 428 451 s 429 451 (1), (2) 470 s 431 17, 21 s 433 451

(2)(4) 451 s 434 451

(3) 451 s 435 452 s 436(2) 452 s 437 454 s 438 455 s 441 451, 452, 454 s 442(2)(

a) 452

(b) 452 (3), (4) 452 s 444 452 (1), (2) 452 (4)(7) 453 s 445 452 (1)(3) 453 (5), (

6) 453 s 446 452 s 447 452, 453 (1)(3) 453

(4) 454 s 448 21 s 449 453 s 451 454 (1)(3) 454 s 452 454 s 453 454

(3) 454 s 459 335 s 465 11, 12, 13, 441, 443, 493

(1) 443

(2) 444

(3) 443

(5) 443

(6) 443

(7) 444 s 466 11, 441, 443 s 467 11, 441, 443 (1), (2) 444 s 472(1) 447

(2) 447 Part 16 (ss 475539) 445 s 475(1) 445 (2), (3) 445 s 476 17 s 477 14, 445

s 479 15

s 480 15, 17, 445 s 482 445 s 485 454 s 486 454 s 487 357, 454 ss 488497 454 s 48

9 455

(2) 455

(4) 455 s 490 455 s 491 455 (1), (2) 455 s 495 464 s 498 454 (2), (3) 452 ss 4995

01 454 s 502 408, 454 ss 503505 454 s 506 453, 454 ss 507509 454 s 510 407, 454, 4

55 s 511 389, 454, 455 (3), (4) 455 (5), (6) 456 ss 512514 454, 455 s 515 389, 45

4 ss 516526 454, 456 s 517 456 s 519 456 s 520 456 (2)(a) 456 (3)(5) 456 s 521 456

s 522(5) 456 s 533 456 s 523 456

(3) 456 s 532 347 ss 533536 347 Part 17 (ss 540657) 189 s 540 189 (1)(3) 189 (4)(a)

189

(b) 189 s 549 188, 190 s 550 188, 190 s 551 188, 190 s 552 225, 226

(3) 184 s 553 183, 184

(2) 183 s 554 192 s 555 192, 193 (3)(b) 75 s 556 193 s 560 149, 182 s 561 182, 1

88, 190

(a) 182 s 568 191 s 569 191 s 570 191 s 571 191

(7) 408 s 573(5) 408 s 580 221, 225 s 581 221 s 582 221 s 583 221 s 584 225 s 58

5 18, 223 s 586 192 s 587 223, 225 s 588 225 s 590 223 s 592 192, 222, 225 s 593

60, 192, 223, 224 s 597 59, 192, 224 s 598 49, 224 s 600 49, 225 s 601 225 s 60

3 49 s 606 224 s 610 183, 226, 227 s 611 227, 476

(2) 229 s 612 227 s 613 227 s 614 227 s 615 227 s 617 118, 127 (2)(b) 134 s 618

127, 128 s 619 128 (2), (3) 128

xxxviii

s 620 189 s 629(1) 119

(2) 119 s 630 94, 99, 100, 102, 118, 119, 120, 121, 125, 126, 133, 135

(2) 99, 126

(b) 127, 135

(4) 99, 127, 135

(5) 127 s 633 99, 100, 269, 118, 127 (3), (4) 127 s 635(1) 127 Part 16, Ch 10 (s

s 641653) 134 s 641 21, 128, 133, 138 (1)(a) 137

(b) 134 (2)(4) 138 s 642 128, 134 s 643 128, 134, 137, 144 (2), (3) 137

(5) 137 s 644 128, 134 (1), (2) 137 (4), (5) 137

(7) 137 s 645 128, 134, 135

(2) 136 s 646 128, 133, 134, 136

(2) 136

(4) 136 s 647 128, 134, 136 s 648(1) 136

(2) 136 s 649 128, 134, 136 (2)(4) 136 s 650 128, 134, 136 s 651 128, 134 s 653 1

36 s 656 18 Part 18 (ss 658737) 160 s 658 133, 139

(2) 139 s 659 140

(1) 140 s 660(2) 139 s 661 140, 228

(4) 140 s 662 202 s 669(1) 140 s 670 18, 140, 199 s 678 133 s 677 133, 150, 151

(1) 151

(d) 151

(2) 152 s 678 150, 151, 152, 155, 365

(1) 151

(3) 151 s 679 150 s 680 150, 155 s 681 133, 150, 153 (2)(a) 153, 154

(b) 153, 154

(c) 154

(d) 154

(f) 153 s 682 133, 150 s 683 150, 151 Ch 3 (ss 684689) 160 s 684 128 (1), (2) 128

(3), (4) 129 s 685 130 s 686(1) 129

(2) 129 s 687(4) 129

(5) 129 s 688 129 s 689 128, 130

(5) 130 Ch 4 (ss 690708) 160 s 690 141 s 691 141

(1) 141 s 692 141 s 693 141

(5) 141 s 694 133, 141, 142 (2)(5) 142 s 695 141

(2) 143, 408 s 696 141, 143 (2), (3) 143 s 697 141

s 698 141 s 699 141

(2) 408 s 700 141 s 701 133, 141

(1) 142

(2)(a) 142

(b) 142

(3)(a) 142

(b) 142

(4)(6) 142

(8) 142 s 702 141 s 703 141 s 704 141 s 705 141 s 706 141, 147 s 707 141 s 708 1

41 Ch 5 (ss 709723) 143 s 709 143

(2) 143 s 710 133, 143

(2) 143 s 711 143 s 714 147 s 713 143 s 714 143, 144, 147

(2) 144

(3)(a) 144

(b) 144

(4) 49

(5) 143

(6) 144 s 715 144, 147 s 716 143, 144

(1) 144 s 717(2) 408 s 718(2) 408 s 719 133, 143, 144 s 720 133, 143 s 721 133,

144

(6) 140 s 723(1) 144 Ch 6 (ss 724732) 147, 148 s 724(1)(b) 148 s 725(1) 148

(2) 148 s 734 145, 146

(4) 145 s 735 420 (2)(5) 145 s 739 221, 420 s 740 421 s 741 193 s 743 418 s 744 4

18 s 745 418 s 746 418 s 747 418 s 748 418 s 752 419 Part 20, Ch 1 (ss 755760) 8

s 759 140 s 761 7, 8, 18, 30, 104, 105, 525

(4) 105 s 762 105, 415, 416, 526 s 763 105 s 767 30, 31, 105

(3) 106 Part 21 (ss 768790) 193 s 768 193 s 769 193, 209 s 770 206 s 771 10, 193

(4)(b) 193 s 775 209 s 779 188, 192, 193, 195 Ch 2 (ss 783790) 194 s 784 194 s 78

6 194 Part 23 (ss 820853) 143, 160, 169 s 829 160 s 830(1) 161

(2) 161 s 831 161

(3) 162

(5) 162 s 832 165

(4) 162 s 833 165 s 834 165 s 835 165 s 836(1) 168 s 837 170 s 838 168

(1)

168

(4)

168 s 847(2) 169

(3)

169 Part 24 (ss 854859) 16, 245 s 854 245

(2)

245

(3)(b) 245

s 855 246

s 856 168

(1)(4) 246 s 858(1) 246 (2), (3) 247

(4) 246 Part 25 (ss 860894) 423 s 860 428, 431, 433 s 861 431 s 866 433 s 867(3)

129 s 870 433 s 876 434 s 877 434 s 881 433 s 885 433 s 887 434 s 895 468, 470,

471, 473, 474, 487 s 896 468, 470, 473 s 897 468 s 898 468 s 899 468, 470, 473,

474 s 900 468, 474, 475 s 901 468, 474 Part 28 (ss 942992)

Ch 1 (ss 942965) 471

s 979 482

s 981 483

s 983 484

s 984 484

s 993 362, 366

s 994 29, 30, 48, 140, 268, 269, 270, 271,

272, 273, 275, 279, 281, 282, 283, 284, 152, 171, 216, 251, 261, 265

(1) 36 s 995 48, 88, 140, 279, 280, 281

s 996 48, 140, 268, 273, 275, 279, 280, 281

(1) 274

(2)(a) 273

(b)

273

(c)

274

(e) 274

s 979(1)(4) 470

s 1077 192

s 1135 399

s 1173 308

s 1266 245

s 1295 245

Sch 2 36

Sch 4 57

Sch 5 57

Sch 13

Part IV, para 29 381 Company Directors Disqualication Act

1986 34, 36, 361, 363, 376

s 1 372

s 2 361, 362

s 3 362

s 4 362

s 5 362

s 6 364, 373

(1)(b) 364, 371

s 7 362

s 8 363

s 9 362, 372

s 10 366

s 11 292

s 15 372

s 17 373

Sch 1 362, 373

Competition Act 1998 471, 482 Chapter I 372 Chapter II 372

Contracts (Rights of Third Parties) Act 1999 50, 52, 54, 89, 189 Courts and Lega

l Services Act 1990 s 58B 537 Criminal Justice Act 1993 220, 229, 231,

232, 233, 344, 457, 477, 480

Part V 229

Sch 2 229, 231

Deregulation and Contracting Out Act 1994 s 13 521 Sch 5 521 Disability Discrimi

nation Act 1995 295, 399

Employment Act 1980 26 Employments Rights Act 1996 542 s 166 297, 542 s 167 427,

542 s 168 427, 542 s 169 427 s 170 427 s 182 297 Enterprise Act 2002 2, 359, 37

2, 426, 499, 500, 506, 509, 514, 542 s 251 506 Part 10 498 Sch 16 499, 503 Envir

onment Act 1995 s 57 Equal Pay Act 1970 295

Family Law Reform Act 1969 s 1 239 Financial Services and Markets Act 2000 13, 1

4, 34, 45, 148, 176, 185, 186, 231, 244, 375, 442, 476, 477, 480 Part IV (ss 4055

) 444 Part VI (ss 72103) 417 s 72 176 s 75 176 s 77 177 s 78 177 s 79(3) 177, 179

s 80 179 s 81 177, 179

(1) 177

(2) 177

s 82 179

s 83 177

s 85 178

(1)(3) 178

s 86 178

(1) 178

s 88 178

s 89 178

s 90 178, 179

(3) 179

(6) 180

(7) 179, 181

s 91 178

s 92 178

s 93 178

s 94 178

s 96A(2)(f) 244

s 96B(1) 244

(2) 244

s 114(8) 233

s 118(2) 232

(10) 232

s 122 233

s 123(1) 232

(2) 233

(3) 232

s 134 233

s 135 233

s 136 233

s 174(2) 233

s 176A(5) 506

Part XV (ss 212224) 37

Part XXIV (ss 355379) 37

s 382 178

(1) 233

(8) 233

s 383 178

(1) 233

(3) 233

(10) 233

s 384(1) 233

(6) 233

Health and Safety at Work Act 1974 361, 362 Housing Act 1957 26 Human Rights Act

1998 40, 41, 374, 375, 479 s 6 40, 41

Information and the Companies (Audit, Investigations and Community Enterprise) A

ct 2004 457

Insolvency Act 1986 2, 30, 34, 283, 360, 369, 376, 391, 405, 426, 431, 490, 497,

504, 509, 510, 514, 516, 525 ss 17 490 s 8 500 s 14 37 s 22 308 s 47 308 s 74 36

, 526

(3) 20

s 76 147

s 77 469

(2) 63 s 79 282 s 84 493, 532 s 89 531, 532 s 91 358 s 103 358 s 110 243, 470, 4

71, 472, 476, 487 s 112 343, 535, 537 s 114 358 s 115 537 s 116 543 s 122 130, 5

25 (1)(g) 29, 58, 251, 281, 291 s 123 525, 526, 527 (1)(e) 137 s 124 282, 527, 5

43 s 124A 494 s 125(2) 282 s 127 207, 495, 528 s 129(2) 282 s 130 529 s 131 308,

528 s 132 528 s 133 529 s 135 527 s 136 528 s 139 528 s 140 528 s 141 528 s 143

533 s 146 543 s 156 537 s 165 535 s 166 519, 535

s 167 343, 534 s 175 308 s 187 342 s 201 543 s 208(1) 536 s 212 48, 316, 461, 50

5, 534, 537 s 213 366, 367, 373 s 214 339, 340, 366, 367, 368, 371 s 214A 36 s 2

16 373 s 217 373 s 237 536 s 239 437 s 245 435, 436, 437 s 315 217 s 320 217 Sch

B1 428, 498, 499, 501, 502, 505, 509 para 14 499, 503 para 18(6) 502 para 26 50

2, 503 para 35 500 para 36 500

(2) 500

para 40 507

para 41(4)

para 43 507

(4) 431, 508

para 44 503

para 59 510

(c) 510 para 68 510 para 71 508 para 83 506 para 84 506 para 96 506 para 99 509

para 108(2) Sch 1 504 Sch 4 Part I 474 Sch 6 308, 426, 506, 541 para 11 426 Inso

lvency Act 2000 366, 372, 492, 493 s 1 493 s 4 491 s 6 366

Sch 1 495, 496, 497

para 7 494

para 27 496

para 28 496

Sch 2 491

para 5 495

para 6 492

para 7 492

para 10 492

Interpretation Act 1978 384

Judgements Act 1838 531 s 17 540

Land Compensation Act 1961 26

Law of Property Act 1925 s 85(1) 423 s 101 438

Law of Property (Miscellaneous Provisions) Act 1989 539 s 2(1) 52

(3) 52

Limitation Act 1980 s 8 197 s 9(1) 369

Limited Liability Partnerships Act 2000 31, 33, 38 Limited Partnerships

Act 1907 31, 38

Mental Health Act 1983 216 Minors' Contracts Act 1987 238 Misrepresentation Act 19

67 181

s 2 47

New Zealand Workers' Compensation Act 1922 5

Partnership Act 1890 31, 38 s 24 37 s 24(5) 30

Pensions Act 1995 s 47 457 s 48 457

Political Parties, Elections and Referendums Act 2000 348 Protection from Harass

ment Act 1997

2

Table of statutes

Public Interest Disclosure Act 1998 457 Public Trustee Act 1906 3, 4

Race Relations Act 1976 295

Sale of Goods Act 1979 238 Sex Discrimination Act 1975 295 Social Security and A

dministration Act 1982

s 121C 373 s 121D 373 Social Security Act 1998 373

s 64 373 Stannaries Act 1869 390 Statute of Frauds 1677

s 4 85 Stock Transfer Act 1963 208 Sch 1 207 Supply of Goods and Services Act 19

82 s 13 340

Third Parties (Rights Against Insurers) Act 1930 539 Trade Marks Act 1994 s 25 4

31 Trade Union and Labour Relations

(Consolidation) Act 1992

s 117(1) 14

s 224 26

Trustee Act 1925 533 s 40 217 s 61 533

Coventions

European Convention on Human Rights

374, 375

Art 6 40, 375

Art 8 376

Art 9 376

Art 10 376

Art 14 375

European Directives

First Council Directive (68/151/EEC)

51

Takeover Bids Directive (2004/25/EC)

471

Transparency Directive (2004/109/EC) 176, 244

Prospectus Directive (2003/71/EC) 184, 185

Statutory Instruments

Civil Procedure Rules 1998 (SI 1998/3132 L.17) 263

Companies Act 1985 (International Accounting Standards and Other Accounting Amen

dments) Regulations 2004 (SI 2004/2947) Art 4 448

Companies Act 1985 (Electronic Communications) Order 2000 (SI 2000/3373) 380, 38

5, 405, 409, 410

Companies (Acquisition of Own Shares) (Treasury Shares) Regulations 2003 (SI 200

3/1116) 147

Companies (Model Articles) Regulations 2008 (SI 2008/3229) 16, 17, 55 Art 69 167

, 168, 169 Art 30 167 Art 52 381

Companies (Tables AF) Regulations 1985 (SI 1985/805) 410 Table A 17, 410

Companies (Table A to F) (Amendment) Regulations 2007 (SI 2007/2541) and Compani

es (Table A to F) (Amendment) (No 2) Regulations 2007 (SI 2007/2826) Table A 166

, 167, 168, 193, 195, 196, 199, 294, 302, 303, 304, 305, 313, 314, 315, 316, 325

, 354, 360, 361, 385, 386, 387, 391, 392, 393, 395, 400, 401, 402, 403, 404 Reg

2 355 Reg 5 198 Reg 20 197 Reg 21 197 Reg 21 197 Reg 24 216 Reg 26(5) 10 Reg 30

216 Reg 31 216 Reg 36 381