Professional Documents

Culture Documents

Special Commodity Levy

Uploaded by

Anushka KumaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Special Commodity Levy

Uploaded by

Anushka KumaraCopyright:

Available Formats

PARLIAMENT OF THE DEMOCRATIC

SOCIALIST REPUBLIC OF

SRI LANKA

SPECIAL COMMODITY LEVY

ACT, No. 48 OF 2007

Printed on the Order of Government

[Certified on 15th October, 2007]

PRINTED AT THE DEPARTMENT OF GOVERNMENT PRINTING, SRI LANKA

TO BE PURCHASED AT THE GOVERNMENT PUBLICATIONS BUREAU, COLOMBO 5

Price : Rs. 7.00 Postage : Rs. 5.00

Published as a Supplement to Part II of the Gazette of the Democratic

Socialist Republic of Sri Lanka of October 19, 2007

1 Special Commodity Levy

Act, No. 48 of 2007

2PL 0023804,350 (08/2007)

[Certified on 15th October 2007]

L.D.O. 40/2007.

AN ACT TO PROVIDE FOR THE IMPOSITION OF A COMPOSITE LEVY ON

CERTAIN SPECIFIED COMMODITY ITEMS IN LIEU OF THE AMOUNT

CHARGEABLE ON SUCH COMMODITY ITEMS AS A TAX, DUTY, LEVY, CESS

OR ANY OTHER CHARGE IN ORDER TO OVERCOME THE COMPLEXITIES

ASSOCIATED WITH THE APPLICATION AND ADMINISTRATION OF MULTIPLE

TAXES ON SUCH SPECIFIED COMMODITY ITEMS; AND TO PROVIDE FOR

MATTERS CONNECTED THEREWITH OR INCIDENTAL THERETO.

BE it enacted by the Parliament of the Democratic Socialist

Republic of Sri Lanka as follows :

1. This Act may be cited as the Special Commodity Levy

Act, No. 48 of 2007.

2. (1) From and after the date of the coming into operation

of this Act, there shall be imposed a levy to be called the

Special Commodity Levy on certain commodity items

which shall from time to time be specified by the Minister by

Order published in the Gazette.

(2) The period of validity of every such Order and the

rate of the Special Commodity Levy to be imposed in respect

of each such specified item, either on ad valorem or specific

basis, shall also be specified in the Order.

(3) Every Order made under subsection (1) which is valid

for a period of over thirty days, may be amended or varied by

adding thereto or removing therefrom any item or by revising

the rates specified therein.

(4) No Order made under subsection (3) may be amended

or varied until the expiration of thirty days from the date of

the making thereof.

Imposition of

Special

Commodity

Levy.

Short title.

2 Special Commodity Levy

Act, No. 48 of 2007

(5) The Special Commodity Levy so imposed shall be a

composite levy and during the period any Order published

in terms of subsection (1) is in force, no other tax, duty, levy

or cess or any other charge imposed in terms of any of the

laws specified in the Schedule to this Act, shall be applicable

in respect of the commodity items specified in any such Order.

3. The Special Commodity Levy, imposed under section

2, in lieu of any tax, duty, levy or cess or any other charge

imposed in terms of any of the laws specified in the Schedule

to this Act, shall notwithstanding anything to the contrary in

this Act, be collected, administered and recovered by the

Director - Genaral of Customs, in accordance with the

provisions of the Customs Ordinance (Chapter 235).

4. The Director - General of Customs shall remit all sums

collected by him as Special Commodity Levy in terms of this

Act, to the Consolidated Fund.

5. (1) Notwithstanding the provisions of section 2, the

Minister may, where he is of opinion that in view of the

prevailing economic considerations that it is expedient

so to do, by Order published in the Gazette waive for a period

of time to be specified in such Order, the Special Commodity

Levy chargeable under section 2 in respect of any

specified item.

(2) During the period any Order published in terms of

subsection (1) is in force, no other tax, duty, levy or cess or

any other charge imposed in terms of any of the laws specified

in the Schedule to this Act, shall be applicable in respect of

the commodity items specified in any such Order.

6. Where any commodity item is made subject to an

Order under section 2, the rate payable in respect of such

commodity item shall be such rate as is applicable to such

item at the time of submission of the Bill of Entry.

Collection,

administration

and recovery of

the Special

Commodity

Levy.

Special

Commodity

Levy to be

remitted to the

Consolidated

Fund.

Minister may

waive the Special

Commodity

Levy on certain

commodities.

Determination of

the applicable

rate.

3 Special Commodity Levy

Act, No. 48 of 2007

7. Every Order made by the Minister in terms of section

2 and section 5, shall

(i) be in operation immediately upon the Minister

affixing his signature thereto;

(ii) be published in the Gazette as soon as convenient;

(iii) be approved by Resolution of Parliament as soon as

convenient thereafter; and

(iv) if not approved by Parliament, be deemed to be

rescinded with effect from the date of such

resolution, without prejudice to anything previously

done thereunder.

8. Where an Order made under section 2 or section 5 is

rescinded as provided for in paragraph (iv) of section 7, the

commodity items to which the Orders relate shall become

subject to the payment of any tax, duty, levy or cess or other

charge imposed in terms of any of the laws specified in the

Schedule to this Act.

9. In the case of any inconsistency between the Sinhala

and Tamil texts of this Act, the Sinhala text shall prevail.

SCHEDULE (Sections 2 and 8)

1. The Finance Act, No. 11 of 2002 (Part I).

2. The Value Added Tax Act, No. 14 of 2002.

3. The Finance Act, No. 5 of 2005 (Part I).

4. The Customs Ordinance (Chapter 235).

5. The Sri Lanka Export Development Act, No. 40 of 1979.

6. The Excise (Special Provisions) Act, No. 13 of 1989

Order to be

placed before

Parliament

& c,.

Effect of an

Order being

deemed to be

rescinded.

Sinhala Text to

prevail in case of

inconsistency.

4 Special Commodity Levy

Act, No. 48 of 2007

Annual subscription of English Bills and Acts of the Parliament Rs. 885 (Local), Rs. 1,180

(Foreign), Payable to the SUPERINTENDENT, GOVERNMENT PUBLICATIONS BUREAU, DEPARTMENT OF

GOVERNMENT INFORMATION, NO. 163, KIRULAPONA MAWATHA, POLHENGODA, COLOMBO 05 before

15th December each year in respect of the year following.

You might also like

- Dominion Lawsuit Patrick ByrneDocument106 pagesDominion Lawsuit Patrick ByrneGMG EditorialNo ratings yet

- Lawyer Disbarment GroundsDocument31 pagesLawyer Disbarment GroundsJo RylNo ratings yet

- Private PropertyDocument2 pagesPrivate PropertyMon Sour CalaunanNo ratings yet

- Taxation in The PhilippinesDocument12 pagesTaxation in The PhilippinesAdobo Hunter100% (1)

- (Historical Materialism Book) Alvaro Garcia Linera - Plebeian Power - Collective Action and Indigenous, Working-Class and Popular Identities in Bolivia (2014, Brill) - LibgeDocument352 pages(Historical Materialism Book) Alvaro Garcia Linera - Plebeian Power - Collective Action and Indigenous, Working-Class and Popular Identities in Bolivia (2014, Brill) - LibgeAndré Luan Nunes MacedoNo ratings yet

- Nicaragua Vs United States (Summary) On Self Defence and Use of Force - Public International LawDocument14 pagesNicaragua Vs United States (Summary) On Self Defence and Use of Force - Public International LawGil Aragones III50% (2)

- CORPO - 96-105 Close CorporationDocument9 pagesCORPO - 96-105 Close CorporationlaursNo ratings yet

- Nazareth vs. VillarDocument1 pageNazareth vs. VillarIshmael SalisipNo ratings yet

- Organizing a Mathematics Club MeetingDocument1 pageOrganizing a Mathematics Club MeetingSonny Matias100% (2)

- Parliament of The Democratic Socialist Republic of Sri LankaDocument4 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

- Strategic Development ProjectDocument5 pagesStrategic Development ProjectanushaNo ratings yet

- Vat RuleDocument105 pagesVat Ruleshankar k.c.No ratings yet

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- WBST - SOD - Act - 1999 - Incorporating The Changes Made in WB Taxation (Amendment) BILL, 2018 Dated 27.11.2018Document7 pagesWBST - SOD - Act - 1999 - Incorporating The Changes Made in WB Taxation (Amendment) BILL, 2018 Dated 27.11.2018Himangsu SekharNo ratings yet

- Compendium of Law&Regulations For-MailDocument281 pagesCompendium of Law&Regulations For-MailAmbuj SakiNo ratings yet

- Exemption Under GSTDocument7 pagesExemption Under GSTDebaNo ratings yet

- PAL ActDocument8 pagesPAL ActsudumalliNo ratings yet

- Customs Tariff Act, 1975Document206 pagesCustoms Tariff Act, 1975rkaran22No ratings yet

- Vat Act 1997 Rev2009Document42 pagesVat Act 1997 Rev2009Kessy JumaNo ratings yet

- I Direct TaxDocument155 pagesI Direct TaxRajnish ShastriNo ratings yet

- VAT ActDocument16 pagesVAT ActcasarokarNo ratings yet

- The Special Economic Zone Act, 2005Document5 pagesThe Special Economic Zone Act, 2005SreejithNo ratings yet

- Levying Customs DutiesDocument14 pagesLevying Customs DutiesanushaNo ratings yet

- The Customs Tariff Act, 1975: EctionsDocument1,116 pagesThe Customs Tariff Act, 1975: EctionsAndrea RobinsonNo ratings yet

- Code of Fiscal BenefitsDocument19 pagesCode of Fiscal Benefitsantonior70No ratings yet

- Vat Act 6232016110150 AmDocument53 pagesVat Act 6232016110150 AmTeken AntalyaNo ratings yet

- 2 UnitDocument36 pages2 UnitIndu Prasoon GuptaNo ratings yet

- Central Excise Tariff Act 1985Document13 pagesCentral Excise Tariff Act 1985Luvjoy ChokerNo ratings yet

- Board of Revenue Abolition ActDocument4 pagesBoard of Revenue Abolition Actnaveen kumar duraisamyNo ratings yet

- 201610251310532161FederalExciseAct2005updatedupto1 7 2016latestDocument67 pages201610251310532161FederalExciseAct2005updatedupto1 7 2016latesttylor32No ratings yet

- GST State ActDocument27 pagesGST State ActsolomonNo ratings yet

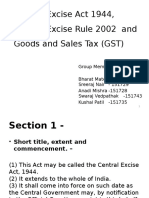

- Central Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)Document42 pagesCentral Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)kushal patilNo ratings yet

- Overview of Central ExciseDocument31 pagesOverview of Central ExciseMadhuree PerumallaNo ratings yet

- 2008 Customs Tariff - TV NigeriaDocument552 pages2008 Customs Tariff - TV NigeriaAriKurniawanNo ratings yet

- CGST Act SummaryDocument371 pagesCGST Act SummaryRohan KulkarniNo ratings yet

- Short Title, and Commencement. - (1) This Act May Be Called The Central Boards of RevenueDocument3 pagesShort Title, and Commencement. - (1) This Act May Be Called The Central Boards of RevenueSai BhargavNo ratings yet

- VATActNo15 (E) 2008Document12 pagesVATActNo15 (E) 2008jing qiangNo ratings yet

- Bureau of Internal RevenueDocument4 pagesBureau of Internal RevenueYna YnaNo ratings yet

- Ca Suraj Satija Ssguru Charge of GSTDocument12 pagesCa Suraj Satija Ssguru Charge of GSTSunny YadavNo ratings yet

- 20161025131053252FederalExciseAct2005updatedupto1 7 2016latest PDFDocument67 pages20161025131053252FederalExciseAct2005updatedupto1 7 2016latest PDFKashif Ali RazaNo ratings yet

- Law On ExciseDocument31 pagesLaw On ExciseMrandMrs GligorovNo ratings yet

- Gujarat Value Added Tax ActDocument7 pagesGujarat Value Added Tax ActvikrantkapadiaNo ratings yet

- Section 10 - Power To Grant Exemption From Tax - LEVY OF, AND EXEMPTION FROM, TAXDocument2 pagesSection 10 - Power To Grant Exemption From Tax - LEVY OF, AND EXEMPTION FROM, TAXalisagasaNo ratings yet

- Levy Of, AND Exemption From TaxDocument33 pagesLevy Of, AND Exemption From Taxshivam beniwalNo ratings yet

- قانون ضريبة الدخلDocument49 pagesقانون ضريبة الدخلMr AzounyNo ratings yet

- The Central Boards of Revenue Act 1963Document3 pagesThe Central Boards of Revenue Act 1963Anil BeniwalNo ratings yet

- Sro 327 PDFDocument20 pagesSro 327 PDFOmer ToqirNo ratings yet

- Foreign Trade Act SummaryDocument35 pagesForeign Trade Act SummaryYana Fitri Mawaddatan WarahmahNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument7 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledAngeli SoabasNo ratings yet

- Excise Tax Proclamation No 307 2002Document22 pagesExcise Tax Proclamation No 307 2002Temesgen EndalewNo ratings yet

- Collection and Deduction of Tax at SourceDocument64 pagesCollection and Deduction of Tax at SourceMohammad SaadNo ratings yet

- Entry Tax Goods Act 2001Document17 pagesEntry Tax Goods Act 2001letmelearnthisNo ratings yet

- INCOME TAX ACTDocument812 pagesINCOME TAX ACTvermanavalNo ratings yet

- Sales Tax Rule BookDocument126 pagesSales Tax Rule BookAbhijeet SinghNo ratings yet

- Kenya Revenue Authority Act 2of 1995Document17 pagesKenya Revenue Authority Act 2of 1995PatrtickNo ratings yet

- This Research Guide Summarizes The Sources of Philippine Tax LawDocument6 pagesThis Research Guide Summarizes The Sources of Philippine Tax LawMeanne Estaño CaraganNo ratings yet

- This Chapter Extends To The Whole of India.: Ommodities Ransaction AXDocument5 pagesThis Chapter Extends To The Whole of India.: Ommodities Ransaction AXvickytatkareNo ratings yet

- Guide To Philippines Tax Law ResearchDocument6 pagesGuide To Philippines Tax Law ResearchStephen BNo ratings yet

- Chamber vs. Romulo 614 SCRA 605 2010Document17 pagesChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroNo ratings yet

- Revenue Bulletin No. 1-2003 No Ruling AreasDocument3 pagesRevenue Bulletin No. 1-2003 No Ruling AreasArianne CyrilNo ratings yet

- Federal Law No (26) of 2020 On Amending Certain Provisions of Federal Law No (2) of 2015 Regarding Commercial Companies - EN - 20210824125840Document23 pagesFederal Law No (26) of 2020 On Amending Certain Provisions of Federal Law No (2) of 2015 Regarding Commercial Companies - EN - 20210824125840Sarfudheen ParichalilNo ratings yet

- Part I-FED Act 2005 (837-854)Document9 pagesPart I-FED Act 2005 (837-854)Simi SheenNo ratings yet

- Serial No NoDocument27 pagesSerial No NovenkynaiduNo ratings yet

- Guide To Philippine Tax Law ResearchDocument156 pagesGuide To Philippine Tax Law ResearchAlphia RodriguezNo ratings yet

- CENVAT and Special Duty Rates on Excisable GoodsDocument2 pagesCENVAT and Special Duty Rates on Excisable GoodsKrishna Kumar VermaNo ratings yet

- Lesson Plan Teach SSC 2Document9 pagesLesson Plan Teach SSC 2Irish OrtezaNo ratings yet

- Davies-2010-Critical Urban Studies - New DirecDocument237 pagesDavies-2010-Critical Urban Studies - New DirecGerardoNo ratings yet

- BEGP2 OutDocument28 pagesBEGP2 OutSainadha Reddy PonnapureddyNo ratings yet

- People of The Philippines Vs Jesus Nuevas y GarciaDocument1 pagePeople of The Philippines Vs Jesus Nuevas y Garciajay100% (1)

- AstrinakiDocument12 pagesAstrinakilawnboy2812No ratings yet

- Par e PN 2020 21Document42 pagesPar e PN 2020 21Ancy RajNo ratings yet

- PAD118Document190 pagesPAD118Olatunji MosesNo ratings yet

- Theories of Poverty: A Critical ReviewDocument8 pagesTheories of Poverty: A Critical ReviewSakina Khatoon 10No ratings yet

- Nationalism and Non-Cooperation Movement in IndiaDocument12 pagesNationalism and Non-Cooperation Movement in IndiaShaurya TiwariNo ratings yet

- Exploitation, and Discrimination Act". Under This Law, There Are Seven Forms of Child AbuseDocument59 pagesExploitation, and Discrimination Act". Under This Law, There Are Seven Forms of Child AbuseIris AngelaNo ratings yet

- What does it take to be a good parentDocument10 pagesWhat does it take to be a good parentR Shaiful MohamadNo ratings yet

- PMU Letter - Regading Construction Work - Uyanga TranslationDocument2 pagesPMU Letter - Regading Construction Work - Uyanga TranslationУянга ВеганNo ratings yet

- Civil Judgment - Kevin D. Townsend & Other V The Minister of Safety and OthersDocument10 pagesCivil Judgment - Kevin D. Townsend & Other V The Minister of Safety and OthersAndré Le RouxNo ratings yet

- Frivaldo vs. COMELEC, 257 SCRA 731Document7 pagesFrivaldo vs. COMELEC, 257 SCRA 731Inez Monika Carreon PadaoNo ratings yet

- Annotated BibliographyDocument5 pagesAnnotated BibliographyelliotchoyNo ratings yet

- Che Guevara's Racism, Misogyny and Lack of Ethics ExposedDocument14 pagesChe Guevara's Racism, Misogyny and Lack of Ethics Exposedtamakun0No ratings yet

- Comparative Police System - REVIEWERDocument48 pagesComparative Police System - REVIEWERMitchiko KarimaguNo ratings yet

- Reserved On: November 03, 2015 Pronounced On: November 06, 2015Document11 pagesReserved On: November 03, 2015 Pronounced On: November 06, 2015SatyaKamNo ratings yet

- PNP Narrative 2Document31 pagesPNP Narrative 2Ray Ann R. CasidoNo ratings yet

- Topic 4 Canons of Taxation PDFDocument2 pagesTopic 4 Canons of Taxation PDFsarah andrews100% (1)

- April 2010Document19 pagesApril 2010Shaneela Rowah Al-QamarNo ratings yet

- Beatrice Fernandez V Sistem Penerbangan Malaysia & Ors (FC)Document11 pagesBeatrice Fernandez V Sistem Penerbangan Malaysia & Ors (FC)Sih Hui WoonNo ratings yet