Professional Documents

Culture Documents

Auxiliaries To Trade

Uploaded by

Sangam GargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auxiliaries To Trade

Uploaded by

Sangam GargCopyright:

Available Formats

7

Auxiliaries to Trade

7.1 Introduction

You are already familiar with the terms industry, trade and commerce.

All these are interdependent and cannot be seen in isolation. Auxiliaries

to trade or aids to trade also provide necessary support to trade. In the

present lesson we are concerned with auxiliaries to trade, such as

transport, warehousing, banking and finance, and insurance.

7.2 Objectives

After studying this lesson you will be able to:

explain the importance of transport;

enlist the activities related to transport;

enumerate various modes of transport;

explain the meaning of warehousing and its uses;

describe the suitable arrangements for storage;

explain the functions of warehousing;

define the terms Insurance and Insurance premium;

enumerate the uses of insurance;

identify the types of risks covered by insurance;

disucss the role of finance and banking;

10 :: Business Studies

describe the term commercial bank and its functions; and

identify various types of bank financing and credit.

7.3 Importance of Transport with reference to Trade

(i) Transport plays a very important role in marketing and distribution

of goods both within a country as well as outside.

(ii) Transport helps in bring about stable and uniform prices in

different markets as traders are able to equalise the supply of

goods at different places according to demand.

(iii) Consumers have the benefit of getting goods according to their

needs as supply can be adjusted to demand through transport.

(iv) Producers can concentrate on production activities as they can

fulfill their requirements of raw materials conveniently through

transport.

(v) Traders, producers and consumers living in different parts of the

world can interact with each other with the help of transport.

7.4 Activities relating to Transport

Various activities relating to transport are as follows:

(i) Carrying goods and passengers

(ii) Carrying raw materials

(iii) Carrying live-stock

(iv) Carrying oil and gas through pipe line transport

(v) Carrying mail

(vi) Movement of raw materials and goods within a factory.

7.5 Modes of Transport

The various modes of transport can be divided into the following three

categories:

(i) Land Transport, (ii) Water Transport, (iii) Air Transport

Auxiliaries to Trade :: 11

(i) Land Transport:

It can be sub-divided into two: (a) Road Transport (b) Rail

Transport.

Road Transport: The means of transport by road include carts,

thelas, cycles, rickshaws, tempos, trucks, etc.

Rail Transport: It consists of carriage of goods, livestock,

pasengers, etc. by railways.

Motor transport and rail transport are two important means of

land transport. Motor transport is used to carry heavy goods but

has limited carrying capacity. Rail transport is used to carry

bulky and heavy goods and goods in large quantities.

(ii) Water Transport:

It includes carriage by inland water-ways and ocean transport.

Inland Waterways: These include canals and rivers. Canals are

artificial water ways constructed for the purpose of navigation

and irrigation. Rivers are natural waterways. Canals as well as

rivers are suitable for plying boats and steamers for carrying

goods and passengers. Inland waterways are used in home trade

to carry bulky goods.

Ocean Transport: The means of transport by sea or ocean consist

of ships which carry goods from one country to another separated

by sea and oceans. There are two types of ships available for

transport of goods by sea or ocean: Liners and Tramps.

Liners are ships owned by big companies which have fixed routes

and fixed time schedules to carry goods and passengers.

Tramps are owned by small shipping companies which do not

have fixed time schedules or fixed routes but carry cargo only

when they have full load.

(iii) Air Transport:

Generally less bulky goods of high value are transported by air.

Though air transport is relatively more expensive, it is the

12 :: Business Studies

speediest means of transport and therefore more time saving than

other means of transport.

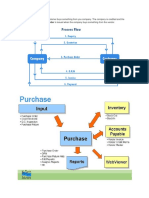

The following chart shows the various modes of transport.

Modes of Transport

Land Transport Water Transport Air Transport

Inland Water Transport Ocean Transport

Liners Tramps

Canal Transport River Transport

Road Rail

Transport Transport

Intext Question 7.1

I. Match the following

(A) (B)

(i) Inland water ways (a) Foreign trade

(ii) Ocean transport (b) Less bulky and valuable items

(iii) Air transport (c) Home Trade

(iv) Rail Transport (d) Truck

(v) Road Transport (e) Large quantity of goods

7.6 Warehousing

Meaning and uses

A warehouse is an establishment for the storage of goods. Warehousing

means storing goods in the warehouse.

The uses of warehousing are outlined below:

(i) It helps merchants and manufacturers in storing their goods in

case they do not have their own warehouses or their warehouses

have limited capacity.

Auxiliaries to Trade :: 13

(ii) Special warehouses which store imported goods provide importers

the facility of paying custom duties in instalments, thus saving

large amounts of capital from being blocked.

(iii) It facilitates the transfer of ownership of goods stored in

warehouses without actual delivery of the same. The owner gets

a document known as a warehouse warrant from the warehouse

keeper at the time of keeping his goods in the warehouse. The

owner can sell the goods by delivery of the warrant. Thus, goods

kept in a warehouse can change hands several times through a

warehouse warrant without actual delivery.

(iv) It provides the manufacturer with the facility of selling his goods

at favourable prices depending upon the market situation;

particularly warehouses situated near the main trading centres.

(v) Warehousing enables the consumer to consume perishable goods,

if they so like, throughout the year by maintaining a regular

supply of goods like fruits, eggs and vegetables etc. with the

use of cold storage.

7.7 Suitable arrangements for Storage

Storage is an important function in the marketing process. This function

involves holding of goods from the time they are produced until they

are needed for consumption. Hence necessary arrangements must be

made for proper storage of goods in the warehouse. The following

arrangements are considered to be necessary for proper storage of goods:

(i) Inspection of goods is necessary before they are accepted for

storage to check quantity or number.

(ii) Storage facilities should be made available near the railway

sidings, air-port and sea port where the goods can be loaded and

unloaded conveniently.

(iii) Sufficient space should be provided to keep the goods in proper

order.

14 :: Business Studies

(iv) Cold storage facilities should be provided for perishable goods

such as vegetables, fruits, eggs and butter.

(v) Facilities for loading and unloading should be provided near

storage.

(vi) Availability of shelves, stacks, bins, etc. should be ensured for

proper arrangement of goods so that they can be easily taken

away without much loss of time.

(vii) Arrangement for safety and security of goods must be provided

against fire, theft, and exposure to water, dust etc.

7.8 Functions of Warehousing

The functions of warehousing may be stated as follows:

(i) The basic function of warehousing is to store large quantities of

goods and made available as and when required.

(ii) Warehousing ensures supply of goods in the market as and when

needed. Thus, it prevents wide fluctuations in prices. In other

words, it stabilises the prices by regulating the supply of goods.

(iii) Once the goods are handed over to the warehouse keeper for

storage, the whole responsibility of the goods so stored passes

on to the warehouse-keeper. Thus the risk of loss or damage to

goods in storage is borne by the warehouse keeper.

(iv) Sometime the warehouse-keeper also performs the functions of

grading and branding of goods on behalf of the manufacturer,

wholesaler or the importer of goods.

Intext Question 7.2

Choose the appropriate words from the following to fill up the

blanks.

Price, Warehouse-keeper, cold storage, Warrant, Import duties.

(i) The ownership of goods kept in warehouse can be

transferred by mere delivery of the warehouse ___________.

Auxiliaries to Trade :: 15

(ii) Perishable goods require _________________facilities.

(iii) Importer can pay _______________________ in

instalments for goods kept in special warehouses.

(iv) The person who issues warehouse warrant for goods kept

in a warehouse is known as a ______________________.

(v) Warehousing prevents wide fluctuation in ____________.

7.9 Insurance

You are already familiar with the meaning of insurance. The owner of

goods can be covered for risk of loss if he has a contract with the

insurance company known as insurance contract.

The term 'Insurance' refers to a contract between two parties, one known

as insured and the other insurer, whereby the insurer agrees to protect

the insured against risks of loss or damage or liability on payment of

a certain amount by the insured known as premium. This contract is

put in writing and is known as Insurance Policy. The person whose

risk is insured is called insured or Assured and the person or the

company which insures is known as insurer, Assurer or Under

writer. The consideration in return for which the insurer agrees to

make good the loss is known as Premium. This premium may be paid

by the insured monthly, quarterly, half-yearly or annually.

A contract of insurance can be easily explained with the help of an

example. Suppose A owns a house worth Rs.10,00,000. He gets it

insured for Rs. 5,00,000 against fire with an insurance company by

paying Rs.10,000. These terms are put in writing on a document. In the

given example, A the owner of the house is known as insured, the

insurance company is known as insurer, the subject matter of insurance

is the house, Rs.10,000 which is paid to the insurance company is

the Premium, and the document on which the terms are written is

known as Policy.

Now, in the given example, if the entire house is damaged due to fire,

the loss or damage can be claimed only upto the value insured i.e., Rs.

16 :: Business Studies

5 lakh for which there was insurance cover (policy). In other words,

in a contract of insurance only the actual loss can be claimed only upto

the value specified in the insurance policy.

7.10 Risks covered by Insurance

The type of risks covered by insurance varies according to the subject

of insurance. Risk is an unexpected happening of some future event

which can be insured with the insurance company at the time of

insurance contract. The various types of risks which can be insured

may be grouped as follows:

(i) Life Insurance : old age and death.

(ii) Fire Insurance : risk of loss or damage to property, goods and

consequential losses caused by fire.

(iii) Marine Insurance : risk of loss or damage to ship or cargo.

(iv) General Insurance : risk of loss or damage due to theft and

burglary in a premises, risk of loss or damage to properties and

assets, and risk of loss or damage due to accidents.

7.11 Uses of Insurance

Insurance plays an important role in the present commercial world as

explained below:

(i) It protects business from losses which may arise due to fire,

theft, burglary, etc. as it compensates for the loss to the insured.

(ii) Business is protected from immediate financial problem due to

loss arising from insured events because the loss can be recovered

within a short period.

(iii) Insurance enables the risk of loss to be spread over a large

number of people; the premium is charged from large number of

persons but very few have claim for loss.

(iv) The insured does not bear the risk of loss alone.

(v) Business firms can concentrate on business activity and can grow

Auxiliaries to Trade :: 17

with the protection given by the insurance company against

various risks.

(vi) To a great extent insurance has contributed to the increase in

volume of international trade through coverage of losses in transit.

(vii) It provides employment opportunities to a large number of people.

Intext Questions 7.3

I. State whether the following statements are true or false:

(i) The terms and conditions of insurance contract are written

in the insurance policy.

(ii) The person whose risk is insured is known as insurer.

(iii) The person who bears the risk is known as insured.

(iv) Insured pays insurance premium to the insurer.

(v) Actual loss or damage suffered can be claimed from the

insurer even if it is more than the value specified in the

insurance cover (policy).

II. Match the following :

(A) (B)

(i) Life Insurance (a) Property or goods

(ii) Fire Insurance (b) Old age

(iii) General Insurance (c) Ship

(iv) Marine Insurance (d) Accident

7.12 Finance and Banking

Banking :

Banking means acceptance of deposits from the public and giving credit

or loans. In simple words, Banking means the business of a bank or

18 :: Business Studies

a banker, and bank means an institution which deals in money and

credit.

Role of Finance and Banking

Finance is the life blood of commerce and industry. Every business

firm needs funds to meet various types of requirement. Some funds are

required for long periods while some funds are required for a short

period in order to carry out day to day work. Bank loans and credit are

important sources of finance for trade and industry. Banks occupy an

important place in the modern business world. No country can make

industrial and commercial progress without a well organized banking

system. Banks offer opportunities of investment and safe custody of

deposits. They encourage the habit of saving among the public. Banks

deal in money and credit. They mobilise small savings and channelise

them to more productive uses. By providing adequate funds to business

firms, banks enable management to generate further wealth for the

good of society. They facilitate settlement of debts and transfer of

money from one place to another. In addition to these, banks also

assist consumers to finance their purchases of costly goods and services.

Thus, banking and finance are indispensable spokes in the wheels of

commerce and industry.

Commercial Bank

A commercial bank may be defined as a bank that accepts deposits

withdrawable on demand, grants loans and advances and renders a

number of other services.

7.13 Functions of Commercial Banks

The main functions of a commercial bank may be broadly outlined as

follows:

(i) Accepting Deposits :

Commercial banks receive deposits from individuals, firms and other

institutions. Three types of deposits are usually accepted i.e., (a) Fixed

deposits, (b)Savings deposits, and (c) Current deposits.

Auxiliaries to Trade :: 19

(a) Fixed Deposits: These deposits are accepted for a fixed period

of time ranging from a minimum of 15 days. For example it may

be for 3 months, 6 months, 1 year, 2 years or more. The rate of

interest depends on the period of deposit and it is higher than

that of other types of deposits.

(b) Saving Deposits: These are deposits from which withdrawals

can be made only to a limited number of times as fixed by a

bank where deposits can be made as and when the depositor

likes. The rate of interest allowed is higher than that on a current

deposit but lower than that on a fixed deposit.

(c) Current Deposits: On current deposits there is no restriction on

the number of withdrawals and deposit of money. Interest is not

generally allowed on such deposits; even if it is allowed, it is

very nominal.

(ii) Lending Money:

Banks grant financial assistance with or without security. These loans

are in the form of cash credit, overdrafts, loans and advances. Banks

charge interest on loans. These will be discussed in the next section.

(iii) Agency Functions:

Agency functions are those functions which are rendered by banks as

agents to their depositors and borrowers. The main functions are listed

below:-

(a) Payment of insurance premium, subscriptions, interest, rent, etc.

(b) Collection of cheques, bills and promissory notes.

(c) Collection of dividend and interest on shares and debentures

(d) Collection of salaries, pensions, etc.

(e) Purchase of shares and bonds on behalf of customers

(f) Banks stand guarantee for customers dues.

20 :: Business Studies

(iv) General Services:

Besides agency services, banks perform many other services of general

utility to the public as well as to the customers, such as issue of letter

of credit and travellers cheques, acceptance of bills on behalf of

customers, acting as a referee regarding financial position of customers,

undertaking foreign exchange business, underwriting loans floated by

Government and public bodies, safe keeping of valuables in lockers,

and issue of credit card.

7.14 Types of Bank Financing and Credit

Banks provide financial assistance and grant credit facilities. The

different types of finance and credit provided by banks are given below:

(i) Loans and Advances:

Banks grant loans and advances for short, medium and long term

generally against security.

(ii) Cash-credit:

It is an arrangement by which the customer can avail of credit upto a

certain limit from his bank. Interest is charged only on the amount

actually used by customer. It is generally granted against security.

(iii) Overdraft:

When a depositor is allowed to draw more than his bank balance but

upto a certain limit, it is known as overdraft.

(iv) Discounting of Bills:

The holder of bills receivable (B/R) can encash the same from the

bank before its due date. The bank pays the face value less discount

which is the interest at current rate upto due date.

(v) Loans against documents of title:

A customer can get a loan against documents of title to goods such as

Railway Receipt, Bill of Lading, etc.

Auxiliaries to Trade :: 21

(vi) Loan against life insurance policy, FDR and NSC, etc:

Banks also grant loans against life insurance policy, fixed deposit receipt,

National Saving Certificates, and other securities.

Intext Questions 7.4

I. Fill in the blanks

(i) Fixed Deposit Receipt is issued when the deposit is for a

_____________ period.

(ii) There are no restrictions on the number of withdrawals in

____________ deposits.

(iii) The rate of interest on ___________ deposits is higher

than current deposits but less than that of fixed deposits.

(iv) When an account-holder can withdraw more than his bank

balance upto a certain limit it is called ____________

facility.

II Match the following:

(A) (B)

(i) Agency function (a) Cash credit

(ii) General services (b) Collection of cheques

(iii) Lending money (c) Credit card

(iv) Fixed deposits (d) Limited number of

withdrawals.

(v) Current deposits (e) Fixed period

(vi) Savings deposits (f) Unlimited number of

withdrawals.

22 :: Business Studies

7.15 What You Have Learnt

Transport

Transport relates to carriage of goods and passengers within and outside

a country.

Importance of transport with reference to Trade

1. It facilitates home trade and foreign trade.

2. It equalizes supply of goods in the market and thus ensures

stable and uniform prices.

3. Consumers can get goods according to their needs.

4. Producers can concentrate on the production process.

5. Producers, traders and consumers can interact with each other.

Activities relating to transport

Carrying of goods and passengers, raw material, live stock, oil and gas,

mail, and movement of raw materials and goods within the factory.

Modes of Transport

Modes of transport are divided into three categories:

(1) Land transport, (2) Water transport, (3) Air transport.

Land Transport :

It includes road and rail transport.

Water Transport :

It includes inland water ways and ocean transport. Ocean transport

further includes carriage by ships which may be tramps and liners.

Air transport :

It carries passengers and less bulky and valuable items to far off places.

Auxiliaries to Trade :: 23

Warehousing

It means storing goods in the warehouse.

Uses of Warehousing

1. It helps in storing goods.

2. Payment of customs duties in instalments.

3. Transfer of ownership of goods without actual delivery.

4. Benefit of selling goods at favourable prices.

5. Availability of perishable goods throughout the year.

Suitable arrangement for storage

1. Inspection of goods

2. Storage facilities near railway sidings, Airport and Seaport

3. Sufficient space

4. Cold storage facilities

5. Shelves, stacks and bins, etc.

6. Safety and security of goods.

Functions of Warehousing

1. Store and preserve large quantities of goods.

2. Stabilises prices by regulating supply of goods.

3. The risk of loss or damage is borne by warehouse-keeper.

4. Service of grading and branding is provided.

Insurance

It is a contract between the insured and an insurance company (insurer)

whereby the insurer agrees to protect the insured against risks of loss

or damage or liability on payment of certain amount i.e. premium. The

document on which the contract is written is called an insurance policy.

24 :: Business Studies

Risks covered by Insurance

Old age and death, loss or damage to property and goods, ship and

cargo, risk of loss or damage due to theft, burglary, and accidents.

Uses of Insurance

1. Protects business from losses due to fire, theft and burglary.

2. Protects business from immediate financial problem due to

happening of insured events.

3. Spreads risk of loss over a large number of people

4. Leads to growth of business.

5. Increases the volume of international trade.

6. Provides employment opportunities.

Finance and Banking

Banking means the business of a bank or a banker and bank refes to

an institution which deals in money and credit.

Role of Finance and Banking

The enable the management of business firms to generate further wealth

for the good of society because they mobilise small savings and

channelise them to more productive uses. Banking and finance are

indispensable spokes in the wheels of commerce and industry.

Commercial Banks

They accept deposits, advances, loans, and render various services.

Functions of commercial banks

Receiving deposits, lending money, agency functions, and general

services.

Types of Bank financing and credit

Loans and advances, cash credit, overdraft, discounting of bills, loan

Auxiliaries to Trade :: 25

against document of titles, loan against B/R, FDR and Life Insurance

Policy, etc.

7.16 Terminal Exercise

1. State the various activities relating to transport.

2. State any two modes of Water transport.

3. Enumerate the various modes of Road transport.

4. Briefly explain : (a) Liner, (b) Tramp, (c) Warehouse warrant,

(d) Overdraft, (e) Cash credit, (f) Current deposits, (g) fixed

deposits.

5. Explain briefly the importance of transport with reference to

trade.

6. Explain briefly the various modes of transport.

7. Explain the functions of warehousing.

8. What is meant by Warehousing? Enumerate the steps which are

necessary for suitable arrangements for storage of goods.

9. Explain the uses of warehousing to a manufacturer, trader and

importer of goods.

10. State the various uses of insurance.

11. What is meant by insurance? State the risks covered by different

types of insurance contracts.

12. Explain briefly the role of finance and banking in development

of commerce and industry.

13. What is a commercial bank? Explain briefly the various types

of bank deposits.

14. Explain the functions of a commercial banks.

15. Define banking and explain briefly the various types of bank

financing and credit.

26 :: Business Studies

7.17 Answers to Intext Questions

7.1 (i) c (ii) a (iii) b (iv) e (v) d

7.2 (i) Warrant, (ii) Cold storage, (iii) Import duties,

(iv) Warehouse-keeper, (v) Price

7.3 I. (i) true, (ii) false, (iii) false, (iv) true, (v) false.

II. (i) b, (ii) a, (iii) d, (iv) c.

7.4 I. (i) fixed, (ii) current, (iii) savings, (iv) overdraft

II. (i) b, (ii) c, (iii) a, (iv) e, (v) f, (vi) d.

You might also like

- Designing Distribution Networks and Applications To Online SalesDocument43 pagesDesigning Distribution Networks and Applications To Online SalesOmpriya Tripathi100% (2)

- Transport Peer Graded Assignment CourseraDocument5 pagesTransport Peer Graded Assignment CourseraAayush ThakurNo ratings yet

- Project On Mutual FundDocument46 pagesProject On Mutual Fundr7118969No ratings yet

- Methods of Payment in International TradeDocument13 pagesMethods of Payment in International Tradelovepreet singhNo ratings yet

- Omnichannel DistributionDocument24 pagesOmnichannel DistributionHarisvan To SevenNo ratings yet

- Supply Chain Management Quiz PDFDocument7 pagesSupply Chain Management Quiz PDFbhartia100% (2)

- Impact of It in RetailingDocument33 pagesImpact of It in RetailingSuresh Jayarama50% (2)

- SAP IS Oil TerminologyDocument5 pagesSAP IS Oil Terminologympsurender100% (1)

- Sample Company Profile For Cleaning Supplies Business PDFDocument18 pagesSample Company Profile For Cleaning Supplies Business PDFY.P SuastikaNo ratings yet

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624No ratings yet

- Sales OrderDocument17 pagesSales OrderRafdi Raziq100% (1)

- Availability CheckDocument41 pagesAvailability CheckTek's Notani50% (2)

- Financial Derivatives: An International PerspectiveDocument131 pagesFinancial Derivatives: An International Perspectiveअंजनी श्रीवास्तव0% (1)

- Storage Type Indicators in SAP WMDocument13 pagesStorage Type Indicators in SAP WMMohammed Savad0% (1)

- Powerpoint Presentation On Financial & Ratio Analysis of Pharmaceutical CompanyDocument17 pagesPowerpoint Presentation On Financial & Ratio Analysis of Pharmaceutical CompanyAviral Tripathi100% (2)

- Auxiliaries To TradeDocument5 pagesAuxiliaries To TradeAbharika100% (1)

- Emerging Trends in Capital MarketDocument20 pagesEmerging Trends in Capital MarketAvinash Hacholli0% (1)

- Credit RatingDocument15 pagesCredit RatingKrishna Chandran PallippuramNo ratings yet

- Indian Foreign Exchange ReserveDocument10 pagesIndian Foreign Exchange Reserveece_shreyasNo ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Export Finance ProjectDocument67 pagesExport Finance ProjectVinay Singh67% (3)

- Session 1 - Classification of Export FinanceDocument28 pagesSession 1 - Classification of Export FinanceJc Duke M Eliyasar100% (1)

- Role of FDI in Indian EconomyDocument16 pagesRole of FDI in Indian EconomyAnna Anjana VargheseNo ratings yet

- Interconnected Stock Exchange (ISE)Document9 pagesInterconnected Stock Exchange (ISE)Anoop KoshyNo ratings yet

- ADR and GDR - CFDocument16 pagesADR and GDR - CFlove_abhi_n_22100% (4)

- Issue ManagementDocument30 pagesIssue Managementmohanbkp100% (2)

- Online Trading DerivativesDocument35 pagesOnline Trading DerivativesAmol Kadam100% (2)

- Research Paper On FIIDocument7 pagesResearch Paper On FIIchitkarashellyNo ratings yet

- Mutual Fund Distribution ChannelsDocument15 pagesMutual Fund Distribution Channelsdurgeshnandan600240% (5)

- 56706icaibosugans FND May19 p2 PDFDocument22 pages56706icaibosugans FND May19 p2 PDFNix WixNo ratings yet

- Ibm MCQ Question BankDocument9 pagesIbm MCQ Question BankpavandongreNo ratings yet

- Clearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghDocument22 pagesClearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghpreetsinghjjjNo ratings yet

- Part B FinalDocument7 pagesPart B FinalPeruriHarishNo ratings yet

- EIC Project Report On Pharmaceutical IndustryDocument52 pagesEIC Project Report On Pharmaceutical IndustrykalpeshsNo ratings yet

- SAPMDocument54 pagesSAPMGuruKPO100% (3)

- CAPITAL-MARKET-BBA-3RD-SEM - FinalDocument84 pagesCAPITAL-MARKET-BBA-3RD-SEM - FinalSunny MittalNo ratings yet

- Gold As An Investment OptionDocument19 pagesGold As An Investment OptionkundvalliNo ratings yet

- Discount MarketDocument13 pagesDiscount MarketAakanksha SanctisNo ratings yet

- Project On Micromax MobileDocument38 pagesProject On Micromax MobileHaneen Khan83% (6)

- Financial ServicesDocument27 pagesFinancial ServicesPoonam100% (1)

- PestelDocument12 pagesPestelsamy7541100% (2)

- DP World Internship ReportDocument40 pagesDP World Internship ReportSaurabh100% (1)

- Hypothesis For Mutual FundsDocument1 pageHypothesis For Mutual Fundskrishnalohia9100% (1)

- What Is Equity MarketDocument27 pagesWhat Is Equity MarketkoppulaNo ratings yet

- Foreign Institutional InvestorsDocument15 pagesForeign Institutional InvestorsJagritiChhabraNo ratings yet

- Assignment For Mba Students Portfolio ManagementDocument12 pagesAssignment For Mba Students Portfolio ManagementRajan ShrivastavaNo ratings yet

- Balance of Payments: International FinanceDocument42 pagesBalance of Payments: International FinanceSoniya Rht0% (1)

- Report On Wealth ManagementDocument67 pagesReport On Wealth ManagementanuboraNo ratings yet

- Evaluating The Working Capital Requirements of DLFDocument36 pagesEvaluating The Working Capital Requirements of DLFVivek Kumar Gupta100% (1)

- Indian Financial SystemDocument16 pagesIndian Financial Systemshankarinadar100% (1)

- Financial ServicesDocument28 pagesFinancial ServicesPrasad Sandepudi100% (1)

- Mutual Funds Vs Gold Saving FundsDocument19 pagesMutual Funds Vs Gold Saving Fundschaluvadiin100% (1)

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingStone HsuNo ratings yet

- Main ProjectDocument121 pagesMain Projectbhargava prathapNo ratings yet

- MONEY MARKET Project - McomDocument50 pagesMONEY MARKET Project - McomRavi Sahani100% (1)

- Swot Analysis of The Indian Aviation IndustryDocument1 pageSwot Analysis of The Indian Aviation IndustryTejas Soni0% (1)

- Merchant Banking in IndiaDocument51 pagesMerchant Banking in IndiaAadhish PathareNo ratings yet

- Portfolio Performance EvaluationDocument15 pagesPortfolio Performance EvaluationMohd NizamNo ratings yet

- Capital Budgeting Management Accounting Sem V T.y.bafDocument6 pagesCapital Budgeting Management Accounting Sem V T.y.bafShravan BaneNo ratings yet

- IB0016 - International Logistics and Distribution ManagementDocument6 pagesIB0016 - International Logistics and Distribution ManagementAbhranil GuptaNo ratings yet

- WAREHOUSINGDocument9 pagesWAREHOUSINGKennedy KoduorNo ratings yet

- Principles of Material Handling AssignmentDocument27 pagesPrinciples of Material Handling AssignmentMuriithi MichaelsNo ratings yet

- Lesson 11Document7 pagesLesson 11Priyambada PradhanNo ratings yet

- Explain The Advantages of Warehousing?Document12 pagesExplain The Advantages of Warehousing?Krunal SangharajkaNo ratings yet

- E - Notes Week 2Document2 pagesE - Notes Week 2tukur chubadoNo ratings yet

- Warehousing: Warehouse: This Is A Building or A Part of A Building Where Goods Are Received and Stored UntilDocument11 pagesWarehousing: Warehouse: This Is A Building or A Part of A Building Where Goods Are Received and Stored UntilangaNo ratings yet

- Introduction To WarehousesDocument4 pagesIntroduction To WarehousesSumanth Bs100% (4)

- SI Unit 1Document59 pagesSI Unit 1Safeer ArshadNo ratings yet

- Commerce Question and AnswerDocument17 pagesCommerce Question and Answerngombenepharty4No ratings yet

- Marketing Mevin MefrinDocument65 pagesMarketing Mevin MefrinSuresh Babu ReddyNo ratings yet

- Sargent Price Book 2012Document446 pagesSargent Price Book 2012Security Lock DistributorsNo ratings yet

- E Transport PDFDocument21 pagesE Transport PDFbaoovidiuNo ratings yet

- 3PL - DHL, DTDC CaseDocument14 pages3PL - DHL, DTDC Casepeednask0% (2)

- Order #1 COVID-19 Public Health Plan For Suburban Milwaukee CountyDocument15 pagesOrder #1 COVID-19 Public Health Plan For Suburban Milwaukee CountyTMJ4 News100% (2)

- Logistics of Big Bazaar and ProblemsDocument14 pagesLogistics of Big Bazaar and ProblemsAnonymous Vj8Rk8No ratings yet

- Is There A Future For Service Stations?Document25 pagesIs There A Future For Service Stations?SchreiberNo ratings yet

- Logistics Management of FlipkartDocument16 pagesLogistics Management of Flipkartfarhan2091100% (1)

- Order To Cash User ManualDocument21 pagesOrder To Cash User ManualdevdutsahaNo ratings yet

- Chopra and Meindl-Chapter 4Document12 pagesChopra and Meindl-Chapter 4Abc AnalysisNo ratings yet

- JDE Advanced Preferences March 9th 2011 OTV2Document29 pagesJDE Advanced Preferences March 9th 2011 OTV2chatwithgmNo ratings yet

- Special Order - Quick Guide - Nav 6.2Document53 pagesSpecial Order - Quick Guide - Nav 6.2Sangeeth Unnithan0% (1)

- AFS MTO and PTDocument4 pagesAFS MTO and PTmjNo ratings yet

- What Is Transfer Order?: Ans. Transfer Order: Before Going For Picking The Goods You Need To Create ADocument10 pagesWhat Is Transfer Order?: Ans. Transfer Order: Before Going For Picking The Goods You Need To Create ASushma AvalaNo ratings yet

- Pros and Cons of CDCDocument3 pagesPros and Cons of CDCPrakash Jeswani0% (1)

- Delivery Advice - 20200323 - 130817 PDFDocument1 pageDelivery Advice - 20200323 - 130817 PDFNacreg KrijNo ratings yet

- Term II: Supply Chain Management (SCM) : Rohit Gupta Operations Management Area EmailDocument29 pagesTerm II: Supply Chain Management (SCM) : Rohit Gupta Operations Management Area EmailSUSHANT AGARWALNo ratings yet

- Amazon (Company) : Trade Name Formerly Type Traded AsDocument48 pagesAmazon (Company) : Trade Name Formerly Type Traded AsBMikeNo ratings yet

- Product & Service DifferentiationDocument38 pagesProduct & Service DifferentiationAbdur RahmanNo ratings yet

- Gardenia HistoryDocument9 pagesGardenia HistoryVia AbadNo ratings yet

- CIA 1 Component 1Document16 pagesCIA 1 Component 1Arindam DasNo ratings yet