Professional Documents

Culture Documents

Exercises Chapter 1 & 2

Uploaded by

Kiko Doragon Inoue TsubasaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises Chapter 1 & 2

Uploaded by

Kiko Doragon Inoue TsubasaCopyright:

Available Formats

9/9/2012

1

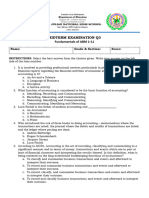

CHAPTER 1 ACCOUNTING IN BUSINESS

IN BOOK-KEEPING MODEL, WHAT SHOULD BE THE INPUT & OUTPUT?

Record Sort Summarize

INPUT OUTPUT

Most people draw a distinction between book-keeping & accounting. Accountants know how to do

everything that a book-keepers does. In addition, they do much more. Next to each of the following, write a

B if it is done by both a book-keeper and an accountant; write an A if the activities is done only by

accountant?

a, Making a record of daily cash sales

b, Interpreting and analyzing the results of weekly summary of events affecting the business

c, Classifying events affecting the business according to type of events

d, Setting up a book-keeping system

FILL IN THE MISSING WORDS, CIRCLE THE CORRECT RESPONSES

Accounting defined

1, The accounting process (or accounting cycle) may be defined as the systematic process

that identifies, measures, and reports relevant.information

about business organisations to interested users

2, Accountants observe many events of a business entity and---------------and measure in

financial terms (in dollars) those events considered evidence of economic activities (or

events)

3,Which of the following would be considered economic activities?

A, Manufacture of goods

B, Sale of manufactured goods,

C, Treatment of a hospital patient

D, Purchase of a large piece of machinery

The nature of accounting information

4, Accountants report on financial activities by preparing financial statements (reports).

Often, accountants are asked to interpret these statements and reports for various groups

such as management and creditors, to determine how the business entity is performing

compared to (prior/future) years and other similar business entities

5, Timeliness requires financial information to be provided at a time when it may be

considered in reaching a decision. The usefulness of information (increase/decrease) with

time

6,Accounting information is useful to managers and workers, investors and creditors,

and other parties such as government agencies. Accounting information provides data to

help the decision-making process of persons:

A. Inside the business entity (internal decision-maker)

B. Outside the business (external decision-makers)

C.Both (a) and (b)

FILL IN THE MISSING WORDS, CIRCLE THE CORRECT RESPONSES

Types of decision-makers

7, Accounting is often divided into two categories: managerial accounting (for internal

decision-makers) and financial accounting (for--------------decision-makers)

8,Creditors and lenders. Should a loan be granted to the business entitiy? Will the business

entity be able to pay its..as they become due?

9, Financial statements are formal R. Providing information on a business

entity's financial position (solvency), cash inflows and outflows, and the results of

operations

10, Financial accounting information is historical in nature, reporting on what has happened

in the .Thus, external parties use relevant and reliable financial statements to

make present decisions about future events

11, Financial statements are practical means of demonstrating that business has achieved

these primary objectives. The financial statement that reflects a company's profitability is

the i..s

12,The .shows the change in owner's equity between the

beginning of the period (ex: a month) and the end of that period

13,A fourth financial statement, the statement of cash flows, shows the cash inflows

andoutflows for a company over a period of time

FILL IN THE MISSING WORDS, CIRCLE THE CORRECT RESPONSES

MATCH EACH OF THE FOLLOWING STATEMENTS WITH ITS PROPER TERM

1. An information system that provides reports to stakeholders about the economic

activities and condition of a business

2. Assets = Liabilities + Owners Equity

3. The resources owned by a business

4. A list of assets, liabilities and owners equity that have occurred during a specific period

of time, such as a month or a year

5. An economic event or condition that directly changes an entitiess financial condition or

directly affects its results of operations

A. Account B. Account Payable C. Account Receivable

D. Accounting E. Accounting Equation F. Assets

G. Financial Accounting H. Management Accounting I. Business transactions

J. Expense K. Liabilities L. Owners Equity

M. Revenue N. Prepaid expense O. Balance sheet

P. Statement of Cash flow Q. Statement of Owners Equity R. Income Statement

9/9/2012

2

MATCH EACH OF THE FOLLOWING STATEMENTS WITH ITS PROPER TERM

6. The amounts used in the process of earning revenue

7. A specialized field of accounting concerned primarily with the recording and

reporting of economic data and activities to stakeholders outside the business

8. A summary of the revenue and expenses for a specific period of time such as

a month or a year

9. The rights of creditors that represent debts of the business

10. The rights of the owners

A. Account B. Account Payable C. Account Receivable

D. Accounting E. Accounting Equation F. Assets

G. Financial Accounting H. Management Accounting I. Business transactions

J. Expense K. Liabilities L. Owners Equity

M. Revenue N. Prepaid expense O. Balance sheet

P. Statement of Cash flow Q. Statement of Owners

Equity

R. Income Statement

MATCH EACH OF THE FOLLOWING STATEMENTS WITH ITS PROPER TERM

11. Items such as supplies that will be used in the business in the future

12.The amount of a business earned by selling goods or services to its

customers

13. A summary of the cash receipts and cash payments for a specific period of

time, such as a month or a year

14. A summary of the changes in owners equity that have occurred during a

specific period of time, such as a month or a year

A. Account B. Account Payable C. Account Receivable

D. Accounting E. Accounting Equation F. Assets

G. Financial Accounting H. Management Accounting I. Business transactions

J. Expense K. Liabilities L. Owners Equity

M. Revenue N. Prepaid expense O. Balance sheet

P. Statement of Cash flow Q. Statement of Owners

Equity

R. Income Statement

MATCH EACH OF THE FOLLOWING STATEMENTS WITH ITS PROPER TERM

15. The liability created by a purchase on account

16. A claim against the customer

17. An accounting form that is used to record the increases and decreases in each

financial statement item

18. A specialized field of accounting that used estimated data to aid management in

running day-to-day operations and in planning future operations

A. Account B. Account Payable C. Account Receivable

D. Accounting E. Accounting Equation F. Assets

G. Financial Accounting H. Management Accounting I. Business transactions

J. Expense K. Liabilities L. Owners Equity

M. Revenue N. Prepaid expense O. Balance sheet

P. Statement of Cash flow Q. Statement of Owners

Equity

R. Income Statement

Classification: Asset, Liability, Revenue, Expense? If you think that

any item might fit into more than one of these categories, explain why?

a. Bank

b. S,Peel Capital

c. Accounts Payable

d. Accounts Receivable

e. Inventory for Funiture

Fabrics

f. Interest

g. Investment

h. Land mortaged to a Building Society

i. Mortage Payable

j. Motor Vehicles

e. Rent

k. Salaries & Wages

l. Repair Fees

m. Inventory of Other Materials

N . Tools

Answer the following questions

(Hint: Use the accounting equation.)

Cadence Office Supplies has assets equal to $123,000 and liabilities equal to

$47,000 at year-end. What is the total equity for Cadence at year-end?

At the beginning of the year, Addison Companys assets are $300,000 and its equity

is $100,000. During the year, assets increase $80,000 and liabilities increase

$50,000. What is the equity at the end of the year?

At the beginning of the year, Quasar Companys liabilities equal $70,000. During

the year, assets increase by $60,000, and at year-end assets equal $190,000.

Liabilities decrease $5,000 during the year. What are the beginning and ending

amounts of equity?

Leora Holden began a professional practice on June 1 and plans to prepare financial

statements at the end of each month. During June, Holden (the owner) completed these

transactions.

a. Owner invested $60,000 cash along with equipment that had a $15,000 market value.

b. Paid $1,500 cash for rent of office space for the month.

c. Purchased $10,000 of additional equipment on credit (payment due within 30 days).

d. Completed work for a client and immediately collected the $2,500 cash earned.

e. Completed work for a client and sent a bill for $8,000 to be received within 30 days.

f. Purchased additional equipment for $6,000 cash.

g. Paid an assistant $3,000 cash as wages for the month.

h. Collected $5,000 cash on the amount owed by the client described in transaction e.

i. Paid $10,000 cash to settle the liability created in transaction c.

j. Owner withdrew $1,000 cash for personal use.

Analysing the transactions?

Show new balances after each transaction.

9/9/2012

3

Analysing the transactions?

Show new balances after each transaction.

Required

+Cash

+Accounts Receivable

+Equipment

+Accounts Payable

+Holden, Capital

+Holden, Withdrawals

+Revenues; and Expenses.

Then use additions and subtractions to show the effects of the transactions

on individual items of the accounting equation. Show new balances after each

transaction.

Create a table like the one in Exhibit 1.9, using the following headings for columns:

Provide an example that creates the desbribed

effects for the separate case a through g

a. Increases an asset and increases a liability

b. Decreases a liability and increases a liability

c. Decreases an asset and decreases a liability

d. Increases an asset and decreases an asset

e. Increases a liability and decreases equity

f. Increases an asset and increases equity

g. Decreases an asset and decreases equity

CHAPTER 2 ANALYSING TRANSACTIONS CHAPTER 2 ANALYSING

The following is a list of accounts and identification letters A through J for

Shannon Management Co.:

a. Shannon, Capital

b. Interest Payable

c. Land

d. Shanoon, Withdrawals

e. Fees Earned

f Prepaid Rent

g Advertising Expense

h Unearned Revenue

i. Commissions Earned

j. Notes Receivable

Use the formbelow to

identify the type of account

and its normal balance. The

first itemis filled in as an

example.

CHAPTER 2 ANALYSING

Josephine's Bakery had the following assets and liabilities at the beginning and

end of the current year:

a. If Josephine made no investments in the business and withdrew no assets during

the year, what was the amount of net income earned by Josephine's Bakery?

b. If Josephine invested an additional $12,000 in the business during the year, but

withdrew no assets during the year, what was the amount of net income earned by

Josephine's Bakery?

Assets Liabilities

Beginning of the year $ 114,000 $ 68,000

End of the year 135.000 73.000

EXERCISE 1: MAKING THE JOURNAL ENTRIES???

1. J. Scott invests $20,000 cash to start the business.

4. Borrowed $1,000 cash from Bank to pay for

suppliers payables

2. Purchased equipment for $15,000 cash.

3. Purchased Supplies of $200 and Equipment

of $1,000 on account.

6. Paid advertising fees of $800 cash

5. Provided consulting services receiving $3,000 cash

7. A withdrawal of $500 cash is made by the owner.

9/9/2012

4

EXERCISE 2

1, LINH deposits $ 25,000 in a bank account in the name of ACC

2, Exchanged $ 20,000 cash for land

3, Buying supplies for $ 1,350 and agreeing to pay the supplier in the near future

4, During its first month of operations, ACC provided services to customers,

earning fees of $ 7,500 and receiving the amount in cash

5, The expenses paid during the month were as follows: wage $2,125$; rent $ 800

and miscellaneous $725

6, ACC pays $ 950 to creditors during the month

7. At the end of the month, the cost of the supplies on hand (not used) is $ 550.

The remainder was used in the operation of business and treated as expense

8, At the end of the month, LINH withdraws $ 2,000 in cash from the business for

personal use

You might also like

- Nation of Islam Timeline and Fact Sheet (Brief)Document6 pagesNation of Islam Timeline and Fact Sheet (Brief)salaamwestnNo ratings yet

- Ballotpedia Writing Style Guide (Spring 2016)Document54 pagesBallotpedia Writing Style Guide (Spring 2016)Ballotpedia67% (3)

- Accounting Basics: Inputs, Outputs and Financial StatementsDocument7 pagesAccounting Basics: Inputs, Outputs and Financial StatementsKiko Doragon Inoue TsubasaNo ratings yet

- The Marcos DynastyDocument19 pagesThe Marcos DynastyRyan AntipordaNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- Cfas StodocuDocument31 pagesCfas StodocuRosemarie Cruz100% (1)

- Financial Management AssignmentDocument53 pagesFinancial Management Assignmentmuleta100% (1)

- 3+Minute+Sales+Multiplier - PDF Jho Benson TopppDocument6 pages3+Minute+Sales+Multiplier - PDF Jho Benson TopppAndressa Nunes BatistaNo ratings yet

- Quiz Bee Problems Version 1Document68 pagesQuiz Bee Problems Version 1Lalaine De JesusNo ratings yet

- Final ReportDocument729 pagesFinal ReportKiko Doragon Inoue TsubasaNo ratings yet

- Quizbee QuestionsDocument19 pagesQuizbee QuestionsLalaine De JesusNo ratings yet

- PRINCIPLES OF FINANCIAL ACCOUNTING EXAMDocument5 pagesPRINCIPLES OF FINANCIAL ACCOUNTING EXAMJia SNo ratings yet

- C3 Accounting & Information SystemDocument22 pagesC3 Accounting & Information SystemSteeeeeeeephNo ratings yet

- Midterms Q3 FABM1Document10 pagesMidterms Q3 FABM1Emerita MercadoNo ratings yet

- Accounting1 Midterm Exam 1st Sem Ay2017-18Document13 pagesAccounting1 Midterm Exam 1st Sem Ay2017-18Uy SamuelNo ratings yet

- LP DLL Entrep W1Q1 2022 AujeroDocument5 pagesLP DLL Entrep W1Q1 2022 AujeroDENNIS AUJERO100% (1)

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- Fabm Gauge ReviewerDocument15 pagesFabm Gauge ReviewerJade ivan parrochaNo ratings yet

- Thery of AccountsDocument13 pagesThery of AccountsTerrence Von KnightNo ratings yet

- Financial AccountingDocument11 pagesFinancial AccountingIshitaKothariNo ratings yet

- Giao Trinh Tacn Ke Toan Tai ChinhDocument76 pagesGiao Trinh Tacn Ke Toan Tai ChinhMinh Lý TrịnhNo ratings yet

- Statement of Financial PositionDocument25 pagesStatement of Financial Positiontamorromeo908No ratings yet

- Accounting principles assignment on chapters 1 and 2Document36 pagesAccounting principles assignment on chapters 1 and 2DrGeorge Saad AbdallaNo ratings yet

- MCQ and TRUE FALSE QUESTION - Chapter 1-4Document11 pagesMCQ and TRUE FALSE QUESTION - Chapter 1-4IrdinaNo ratings yet

- Accounting 1 - Lesson 2Document3 pagesAccounting 1 - Lesson 2Vhetty May PosadasNo ratings yet

- Acc 103 Quiz ReviewerDocument7 pagesAcc 103 Quiz Reviewerfernandezmaekyla1330No ratings yet

- Financial Reports ExplainedDocument9 pagesFinancial Reports ExplainedPapa DeltaNo ratings yet

- Mod4 Part 1 Essence of Financial StatementsDocument16 pagesMod4 Part 1 Essence of Financial StatementsAngeline de SagunNo ratings yet

- Review of The Accounting ProcessDocument5 pagesReview of The Accounting Processrufamaegarcia07No ratings yet

- FABM Q3 L4. SLEM - W4 - 2S - Q3 - Five Major AccountDocument16 pagesFABM Q3 L4. SLEM - W4 - 2S - Q3 - Five Major AccountSophia MagdaraogNo ratings yet

- Question SetDocument3 pagesQuestion SetmyuploadsNo ratings yet

- Exam 1 QuestionsDocument16 pagesExam 1 QuestionsArumugamm Ratheeshan100% (1)

- Accounting EquationDocument37 pagesAccounting Equationkimrabaja14No ratings yet

- 1st Term s1 Financial AccountDocument21 pages1st Term s1 Financial AccountAsabia OmoniyiNo ratings yet

- Act Module4 Cashflow Fabm 2 5.Document11 pagesAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.No ratings yet

- Activity 2 Fundamentals of AccountingDocument25 pagesActivity 2 Fundamentals of AccountingLaiza Cristella SarayNo ratings yet

- Lecture Notes Chapters 1-4Document28 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- One and Two Marks Answers PDFDocument48 pagesOne and Two Marks Answers PDFsharkulNo ratings yet

- Financial AccountingDocument85 pagesFinancial Accountingsushainkapoor photoNo ratings yet

- Lecture Notes Chapters 1-4Document32 pagesLecture Notes Chapters 1-4BlueFireOblivionNo ratings yet

- BASIC ACCO Simulated MidtermDocument10 pagesBASIC ACCO Simulated MidtermistepNo ratings yet

- Mcq for IntroDocument52 pagesMcq for IntroJahanzaib ButtNo ratings yet

- FAR mock examDocument5 pagesFAR mock examSugar PandaNo ratings yet

- Practice Quiz 02 ACTG240 Q2202021Document9 pagesPractice Quiz 02 ACTG240 Q2202021Minh DeanNo ratings yet

- 1st Term s1 Financial AccountDocument22 pages1st Term s1 Financial Accountonasanyaolu0916No ratings yet

- 02 Accounting Process (Student)Document31 pages02 Accounting Process (Student)Christina DulayNo ratings yet

- Acc101-FinalRevnew 001yDocument26 pagesAcc101-FinalRevnew 001yJollybelleann MarcosNo ratings yet

- Worksheet 4 CFS Acctg 2Document12 pagesWorksheet 4 CFS Acctg 2Jennifer FabiaNo ratings yet

- Chapter 1 SolutionsDocument53 pagesChapter 1 SolutionsMarwan YasserNo ratings yet

- 1 Basics of Financial Accounting - 220926 - 163000Document23 pages1 Basics of Financial Accounting - 220926 - 163000Health AlertnessNo ratings yet

- Quiz - FARDocument12 pagesQuiz - FARJay Abril RondarisNo ratings yet

- Business organization quiz answersDocument209 pagesBusiness organization quiz answersAaron Carter Kennedy100% (1)

- CEL 1 TOA Answer Key 1Document12 pagesCEL 1 TOA Answer Key 1Joel Matthew MozarNo ratings yet

- Solution manual for financial accounting 11th edition robert libby patricia libby frank hodgeDocument52 pagesSolution manual for financial accounting 11th edition robert libby patricia libby frank hodgemarcuskenyatta275No ratings yet

- Partnership and Corporation Accounting Quiz Test IDocument5 pagesPartnership and Corporation Accounting Quiz Test IDoysabas A. Scott ElizarNo ratings yet

- Intro to Accounting & Business ModuleDocument4 pagesIntro to Accounting & Business ModuleTBA PacificNo ratings yet

- Level 4 ThoeryDocument4 pagesLevel 4 ThoeryElias TesfayeNo ratings yet

- Chapter 01 02 Selected MCQsDocument7 pagesChapter 01 02 Selected MCQsLe Hong Phuc (K17 HCM)No ratings yet

- List of Basic Accounting McqsDocument11 pagesList of Basic Accounting Mcqsalc4levelsNo ratings yet

- The Adjusting Process True/False QuizDocument13 pagesThe Adjusting Process True/False QuizEly IseijinNo ratings yet

- Exercises of Financial AccountingDocument25 pagesExercises of Financial AccountingSai AlviorNo ratings yet

- Basic AccountsDocument31 pagesBasic AccountspoornapavanNo ratings yet

- 20090531143401953Document26 pages20090531143401953kalechiru0% (2)

- Financial StatementsDocument3 pagesFinancial Statementsprintcopyxerox printcopyxeroxNo ratings yet

- MFM Create Account TestsDocument8 pagesMFM Create Account TestsKiko Doragon Inoue TsubasaNo ratings yet

- Designing Your User Interface Using ViewsDocument36 pagesDesigning Your User Interface Using ViewsKiko Doragon Inoue TsubasaNo ratings yet

- KC001Document30 pagesKC001timtailieu_so1_inNo ratings yet

- Bao Cao Cty Me EngDocument31 pagesBao Cao Cty Me EngKiko Doragon Inoue TsubasaNo ratings yet

- Chapter 2 Exercises in ClassDocument3 pagesChapter 2 Exercises in ClassKiko Doragon Inoue TsubasaNo ratings yet

- Atm Machine FSMDocument8 pagesAtm Machine FSMpraveenbhongiriNo ratings yet

- OS Assignment 1: Introduction: Student NameDocument2 pagesOS Assignment 1: Introduction: Student NameKiko Doragon Inoue TsubasaNo ratings yet

- Operational Auditing Internal Control ProcessesDocument18 pagesOperational Auditing Internal Control ProcessesKlaryz D. MirandillaNo ratings yet

- Solorzano - 2019 - High Stakes Testing and Educational Inequality in K-12 SchoolDocument23 pagesSolorzano - 2019 - High Stakes Testing and Educational Inequality in K-12 Schoolcandas.zorNo ratings yet

- WP Armenian LanguageDocument11 pagesWP Armenian LanguageJana LindenNo ratings yet

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- Uttarakhand NTSE 2021 Stage 1 MAT and SAT Question and SolutionsDocument140 pagesUttarakhand NTSE 2021 Stage 1 MAT and SAT Question and SolutionsAchyut SinghNo ratings yet

- Food Takila & Restaurant AgreementDocument6 pagesFood Takila & Restaurant AgreementExcalibur OSNo ratings yet

- CW Module 4Document10 pagesCW Module 4Rodney Warren MaldanNo ratings yet

- Fondazione Prada - January 2019Document6 pagesFondazione Prada - January 2019ArtdataNo ratings yet

- Bai Tap Tong Hop Ve 12 Thi Trong Tieng Anh Co Dap An Day Du 1286849230Document9 pagesBai Tap Tong Hop Ve 12 Thi Trong Tieng Anh Co Dap An Day Du 1286849230Linh Nguyễn Lê ÁiNo ratings yet

- Intercultural Presentation FinalDocument15 pagesIntercultural Presentation Finalapi-302652884No ratings yet

- InterContinental Global Etiquette Compendium FO backTVDocument12 pagesInterContinental Global Etiquette Compendium FO backTVGian SyailendraNo ratings yet

- Basic Etiquettes Inc IntroductionsDocument8 pagesBasic Etiquettes Inc Introductionsayesha akhtarNo ratings yet

- Electronic Ticket Receipt: ItineraryDocument2 pagesElectronic Ticket Receipt: ItineraryChristiawan AnggaNo ratings yet

- Intercape Sleepliner Ticket from Cape Town to JohannesburgDocument1 pageIntercape Sleepliner Ticket from Cape Town to JohannesburgRobert Bailey100% (1)

- Sharmaji by Anjana AppachanaDocument2 pagesSharmaji by Anjana Appachanasj3No ratings yet

- Texas Commerce Tower Cited for Ground Level FeaturesDocument1 pageTexas Commerce Tower Cited for Ground Level FeatureskasugagNo ratings yet

- Plum FacialDocument1 pagePlum FacialhhfddnNo ratings yet

- Active Directory Infrastructure DesigndocumentDocument6 pagesActive Directory Infrastructure Designdocumentsudarshan_karnatiNo ratings yet

- Literature ReviewDocument6 pagesLiterature Reviewapi-549249112No ratings yet

- Research For ShopeeDocument3 pagesResearch For ShopeeDrakeNo ratings yet

- Prospects For The Development of Culture in UzbekistanDocument3 pagesProspects For The Development of Culture in UzbekistanresearchparksNo ratings yet

- Barangay SindalanDocument1 pageBarangay SindalanAna GNo ratings yet

- The Impact of E-Commerce in BangladeshDocument12 pagesThe Impact of E-Commerce in BangladeshMd Ruhul AminNo ratings yet

- Receivable Financing Pledge Assignment ADocument34 pagesReceivable Financing Pledge Assignment AJoy UyNo ratings yet

- 01082023-Stapled Visa ControversyDocument2 pages01082023-Stapled Visa Controversyakulasowjanya574No ratings yet