Professional Documents

Culture Documents

Malaysia Palm Oil Industry Outlook To 2018 - Demand For Biofuel To Drive Production

Uploaded by

KenResearch0 ratings0% found this document useful (0 votes)

256 views13 pagesMalaysia palm oil market research report providing statistics on production, consumption, planted area, industry revenue, exports, segments and market share analysis of major palm oil producers

Original Title

Malaysia Palm Oil Industry Outlook to 2018 – Demand for Biofuel to Drive Production

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMalaysia palm oil market research report providing statistics on production, consumption, planted area, industry revenue, exports, segments and market share analysis of major palm oil producers

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

256 views13 pagesMalaysia Palm Oil Industry Outlook To 2018 - Demand For Biofuel To Drive Production

Uploaded by

KenResearchMalaysia palm oil market research report providing statistics on production, consumption, planted area, industry revenue, exports, segments and market share analysis of major palm oil producers

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

1

This is a licensed product of Ken Research and should not be copied

2

This is a licensed product of Ken Research and should not be copied

TABLE OF CONTENTS

1. Overview of Palm Oil Industry

Negative impacts

1.1. Palm oil and Palm Kernel Oil Products and Applications

Palm Oil Usage in Food

Non Food Uses of Palm oil

2. Global Palm Oil Market Scenario

2.1. Global Production of Crude Palm Oil, 2008-2013

2.2. Global Consumption of Palm Oil, 2008-2013

2.3. Major Importers of Palm Oil Worldwide, 2008-2013

2.4. Malaysia and Indonesia Palm Oil Industry Comparisons

3. Malaysia Palm Oil Industry Introduction

3.1. Production Process of Palm Oil

3.2. Major Malaysia Palm Oil Industry Participants

Upstream Producers

Downstream Producers

Exporters - Importers

Industry Organizations

Customers

4. Malaysia Palm Oil Market Size

4.1. By Revenue, 2008 2013

4.2. By Production, 2008-2013

4.2.1. Average Annual Prices of Palm Oil Products, 2008-2013

4.3. By Palm Oil Stock, 2008-2013

4.4. By Palm Oil Planted Area, 2008-2013

Crude Palm Oil Yield, 2008-2013

3

This is a licensed product of Ken Research and should not be copied

4.5. By Palm Oil Consumption, 2008-2013

5. Exports and Imports of Palm Oil in Malaysia

5.1. Malaysia Palm Oil Exports

5.1.1. By Value 2008-2013

5.1.2. By Volume, 2008-2013

5.1.3. Malaysia Palm Oil Exports Segmentation

5.1.3.1. By Major Countries, 2008-2013

5.1.3.2. By Major Ports, 2008-2013

5.2. Malaysia Palm Oil Imports

5.2.1. By Value, 2008-2012

5.2.2. By Volume, 2008-2013

6. Malaysia Palm Oil Market Segmentation

6.1. By Ownership, 2008-2013

6.2. By Establishments, 2008-2013

6.3. By Mature and Immature Planted Area, 2008-2013

7. Malaysia Biodiesel Market Introduction and Size, 2008-2013

8. Trends and Developments in Malaysia Palm Oil Industry

Increasing Government Contribution

Smallholder Sustainability Support Programme

Increased Focus towards Downstream Technology

9. Government Role in Malaysia Palm Oil Industry

Regulations by the government of Malaysia

10. SWOT Analysis of Malaysia Palm Oil Industry

11. Growth Drivers and Restraints of Malaysia Palm Oil Industry

11.1. Growth Drivers

Rising Demand for Oils and Fats

4

This is a licensed product of Ken Research and should not be copied

Demand for Non Food Applications

Economic Advantages of palm oil

11.2. Restraints

Ageing Tree Population

Labor Shortage

Spreading Plant Disease

Declining Availability of New Lands

Stagnating National Yields

Production Growth Uncertain

12. Environmental Impacts and Sustainable Development in the Malaysian palm oil industry

Land Use Conversion

Fertilizers and pesticides

Emissions from milling process

Sustainable Development

13. Competitive Landscape of Malaysia Palm Oil Industry

13.1. Market Share of Major Players in Malaysia Palm Oil Industry by Planted Area,

2013

13.2. Revenues of Major Players, 2013

13.3. Major Investments in the Malaysia Palm Oil Industry

14. Company Profiles of Major Players

14.1. Sime Darby Plantation Berhard

14.1.1. Business Overview

14.1.2. Business Strategies

Differentiation and Extension of Upstream and Downstream Operations

Adoption of Sustainable Practices

Increased Focus towards R&D

Continued Performance improvement

5

This is a licensed product of Ken Research and should not be copied

14.1.3. Key Performance Indicators, 2012-2013

14.2. FELDA

14.2.1. Business Overview

14.2.2. Business Strategies

Aggressive Replanting Strategy

Focus on Operational Improvement

14.3. Wilmar International

14.3.1. Business Overview

14.3.2. Business Strategies

Integrated Business Model

Spreading Its Plantation Business

Expansion of Distribution Network

14.4. Kuala Lumpur Kepong

14.4.1. Business Overview

14.4.2. Business Strategies

Maintaining Cost efficiency

Acquisitions

Increased Mechanization

14.5. United Plantation

14.5.1. Business Overview

14.5.2. Business Strategies

Gaining Knowledge on Crop Improvement

Backward Integration

Increased Focus on Replanting

14.5.3. Key Performance Indicators, 2011-2013

14.6. Boustead

14.6.1. Business Overview

6

This is a licensed product of Ken Research and should not be copied

14.6.2. Business Strategies

Strengthening of Core Business Areas

Focus on Improving palm Oil Productivity

14.6.3. Key Performance Indicators, 2012-2013

14.7. Hapseng Plantation Berhard

14.7.1. Business Overview

14.7.2. Business Strategies

Diversification

Expansion of Planted Area

14.7.3. Key Performance Indicators, 2011-2013

14.8. IOI Corporation

14.8.1. Business Overview

14.8.2. Business Strategies

Vertical Integration of Business Activities

Focused R&D towards Clonal Palms

Operational Efficiency

14.8.3. Key Performance Indicators, 2011-2013

14.9. Tradewinds Plantation Berhard

14.9.1. Business Overview

14.9.2. Business Strategies

Increased Investment in R&D

Effective Agronomic Techniques

15. Malaysia Palm Oil Industry Future Outlook and Projections

15.1. Cause and Effect Relationship between Dependent and Independent Factors of

Malaysia Palm Oil Industry

15.2. Future Outlook and Projections

16. Macroeconomic and Industry Factors

7

This is a licensed product of Ken Research and should not be copied

16.1. Population, 2008-2018

16.2. Consumer Expenditure on Food, 2008 2018

16.3. Gross Domestic Product, 2008 2018

16.4. Fresh Fruit Bunch Yield, 2008- 2018

17. Appendix

17.1. Market Definition

17.2. Abbreviations

17.3. Research Methodology

Data Collection Methods

Approach

Variables (Dependent and Independent)

Final Conclusion

17.4. Disclaimer

8

This is a licensed product of Ken Research and should not be copied

LIST OF FIGURES

Figure 1: Palm Oil Production and Refining Process

Figure 2: Malaysia Palm Oil Industry Market Size on the Basis of Revenue in USD Million,

2008-2013

Figure 3: Malaysia Palm Oil Industry Market Size on the Basis of Consumption in Thousand

Tones, 2008-2013

Figure 4: Malaysia Palm Oil Industry Market Segmentation by Ownership on the Basis of Palm

Oil Planted Area in Percentage, 2008-2013

Figure 5: Key Performance Indicators of Sime Darby, 2012-2013

Figure 6: Key Performance Indicators of United Plantations, 2011-2013

Figure 7: Key Performance Indicators for Boustead Plantations, 2012-2013

Figure 8: Key Performance Indicators of HapSeng Plantations, 2011 -2013

Figure 9: Key Performance Indicators of IOI Corporation, 2011-2013

Figure 10: Malaysia Palm Oil Industry Future Projections on the basis of Revenue in USD

million, 2013-2018

Figure 11: Population of Malaysia in Million, 2008-2018

Figure 12: Consumer Expenditure on Food in Malaysia in USD Million, 2008-2018

Figure 13: Gross Domestic Product in Malaysia in USD Billion, 2008-2018

Figure 14: FFB Yield in Malaysia in Tons per Hectare, 2008-2018

9

This is a licensed product of Ken Research and should not be copied

LIST OF TABLES

Table 1: Worldwide Production of Different Types of Oil Seeds in Million Tones, 2008-2012

Table 2: Global Production of the Palm Oil by Major Countries in Thousand Tons, 2008-2013

Table 3: Global Consumption of the Palm Oil by Major Countries in Thousand Tons, 2008-2013

Table 4: Import of Palm Oil by Major Countries in Thousand Tons, 2008-2013

Table 5: Comparison of Palm Oil Industry in Indonesia and Malaysia, 2013

Table 6: Malaysia Palm Oil Industry Market Size on the Basis of Production of Palm Oil in

Thousand Tons, 2008-2013

Table 7: Average Annual Price of Palm Oil in MYR/Ton, 2008-2013

Table 8: Malaysia Palm Oil Industry Market Size on the Basis of Palm Oil Planted in Hectares,

2008-2013

Table 9: Crude Palm Oil Yield of Malaysia by Region in Tons/Hectare, 2008-2013

Table 10: Palm Oil Exports by Value in USD Million, 2008-2013

Table 11: Export Duty on Crude Palm Oil Valid till June 2014

Table 12: Malaysia Palm Oil Exports by Volume in Tones, 2008-2013

Table 13: Exports by Major ports in tons, 2008-2013

Table 14: Malaysia Palm Oil Imports by Value in USD Million, 2008-2013

Table 15: Malaysia Palm Oil Industry Market Segmentation by Ownership on the Basis of Palm

Oil Planted Area in Hectares, 2008-2013

Table 16: Number and Capacity in Tones of FFB Mills in Malaysia, 2008-2013

Table 17: Number and Capacity (in Tones) of Palm Kernel Crushers in Malaysia, 2008-2013

Table 18: Number and Capacity (in Tones) of Refineries in Malaysia, 2008-2013

Table 19: Number and Capacity (in Tones) of Oleo chemical Plants in Malaysia, 2008-2013

Table 20: Malaysia Palm Oil Industry Market Segmentation on the Basis of Mature and

Immature Planted Area in Malaysia in Hectares, 2008-2013

Table 21: Bio Diesel Production in Malaysia in Million Tons, 2008-2013

Table 22: SWOT Analysis of Malaysia Palm Oil Industry

10

This is a licensed product of Ken Research and should not be copied

Table 23: Market Share of Major Players in Malaysia Palm Oil Industry by Total Planted Area in

Malaysia in Percentage, 2013

Table 24: Plantation Revenues of Major players in Malaysia in MYR Million, 2013

Table 25: Comparative Analysis of Major Players in the Malaysia Palm Oil Industry

Table 26: Cause and Effect Relationship Analysis between Industry Factors and Expected

Prospects of Malaysia Palm Oil Market

Table 27: Correlation Matrix of Malaysia Palm Oil Industry

Table 28: Regression Coefficients Output

11

This is a licensed product of Ken Research and should not be copied

Executive Summary

The report titled Malaysia Palm Oil Industry Outlook to 2018 Demand for Bio Fuel to

Drive Production provides a comprehensive analysis of the various aspects such as industry

revenue and production of Global, Indonesia, Thailand, Columbia, Papa Guinea and Malaysia

Palm Oil industry. The report discusses export and import scenario, palm oil upstream and

downstream participants, exporters, importers and customers and various establishments

operating in the Malaysia Bio fuel industry. The report also covers the market shares of major

palm oil companies in Malaysia. The publication includes the opinions and statistics provided by

several industry veterans related to palm oil consumption, SWOT, drivers, restraints, future

outlook and companies positioning in the sector.

The production of palm oil has dominated the global vegetable oil market over the years,

accounting for approximately ~ share in world vegetable oil production in 2012. The worldwide

production of palm oil has increased from ~ million tons in 2008 to almost ~ million tons in

2012. Malaysia Palm Oil Industry which is heavily dependent on the production and yield of

palm oil and its products, registered revenues of USD ~ million in 2012. Even so with the

decline in prices of palm oil, the revenues decreased by 19.44% compared to 2011. The various

factors which have been driving the market over the period 2008-2013 are the rising demand for

oils and fats, the economic advantages of palm oil, the non-food application of palm oil. The

Malaysia Palm Oil Industry registered a negative CAGR of 4.7% from USD 2,657.14 million in

2008 to USD ~ million in 2013.

The Malaysia palm oil industry comprises of eight major segments namely crude palm oil, crude

palm kernel oil, palm kernel, palm kernel cake, palm olein, palm stearin, bio fuels and oleo

chemicals. Production of crude palm oil increased at a CAGR of 1.62% from ~ thousand tons in

2008 to ~ thousand tons in 2013. Land holdings of oil palm plantation in Malaysia are divided

amongst government, private estates, state and small holders. The highest share of landholdings

was under private estates comprising of 60.3% of Malaysias palm oil planted area in 2008

which had increased to ~% in 2013. The land under small holders had increased from ~ hectares

in 2008 to ~ hectares in 2013.

The Malaysia palm oil industry comprises of various establishments such as mills, refineries and

oleo chemical plants which together undertake the palm oil extraction and processing. The

number of FFB mills in Malaysia in 2008 was ~ which increased to ~ in 2013. The capacity of

the refineries in 2008 was reported as 19.2 million tons which increased to ~ million tons in

2013.

In terms of competition, the Malaysia palm oil industry is a highly fragmented. The three main

players of this industry in terms of market share are Felda Global Ventures, Sime Darby Berhad

and Trade winds plantations. The revenues of FGV were reported as ~ MYR million in 2013.

12

This is a licensed product of Ken Research and should not be copied

The palm oil industry in Malaysia is changing at a brisk rate. Technological advancements and

mergers as well as competitive pressures from Indonesia have been significantly changing the

Industry. Revenues from the palm oil industry in Malaysia are expected to expand to USD 2.1

billion in 2018, growing at a CAGR of ~% from 2013 to 2018.

Key Topics Covered in the Report

The market size of the Malaysia Palm Oil Industry, 2008-2013

Market segmentation of Malaysia Palm Oil Industry by Establishments, 2008-2013

Market segmentation of Malaysia Palm Oil Industry by Ownership, 2008-2013

Market segmentation of Malaysia Palm Oil Industry by Palm oil Planted Area, 2008-

2013

Trends and Developments in the Malaysia Palm Oil Industry

Government Regulations in Malaysia Palm Oil Industry

SWOT Analysis of Malaysia Palm Oil Industry

Growth Drivers and Restraints of Malaysia Palm Oil Industry

Market Share of Major Players in Malaysia Palm Oil Industry

Company profiles of major players in Malaysia Palm Oil Industry

Future outlook and projections on the basis of revenue in Malaysia Palm Oil Industry,

2014-2018

13

This is a licensed product of Ken Research and should not be copied

Read more- http://www.kenresearch.com/agriculture-food-beverages/food-industry-

research-reports/malaysia-palm-oil-market-research-report/525-104.html

Contact Person- Ankur Gupta

Email Id- ankur@kenresearch.com

You might also like

- Ficb 103Document15 pagesFicb 103Diana HanafiNo ratings yet

- Hup Seng Perusahaan MakananDocument4 pagesHup Seng Perusahaan MakananChaziraNo ratings yet

- Sime Darby Plantation Roadshow HighlightsDocument44 pagesSime Darby Plantation Roadshow HighlightsSubashini NadrasNo ratings yet

- Mpob Oil PalmDocument14 pagesMpob Oil PalmJoselyn ChewNo ratings yet

- Case Studies Presentation: Sime Darby's Cost Overrun IssuesDocument35 pagesCase Studies Presentation: Sime Darby's Cost Overrun Issuesruhiyatiidayu100% (1)

- ChangeDocument27 pagesChangePoonam SatapathyNo ratings yet

- Factors:: 1. Electricity Crisis 2. Gas Energy Crisis 3. Water Crisis 4. Fuel Crisis &othersDocument4 pagesFactors:: 1. Electricity Crisis 2. Gas Energy Crisis 3. Water Crisis 4. Fuel Crisis &othersAdeel Khan100% (1)

- Malaysia 2012 Mineral YearbookDocument8 pagesMalaysia 2012 Mineral YearbookAli ZarehNo ratings yet

- Twinkle Palm Oil Ventures Set to Redefine Standard Palm Oil ProcessingDocument35 pagesTwinkle Palm Oil Ventures Set to Redefine Standard Palm Oil ProcessingMumtahinaNo ratings yet

- Oil PalmDocument126 pagesOil Palmizzatizulaikha100% (1)

- Report Sime DarbyDocument6 pagesReport Sime DarbyNor Azura0% (1)

- Nestle vs F&N: Comparing Capital Structure and Financial PerformanceDocument18 pagesNestle vs F&N: Comparing Capital Structure and Financial PerformanceLina LinaNo ratings yet

- Sime Darby Plantation: World's Largest Palm Oil ProducerDocument1 pageSime Darby Plantation: World's Largest Palm Oil ProducerNorazila SupianNo ratings yet

- Palm Oil Small Holder LivelihoodsDocument32 pagesPalm Oil Small Holder Livelihoodsrvm1010No ratings yet

- Chapter 3 OPM GROUP ASSIGNMENTDocument5 pagesChapter 3 OPM GROUP ASSIGNMENTSaleh Hashim100% (1)

- Malaysian SMEs - Building Blocks For Economic GrowthDocument13 pagesMalaysian SMEs - Building Blocks For Economic GrowthsinmeitehNo ratings yet

- Palm Oil MalaysiaDocument90 pagesPalm Oil MalaysiaahmadNo ratings yet

- Malaysia Fertiliser MarketDocument21 pagesMalaysia Fertiliser MarketRamkannan Parasumanna Chandrasekaran0% (1)

- Ibm641 Report (Maybelline)Document18 pagesIbm641 Report (Maybelline)Backup kerjaNo ratings yet

- The Impacts and Opportunities of Palm Oil in Southeast AsiaDocument80 pagesThe Impacts and Opportunities of Palm Oil in Southeast AsiaGanip Gunawan100% (1)

- The Palmoil Financing HandbookDocument69 pagesThe Palmoil Financing HandbookanilgrandhiNo ratings yet

- FGVDocument4 pagesFGVfaridzawiNo ratings yet

- Oil Palm CHP Aik ChinDocument35 pagesOil Palm CHP Aik Chingsch13100% (2)

- MPOC - Fact Sheet On Malaysian Palm Oil (2010 Version)Document66 pagesMPOC - Fact Sheet On Malaysian Palm Oil (2010 Version)sl1828100% (1)

- Lotus KFM Berhad FADocument19 pagesLotus KFM Berhad FAGeorge BichangaNo ratings yet

- Cel 2106 Class Material 4 (Week 6-7)Document22 pagesCel 2106 Class Material 4 (Week 6-7)sham jailaniNo ratings yet

- Written Up AromaDocument3 pagesWritten Up AromaShikin YazidNo ratings yet

- PWC Palm Oil Plantation 1Document16 pagesPWC Palm Oil Plantation 1Anonymous DJrec2No ratings yet

- CCM Chemical Company's Strategic Growth PlanDocument37 pagesCCM Chemical Company's Strategic Growth PlanMohammed Hammoudeh100% (2)

- Nestle AnalysisDocument20 pagesNestle AnalysisDiv Kabra100% (1)

- The Pirates of The SilverlandDocument25 pagesThe Pirates of The Silverlandyumiko_sebastian2014No ratings yet

- IOI Group Background: Malaysia's Biggest EnterpriseDocument1 pageIOI Group Background: Malaysia's Biggest Enterprisescribdoobidoo100% (1)

- Palm Oil Plantation 2012Document12 pagesPalm Oil Plantation 20122oooveeeNo ratings yet

- An Investigation Into The Challenges Facing The Planning of ManpowerDocument11 pagesAn Investigation Into The Challenges Facing The Planning of ManpowerresearchparksNo ratings yet

- Research Paper 56 IfikrDocument43 pagesResearch Paper 56 IfikrAlliya IyaNo ratings yet

- Tesco Stores Malaysia SDN BHDDocument17 pagesTesco Stores Malaysia SDN BHDBerries Violetta0% (1)

- Digital Journey MapDocument11 pagesDigital Journey MapTahnee TsenNo ratings yet

- Forum Discussion - Thibasri VasuDocument2 pagesForum Discussion - Thibasri VasuLokanayaki SubramaniamNo ratings yet

- Josapine Pineapple in Peat SoilsDocument14 pagesJosapine Pineapple in Peat Soilsjoeharry77No ratings yet

- SIME DARBY BERHAD: MALAYSIA'S LEADING DIVERSIFIED CONGLOMERATEDocument7 pagesSIME DARBY BERHAD: MALAYSIA'S LEADING DIVERSIFIED CONGLOMERATEHari Dass100% (2)

- Crude Palm OilDocument19 pagesCrude Palm OilmarpadanNo ratings yet

- Swot of AirasiaDocument13 pagesSwot of AirasiaShirley LinNo ratings yet

- Faculty of Business and Management: Sample of Good AssignmentDocument35 pagesFaculty of Business and Management: Sample of Good AssignmentSashiNo ratings yet

- G. Problems N SolutionDocument2 pagesG. Problems N SolutionAmirul NorisNo ratings yet

- Felda Usm PaperDocument24 pagesFelda Usm PaperragunatharaoNo ratings yet

- LPG Supply Chain ReportDocument91 pagesLPG Supply Chain ReportHarsh Choudhary100% (1)

- Project On KOFDocument44 pagesProject On KOFkp vineetNo ratings yet

- Thailand Fertilizer Industry Research ReportDocument9 pagesThailand Fertilizer Industry Research Reportkenresearch12No ratings yet

- Seeking For Sustainability: Actor's Perspective On The Malaysian Sustainable Palm Oil Certification Scheme (MSPO)Document14 pagesSeeking For Sustainability: Actor's Perspective On The Malaysian Sustainable Palm Oil Certification Scheme (MSPO)Boris KaidoNo ratings yet

- Case Study Eco 1 PDFDocument11 pagesCase Study Eco 1 PDFWAN NURUL HIDAYAH WAN ZAININo ratings yet

- A14C13 KLIBEL6 Acc 30 gJWu9qe77V-1Document11 pagesA14C13 KLIBEL6 Acc 30 gJWu9qe77V-1subashiniNo ratings yet

- Alemu Integrated Farms LTD Palm Oil PlanDocument36 pagesAlemu Integrated Farms LTD Palm Oil PlanOsama MouadamaniNo ratings yet

- Project FeasibilityDocument15 pagesProject FeasibilityAmritRoshniKaurNo ratings yet

- Port Report - Malaysia - IIFT Delhi - Manisha Mazumdar - 26A PDFDocument20 pagesPort Report - Malaysia - IIFT Delhi - Manisha Mazumdar - 26A PDFManisha MazumdarNo ratings yet

- Partnership Pattern, Strategy and Income of Oil Palm Farming of PT Lestari Tani Teladan in Donggala, Central SulawesiDocument8 pagesPartnership Pattern, Strategy and Income of Oil Palm Farming of PT Lestari Tani Teladan in Donggala, Central SulawesiinventionjournalsNo ratings yet

- Oil, Gas & EnergyDocument18 pagesOil, Gas & EnergyThursdayMemoria100% (1)

- Indian Oil and Gas Outlook 2015Document3 pagesIndian Oil and Gas Outlook 2015iData InsightsNo ratings yet

- Ilide - Info Marketing Strategy of Bajaj Automobilesdoc PRDocument10 pagesIlide - Info Marketing Strategy of Bajaj Automobilesdoc PRSharvin GhadigaonkarNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Philippines Higher Education Industry, Learning Sector Market ReportDocument17 pagesPhilippines Higher Education Industry, Learning Sector Market ReportKenResearchNo ratings yet

- Asia Pacific Insulin Market Review To 2018 - by Location, Trends and GrowthDocument17 pagesAsia Pacific Insulin Market Review To 2018 - by Location, Trends and GrowthKenResearchNo ratings yet

- China Insulin Market Review To 2018 - Increasing Focus On R&D InvestmentsDocument12 pagesChina Insulin Market Review To 2018 - Increasing Focus On R&D InvestmentsKenResearchNo ratings yet

- India PVC Pipes Fitting, Plastic Pipes and CPVC Pipes Market Production and Growth DriversDocument16 pagesIndia PVC Pipes Fitting, Plastic Pipes and CPVC Pipes Market Production and Growth DriversKenResearch0% (1)

- France Ceramic Industry Outlook To 2018 - Executive SummaryDocument9 pagesFrance Ceramic Industry Outlook To 2018 - Executive SummaryKenResearchNo ratings yet

- Trends and Developments Nuclear Power BrazilDocument12 pagesTrends and Developments Nuclear Power BrazilKenResearchNo ratings yet

- China Money Remittance and Payments Market Report To 2018: Ken ResearchDocument14 pagesChina Money Remittance and Payments Market Report To 2018: Ken ResearchKenResearchNo ratings yet

- Market Share Bank Saudi Arabia Remittance Market: Ken ResearchDocument12 pagesMarket Share Bank Saudi Arabia Remittance Market: Ken ResearchKenResearchNo ratings yet

- Kuwait Naphtha Market Future Outlook & Projections, 2014-2018Document8 pagesKuwait Naphtha Market Future Outlook & Projections, 2014-2018KenResearchNo ratings yet

- Macro Economic Factors in Qatar Naphtha Market - Ken ResearchDocument15 pagesMacro Economic Factors in Qatar Naphtha Market - Ken ResearchKenResearchNo ratings yet

- KSA Energy Fuel Naphtha Market ReportDocument8 pagesKSA Energy Fuel Naphtha Market ReportKenResearchNo ratings yet

- Europe Portable and Transportation Fuel Cell Market AnalysisDocument12 pagesEurope Portable and Transportation Fuel Cell Market AnalysisKenResearchNo ratings yet

- India Micro Irrigation System Market Outlook To 2018Document17 pagesIndia Micro Irrigation System Market Outlook To 2018KenResearchNo ratings yet

- Japan Agricultural Equipment Industry Outlook To 2018 - Market Research ReportDocument8 pagesJapan Agricultural Equipment Industry Outlook To 2018 - Market Research ReportKenResearchNo ratings yet

- Italy Ceramic Industry Outlook To 2018 - Market Intelligence ReportDocument11 pagesItaly Ceramic Industry Outlook To 2018 - Market Intelligence ReportKenResearchNo ratings yet

- China Cooking Oil, Palm Oil, Soybean Oil and Vegetable Oil Market ReportDocument11 pagesChina Cooking Oil, Palm Oil, Soybean Oil and Vegetable Oil Market ReportKenResearchNo ratings yet

- Europe Ceramic Industry Trends and Future ProspectsDocument19 pagesEurope Ceramic Industry Trends and Future ProspectsKenResearchNo ratings yet

- Market Segmentation of Vietnam Seed Market by Hybrid and Non Hybrid SeedsDocument11 pagesMarket Segmentation of Vietnam Seed Market by Hybrid and Non Hybrid SeedsKenResearchNo ratings yet

- South Korea LED Lighting Market Size, Trends and Development - Ken ResearchDocument11 pagesSouth Korea LED Lighting Market Size, Trends and Development - Ken ResearchKenResearchNo ratings yet

- India Micro Irrigation System Market Outlook To 2018Document17 pagesIndia Micro Irrigation System Market Outlook To 2018KenResearchNo ratings yet

- Europe Athletic Apparel and Footwear Industry Research ReportDocument12 pagesEurope Athletic Apparel and Footwear Industry Research ReportKenResearchNo ratings yet

- India Agricultural Equipment Industry Trends and Future ProspectsDocument14 pagesIndia Agricultural Equipment Industry Trends and Future ProspectsKenResearchNo ratings yet

- Global EOR Market Value Is Expected To Reach USD 640 Billion by 2018Document12 pagesGlobal EOR Market Value Is Expected To Reach USD 640 Billion by 2018KenResearchNo ratings yet

- The US Telemedicine Market Outlook To 2018Document9 pagesThe US Telemedicine Market Outlook To 2018KenResearchNo ratings yet

- Market Research and Future Outlook of Germany Packaged Food IndustryDocument16 pagesMarket Research and Future Outlook of Germany Packaged Food IndustryKenResearchNo ratings yet

- China Cooking Oil, Palm Oil, Soybean Oil and Vegetable Oil Market ReportDocument11 pagesChina Cooking Oil, Palm Oil, Soybean Oil and Vegetable Oil Market ReportKenResearchNo ratings yet

- South Korea LED Lighting Market Size, Trends and Development - Ken ResearchDocument11 pagesSouth Korea LED Lighting Market Size, Trends and Development - Ken ResearchKenResearchNo ratings yet

- Japan Polysilicon Market Outlook To 2018 - Driven by Rising Solar Power CapacityDocument8 pagesJapan Polysilicon Market Outlook To 2018 - Driven by Rising Solar Power CapacityKenResearchNo ratings yet

- India Healthcare IT Industry Research Report - Ken ResearchDocument12 pagesIndia Healthcare IT Industry Research Report - Ken ResearchKenResearchNo ratings yet

- Market Report On Video Games Industry in IndiaDocument11 pagesMarket Report On Video Games Industry in IndiaKenResearchNo ratings yet

- Oil and Gaz Company 1Document11 pagesOil and Gaz Company 1Lariane CherifNo ratings yet

- Consumable RatesDocument30 pagesConsumable Ratesvikrant sehgalNo ratings yet

- The Manager HR, Pakistan Petroleum LimitedDocument2 pagesThe Manager HR, Pakistan Petroleum LimitedShakeel AhmedNo ratings yet

- Bharat Petroleum Corporation LTDDocument7 pagesBharat Petroleum Corporation LTDChetan NarasannavarNo ratings yet

- Lol Te ML 03 enDocument17 pagesLol Te ML 03 enGoudjilNo ratings yet

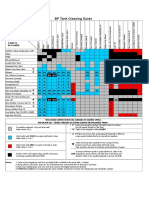

- BP Tank Cleaning Guide05Document1 pageBP Tank Cleaning Guide05CELESTIALNo ratings yet

- Paginas para Busqueda de Trabajo PetroleroDocument9 pagesPaginas para Busqueda de Trabajo PetroleroAngel AponteNo ratings yet

- Ae472 QPDocument2 pagesAe472 QPMegha G KrishnanNo ratings yet

- Thermax lubrication scheduleDocument4 pagesThermax lubrication scheduleNguyễn Thanh LâmNo ratings yet

- SIWES Industrial Training Report PDFDocument34 pagesSIWES Industrial Training Report PDFHASTINGS EMURASHENo ratings yet

- Api MPMS 2.8a - 1991 - R2007 PDFDocument32 pagesApi MPMS 2.8a - 1991 - R2007 PDFآتیش اتیشیNo ratings yet

- JPT 2017-FebreroDocument84 pagesJPT 2017-Febreroabraham dominguezNo ratings yet

- How Oil is Formed in 4 StepsDocument41 pagesHow Oil is Formed in 4 StepsAbba YakubuNo ratings yet

- Industries of Lahore and IsbDocument7 pagesIndustries of Lahore and IsbOmer Nadeem100% (1)

- Dew Journal Editorial CalenderDocument4 pagesDew Journal Editorial CalenderALOK RANJANNo ratings yet

- Tank Capacity ExcelDocument6 pagesTank Capacity ExcelRoni VincentNo ratings yet

- Tabela de Equivalência de Equivalência - IndustriaisDocument2 pagesTabela de Equivalência de Equivalência - IndustriaisJorcyCarvalhoNo ratings yet

- CV Edzarliando 20Document4 pagesCV Edzarliando 20ikhzan cadetNo ratings yet

- Honeywell Enraf Blender Referen 2012Document6 pagesHoneywell Enraf Blender Referen 2012Javier Alejandro QuingaNo ratings yet

- Press Release Inauguration of Usan 2Document2 pagesPress Release Inauguration of Usan 2edge2daboneNo ratings yet

- A 26Document1 pageA 26AnuranjanNo ratings yet

- CNPC CNOOC and SINOPEC in Iraq Successful Start and Ambitious Cooperation Plan PDFDocument22 pagesCNPC CNOOC and SINOPEC in Iraq Successful Start and Ambitious Cooperation Plan PDFazareiforoushNo ratings yet

- Degassing Stations and Gas-Oil Separation ProcessDocument12 pagesDegassing Stations and Gas-Oil Separation ProcessashrafsaberNo ratings yet

- Presentation On Offshore Structures and Offshore Engineering DeliverblesDocument26 pagesPresentation On Offshore Structures and Offshore Engineering DeliverblesPartha Sarathi100% (2)

- FIPI Oil & Gas Industry Awards 2021 Entry FormDocument6 pagesFIPI Oil & Gas Industry Awards 2021 Entry Formsarthika DanthuluriNo ratings yet

- Oil and Gas Dec 2010Document32 pagesOil and Gas Dec 2010sakoboyNo ratings yet

- Volve Field FactsDocument7 pagesVolve Field FactsS KohliNo ratings yet

- LPG Pump Locations in Andhra PradeshDocument64 pagesLPG Pump Locations in Andhra Pradeshrameshpunna_117386No ratings yet

- AMP BrochureDocument8 pagesAMP BrochureDavid GNo ratings yet

- The Risk in Petroleum Supply Chain A Review and TypologyDocument24 pagesThe Risk in Petroleum Supply Chain A Review and Typologyईन्द्रनील रायNo ratings yet