Professional Documents

Culture Documents

Studii Economice - Coface

Uploaded by

Velicanu Bekk ZsuzsaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Studii Economice - Coface

Uploaded by

Velicanu Bekk ZsuzsaCopyright:

Available Formats

HOME STUDII ECONOMICE HUNGARY

STRENGTHS

Efficient infrastructures and regulatory framework

Diversified economy

Skilled workforce

Important stock of foreign direct investments

WEAKNESSES

High public debt

Considerable external financing needs

Borrowers highly exposed to exchange rate risk

Authoritarian drift of the political power

SYNTHESIS

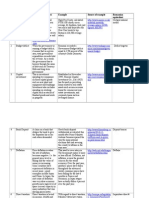

MAJOR MACRO ECONOMIC INDICATORS

2011 2012 2013(e) 2014(f)

GDP growth (%) 1.6 -1.7 0.5 1.5

Inflation (yearly average) (%) 3.9 5.7 2.2 2.5

Budget balance (% GDP) 4.2 -2.0 -2.9 -3.0

Current account balance (% GDP) 0.9 1.6 1.7 1.7

Public debt (% GDP) 81.4 79.2 79.8 80.0

(e) Estimate (f) Forecast

RISK ASSESSMENT

Growth driven by its external components

In 2014 external demand will be the main contributor to growth due to a buoyant demand from Europe (76% of good

exports), in particular Germany (26%). Hungarys export industry is concentrated on multimedia goods and household

appliances (40% of exports) and the automotive sector (20%). Many car manufacturers are investing in the country to

ensure their subcontracting. Furthermore, agriculture, services (financial and telecommunications), as well as construction

are expected to continue to grow. In contrast, household consumption will remain hampered by the drying up of bank credit,

which began in 2009. The excessive expansion of foreign exchange loans (Swiss francs and euros) in the past, enabled by

foreign capital, is expected to continue to fall in 2014 on the back of household deleveraging and regulatory measures

POPULATION

9.912 MILLION

GDP

130.563 US$ BILLION COUNTRY RISK

ASSESSMENT

BUSINESS

CLIMATE

B A2

Hungary / Studii economice - Coface http://www.coface.ro/Studii-economice/Hungary

1 din 2 07.03.2014 14:48

imposed on the banks. The banking system is characterized by a significant and growing stock of non-performing loans

(18% of total loans), restrictive regulation (moratorium on mortgages, freezing exchange rates of foreign exchange loans)

and the highest taxes in Europe. Bank profitability has collapsed since 2010. They will continue to restrict lending to the

private sector, which will restrain investment in 2014. Finally, inflation slowed sharply in late 2013, recording its slowest level

since 1993, in the wake of cuts of 10% in January and then 11% in November in the regulated prices of gas and electricity.

The Central Banks accommodative monetary policy, under which its key rate fell to a historic low of 3.4% in October 2013,

is therefore expected to continue.

Fiscal deficit expected to remain under control despite electoral context

In June 2013, the European Commission ended its Excessive Deficit Procedure (EDP) to which Hungary has been subject

for nine years. To boost its popularity, the Fidesz party could be inclined to increase public spending in the run-up to the

parliamentary elections due in April 2014. Public investment increased considerably in 2013, reflecting impact on public

accounts of the governments electoral campaign. With the highest debt in central and Eastern Europe, interest payments

put a strain on State budget by 10%. Nevertheless, to maintain his popularity the Fidesz cannot afford to be placed under

Excessive Deficit Procedure again. In this context, the public deficit should not exceed the 3% ceiling.

In 2014, stronger European demand will shore up the current account surplus. Hungarys central bank applies a floating

parity regime against the euro with fluctuation bands of +/-15%. Although the current account surplus supports the forint, the

level of foreign exchange reserves (covering 5 months of imports) would probably be insufficient should there be a lasting

crisis of financial market confidence, especially in the event of budget slippage (as in 2010 in a electoral context).

A controversial political environment

The government has been seen to be shifting towards authoritarianism since the election victory of the centre-right Fidesz

party in April 2010. With a two-thirds majority, the government of Prime Minister Viktor Orban adopted a new constitution in

January 2012 restricting, in particular, the independence of the judiciary, the central bank and the media. This move is

accompanied by the adoption of some thirty laws which can be amended only with a two thirds majority, making it difficult for

any future majority government to change them. In March 2013, the former minister of the economy, Gyorgy Matolcsy, a

close ally of Prime Minister Orban, was appointed to head the central bank. This appointment raises doubts over the banks

independence. At the same time, an income tax rate of flat 16% on household was introduced which hit the lowest-income

households. Although a worsening social situation cannot be completely ruled out, its very probable that the Fidesz will hold

onto its stranglehold at the parliamentary elections in April 2014 against a dispersed opposition. Finally, the business

environment is deteriorating but the country is still one of the better places to do business in Central and Eastern Europe.

Nonetheless, the business climate remains tense and investor confidence has been damaged by the exceptional taxes

introduced in October 2010.

Hungary / Studii economice - Coface http://www.coface.ro/Studii-economice/Hungary

2 din 2 07.03.2014 14:48

You might also like

- Freddie My LoveDocument8 pagesFreddie My LoveRacheal YoungNo ratings yet

- Automatic Account DeterminationDocument17 pagesAutomatic Account Determinationsaif78692100% (1)

- Hydro V NIA Case AnalysisDocument2 pagesHydro V NIA Case AnalysisClark Vincent PonlaNo ratings yet

- Stockholders of F. Guanzon v. RDDocument1 pageStockholders of F. Guanzon v. RDJL A H-Dimaculangan0% (1)

- Romania Long Term OutlookDocument5 pagesRomania Long Term OutlooksmaneranNo ratings yet

- The Main Objectives of The EU Are: To Promote Economic and Social Progress, To Introduce EuropeanDocument3 pagesThe Main Objectives of The EU Are: To Promote Economic and Social Progress, To Introduce EuropeanBence CsillagNo ratings yet

- European Economy: Macroeconomic Imbalances Hungary 2013Document34 pagesEuropean Economy: Macroeconomic Imbalances Hungary 2013Catalina GalerNo ratings yet

- 12 For 2012: Why Poland Will Avoid Recession Even If Whole EU Does NotDocument3 pages12 For 2012: Why Poland Will Avoid Recession Even If Whole EU Does NotPeter RheeNo ratings yet

- Assessment 2A. International Monetary EconomicsDocument6 pagesAssessment 2A. International Monetary EconomicsBình MinhNo ratings yet

- Country Intelligence: Report: TurkeyDocument27 pagesCountry Intelligence: Report: TurkeyFlorian SarkisNo ratings yet

- Greece Financial CrisisDocument11 pagesGreece Financial CrisisFadhili KiyaoNo ratings yet

- Country+Essentials BG FinalDocument7 pagesCountry+Essentials BG FinalDiana IstrateNo ratings yet

- Euro Crisis's Impact On IndiaDocument49 pagesEuro Crisis's Impact On IndiaAncy ShajahanNo ratings yet

- Mapping Flows and Patterns Gábor HunyaDocument33 pagesMapping Flows and Patterns Gábor HunyaAnnisa NurrinNo ratings yet

- By, Gaurav Sinha Bhaskar SinghDocument36 pagesBy, Gaurav Sinha Bhaskar SinghSauabh SrivastavaNo ratings yet

- Why RomaniaDocument40 pagesWhy RomaniascrobNo ratings yet

- Economy of HungaryDocument2 pagesEconomy of HungaryAnnamária HorváthNo ratings yet

- Greece Unlikely To Escape Its Worst Financial Crisis of Modern TimesDocument6 pagesGreece Unlikely To Escape Its Worst Financial Crisis of Modern TimesHarris A. SamarasNo ratings yet

- International BusinessDocument5 pagesInternational BusinessSiva gNo ratings yet

- President Hollande One Year On - What's Next? An Analysis From APCO Worldwide in ParisDocument12 pagesPresident Hollande One Year On - What's Next? An Analysis From APCO Worldwide in ParisAPCO WorldwideNo ratings yet

- Govt Debt and DeficitDocument4 pagesGovt Debt and DeficitSiddharth TiwariNo ratings yet

- La Crisis de Deuda en Zona Euro 2011Document10 pagesLa Crisis de Deuda en Zona Euro 2011InformaNo ratings yet

- Motivation LetterDocument5 pagesMotivation LetterVlad ArmeanuNo ratings yet

- Greek Financial Crisis May 2011Document5 pagesGreek Financial Crisis May 2011Marco Antonio RaviniNo ratings yet

- EN EN: European CommissionDocument24 pagesEN EN: European Commissionapi-58353949No ratings yet

- Romania Gained From Joining The EU, Despite Huge Opportunity LossesDocument7 pagesRomania Gained From Joining The EU, Despite Huge Opportunity LossesAnonymous iPygecNo ratings yet

- Has Austerity Failed in EuropeDocument3 pagesHas Austerity Failed in EuropeAndreea WeissNo ratings yet

- Highlights: Economy and Strategy GroupDocument33 pagesHighlights: Economy and Strategy GroupvladvNo ratings yet

- Dambovita Sum Up Research - GrecuDocument8 pagesDambovita Sum Up Research - GrecuCristina CristeaNo ratings yet

- Country Intelligence Report 2Document34 pagesCountry Intelligence Report 2Li JieNo ratings yet

- 2013 March Ernst & Yang Report German EconomyDocument8 pages2013 March Ernst & Yang Report German Economygpanagi1No ratings yet

- Philippines GDP Growth Projections 1.0-6.7% 2008-2013Document4 pagesPhilippines GDP Growth Projections 1.0-6.7% 2008-2013joeynunezNo ratings yet

- Romania'S Challenges For Joining The Eu: A Dream Too Far Away?Document4 pagesRomania'S Challenges For Joining The Eu: A Dream Too Far Away?Larisa PîrvuNo ratings yet

- Deutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsDocument32 pagesDeutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsRichard HongNo ratings yet

- Country Strategy 2011-2014 MoldovaDocument21 pagesCountry Strategy 2011-2014 MoldovaBeeHoofNo ratings yet

- Evolution of The Economic Leading Indicator: Authors of This EditionDocument5 pagesEvolution of The Economic Leading Indicator: Authors of This EditionIulia Sirghi-ZolotcoNo ratings yet

- LEVY Inst. PN 12 11Document5 pagesLEVY Inst. PN 12 11glamisNo ratings yet

- Greece Country Strategy Black Sea Bank's 2011-2014 Strategy for GreeceDocument19 pagesGreece Country Strategy Black Sea Bank's 2011-2014 Strategy for GreeceBeeHoofNo ratings yet

- International Finance - Team ProjectDocument27 pagesInternational Finance - Team ProjectInesNo ratings yet

- Sweden CounEEEEtry ProfileDocument10 pagesSweden CounEEEEtry ProfileAlyssa GoNo ratings yet

- Debt Crisis in GreeceDocument6 pagesDebt Crisis in Greeceprachiti_priyuNo ratings yet

- Market Report JuneDocument17 pagesMarket Report JuneDidine ManaNo ratings yet

- Afghanistan EcoDocument5 pagesAfghanistan EcoMaseeh Ahmad WassilNo ratings yet

- Project ReportDocument5 pagesProject Reportkian kashefiNo ratings yet

- EcbDocument210 pagesEcbhnkyNo ratings yet

- Romania Crisis 2008Document28 pagesRomania Crisis 2008Sorocan NicolaeNo ratings yet

- Responding to the European Sovereign Debt CrisisDocument25 pagesResponding to the European Sovereign Debt CrisisJJ Amanda ChenNo ratings yet

- Poland On Its Way To GreeceDocument7 pagesPoland On Its Way To GreeceH5F CommunicationsNo ratings yet

- Hellenic Republic WasDocument2 pagesHellenic Republic WasAdriana DhaniyahNo ratings yet

- Introduction To European Sovereign Debt CrisisDocument8 pagesIntroduction To European Sovereign Debt CrisisVinay ArtwaniNo ratings yet

- EC Greece Forecast Autumn 13 PDFDocument2 pagesEC Greece Forecast Autumn 13 PDFThePressProjectIntlNo ratings yet

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeFrom EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNo ratings yet

- Eurozone Forecast Summer2011 GreeceDocument8 pagesEurozone Forecast Summer2011 GreeceBenin Uthup ThomasNo ratings yet

- News/uk-News/uk-Average-Salary-26500 - Figures-3002995Document7 pagesNews/uk-News/uk-Average-Salary-26500 - Figures-3002995AnaMariaNo ratings yet

- Montenegro Economic Developments in Q2 2016Document4 pagesMontenegro Economic Developments in Q2 2016nektariniNo ratings yet

- Q&A: What Are The Risks Ahead For European Sovereign Ratings in 2014?Document11 pagesQ&A: What Are The Risks Ahead For European Sovereign Ratings in 2014?api-228714775No ratings yet

- Outlook On Finland Revised To Negative On Subpar Growth Prospects 'AAA/A-1+' Ratings AffirmedDocument8 pagesOutlook On Finland Revised To Negative On Subpar Growth Prospects 'AAA/A-1+' Ratings Affirmedapi-231665846No ratings yet

- Rising Domestic Demand and Net Exports Underpin German GrowthDocument15 pagesRising Domestic Demand and Net Exports Underpin German Growthapi-228714775No ratings yet

- Partnership Agreement 2014RO16M8PA001!1!2Document460 pagesPartnership Agreement 2014RO16M8PA001!1!2Marian I. GhionuNo ratings yet

- Topic of The Week For Discussion: 4 To 10 June 2012: Topic: Greece Debt CrisisDocument2 pagesTopic of The Week For Discussion: 4 To 10 June 2012: Topic: Greece Debt Crisisrockstar104No ratings yet

- Ci17 5Document11 pagesCi17 5robmeijerNo ratings yet

- The Greek Economy and The Potential For Green Development: George PagoulatosDocument10 pagesThe Greek Economy and The Potential For Green Development: George PagoulatosAngelos GkinisNo ratings yet

- Portugal Economy ReportDocument17 pagesPortugal Economy Reportsouravsingh1987No ratings yet

- G P P C: Group of TwentyDocument13 pagesG P P C: Group of Twentya10family10No ratings yet

- Academic Style PRACTICEDocument1 pageAcademic Style PRACTICEVelicanu Bekk ZsuzsaNo ratings yet

- Us Weekly - 30 December 2013Document84 pagesUs Weekly - 30 December 2013Velicanu Bekk Zsuzsa100% (1)

- FINAL RESULTS III General Economics January 2014Document1 pageFINAL RESULTS III General Economics January 2014Velicanu Bekk ZsuzsaNo ratings yet

- Rezultate La BAZELE ECONOMETRIEI Din 9.02.2014 EG: Prof. Cristian DRAGOŞDocument1 pageRezultate La BAZELE ECONOMETRIEI Din 9.02.2014 EG: Prof. Cristian DRAGOŞVelicanu Bekk ZsuzsaNo ratings yet

- Business Culture - China Vs USDocument15 pagesBusiness Culture - China Vs USalex metalNo ratings yet

- Problems SolutionsDocument3 pagesProblems SolutionsVelicanu Bekk ZsuzsaNo ratings yet

- Business Etiquette in ChinaDocument14 pagesBusiness Etiquette in Chinatrilokrarotia7656No ratings yet

- Even Levi Can Make Mistakes - Problem-Solution ReportDocument2 pagesEven Levi Can Make Mistakes - Problem-Solution ReportVelicanu Bekk ZsuzsaNo ratings yet

- Problems SolutionsDocument3 pagesProblems SolutionsVelicanu Bekk ZsuzsaNo ratings yet

- Latvia government expenditure by function 2000-2010Document17 pagesLatvia government expenditure by function 2000-2010Velicanu Bekk ZsuzsaNo ratings yet

- Latvia government expenditure by function 2000-2010Document17 pagesLatvia government expenditure by function 2000-2010Velicanu Bekk ZsuzsaNo ratings yet

- Features Academic Writing - ParagraphingDocument2 pagesFeatures Academic Writing - ParagraphingVelicanu Bekk ZsuzsaNo ratings yet

- Tasksheet Course Two Business DiscourseDocument3 pagesTasksheet Course Two Business DiscourseVelicanu Bekk ZsuzsaNo ratings yet

- Business Communication - Semester 1 - Course Objectives and SyllabusDocument1 pageBusiness Communication - Semester 1 - Course Objectives and SyllabusVelicanu Bekk ZsuzsaNo ratings yet

- Intro CommunicationDocument15 pagesIntro CommunicationPascDoinaNo ratings yet

- Tasksheet Course Two Business DiscourseDocument3 pagesTasksheet Course Two Business DiscourseVelicanu Bekk ZsuzsaNo ratings yet

- Siteuri MNC FdiDocument2 pagesSiteuri MNC FdiVelicanu Bekk ZsuzsaNo ratings yet

- Introduction To Communication - Seminar WorksheetDocument5 pagesIntroduction To Communication - Seminar WorksheetVelicanu Bekk ZsuzsaNo ratings yet

- YWE Acceptance CriteriaDocument32 pagesYWE Acceptance CriteriaikeacatalogueNo ratings yet

- Introduction To Communication - Seminar WorksheetDocument5 pagesIntroduction To Communication - Seminar WorksheetVelicanu Bekk ZsuzsaNo ratings yet

- YWE Acceptance CriteriaDocument32 pagesYWE Acceptance CriteriaikeacatalogueNo ratings yet

- Adaobe Photoshop Lightroom SerialDocument1 pageAdaobe Photoshop Lightroom SerialVelicanu Bekk ZsuzsaNo ratings yet

- Cra Law Virtua 1aw Lib RaryDocument29 pagesCra Law Virtua 1aw Lib RaryGabbie DionisioNo ratings yet

- SecureSpan SOA Gateway Gateway & Software AGDocument4 pagesSecureSpan SOA Gateway Gateway & Software AGLayer7TechNo ratings yet

- FRANCEDocument10 pagesFRANCEAlidon MichaelNo ratings yet

- Cash Flow and Financial Statements of Vaibhav Laxmi Ma Galla BhandarDocument14 pagesCash Flow and Financial Statements of Vaibhav Laxmi Ma Galla BhandarRavi KarnaNo ratings yet

- Maxwell-Johnson Funeral Homes CorporationDocument13 pagesMaxwell-Johnson Funeral Homes CorporationteriusjNo ratings yet

- Crla 4 Difficult SitDocument2 pagesCrla 4 Difficult Sitapi-242596953No ratings yet

- ShineMaster Manual 202203Document13 pagesShineMaster Manual 202203João Pedro MagalhãesNo ratings yet

- Topics PamelaDocument2 pagesTopics Pamelaalifertekin100% (2)

- ALL INDIA MOCK TEST BOARD PATTERN TERM-II CLASS XII CBSE COMPUTER SCIENCEDocument3 pagesALL INDIA MOCK TEST BOARD PATTERN TERM-II CLASS XII CBSE COMPUTER SCIENCEPrateek PratyushNo ratings yet

- PRALHAD MAHANAND SATVILKAR-A Project Report PDFDocument1 pagePRALHAD MAHANAND SATVILKAR-A Project Report PDFPRALHADNo ratings yet

- January Philippine Historical EventsDocument5 pagesJanuary Philippine Historical Eventsjeric mayugbaNo ratings yet

- QSCL035284B Air Quote For Expeditors Chile Transportes Internacionales Limitada - OSL - SCL - P0640220Document2 pagesQSCL035284B Air Quote For Expeditors Chile Transportes Internacionales Limitada - OSL - SCL - P0640220MINEC SpANo ratings yet

- Ventana Research S&OP Study Results For Oliver WightDocument31 pagesVentana Research S&OP Study Results For Oliver WightDavid RennieNo ratings yet

- EMDR Therapy Treatment of Grief and Mourning in Times of COVID19 CoronavirusJournal of EMDR Practice and ResearchDocument13 pagesEMDR Therapy Treatment of Grief and Mourning in Times of COVID19 CoronavirusJournal of EMDR Practice and ResearchIsaura MendezNo ratings yet

- Japanese Period GerphisDocument4 pagesJapanese Period GerphisCharles Ronel PataludNo ratings yet

- Collective Bargaining:-Collective Bargaining Is A Technique byDocument13 pagesCollective Bargaining:-Collective Bargaining Is A Technique bysaquibhafizNo ratings yet

- List of CPD Courses 2014Document4 pagesList of CPD Courses 2014mmohsinaliawanNo ratings yet

- Newsletter No 3 - 5 May 2017Document3 pagesNewsletter No 3 - 5 May 2017Kate SpainNo ratings yet

- PrideDocument4 pagesPrideKedar DesaiNo ratings yet

- CSS 9-Summative TEST 3Document2 pagesCSS 9-Summative TEST 3herbert rebloraNo ratings yet

- Title 5 - Tourism Demand 2021Document36 pagesTitle 5 - Tourism Demand 2021RAZIMIE BIN ASNUH -No ratings yet

- Fair Value Definition - NEW vs. OLD PDFDocument3 pagesFair Value Definition - NEW vs. OLD PDFgdegirolamoNo ratings yet

- KenEi Mabuni Sobre ReiDocument6 pagesKenEi Mabuni Sobre ReirfercidNo ratings yet

- Company Profile: "Client's Success, Support and Customer Service Excellence Is Philosophy of Our Company"Document4 pagesCompany Profile: "Client's Success, Support and Customer Service Excellence Is Philosophy of Our Company"Sheraz S. AwanNo ratings yet

- Environmental Impact Assessment (Eia) System in The PhilippinesDocument11 pagesEnvironmental Impact Assessment (Eia) System in The PhilippinesthekeypadNo ratings yet

- Codex Alimentarius Commission: Procedural ManualDocument258 pagesCodex Alimentarius Commission: Procedural ManualRoxanaNo ratings yet